1. Introduction

Amid the rapid advancement of information technology, the wave of digital transformation is sweeping across industries worldwide. The widespread adoption of digital technologies such as cloud computing, big data, and artificial intelligence (AI) has profoundly reshaped business models and market competition landscapes. Corporate M&A, as a key strategic tool for optimizing resource allocation, is exhibiting new characteristics and trends under the dual influence of traditional economic factors and digital transformation. Many companies are accelerating their digital transformation by acquiring firms with advanced digital technologies or significant big data resources. Against this backdrop, the motives for corporate M&A are no longer limited to traditional drivers such as market expansion and financial synergy; instead, they increasingly focus on technology acquisition, data resource integration, and the digital transformation of business models.

This paper takes Alibaba's acquisition of Ele.me as a case study to explore the motives and strategic adjustment paths of corporate M&A in the context of digital transformation. As a leading global internet giant, Alibaba’s acquisition of Ele.me serves as a typical and representative case. Ele.me, as a leading food delivery platform in China, possesses strong digital operational capabilities and extensive user data resources, which align closely with Alibaba's digital transformation strategy. Through this acquisition, Alibaba not only expanded its presence in the local lifestyle services market but also enhanced its digital capabilities in real-time delivery, intelligent scheduling, and user management. This paper analyzes the case from three main perspectives: the motives for the acquisition, the strategic adjustment paths after the acquisition, and the outcomes of post-merger integration. Specifically, this paper first applies theories related to M&A synergy to analyze the motives behind Alibaba's acquisition of Ele.me, including technology acquisition, market expansion, user resource integration, and financial synergy. Secondly, it explores the strategic adjustment paths following the acquisition, focusing on business and technology integration, data resource consolidation, and organizational restructuring. Finally, it identifies issues encountered during the acquisition process and provides strategic recommendations to serve as a reference for other enterprises engaging in M&A activities in the context of digital transformation. Through a comprehensive analysis of Alibaba's acquisition of Ele.me, this paper not only validates the effectiveness of M&A theories in the context of digital transformation but also offers practical guidance for enterprises formulating M&A strategies in the digital era.

2. Theoretical foundation and literature review

2.1. Theory of corporate mergers and acquisitions

2.1.1. Synergy theory

The synergy theory posits that mergers and acquisitions (M&A) can achieve a "1+1>2" effect by integrating resources and optimizing processes. Weston and others have suggested that synergies primarily manifest in three aspects: operations, management, and finance [1]. In terms of operational synergy, enterprises can leverage economies of scale to reduce production costs, share resources, and expand their market reach. Management synergy refers to the improvement in overall management efficiency when a company with advanced management experience and an efficient team merges with a company with lower management efficiency, thus promoting effective resource allocation. In terms of financial synergy, after a merger, companies can optimize internal funds through reasonable allocation, reduce financing costs, and enhance financial performance. For instance, a profitable company acquiring a loss-making one can use tax planning to offset losses and reduce taxes, improving the overall financial performance of the combined entity. Additionally, the company’s financing capability and credit rating can be enhanced, allowing it to acquire funds at lower costs.

2.1.2. Market power theory

Through mergers and acquisitions, companies can reduce competitors, alter market structure, expand market share, and enhance their ability to control market prices and output, thus obtaining monopoly profits or competitive advantages. For example, after the merger of large companies within an industry, the industry concentration may increase, allowing the merged entity to have greater influence over market pricing, resource acquisition, and other areas, thereby solidifying its market position.

2.1.3. Undervaluation theory

When the market value of the target company is undervalued for various reasons, the acquiring company may see this as an opportunity for acquisition. Two ratios are commonly used to assess whether a company’s value is undervalued: the Tobin's Q ratio (market value to replacement cost) and the value ratio (market value to book value of assets). Undervaluation may arise from a market misjudgment of the target company’s future development potential or from poor management within the target company. By acquiring the company, the acquirer can improve its integration and unlock its potential, thus increasing its value.

2.1.4. Principal-agent theory

The separation of ownership and management in a company creates agency problems, where management may pursue personal interests. M&A can act as an external governance mechanism. When management makes poor decisions, potential acquirers can initiate a merger to replace management and maximize shareholder interests. However, M&A may also be driven by management's personal interests, necessitating improvements in corporate governance to constrain such behaviors. A variation of agency theory is the managerialism theory proposed by Mueller in 1969.Agency theory indicates that when markets fail to resolve agency issues, mergers and acquisitions or market activities can play a role in addressing these problems. Managerialism theory, on the other hand, asserts that the agency problem has not been solved and that mergers and acquisitions are merely a manifestation of an agency problem associated with managerial inefficiency. Managerialism theory posits that the management of the acquiring company does not seek to maximize shareholder wealth but rather pursues personal interests, such as diversifying operational risks and expanding control. Specifically, this takes the form of pursuing mixed mergers and engaging in diversified operations [2]. Therefore, managers' interests are inversely proportional to the company’s operational risks.

2.2. Digital transformation theory

2.2.1. Concept and implications of digital transformation

Digital transformation refers to the comprehensive change and optimization of a company's strategy, business model, organizational structure, and operational processes through the use of digital technologies, aimed at adapting to the development needs of the digital economy era. Its core lies in the intelligentization of decision-making, automation of business processes, and personalization of customer experience through the collection, analysis, and application of data.

2.2.2. Impact mechanisms of digital transformation on corporate mergers and acquisitions

In terms of target selection, under the digital context, M&A targets in industries, technology, and data show new characteristics. In terms of valuation methods, the focus shifts to exploring the challenges of digital asset valuation and adjustments to new valuation methods and models. Regarding integration strategies, companies undergo transformations in business, technology, and organization. From a technological perspective, digital technologies provide companies with new production tools and methods, such as automated production lines, intelligent supply chain management systems, etc., which improve production efficiency and operational management. From a business perspective, digital transformation drives companies to innovate business models and expand into new business areas, such as platform-based economy models and digital service models based on the internet. From an organizational perspective, digital transformation requires companies to break down traditional hierarchical structures and establish more flexible and efficient flat organizations to adapt to the rapidly changing market environment.

2.3. Literature review

2.3.1. Motivations for corporate mergers and acquisitions

2.3.1.1. Achieving synergy effects

Early research on the motivations for corporate mergers and acquisitions primarily focused on traditional economic theories. Japanese strategic expert Hiroyuki Itami divided the concept of synergy into two parts: "complementary effects" and "synergy effects". He acknowledged that complementary effects and synergy effects often occur simultaneously. True synergy can only occur when a company begins to utilize its unique resources—intangible assets (which may include trademarks, customer recognition, technological expertise, or even a corporate culture that generates strong employee identification). This synergy, being difficult for competitors to replicate, can bring a more lasting competitive advantage to the company. Mark L. Sirower [3] suggested that "synergy effects" must be considered in a competitive context, meaning they should reflect the growth in overall benefits of the merged company exceeding the market's expected sum of the target and acquiring companies' individual performance as separate entities. John Wells, using the PIMS database, studied synergy effects by comparing a company's actual performance with the expected performance if each of the companies operated independently. Using various methods, he tested the potential impacts of shared business behavior, knowledge, skills, and corporate image. The results indicated that achieving synergy effects depended, to some extent, on the content being shared.

2.3.1.2. Increase market share and enhance market pricing power

In the context of market power theory, theoretical analysis by Barton & Sherman [4] and others suggests that mergers and acquisitions help the acquiring companies build entry barriers and form and strengthen their market power. Empirical research by Vita and Sacher [5] also shows a positive relationship between corporate M&A activities and market power, a relationship that is statistically significant. After a merger, the market share of companies increases, their market pricing power strengthens, and profitability improves. However, this also triggers discussions about monopoly and market competition. Ellert [6] found that acquirers seeking to gain or enhance market power through mergers, or to obtain non-competitive advantages related to company size, often face antitrust opposition, which can prevent them from achieving their objectives. Moeller [7] found in empirical analysis that mergers could lead to a reduction in market power, possibly due to the misalignment of goals between the company's actual controllers and professional managers. Focarelli and Panetta [8], in their study using data from the banking industry, also found a negative impact of mergers on market power.

2.3.1.3. Reduce transaction costs and improve resource allocation

Research based on transaction cost theory focuses on how companies optimize their supply chains through mergers and acquisitions, reduce transaction costs, and improve resource allocation efficiency. Williamson [9] argued that the fundamental reason for corporate mergers and acquisitions is to save transaction costs. Previous studies differentiated M&A types based on the characteristics of the industries, geographic locations, and internal relationships of the merging companies, and then analyzed the performance of the M&A, essentially testing the effectiveness of different transaction cost savings through mergers. Moreover, the reasons for mergers are not necessarily technical. Economic organizational forms are only entirely determined by technology under two conditions: (1) possessing a superior and unique technology, and (2) the technology can only be matched by a very specific organizational form. However, this kind of superior technology is extremely rare, and such unique organizations to match the technology are almost nonexistent. Therefore, the main reason for mergers and acquisitions lies in saving transaction costs.

2.3.1.4. Acquire digital technologies, resources, and talent

The motivations behind corporate mergers and acquisitions are dynamic and change over time. Different companies may have different motivations when acquiring different targets. Mergers are the result of multiple factors acting together, and there is no single theory that can fully explain the motivations behind M&As [10]. With the development of digital technologies, the impact of digital transformation on corporate M&A motivations has become a new research focus. In addition to traditional motivations such as synergy effects and market power, motivations like diversification and managerial incentives are also considered. Su Dongwei found that when companies face significant market operating risks and have surplus resources, they may choose diversification, which not only helps absorb excess capacity and resources but also spreads operational risks, reduces transaction costs, and enables the coordinated development of the company [11]. Research by many Western scholars indicates that due to the separation of ownership and control, managers often make M&A decisions that serve their private interests, at the expense of shareholder wealth [12]. In China, the lack of ownership and supervision leads to a common phenomenon of "insider control" in listed companies, significantly affecting M&A performance [13]. Companies actively engage in mergers and acquisitions to acquire digital technologies, data resources, and digital talent. However, research on new motivations such as technology acquisition and data resource integration under the digital transformation context is still relatively scarce.

2.3.2. Corporate strategic adjustments

2.3.2.1. Reasons for strategic adjustment

The strategic adjustments made after mergers and acquisitions (M&A) are often the result of both internal and external factors. From the external environment, dynamic changes in market demand are key. With rapid shifts in consumer preferences, companies must adjust their strategies to meet new demands. For example, in the internet technology industry, consumer demand for convenient mobile office solutions and social entertainment has prompted many companies to acquire related startups and adjust their business strategies by shifting focus to mobile application development and services. In 2015, QiXin Group transformed its corporate strategic plan from traditional stationery marketing to a "hardware + software + services" strategy and formulated an "Internet +" strategic transformation plan. For QiXin Group to achieve its strategic transformation, it had to integrate with the "Internet +" industry and leverage the advantages of the internet for rapid development. In this context, QiXin Group chose to acquire Hangzhou MaiMiao and YinPeng Cloud, which were leaders in the SaaS business within the industry, in order to accelerate its own strategic transformation [14]. Changes in policies and regulations can also drive strategic adjustments. In the financial sector, regulatory policies constantly change in terms of capital adequacy and business scope. After an M&A, the financial institutions must adjust their business layout and operational strategies to comply with new regulations. Internally, the integration of resources and capabilities is an important consideration. If the resources of the merging companies cannot be effectively coordinated—such as differences in technology, culture, and market channels—then a strategic re-planning is necessary. This could involve adjusting strategies to preserve each company's technological strengths and rebuilding the cooperation model.

2.3.2.2. Paths of strategic adjustment

The paths of strategic adjustment are diverse. First is business restructuring. Companies often divest non-core businesses and concentrate resources on developing their core competencies. For example, General Electric, after a series of mergers and acquisitions, divested its traditional business areas such as home appliances and focused on core fields such as aviation engines and power equipment, thereby concentrating its business and enhancing overall competitiveness. Second is organizational structure reform. To adapt to the increased scale and business complexity after a merger, companies may need to redesign their organizational structure. For instance, when Lenovo acquired IBM’s personal computer business [15], it constructed a globally integrated organizational structure to merge the advantages of both companies’ resources, optimize management processes, and improve operational efficiency. Third is brand strategy adjustment. After a merger, a company may need to reposition its brands to avoid brand conflicts. For example, after Unilever acquired numerous brands, it implemented differentiated positioning for each, launching specialized products targeting different consumer groups and markets, thereby achieving multi-brand synergy [16].

2.3.2.3. Consequences of strategic adjustment

Positive Aspects: Successful strategic adjustments can improve corporate performance. By optimizing resource allocation and expanding market share, companies can achieve better outcomes. For instance, after Meituan acquired Mobike [17], it integrated the bike-sharing service into its ecosystem, expanding its business boundaries, increasing user engagement, and boosting revenue growth. Strategic adjustments also help enhance a company's innovation capability. By integrating the research and development (R&D) resources of the acquiring and target companies, a company can accelerate its innovation process. After Huawei acquired several technology companies, it absorbed their cutting-edge technologies and R&D talents, enhancing its telecommunications technology research and development strength and driving the innovation of 5G technology.

Negative Aspects: Strategic missteps may lead to internal confusion. Improper organizational adjustments can lead to management conflicts and employee turnover. For example, after HP acquired Compaq, the integration of their organizational structures was chaotic, leading to frequent management conflicts and performance declines [18]. Additionally, strategic adjustments could lead to financial difficulties. If the investment required for business restructuring is too large or the expected returns do not materialize, the financial burden of the company increases, affecting its debt repayment and long-term development ability. Previous research has primarily focused on target selection, valuation methods, and post-merger integration strategies. However, in the digital age, further research is needed to explore how corporate M&A strategies can adapt to the changes brought about by digital technology developments, how to assess the value of digital assets, and how to integrate digital businesses.

2.3.3. Digital transformation

2.3.3.1. Transformation methods

Technology Architecture Upgrades: After a merger, companies typically integrate the information technology infrastructure of both entities, discard outdated systems, and build a unified cloud platform architecture. For example, server resources, originally distributed across different regions and business units, are migrated to the cloud, enabling centralized data storage and management, which reduces hardware maintenance costs. At the same time, advanced technologies such as big data analytics, artificial intelligence, and machine learning are introduced to explore the potential value in massive business data [19]. For instance, machine learning algorithms can be used to analyze customer purchasing behavior, enabling targeted marketing and improving customer conversion rates and loyalty.

Digital Re-engineering of Business Processes: Breaking down the barriers between business processes of the merged companies, core business processes are reorganized and optimized [20]. Taking supply chain management as an example, digital tools are used to achieve end-to-end visibility and monitoring of the entire process, from raw material procurement and production to product distribution. By employing the Internet of Things (IoT) technology, real-time data from production line equipment is collected, and preventive maintenance is conducted based on data analysis results. This reduces equipment downtime, improves production efficiency, and enhances product quality. In addition, digital tools such as electronic contracts and invoices are introduced, automating and digitizing business processes, improving processing speed and accuracy.

Organizational Structure and Talent Transformation: To meet the needs of digital transformation, companies adjust their organizational structures by establishing dedicated digital transformation offices or teams responsible for overseeing and coordinating the transformation efforts. These teams are given cross-departmental decision-making authority to ensure the smooth progression of digital projects. In terms of talent, on one hand, companies recruit professionals with digital skills and experience, such as data scientists and digital marketing experts. On the other hand, they provide digital training for existing employees to enhance their digital literacy and skill levels, creating a digital culture that encourages employees to actively embrace digital change [21].

2.3.3.2. Economic consequences

Cost Efficiency: In the short term, digital transformation requires significant investment in technology procurement, system upgrades, and employee training, leading to increased costs. However, from a long-term perspective, the cost reduction effect is significant [22]. By re-engineering business processes and automating tasks, labor costs are reduced. For example, automated financial settlement processes significantly reduce the workload of financial personnel, saving labor costs. At the same time, precise supply chain management and optimized production plans reduce inventory costs and production waste. Research by Lv Kekov [23] and others on digital transformation shows that companies that successfully achieve digital transformation experience an average reduction in operating costs of 15%-20% within 3-5 years after transformation.

Revenue Growth: Digital transformation opens up new revenue streams for companies. By leveraging digital marketing tools, companies can expand market coverage and reach more potential customers [24]. For example, through social media platforms and online advertising, companies can attract customers worldwide, increasing product sales. Moreover, digital product and service innovation also serves as a new engine for revenue growth. Traditional manufacturing companies, for instance, can offer remote product monitoring and maintenance services as part of their digital transformation, providing value-added services and charging fees, thus shifting from a purely product sales model to a "product + service" model, which enhances profitability. According to data from listed companies in China from 2007 to 2018, companies that successfully implemented digital transformation experienced revenue growth rates 8-12 percentage points higher than those that did not undergo transformation [25].

Market Value Increase: In the capital market, the signal of digital transformation sends a positive message to investors, thereby enhancing the company’s market value. Digital transformation improves operational efficiency, boosts innovation capacity, and enhances the company’s growth potential, which is recognized by investors. For example, companies can use big data analytics for precise decision-making, improving return on investment and boosting investor confidence. In terms of stock price performance, companies that progress faster with digital transformation tend to have higher price-to-earnings ratios than the industry average [19], and their market capitalization increases, reflecting the market’s optimism about the future prospects of their digital transformation.

3. Case study introduction

3.1. Introduction of the merger parties

3.1.1. Acquiring party: Alibaba

Alibaba was founded in 1999 by Jack Ma, Joe Tsai, and 16 other individuals in Hangzhou, Zhejiang Province. It is a globally renowned internet giant with a wide range of businesses covering e-commerce, fintech, cloud computing, digital media, entertainment, and more. The company owns famous brands such as Taobao, Tmall, Alibaba Cloud, Alipay, and Cainiao Network, forming a vast business ecosystem. In the e-commerce sector, Taobao and Tmall have monthly active users numbering in the hundreds of millions, demonstrating strong competitive power; Alibaba Cloud, as China's leading cloud service provider, continues to experience revenue growth.

Alibaba's corporate strategy combines elements of both diversified and vertically integrated operations, with a stronger focus on diversification. The company's business layout spans multiple areas, including Taobao (C2C), Tmall (B2C), 1688 (B2B), and other e-commerce platforms; Alibaba Cloud, which provides cloud computing, big data, and AI services to businesses; new retail formats like Hema Xiansheng and Intime Department Store that integrate online and offline operations; and cross-border e-commerce platforms such as Lazada and AliExpress. These businesses are spread across different industries and markets, and while there are some synergistic effects, they operate independently, forming a broad ecosystem that reflects the core characteristics of a diversification strategy.

Alibaba also exhibits aspects of vertical integration in certain fields, particularly in its e-commerce ecosystem, where it integrates upstream and downstream resources to create a complete supply chain-to-consumer closed loop. At the upstream level, the 1688 platform connects manufacturers with suppliers, providing stable sources of goods and optimizing supply chain efficiency. In the midstream, Taobao and Tmall serve as core transaction platforms, connecting businesses with consumers and offering a diverse selection of products in a convenient transaction environment. Downstream, Cainiao Network ensures efficient delivery to consumers through intelligent logistics and distribution services, while Alipay provides payment and financial services, completing the transaction loop. Furthermore, Alibaba Cloud supports the entire ecosystem with cloud computing, big data, and AI technology, and its research arm, DAMO Academy, drives technological innovation, injecting continuous power into the e-commerce ecosystem. This vertical integration achieves seamless connection from the supply chain to the consumer end. Overall, Alibaba's strategy is centered on diversified operations, with the goal of building a large commercial ecosystem by entering multiple fields, while adopting vertical integration strategies in certain core businesses (such as e-commerce) to enhance competitiveness and control. This hybrid strategy enables the company to achieve synergies across various sectors while maintaining flexibility and innovation.

In recent years, Alibaba Group has conducted extensive and in-depth exploration and practice in the field of digital transformation. Through technological innovation and business model reform, the company has driven comprehensive upgrades of both itself and its ecosystem. By leveraging cloud computing and big data, intelligent logistics and supply chain management, new retail models, digital business services, and AI technology, Alibaba has fully promoted its digital transformation and that of its ecosystem. Its use of big data and AI technology in platforms such as Taobao and Tmall has optimized user experience, while Alibaba Cloud provides cloud computing and data solutions to support enterprise digitization. Cainiao Network enhances logistics efficiency, Ant Group drives fintech and blockchain applications, and Hema Xiansheng and smart stores reshape the retail sector. At the same time, Alibaba has expanded its cross-border e-commerce business through its globalization strategy, utilized DingTalk for enterprise digital management, advanced frontier technology research through DAMO Academy, and contributed to sustainable development through green data centers and digital agriculture. These efforts not only strengthen Alibaba's core competitiveness but also provide valuable reference for the industry's digital transformation, demonstrating the profound impact of digital technologies on business models. Alibaba plays a key role in advancing China's and the global digital economy, continuously expanding its business boundaries through innovation and strategic layout.

3.1.2. Target company: Ele.me

Ele.me was founded in 2008 and is China’s leading food delivery platform. Ele.me's market coverage spans over 2,000 cities across China, including first-tier, second-tier, third-tier, and lower-tier cities, with hundreds of millions of registered users. The platform’s monthly active user count (MAU) continues to grow, especially with a significant market share among younger users. Ele.me has attracted millions of food and retail merchants, ranging from large chain brands to small and medium-sized local restaurants, offering a wide variety of choices. Additionally, it has established an efficient and instantaneous delivery system with a vast team of delivery personnel, capable of responding quickly to order demands and covering core areas and surrounding regions of the cities. In addition to food delivery, Ele.me has expanded into instant delivery services for fresh produce, supermarkets, pharmaceuticals, and other sectors, further expanding its market reach. Furthermore, through its intelligent scheduling system and data analysis capabilities, it has optimized delivery efficiency and service quality, thus increasing market penetration.

Ele.me has constructed a comprehensive digital operation framework that enables efficient coordination and intelligent management across the entire process, from the user end to the delivery end. The company’s digital operations are divided into the user end, merchant end, delivery end, and back-end management. The operations are designed for high efficiency through flattening, middle platform support, and ecosystem collaboration. As a representative digital enterprise, Ele.me benefits from a strong digital workforce, relying on a powerful frontier technology team consisting of data scientists, algorithm engineers, software developers, and product managers, all focused on the platform’s technological innovation and optimization. It also has teams for user operations, merchant operations, and delivery operations, which are responsible for daily operations, activity planning, and resource coordination on the platform. The data analysis team analyzes user behavior, order data, and market trends to provide data support for business decisions. The rider management and support team handles recruitment, training, scheduling, and performance management of riders, ensuring delivery efficiency and service quality, thus collectively building an efficient and collaborative digital operation system. The core digital technologies driving this system include intelligent scheduling, data platforms, cloud computing, and AI customer service, enabling the entire process from order placement to delivery to be fully digitized. This improves business efficiency and user experience, creating an efficient and intelligent food delivery and local services platform. This architecture not only enhances user experience and operational efficiency but also provides a strong foundation for Ele.me to maintain a leading position in the highly competitive market.

3.2. M&A process

In April 2016, Ele.me officially announced it had received an investment of $1.25 billion, with Alibaba contributing $900 million and Ant Financial investing $350 million. Prior to this, Ele.me had rapidly risen in the food delivery market but faced fierce competition from Meituan, requiring capital and resource support. Alibaba sought to invest in the local lifestyle services sector and establish a strategic partnership with Ele.me. This investment addressed both parties' needs and marked the beginning of their collaboration. As a result, Alibaba became an important shareholder in Ele.me and aimed to further strengthen its control over Ele.me to advance its new retail strategy.

In April 2017, to integrate Ele.me's delivery capabilities with Koubei's merchant resources and create synergies, Alibaba and Ant Financial further increased their stake in Ele.me with a total investment of $400 million, making them one of Ele.me's largest shareholders. This enhanced Alibaba's capital control and provided Ele.me with ample funding to expand its scale and invest in technology, helping it grow in the competitive food delivery market. The deepened capital tie transformed their relationship from a strategic partnership to a more tightly bound collaboration. In terms of business, Alibaba deeply integrated its local lifestyle services platform, "Koubei," with Ele.me, creating a complete local services system that combines "home delivery + in-store services." This integration strengthened the parties' positions in local lifestyle services, new retail, technology empowerment, and ecosystem collaboration, not only solidifying Ele.me's market position but also offering significant support for Alibaba's digital transformation and ecosystem expansion.

In April 2018, Alibaba, aiming for full control of Ele.me's operations and to incorporate it into its ecosystem, jointly with Ant Financial, fully acquired Ele.me for $9.5 billion. This acquisition set a record as the largest cash acquisition in China’s internet sector at the time and attracted significant attention within the industry. By fully acquiring Ele.me, Alibaba integrated Ele.me completely into its new retail strategy, deeply merging it with its ecosystem's online and offline resources and other businesses.

4. Case analysis

4.1. Analysis of M&A motives

4.1.1. Strengthening digital capabilities

Ele.me was chosen as the M&A target in Alibaba’s corporate strategy primarily due to its technological advantages and rich data resources in digital systems. These include intelligent order scheduling, user profiling and personalized recommendations, merchant digital empowerment, real-time delivery networks, data platforms and cloud computing, intelligent customer service, and risk control systems. These digital systems are key components of Ele.me’s core competitiveness. Ele.me’s leading position in the food delivery market complements Alibaba's local services layout. Ele.me’s real-time delivery algorithm can intelligently schedule orders based on multiple data dimensions such as merchant location, order density, and rider location, ensuring precise assignment of orders to the most suitable rider, which significantly improves delivery efficiency. By integrating this well-established real-time delivery network into Alibaba's technology ecosystem, it helps further integrate online and offline resources, enhancing the group's digital capabilities in logistics and intelligent decision-making, and driving the new retail strategy. At the same time, this acquisition strengthens Alibaba's competitiveness in the O2O (online-to-offline) space, providing critical support for its digital transformation. Therefore, through the acquisition of Ele.me, Alibaba can access these technologies and data, further perfecting its technical layout and data assets in the local services sector, and improving its digital service capabilities. Ele.me’s digital operational capabilities and technological advantages also provide Alibaba with stronger competitiveness, enabling it to better respond to challenges from competitors like Meituan.

From Alibaba’s overall strategic perspective, this acquisition is a crucial step in building a digital ecosystem. Local lifestyle services are an indispensable part of the digital ecosystem, and acquiring Ele.me helps Alibaba deeply integrate e-commerce, finance, logistics, cloud computing, and local lifestyle services to create a mutually reinforcing, collaborative development ecosystem, solidifying its leading position in the digital economy. Ele.me’s business complements Alibaba’s Koubei (in-store services) and Hema Fresh (new retail), collectively constructing a "home delivery + in-store" local service ecosystem.Alibaba integrates the data and services of these businesses to provide a more comprehensive and convenient digital lifestyle experience for users, and a one-stop digital operation solution for merchants, further enhancing the competitiveness of the entire ecosystem.

4.1.2. Market expansion

Through the acquisition of Ele.me, Alibaba can expand into two key markets: the local lifestyle services market and the delivery logistics market. In the local lifestyle services market, it can further expand and solidify its position. The local lifestyle market is a high-frequency, high-potential consumption scenario, covering food delivery, in-store services, fresh food delivery, and other sectors. This market naturally synergizes with Alibaba's core businesses, including e-commerce, Alipay, and the Cainiao logistics network. The acquisition not only allows Alibaba to quickly gain Ele.me’s platform, market share, and user base in the food delivery sector, but also leverages Ele.me’s delivery network and merchant resources to accelerate its penetration into the local lifestyle services market. By integrating Ele.me’s business and undergoing business transformation, Alibaba has further enriched its ecosystem, expanding its market coverage from online e-commerce to offline local lifestyle services. This enables it to offer a seamless consumer experience that meets users' diverse consumption needs, enhancing user stickiness and market competitiveness, while also laying a solid foundation for its current digital transformation and future new retail strategy.

In the delivery logistics market, Alibaba’s Cainiao network can utilize Ele.me’s delivery network to expand its business in the real-time delivery sector and optimize logistics resource allocation. At the same time, Ele.me’s integration with platforms like Alipay and Taobao allows users to easily access Ele.me to place orders while using these platforms, greatly increasing Ele.me’s exposure and order volume.

4.1.3. Acquiring user resources

As China’s leading food delivery platform, Ele.me has a large, young user base and frequent consumption scenarios. The vast consumer data, merchant operation data, and other information accumulated by Ele.me complement Alibaba's existing e-commerce data, payment functions, and logistics ecosystem. Alibaba not only gains direct access to Ele.me’s hundreds of millions of users, allowing it to gain a more comprehensive insight into user needs, which provides strong support for targeted marketing and personalized recommendations, but also integrates these users with platforms like Taobao, Alipay, and Koubei, achieving data interoperability and traffic synergy. This integration increases user stickiness and consumption frequency, further expanding its user coverage and market share in the local lifestyle services sector. Moreover, Ele.me’s user behavior data provides Alibaba with more detailed user profiles, which helps in precise marketing and personalized services, thereby further consolidating its competitive advantage in the local lifestyle services market. This acquisition not only helps Alibaba quickly enter the high-frequency local lifestyle market but also uses the synergies of the digital ecosystem to provide an important user base for building a more complete digital ecosystem.

4.1.4. Financial synergy

Alibaba's goals for the acquisition, in terms of profitability, are to quickly gain market share in the local lifestyle services sector, thereby increasing revenue sources and enhancing overall revenue scale. Ele.me’s high-frequency transaction scenarios generate synergies with Alibaba's various businesses, further boosting user activity and transaction frequency, enhancing the platform’s monetization ability. The integration of Ele.me’s logistics and delivery network with Alibaba's Cainiao network optimizes delivery efficiency and reduces operational costs, achieving economies of scale. Additionally, by acquiring Ele.me, Alibaba gains its accumulated user data, merchant resources, and digital capabilities, providing data support for targeted marketing and business expansion, further enhancing financial returns and investment value.Overall, this acquisition not only strengthens Alibaba’s competitiveness in the local lifestyle services sector but also realizes resource optimization and long-term value creation through financial synergies [25].

4.2. Acquisition results

4.2.1. Improvement in financial performance and revenue growth

From Alibaba’s perspective, the acquisition led to significant growth in its financial metrics. According to Alibaba's financial reports, revenue in the local services sector has continued to grow post-acquisition, but the growth rate has been affected by market competition from Meituan and others. For example, in FY 2020, local services revenue reached 25.44 billion RMB, a 41% year-on-year increase. Alibaba’ s annual report [26] noted that Ele.me’ s daily order volume had seen significant growth. However, due to fierce market competition and high subsidies, Ele.me was still in a loss-making state post-acquisition. The losses in the local services sector put pressure on overall profit margins. To address this, Alibaba enhanced Ele.me's operational efficiency and user experience through technological empowerment, ecosystem synergy, and new retail integration. Despite these efforts, Ele.me's profitability and market share still faced challenges from Meituan's strong competition. Alibaba subsequently made large subsidies and marketing investments, resulting in a significant increase in the costs of the local services sector, which impacted short-term profitability. However, in the long run, Ele.me's business growth has brought new revenue growth points for Alibaba. As business integration progresses, synergies gradually emerge, cost control is optimized, and overall profitability improves.

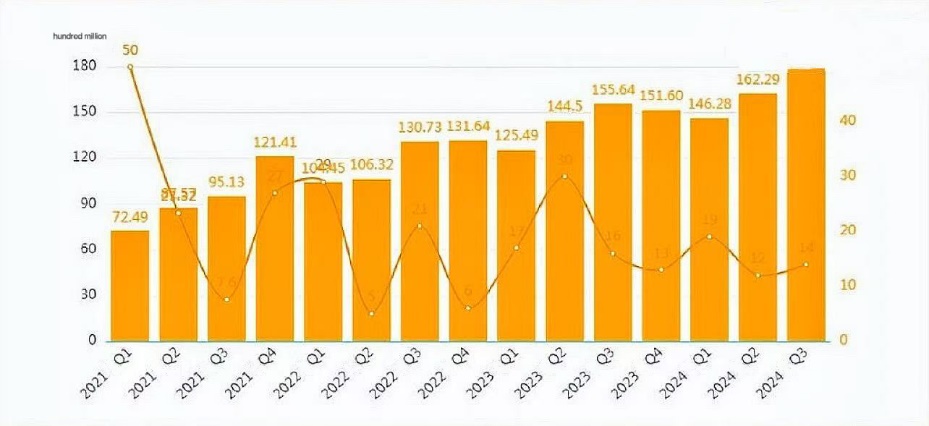

Alibaba's share of revenue from the local services market has increased year by year. In FY 2024, the local services group, composed of “to home” (Ele.me) and “to destination” (AutoNavi), reported revenue of 59.8 billion RMB, a 19% increase year-on-year. Adjusted EBITA loss was reduced from 13.1 billion RMB in the previous fiscal year to 9.8 billion RMB, a 25% reduction in loss. In Q3 of FY 2025, driven by increased orders from Ele.me and AutoNavi, local services group revenue grew 12% year-on-year to 16.99 billion RMB, with losses narrowing from 2.068 billion RMB in the same period last year to 596 million RMB. Below is a chart of Alibaba's local services revenue and year-on-year growth rate:

Figure 1: Alibaba local services revenue and year-on-year growth rate chart

Source: Wangjing She

Ele.me gradually lost its leading position in the fierce food delivery market, and its market share continued to decline. Since the second half of 2018, Ele.me's market share has been gradually surpassed by Meituan. Although according to data released by Analysys in September 2019, Ele.me’s overall market share continued to rise to 43.9%, as shown in Figure 2:

Figure 2: Market share trend of Ele.me + Baidu Waimai from 2017-2019

Data source: Analysys monitoring data

However, by July 2020, Ele.me’s market share fell below 30%. By the first half of 2021, Ele.me’s market share further dropped to around 25%.

4.2.2. User growth

Through the integration of both parties' user systems, Alibaba achieved the sharing and transformation of user resources. In FY 2021, Ele.me continued to enhance merchant supply and operational efficiency, with the number of merchants increasing. At the same time, the number of Ele.me Super Members saw strong growth, with membership numbers increasing by about 40% year-on-year in Q4 of FY 2021. Not only did Ele.me’s user base grow, but user activity across Alibaba’s other businesses also benefited from the addition of local services, enhancing the overall ecosystem's attractiveness to users. However, despite Alibaba’s significant investment in Ele.me, Ele.me’s market share increased post-acquisition but still lagged behind Meituan. Meituan’s dominance in the food delivery market remained strong. Figure 3: Monthly Active User Statistics for Food Delivery Apps in Q2 2017 is as follow.

Figure 3: Monthly active user statistics for food delivery apps in Q2 2017

Source: China business industry research institute

4.2.3. Enhancement of digital capabilities

Since acquiring Ele.me, Alibaba’s digital capabilities have received strong support. Firstly, Ele.me has deeply integrated with Alibaba's technology, driving the digital upgrade of local life services. Ele.me’s instant delivery algorithms, intelligent scheduling system, and data middle platform have been integrated with Alibaba’s cloud computing, big data, and artificial intelligence technologies. This integration further optimized the end-to-end digital experience in local life services, enhancing operational efficiency, user experience, and the group’s overall digital capabilities in logistics, delivery, and intelligent decision-making, successfully achieving technological collaboration and innovation.

Moreover,Alibaba leveraged Ele.me's digital practices to empower the entire ecosystem and improve user experience. Through Ele.me’s digital practices, Alibaba gained valuable technical expertise in instant delivery, intelligent scheduling, and user operations, which were then applied to other business segments and partners. Furthermore, by leveraging Ele.me’s technology and operational experience, the user experience in local life services was significantly enhanced, such as more efficient delivery services, more accurate recommendation algorithms, and more intelligent customer service systems. The integration of both companies’ data allowed Alibaba to gain deeper insights into user needs, providing strong support for precision marketing and personalized recommendations, further strengthening its advantage in the digital services sector.

5. Research conclusion and recommendations

5.1. Research conclusions

5.1.1. Diversification of merger and acquisition motivations

In the context of digital transformation, the motivations for mergers and acquisitions (M&A) have become increasingly diversified. Key driving factors include acquiring technology, market expansion, business transformation, and data resource integration. The case of Alibaba's acquisition of Ele.me demonstrates that M&A not only allows firms to acquire digital technologies and data resources but also facilitates market share expansion, enhances user loyalty, and achieves financial synergies. These motivations are interwoven, collectively driving companies to leverage M&A as a tool for digital transformation and strategic upgrades.

5.1.2. Significant adjustments in M&A strategy

Digital transformation has deeply influenced corporate M&A strategies, particularly in terms of target selection, valuation methods, and integration strategies. After acquiring Ele.me, Alibaba placed a stronger emphasis on the integration of digital technologies and data resources. It adopted new valuation methods to assess digital assets and focused on technology and business integration, data management, and organizational culture changes during the integration process. These strategic adjustments significantly enhanced Alibaba's competitiveness in the local life services sector.

5.2. Management recommendations

5.2.1. Clarify merger and acquisition strategic objectives

Before implementing a merger or acquisition, companies should thoroughly analyze their own digital transformation needs and clearly define the strategic objectives of the M&A. This ensures that the M&A activity aligns with the overall strategic direction of the company and avoids blindly following trends. Alibaba's acquisition of Ele.me successfully expanded its local life services market and achieved deep integration of technology and business, thanks to its clear strategic goals.

5.2.2. Enhance digital asset valuation

Given the unique characteristics of digital assets, companies should establish scientifically sound valuation models and methods to accurately assess the value of target enterprises. Alibaba, during its acquisition of Ele.me, fully considered the potential value of its digital technologies and data resources, thereby avoiding M&A risks arising from incorrect valuations. In M&A negotiations, the potential value and risk factors of digital assets should also be carefully considered.

5.3. Research limitations

5.3.1. Limited sample size

This research primarily focuses on the case study of Alibaba's acquisition of Ele.me, which involves a single sample. This limited sample size may introduce certain limitations. Future studies could expand the sample size to include more M&A cases across different industries and companies, thereby enhancing the generalizability of the findings.

5.3.2. Insufficient quantitative analysis

While this study employs event study methods and case analysis, the application of some complex quantitative models is not explored in depth. The evaluation of M&A performance may not be fully comprehensive. Future research could incorporate more quantitative analysis methods, such as financial indicator analysis and data mining, to offer a more holistic assessment of M&A performance.

5.4. Research outlook

Future studies can investigate the differences in M&A motivations and integration strategies between industries and companies of different sizes, providing more targeted M&A strategic guidance. For example, M&A motives and integration strategies may differ significantly between traditional industries and internet-based industries during their digital transformation. As digital technologies continue to evolve, new M&A models and business models may emerge, such as M&As based on blockchain technology or data asset transactions. Future research should closely monitor these emerging models and examine their impact on corporate M&A strategies. Additionally, future studies could strengthen the tracking and analysis of long-term performance post-M&A, especially regarding how integration efforts under digital transformation affect a company's market competitiveness and innovation capabilities in the long run. Alibaba’s acquisition of Ele.me demonstrates that despite facing market competition and financial pressure in the short term, M&A can provide significant technological synergy and market expansion opportunities in the long run.

References

[1]. Weston J F,Chung K S,Hoag S.Mergers,restructuring,and corporate control[M].Upper Saddle River:Prentice Hall,1990.

[2]. Ai, Q., & Xiang, Z. (2004). The motives and theoretical analysis of corporate mergers and acquisitions. Journal of Zhongnan University of Economics and Law, (02), 113-117.

[3]. Zhang, Q., & Zhou, L. (2003). Research and development of the synergy effect of corporate mergers and acquisitions. Accounting Research, (06), 44-47.

[4]. Barton D M, Sherman R.The price and profit effects of horizontal merger:A case study[J].Journal of Industrial Economics, 1984, 33 (2) :165-77.

[5]. Vita M G, Sacher S.The competitive effects of not-for-profit hospital mergers:a case study[J].Journal of Industrial Economics, 2001, 49 (1) :63–84.

[6]. Ellert J C.Mergers, antitrust law enforcement and stockholder returns[J].Journal of Finance, 1976, 31 (2) :715–732.

[7]. Moeller S B, Schlingemann F P, Stulz R M.Wealth destruction on a massive scale?A study of acquiring-firm returns in the recent merger wave[J].Journal of Finance, 2005, 60 (2) :757-782.

[8]. Focarelli D, Panetta F.Are mergers beneficial to consumers?Evidence from the market for bank deposits[J].American Economic Review, 2003, 93 (4) :1152-1172.

[9]. Williamson, O. (2003). Capitalist economic systems. Beijing: Commercial Press.

[10]. Zeng, H. (2016). A literature review of the motives for corporate mergers and acquisitions. Modern Economic Information, (08), 134-135.

[11]. Zeng, H. (2016). A literature review of the motives for corporate mergers and acquisitions. Modern Economic Information, (08), 134-135.

[12]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[13]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[14]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[15]. Zhang, Q. (2020). A study on the performance of Lenovo Group's acquisition of IBM's x86 business (Master’s thesis). Lanzhou University of Finance and Economics. https://doi.org/10.27732/d.cnki.gnzsx.2020.000231

[16]. Wang, L. (2015). A study on Unilever's acquisition strategy under the "Going Out" background. Modern Economic Information, (06), 25.

[17]. Tan, W. (2022). Financial synergy analysis of Meituan's acquisition of Mobike. Northern Economic and Trade, (01), 90-93.

[18]. Zhou, C., & Zhang, J. (2003). The option characteristics of corporate mergers and acquisitions and their option value measurement: An evaluation of HP's acquisition of Compaq. Price Theory and Practice, (03), 55-56. https://doi.org/10.19851/j.cnki.cn11-1010/f.2003.03.031

[19]. Wu, F., Hu, H., Lin, H., et al. (2021). Corporate digital transformation and capital market performance: Empirical evidence from stock liquidity. Management World, 37(07), 130-144+10. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

[20]. Wu, F., Hu, H., Lin, H., et al. (2021). Corporate digital transformation and capital market performance: Empirical evidence from stock liquidity. Management World, 37(07), 130-144+10. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

[21]. Yan, R., & Qian, X. (2018). Strategic analysis of digital transformation of Chinese operators in the era of digital economy. China Soft Science, (04), 172-182.

[22]. Zhang, Y., Li, X., & Xing, M. (2021). Corporate digital transformation and audit pricing. Audit Research, (03), 62-71.

[23]. Lv, K., Yu, M., & Ruan, Y. (2023). Corporate digital transformation and resource allocation efficiency. Science Research Management, 44(08), 11-20. https://doi.org/10.19571/j.cnki.1000-2995.2023.08.002

[24]. Yi, J., & Wang, Y. (2021). The impact of digital transformation on corporate exports. China Soft Science, (03), 94-104.

[25]. Yi, J., & Wang, Y. (2021). The impact of digital transformation on corporate exports. China Soft Science, (03), 94-104.

[26]. Xiong, Y., & Pei, X. (2022). Research on the accounting of corporate data assets: A case study of Alibaba. Chinese Certified Public Accountant, (03), 111-116. https://doi.org/10.16292/j.cnki.issn1009-6345.2022.03.023

Cite this article

She,X. (2025). Research on Corporate M&A Motives and Strategic Adjustment Paths in the Context of Digital Transformation — A Case Study of Alibaba's Acquisition of Ele.me. Advances in Economics, Management and Political Sciences,170,137-152.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 9th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Weston J F,Chung K S,Hoag S.Mergers,restructuring,and corporate control[M].Upper Saddle River:Prentice Hall,1990.

[2]. Ai, Q., & Xiang, Z. (2004). The motives and theoretical analysis of corporate mergers and acquisitions. Journal of Zhongnan University of Economics and Law, (02), 113-117.

[3]. Zhang, Q., & Zhou, L. (2003). Research and development of the synergy effect of corporate mergers and acquisitions. Accounting Research, (06), 44-47.

[4]. Barton D M, Sherman R.The price and profit effects of horizontal merger:A case study[J].Journal of Industrial Economics, 1984, 33 (2) :165-77.

[5]. Vita M G, Sacher S.The competitive effects of not-for-profit hospital mergers:a case study[J].Journal of Industrial Economics, 2001, 49 (1) :63–84.

[6]. Ellert J C.Mergers, antitrust law enforcement and stockholder returns[J].Journal of Finance, 1976, 31 (2) :715–732.

[7]. Moeller S B, Schlingemann F P, Stulz R M.Wealth destruction on a massive scale?A study of acquiring-firm returns in the recent merger wave[J].Journal of Finance, 2005, 60 (2) :757-782.

[8]. Focarelli D, Panetta F.Are mergers beneficial to consumers?Evidence from the market for bank deposits[J].American Economic Review, 2003, 93 (4) :1152-1172.

[9]. Williamson, O. (2003). Capitalist economic systems. Beijing: Commercial Press.

[10]. Zeng, H. (2016). A literature review of the motives for corporate mergers and acquisitions. Modern Economic Information, (08), 134-135.

[11]. Zeng, H. (2016). A literature review of the motives for corporate mergers and acquisitions. Modern Economic Information, (08), 134-135.

[12]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[13]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[14]. C.Tuch,N.O.Sullivan.The Impact of Acquisitions on Firm Performance:A Review of the Evidence.International Journal of Management Review,2007,9(2):pp.141~170.

[15]. Zhang, Q. (2020). A study on the performance of Lenovo Group's acquisition of IBM's x86 business (Master’s thesis). Lanzhou University of Finance and Economics. https://doi.org/10.27732/d.cnki.gnzsx.2020.000231

[16]. Wang, L. (2015). A study on Unilever's acquisition strategy under the "Going Out" background. Modern Economic Information, (06), 25.

[17]. Tan, W. (2022). Financial synergy analysis of Meituan's acquisition of Mobike. Northern Economic and Trade, (01), 90-93.

[18]. Zhou, C., & Zhang, J. (2003). The option characteristics of corporate mergers and acquisitions and their option value measurement: An evaluation of HP's acquisition of Compaq. Price Theory and Practice, (03), 55-56. https://doi.org/10.19851/j.cnki.cn11-1010/f.2003.03.031

[19]. Wu, F., Hu, H., Lin, H., et al. (2021). Corporate digital transformation and capital market performance: Empirical evidence from stock liquidity. Management World, 37(07), 130-144+10. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

[20]. Wu, F., Hu, H., Lin, H., et al. (2021). Corporate digital transformation and capital market performance: Empirical evidence from stock liquidity. Management World, 37(07), 130-144+10. https://doi.org/10.19744/j.cnki.11-1235/f.2021.0097

[21]. Yan, R., & Qian, X. (2018). Strategic analysis of digital transformation of Chinese operators in the era of digital economy. China Soft Science, (04), 172-182.

[22]. Zhang, Y., Li, X., & Xing, M. (2021). Corporate digital transformation and audit pricing. Audit Research, (03), 62-71.

[23]. Lv, K., Yu, M., & Ruan, Y. (2023). Corporate digital transformation and resource allocation efficiency. Science Research Management, 44(08), 11-20. https://doi.org/10.19571/j.cnki.1000-2995.2023.08.002

[24]. Yi, J., & Wang, Y. (2021). The impact of digital transformation on corporate exports. China Soft Science, (03), 94-104.

[25]. Yi, J., & Wang, Y. (2021). The impact of digital transformation on corporate exports. China Soft Science, (03), 94-104.

[26]. Xiong, Y., & Pei, X. (2022). Research on the accounting of corporate data assets: A case study of Alibaba. Chinese Certified Public Accountant, (03), 111-116. https://doi.org/10.16292/j.cnki.issn1009-6345.2022.03.023