1. Introduction

The rapid rise of internet enterprises has become a defining feature of global economic development, driven by advancements in information technology and widespread internet adoption. Over three decades, China’s internet sector has evolved from fragmented infrastructure and immature industrial chains into a thriving ecosystem. By December 2024, China’s internet user base reached 1.108 billion, with a penetration rate of 78.6%, and 1.029 billion users adopting online payment services. Leading internet enterprises such as JD.com, Alibaba, Tencent, and Meituan ranked among the top 100 in the 2024 China Top 500 Enterprises list, reflecting their robust competitiveness.

Current literature on internet enterprises’ advantages can be mainly divided into three categories. The first category analyzes the advantages of internet enterprises from the perspective of resource-efficient allocation. For example, the internet supports corporate digital transformation, facilitating the optimization of human resource management structures [1]. Internet platforms not only enable the digitization of human resource management activities but also accommodate diverse employment models such as project-based, part-time, and remote work [2]. The concept of a “digital value chain” is also highly valued, indicating that by digitizing traditional elements, internet platforms innovate resource allocation and integration methods, thereby enhancing overall resource utilization efficiency [3].

The second category explores the business marketing models of internet enterprises from the dimension of innovative marketing. For instance, the positive relationship between internet enterprises’ marketing capabilities and corporate performance is highlighted, mediated by the effectiveness of corporate collaborations [4]. Compared to traditional enterprises, internet companies can leverage new media technologies to develop a “traffic economy” and build online-offline omni-channel marketing systems [5]. Other research emphasizes product positioning differentiation and integrated online-offline marketing strategies for internet firms [6].

The third category examines how digitalization enhances consumer services. For example, studies propose that internet platforms, as digital infrastructure, drive the servitization transformation of manufacturing enterprises [7]. By analyzing consumer behavioral data, browsing histories, and other information, enterprises can leverage the internet to provide tailored product recommendations and build personalized recommendation systems [8]. Additionally, the internet’s capacity for real-time, accurate information transmission and exchange enables enterprises to offer consumers efficient logistics services [9].

However, these studies largely overlook the unique conditions enabling internet enterprises to gain an edge in market competition through economies of scale. This paper addresses this gap by analyzing the value creation mechanisms of internet platforms, thereby expanding the theoretical understanding of economies of scale in the digital era and offering insights for the real economy’s digital transformation.

Contributions of this study can be evaluated from three perspectives. The first is to construct an analytical framework for production-side competitive advantages of internet enterprises, moving beyond existing research’s focus on operational aspects. The second is to enrich the theoretical implications of economies of scale in the internet era, addressing gaps in explaining the value creation mechanisms of digital platforms. The third is to provide actionable pathways for the real economy’s digital transformation through case studies of internet enterprises.

The remainder of this paper is structured as follows. Section 2 discusses the traditional mechanism of economies of scale. Section 3 illustrates the advantages of internet enterprises to develop economies of scale. Section 4 presents a case study of Tencent, and Section 5 concludes with practical implications and points out the possible improvement of this paper in the future.

2. Economies of scale in traditional enterprises

The expansion of production scale, through which enterprises achieve cost advantages via increasing returns to scale, serves as a critical driver of specialized production and trade between different enterprises [10]. The fixed inputs in enterprise production—such as equipment, instruments, factories, and research and development (R&D) expenditures during product development—can be considered fixed costs in the early stages of production. As output increases, these fixed costs are spread over each unit of product, causing average costs to decline rapidly. The short-term average cost curve of a firm is U-shaped. The initial downward phase reflects economies of scale, where the increase in output outpaces the rise in costs. In the long run, firms can invest to expand production capacity and upgrade systems, breaking free from the constraints of short-term cost curves. Consequently, the long-run average cost curve becomes the lower envelope of all short-term cost curves corresponding to different resource endowments, forming a flatter U-shaped curve. Both short- and long-term U-shaped curves indicate that economies of scale cannot expand indefinitely. For traditional enterprises, factors such as fixed capital depreciation and rising labor costs eventually push marginal costs upward. As production scales expand further, firms inevitably enter a phase of diseconomies of scale.

3. Advantages of internet enterprises in realizing economies of scale

3.1. Low marginal costs for digital products

Compared to traditional businesses, the unique nature of internet products and transaction models grants internet enterprises distinct advantages in economies of scale. First, digital products—such as software, e-books, digital albums, streaming content, and online courses—incur high initial fixed costs (for example, licensing fees), but the marginal cost of distributing and replicating these products to new users is nearly zero. Second, internet enterprises face no physical capacity or inventory constraints. Unlike physical goods, digital products do not incur costs for excess inventory due to oversupply. Third, internet enterprises offering cloud services or digital resources avoid costs tied to physical stores, equipment depreciation, or transportation losses.

These factors enable internet enterprises to maintain extremely low marginal costs over extended periods. Thus, while fixed cost allocation mechanisms grant them economies of scale akin to traditional industries, their slowly rising marginal costs—unlike the rapid cost escalation in traditional firms—allow virtually unlimited output expansion. This drives average costs to minimal levels, creating far stronger economies of scale than those achievable by physical enterprises.

3.2. Enhancement of platform value through network effects

Driven by network externalities, demand for a service often depends on the number of its users [11]. In other words, a service gains value as its user base grows. For internet platforms, a large user base expands information exchange and service utility, attracting even more users. Compared with substitutable alternatives, a platform with dominant user numbers becomes the most efficient choice, while switching costs (for example, time and data migration) also reinforce user loyalty. Similarly, platforms initially serving a single function can evolve into interconnected hubs as user numbers grow, creating positive feedback loops that further expand scale. Thus, in network-effect-driven industries, early movers that capture the majority of market share often gain monopolistic advantages, a key pathway for internet enterprises to achieve economies of scale.

3.3. Low-cost coverage of the long-tail market

From the perspective of fulfilling diverse consumer demands, the long-tail effect in the internet economy allows enterprises to capture broader market segments and enhance economies of scale. Unlike traditional models, internet platforms can profitably serve niche demands beyond mainstream products. Modern consumers increasingly seek personalized options, shifting demand from the concentrated “head” to the fragmented “tail” of the market curve [12]. Traditional businesses, constrained by inventory and market data limitations, focus only on high-volume “head” demands, abandoning the aggregated potential of the “tail.” However, the collective volume of these niche demands can rival or even exceed that of popular products.

Free from physical limitations like storage or shelf space, internet enterprises can efficiently cater to long-tail demands. Platforms also reduce market research costs by leveraging user preference data. Crucially, the same technology, resources, or algorithms can serve multiple personalized scenarios, meaning that addressing both “head” and “tail” demands primarily requires upfront fixed costs, with minimal marginal cost increases (limited to system maintenance). Thus, diversification and personalization do not conflict with mass production. By covering broader demands at low cost, internet enterprises leverage algorithmic and platform advantages to amplify economies of scale and strengthen market competitiveness.

4. Case study on Tencent

4.1. The development history of Tencent

Tencent’s evolution from a chat software developer to an internet powerhouse exemplifies its core strategies in the digital economy: accumulating a massive user base, continuously expanding coverage, and monetizing through value-added services (for example, social platforms, gaming) and online advertising. Founded in Shenzhen, China, in 1998, Tencent initially focused on online paging systems. In 1999, QQ was launched, followed by subscription-based services like QQ Membership, QQ Show, QQ Mail, and QQ Games. In 2011, WeChat emerged, later spawning features such as WeChat Pay, Red Packets, Wealth Management, Mini Programs, Video Channels, and WeCom. In gaming, Tencent became China’s largest online gaming platform by 2009 and the highest-revenue game operator by 2013. By 2024, Tencent Games topped global mobile game developers with $6.25 billion in revenue, surpassing the second-ranked company by over $4 billion.

4.2. Specific manifestation of economies of scale

First of all, according to the mechanisms discussed in Section 3, a billion-user base brings both near-zero marginal cost and high marginal return. By January 2018, WeChat had over 1 billion global monthly active users (MAUs), with mobile payment transactions exceeding 1 billion daily by December. In September 2019, Tencent Video surpassed 100 million paying subscribers. As discussed earlier, fixed costs like bandwidth and servers are amortized across massive user bases, reducing per-user service costs for platforms like QQ and WeChat close to zero. This vast user base forms the foundation for monetizing value-added services. Tencent’s Third Quarter 2024 Earnings Report revealed that value-added services accounted for 49% of total quarterly revenue (18% from social networks, 22% from domestic games, and 9% from international games), while advertising contributed 18%, and financial technology enterprise services accounted for 32%. This underscores how membership fees, advertisements, gaming microtransactions, and payment fees all depend on Tencent’s scale-driven amplification effects.

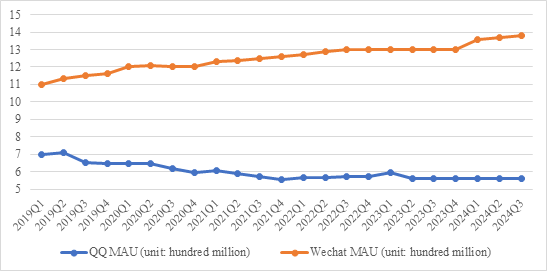

In addition, the user migration from QQ to WeChat manifests Tencent’s efforts to enhance platform value and maximize the profits of spin-off services by increasing user engagement. For social platforms, user numbers determine market dominance. In March 2010, QQ became the first online application (App) globally to surpass 100 million concurrent users. However, as smartphones replaced personal computers (PCs), QQ’s PC-centric design, complex interface, and weak integration with mobile address books and payments, led to attrition. Its monetization—reliant on memberships, advertisements, and games—also faced limitations. Migrating users to WeChat proved critical for Tencent to sustain and broaden its economies of scale. Figure 1 below depicts QQ and WeChat’s MAUs from first quarter 2019 to third quarter 2024. It reveals a widening gap in MAUs over the past three years, cementing WeChat’s dominance as a universal communication and social platform.

Moreover, Tencent’s emphasis on the long-tail effect is evident in its diversified resource and service offerings. Platforms like QQ Music and Tencent Video aggregate content spanning mainstream and niche preferences, catering to diverse consumer tastes. WeChat Mini Programs address both high-frequency needs (for example, dining, healthcare) and long-tail scenarios (for example, printing, venue reservations, travel), attracting users through varied services. Expanding user bases, in turn, incentivize more long-tail suppliers (for example, small merchants, niche advertisers) to join, creating a virtuous cycle of scale economies. As of the third quarter in 2024, Tencent Music had 119 million subscribers, Tencent Video reached 116 million paying members, and WeChat Mini Programs facilitated over 2 trillion yuan in gross merchandise value.

Figure 1: QQ and WeChat’s MAU (data from: 2019-2024 quarterly earnings conference)

4.3. Strategic recommendations

There is a misconception that the internet economy simply involves traditional brick-and-mortar stores opening online sales channels. In reality, the distinction between internet-based enterprises and traditional businesses goes far beyond superficial differences in sales venues and methods. To deeply integrate into the internet economy, companies must understand the underlying logic of leveraging digital platforms to secure competitive advantages, such as reducing average costs, increasing average revenue, and expanding market share.

Nevertheless, even if a single enterprise holds a significant competitive edge in the internet economy, it remains exceedingly difficult to establish a monopoly. Unlike traditional industries, internet products and services face rapid obsolescence and high substitutability. While internet enterprises enjoy stronger scale advantages, monopolies are unsustainable, as profit-driven demand attracts new entrants. Competing platforms—like Weibo, Xiaohongshu (RED), Youku, Bilibili, Douyin, Meituan, Ele.me, and DingTalk—demonstrate the fragmented nature of internet markets. For Tencent, the key to defending its dominance while expanding lies in leveraging its unique strengths and fostering cross-platform collaboration. For instance, while WeChat dominates communication, nearly all major non-Tencent platforms allow users to register via WeChat or QQ, enhancing user retention and mutual growth. Such partnerships reflect the futility of zero-sum competition in the internet economy.

From a regulatory perspective, to mitigate monopoly risks and protect consumer rights, policymakers must strengthen antitrust frameworks. Measures could include mandatory merger reviews, transparency requirements for non-sensitive data from dominant enterprises, real-time monopoly monitoring, and third-party nonprofit supervision of user data. These steps ensure that scale economies benefit consumers through diverse choices, not collusive exclusion.

5. Conclusion

This study identifies three key advantages enabling internet enterprises to harness scale economies more effectively than traditional enterprises. Firstly, the unique nature of network-based information products maximizes the mechanism of fixed cost allocation. Secondly, platform value and user retention in the internet economy increase with the growth of user numbers. Thirdly, the low-cost coverage of long-tail demands by internet platforms expands potential user markets.

At their core, cost allocation, network effects, and the long-tail effect correspond to three enhancements provided by internet platforms, namely, lowering average costs, increasing average revenue, and broadening market share. Investigating the competitive advantages of internet enterprises is not intended to undermine the real economy, but rather to analyze the economic logic behind their successful models, reflect on the value-creation mechanisms enabled by internet platforms, and offer universal insights for the transformation and upgrading of traditional industries. These insights include shifting from selling physical goods to offering information, resources, and services, transitioning from operating offline flagship stores to building online user-aggregating platforms, and expanding focus from best-selling products to comprehensively addressing market demands. Ultimately, the rise of internet enterprises relies not on overturning traditional economic models, but on innovative upgrades to conventional production factors in the information age.

This paper primarily contrasts the principles of economies of scale in traditional industries and the internet sector, combining a case study to explore the evolved implications of economies of scale in the internet era and the opportunities internet platforms provide to enterprises. However, this research remains focused on qualitative analysis and lacks quantitative methods to derive conclusions from specific data. In future studies, collecting input and output data from leading internet enterprises will be prioritized to further refine the arguments through empirical perspectives.

References

[1]. Yue, H. (2025) The Impact of Industrial Internet on Manufacturing Firms’ Digital Innovation Capability: The Mediating Role of Internal Control. Management and Administration, 2025(2), 1–18.

[2]. Duan, G. (2025) Optimizing Human Resource Management in Textile Enterprises Under the “Internet+” Era. Chemical Fibers & Textile Technology, 54(1), 94–96.

[3]. Zhang, M., Sun, X., and Liu, J. (2025) Industrial Internet Platforms Empowering Digital Value Chain Operations in Manufacturing Firms: A Case Study of Haier COSMO Plat. Foreign Economics & Management, 2025(2), 1–20.

[4]. Su, Y., and Zhang, Y. (2025) The Impact of Marketing Capability on Firm Performance in the Internet Era: The Mediating Role of Collaborative Effectiveness. Market Weekly, 38(1), 77–81.

[5]. Deng, X. (2025) Business Model Innovation of Chinese Unicorn Enterprises Under the “Internet+” Context. Modern Business, 2025(2), 32–35.

[6]. Xia, X., Zhang, L. and Gu, X. (2025) SWOT Analysis-Based Marketing Strategy Research: A Case Study of Yuanfudao. China Market, 2025(5), 119–122.

[7]. Liu, Y., Liao, Z. and Mei, S. (2025) Digital Servitization in Manufacturing Firms via Industrial Internet Platforms: The Chain-Mediating Role of Sensemaking. Review of Economy and Management, 41(1), 97–108.

[8]. Zhuge, Y. (2025) Innovative Marketing Strategies for Leather Product Enterprises in the Internet Era. China Leather, 2025(2), 1–5.

[9]. Yan, X. (2025) Integration of Business and Finance in Logistics Enterprises Under “Internet+”: A Case Study of SF Express. China Storage & Transport, 2025 (1), 70–71.

[10]. Krugman, Paul R. (1985) Increasing Returns and the Theory of International Trade. National Bureau of Economic Research, Working Paper Series, w1752, 1–56.

[11]. Shy, O. (2001) Telecommunication. In The Economics of Network Industries (Chapter 5). Cambridge: Cambridge University Press.

[12]. Hart, M. A. (2007) The Long Tail: Why the Future of Business Is Selling Less of More by Chris Anderson. Journal of Product Innovation Management, 24 (3), 274–276.

Cite this article

Huang,Y. (2025). The Mechanisms of Economies of Scale in the Expansion of Internet Enterprises. Advances in Economics, Management and Political Sciences,185,135-140.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yue, H. (2025) The Impact of Industrial Internet on Manufacturing Firms’ Digital Innovation Capability: The Mediating Role of Internal Control. Management and Administration, 2025(2), 1–18.

[2]. Duan, G. (2025) Optimizing Human Resource Management in Textile Enterprises Under the “Internet+” Era. Chemical Fibers & Textile Technology, 54(1), 94–96.

[3]. Zhang, M., Sun, X., and Liu, J. (2025) Industrial Internet Platforms Empowering Digital Value Chain Operations in Manufacturing Firms: A Case Study of Haier COSMO Plat. Foreign Economics & Management, 2025(2), 1–20.

[4]. Su, Y., and Zhang, Y. (2025) The Impact of Marketing Capability on Firm Performance in the Internet Era: The Mediating Role of Collaborative Effectiveness. Market Weekly, 38(1), 77–81.

[5]. Deng, X. (2025) Business Model Innovation of Chinese Unicorn Enterprises Under the “Internet+” Context. Modern Business, 2025(2), 32–35.

[6]. Xia, X., Zhang, L. and Gu, X. (2025) SWOT Analysis-Based Marketing Strategy Research: A Case Study of Yuanfudao. China Market, 2025(5), 119–122.

[7]. Liu, Y., Liao, Z. and Mei, S. (2025) Digital Servitization in Manufacturing Firms via Industrial Internet Platforms: The Chain-Mediating Role of Sensemaking. Review of Economy and Management, 41(1), 97–108.

[8]. Zhuge, Y. (2025) Innovative Marketing Strategies for Leather Product Enterprises in the Internet Era. China Leather, 2025(2), 1–5.

[9]. Yan, X. (2025) Integration of Business and Finance in Logistics Enterprises Under “Internet+”: A Case Study of SF Express. China Storage & Transport, 2025 (1), 70–71.

[10]. Krugman, Paul R. (1985) Increasing Returns and the Theory of International Trade. National Bureau of Economic Research, Working Paper Series, w1752, 1–56.

[11]. Shy, O. (2001) Telecommunication. In The Economics of Network Industries (Chapter 5). Cambridge: Cambridge University Press.

[12]. Hart, M. A. (2007) The Long Tail: Why the Future of Business Is Selling Less of More by Chris Anderson. Journal of Product Innovation Management, 24 (3), 274–276.