1. Introduction

The stock market plays a vital role in the modern financial system, promoting capital allocation and corporate financing. However, in recent years, China's stock market has faced many challenges, including the failure of corporate governance, problems with information disclosure, and significant equity pledge risks. These issues not only weaken investor confidence but also threaten the stability of the entire financial market. To enhance market transparency, protect investors' interests, and promote the healthy development of China's stock market, this study analyzes specific cases and proposes targeted solutions, focusing on solving the problems of corporate governance failure, incomplete information disclosure, and prominent equity pledge risks.

Existing literature has widely discussed the importance of corporate governance and information disclosure in the stock market. For example, Zhang Xu and Xu Wenting emphasized the role of effective corporate governance in preventing financial fraud [1]. Zhang Gaowu stressed the necessity of transparent information disclosure for investor protection [2]. However, these studies often focus on a single dimension and lack comprehensive risk management strategy research. This study aims to fill this gap by integrating multi-dimensional risk management and proposing comprehensive solutions to address the challenges of China's stock market.

This study mainly adopts the case analysis method. It first analyzes three typical cases to reveal the main risks of China's stock market. Through detailed analysis of these cases, the root causes of the problems are identified. Subsequently, the study reviews the existing regulatory framework and proposes targeted improvement suggestions. The focus is on improving corporate governance, strengthening information disclosure, and standardizing equity pledge business. By integrating these elements, this study aims to provide a comprehensive solution for China's stock market risk management.

2. Analysis of typical risk cases in china's stock market and existing problems

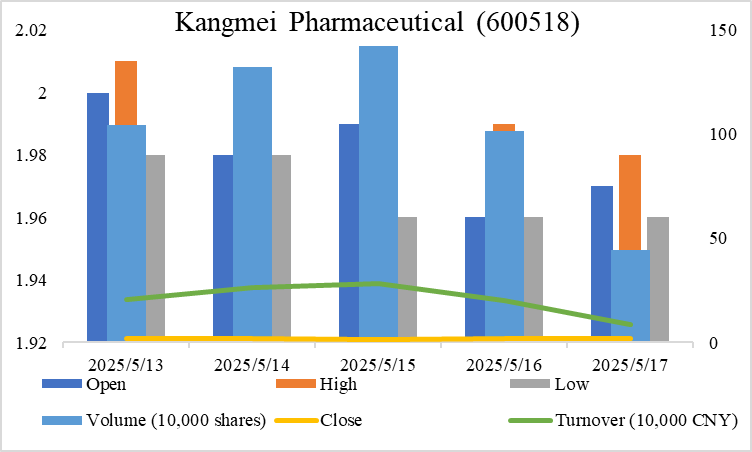

2.1. Kangmei Pharmaceutical's financial fraud case

Kangmei Pharmaceutical's financial fraud case is a typical example of problems in corporate governance and information disclosure. As shown in Figure 1, from 2016 to 2018, the company engaged in financial fraud by forging business operations, inflating revenues and profits, with the amount involved reaching tens of billions of yuan. This case highlights the defects in the company's internal governance structure, lacking an effective check-and-balance mechanism, which allows management to easily manipulate financial data. At the same time, the poor implementation of the information disclosure system prevents investors from obtaining true and accurate company information, increasing investment risks.

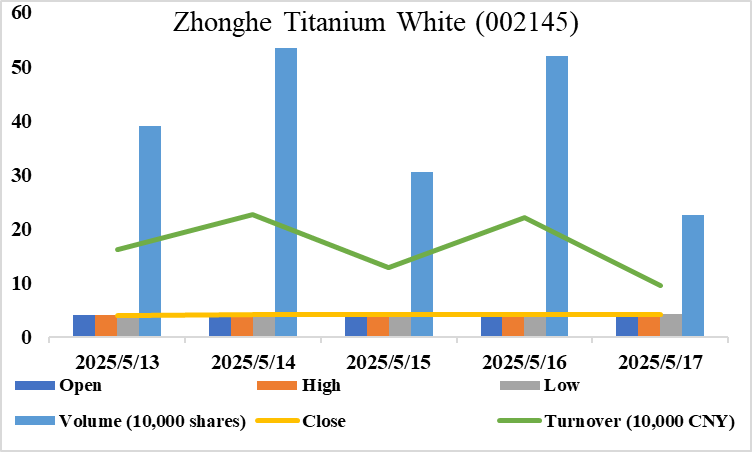

2.2. Zhonghe Titanium's illegal share reduction case

Zhonghe Titanium's illegal share reduction case further exposes the risks of illegal cooperation between some securities firms and listed companies in the market. As shown in Figure 2, on April 12, 2024, the actual controller of Zhonghe Titanium colluded with CITIC Securities and Haitong Securities to evade the lock-up period and engage in block-financing arbitrage, resulting in a total fine of 235 million yuan. Such behavior not only undermines the fairness and transparency of the market but also leads to market manipulation and insider trading issues, harming the interests of small and medium-sized investors.

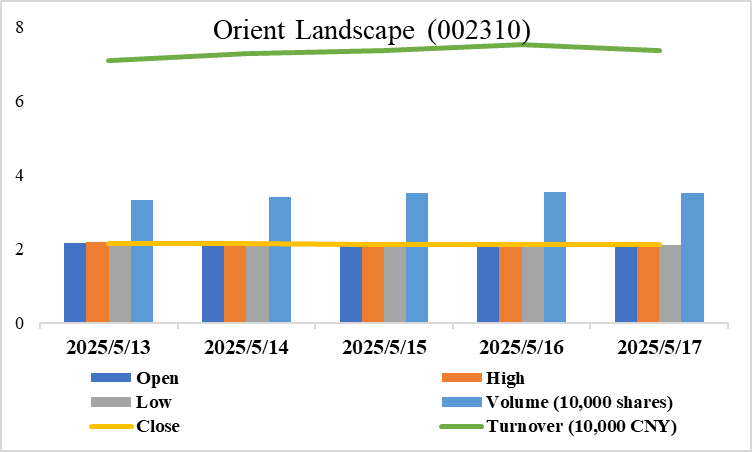

2.3. Orient Landscape's equity pledge burst case

Orient Landscape's equity pledge burst case reveals the risks associated with equity pledge business. As shown in Figure 3, in 2018, against the backdrop of deleveraging and trade wars, the A-share market experienced a significant decline. Orient Landscape's equity pledge-style repurchase burst, leading to a change in the actual controller and the founder losing ultimate control. The company's large number of equity pledges were forcibly liquidated when the market fell, triggering further share price declines and forming a vicious cycle. This case indicates that when the market experiences significant fluctuations, equity pledges may trigger liquidity risks and control changes, not only affecting the stable operation of the company itself but also potentially causing chain reactions in the market.

From the current characteristics of the above cases, it can be seen that China's stock market has many problems in corporate governance, information disclosure, and equity pledges. These problems not only harm the interests of investors but also affect the stability and healthy development of the market. At present, the risks and challenges faced by China's stock market mainly include imperfect corporate governance and information disclosure, frequent market manipulation and insider trading, and prominent equity pledge risks. The existence of these problems makes it particularly important to strengthen stock market risk management.

3. Specific analysis of risks and challenges

3.1. Imperfect corporate governance and information disclosure

Corporate governance and information disclosure are the cornerstones of the stock market, but there are still many shortcomings in these two aspects in China's stock market. The main defects in the corporate governance structure are reflected in the failure of internal check-and-balance mechanisms, which allow management to easily manipulate financial data and harm shareholders' interests. For example, the imperfections in the corporate governance structure may lead to management using their positions for interest transfers, affecting the effectiveness of corporate governance [2]. In terms of information disclosure, although the China Securities Regulatory Commission (CSRC) has strict requirements for information disclosure, some companies still have problems with false disclosure and concealment of information in actual implementation. This incomplete information disclosure makes it difficult for investors to accurately assess the value and risks of companies, thereby increasing the uncertainty of investment [1].

3.2. Frequent market manipulation and insider trading

Market manipulation and insider trading have always been chronic problems in the stock market. Illegal cooperation between some securities firms and listed companies, such as the illegal share reduction case of Zhonghe Titanium, not only undermines the fairness and transparency of the market but also leads to market manipulation and insider trading issues [3]. Such behavior not only harms the interests of small and medium-sized investors but also disrupts the long-term healthy development of the market. Despite the continuous strengthening of regulatory efforts by regulatory authorities, market manipulation and insider trading problems still occur frequently, reflecting that there are still shortcomings in the implementation of regulatory measures [4].

3.3. Prominent equity pledge risks

Equity pledge is one of the important ways for listed companies to finance, but in recent years, the risks associated with equity pledge have gradually become more prominent [5]. When the market experiences significant fluctuations, equity pledges may trigger liquidity risks and control change risks. For example, the equity pledge burst of Orient Landscape shows that equity pledges may trigger chain reactions when the market falls, affecting the stable operation of the company. In addition, equity pledges may also lead to the instability of the corporate governance structure, further increasing market uncertainty [6].

3.4. Regulatory lag and gaps

While China's stock market is developing rapidly, the construction of the regulatory system is relatively lagging, and there are some regulatory gaps. For example, in leveraged acquisitions, complex financing structures and multi-layered nested arrangements make regulatory efforts more difficult, making it easier for regulatory gaps to appear [7]. In addition, the regulatory strength of information disclosure still needs to be strengthened, especially in the aspect of piercing the corporate veil regulation, and regulatory measures need to be further improved [8]. The existence of regulatory lag and gaps allows some illegal and regulatory violations to take advantage of the situation, increasing market risks [9].

3.5. Imperfect market mechanisms

The imperfection of the stock market's mechanisms is also one of the important challenges currently faced. For example, structural defects in the trading mechanism and the imperfection of the investor protection mechanism may affect the stable operation of the market. In addition, the imperfection of market mechanisms may also lead to lower price discovery efficiency, further amplifying market volatility. For example, the current circuit breaker mechanism limits market liquidity to some extent, and the absence of the T+0 trading mechanism makes the market lack an effective adjustment mechanism when facing short-term fluctuations [10]. Therefore, improving market mechanisms, optimizing trading rules, and strengthening investor protection are urgent problems that need to be solved in the current stock market.

In summary, China's stock market has many problems in corporate governance, information disclosure, equity pledges, regulatory mechanisms, and so on. These problems not only increase market risks but also affect the stability and healthy development of the market. Therefore, strengthening stock market risk management, improving related systems, and enhancing regulatory levels are important tasks currently facing China's stock market.

4. Risk Management and recommendations

4.1. Improving corporate governance and information disclosure systems

To address the problems of imperfect corporate governance and information disclosure, the following aspects should be considered:

Strengthening corporate governance structure is a key step in solving the problems of imperfect corporate governance and information disclosure. It is necessary to further improve the supervisory functions of the board of directors and the board of supervisors, making them a solid force to check the management. The introduction of the independent director system is particularly important. By attracting professionals independent of the company's management to join the board of directors, the independence and objectivity of the board can be effectively improved. This, in turn, enhances the supervision and restraint of management decisions and actions, avoids excessive concentration of power, and reduces the possibility of financial fraud and information manipulation from the source of corporate governance.

Enhancing information disclosure regulation is an important measure to ensure the authenticity and transparency of market information. Regulatory authorities should strive to improve the transparency and accuracy of information disclosure, ensuring the strict implementation of information disclosure regulations. For illegal and regulatory violations such as false disclosure and concealment of information, penalties must be increased significantly to raise the cost of violations and form a strong deterrent. At the same time, in line with the trend of technological development, big data and artificial intelligence technologies should be fully utilized to monitor and analyze information disclosure in real-time and in-depth, promptly identifying abnormal situations and making it impossible for violations to hide, thereby ensuring that investors can obtain true and reliable company information.

4.2. Strengthening market regulation

Improving the regulatory system is an important guarantee for regulating the order of the stock market. At present, there are problems of overlapping functions and gaps between regulatory authorities. Therefore, it is necessary to strengthen the coordination and cooperation between regulatory authorities and build an efficient communication bridge to integrate scattered regulatory forces. Establishing a cross-departmental regulatory coordination mechanism is particularly crucial. Each department should coordinate and cooperate in formulating policies and conducting regulatory actions, ensuring the consistency and continuity of regulatory policies in different fields and links, making it impossible for illegal and regulatory violations to exploit regulatory loopholes to evade punishment, and creating a tight and orderly regulatory environment for the stock market.

Enhancing law enforcement intensity is a core means to maintain market fairness and justice. Market manipulation and insider trading and other illegal and regulatory violations severely disrupt market order and harm investors' interests. A "zero-tolerance" attitude must be adopted to increase the crackdown. Regulatory authorities should optimize the law enforcement process, improve the professional quality of law enforcement officers, and improve law enforcement efficiency to quickly respond to and accurately strike illegal and regulatory violations. At the same time, through in-depth case analysis, presenting the means of typical illegal and regulatory violations and their harmful consequences clearly, and combining them with regular warning education, a strong signal that violations will be prosecuted should be sent to market participants, prompting them to deeply recognize the importance of compliance operations, enhancing compliance awareness from the ideological root, and jointly maintaining the healthy ecology of the stock market.

4.3. Standardizing equity pledge business

Improving equity pledge rules is a key measure to prevent systemic risks. Given the risk hidden dangers in equity pledge business, it is necessary to start from the institutional level, clearly set strict entry conditions, and carefully assess the qualifications and operating conditions of enterprises applying for equity pledges to exclude high-risk entities. At the same time, the pledge ratio should be reasonably limited to avoid companies over-pledging equity and falling into crisis, and detailed risk control requirements should be established, such as regulating the use of pledged funds. Through the improvement of these rules, the systemic risks that may be triggered by equity pledges can be effectively reduced, ensuring the stable development of enterprises and the market.

Enhancing risk monitoring and early warning is an important line of defense to ensure the stable operation of equity pledge business. Establishing a scientific and complete equity pledge risk monitoring system is urgent. The system must have the ability to track the market value of pledged shares in real-time and accurately assess pledge risks through the analysis of multi-dimensional data such as stock price fluctuations and market conditions. Once the pledge risk reaches the pre-set warning threshold, the emergency response mechanism should be quickly activated to require companies to supplement collateral to enhance guarantee capabilities or to conduct early repurchase operations, controlling risks in the bud and effectively avoiding market chain reactions caused by equity pledge bursts, maintaining the stable and orderly operation of the capital market.

4.4. Optimizing market mechanisms

Improving trading mechanisms is a core path to enhancing the vitality and efficiency of the stock market. There are currently some rigid rules and cumbersome processes in stock trading that hinder the smooth operation of the market. Therefore, it is necessary to systematically optimize stock trading rules and thoroughly eliminate institutional obstacles in the trading process. Taking the market maker system as an example, further improving this system by introducing more professional market makers can enhance the liquidity of the market's two-way trading. Market makers, through professional analysis and trading operations, can promote stock prices to more accurately reflect their intrinsic value, improve market price discovery efficiency, and make stock market trading more efficient and active, creating a good trading environment for market participants.

Strengthening investor protection is an important cornerstone for maintaining the stability and fairness of the stock market. Investors are an important part of the stock market, but currently, investors face problems such as weak awareness of rights protection and poor channels for rights protection when facing infringement. Therefore, it is urgent to build a comprehensive and multi-level investor protection system, improving investor protection mechanisms from multiple dimensions such as law and education. On the one hand, through a variety of financial knowledge popularization activities, investors' awareness of their rights and their ability to protect their rights can be improved. On the other hand, a diversified investor dispute resolution mechanism including litigation, arbitration, and mediation should be established to simplify the dispute resolution process, ensuring that investors can obtain timely and effective protection through convenient and efficient channels when their legitimate rights and interests are damaged, restoring investors' confidence in the market and promoting the healthy and sustainable development of the stock market.

4.5. Enhancing market transparency

Enhancing the timeliness of information disclosure is key to improving market transparency and ensuring the scientific nature of investors' decision-making. In the rapidly changing capital market, the timeliness of information is crucial. If there is a delay in the disclosure of significant matters by listed companies, investors will find it difficult to make accurate judgments based on the latest situation, which can easily lead to decision-making mistakes. Therefore, regulatory authorities should further strictly require listed companies to disclose significant information quickly and accurately within the prescribed time limit once it occurs, ensuring that investors can obtain key information in the first place, effectively reducing investment risks caused by information delays, and making market transactions based on more timely and true information, promoting the fairness and efficiency of the capital market.

Promoting piercing the corporate veil regulation is an effective means to deal with the complexity of financial markets and prevent regulatory arbitrage. With the continuous deepening of financial innovation, financial products and transaction structures are becoming increasingly complex. Some institutions may use the concealment of structural design for regulatory arbitrage, posing potential risks to financial markets. Piercing the corporate veil regulation requires regulatory authorities to conduct comprehensive, in-depth, and dynamic regulation of all aspects such as the source of funds, underlying assets, and risk transmission through complex financial products and transaction structures. No matter how complex the transaction levels or how hidden the structure, the real situation can be clearly presented, ensuring that there are no blind spots or gaps in regulation, fundamentally eliminating regulatory arbitrage behavior, maintaining the healthy and stable operation of financial markets, and ensuring the safety of the financial system.

Through the above measures, the risks in China's stock market can be effectively reduced, and the stability and transparency of the market can be improved. This not only helps protect investors' interests but also promotes the long-term healthy development of the stock market.

5. Conclusion

This study, through in-depth analysis of three typical cases—Kangmei Pharmaceutical's financial fraud case, Zhonghe Titanium's illegal share reduction case, and Orient Landscape's equity pledge burst case—explores the existing problems in China's stock market risk management. The study finds that there are significant deficiencies in corporate governance and information disclosure, frequent market manipulation and insider trading, and prominent equity pledge risks. This paper proposes targeted solutions, including improving corporate governance and information disclosure, strengthening market regulation, and standardizing equity pledge business. The conclusion indicates that optimizing the regulatory framework and market mechanisms is of great significance for enhancing the stability and transparency of China's stock market, significantly strengthening market stability and transparency, promoting its long-term healthy development, and protecting investors' interests.

However, this study also has some limitations. The study is mainly based on a limited number of case analyses and may not fully cover the entire picture of the stock market. Future research can expand the sample scope and include more diversified cases to provide a more comprehensive understanding. In addition, future research can further explore the impact of technological progress and international market trends on China's stock market risk management. Future research can test the effectiveness of the proposed solutions through empirical research or simulation analysis.

References

[1]. Zhang, G. W. (2005). Research on Corporate Governance and Information Disclosure of Listed Companies in China. Beijing Jiaotong University.

[2]. Zhang, X. and Xu, W. T. (2023). The Generation Mechanism of Major Risks in China's Stock Market—A Theoretical Explanation Based on Liquidity Supply and Demand Imbalance. Finance, 13(1), 11-19.

[3]. Ma, L. F. , Zhang, X. Q. (2020). Controlling Shareholders' Equity Pledge and Investor Relationship Management. China Industrial Economics, (11), 156-173.

[4]. Chen, Y. (2024). The Reality Difficulties and Path Optimization of Environmental Information Disclosure System of Commercial Banks from the Perspective of Green Finance. Frontiers of Social Sciences, 13(8), 580-588.

[5]. Chen, J. R. and Wang, Y. X. (2019). A Review of the Impact of Domestic Listed Companies' Controlling Shareholders' Equity Pledge on Enterprises. Modern Management, 9(4), 543-549.

[6]. Zheng, W. W. , Qu, Q. , An, L. L. and Liu, Y. B. (2024). Controlling Shareholders' Equity Pledge and Corporate Illegal Behavior—From the Perspective of Internal Control and External Supervision. Modern Financial Research, 29(12), 36-46.

[7]. Ma, L. , & Li, D. N. (2024). Risk Constraints and Corporate Financing Guarantee Mechanisms of Equity Pledge Financing Business. Economic Science, (03), 115-137.

[8]. Gao, H. T. (2017). On the Illegality and Prevention of Information Manipulation. Securities Law Review, 22(04), 455-471.

[9]. Zeng, B. , & Han, S. R. (2017). Risks, Governance, and Regulation of Leveraged Acquisitions by Listed Companies. Securities Law Review, 22(04), 321-340.

[10]. Rong, S. Y. , Wu, Y. (2023). Research on the Relationship between Securities Market Fluctuations and Economic Stability and Risk Prevention Mechanisms. World Economic Exploration, 12(4), 414-420.

Cite this article

Gu,R. (2025). China's Stock Market Risk Management: Case Analysis and System Optimization. Advances in Economics, Management and Political Sciences,193,156-163.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang, G. W. (2005). Research on Corporate Governance and Information Disclosure of Listed Companies in China. Beijing Jiaotong University.

[2]. Zhang, X. and Xu, W. T. (2023). The Generation Mechanism of Major Risks in China's Stock Market—A Theoretical Explanation Based on Liquidity Supply and Demand Imbalance. Finance, 13(1), 11-19.

[3]. Ma, L. F. , Zhang, X. Q. (2020). Controlling Shareholders' Equity Pledge and Investor Relationship Management. China Industrial Economics, (11), 156-173.

[4]. Chen, Y. (2024). The Reality Difficulties and Path Optimization of Environmental Information Disclosure System of Commercial Banks from the Perspective of Green Finance. Frontiers of Social Sciences, 13(8), 580-588.

[5]. Chen, J. R. and Wang, Y. X. (2019). A Review of the Impact of Domestic Listed Companies' Controlling Shareholders' Equity Pledge on Enterprises. Modern Management, 9(4), 543-549.

[6]. Zheng, W. W. , Qu, Q. , An, L. L. and Liu, Y. B. (2024). Controlling Shareholders' Equity Pledge and Corporate Illegal Behavior—From the Perspective of Internal Control and External Supervision. Modern Financial Research, 29(12), 36-46.

[7]. Ma, L. , & Li, D. N. (2024). Risk Constraints and Corporate Financing Guarantee Mechanisms of Equity Pledge Financing Business. Economic Science, (03), 115-137.

[8]. Gao, H. T. (2017). On the Illegality and Prevention of Information Manipulation. Securities Law Review, 22(04), 455-471.

[9]. Zeng, B. , & Han, S. R. (2017). Risks, Governance, and Regulation of Leveraged Acquisitions by Listed Companies. Securities Law Review, 22(04), 321-340.

[10]. Rong, S. Y. , Wu, Y. (2023). Research on the Relationship between Securities Market Fluctuations and Economic Stability and Risk Prevention Mechanisms. World Economic Exploration, 12(4), 414-420.