1. Introduction

In today’s world, where globalization and digital technology are closely connected, companies are facing more and more competition for talented people. One important goal for many organizations is how to build a smart and fair pay system that can attract and keep great employees. This is especially true in the tech industry, where innovation depends on teams with strong skills. A good pay system can help motivate workers, make teamwork stronger, and help the company grow in the long term. Amazon, as one of the most powerful internet companies in the world, has created its own system for giving rewards and motivating employees, using its strong platform and fast decision-making ability.

Amazon’s pay system is used not only for top leaders and board members, but also for regular and middle-level employees. The main feature of this system is its strong use of stock rewards, like RSUs (Restricted Stock Units), and a focus on long-term goals. In addition, Amazon has removed traditional parts of board pay, like bonuses or meeting fees. This makes the system simpler and tries to keep board members focused on the same interests as the company’s shareholders. These pay choices may help Amazon look better in the stock market, but they also bring questions about fairness, how many types of rewards are offered, and whether employees are really happy with the system.

This paper will use Amazon as the main example to look at how its pay system works, why it was designed that way, and what problems it might have. It will also study good practices from other tech companies, and give ideas to help improve pay systems in similar large companies.

2. Main compensation system

2.1. System introduction

Amazon’s compensation system shows a clear focus on long-term incentives. According to the company’s most recent reports on how it pays its board members, the main parts of its pay structure include a fixed yearly cash amount and stock-based rewards called RSUs (Restricted Stock Units). At the same time, Amazon has removed some traditional payment items, such as bonuses, meeting attendance fees, and other extra benefits. This design shows that Amazon wants to create a pay system that focuses more on performance and makes sure that board members care about the same things as the company’s shareholders.

For people who serve on Amazon’s board but are not company employees, the company gives each of them a fixed cash retainer of $100,000 every year. If a board member takes on the extra responsibility of being the Lead Independent Director, they receive an additional payment of $30,000. The chairman's board members will receive additional compensation ranging from $15,000 to $25,000, depending on the importance of the committee they lead. In addition to these cash payments, each board member receives an annual RSU worth $290,000 [1]. These RSUs become fully owned, or “vested,” after one year. RSUS can help reduce earnings volatility and improve earnings per share and operating profit over the long term across industries [2]. New directors also receive the same amount of RSUs when they join, which shows that Amazon wants to treat new and current board members equally when it comes to long-term rewards. This system helps make sure that all directors, whether they are new or experienced, pay close attention to how the company’s stock price performs over time.

Moreover, Amazon does not pay any extra money to directors just for attending meetings, which is something that many other companies still do. Instead, Amazon chooses to only cover necessary travel costs when directors need to attend official company events. This policy not only keeps costs low but also makes the company’s compensation system simpler and more focused. By removing less important payment items and focusing on core incentives, Amazon builds a pay structure that encourages directors to concentrate on the company’s future growth and success. As shown in Table 1, directors' compensation includes cash compensation, RSU awards, and travel reimbursements. There are no meeting fees, and stock ownership is encouraged but not formally required.

|

Compensation Element |

Amount / Description |

|

Cash Retainer |

$100,000/year |

|

Lead Independent Director |

+$30,000/year |

|

Committee Chair Premiums |

$15K-$25K/year |

|

Annual RSU Grant |

$290,000 (vests in 1 year) |

|

New Director RSU Grant |

$290,000 (vests in 1 year) |

|

Meeting FeesOther Benefits |

None |

|

Other Benefits |

Travel reimbursements only |

|

Stock Ownership Requirement |

Non-formal, encouraged via RSUs |

The company does not have a strict rule that forces board members to own a certain amount of company stock. Instead, Amazon uses its stock-based reward system to encourage board members to take on a shareholder’s point of view by themselves. Through this method, the company hopes that directors will naturally feel a sense of responsibility for the company’s future and act in a way that supports strong and careful corporate governance.

When it comes to regular employees and mid-level managers, Amazon mostly uses a three-part pay structure. This includes a basic salary, yearly stock rewards, and a signing bonus. The basic salary that Amazon offers is often a little lower than the average pay in the market for similar jobs. However, the part of the pay that comes from stock rewards is usually much higher than what other companies provide. These stock rewards are not given all at once. Instead, they are given in steps over a few years, based on how long the employee stays at the company. This helps Amazon reduce its short-term labor costs, while also encouraging employees to stay at the company longer.

In addition, for employees who work in warehouses or delivery and logistics roles, Amazon offers several types of benefits that support their daily needs and future goals. These benefits include health insurance, paid time off, assistance with school tuition, and other programs designed to enhance employees’ well-being. The benefit for the specific job can increase employee engagement by 18% [3]. This indicates that Amazon designs various rewards and benefits tailored to the type of work each employee group performs. The goal is to make sure that every kind of worker feels fairly treated and motivated.

Overall, Amazon’s pay system is designed to reward employees and leaders not just for what they do today, but for the value they bring in the future. It also tries to keep the interests of the company and the shareholders in the same direction. The system is highly structured and similar across different groups, which makes it easier to manage and understand. At the same time, this approach helps Amazon stay competitive in the global job market by making it more attractive to both current workers and new talent from around the world.

2.2. The background and development of Amazon’s compensation system

Amazon’s board compensation system is mainly designed with two goals in mind: keeping it simple and clear, and focusing on long-term rewards. The key part of this system is the yearly grant of Restricted Stock Units, also known as RSUs. For many years, Amazon has chosen not to offer extra money for attending meetings or give traditional bonuses to its board members. This is done to avoid short-term motivation that may not help the company in the long run. Instead, Amazon uses stock-based rewards to make sure board members think about the company’s long-term goals and work in ways that support future growth.

Each board member at Amazon can receive RSUs worth $290,000 every year. These stock units are given all at once and become fully owned, or “vested,” after just one year. This kind of “full vesting after one year” system is simple and flexible. It allows directors to quickly receive the full value of their stock rewards without waiting many years. However, at the same time, this method also reduces the pressure or need for directors to stay with the company for a longer period. In other words, because they get all the stock so quickly, there may be less reason for them to remain on the board or stay deeply involved for several years.

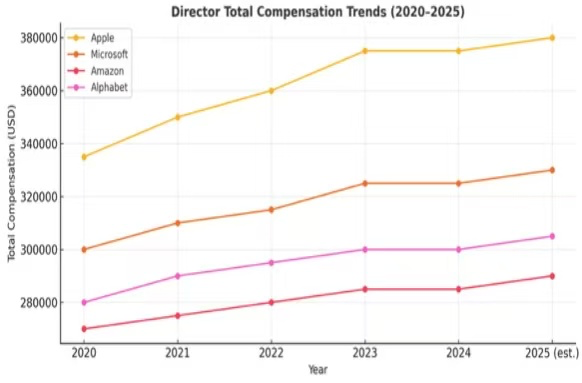

According to Figure 1, in recent years from 2020 to 2025, Apple and Microsoft have significantly increased the total compensation for their board members, while Amazon’s increase has been relatively small. Amazon boardroom compensation rose from $270,000 to $285,000, well below Apple's rise from $335,000 to $375,000 [4]. Although Amazon has maintained a stable long-term incentive structure, it has been slow to respond to increasing competition in the market [5].

Meanwhile, Amazon does not set a mandatory stock ownership requirement for its directors. Instead, it simply encourages them to accumulate shares through RSU grants. In contrast, Apple requires its directors to hold shares worth five times their annual retainer within five years, and Alphabet sets a requirement of holding 15,000 company shares. In comparison to these standards, Amazon seems deficient in governance discipline and alignment with shareholder interests [6].

2.3. Compensation structure

Amazon’s board compensation system includes six main components (as shown in Figure 1): base annual cash retainer, additional pay for the Lead Director, committee chair premiums, annual RSU grants, RSU awards for new directors, and travel reimbursements [1]. In conclusion, the "Low cash, high equity" compensation structure of Amazon emphasizes long-term value by lowering the percentage of fixed cash payments. Yet, the system does not require mandatory shareholdings, does not provide for meeting fees, and lacks performance-based components like PSU. This achieves a balance between rigorous governance discipline and flexibility [7].

|

Rank |

Company |

Cash Reteiner |

Equity (RSUs) |

Total Compensation |

Notes |

|

1st |

Apple |

$100,000 |

~$275,000 |

$375,000 |

RSUs vest after 1 year |

|

2nd |

Microsoft |

$125,000 |

~$200,000 |

$325,000 |

No attendance fees |

|

3rd |

Alphabet |

$75,000 |

~$225,000 |

$300,000 |

15,000 shareholding required |

|

4th |

Amazon |

$0 |

~$285,000 |

$285,000 |

Equity only, no cash |

According to Table 2, Apple adopts a stable mixed structure, offering $100,000 in cash and $275,000 in RSUs [4]. Microsoft places more emphasis on cash, providing $125,000 in cash and $200,000 in RSUs, along with a mandatory stock ownership requirement of five times the annual cash retainer [8]. Alphabet uses a combination of PSUs and GSUs to tie compensation closely to performance and market value, making it the strongest among the four companies in terms of aligning director incentives with shareholder interests.

2.4. Problems in Amazon’s compensation system

Even though Amazon’s pay structure is clear and works efficiently, it still faces several important problems, especially as competition for talent in the tech industry becomes stronger and more complex:

2.4.1. Not enough links to performance

Bertrand and Mullainathan [5] illustrate how market pressures and other external factors can affect executive compensation, implying that in the absence of a performance-constrained framework, compensation cannot accurately reflect managerial contributions [5].

2.4.2. Amazon board members only receive RSUs

Unlike Alphabet, which gives stock based on how well the company performs (PSUs), Amazon does not clearly connect pay with actual performance results. McKinsey points out that organizations that focus on employee performance have an advantage over their competitors: their revenue growth rate is on average 30 per cent higher and their staff turnover rate is roughly 5 percentage points lower [9].

2.4.3. Short-term rewards reduce motivation

Like Apple, Amazon gives out all RSUs within one year. This is simple to manage but may not be the best way to keep directors for the long term or support long-term planning.

2.4.4. Limited types of rewards

Amazon does not offer other bonuses or flexible payment options. This makes the job less attractive, especially compared to Apple, which gives product benefits, or Microsoft, which has long-term service plans.

2.4.5. No strong stock ownership rule

Amazon does not clearly ask board members to hold company shares. This weakens the connection between directors and shareholders. In contrast, Alphabet requires 15,000 shares, Apple wants $500,000 in shares within five years, and Microsoft requires owning stock worth five times the cash salary.

2.5. Factors that affect how to build and improve a pay system

To make its pay system better and more competitive in the tech industry, Amazon should focus on several important factors:

2.5.1. Trends in the industry

Since companies like Apple and Microsoft continue to raise their board pay, Amazon needs to adjust its own system in time to stay attractive to top-level talent.

2.5.2. Stronger connection to shareholder interests

Amazon could consider using a system like Alphabet’s, where board members get rewards based on both financial and non-financial performance. This would help make the rewards more meaningful and based on real results.

2.5.3. More flexible reward periods

Instead of giving all stock in one year, Amazon could use a longer vesting schedule, such as over 2–3 years. This would help encourage long-term service by giving rewards over time.

2.5.4. More choices in how pay is given

Amazon could let directors choose how much of their pay they want in cash or in stock. This idea is already used for employees at Alphabet and gives more flexibility and personal fit for each person.

Amazon can maintain its systems' effectiveness and simplicity while increasing its competitiveness by taking note of other businesses' successes and implementing similar adjustments [6].

3. Comparative analysis

Apple has a typical “cash + stock” dual reward model for its board members. In 2024, Apple gives each regular director $100,000 in cash and around $275,000 in RSUs (Restricted Stock Units), for a total of $375,000 per year, which is the highest among the four companies. These RSUs vest fully within one year. Apple also requires its directors to hold Apple stock worth five times their annual cash pay (about $500,000) within five years, which helps ensure that directors’ interests stay aligned with those of shareholders. Although Apple does not use performance-based stock units (PSUs), it still creates a strong financial link through the consistent value of RSU rewards. Right from the start, directors have a clear long-term reward plan. This system balances strength and clarity, offering reliable income while supporting long-term goals and stability in company leadership [4].

Microsoft has a more balanced and steady board compensation plan. Its total board pay is $325,000, with $125,000 in cash and about $200,000 in RSUs. This shows a style that focuses more on stability, with less weight placed on stock. A key feature of Microsoft’s system is the strict rule that directors must hold company stock worth five times their annual cash pay. This is one of the clearest stock-holding rules among big companies. While Microsoft does not use PSUs or pay for attending meetings, it still gives stock directly and requires it to be held over time. This setup helps make sure directors do not focus only on short-term stock price changes. Instead, they are more likely to care about the company’s long-term growth and value to shareholders. This “soft reward plus hard rule” structure might serve as a good model for Amazon, particularly in terms of deterring board members from thinking in the short term [8].

Alphabet is the only company among the four that uses both PSUs (performance stock units) and GSUs (Google stock units) to reward its board members. This makes its reward structure more complex but also more clearly tied to performance. Directors at Alphabet must hold at least 15,000 shares of company stock. Senior managers also receive rewards based on company size, stock return, and other key results like total shareholder return (TSR). This gives the system both flexibility and strong performance requirements. About 73% of Alphabet’s board compensation is given through stock rewards, showing a strong focus on long-term company success. While the pay may not be as steady as Apple’s in the short term, it does a good job of connecting directors’ behavior with company goals. As shown in charts, Alphabet is the only one among the four that always uses performance-based reward links. This type of approach provides Amazon with a significant example to follow if it wishes to enhance the management of its board and the support of its long-term objectives [10].

Compared to these companies, Amazon still follows a “low cash, high stock” approach. It pays $285,000 in total, only in RSUs, with no meeting pay or required stock holding rules. This kind of system may have worked well in the company’s early growth years, but now, in a time where good governance and investor attention are more important, its system starts to look weaker.

As mentioned earlier, Amazon had the smallest increase in board pay from 2020 to 2024, going only from $270,000 to $285,000. This is far below the changes made by Apple and Microsoft. Also, Amazon still does not use PSUs or GSUs and has no rules for required stock holding or performance-based rewards. This makes its board pay system less transparent, less precise, and less attractive to top talent compared to its peers.

4. Conclusion

This study analyzes Amazon’s board compensation system by comparing it both across companies and over time. The research highlights the strengths and weaknesses of Amazon’s current structure and identifies areas for improvement. Amazon has long emphasized stock-based incentives, building a compensation model centered on Restricted Stock Units (RSUs), with minimal cash pay and simplified benefits. The goal of this approach is to align board members with the company’s long-term strategic goals.

However, a comparison with Apple, Microsoft, and Alphabet shows that Amazon’s system still has room for improvement in several key areas. First, Amazon lacks a strong performance-based reward mechanism, such as the Performance Stock Units (PSUs) used by Alphabet, which makes its incentive system less powerful. Second, Amazon has not set any mandatory stock ownership rules, while Apple and Microsoft require directors to hold shares equal to five times their annual cash pay or a fixed share amount. These rules help ensure better alignment between directors and shareholders.

In terms of compensation growth, Amazon has shown the smallest increase over the past five years, with total board pay rising only from $270,000 to $285,000. This is much slower than the increases seen at Apple and Microsoft and may reduce Amazon’s ability to attract top-level board talent.

To improve its compensation system, Amazon could introduce performance-based incentives linked to metrics such as company value growth, TSR, or financial performance. It should also consider diversifying its pay structure, setting clear stock ownership requirements, and restoring a portion of cash payments to enhance short-term attractiveness and strengthen long-term commitment from board members.

By learning from the strong incentive system of Alphabet, the balanced structure of Apple, and the ownership discipline of Microsoft, Amazon can develop a board compensation system that remains transparent and efficient, while also becoming more competitive and better aligned with strong governance standards.

References

[1]. Park, W., Sernova, E. and Park, C.-Y. (2025) From short-term volatility to long-term growth: Restricted stock units’ impact on earnings per share and profit growth across sectors. Int. J. Financ. Stud., 13(2), 104.

[2]. Frydman, C. and Jenter, D. (2010) CEO compensation. Annu. Rev. Financ. Econ., 2, 75–102.

[3]. Murphy, K.J. (1999) Executive compensation. In: Ashenfelter, O. and Card, D. (Eds.), Handb. Labor Econ., 3, 2485–2563.

[4]. Core, J.E. and Larcker, D.F. (2002) Performance consequences of mandatory ownership guidelines. J. Financ. Econ., 64(3), 487–513.

[5]. Bertrand, M. and Mullainathan, S. (2001) Are CEOs rewarded for luck? The ones without principals are. Q. J. Econ., 116(3), 901–932.

[6]. Gabaix, X. and Landier, A. (2008) Why has CEO pay increased so much? Q. J. Econ., 123(1), 49–100.

[7]. Edmans, A., Gabaix, X. and Jenter, D. (2017) Executive compensation: A survey of theory and evidence. Handb. Econ. Corp. Gov., 1, 383–539.

[8]. Jensen, M.C. and Murphy, K.J. (1990) Performance pay and top-management incentives. J. Polit. Econ., 98(2), 225–264.

[9]. Sundaramurthy, C. and Lewis, M. (2003) Control and collaboration: Paradoxes of governance. Acad. Manage. Rev., 28(3), 397–415.

[10]. Balsam, S. and Yin, J. (2005) Explaining firm performance: The role of employee stock options. Rev. Account. Finance, 4(1), 5–28.

Cite this article

Hao,Y. (2025). Board Incentive Structures in the Tech Sector: An Analysis of Amazon’s Compensation System. Advances in Economics, Management and Political Sciences,207,16-23.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Park, W., Sernova, E. and Park, C.-Y. (2025) From short-term volatility to long-term growth: Restricted stock units’ impact on earnings per share and profit growth across sectors. Int. J. Financ. Stud., 13(2), 104.

[2]. Frydman, C. and Jenter, D. (2010) CEO compensation. Annu. Rev. Financ. Econ., 2, 75–102.

[3]. Murphy, K.J. (1999) Executive compensation. In: Ashenfelter, O. and Card, D. (Eds.), Handb. Labor Econ., 3, 2485–2563.

[4]. Core, J.E. and Larcker, D.F. (2002) Performance consequences of mandatory ownership guidelines. J. Financ. Econ., 64(3), 487–513.

[5]. Bertrand, M. and Mullainathan, S. (2001) Are CEOs rewarded for luck? The ones without principals are. Q. J. Econ., 116(3), 901–932.

[6]. Gabaix, X. and Landier, A. (2008) Why has CEO pay increased so much? Q. J. Econ., 123(1), 49–100.

[7]. Edmans, A., Gabaix, X. and Jenter, D. (2017) Executive compensation: A survey of theory and evidence. Handb. Econ. Corp. Gov., 1, 383–539.

[8]. Jensen, M.C. and Murphy, K.J. (1990) Performance pay and top-management incentives. J. Polit. Econ., 98(2), 225–264.

[9]. Sundaramurthy, C. and Lewis, M. (2003) Control and collaboration: Paradoxes of governance. Acad. Manage. Rev., 28(3), 397–415.

[10]. Balsam, S. and Yin, J. (2005) Explaining firm performance: The role of employee stock options. Rev. Account. Finance, 4(1), 5–28.