1. Introduction

The GameStop price bubble during 2021 was caused by different factors, the dominant factor is short squeeze, while there are still some debates for this remarkable stock market issue. GameStop's stock, which traded around $20 at the beginning of January 2021, due to the retail investor's collective movement, and their faith in counter-hegemony for finance traditional order, soared to its highest point of $482.850 by the end of January 2021 [1], resulting in massive losses for short sellers and sparking what is known as a "short squeeze". This unprecedented issue emphasized the power of collective retail trading and raised critical questions about market behavior, the role of trading platforms in facilitating or restraining such activity, and the influence of social media [2]. As media coverage intensified, the GameStop phenomenon transformed into a cultural movement, symbolizing the democratization of finance and challenging traditional notions of market participants. The episode served as a vivid reminder of the complexities of asset price bubbles and the evolving landscape of the financial markets in the digital age. Therefore, this paper will discuss how the different factors play a role in this massive financial issue. The paper divides the development of the problem into four factors: the short squeeze, the impact of social media, the impact by retail investors, and the impact of online sales. Above all, based on the data and four main factors, this paper will briefly explain how the above four factors play a role in GameStop financial issue.

2. Literature review

2.1. Short squeeze

The short squeeze, the dominant factors of GameStop stock’s price bubble during early 2021 reveal a fascinating case study in market dynamics, investor behavior, and the power of collective action in the digital age. There are number of aspects for this classical short squeeze in GameStop.

The first is GameStop's high short interest, GameStop had one of the highest short interest ratios in the market during early 2021, with more than 140% of its available shares sold short at its peak. This made it a prime candidate for a short squeeze. However, the GameStop’s stock obviously is under-valued. Due to the short sellers' massive short selling, a part of retail investors began to long sell the GameStop’s stock together to stop the trend of falling. As the more retail investors and some of institutions to participate in the long selling, the price of GameStop’s stock to rise. Lots of short sellers receive their margin call and had to buy back the stocks, this short squeeze further driving the stock's price higher, eventually creating a huge price bubble.

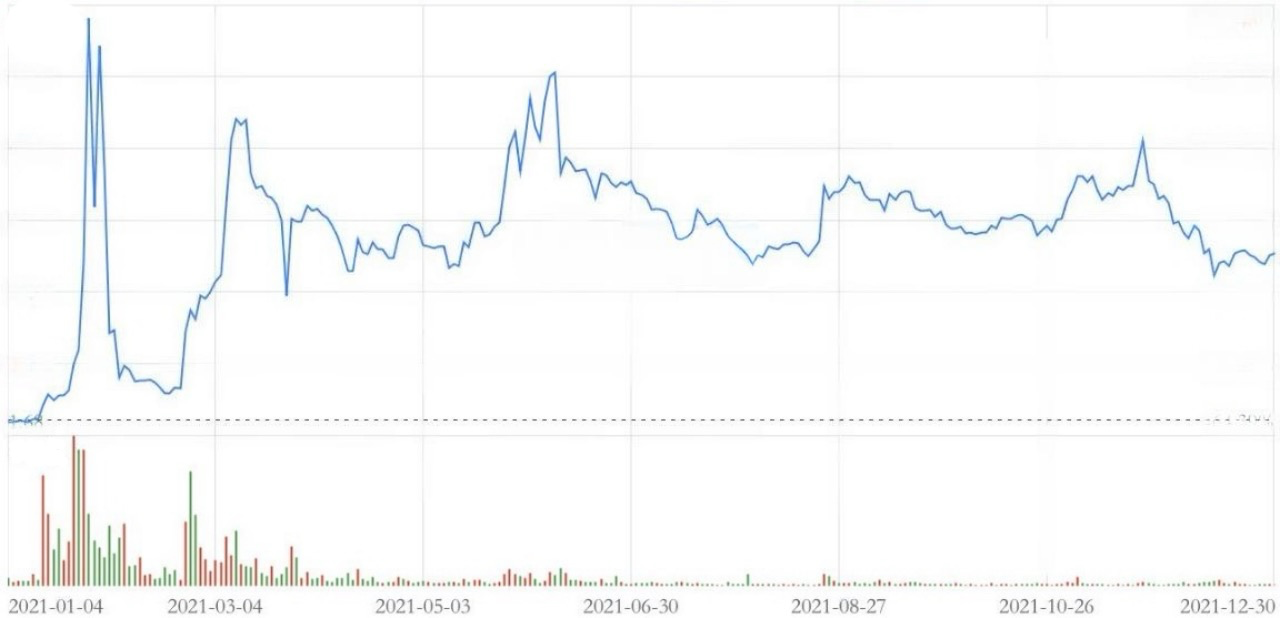

The second is retail investor mobilization, retail investors on the Reddit and WallStreetBets identified the opportunity and began purchasing shares and options. Their coordinated buying actions rapidly increased demand, leading to a sharp price spike [3]. As retail investors bought into GameStop, the stock price climbed from around $20 to nearly $483 within a matter of weeks (The Chart is below). This unprecedented volatility attracted media attention, drawing more investors into the fray, and eventually caused a huge price bubble during January 2021.

More importantly, the retail investor's desire to counter-hegemony for financial system increase sharply, which added to the momentum as more people joined in to buy the stock. Due to the increasing stock price, amounts of hedge funds and institutional investors faced significant losses due to their short positions. One of the most notable examples was Melvin Capital, a hedge fund that suffered substantial losses and required a capital infusion from other investors to stabilize after the squeeze. Obviously, this movement that further pushed up GameStop's stocks, and eventually cause a massive price bubbles.

The events surrounding the GameStop short squeeze prompted discussions about market regulation, the practices of short selling, and the role of trading platforms. Calls for greater transparency and scrutiny of short selling practices emerged in response to the volatility. Platforms like Robinhood faced backlash for restricting trading on GameStop and other stocks during the height of the volatility, raising questions about market access and fairness. This remarkable issue reveals that the public's desire to push democratization of finance [4].

Above all, the GameStop short squeeze serves as a compelling illustration of the complexities within financial markets, and the short squeeze plays a dominant role to sharply rise in GameStop stock. More importantly, this event demonstrates that investor behavior, technology, and social dynamics intersect. It stresses the potential impact of retail investors and raises important questions about regulation, market stability, and the future of trading in an increasingly digital and interconnected world. The events surrounding GameStop have left a lasting mark, prompting ongoing discussions about the nature of investing, community engagement, and the evolving landscape of the financial markets.

2.2. The impact of social media and online stock trading platforms

The impact of social media and online stock trading platforms is also a great factor that lead to the bubble of GameStop stock in 2021. There are some aspects that social media and online stock trading platforms can affect the stock.

2.2.1. Online platforms

Online platforms have provided investors with the opportunity to share information and strategies, with platforms such as Reddit, are gradually being more notable. These platforms can significantly encourage the enthusiasm of individual stock buyers, then creating a massive demand for certain stocks. By discussing and exchanging ideas within these communities, with different investors, they gained valuable insights and generated a collective momentum that can drive the market performance of specific stocks. As a result, the online platform is also a great factor that cause the bubble of GameStop in 2021 [5].

2.2.2. Key figures

Moreover, the key figures have a great influence on the price of the GameStop stock too. Some influential persons post on the social media platforms such as Twitter tweed the stock of GameStop and attract more individuals to buy it. This kind of influential people can draw lots of attention in a short time. For example, Elon Mask published a post about the stock GameStop on Twitter (the image below). After that, a lot of small investors go to buy the stock and generate a great strength.

As we can see, the price of the stock of GameStop’s stock rises immediately after Elon Musk tweeted his poster on Twitter.

2.2.3. Online stock trading applications

Thirdly, the convenience of online stock trading applications gave the investors a easy way to buy stocks at anytime and anywhere. Additionally, this kind of applications are less commissions and brokerage fees compared to the traditional offline stock trading platforms. As a result, more small investors would choose to buy the stocks online. So the participation from small investors are encouraged. For instance, Robinhood and Barron's are two famous online stock trading applications.

2.2.4. Psychological and social factors

Finally, the compelling narrative of small retail investors, akin to David, taking on large institutional investors, such as Goliath, may have struck a chord with many individuals. This powerful and relatable story resonated effectively with the public and inspiring a sense of empowerment and unity among small investors. The idea of the underdog triumphing over powerful financial institutions motivated a lot of people to join the case, pooling their resources and efforts to collectively lead to the movement. This collective action galvanized existing participants and attracted new investors who were drawn to the David vs. Goliath theme, showcasing the potential for similar narratives to effectively energize investors in future market movements [6]. Moreover, this kind of stories can be spread more quickly and effetively by the online stock trading platforms and social media.

2.2.5. Conclusion

The four aspects that mentioned above all affected and caused the price bubble of the stock of GameStop in 2021. More specifically, the Internet gave the investors convenient and cheap way to invest, the key figures motivated them to focus on the stock and invest, and stories also encourage them to join the case in a psychological way. All of them make the retail investors buy the stock and make short sellers buy back their most short stocks. That makes short squeeze and finally caused price bubble.

2.3. Impact by retail investors

There exists a direct correlation between collective action and sentiment among retail investors, contributing to the formation of an asset bubble in GameStop stock. They coordinated their efforts through social media platforms to collectively purchase GameStop shares with the aim of pressuring short sellers. However, the sentiment of retail investors is often influenced by market fluctuations. As stock prices begin to decline, they sell out of apprehension, further exacerbating the downward trend. The irrational behavior exhibited by retail investors and the influx of a large number of such investors have resulted in a herding effect that has led to an asset bubble in GameStop's price.

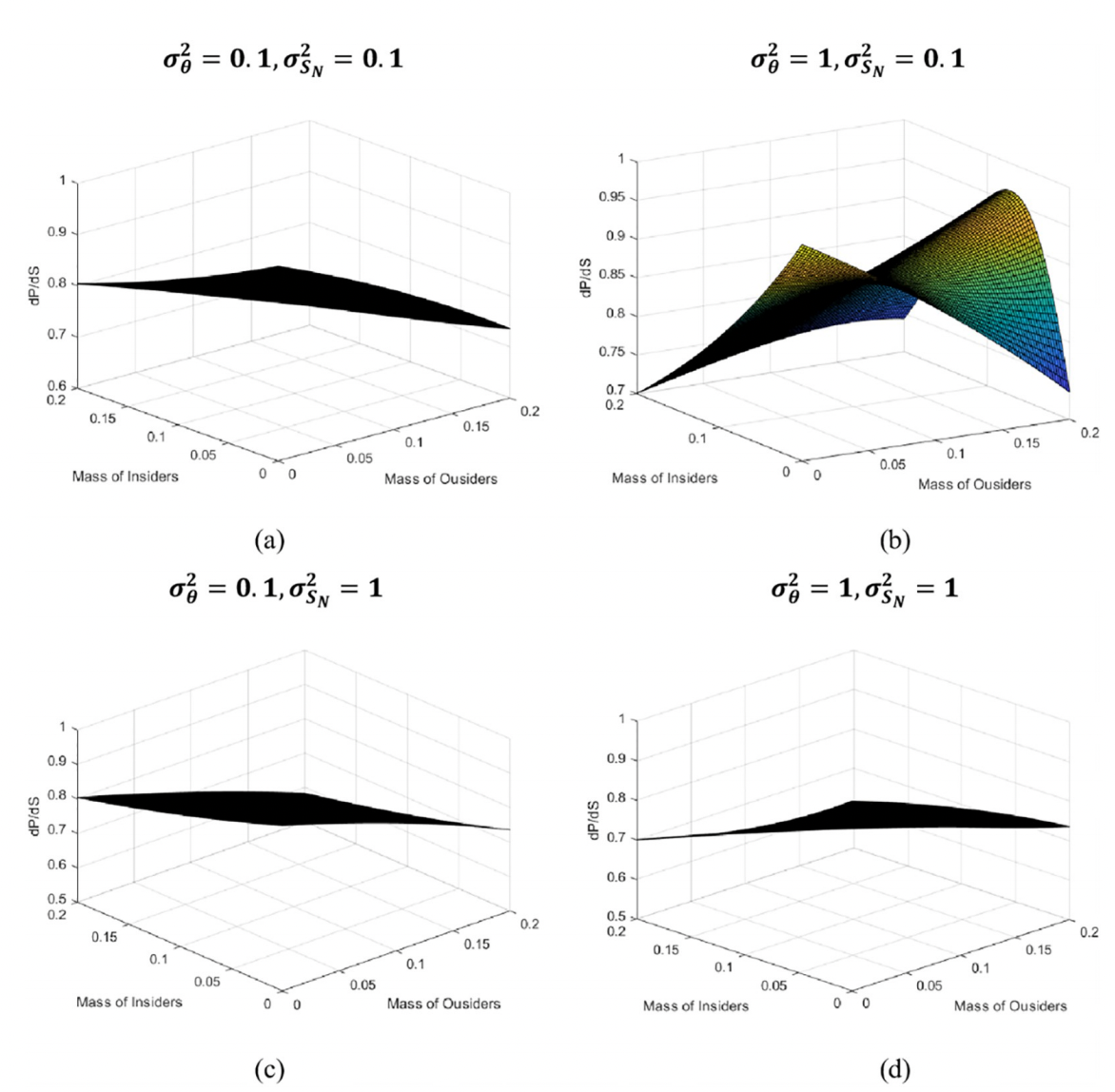

MATLAB to conduct numerical simulation to show how the ratio changes of different types of investors affect the market price. The sensitivity of price to retail investors was analyzed under the conditions of different information quality and sentiment changes.

Low information quality and the low mood changes (sigma squared _ theta equals 0.1, the sigma squared _SN = 0.1) of the second high information quality, and low mood changes ((sigma squared _ theta = 1, sigma squared _SN = 0.1), the third and fourth respectively low information quality and high mood changes (sigma squared _ theta = 0.1, σ²_SN = 1) and high information quality and high sentiment (σ²_θ = 1, σ²_SN = 1) According to the chart, we can know the extent of the influence of retail investor sentiment on prices under different market structures. When the proportion of retail investors in the market is close to 1, the sensitivity of price to retail investor sentiment reaches its maximum. But as the proportion of informed institutional investors increases, the information is integrated into asset prices, thereby reducing the impact of retail sentiment on prices and increasing the sensitivity of prices to information [7].

It can be seen that in the GameStop incident, more and more retail investors on the Internet are pitted against large institutions, which leads to the gradual withdrawal of these large institutions. In addition, the pandemic caused people to stay at home with more disposable income, which they used to buy stocks, further forcing these institutions to exit their short positions at GameStop. As retail investors join the fray, their collective enthusiasm and belief that more will continue to push prices higher, causing stock prices to rise sharply. In addition, with the increase of retail investors, the frenzied increase in stocks led to the original short-selling institutions receiving margin calls and being forced to buy back a large number of previously shorted GameStop stocks, resulting in short squeezing, further raising stock prices, and causing a price bubble [8].

2.4. The impact of online sales and its impact on stocks

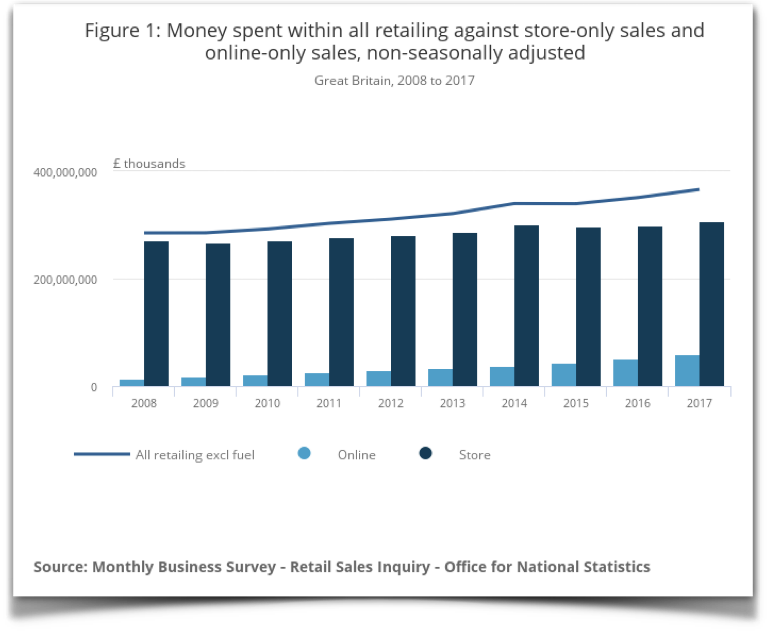

With the rapid development of the Internet industry, various traditional industries have received unprecedented impact, including GameStop company. The company’s main business is selling games and electronic products, and with the popularity of e-commerce and digital sales, its off-line physical store business is facing serious challenges. Because internet sales have such a big impact on offline sales. Back in 2017, PWC did a corresponding survey, and they looked at the top 500 cities and towns in the UK. They found that fewer new stores were opening, but that the number of closings was increasing. A total of 1,772 stores were lost in 2017. In the UK, online sales alone grew rapidly by 15.9% in 2017, while in-store sales were up 2.3% on the previous year. In 2018, the proportion of online spending in the UK hit a record high, rising to 18.2% in August.

This data clearly indicates that online spending is growing faster than in-store sales, with online sales up 15.9% in 2017 compared to the previous year. This decade-long shift highlights the changing landscape of retail, heavily influenced by technological advancements and shifting consumer behaviors. The impact on offline sales has significantly affected retail-oriented companies like GameStop. The company's offline business is facing serious challenges, leading to a reliance on market to drive stock prices. This divergence between fundamentals and stock prices ultimately results in the bursting of the price bubble [9].

This table shows GameStop's sales since 2015, especially the small increase in 2018, but there were many store closures in 2019.

The shift to e-commerce is not a recent phenomenon. This has been a gradual shift over the past decade due to the convenience and accessibility of online shopping. Consumers increasingly prefer online shopping because of its wide range of products, competitive prices and easy home delivery. Technological advances have accelerated this trend, such as faster Internet speeds, the proliferation of smartphones, and the development of online shopping platforms. Compared with traditional physical stores, e-commerce platforms have more advantages. Consumers can have a wider choice, and prices are often lower due to lower overhead costs. At the same time, online stores can offer a distinctive shopping experience by using algorithms and data analytics that can recommend products based on consumers' personal preferences [10].

For traditional retailers like GameStop, offline sales have been impacted, resulting in a series of chain reactions for the company. GameStop's stock has experienced a phenomenal rise in a short period of time, but that rise has gone far beyond what its fundamentals can support. During the formation of GameStop's price bubble, a large number of short sellers took short positions in the company. As share prices soared, these short sellers faced enormous pressure to lose money. To cut their losses, they had to cover short positions at high prices, which further exacerbated stock price volatility [11]. However, when market sentiment began to shift, the short-sellers' covering also ground to a halt, accelerating the fall in share prices. Retail investor sentiment also plays a big role. Organized through social media platforms, they collectively bought GameStop shares to squeeze short sellers. However, retail investor sentiment is often vulnerable to market fluctuations. When prices start to fall, some retail investors may sell out of panic, exacerbating the downward trend.

In conclusion, the shift to e-commerce has had a significant impact on GameStop's offline sales, which has been a long-term trend. The decade-long decline in brick-and-mortar sales is not the direct cause of GameStop's sudden, dramatic stock price rise in 2021 (Anand and Pathak, 2022). Instead, the surge has nothing to do with company performance, including the influence of social media, the enthusiasm of retail investors and the mechanism of a short squeeze. The negative trends that exist in offline sales are well known and have affected the company for years [12]. So the reason the bubble burst was not the continuation of these negative trends, but the absence of any substantial positive developments to sustain artificially inflated stock prices. The disconnect between the company's deteriorating and soaring share price highlights the speculative nature of the bubble, driven more by investors and market manipulation.

3. Conclusion

The GameStop price bubble in 2021 was driven by multiple factors that collectively created an unprecedented financial phenomenon. This conclusion analyze the main four factors behind this bubble, respectively the short squeeze, the impact of social media, the impact of retail investors, and the online sales.

First of all, the short squeeze was dominant factor in the sharp increase of GameStop's stock price. GameStop had a high short interest, making it a prime target for a short squeeze. As retail investors coordinated their buying efforts, the stock price surged, forcing short sellers to cover their positions by buying back shares at increasingly higher prices, further driving up the stock price. This created a feedback loop of rising prices and increased buying pressure, culminating in a massive price bubble.

In addition, social media and online stock trading platforms played a crucial role in inflating GameStop's stock price. Platforms like Reddit for information exchange and strategy sharing among investors. For instance, Elon Musk, strenghen this effect by getting massive attention to GameStop through his posts. This collective enthusiasm result in huge demand for GameStop stocks, further fueling the bubble. More importantly, online stock trading platform, such as Robinhood, broden the access to the stock market, allowing numbers of retail investors to participate in the stock market, and become a vital variable. Therefore, the influx of retail investors significantly drove up GameStop's stock price.

Moreover, the collective action of retail investors was a critical factor. Their collective movement on social media to obtain GameStop shares for pressuring short sellers led to a classical short squeeze. Retail investors, driven by complicated financial motivations and the willing to counteract perceived market injustices, collectively bought into GameStop, causing its price to soar. This collective action was fueled by the "David vs. Goliath" narrative, which resonated deeply with many individual investors, creating a powerful and incredible force in the market.

At last, the impact of online sales reshaped the retail landscape, significantly impacting traditional businesses like GameStop. As consumers increasingly favored online shopping for its convenience and competitive pricing, GameStop's offline sales decreased sharply. The decline in GameStop's fundamental business performance contrasted sharply with the surge in its stock price, highlighting a disconnect that is often a precursor to a price bubble.

Above all, the GameStop price bubble of 2021 was not the result of a single factor but a combination of several interrelated elements. The classical short squeeze, the impact of social media, the assignable effect of retail investors, and the reshaped online sales landscape all played significant roles. This multifaceted interaction emphasizes the complexity of modern financial markets: technological advancements and social dynamics can converge to create extraordinary market phenomena. The GameStop financial issue serves as a compelling case study in understanding the drivers of asset price bubbles and the evolving landscape of financial markets in the digital age.

References

[1]. Anand, A., & Pathak, J. (2022). The role of Reddit in the GameStop short squeeze. Economics Letters, 211, 110249.

[2]. Fusari, N., Jarrow, R., & Lamichhane, S. (2020). Testing for asset price bubbles using options data. Johns Hopkins Carey Business School Research Paper, (20-12).

[3]. Gao, B., Hao, H., & Xie, J. (2022). Does retail investors beat institutional investors? ——Explanation of game stop’s stock price anomalies. Plos one, 17(10), e0268387.

[4]. Garvey, R., He, J., & Wu, F. (2024). Retail broker trading restrictions and market liquidity: an examination of GameStop. Applied Economics, 56(34), 4140-4153.

[5]. Hasso, T., Müller, D., Pelster, M., & Warkulat, S. (2022). Who participated in the GameStop frenzy? Evidence from brokerage accounts. Finance Research Letters, 45, 102140.

[6]. Hilliard, J. E., & Hilliard, J. (2023). The GameStop short squeeze: Put–call parity and the effect of frictions before, during and after the squeeze. Journal of Futures Markets, 43(5), 635-661.

[7]. Hunter, W. C., Kaufman, G. G., & Pomerleano, M. (Eds.). (2005). Asset price bubbles: The implications for monetary, regulatory, and international policies. MIT press.

[8]. Lee, J. H., & Phillips, P. C. (2016). Asset pricing with financial bubble risk. Journal of Empirical Finance, 38, 590-622.

[9]. Long, S., Lucey, B., Xie, Y., & Yarovaya, L. (2023). “I just like the stock”: The role of Reddit sentiment in the GameStop share rally. Financial Review, 58(1), 19-37.

[10]. Nathan, G. (2021). THE ANTISOCIAL NETWORK The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees.

[11]. Sammer, H. (1987). Online Stock Trading Systems: Study of an Application. In COMPCON (pp. 161-163).

[12]. Yang, Z. (2022). GameStop or Game Just Started? Leveling the Playing Field for Social Media Meme Investors to Rebuild the Public’s Trust. Journal of Risk and Financial Management, 16(1), 13.

Cite this article

Chen,M.;Yin,H.;Huang,Y.;Zhu,Z. (2025). Research into the Factors that Cause a Price Bubble in GameStop During 2021. Advances in Economics, Management and Political Sciences,202,262-270.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Anand, A., & Pathak, J. (2022). The role of Reddit in the GameStop short squeeze. Economics Letters, 211, 110249.

[2]. Fusari, N., Jarrow, R., & Lamichhane, S. (2020). Testing for asset price bubbles using options data. Johns Hopkins Carey Business School Research Paper, (20-12).

[3]. Gao, B., Hao, H., & Xie, J. (2022). Does retail investors beat institutional investors? ——Explanation of game stop’s stock price anomalies. Plos one, 17(10), e0268387.

[4]. Garvey, R., He, J., & Wu, F. (2024). Retail broker trading restrictions and market liquidity: an examination of GameStop. Applied Economics, 56(34), 4140-4153.

[5]. Hasso, T., Müller, D., Pelster, M., & Warkulat, S. (2022). Who participated in the GameStop frenzy? Evidence from brokerage accounts. Finance Research Letters, 45, 102140.

[6]. Hilliard, J. E., & Hilliard, J. (2023). The GameStop short squeeze: Put–call parity and the effect of frictions before, during and after the squeeze. Journal of Futures Markets, 43(5), 635-661.

[7]. Hunter, W. C., Kaufman, G. G., & Pomerleano, M. (Eds.). (2005). Asset price bubbles: The implications for monetary, regulatory, and international policies. MIT press.

[8]. Lee, J. H., & Phillips, P. C. (2016). Asset pricing with financial bubble risk. Journal of Empirical Finance, 38, 590-622.

[9]. Long, S., Lucey, B., Xie, Y., & Yarovaya, L. (2023). “I just like the stock”: The role of Reddit sentiment in the GameStop share rally. Financial Review, 58(1), 19-37.

[10]. Nathan, G. (2021). THE ANTISOCIAL NETWORK The GameStop Short Squeeze and the Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees.

[11]. Sammer, H. (1987). Online Stock Trading Systems: Study of an Application. In COMPCON (pp. 161-163).

[12]. Yang, Z. (2022). GameStop or Game Just Started? Leveling the Playing Field for Social Media Meme Investors to Rebuild the Public’s Trust. Journal of Risk and Financial Management, 16(1), 13.