1. Introduction

For the last few years now, compensation practices for executives in the technology sector have become a focal point of concern for the public—partially due to increasing worries of the wealth gap, heightened shareholder activism, and a greater focus on ESG-related responsibilities. The world’s leading technology companies have dominated international equity markets, shaped politics and culture, and as a result, have faced intense scrutiny over their internal governance and incentive systems.

Microsoft stands out among industry leaders not only for its size and profits, but mainly for its visible and deliberate attempts to change its compensation philosophy over the last decade. The comprehensive transformation of the corporate strategy along with the overhaul of the executive compensation system started with Satya Nadella’s appointment as CEO in 2014, who has since then moved the company away from static pay structures and tenure-based stock options to more flexible, outcome-focused pay systems. Microsoft now increasingly shifts away from outdated compensation models to a resolute results-oriented approach based on Long-Term Incentives (LTI). These LTIs are tied to measurable targets including Total Shareholder Return (TSR) and Return on Capital Employed (ROCE). In recent years, those incentives have evolved further to include ESG benchmarks, marking a significant change in Microsoft’s governance outlook. This shift marks a movement away from short-term financial results towards sustainable value creation, branding executive remuneration relative to the company’s ethical actions and reputation management.

Alongside these structural reforms, Microsoft has made notable strides in intertwining social and environmental concerns with its appraisal systems for executives and their professional evaluation. The organization has moved beyond a sole focus on incentivizing business growth and profit generation. There are significant shifts owing to increased pressure from investors and regulators, driving the company to undertake concrete measures in ESG alignment. Microsoft has attempted to integrate its enduring vision for sustainability with the company’s overall ethos of “compensation strategy” by linking leadership rewards to milestones such as achieving carbon neutrality, enhancing diversity and inclusion metrics, as well as ensuring the AI deployment is ethical.

In numerous ways, Microsoft’s compensation reform works in favor of the entire technology corporate sector. Between 2014 and 2024, the company’s DEF 14A proxy statements documented this transformation, describing an increasing transparency-bounded relationship between the executive pay, shareholders value and remuneration as well as the use of multi-dimensional performance criteria which are more holistic. These filings also reveal a fundamental governance problem: balancing socially responsible remuneration practices with increasing social and ethical concerns—this is the central challenge of corporate governance today.

This paper looks at Microsoft’s changing executive pay system in the context of the last transformative decade, assessing the organizational logic that has shaped its development and the enduring problems it still faces. It further examines the strategic, ethical, and regulatory forces that influence the immediate direction of the company. In so doing, the paper situates Microsoft’s incentives system into a broader discourse on modernizing governance and corporate accountability in the booming global technology industry.

2. Evolution and structural features of Microsoft’s executive compensation system

2.1. Nadella’s initial reform period (2014–2016)

The appointment of Satya Nadella as Microsoft’s CEO in 2014 heralded a transformative moment in the company’s culture in tandem with its approach to executive remuneration practices. Nadella endorsed the so-called ‘growth mindset’ which embodies agility, innovation, cross-department collaboration and drives integrated strategic shifts at the design level concerning leadership compensation architecture. Microsoft has shed under appointment entitlement-based compensation paradigms in favor of performance measured systems tied to results and quantifiable metrics.

According to the 2016 DEF 14A filing, Nadella’s total compensation amounted to $17.7 million, of which more than $10 million came from LTI awards tied to TSR and ROCE performance benchmarks. This marked an overhaul in the approach taken to executive remuneration, as the focus shifted to incentivizing value creation that was quantifiably measurable. Essentially, Microsoft began to lay the groundwork for a wider change in corporate governance and started to institutionalize performance accountability in assessing governance effectiveness and leadership impact [1].

2.2. Expansion of performance metrics and governance transparency (2017–2020)

In the years spanning 2017 to 2020, Microsoft made significant advancements to its performance evaluation system, one of which included expanding the metrics defined to evaluate and set executive compensation. Perhaps the most important addition during this timeframe was the introduction of relative performance measures, most notably benchmarking Microsoft's Total Shareholder Return against the S&P 500 and custom industry peer groups. These were integrated into multi-year evaluation periods with long-term incentive (LTI) payments recalibrated based on the degree to which Microsoft exceeded or underperformed relative to these benchmarks.

The firm improved transparency in its goal-setting practices in 2017 and relative TSR, alongside a defined competitive cohort, was used to measure LTI compensation payments [2]. Enhancing annual performance evaluations as they became more holistic in 2018 with the addition of qualitative metrics like customer satisfaction and the health of the innovation pipeline came to add value. Although these elements had yet to be quantitatively weighted in compensation formulas, reflecting increased focus on non-financial performance evaluation metric [3].

One of the major changes came with the filing of the DEF 14A form in 2019 which adopted “Pay-for-Performance” disclosure system. This gave stakeholders the ability to view the payment of the CEO and the returns from shares beside each other [4]. This made the reason why executive pays were made easier to understand for shareholders and regulators. By 2020, Microsoft had taken further steps to refine its benchmarking approach expanding the comparison group to include global leaders in technology and cloud industries. Other factors like ROCE and customer engagement were added to reflect the company’s shifting business priorities more accurately [5]. Along with these changes, providing clear explanations showing how certain results impacted bonuses indicated that the company was trying to become more analytically market aligned and rigorously driven compensation that balanced external investor expectations with internal governance logic.

2.3. ESG integration and forward-looking governance (2021–2024)

In 2021, Microsoft purposely began embedding environmental, social, or governance (ESG) within its executive pay framework. This inclusion was the result of creating new LTI goals that were clearly associated with achieving ESG benchmarks such as becoming carbon neutral, developing frameworks for governing responsible artificial intelligence, and reinforcing organizational cybersecurity resilience [6].

By 2022, this integration was more formalized as Microsoft embedded climate-related goals into its compensation incentives. The DEF 14A filing of that year described a more defined set of sustainability-linked metrics which included reduction of greenhouse gas emissions, enhancement of workforce diversity and inclusion, and ethical AI implementation [7]. Notably, the range of ESG-linked incentivized pay bifurcation shifted to include more senior leadership positions than just the CEO, suggesting an organized attempt to institutionalize oversight sustainability across Microsoft’s governance framework. With these changes, Enhanced ESG Transparency was provided wherein detailed disclosures on the influence of ESG performance on LTI payouts were provided to investors as silence no longer was an option.

According to the 2023 proxy statement, approximately 15% of the CEO’s performance assessment was influenced by ESG-related goals, which indirectly affected the final LTI payout [8]. This was further supported in 2024 with the addition of a new comprehensive module dubbed "Pay vs. Performance." [9] This unique evaluative framework positioned executive pay not only against shared value creation, but also against ESG progress and feedback from stakeholders. With this shift, Microsoft demonstrated its commitment to adopting a governance framework that balances fiduciary obligation with proactive risk assessment and ethical accountability.

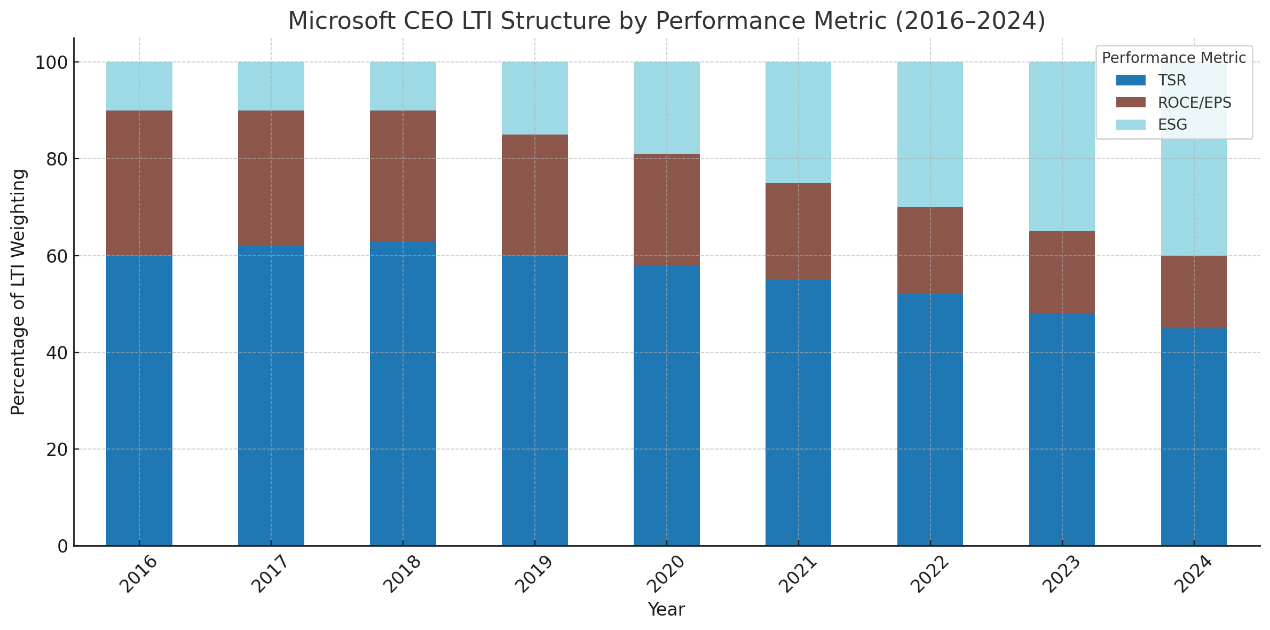

This change in the structure of compensation systems is clearly reflected in the shifting Microsoft incentive program sponsor architecture. As shown in figure 1, the ESG-performance-related metrics in the CEO’s remuneration package has grown substantially post 2020. While some traditional financial metrics like Total Shareholder Return (TSR), Return on Capital Employed (ROCE), and Earnings Per Share (EPS) seemed prevalent in the earlier periods, they have gradually waned in influence. By 2024, ESG components had increased from less than 10% in 2016 to almost 40% of the total LTI diagram allotted. This progressive and purposeful evolution reflects Microsoft’s commitment further illustrates the intention to actively go beyond dollar-denominated metrics towards a more comprehensive system that incentivizes long-term sustainable and ethical organizational stewardship, and multi-layered stakeholder accountability.

Taken in their entirety, these reform stages Microsoft has implemented highlight the shift away from a Microsoft remuneration model based on conventional structure towards a more adaptive compensation framework anchored in evolving governance practices and a heightened sensitivity to ethical and social responsibilities. The resulting model exemplifies the emerging characteristic of twenty-first century corporate governance which seeks to balance overdue focus on the financial performance with a social metric and environmental responsibility.

3. Key issues and controversies in Microsoft’s executive compensation framework

Microsoft’s attempts to incorporate ESG concerns into its executive pay alignment strategies have fundamentally mitigated some peripheral ethical issues, yet more deep-rooted and systematic concerns remain. The lingering unresolved structural tensions create major fairness concerns regarding equity redistribution, strategic synergies inconsistency across interlinked value outcomes. Moreover, inefficacy of governance processes illustrates inadequate representation of multi-stakeholder viewpoints.

3.1. Widening pay disparity and perceptions of inequity

One of the most long-standing critiques within Microsoft stems from the compensation structure and the vast divergence between the chief executive officer leviathan scale remuneration and that of the average worker. Microsoft DEF 14A documents have indicated a consistent upward trajectory of the CEO to median-worker ratio since 2018, which can be attributed to rising equity-based remuneration awarded to the top rank. These compensation packages masquerading under the guise of performance-driven and shareholder value aligned are, in reality, so disproportionate to the rest of the workforce that it severely diminishes any cohesive organizational sense. In the absence of wage growth for the broader employee base, excessive rewards breed disenchantment and perceptions of entrenched inequities within hierarchical structures [10].

This disconnect also puts additional pressure on Microsoft’s implicit moral agreement with its workforce considering its commitments to providing equitable economic opportunities and fostering shared growth. Discontent arises further when external ESG commitments juxtapose starkly with internally mandated pay structures. Moreover, a chronic gap in the distribution of compensation hampers talent retention, particularly among driven mid-level managers and high-performing teams who feel their upward mobility is stunted within a given structure.

Figure 2 illustrates this issue by showing Microsoft’s ratio of the CEO’s pay to the median employee’s pay from 2016 to 2024. During this period, the ratio increased steadily from around 120:1 to over 300:1.

![Figure 2. Microsoft CEO-to-Median Employee Pay Ratio (2016–2024) [1-9]](https://file.ewadirect.com/press/media/markdown/document-image2_FkFCogz.png)

3.2. Overemphasis on financial performance metrics

From 2016 to 2022, Microsoft continued using quantitative metrics, such as Total Shareholder Return (TSR), Return on Capital Employed (ROCE), and Earnings Per Share (EPS) to measure their Long-Term Incentive (LTI) design. These indicators are frequently used because they are simple to measure and resonate with shareholders. However, focusing exclusively on these metrics’ risks encouraging executives to deliver what is most financially rewarding at the time, deterring innovation, institutional flexibility, and the enduring resilience of the organization.

Focusing exclusively on organizational hard targets stifles risk-taking, cross-discipline collaboration, and innovative thinking—hallmarks of enduring business growth [11]. Such pay-for-performance systems often fall short in fostering transformative value, largely because they overlook forward-looking qualitative indicators such as R&D pipeline robustness or investment in workforce development. Additionally, the lack of formal structures to still recognize ethical leadership or chronic product durability and social value undermines Microsoft's goal of being a responsible global corporate citizen.

Microsoft's movement towards generative artificial intelligence, implementing algorithms with ethical considerations, and crafting robust cloud infrastructures renders the absence of non-financial performance metrics in executive pay structures more troubling. The absence of these indicators creates a misalignment between Microsoft’s incentive structure and the company's shifting goals alongside society's evolving expectations of corporate governance in the 21st century.

3.3. Benchmarking and the compensation spiral

Another structural vulnerability within Microsoft's executive compensation model is its use of peer benchmarking as a reference for strategic compensation policy decisions. Based on peer benchmarks, Microsoft contributes to compensation inflation—often called the “ratcheting effect.” While this approach is common practice in the industry, it creates a disconnect between compensation, the actual performance of the company, along with undermined economic forces, fueling exacerbated growth.

The so-called “competitive parity” leads to diffused focus on measurable outcomes and shifts the center of gravity for company-wide remuneration, further divorcing compensation from clearly articulated Microsoft strategies [12]. This further erodes Microsoft's capacity to address internal priorities, equity among organizational levels, or performance-based differentiated achievement. Contextualized benchmarking from firms in different regulatory and market environments may, however, distort Microsoft’s strategic needs, leading to incentives that prompt misaligned actions with specific strategic focus.

The very competitive reasoning that underlies benchmarking applies to peer firms as well, creating a self-sustaining cycle that increases executive compensation throughout the industry. In this manner, what was meant to serve as an impartial calibration tool turns out to be a counterproductive mechanism that safeguards against objective evaluation, in contrast, accelerating market driven pay inflation, undermining the controlling function that market benchmarks are meant to fulfill.

3.4. Limited internal participation in compensation governance

Microsoft’s present governance structure for paying executives is still mostly top-down, decided by an independent Compensation Committee made up exclusively of non-executive directors. While this governance arrangement fulfills independence criteria for regulatory compliance, it fails to provide any meaningful pathways for employee input, involvement, or representative feedback. The lack of advisory panels or structured consultations diminishes the legitimacy of pay decisions and perpetuates a broader organizational sense of opacity.

Research shows that even the most minimal forms of employee participation, such as non-binding attendance at governance discussions, can enhance pay transparency and develop a sense of organizational accountability for the compensation system [13]. This gap is striking in Microsoft’s case, given that the company is known, and often praised, for its strong employee relations and the activism in stakeholder inclusive capitalism. By failing to include internal stakeholders in discussions surrounding remuneration policies, the company risks misaligning its compensation strategies with evolving workforce demographics, generational shifts, strategic alignment, and coherent values.

In international settings that are more dominant in co-determination norms, like Germany, Microsoft’s governance model is likely to be seen as increasingly outdated in light of global shifts toward greater inclusiveness and decentralized frameworks for governance and decision-making [14].

4. Reform pathways for Microsoft and the broader technology sector

4.1. Diversifying performance metrics

In order to minimize reliance on traditional financial metrics, Microsoft should further refine the multidimensional metrics of performance used for executive pay. Immediate focus should be given to incorporating ESG objectives, innovation outcomes, engagement levels, as well as governance of AI responsibility. Microsoft could, for instance, track ESG emission goals as digitally monitored milestones, inclusiveness benchmarks, and ethical supply chain compliance standards [15].

Innovation performance might be evaluated using internal research and development productivity, collaboration metrics from different functional areas, and new product readiness. Within AI, applicable evaluative criteria could be fairness evaluations of algorithms, transparency in models, and bias eluding in automated systems. In addition, retention rates of high-potential employees, participation in mentorship roles, and employee net promoter scores would allow the organization to shift the focus from shareholder primacy towards balance with meaningful organizational wellbeing.

Integrating these qualitative perspectives helps construct resilient, multifunctional, and socially responsible corporations. Combating short term-focus while enhancing Microsoft’s reputation as a governance frontrunner dedicated to value creation further demonstrates Microsoft as a builder of sustainable growth structural equity.

4.2. Redesigning equity grant structures and vesting conditions

To maintain equity and prevent opportunistic exploitation, Microsoft Corporation needs to rethink its equity-based incentive schemes to avert the practice of stock awards at lower valuations and peak-price cash outs. An effective alternative would be to integrate linear, milestone-based vesting schedules tied to both financial and non-financial metrics. Instead of granting restricted stock units (RSUs) at a specified value on the grant date, these should be earned through exemplary performance over multiple years [16].

A more robust structure could intertwine relative ESG (Environment, Social, and Governance) factors to TSR (Total Shareholder Returns) to account for market relativity and the social responsibility quotient of the firm. Additionally, vesting schedules could be tiered towards innovation or cross-functional team goals, reinforcing alignment with strategic objectives. Short-term gaming would be mitigated by adopting partial cliff vesting where equity only vests after surpassing cumulative goals. Companies could also apply back-loaded vesting angles, concentrating equity rewards toward the close of a performance period, thereby shifting compensation from passive tenure to a stronger link with genuine long-term value creation.

4.3. Enhancing transparency and internal communication

Lack of transparency within compensation frameworks risks eroding trust and fostering misconceptions regarding situational analysis and the logic behind rewards. To solve this issue, it is advisable for Microsoft to initiate a quarterly internal visual reporting system showcasing the executive compensation structures, relevant KPIs, awarded milestones and their triangulation towards high-level strategic goals [17]. Such reports could also be accompanied by explanatory briefings and feedback forums to help employees understand the functioning of performance-based pay.

Developing an internal “compensation dashboard” where real-time performance triggers are measured against incentives could enhance access through the company’s intranet. Such tools would cultivate Microsoft’s shared understanding and embed them in the company’s cultural narrative. To enhance participation, Microsoft can include anonymous assessments on perceived fairness of compensation, interactive models on consequences of varying results on compensation, and open cross-level discussions on the pay structures. When paired with open feedback forums and interactive tools, these measures help build mutual understanding, reinforce accountability, and encourage meaningful engagement across organizational levels.

4.4. Institutionalizing participatory compensation governance

To fix the legitimacy deficits and improve the correspondence between Microsoft employees' expectations and executive remuneration, Microsoft should consider adding formal mechanisms for internal stakeholder participation in the governance of compensation. Possible options are to appoint non-voting employee representatives to the Compensation Committee or to create an advisory board that specifically reviews remuneration proposals [18]. Compensations forums held on a regular basis, accompanied by an open, company-wide summary of proceedings, would foster a culture of responsiveness and transparency.

By integrating monitored governance standards, Microsoft is able to construct a legally compliant payscale that simultaneously aligns with fiduciary expectations and embraces inclusivity [13]. The participatory frameworks would enable the firm to keep pace with international developments embracing stakeholder involvement in corporate governance and serve as a responsive mechanism for detecting burgeoning dissatisfaction or reputational threats. Such modifications, drawing from European co-determination and preeminent ESG governance frameworks, would cultivate Microsoft's reputation as a primary innovator in inclusive compensation strategies, transcending the role of best-practice implementer to norm-shaping global influencer.

5. Conclusion

The past ten years of Microsoft’s executive pay reforms show the interplay of realignment and modern governance in the context of emergent societal standards. What started as an attempt to align pay with performance under Satya Nadella has transformed into a complex, multi-layered incentive system. This new system integrates traditional financial metrics alongside “value” creation objectives and ESG commitments that are increasingly expected by stakeholders. Microsoft’s evolving compensation systems reflexively respond not only to the investors, but also to the demand of ethical accountability and sustainable leadership. Beyond driving performance, Executive compensation not only signals Microsoft’s institutional priorities but also serves as a medium for expressing its ethical commitments—both to employees and to the broader public.

However, the enduring core structural challenges of an overemphasis on thin-sliced financial measures, escalation in the compensation gap between executives and other employees, and lack of participatory governance still requires some recalibration. Even within Microsoft’s market leading position, the legitimacy and motivational effectiveness of its compensation system is under constant need of reassessment due to stakeholder multifactionism and cross-sectoral scrutiny. The changes suggested in this study, which include redefining employee relations policies and integrating employee perspectives into governance frameworks or expanding the range of performance metrics, aim at establishing a more ethically consistent and strategically coherent compensation system. These changes seek to reinforce the reputational Microsoft has earned for good governance during this period of intensified scrutiny by more closely aligning compensation with supporting long-term value creation.

Executive compensation in the tech sector will face sustainability issues depending on how AIF firms deal with ethical complications, the regulatory environment, and changes in workforce dynamics. As tech companies continue to expand globally and push the boundaries of innovation, their incentive systems need to balance compliance with flexibility. In this sense, Microsoft’s trajectory offers both lessons and preliminary best practices. It illustrates the possibility of leveraging compensation systems for institutional change while reminding that solely technocratic reforms without inclusive governance and meaningful stakeholder engagement are insufficient. Companies must embed value-based governance with performance parameters alongside incentivizing efficiency.

References

[1]. Microsoft Corporation. (2016). Notice of 2016 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar16/index.html

[2]. Microsoft Corporation. (2017). Notice of 2017 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar17/index.html

[3]. Microsoft Corporation. (2018). Notice of 2018 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar18/index.html

[4]. Microsoft Corporation. (2019). Notice of 2019 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar19/index.html

[5]. Microsoft Corporation. (2020). Notice of 2020 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar20/index.html

[6]. Microsoft Corporation. (2021). Notice of 2021 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar21/index.html

[7]. Microsoft Corporation. (2022). Notice of 2022 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar22/index.html

[8]. Microsoft Corporation. (2023). Notice of 2023 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar23/index.html

[9]. Microsoft Corporation. (2024). Notice of 2024 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar24/index.html

[10]. Gregoriou, A., Healy, J., Nguyen, N. Q., Nguyen, T. T. T., & Nguyen, T. T. T. (2024). CEO Long-Term Incentive Plan Compensation and the Adoption of Double Materiality Disclosures: Evidence from the UK. SSRN.

[11]. Gan, H., Park, M. S., & Suh, S. H. (2024). Non-financial Performance Measures and CEO Compensation: An Analysis of Web Traffic. Stanford Graduate School of Business.

[12]. The Conference Board, & ESGAUGE. (2024, January). ESG Performance Metrics in Executive Pay. Harvard Law School Forum on Corporate Governance.

[13]. Davila, A., & Venkatachalam, M. (2004). Non-financial Performance Measures and CEO Cash Compensation: Evidence from the Airline Industry. Journal of Management Accounting Research, 16, 1–21.

[14]. Vitols, S. (2005). Changes in Germany’s Bank-Based Financial System: A Variety of Capitalism Perspective. German Politics, 14(2), 131–153.

[15]. Candriam. (2023). The State of Pay: ESG Metrics in Executive Remuneration.

[16]. Bhagat, S., & Romano, R. (2009). Reforming Executive Compensation: Focusing and Committing to the Long-term. Yale Journal on Regulation, 26(2), 359–372.

[17]. Harvard Law School Forum on Corporate Governance. (2024, February). Compensation Design Calls for Radical Simplification.

[18]. Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835–2857.

Cite this article

Ding,Y. (2025). Redefining Executive Incentives in the Tech Industry: An In-Depth Analysis of Microsoft’s Compensation Strategy. Advances in Economics, Management and Political Sciences,190,242-250.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Digital Transformation in Global Human Resource Management

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Microsoft Corporation. (2016). Notice of 2016 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar16/index.html

[2]. Microsoft Corporation. (2017). Notice of 2017 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar17/index.html

[3]. Microsoft Corporation. (2018). Notice of 2018 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar18/index.html

[4]. Microsoft Corporation. (2019). Notice of 2019 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar19/index.html

[5]. Microsoft Corporation. (2020). Notice of 2020 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar20/index.html

[6]. Microsoft Corporation. (2021). Notice of 2021 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar21/index.html

[7]. Microsoft Corporation. (2022). Notice of 2022 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar22/index.html

[8]. Microsoft Corporation. (2023). Notice of 2023 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar23/index.html

[9]. Microsoft Corporation. (2024). Notice of 2024 Annual Shareholders Meeting and Proxy Statement (Form DEF 14A). Microsoft Investor Relations. Retrieved from https: //www.microsoft.com/investor/reports/ar24/index.html

[10]. Gregoriou, A., Healy, J., Nguyen, N. Q., Nguyen, T. T. T., & Nguyen, T. T. T. (2024). CEO Long-Term Incentive Plan Compensation and the Adoption of Double Materiality Disclosures: Evidence from the UK. SSRN.

[11]. Gan, H., Park, M. S., & Suh, S. H. (2024). Non-financial Performance Measures and CEO Compensation: An Analysis of Web Traffic. Stanford Graduate School of Business.

[12]. The Conference Board, & ESGAUGE. (2024, January). ESG Performance Metrics in Executive Pay. Harvard Law School Forum on Corporate Governance.

[13]. Davila, A., & Venkatachalam, M. (2004). Non-financial Performance Measures and CEO Cash Compensation: Evidence from the Airline Industry. Journal of Management Accounting Research, 16, 1–21.

[14]. Vitols, S. (2005). Changes in Germany’s Bank-Based Financial System: A Variety of Capitalism Perspective. German Politics, 14(2), 131–153.

[15]. Candriam. (2023). The State of Pay: ESG Metrics in Executive Remuneration.

[16]. Bhagat, S., & Romano, R. (2009). Reforming Executive Compensation: Focusing and Committing to the Long-term. Yale Journal on Regulation, 26(2), 359–372.

[17]. Harvard Law School Forum on Corporate Governance. (2024, February). Compensation Design Calls for Radical Simplification.

[18]. Eccles, R. G., Ioannou, I., & Serafeim, G. (2014). The Impact of Corporate Sustainability on Organizational Processes and Performance. Management Science, 60(11), 2835–2857.