1. Introduction

In recent years, global economic uncertainty has markedly intensified, rendering the performance and correlation between safe-haven and non-safe-haven assets a crucial area of research. Gold, a conventional safe-haven asset, has been extensively analyzed for its price responsiveness to market emotion, inflation anticipations, and global crises [1]. Fuel oil, as an industrial commodity, is intricately linked to global energy consumption, economic fluctuations, and geopolitical influences [2]. Despite the extensive analysis of the individual performance of gold and fuel oil in existing literature, there is a scarcity of research concerning their dynamic interplay during extreme economic conditions, such as the COVID-19 pandemic, and its implications for portfolio management [3]. The COVID-19 epidemic has underscored the necessity of comprehending the reactions of various asset classes to crises. Research indicates that gold typically excels during periods of market volatility , but fuel oil prices are significantly affected by fluctuations in global energy demand and supply chains [4]. This study aims to contribute to the existing body of knowledge by examining the price patterns, correlations, and volatility of gold and fuel oil futures from 2019 to 2021, utilizing data from the CSMAR database. Python is employed for data analysis, encompassing trend analysis, Pearson correlation coefficients, 30-day rolling correlations, and volatility assessment. The study provides empirical insights into the interaction between safe-haven and non-safe-haven assets during extreme events, thereby contributing to academic literature. Secondly, it offers practical advice for investors to enhance asset allocation and risk management during market volatility. The results also act as an essential reference for policymakers and market participants aiming to manage the financial consequences of global crises.

2. Literature Review

Baur and McDermott examined gold's efficacy as a safe haven in financial crises, concentrating on the disparities in gold's performance during global compared to regional crises. Their findings demonstrated that gold functions as a safe-haven asset more effectively during global crises than regional ones, particularly during global financial recessions, when it can preserve its value amid significant volatility in other assets [1]. Ji, Bouri, and Roubaud examined the volatility spillovers between gold and oil to assess the importance of their reciprocal impact. They analyzed the volatility transmission between gold and WTI crude oil futures from 2000 to 2017 using a vector auto-regressive (VAR) model and a Generalized Auto-regressive Conditional Heteroskedasticity (GARCH) model. Their findings indicated that while the correlation between gold and oil may vary during particular economic shocks, the volatility spillover effect between the two is typically weak, suggesting that their price fluctuations are largely independent [5]. Reboredo and Ugolini's study, employing daily gold and oil futures prices from January 2019 to December 2020, demonstrated a notable decline in the association between gold and oil once the pandemic commenced. Pandit and Luo developed a novel predictive model to evaluate the dynamic link between gold and crude oil, utilizing machine learning techniques to improve understanding of price relationships amid economic disturbances. Their approach demonstrates improved precision in forecasting short-term price correlations, highlighting the effectiveness of modern data-driven techniques in commodities analysis [6]. Maghyereh, Awartani, and Tziogkidis examined cross-hedging prospects between gold and oil futures in turbulent markets. Their conclusion indicated that although these two assets typically operate independently, their correlation may alter considerably during market upheaval, implying the necessity for dynamic adjustments in diversified portfolios according to market conditions [7].

Primarily, the majority of research concentrate on gold or fuel oil separately, with minimal consideration of their interdependent relationship during dire economic circumstances. Secondly, although the effects of COVID-19 on individual assets have been examined, there is an absence of systematic analysis of the evolution of the relationship between gold and fuel oil before and after the pandemic.

3. Methodology

3.1. Data

The principal data source for this analysis is the CSMAR database, which offers daily closing prices for gold and fuel oil futures from 2019 to 2021, encompassing a timeframe of considerable economic upheaval owing to the COVID-19 pandemic [8]. The data cleansing procedure commenced with the importation of the raw data. Essential columns, such as the date and closing price, were chosen and redefined utilizing rename(). The date column was transformed into a standardized datetime format using pd.to_datetime(). The data was aggregated by date using groupby() and mean() to accommodate possibly multiple contracts on the same day. The gold and fuel oil datasets were ultimately merged on the date column utilizing pd.merge() with an inner join to guarantee the synchronization of the time series [9]. The purified and consolidated dataset was subsequently prepared for additional analysis. As shown in Table 1, part of the data has been formatted.

Table 1: Part of the results of data cleaning

Date | Gold_Price | Fuel_Price |

2019-01-02 | 286.61875 | 2306.500000 |

2019-01-03 | 288.36250 | 2316.083333 |

2019-01-04 | 289.69375 | 2370.500000 |

2019-01-07 | 286.45000 | 2415.750000 |

2019-01-08 | 287.27500 | 2419.250000 |

3.2. Data analysis

A trend analysis of fuel oil and gold futures was conducted subsequent to data processing. The Pearson correlation coefficient was employed to examine the linear relationship between fuel oil and gold. The Pearson correlation coefficient r is computed as follows:

\( r=\frac{\sum ({x_{i}}-\bar{x})({y_{i}}-\bar{y})}{\sqrt[]{\sum {({x_{i}}-\bar{x})^{2}}\sum {({y_{i}}-\bar{y})^{2}}}} \) (1)

Where variables \( {x_{i}} \) and \( {y_{i}} \) denote the prices of gold and fuel oil, respectively, while \( \bar{x} \) and \( \bar{y} \) signify their mean values [10]. A 30-day rolling correlation was computed to evaluate the fluctuations in the association during the pandemic. This dynamic rolling correlation detects transient variations in asset connections that may remain obscured in a static correlation analysis [11]. Finally, the standard deviation of daily returns for both gold and fuel oil futures was calculated across different time intervals to assess the volatility of these assets before and after the pandemic.

4. Key findings

4.1. Price Trends

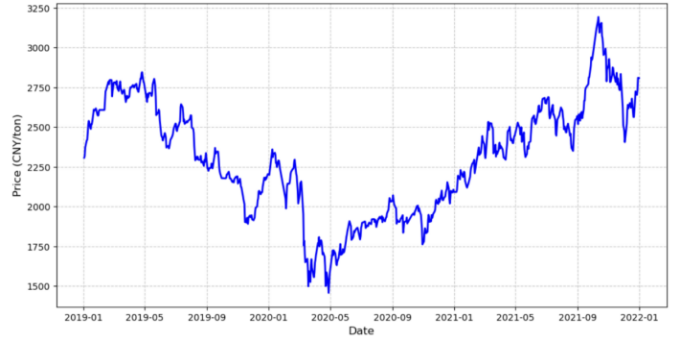

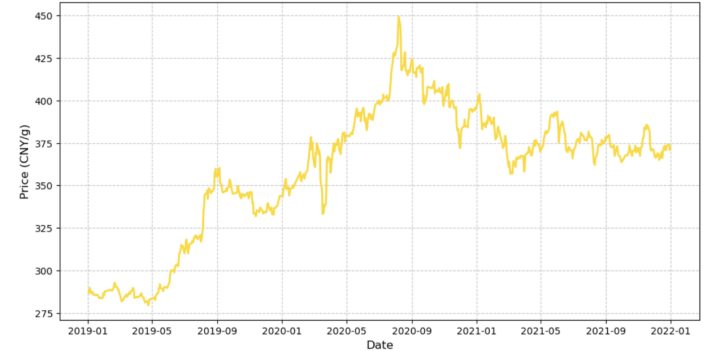

Figure 1: Gold future price trend Figure 2: Fuel oil future price trend

The price of gold underwent a steady increase throughout the COVID-19 epidemic. As shown in Figure 1, between January 2019 and January 2021, gold prices escalated from roughly 285 CNY/g to a zenith of 460 CNY/g in mid-2020, signifying a gain of over 60%. The principal reason driving this price escalation was the increased demand for safe-haven assets, as investors pursued stability during market upheaval [5]. The mid-2020 peak illustrates gold's capacity to maintain value during financial upheaval, reinforcing its reputation as a reliable store of value [1]. After 2020, gold prices gradually stabilized, fluctuating around 375 CNY/g.

Conversely, fuel oil prices exhibited considerable volatility. From January to April 2020, fuel oil prices fell from around 2500 CNY/ton to 1500 CNY/ton, representing a 40% fall. This significant decline was primarily attributed to a 6% reduction in global energy use during the COVID-19 pandemic [12]. The outbreak severely impacted transportation and industrial activities, leading to reduced demand for energy commodities [13]. With the resurgence of industrial activity and the global economic recovery, fuel oil prices steadily increased, reaching approximately 3200 CNY/ton by the conclusion of 2021. This rebound signifies a resurgence of economic activity and heightened energy demand [3].

4.2. Correlation analysis

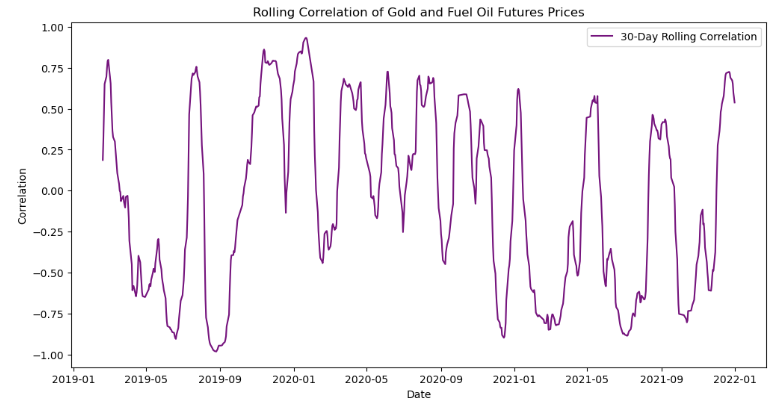

Figure 3: Rolling correlation of gold and future prices

Throughout the study period (2019–2021), the Pearson correlation coefficient between gold and fuel oil futures prices was calculated to be -0.4919. This reflects an inverse relationship between the two commodities: the price of gold typically declines when the price of fuel oil rises, and conversely [2]. The adverse correlation can be explained by the differing determinants of the two assets. Fuel oil is predominantly affected by industrial demand and global energy consumption, whereas gold is chiefly influenced by safe-haven demand and international crises [6].

Figure 3 illustrates that the correlation between gold and fuel oil varied between -1 and +1, indicating considerable volatility, according to a 30-day rolling correlation analysis. This variation demonstrates how the correlation between the two commodities shifts in response to fluctuating market conditions [14]. The broad spectrum of correlation values indicates that the relationship between the two assets can be significantly affected by external variables, including economic crises and recovery periods. The dynamic nature of correlation underscores the necessity of accounting for external influences, such as worldwide pandemics and economic recoveries, when assessing the correlations among various asset classes [15].

4.3. Pre and Post-COVID Analysis

Prior to the pandemic, a substantial inverse association existed between gold and fuel oil futures, shown by a correlation coefficient of -0.826. The inverse relationship remained rather stable under normal economic conditions, with fuel oil's performance closely linked to global industrial activity and energy consumption, while gold served as a safe haven during periods of market volatility [16].Following the commencement of the COVID-19 epidemic in early 2020, the connection between gold and fuel oil futures markedly diminished, declining to -0.375 by March 2020. This shift reflects the intricacy of the pandemic's influence on these two asset classes. During the initial stages of the pandemic, substantial demand shocks led to a decline in fuel oil prices, whilst gold prices surged as investors sought safe-haven assets [17]. Nonetheless, the adverse correlation between the two diminished as gold prices stabilized and fuel oil prices rebounded with the resurgence of the global economy and the resumption of industrial activity [2].

4.4. Volatility Analysis

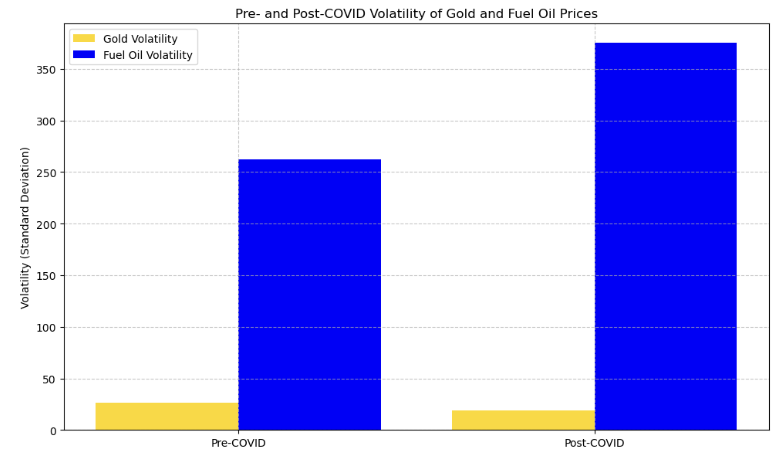

Figure 4: Pre and Post-COVID volatility and fuel oil prices

The standard deviation of daily returns, indicative of gold volatility, diminished from 26.50 before the pandemic to 19.27 after the COVID-19 epidemic. The reduction in volatility indicates that gold could function as a reliable asset in times of uncertainty. Gold's designation as a safe-haven asset resulted in diminished price volatility amid the pandemic's unpredictable market conditions [5].Conversely, fuel oil experienced a significant increase in volatility throughout the pandemic. Before the outbreak, fuel oil volatility was 262.08; in the post-COVID period, it rose to 375.12. This significant rise is attributed to the decline in global energy consumption during the initial months of the pandemic and the subsequent supply chain disruptions [3]. The volatility of fuel oil was further exacerbated by the unpredictability of industrial demand, highlighting the asset's vulnerability to shocks and recovery trends in the global economy [5].

4.5. Discussion

In a portfolio, safe-haven assets and non-safe-haven assets serve distinct functions, offering stability and growth potential, respectively. Gold, the Japanese yen, the Swiss franc, and U.S. Treasury bonds are commonly acknowledged as safe-haven assets [17]. In times of crisis, they typically demonstrate low or negative correlations with high-risk assets. During the COVID-19 pandemic, safe-haven assets exhibited stable performance, whereas industrial commodities like oil, influenced by global economic cycles, underwent significant price volatility, even descending to unprecedented levels, with prices briefly turning negative [15]. In investment strategies, judiciously allocating safe-haven and non-safe-haven assets can mitigate risk while optimizing returns. Safe-haven assets offer protection against volatility, whereas non-safe-haven assets facilitate the realization of returns during economic recoveries. With the enhancement of market stability, investors may consider increasing their investment in industrial assets, such as fuel oil, while maintaining a share of safe-haven assets like gold to reduce risk. Understanding the characteristics of safe-haven and non-safe-haven assets is crucial for tackling macroeconomic fluctuations[18]. Utilizing this knowledge, investors can enhance portfolio performance and more effectively manage market volatility. Incorporating diverse asset classes within a portfolio enables investors to mitigate risk amid market fluctuations and capitalize on growth prospects during economic resurgence.

5. Conclusion

This study examines the fluctuating relationship between gold and fuel oil futures from 2019 to 2021, especially during the COVID-19 pandemic. The findings indicate an inverse relationship between gold and fuel oil, with gold serving as a safe-haven asset amid market volatility, whereas fuel oil was more influenced by global energy demand fluctuations. During the pandemic, the relationship between the two assets diminished as gold prices escalated and fuel oil prices decreased but stabilized as the economy rebounded. The findings enhance comprehension of the interaction between these two assets under extreme economic conditions and offer practical insights for portfolio management, highlighting the necessity of balancing safe-haven and industrial assets. Nevertheless, the study possesses limitations, notably its concentration on merely two commodities and a brief duration. Future research may investigate a wider range of asset classes and extended time frames to offer a more thorough understanding of asset correlations during crises.

References

[1]. Baur, D. G., & McDermott, T. K. (2020). Is gold a safe haven? International evidence. Journal of Banking & Finance, 119, 1886-1898.

[2]. Salimi, M., & Amidpour, M. (2022). The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries. World (Basel), 3(3), 607-618.

[3]. Mensi, W., Reboledo, J. C., & Ugolini, A. (2021). Price-switching spillovers between gold, oil, and stock markets: Evidence from the USA and China during the COVID-19 pandemic. Resources Policy, 73, 102217.

[4]. Nicolau, M., & Palomba, G. (2015). Dynamic relationships between spot and futures prices: The case of energy and gold commodities. Resources Policy, 45, 130-143.

[5]. Ji, Q., Bouri, E., & Roubaud, D. (2018). Dynamic network of implied volatility transmission among US equities, strategic commodities, and BRICS equities. International Review of Financial Analysis, 57, 1-12.

[6]. Pandit, S., & Luo, X. (2024). A novel prediction model to evaluate the dynamic interrelationship between gold and crude oil. International Journal of Data Science and Analytics, 12(2), 89-106.

[7]. Maghyereh, A. I., Awartani, B., & Tziogkidis, P. (2017). Volatility spillovers and cross-hedging between gold, oil, and equities: Evidence from the Gulf Cooperation Council countries. Energy Economics, 68, 440-453.

[8]. CSMAR Database. (2024). China Stock Market & Accounting Research Database. Southeast University Library.

[9]. Adhithya Srija, A., Kedareswari, K., Sahithya, P., Aswini, N., & Vuyyuru, V. A. (2024). Unveiling the Significance of Data Cleaning: A Review of its Impact on Downstream Tasks in Machine Learning and Analytics. Journal of Emerging Technologies and Innovative Research, 11(7), b165-b171.

[10]. Madani, M. A., & Ftiti, Z. (2021). Is gold a hedge or safe haven against oil and currency market movements? A revisit using multifractal approach. Annals of Operations Research, 309(1), 123-145.

[11]. Pham, H., Wei, X., & Zhou, C. (2022). Portfolio diversification and model uncertainty: A robust dynamic mean-variance approach. Mathematical Finance, 32(1), 349-404.

[12]. International Energy Agency. (2021). Global Energy Review 2021: Economic impacts of Covid-19. IEA. https://www.iea.org/reports/global-energy-review-2021/economic-impacts-of-covid-19.

[13]. Armeanu, D. S., Gherghina, S. C., Andrei, J. V., & Joldes, C. C. (2022). Modeling the impact of the COVID-19 outbreak on environment, health sector and energy market. Sustainable Development, 30(5), 1387-1416.

[14]. Naeem, M. A., Qureshi, F., Farid, S., Tiwari, A. K., & Elheddad, M. (2024). Time-frequency information transmission among financial markets: Evidence from implied volatility. Annals of Operations Research, 334(1-3), 701-729.

[15]. Balcilar, M., Ozdemir, Z. A., & Ozdemir, H. (2021). Dynamic return and volatility spillovers among S&P 500, crude oil, and gold. International Journal of Finance and Economics, 26(1), 153-170.

[16]. Fousekis, P. (2023). Contemporaneous dependence between euro, crude oil, and gold returns and their respective implied volatility changes: Evidence from the local Gaussian correlation approach. Studies in Economics and Finance, 40(5), 795-813.

[17]. Wen, F., Tong, X., & Ren, X. (2022). Gold or Bitcoin, which is the safe haven during the COVID-19 pandemic? International Review of Financial Analysis, 81, 102121.

[18]. Naeem, M. A., Rabbani, R., Karim, M., & Billah, S. M. (2023). Religion vs ethics: Hedge and safe haven properties of Sukuk and green bonds for stock markets pre- and during COVID-19. International Journal of Islamic and Middle Eastern Finance and Management, 16(2), 234-252.

Cite this article

Wang,Z. (2025). Safe Haven vs. Non-Safe Haven Assets An Analysis of Gold and Fuel Oil Futures During Pre and Post COVID Periods. Advances in Economics, Management and Political Sciences,172,49-54.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Baur, D. G., & McDermott, T. K. (2020). Is gold a safe haven? International evidence. Journal of Banking & Finance, 119, 1886-1898.

[2]. Salimi, M., & Amidpour, M. (2022). The Impact of Energy Transition on the Geopolitical Importance of Oil-Exporting Countries. World (Basel), 3(3), 607-618.

[3]. Mensi, W., Reboledo, J. C., & Ugolini, A. (2021). Price-switching spillovers between gold, oil, and stock markets: Evidence from the USA and China during the COVID-19 pandemic. Resources Policy, 73, 102217.

[4]. Nicolau, M., & Palomba, G. (2015). Dynamic relationships between spot and futures prices: The case of energy and gold commodities. Resources Policy, 45, 130-143.

[5]. Ji, Q., Bouri, E., & Roubaud, D. (2018). Dynamic network of implied volatility transmission among US equities, strategic commodities, and BRICS equities. International Review of Financial Analysis, 57, 1-12.

[6]. Pandit, S., & Luo, X. (2024). A novel prediction model to evaluate the dynamic interrelationship between gold and crude oil. International Journal of Data Science and Analytics, 12(2), 89-106.

[7]. Maghyereh, A. I., Awartani, B., & Tziogkidis, P. (2017). Volatility spillovers and cross-hedging between gold, oil, and equities: Evidence from the Gulf Cooperation Council countries. Energy Economics, 68, 440-453.

[8]. CSMAR Database. (2024). China Stock Market & Accounting Research Database. Southeast University Library.

[9]. Adhithya Srija, A., Kedareswari, K., Sahithya, P., Aswini, N., & Vuyyuru, V. A. (2024). Unveiling the Significance of Data Cleaning: A Review of its Impact on Downstream Tasks in Machine Learning and Analytics. Journal of Emerging Technologies and Innovative Research, 11(7), b165-b171.

[10]. Madani, M. A., & Ftiti, Z. (2021). Is gold a hedge or safe haven against oil and currency market movements? A revisit using multifractal approach. Annals of Operations Research, 309(1), 123-145.

[11]. Pham, H., Wei, X., & Zhou, C. (2022). Portfolio diversification and model uncertainty: A robust dynamic mean-variance approach. Mathematical Finance, 32(1), 349-404.

[12]. International Energy Agency. (2021). Global Energy Review 2021: Economic impacts of Covid-19. IEA. https://www.iea.org/reports/global-energy-review-2021/economic-impacts-of-covid-19.

[13]. Armeanu, D. S., Gherghina, S. C., Andrei, J. V., & Joldes, C. C. (2022). Modeling the impact of the COVID-19 outbreak on environment, health sector and energy market. Sustainable Development, 30(5), 1387-1416.

[14]. Naeem, M. A., Qureshi, F., Farid, S., Tiwari, A. K., & Elheddad, M. (2024). Time-frequency information transmission among financial markets: Evidence from implied volatility. Annals of Operations Research, 334(1-3), 701-729.

[15]. Balcilar, M., Ozdemir, Z. A., & Ozdemir, H. (2021). Dynamic return and volatility spillovers among S&P 500, crude oil, and gold. International Journal of Finance and Economics, 26(1), 153-170.

[16]. Fousekis, P. (2023). Contemporaneous dependence between euro, crude oil, and gold returns and their respective implied volatility changes: Evidence from the local Gaussian correlation approach. Studies in Economics and Finance, 40(5), 795-813.

[17]. Wen, F., Tong, X., & Ren, X. (2022). Gold or Bitcoin, which is the safe haven during the COVID-19 pandemic? International Review of Financial Analysis, 81, 102121.

[18]. Naeem, M. A., Rabbani, R., Karim, M., & Billah, S. M. (2023). Religion vs ethics: Hedge and safe haven properties of Sukuk and green bonds for stock markets pre- and during COVID-19. International Journal of Islamic and Middle Eastern Finance and Management, 16(2), 234-252.