1. Introduction

Seeking risk control portfolio strategies adapted to market changes is a concern for most investors. The classical Markowitz mean-variance optimization model achieves static control of risk. However, under the condition of real-time market changes, the static model fails to capture the market change factors. Therefore, its effect may be weakened as the market changes [1]. In order to adapt to the dynamically changing market environment and enhance the robustness of the strategy, this study innovatively introduces a dynamic risk-adjusted portfolio strategy, which has the advantage of designing the degree of risk aversion according to the market environment [2], balancing the risk and return, and realizing a more flexible portfolio strategy.

Risks in real markets are thick-tailed and non-normally distributed. Additionally, traditional variance-based risk control cannot effectively control extreme risks. Therefore, this study utilizes a loss percentile-based metric CvaR to measure tail risks. Moreover, CvaR has convexity and consistency, which is easy to linearize for the optimal solution. This study computes the value of CvaR and assigns an upper bound to control the tail losses. Given the fact that CvaR risk control strategy is highly sensitive to the selection of the confidence level

Comprehensive dynamic adjustment and differential control of risk under multiple differentiated

In summary, the multiple differentiated thresholds are set according to the market risk. Additionally, the multiple thresholds are dynamically adjusted by introducing a linear scaling function with a VIX index in order to maximize the return and minimize the cost, where the transaction cost is calculated by the L1 regularization term. Finally, the effectiveness of the strategy is evaluated in terms of risk-adjusted returns and maximum retracement.

2. Method

This study builds on traditional risk control models by introducing a method that adjusts the CVaR upper bound through linear scaling based on the VIX index, allowing the strategy to better adapt to changing market conditions.

2.1. Dynamic portfolio optimization based on differentiated multiple β-CvaR

Firstly

Treatment of CvaR values according to the linearization approach [3]:

After linear optimization [5], the CvaR expression is transformed into a convex function with respect to the weights, which facilitates the use of linear programming to solve for the optimal weights.

Determine the upper bound threshold for multiple differentiated

For multiple

To determine the upper limit of dynamic risk tolerance based on market risk, this study introduces the following linear scaling formula:

Where

Determine the maximized rate of return with minimized L1 regularized transaction costs:

Where

The collation is obtained:

Subject to:

2.2. Dataset

In the experiment, this study employs two representative datasets: the Fama-French 25 Portfolios (FF25) and the GICS Sector Portfolio 11 (GSP11). For the FF25 dataset, monthly returns from 1979 to 1998 are used as in-sample data, while returns from 1999 to 2018 serve as out-of-sample data. For the GSP11 dataset, monthly returns from 1989 to 2009 are used for model training, and data from 2010 to 2020 are used for out-of-sample testing.

The in-sample data is used to train the model and determine the optimal risk tolerance scaling factors. The model is then applied to the out-of-sample period to evaluate its performance. Both datasets are structurally representative: FF25 reflects cross-sectional differences in asset styles and does not require data cleaning for delisting or missing values, offering a stable and long-term return series. GSP11 captures sector-level asset allocation patterns and reflects real-world market behavior through industry rotation.

Together, the two datasets provide structurally distinct views of the market—one based on style factors and the other on industry sectors—allowing for a comparative analysis of model performance under different market environments.

3. Result

This study sets up four groups for comparative analysis, as can be seen in table 1.

|

Group |

Experimental Design |

|

Group1(G1) |

|

|

Group2(G2) |

|

|

Group3(G3) |

|

|

Group4(G4) |

|

To evaluate model performance, we determine the optimal risk tolerance scaling factors

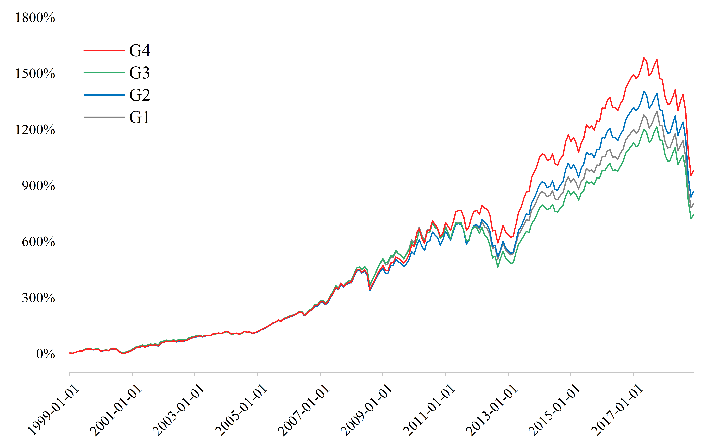

As shown in Figure 1, applying only differentiated thresholds across multiple differentiated

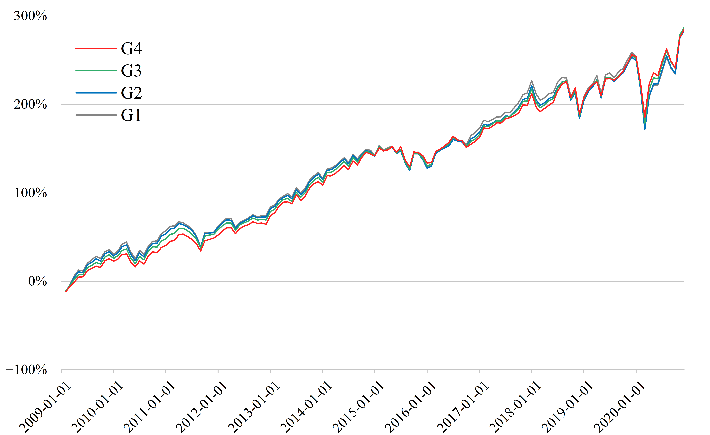

However, Figure 2 shows no statistically significant differences in cumulative returns across all three experimental groups (G2, G3, and G4) compared to the control group, suggesting that the effectiveness of the strategy may depend on the specific dataset or market environment.

|

Performance Metrics |

G1 |

G2 |

G3 |

G4 |

|

Annual Returns(%) |

12.78 |

13.21 |

12.39 |

13.85 |

|

Excess Returns Returns(%) |

10.78 |

11.21 |

10.39 |

11.85 |

|

Annual Volatility(%) |

14.22 |

14.44 |

14.20 |

14.55 |

|

Sharp Ratio |

0.76 |

0.78 |

0.73 |

0.81 |

|

Performance Metrics |

G1 |

G2 |

G3 |

G4 |

|

Annual Returns(%) |

13.21 |

13.21 |

13.08 |

12.92 |

|

Excess Returns Returns(%) |

11.21 |

11.21 |

11.08 |

10.92 |

|

Annual Volatility(%) |

14.86 |

14.52 |

13.77 |

13.04 |

|

Sharp Ratio |

0.75 |

0.76 |

0.80 |

0.83 |

Table 2 and Table 3 show that the risk-adjusted returns (Sharp Ratio) of the strategies on both datasets are significantly improved when the market risk-free rate is 2%.

Table 2 shows that the strategies improve the Sharp Ratio by increasing the excess return of the portfolio. The FF25 dataset features strong heterogeneity across assets, leading to varying sensitivities to market conditions [6]. In particular, small-cap assets may have potential excess returns when the market declines. Therefore, the strategy differentiation threshold setting is manifested in the enhanced ability to capture excess returns.

Table 3 shows that in the GSP11 dataset, the strategy improves the Sharpe ratio by decreasing the volatility of the portfolio return because the data structure of the GSP11 dataset exhibits stronger risk structuring and consistency. Therefore, the strategy is more sensitive to common risk prevention and control, and reduces volatility.

In the two datasets, the strategy acts in different ways, but both significantly increase the Sharpe ratio of the portfolio, indicating that the strategy has good cross-market applicability.

4. Discussion

In this study, four groups of experiments are set up. The differentiated thresholds can optimize the model's ability to respond to different scenarios and accurately regulate risks. Additionally, dynamically change the weights to improve the strategy's ability to respond to market changes. The strategy combines both approaches, using dynamically adjusted differentiated thresholds to achieve multiple levels of flexible risk control. Consequently, a higher confidence level has a higher elasticity in the face of market changes. Therefore, the model takes into account both the release of revenue and risk control. In addition, the VIX index signals are forward-looking, which helps adjust risk exposure in advance, mitigating potential tail events. This also smooths portfolio rebalancing, reducing transaction costs [7], and ultimately improves the strategy’s risk-adjusted performance.

In the multiple differentiated

Excessive constraint conditions in CVaR optimizers may lead to a decline in solver stability. To address this issue, the differentiated constraints under multiple

5. Conclusion

The dynamic adjustment strategy based on multiple differentiated risk thresholds significantly enhances the risk-adjusted returns of investment portfolios. However, its performance varies across different datasets. In the FF25 dataset, characterized by style-based asset rotation and high cross-sectional heterogeneity, the strategy’s differentiated thresholds enable the selection of assets that combine controllable tail risk with strong upside potential. By leveraging asset heterogeneity and market fluctuations, the strategy adjusts the portfolio composition in a way that preserves return potential while managing risk, thereby significantly improving excess returns. On the GSP11 dataset of industry rotation, the correlation of industry indices is high. Based on this asset characteristic, the strategy can effectively identify the risk consistency characteristics of asset structuring and realize risk consistency control, thus significantly reducing the volatility level and tail risk exposure of the strategy. In different datasets, the model takes into account multiple differentiated

The model performs poorly in terms of the maximum retraction rate because the dynamic threshold has the risk of exposing higher risk exposures. Additionally, the differential risk constraints on the multiple differentiated

References

[1]. Park, C., Kim, D. S., & Lee, K. Y. (2022). Asset allocation efficiency from dynamic and static strategies in underfunded pension funds. Journal of Derivatives and Quantitative Studies: 선물연구, 30(1), 2-22.

[2]. Lim, Q. Y. E., Cao, Q., & Quek, C. (2022). Dynamic portfolio rebalancing through reinforcement learning. Neural Computing and Applications, 34(9), 7125-7139.

[3]. Nakagawa, K., Noma, S., & Abe, M. (2020). RM-CVaR: Regularized Multiple β-CVaR Portfolio. Proceedings of the Twenty-Ninth International Joint Conference on Artificial Intelligence (IJCAI-20), 4562–4568.

[4]. Liu, Z., Liu, J., Zeng, Q., & Wu, L. (2022). VIX and stock market volatility predictability: A new approach. Finance Research Letters, 48, 102887.

[5]. Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of risk, 2, 21-42.

[6]. Fahling, E. J., Ghiani, M., & Simmert, D. (2020). Small versus Large Caps—Empirical Performance Analyses of Stock Market Indices in Germany, EU & US since Global Financial Crisis. Journal of Financial Risk Management, 9(04), 434.

[7]. Božović, M. (2024). VIX-managed portfolios. International Review of Financial Analysis, 95, 103353.

[8]. Sannes, H. M. S. (2016). Portfolio optimization with Conditional Value-at-Risk constraints (Master's thesis).

[9]. Kaya, H., Lee, W., & Pornrojnangkool, B. (2011). Implementable tail risk management: An empirical analysis of CVaR-optimized carry trade portfolios. Journal of Derivatives & Hedge Funds, 17(4), 341-356.

[10]. Luo, J. (2024). Integration of Conditional Value-at-Risk (CVaR) in Multi-Objective Optimization. Transactions on Engineering and Technology Research, 3, 92-97.

[11]. Hakobyan, A., & Yang, I. (2021). Wasserstein distributionally robust motion control for collision avoidance using conditional value-at-risk. IEEE Transactions on Robotics, 38(2), 939-957.

Cite this article

Tian,Y. (2025). Dynamic Portfolio Optimization Based on Differentiated Multiple β-CvaR. Advances in Economics, Management and Political Sciences,200,1-8.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Park, C., Kim, D. S., & Lee, K. Y. (2022). Asset allocation efficiency from dynamic and static strategies in underfunded pension funds. Journal of Derivatives and Quantitative Studies: 선물연구, 30(1), 2-22.

[2]. Lim, Q. Y. E., Cao, Q., & Quek, C. (2022). Dynamic portfolio rebalancing through reinforcement learning. Neural Computing and Applications, 34(9), 7125-7139.

[3]. Nakagawa, K., Noma, S., & Abe, M. (2020). RM-CVaR: Regularized Multiple β-CVaR Portfolio. Proceedings of the Twenty-Ninth International Joint Conference on Artificial Intelligence (IJCAI-20), 4562–4568.

[4]. Liu, Z., Liu, J., Zeng, Q., & Wu, L. (2022). VIX and stock market volatility predictability: A new approach. Finance Research Letters, 48, 102887.

[5]. Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. Journal of risk, 2, 21-42.

[6]. Fahling, E. J., Ghiani, M., & Simmert, D. (2020). Small versus Large Caps—Empirical Performance Analyses of Stock Market Indices in Germany, EU & US since Global Financial Crisis. Journal of Financial Risk Management, 9(04), 434.

[7]. Božović, M. (2024). VIX-managed portfolios. International Review of Financial Analysis, 95, 103353.

[8]. Sannes, H. M. S. (2016). Portfolio optimization with Conditional Value-at-Risk constraints (Master's thesis).

[9]. Kaya, H., Lee, W., & Pornrojnangkool, B. (2011). Implementable tail risk management: An empirical analysis of CVaR-optimized carry trade portfolios. Journal of Derivatives & Hedge Funds, 17(4), 341-356.

[10]. Luo, J. (2024). Integration of Conditional Value-at-Risk (CVaR) in Multi-Objective Optimization. Transactions on Engineering and Technology Research, 3, 92-97.

[11]. Hakobyan, A., & Yang, I. (2021). Wasserstein distributionally robust motion control for collision avoidance using conditional value-at-risk. IEEE Transactions on Robotics, 38(2), 939-957.