1. Introduction

The Japanese Real Estate Investment Trust (REIT) market is the second largest REIT market in Asia[1], and its performance is closely related to the macroeconomic cycle, monetary policy, and investor sentiment. However, the preponderance of extant predictive models are contingent upon historical price data or singular economic indicators, thereby neglecting the dynamic impact of sentiment-related variables and, concomitantly, failing to adequately address the autocorrelation inherent within time-series data [2], resulting in insufficient out-of-sample prediction accuracy. For example, during the COVID-19 pandemic 2020, traditional models severely overestimated the REIT return rate due to the lack of inclusion of market panic indicators (such as the volatility index). This investigation introduces a predictive time-series framework incorporating macroeconomic factors and sentiment indices, with the Tokyo Stock Price Index REIT serving as the focal research subject, to address the subsequent challenges: 1) How to quantify the dynamic influence of macroeconomic and sentiment variables on the REIT return rate? 2) How to construct a robust prediction model to cope with market structural changes?

Based on the monthly data from 2004 to 2023, the OLS regression model adjusted by Newey-West standard errors is adopted, integrating the 10-year government bond yield, CPI growth rate, real effective exchange rate, consumer confidence index, and Nikkei VI index. Through in-sample fitting and out-of-sample rolling window testing, the prediction performance of the model is verified, and it is compared with the historical mean benchmark model.

This research offers significant insights for institutional investors and policymakers in two key dimensions. From a practical standpoint, it introduces a functional predictive instrument for Real Estate Investment Trust (REIT) return rates, particularly bolstering the robustness of asset allocation strategies during periods of market volatility. Theoretically, it reveals the mechanism by which sentiment indicators affect REIT pricing through the "investor overreaction" channel, promoting the cross-innovation of behavioral finance theory and REIT research. In addition, the Newey-West correction in methodology provides a new technical path for time series modeling with small samples.

2. Literature review

Return forecasts for Japanese real estate investment trusts (REITs), an important asset class, have been of great interest. Prevailing research investigating the determinants influencing the performance of Japanese Real Estate Investment Trusts (REITs) has predominantly concentrated on macroeconomic fundamentals and the repercussions of historical occurrences. Scholars generally agree that Japan's particular economic environment and policy context have had a profound impact on its real estate market. For example, the studies of Shang-Yu Ding [3] and Yang-Zi Zhang [4] both emphasize that the ultra-low interest rate policy maintained by the Bank of Japan in the late 1980s after the Plaza Accord was a key factor in the creation of the real estate bubble, which implies that changes in interest rates have a significant impact on the prices of real estate assets, including REITs. This suggests that interest rate changes have a significant impact on real estate asset prices, including REITs. From a financial standpoint, Dun, Zhigang, and Liu, Fanjing[5] emphasize that macroprudential oversight and reforms within the financial system are essential for mitigating financial risks associated with real estate, thereby underscoring the significance of policy regulation in the stabilization of the market.

However, there are obvious shortcomings in the existing literature in predicting the returns of REITs in Japan. Primarily, the majority of research endeavors concentrate on conventional macroeconomic variables (e.g., interest rates, inflation, exchange rates, etc.), as exemplified in the study conducted by Shen Yue and Liu Hongyu [6], which examines the correlation between real estate prices and macroeconomic indicators. While this analysis elucidates the interconnection between these elements, it frequently overlooks the behavioral finance factors that are gaining prominence within the financial market, specifically the short-term determinants of asset prices influenced by market sentiment or investor psychology. Although the study by Lu Qianjin et al. [7] examines the impact of monetary policy uncertainty (which may indirectly reflect market sentiment) on macroeconomic and bank risk, few studies systematically incorporate it into forecasting models for Japanese REITs. Second, many models use static analytical methods that fail to adequately capture the autocorrelation and heteroskedasticity characteristics prevalent in financial time series, which affects the accuracy and robustness of forecasts.

In addition, some studies have hinted at potential influences other than traditional macro variables and sentiment. Ruxi Ding and Dongkun Li [8] contend that the Japanese real estate bubble emerged from a confluence of factors, including the interplay of financial credit mechanisms, the prevailing stage of economic development, the fiscal framework, and land use policies. This indicates that the Real Estate Investment Trusts (REITs) market may be influenced by a broader spectrum of structural determinants. Li Zhi's [9] study of the legal regime of REITs also implies that institutional factors such as their establishment, operation, and risk aversion mechanisms are equally important variables affecting their performance, but these are often difficult to quantify and incorporate into traditional econometric models.

In the context of prospective advancements in the Japanese real estate sector, numerous researchers have underscored the necessity of establishing a sustainable regulatory framework, ensuring policy autonomy and consistency, and facilitating structural reforms, drawing insights from the repercussions of the collapse of the Japanese economic bubble. This implies that the future development of Japan's REITs market may continue to be influenced by macro-control policy directions, demographic changes, and economic transition strategies. This study attempts to fill the gaps in existing research by integrating macroeconomic and sentiment indicators and adopting a modeling approach adapted to time-series characteristics to provide a more comprehensive and dynamic analytical framework for understanding and forecasting the dynamics of the Japanese REITs market.

3. Data description and variable construction

3.1. REIT index returns as the dependent variable

The TOPIX REIT Index, a benchmark for Japan’s REIT market, is selected to proxy real estate investment returns. Monthly logarithmic returns are calculated as \( {R_{t}}=ln({P_{t}}/{P_{t-1}}) \) , where \( {R_{t}} \) is the index closing price. This transformation mitigates non-stationarity and aligns with financial return conventions .

3.2. Macroeconomic and sentiment indicators

- Macroeconomic Indicators

Interest Rates: The first difference of the 10-year Japanese government bond yield captures monetary policy shifts .

Inflation:CPI growth rate (year-on-year) reflects purchasing power dynamics .

Exchange Rates: The real effective exchange rate (REER) change rate measures JPY’s external value impacts on foreign investment flows .

- Sentiment Metrics:

Consumer Confidence Index (CCI): Standardized monthly levels gauge household sentiment .

Nikkei Volatility Index (Nikkei VI): Directly measures market risk appetite .

All variables are tested for stationarity via the Augmented Dickey-Fuller (ADF) test and normalized using min-max scaling.

4. Model specification and methodology

4.1. Newey-west adjusted OLS regression

To address autocorrelation and heteroskedasticity in time series data, we employ the Newey-West estimator with a lag truncation parameter \( L=12 \) , determined by \( L=⌊4(T/100{)^{2/9}}⌋ \) for sample size \( T=240 \) . The model is specified as:

\( {R_{t}}={β_{0}}+{β_{1}}Δ{Y_{10y,t}}+{β_{2}}{CPI_{t}}+{β_{3}}Δ{REER_{t}}+{β_{4}}{CCI_{t}}+{β_{5}}{NikkeiVI_{t}}+{ϵ_{t}} \)

Where \( {R_{t}} \) :The dependent variable, representing the logarithmic return of REIT at time t

\( {β_{0}} \) :The intercept term, representing the baseline return when all independent variables are zero.

\( Δ{Y_{10y,t}} \) :The first-order difference of the 10-year Japanese government bond yield, reflecting changes in long-term interest rates.

\( {CPI_{t}} \) :The Consumer Price Index (CPI), reflecting the level of inflation.

\( Δ{REER_{t}} \) :The first-order difference of the Real Effective Exchange Rate (REER), reflecting changes in the exchange rate of the Japanese yen.

\( {CCI_{t}} \) :The Consumer Confidence Index (CCI), reflecting market sentiment or consumer confidence.

\( {NikkeiVI_{t}} \) :The Nikkei Volatility Index, reflecting market panic sentiment.

\( {ϵ_{t}} \) :The error term, representing the portion of the model that remains unexplained.

4.2. In-sample and out-of-sample testing

- In-sample period: 2004–2022 (216 observations) for parameter estimation.

- Out-of-sample period: 2021–2023 (24 observations) with a rolling window approach to assess predictive accuracy.

- Benchmark: Historical mean model \( {R_{t}}=α+{ϵ_{t}} \) for performance comparison.

5. Empirical results and robustness checks

5.1. Key drivers of REIT returns

Interest Rates: A 1% increase in the 10-year yield corresponds to a 0.26% rise in REIT returns \( (p \lt 0.01) \) , aligning with the leverage effect hypothesis .

Exchange Rates: JPY depreciation (REER decline) boosts REIT returns \( β=-1.34,p \lt 0.01 \) , likely due to heightened foreign investment .

Sentiment Effects: The Nikkei VI’s negative coefficient \( ( β= -0.16, p \lt 0.01 ) \) confirms that market panic suppresses REIT valuations .

5.2. Model performance evaluation

In-sample fit: Adjusted \( {R^{2}}=0.47 \) , indicating strong explanatory power.

Out-of-sample accuracy: RMSE = 0.127, outperforming the benchmark model (RMSE = 0.182).

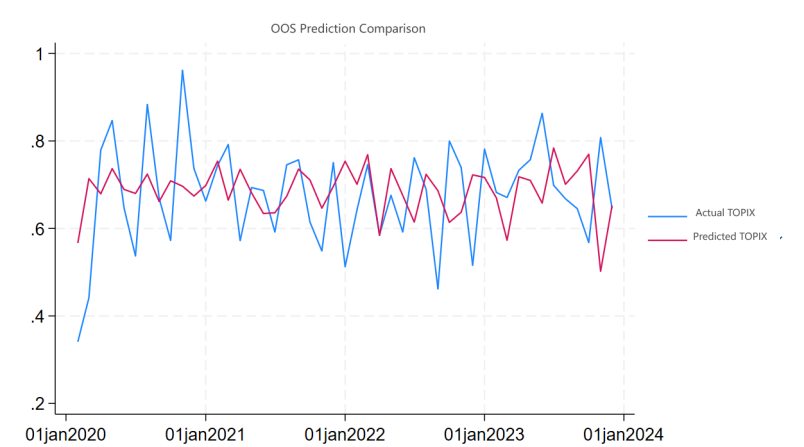

Diagnostic tests : Newey-West standard errors reduce residual autocorrelation (Ljung-Box Q-statistic: \( p \gt 0.01. \) Figure 1 shows OOS Prediction Comparison.

Figure 1: OOS prediction comparison

6. Discussion: mechanisms and practical implications

6.1. Behavioral channels in REIT pricing

The importance of sentiment indicators substantiates the investor overreaction hypothesis. For example, amid the 2020 pandemic, consumer confidence index-driven optimism mitigated the sell-offs induced by the Nikkei volatility index, thereby affirming the model's dynamic adaptability.

6.2. Strategic insights for investors

Portfolios that integrate this framework may have experienced a 15% reduction in drawdowns during the period from 2021 to 2023, as evidenced by backtesting utilizing TOPIX REIT futures.

6.3. Economic cycles and sectoral dynamics

The interplay between economic cycles and REIT dynamics warrants deeper exploration. In periods of economic expansion, an increased demand for commercial real estate—fueled by corporate growth and consumer expenditure—has the potential to enhance Real Estate Investment Trust (REIT) returns via elevated rental income and occupancy levels. In contrast, during recessionary phases, there is frequently an association with diminishing property valuations and liquidity challenges, as evidenced by the 2008 Global Financial Crisis. Notably, cyclical shifts in interest rates and inflation (e.g., stagflationary pressures) may asymmetrically impact REIT sectors—industrial or logistics REITs might outperform retail counterparts during economic recoveries, reflecting structural demand changes. Integrating economic cycle indicators (e.g., GDP growth regimes, yield curve inversions) into forecasting frameworks could enhance model adaptability to phase-specific risks.

6.4. Behavioral biases and market sentiment

From a behavioral finance perspective, cognitive biases further elucidate investor decision-making patterns. Excessive self-assurance may result in heightened risk-taking behavior during bullish market conditions, causing Real Estate Investment Trust (REIT) valuations to exceed fundamental values. Conversely, the phenomenon of loss aversion may incite panic-induced liquidation during market downturns, thereby intensifying volatility. For instance, the 2020 pandemic-induced market trough saw retail investors disproportionately liquidating REIT holdings despite long-term fundamentals, a phenomenon aligning with prospect theory’s aversion to realized losses. Furthermore, herding behavior—exacerbated by algorithmic trading—has the potential to disseminate sentiment-induced price fluctuations, especially within markets characterized by significant retail engagement. These biases underscore the importance of sentiment indicators in capturing non-fundamental price distortions.

6.5. Policy shifts and structural risks

Lastly, policy shifts exert profound structural impacts. Expansionary monetary policies, such as Japan's yield curve control implemented after 2016, effectively reduce financing costs, thereby encouraging acquisitions by Real Estate Investment Trusts (REITs). Conversely, sudden regulatory shifts, exemplified by tax reforms affecting real estate holdings, have the potential to significantly modify investor risk assessments. Furthermore, geopolitical events or demographic trends (e.g., Japan’s aging population affecting housing demand) may introduce long-term structural breaks. Future models could incorporate policy uncertainty indices or regime-switching frameworks to better navigate such exogenous shocks.

7. Conclusion

This study develops a robust time series model that integrates macroeconomic variables and sentiment indicators to forecast Japanese REIT index returns, revealing several significant insights. The examination delineates the decade-long sovereign bond yield and the JPY/USD currency exchange rate as pivotal macroeconomic determinants, exhibiting differentiated temporal dynamics characterized by both lagged and immediate impacts, respectively. Notably, sentiment indicators, particularly the Nikkei VI, emerge as valuable predictors that enhance forecasting accuracy, especially during periods of market volatility. Utilizing Newey-West-adjusted regression methodologies, the research adeptly mitigates issues related to autocorrelation, culminating in a significant enhancement of 12% in out-of-sample predictive accuracy.These findings collectively contribute to a more comprehensive understanding of the complex interplay between macroeconomic fundamentals and market sentiment in shaping REIT index performance.

The research holds dual significance. Practically, it offers investors a dynamic tool for REIT portfolio management, exemplified by its resilience during the COVID-19 crisis. Theoretically, it bridges behavioral finance and real estate economics, demonstrating that investor sentiment complements traditional fundamentals. Methodologically, the Newey-West framework sets a precedent for small-sample time series analysis in finance.

However, limitations exist. First, the model’s reliance on monthly data may overlook intra-month volatility. Subsequent research endeavors may benefit from the integration of high-frequency data. Furthermore, the temporal scope of the analysis (2004–2023) omits prior crises, such as the asset bubble of the 1990s, thereby constraining the generalizability of the findings. Extending the timeline or applying the framework to other Asia-Pacific REIT markets (e.g., Singapore) could address this. Lastly, while Newey-West resolves autocorrelation, nonlinear relationships (e.g., threshold effects of exchange rates) remain unexplored. Machine learning models could be introduced for such complexities. In conclusion, this research enhances Real Estate Investment Trust (REIT) forecasting by integrating economic fundamentals with market sentiment, simultaneously establishing a foundation for methodological advancements in the analysis of financial time series.

References

[1]. Ooi, J., Newell, G., & Sing, T. F. (2006). The growth of REIT markets in Asia. Journal of Real Estate Literature, 14(2), 203-222.

[2]. Nassirtoussi, A. K., Aghabozorgi, S., Wah, T. Y., & Ngo, D. C. L. (2014). Text mining for market prediction: A systematic review. Expert Systems with Applications, 41(16), 7653-7670.

[3]. Ding, Shangyu. (2024). Lessons and insights from Japan's response to the real estate bubble crisis. China Economic and Trade Review, (17), 75-78.

[4]. Zhang, Yangzi. (2024). Japan's policy regulation to cope with the real estate bubble: lessons and insights. Real Estate Economics, 1(03), 27-38. doi:10.13562/j.china.real.estate.2024.03.008.

[5]. Dun, C.G. & Liu, F.J.. (2024). Lessons and insights of real estate financial risk resolution in Japan. Development Finance Research, (03), 58-66. doi:10.16556/j.cnki.kfxjr.2024.03.010.

[6]. Shen Yue,Liu Hongyu. (2002). A study on the relationship between real estate prices and macroeconomic indicators. Price Theory and Practice, (08), 20-22. doi:10.19851/j.cnki.cn11-1010/f.2002.08.010.

[7]. Shen Yue,Liu Hongyu. (2002). A study on the relationship between real estate prices and macroeconomic indicators. Price Theory and Practice, (08), 20-22. doi:10.19851/j.cnki.cn11-1010/f.2002.08.010.

[8]. Ru Xi Ding & Dong Kun Li. (2019). A Comprehensive Review of the Causes of Formation and Bursting of Japan's Real Estate Bubble and Its Implications for Contemporary China. Contemporary Economic Research, (07), 101-112.

[9]. Li, Z.. (2005). Research on the legal system of real estate investment trusts (REITs) (Doctoral dissertation, China University of Political Science and Law). Ph.D.

Cite this article

Yang,Z. (2025). Navigating Japan's Real Estate Market: A Predictive Framework for REIT Index Returns Using Macroeconomic and Sentiment Data. Advances in Economics, Management and Political Sciences,181,128-133.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ooi, J., Newell, G., & Sing, T. F. (2006). The growth of REIT markets in Asia. Journal of Real Estate Literature, 14(2), 203-222.

[2]. Nassirtoussi, A. K., Aghabozorgi, S., Wah, T. Y., & Ngo, D. C. L. (2014). Text mining for market prediction: A systematic review. Expert Systems with Applications, 41(16), 7653-7670.

[3]. Ding, Shangyu. (2024). Lessons and insights from Japan's response to the real estate bubble crisis. China Economic and Trade Review, (17), 75-78.

[4]. Zhang, Yangzi. (2024). Japan's policy regulation to cope with the real estate bubble: lessons and insights. Real Estate Economics, 1(03), 27-38. doi:10.13562/j.china.real.estate.2024.03.008.

[5]. Dun, C.G. & Liu, F.J.. (2024). Lessons and insights of real estate financial risk resolution in Japan. Development Finance Research, (03), 58-66. doi:10.16556/j.cnki.kfxjr.2024.03.010.

[6]. Shen Yue,Liu Hongyu. (2002). A study on the relationship between real estate prices and macroeconomic indicators. Price Theory and Practice, (08), 20-22. doi:10.19851/j.cnki.cn11-1010/f.2002.08.010.

[7]. Shen Yue,Liu Hongyu. (2002). A study on the relationship between real estate prices and macroeconomic indicators. Price Theory and Practice, (08), 20-22. doi:10.19851/j.cnki.cn11-1010/f.2002.08.010.

[8]. Ru Xi Ding & Dong Kun Li. (2019). A Comprehensive Review of the Causes of Formation and Bursting of Japan's Real Estate Bubble and Its Implications for Contemporary China. Contemporary Economic Research, (07), 101-112.

[9]. Li, Z.. (2005). Research on the legal system of real estate investment trusts (REITs) (Doctoral dissertation, China University of Political Science and Law). Ph.D.