1. Introduction

ESG (Environmental, Social, and Governance) is a methodological approach to evaluating the sustainable development of enterprises, representing a more comprehensive assessment framework than traditional financial evaluation methods [1]. Since its formal introduction in 2004 by a United Nations research initiative [2], ESG has consistently attracted societal attention. The deepening of the global concept of sustainable development has led to enterprises assuming significant social responsibilities as an integral part of society and a vital link connecting various entities. Consequently, the emphasis on ESG indicators by both society and enterprises is growing daily. After reviewing relevant literature, we identified gaps in existing research: First, most studies focus on the impact of ESG performance on economic benefits and enterprise value, but the research on the mechanisms of this influence is not yet complete. Second, current research on corporate ESG performance is predominantly industry-wide, with less focus on specific industries.

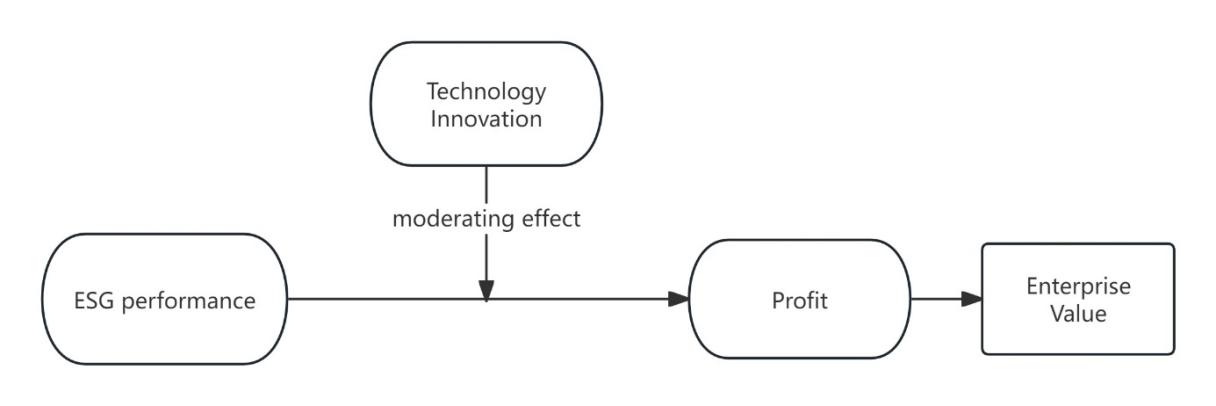

The environment protection industry, facing the integration of digitalization, networking, and intelligentization in its pursuit of high-quality development, must promote the integration and innovation of surveying technology [3]while also confronting multiple pressures from environmental, social, and governance aspects. Therefore, exploring the impact of ESG performance on enterprises and the influence of theoretical and technological innovation on its internal mechanisms is of significant theoretical and practical importance. This paper primarily analyzes the impact of ESG performance on enterprise value and its internal mechanisms, tests the moderating effect of technological innovation in this mechanism through grounded method and regression analysis, and finally proposes relevant suggestions. These suggestions aim to further promote the ESG concept in China and provide theoretical support for enterprises to enhance ESG performance and increase enterprise value through technological innovation.

2. Literature review

2.1 ESG related research

The concept of ESG was initially introduced by Grant Michelson and others [4], focusing on ethical and responsible investment practices. Today, the ESG framework serves as a comprehensive evaluation system for corporate performance, encompassing environmental, societal, and governance factors. It extends and enriches the concepts of green and responsible investment and has become a significant benchmark for assessing corporate sustainability in the international community. In the context of the new economic era, China's "dual carbon" policy and the "14th Five-Year Plan" have positioned green sustainable development as a crucial topic for social progress.Enterprises across various industries can utilize the ESG evaluation system for self-assessment. Considering the unique production and operational methods of different industries, the specific sustainable development issues under the three ESG pillars and their significance to particular enterprises can be analyzed and adjusted according to industry characteristics [5]. However, as an emerging development concept, ESG is largely in the theoretical interpretation phase in China, lacking a unified evaluation standard, which has led to the phenomenon of "greenwashing," where companies claim to adhere to green, low-carbon, and environmentally friendly standards without substance [6]. This necessitates further government efforts to refine the ESG evaluation system and strengthen corporate oversight, while enterprises should also assume greater social and environmental responsibilities and enhance corporate governance.

2.2 The mechanism by which ESG performance affects corporate value

Scholars such as Junqiu Yu and Ying Wang, using a sample of 134 manufacturing companies listed on the A-share market in the Beijing-Tianjin-Hebei region from 2015 to 2018, have proposed that enterprises that undertake more social responsibilities and improve corporate governance contribute to an increase in corporate value [7]. Based on stakeholder theory and signal transmission theory, companies with strong ESG performance are more attentive to the rights and interests of stakeholders, including employees and shareholders, and convey information about corporate development [8]. This is beneficial for establishing long-term, stable cooperative relationships with stakeholders, laying a foundation for sustainable corporate growth [9]. Under the environmental-social-governance evaluation system, a greater number of indicators allow companies to recognize operational shortcomings and identify new business opportunities based on current gaps. By seizing these opportunities through technological innovation, companies can create more and higher corporate value, enhancing the mutually beneficial symbiotic relationship between the enterprise and society, leading to a win-win situation and promoting long-term stable development of the economy and society.

In recent years, researchers have shifted their focus to the mechanisms by which ESG impacts financial performance and corporate value [10]. To better understand these mechanisms, it is essential to examine them within specific industries [11]. Companies that actively fulfill ESG responsibilities can reduce information asymmetry, enabling investors to gain a more comprehensive understanding of the company, form more accurate judgments, and thus lower the risk premium. Additionally, companies exhibiting strong ESG performance convey a positive indication of sustainable and robust growth, thereby elevating investor expectations, fostering greater stakeholder trust, and bolstering investment inclination. Consequently, this leads to heightened liquidity, reduced transaction costs, and enhanced access to the resources necessary for sustainable development. The mitigation of risk, augmentation of capital, and reduction in expenses all contribute towards enhancing the financial value of enterprises.Furthermore, companies that focus on ESG performance are more likely to be conscious of their social and environmental responsibilities, invest more in environmental protection, and enhance their green brand image among consumers [12], which positively affects corporate operations.

2.3 Technology innovation

Some scholars have also found that technological innovation can strengthen a company's sustainable development capabilities [13], as it can directly improve products and services and indirectly enhance corporate value by improving ESG performance [14].In terms of corporate profits, existing studies indicate that investment in research and development can enhance the profit efficiency of technological innovation enterprises at a significance level of 1% [15].However, current research on the impact of technological innovation on corporate profits is relatively scarce. Therefore, environmental protection industry in order to more effectively fulfill its responsibilities in environmental monitoring and regulation, it is imperative for a company to possess a substantial array of technology and patents to ensure the normal conduct of its operations, thereby securing a stable increase in its profits.This paper, taking into account the significant investment of environmental protection enterprises in technological R&D, examines the influence of ESG performance on corporate profits under the impact of technological innovation by considering technological innovation as a moderating factor.

3. Method

This paper explores the correlation between a company's ESG performance and its profits through a case study of a surveying and mapping company in the environmental protection industry, and discovers that technological innovation plays as a certain moderator in the relationship However, through the application of grounded theory to the case study, it was observed that technological innovation did not serve to enhance the relationship; on the contrary, it exerted a dampening effect to a certain extent on the positive correlation between ESG performance and corporate profitability. The conclusions drawn from a single case are difficult to generalize widely and are limited by the attributes of the company within the environmental protection industry. Therefore, this paper will examine the mechanism by which the ESG performance of environmental protection companies affects the increase in corporate profits through statistical analysis with a large sample size, and test the moderating effect of technological innovation in this process. In contrast, the following hypotheses are proposed in this paper:

H1:ESG performance has positive effect on enterprise value.

H2:Technology Innovation weaken the positive effect between ESG performance and enterprise value.

3.1 Variable design

3.1.1 Explanatory variable

At present, China's ESG evaluation system lacks a fully professional set of criteria; however, the majority of companies in the market currently utilize the HuaZheng ESG Index to rate their annual ESG performance on a scale from AAA to CCC, with corresponding numerical values ranging from 1 to 9. In this paper, the HuaZheng ESG Index is adopted, where the average ESG score across the four quarters of the evaluation year is taken to reflect the company's annual ESG performance.

3.1.2 Explained variable

Corporate value is a multifaceted construct, with financial value being reflected through a myriad of financial indicators. In contrast, non-financial values, such as social value, often engender ambiguity due to the absence of a unified measurement standard. Consequently, this study employs the profit component of financial value as a direct reflection of the operational capability of enterprises under varying levels of ESG performance.

3.1.3 Moderator

Technological innovation, serving as the moderating variable in this study, is measured to mitigate the stochastic fluctuations it introduces. Accordingly, the natural logarithm of the annual count of newly added patents plus one for each enterprise is utilized as the metric to gauge the concept of corporate innovation.

3.1.4 Control variable

Due to the fact that corporate profits reflect a company's operational capability over a business cycle, they are influenced by a multitude of factors and are not sufficiently stable. Consequently, to isolate the impact of ESG performance on corporate profits, it is necessary to control for numerous variables. This paper reviews the literature [1,3,5,6],and drawing from the controls used for corporate profits within, selects a set of factors for consideration, including size, roe, Asset-Liability ratio, operating margin.

|

Variation |

Symbol |

Definition |

|

Enterprise ESG Performance |

ESG |

HuaZheng ESG index |

|

Enterprise Net Profit |

p |

The Amount of Net Profit |

|

Technology Innovation |

TI |

Ln(Amount of Patent) |

|

Enterprise Scale |

size |

Ln(Total Assets) |

|

Profitability |

ROE |

Weighted return on equity |

|

OP-Margin |

Net profit/Total operating revenue |

|

|

Solvency |

ALR |

Total liabilities/Total assets |

3.2 Model

Based on the two hypotheses posited in this paper, the following equation model has been established.

3.3 Data analysis

3.3.1 Data collection

This paper conducts a regression analysis using a sample of 31 companies from the environmental protection industry listed on the HuaZheng ESG index for the years 2020-2023. These 31 companies span across the northern, southern, and southwestern regions of China and are all large-scale listed companies with considerable influence, whose data are reliable and credible. They can adequately represent China's environmental protection enterprises.

3.3.2 Summarize

Descriptive analysis reveals that this study employs a sample of 31 companies to investigate the mechanism of interaction between corporate ESG performance and corporate profits over the period from 2020 to 2023.

|

VarName |

Obs |

Mean |

SD |

Min |

Median |

Max |

|

esg |

31 |

3.49 |

1.275 |

1.25 |

4 |

5.75 |

|

p |

31 |

957.25 |

3057.861 |

1.5704 |

161 |

17169 |

|

ti |

31 |

2.55 |

1.490 |

0 |

2.890372 |

4.744932 |

|

size |

31 |

7.72 |

2.551 |

2.097827 |

8.148735 |

10.68178 |

|

alr |

31 |

0.67 |

0.730 |

.0583385 |

.5581616 |

4.3829 |

|

roe |

31 |

2.03 |

0.783 |

.0582689 |

2.107786 |

3.383034 |

|

opmargin |

31 |

0.14 |

0.181 |

.0180064 |

.0903614 |

1.061038 |

3.3.3 Correlation analysis

The results of the correlation analysis distinctly demonstrate a significant positive relationship between corporate ESG performance and corporate profits, indicating that technological innovation is conducive to higher levels of ESG performance within enterprises. However, technological innovation has a significant negative impact on corporate profits. Whether technological innovation plays a positive or negative moderating role between ESG performance and corporate profits remains unknown. Consequently, this paper proceeds to conduct regression tests to ascertain whether technological innovation fosters or inhibits the primary effect in the relationship between ESG performance and corporate profits.H1 is supported.

|

esg |

p |

ti |

size |

alr |

roe |

opmargin |

|

|

esg |

1 |

0.419** |

0.207 |

0.581*** |

-0.333* |

-0.202 |

0.066 |

|

p |

0.265 |

1 |

-0.138 |

0.854*** |

0.111 |

0.253 |

0.271 |

|

ti |

0.117 |

-0.370** |

1 |

-0.062 |

-0.006 |

0.055 |

-0.372** |

|

size |

0.606*** |

0.282 |

-0.093 |

1 |

0.127 |

0.041 |

0.021 |

|

alr |

-0.391** |

-0.028 |

-0.012 |

-0.335* |

1 |

0.275 |

-0.073 |

|

roe |

-0.167 |

-0.048 |

0.011 |

0.048 |

0.088 |

1 |

0.492*** |

|

opmargin |

0.091 |

0.073 |

-0.165 |

0.082 |

-0.008 |

0.127 |

1 |

3.3.4 Regressive analysis

To examine the moderating effect of technological innovation, this study introduces a novel variable, denoted as "ESGTI," within the model framework. The impact of this new variable on corporate profits is assessed to ascertain the effect of technological innovation. Model 113 is the result of detrending to mitigate the internal correlation within the data. The empirical findings from Model 112 clearly indicate that the new variable ESGTI exerts a significant negative influence on corporate profits and technological innovation. This has led to a certain degree of suppression of the positive effect between corporate ESG performance and corporate profits.H2 is supported.

|

(1) |

(2) |

(3) |

|

|

model11 |

model12 |

model13 |

|

|

esg |

702.2602 |

3.0e+03*** |

922.7187** |

|

(585.8424) |

(761.1793) |

(348.4318) |

|

|

ti |

-8.1e+02** |

2.0e+03** |

-8.1e+02** |

|

(381.1808) |

(910.2177) |

(294.7882) |

|

|

size |

131.5777 |

||

|

(280.7921) |

|||

|

alr |

497.8495 |

||

|

(813.2354) |

|||

|

roe |

-27.5769 |

||

|

(724.8788) |

|||

|

opmargin |

-4.5e+02 |

||

|

(3.1e+03) |

|||

|

esgti |

-8.0e+02*** |

||

|

(245.1060) |

|||

|

XZ_c |

-8.0e+02*** |

||

|

(245.1060) |

|||

|

_cons |

-6.4e+02 |

-7.2e+03** |

-11.7404 |

|

(2.8e+03) |

(2.7e+03) |

(1.4e+03) |

|

|

N |

31 |

31 |

31 |

|

adj. R2 |

0.0630 |

0.3900 |

0.3900 |

4. Discussion

This paper focuses on the environmental protection industry for mechanism research, and the impact of the emphasis on ESG performance on corporate profits may vary across different industries. However, for other industries that do not utilize natural resources, such as the financial sector, the conclusions of this paper may differ. Therefore, future research could expand the range of industries included in the sample or further refine the concept of corporate value. Shifting the focus away from financial value and placing more emphasis on a company's social and ecological value could provide a more comprehensive supplement to the conclusions of this study.

5. Conclusion

Drawing on the conclusions derived from the preliminary grounded theory analysis and the subsequent regression results, this paper arrives at two conclusions.

(1)There exists a significant positive correlation between corporate ESG performance and corporate profits, indicating that superior ESG performance is associated with higher corporate profitability and enhanced financial value.

(2)Technological innovation inherently stimulates the increase in corporate profits. However, as a factor that moderates the relationship between corporate ESG performance and corporate profits, technological innovation attenuates the positive association between ESG performance and profitability.

Extending these two fundamental conclusions, this paper posits that superior ESG performance leads to an increase in the trust and credibility of corporate investors and societal stakeholders. The enhanced reputation results in an increase in the capital available to the enterprise, thereby providing more operational capital and thus manifesting a significant positive effect on profits. Similarly, technological innovation attracts additional societal investment, which also positively impacts corporate profits. However, when technological innovation is applied to ESG responsibilities, given that enterprises bear substantial social, governance, and ecological responsibilities within the market and industry chain, more funds are required for research and development in these areas to achieve higher performance in responsibility fulfillment. For instance, in the environmental protection industry, significant financial investment is necessary in new environmental technologies and green production to achieve better ecological and social responsibility governance performance. These substantial financial outlays can directly lead to a reduction in the enterprise's current year profits, thereby exerting an attenuating effect on the relationship between ESG performance and profits. Concurrently, the development of these technologies is not widely known to the general public or corporate investors, and thus cannot directly translate the beneficial impacts of technological innovation through value transmission theory. On the contrary, due to the significant capital investment, an inhibitory effect on profits is formed.

References

[1]. Hadiqa Ahmad, Muhammad Yaqub Seung, Hwan Lee. Environmental-, social-, and governance-related factors for business investment and sustainability: a scientometric review of global trends [J]. Environment, Development and Sustainability, 2023, (26): 2965–2987.

[2]. Li, T.T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. https: //webofscience.clarivate.cn/wos/alldb/full-record/WOS: 000718591900001

[3]. Wang, S.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs [J]. Clean. Prod., 2023, 19, 137980.

[4]. MICHELSON G., WAILES N., FROST L. G. Special Issue on Ethical Investment and Corporate Social Responsibility: Ethical Investment Processes and Outcomes [J]. Journal of Business Ethics, 2004, (1): 1-10. [5] ZHANG Jie. Consequences and Responses of Environmental Negative Events of Dye Enterprises under the ESG Framework: A Case Study of Yabang Shares [D]. Shanghai: School of Accounting, Shanghai University of Finance and Economics, 2023.

[5]. HUANG Shizhong. "Green-washing" and Anti-Green-washing in ESG Reporting [J]. Finance and Accounting Monthly, 2022 (1): 3-11.

[6]. YU Junqiu, WANG Ying. Research on the Impact of Corporate ESG Performance on Corporate Value from the Perspective of Ecological Civilization: Taking Manufacturing Listed Companies in Beijing-Tianjin-Hebei as an Example [J]. Theoretical Research on Finance and Economics, 2021(2): 81-91.

[7]. LYU Hui, LI Zhangquan, ZHAO Guanyue. Research on the Impact of ESG Performance on the High-Quality Development of Coal Enterprises under the Background of Carbon Neutralization [J]. Research on Coal Economics, 2021, 41(10): 19-25.

[8]. LI Wei, ZHANG Yifan. Research on the Impact of ESG Performance on the Sustainable Development Capability of Enterprises: Taking Listed Companies in the Transportation Industry as an Example [J]. Finance and Accounting Communication, 2024(14): 42-48.

[9]. WANG Bo, YANG Maojia. The Impact Mechanism of ESG Performance on Corporate Value: Empirical Evidence from A-Share Listed Companies in China [J]. Soft Science, 2022, 36(6): 78-82.

[10]. LI Xiaorong, XU Tengchong. Research Progress on Environment-Social Responsibility-Corporate Governance [J]. Economic Dynamics, 2022 (8): 133-146.

[11]. XIAO Wendi. Research on the Impact of ESG on Corporate Value: Based on the Mediating Role of Innovation and Research and Development [J]. Management and Science of Small and Medium Enterprises, 2023 (21): 67-69.

[12]. OLTRA V, SAINT JEAN M. Sectoral systems of environmental innovation: An application to the French automotive industry [J].Technological Forecasting ang Social Change, 2009, 76(4): 567-583.

[13]. LU Dan.Research on the Impact of ESG Performance on the Brand Asset Value of High-Tech Enterprises in China: Based on the Moderating Role of Technological Innovation [J]. Financial Observation, 2024(16): 57-64.

[14]. Zhang Ximu. Study on the impact of R& D investment on profit efficiency of technology innovation enterprises from a financing perspective [D].ShenZhen University, 2022(08).

Cite this article

Wang,W.;Ye,F.;Hong,S. (2025). Research on Enterprise Value Mechanism of Environment-protection Industry Based on ESG Performance. Advances in Economics, Management and Political Sciences,198,19-27.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hadiqa Ahmad, Muhammad Yaqub Seung, Hwan Lee. Environmental-, social-, and governance-related factors for business investment and sustainability: a scientometric review of global trends [J]. Environment, Development and Sustainability, 2023, (26): 2965–2987.

[2]. Li, T.T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. https: //webofscience.clarivate.cn/wos/alldb/full-record/WOS: 000718591900001

[3]. Wang, S.; Esperança, J.P. Can digital transformation improve market and ESG performance? Evidence from Chinese SMEs [J]. Clean. Prod., 2023, 19, 137980.

[4]. MICHELSON G., WAILES N., FROST L. G. Special Issue on Ethical Investment and Corporate Social Responsibility: Ethical Investment Processes and Outcomes [J]. Journal of Business Ethics, 2004, (1): 1-10. [5] ZHANG Jie. Consequences and Responses of Environmental Negative Events of Dye Enterprises under the ESG Framework: A Case Study of Yabang Shares [D]. Shanghai: School of Accounting, Shanghai University of Finance and Economics, 2023.

[5]. HUANG Shizhong. "Green-washing" and Anti-Green-washing in ESG Reporting [J]. Finance and Accounting Monthly, 2022 (1): 3-11.

[6]. YU Junqiu, WANG Ying. Research on the Impact of Corporate ESG Performance on Corporate Value from the Perspective of Ecological Civilization: Taking Manufacturing Listed Companies in Beijing-Tianjin-Hebei as an Example [J]. Theoretical Research on Finance and Economics, 2021(2): 81-91.

[7]. LYU Hui, LI Zhangquan, ZHAO Guanyue. Research on the Impact of ESG Performance on the High-Quality Development of Coal Enterprises under the Background of Carbon Neutralization [J]. Research on Coal Economics, 2021, 41(10): 19-25.

[8]. LI Wei, ZHANG Yifan. Research on the Impact of ESG Performance on the Sustainable Development Capability of Enterprises: Taking Listed Companies in the Transportation Industry as an Example [J]. Finance and Accounting Communication, 2024(14): 42-48.

[9]. WANG Bo, YANG Maojia. The Impact Mechanism of ESG Performance on Corporate Value: Empirical Evidence from A-Share Listed Companies in China [J]. Soft Science, 2022, 36(6): 78-82.

[10]. LI Xiaorong, XU Tengchong. Research Progress on Environment-Social Responsibility-Corporate Governance [J]. Economic Dynamics, 2022 (8): 133-146.

[11]. XIAO Wendi. Research on the Impact of ESG on Corporate Value: Based on the Mediating Role of Innovation and Research and Development [J]. Management and Science of Small and Medium Enterprises, 2023 (21): 67-69.

[12]. OLTRA V, SAINT JEAN M. Sectoral systems of environmental innovation: An application to the French automotive industry [J].Technological Forecasting ang Social Change, 2009, 76(4): 567-583.

[13]. LU Dan.Research on the Impact of ESG Performance on the Brand Asset Value of High-Tech Enterprises in China: Based on the Moderating Role of Technological Innovation [J]. Financial Observation, 2024(16): 57-64.

[14]. Zhang Ximu. Study on the impact of R& D investment on profit efficiency of technology innovation enterprises from a financing perspective [D].ShenZhen University, 2022(08).