1. Introduction

The endowment effect refers to the fact that individuals who own a certain item assess its value higher than those who do not own it, i.e., the willingness to accept is generally higher than the willingness to pay, and it is an important theory in behavioral economics. The endowment effect has caused a certain impact on the judgment of traditional neoclassical economics on the effectiveness of the market. In the theory of neoclassical economics, according to the Coase Theorem [1] under the market mechanism of free exchange, when the transaction cost is zero, no matter how the initial endowment is distributed, the result will automatically reach the Pareto optimality, and therefore the market can be cleared, i.e., there is no mismatch between the willingness to accept and the willingness to pay due to the difference in endowment. In reality, however, asymmetric transactions and the difficulty of clearing the market are very common; for example, the volume of housing transactions is significantly lower when house prices fall than when they rise. This asymmetric trading phenomenon is mainly caused by the endowment effect.

The exchange environment required for the typical verification of the endowment effect is not widespread in real life. The common commodity trading parties in life are mostly buyers and sellers, the seller with commodity endowment can only get utility by selling commodities at a profit, and the buyer with capital endowment can only get utility by consuming commodities, which doesn't satisfy the situation of exchange in which the original endowment in the hands of the trader can also bring utility. In actual research, souvenir exchange market, used car market, etc. have become a typical scene to verify the existence of the endowment effect, this paper utilizes the questionnaire form to collect the second-hand book market buyers and sellers of the two sides of the offer, using statistical methods to test the two groups of both sides of the deal with/without endowment of the difference in the offer, proving the existence of the endowment effect.

2. Definition of the Endowment Effect

The endowment effect was proposed by Richard Thaler [1], who suggested that once an individual owns a good, he values it much more highly than he did before he owned it. That is to say, out of fear of loss, people tend to mark up the price of goods too high when they sell them. This phenomenon can be explained by the theory of “loss aversion” in behavioral finance, which holds that a certain amount of loss brings more utility reduction than the same gain brings utility increase. Furthermore, Johnson, Gerald Hubl, and Anat Keinan [2] proposed a query theory in 2007 for the endowment effect, which argues that the output of memory interferes and that the order in which buyers and sellers propose the value of an item will also have an effect on the order in which a uniform item is valued. This theory emphasizes that people do not merely base their demand for the product they own on ownership, but also participate in constructing value judgments in their thought processes. Therefore, people in the decision-making process of the trade-off between benefits and harms are not balanced; the “avoidance of harm” considerations are much greater than the “tend to profit” considerations. This is reflected in the marketplace by the tendency of sellers to take positive factors into account to increase their price judgment, while buyers, on the contrary, tend to lower their prices, making it more difficult to conclude a transaction.

3. Factors Influencing the Endowment Effect

The endowment effect is influenced by many factors such as product characteristics, consumers' characteristics, psychological factors, transaction situations, and market environment. Understanding these influences helps to better understand consumer behavior and provides important references for marketing strategies, and pricing strategies.

3.1. Product Characteristics

The endowment effect on consumers is usually stronger when the product is unique. Unique products will give consumers a stronger sense of belonging and they will overestimate their value. At the same time, people give emotional added value to the products they own, and products with emotional added value increase consumers' emotional investment, causing them to value these products higher than their actual market value. At the same time, sustainability is also an important factor, if there are many substitutes for a product, the endowment effect may be weak; however, if the product has irreplaceable uniqueness or if there are no similar choices in the market, the endowment effect will be stronger.

3.2. Consumer Characteristics

According to research women may be more easily affected by the endowment effect than men, especially when products have emotional value. Women have greater emotional needs and may be more likely to develop a sense of attachment to the product. Meanwhile, older consumers show a stronger endowment effect, especially if the product has long-term use value or personal historical significance. Younger consumers, on the other hand, may have a weaker endowment effect due to novelty seeking or a more rapidly changing interest in the product.

3.3. Psychological Factors

According to prospect theory, people are more sensitive to losses than to gains. This means that once a consumer owns a product she will feel that the psychological loss from losing it is greater than the gain from acquiring it, thus overestimating its value and showing a strong endowment effect.

3.4. Transaction Context

Research has found that the longer the item is owned, the stronger the endowment effect. Items owned for a long time will gradually be integrated into consumers' daily life and personal memories, thus strengthening their sense of dependence on the item and its psychological value. In addition, during the transaction process, if consumers feel a strong emotional connection or psychological satisfaction, they may overestimate the value of these items, thus generating a stronger endowment effect.

3.5. Market Environment

The strength of the endowment effect may also be affected by fluctuations in market prices. When market prices rise, consumers may overestimate the value of items and thus have a stronger endowment effect on them; conversely, when market prices fall, the endowment effect may be weaker. The endowment effect is also affected by how much consumers know about a given product. If consumers know little about the value of the good and the market situation, they may rely more on their personal emotional evaluations and sense of belonging, resulting in a stronger endowment effect.

4. Applications

4.1. Application in the Second-hand Trading Market

4.1.1. The Current Situation of the Second-hand Market

Under the influence of the current economic and consumer environment, a large number of people gradually set up a relatively mature and rational consumption behavior, began to follow the circular economy and sharing economy boom, and participated in the second-hand trading economy.

4.1.2. Second-hand Market under the Influence of Endowment Effect

Since the endowment effect is an “anomaly” in the traditional economic perspective [3,4], many studies have tried to explain its emergence in terms of behavioral economics. In the second-hand market, we find that the endowment effect of the impact of the transaction is often difficult because people tend to hold their products to improve the evaluation, which makes the seller expect a higher price to sell the goods, the buyer tends to lower prices, which makes the buyer and seller on the transaction price of the gap widens, exacerbating the difficulties of second-hand transactions. At the same time, due to the endowment effect will also be affected by the characteristics of the subject matter of the transaction, second-hand transactions in the different subject matter of the transaction under the influence of the difficulty of carrying out the situation there are also differences. For example, some young people are keen on the price of the stars around the price due to scarcity, the price is significantly higher than the market price, at the same time, because most people are in the moment of having a price reduction, it leads to this part of the commodity trading difficulties. At the same time in electronic commodities, due to the rapid renewal of electronic commodities, buyers prefer to have a lower price to eliminate the electronic products, but sellers due to the original high price of the product are not willing to sell at a low price.

5. Research Methodology

Referring to the experiments of Kahneman et al. [5], this study uses a questionnaire to research the impact of the endowment effect on the secondary market by conducting a hypothesis test in the form of a questionnaire.

5.1. Experimental Hypotheses

H1: Second-hand trading behavior is influenced by endowment effect.

H2: In second-hand market, ownership makes sellers tend to increase the price of items.

5.2. Experimental Purpose

This paper adopts an experimental design to investigate the influence of the endowment effect on second-hand trading behavior. A control group and an experimental group were set up in this experiment. The experiment tested the hypotheses by controlling for the ownership of items in second-hand transactions.

The experiment was designed to test hypotheses one and two by controlling for ownership of items in second-hand transactions.

5.3. Description of the Experiment

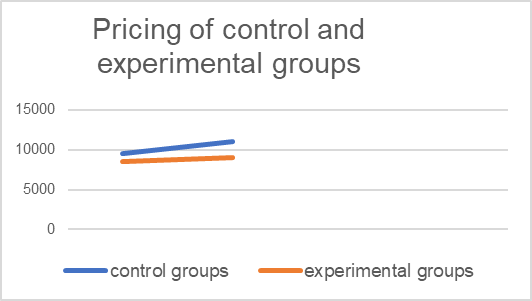

A one-way design was used, with the independent variable being whether or not to have ownership of the item in the second-hand transaction behavior, and the dependent variable being the group's pricing of the item in the second-hand transaction behavior. The mobile phone was chosen as the latest iPhone with an original price of RMB 11,999. The control group is the group that excludes the influence of price setting caused by other factors besides ownership of the item. The experimental group owns the items and excludes other factors to set prices in second-hand transactions (to exclude other influences, the cell phones selected by the experimental group and the control group are all of the same brand, brand new and unused products). The control group and the experimental group are divided into group A, group B, choose the same brand cell phone with the same price of different series, to exclude the influence of other factors other than the function of the cell phone.

5.4. About Design

(1) Choose one community, each group randomly selects 50 residents, (to ensure that the proportion of male and female is comparable, and to ensure that the subjects are evenly distributed for residents of different ages), simulates the second-hand trading environment in the community activity exchange room, and asks them to act as different roles in the price setting for the mobile phone, and asks the price estimation to be accurate to the single digit. The control group simulated a third party agent for mobile phones, and the experimental group simulated a mobile phone holder.

(2) In the simulated situation, the subjects were asked to set prices by filling out a questionnaire. At the end of the experiment, the pricing of different experimental groups were averaged separately.

(3) From the results of the questionnaire, the variation of the pricing of the traded items under the same conditions is derived.

Figure 1: Pricing of control and experimental groups

5.5. Applications in The “Double Eleven Shopping Festival”

5.5.1. The Current Situation of the Shopping Festival

Nowadays, online shopping is very popular in China. Every year there is a big shopping festival called the “Double Eleven Shopping Festival”. During the “Double Eleven” shopping festival in 2024, the cumulative sales of integrated e-commerce platforms and live e-commerce platforms amounted to 1,441.8 billion yuan, a year-on-year increase of 26.6%.

5.5.2. Strategies under the Influence of the Endowment Effect

There are many strategies during the “Double Eleven Shopping Festival”. One of the most famous strategies for shopping on Double 11 every year is to pay a portion of the deposit first, such as if you want to buy a $1,000 product, you need to pay $50 deposit first, and at the same time, this deposit is not refundable even if you don't want the product. In this way, consumers will think that they already own the product after paying the deposit, and even if the price is not so reasonable, consumers will eventually pay.

Another one is a price increase. When the “Double Eleven” activity period ends, the merchants will raise prices, and consumers who buy the same goods will pay a higher price, so people will choose “The Double Eleven Shopping Festival” to buy many things even if they do not need them. Just to avoid missing the regret, which produces a negative emotional purchase. Take “The Double Eleven Shopping Festival” as an example, Taobao only does this once a year, and the sale of large-scale price cuts, once this time may not be able to buy a large reduction in the price of goods. In the case of “The Double Eleven Shopping Festival” large price cuts and then raising prices, the purchase opportunity before the price increase is a “limited opportunity to buy”. If a more limited purchasing opportunity is missed, consumers tend to feel a sense of psychological loss, not only feeling that they have lost the opportunity to purchase, but also feeling that they cannot have the product they want, and consumers anticipate that it will cost them more to purchase the product again.

Psychologically, they have already entered the role of “owner”, which affects their preference and evaluation of products. For consumers involved in online shopping, a considerable portion of the population in the shopping cart will intend to buy but do not buy the goods due to price and other reasons. In the process of understanding this part of the product, consumers have psychologically attached to it, which affects the consumer's preference for the product, missing the “double eleven” buying opportunities, because of the high finiteness of the missed buying opportunities; consumers realize that it is difficult to get a similar purchase again within a year. After missing the purchase opportunity of “Double Eleven”, due to the high finiteness of the missed purchase opportunity, consumers realize that it is very difficult to get a similar purchase opportunity again within one year, and consumers will perceive this as a “loss situation”, resulting in a strong sense of loss. The endowment effect occurs when people feel that they have lost a product. So the endowment effect influences both buyers and sellers.

6. Conclusion

The existence of the endowment effect explains the existence of under-trading and asymmetric trading in the market in reality. This confirms Tunceland Hammitt’s [6] conclusion This paper briefly combed the endowment effect-related research literature through the questionnaire survey to collect experimental data, using statistical methods to process and analyze the data, and found that the endowment effect in different markets has different roles and influences; in the second-hand market, it may result in the sale of goods in a difficult situation, for which the merchants can take positive marketing strategies to solve. For example, to provide a free trial of 3-day satisfaction of the return service, so that consumers briefly have ownership in order to increase the buyer's psychological price, and reduce the seller's selling price. At the same time, sellers can also provide gifts to give away and other services to attract consumers to buy, while you can set up a random price reduction to reduce the gap between the buyer and seller on the psychological price to increase the chances of buying out. However, the Double Eleven Shopping Festival is a positive case of the endowment effect to let consumers briefly have the ownership of belonging to promote consumers to buy, making merchants' sales increase.

Finally, the experiments in this paper at the same time have shortcomings, the sample exists in the community of residents of different age groups of different genders, and there is a different demand for second-hand cell phones, such as the elderly people, so if we want more accurate conclusions, we need to do more researches and have more accurate data.

References

[1]. Thaler, R. H. (1980). Tow and a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1, 39-60.

[2]. Tomas, J. (2013). Rational mistakes: The 6 biggest thinking mistakes in everyday life. Renmin University of China Press.

[3]. Kahneman D., Tversky A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

[4]. Kahneman D., Knetsch J. L., Thaler R. H. (1991). Anomalies: The endowment effect, loss aversion, and status quo bias. Journal of Economic Perspectives, 5(1), 193-206.

[5]. Kahneman D., Knetsch J. L., Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of Political Economy, 98(6), 1325-1348.

[6]. Tuncel T., Hammitt J.K. A New Meta-Analysis on the WTP/WTAD is disparity [J]. Journal of Environmental Economics and Management,2p14,68(1):175-187.

Cite this article

Zhou,M. (2025). The Endowment Effect in Second-hand Market and the "Double Eleven Shopping Festival". Advances in Economics, Management and Political Sciences,176,63-68.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Thaler, R. H. (1980). Tow and a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1, 39-60.

[2]. Tomas, J. (2013). Rational mistakes: The 6 biggest thinking mistakes in everyday life. Renmin University of China Press.

[3]. Kahneman D., Tversky A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 263-291.

[4]. Kahneman D., Knetsch J. L., Thaler R. H. (1991). Anomalies: The endowment effect, loss aversion, and status quo bias. Journal of Economic Perspectives, 5(1), 193-206.

[5]. Kahneman D., Knetsch J. L., Thaler, R. H. (1990). Experimental tests of the endowment effect and the Coase theorem. Journal of Political Economy, 98(6), 1325-1348.

[6]. Tuncel T., Hammitt J.K. A New Meta-Analysis on the WTP/WTAD is disparity [J]. Journal of Environmental Economics and Management,2p14,68(1):175-187.