1. Introduction

In recent years, backdoor listings in the film and television industry have occurred frequently, becoming an important channel for enterprises to rapidly enter the capital market. According to relevant data, from 2011 to 2020, the number of backdoor listing cases in China’s film and television industry increased year by year, accounting for more than 30% of all backdoor listings in the cultural industry. However, the audit risk issues exposed during this process are particularly prominent. Especially notable are cases of backdoor listing companies represented by H&R Century Pictures that were penalized for financial fraud, revealing the complexity and particularity of audit risks in the film and television industry.

The case of H&R Century Pictures’ backdoor listing is an important and typical example within the film and television industry. The process spanned five years and experienced numerous setbacks, ultimately culminating in a successful backdoor listing through Stellar Megaunion in 2016. However, shortly after listing, H&R Century Pictures was investigated by the China Securities Regulatory Commission (CSRC). The investigation revealed multiple financial fraud behaviors during the backdoor listing process, including premature revenue recognition, fabrication of accounts receivable, and under-provisioning for bad debts, which resulted in severe distortion of its financial statements. Consequently, the company was sanctioned by regulatory authorities. This case not only attracted widespread public attention to the financial conditions of the film and television industry but also highlighted the complexity and difficulty of identifying audit risks in the sector.

Audit risks in the film and television industry exhibit significant industry-specific characteristics, primarily manifesting in areas such as revenue recognition, related-party transactions, accounts receivable, and inventory valuation. The complexity and concealment of these risk factors pose numerous challenges to auditors in practice. Therefore, this paper systematically analyzes the intrinsic relationships and research progress of audit risks in the film and television industry and backdoor listings from two perspectives: the characteristics of audit risks in the industry and the current status of research on backdoor listings, aiming to provide theoretical support for subsequent studies.

This study aims to conduct an in-depth analysis of the characteristics of audit risks in the film and television industry, combined with the case of H&R Century Pictures’ backdoor listing, to explore how to identify and prevent audit risks in advance. The goal is to improve the quality and effectiveness of audit work, reduce audit risks, and provide valuable references for the healthy development of the film and television industry.

2. Literature review

2.1. Characteristics of audit risks in the film and television industry

Audit risks in the film and television industry exhibit significant industry-specific characteristics. Existing research primarily analyzes these risks from aspects such as revenue recognition, related-party transactions, accounts receivable, cost accounting, and internal control.

The complexity of revenue recognition and the risk of earnings manipulation in the film and television industry. The industry’s revenue sources are diversified, including copyright sales, box office revenue sharing, derivative product income, and other models [1,2]. Yu Bocheng found that under the current Accounting Standards for Business Enterprises No. 14 – Revenue, the core controversies over revenue recognition in film and television companies focus on four aspects: the determination criteria for applying the gross or net method in film screening businesses, the timing rules for recognizing revenue from film and television drama sales, the impact mechanism of breach of contract clauses on revenue measurement, and the technical treatment of variable consideration estimates [3]. Xie Youmei proposed improvements, advocating for the adoption of the gross amount method for revenue recognition in the film and television drama sales stage and the use of the planned revenue proportion method for cost transfer, thereby mitigating the industry-wide issue of revenue inflation [4]. However, in practice, there are still cases where enterprises manipulate profits by prematurely recognizing copyright revenue [5], highlighting transparency deficiencies in the operational application of current revenue recognition rules. It is worth noting that emerging business models such as online drama revenue sharing, due to the lack of clear accounting standards guidance, have further exacerbated audit risks [6].

The concealment of related-party transactions and challenges in determining fair value. The film and television industry’s supply chain exhibits significant vertical integration characteristics, resulting in frequent and highly concealed related-party transactions [7,8]. Liu Huimin, through empirical analysis, found that some listed companies’ financial statements show abnormally high growth in accounts receivable compared to the growth in main business revenue, revealing potential risks of income and profit manipulation through the accounts receivable account [9]. Typical case studies indicate that related parties continue to conceal asset impairment issues by fabricating accounts receivable collection transactions [10]. In auditing practice, complex equity structures and ambiguous transaction paths significantly increase the difficulty of determining the substance of transactions, leading to systemic obstacles in fair value assessment [11].

The verifiability defects in accounts receivable management and bad debt provision. The cash recovery cycle of film and television projects is significantly affected by policy regulations. For example, the "Ancient Style Ban" policy led to the withdrawal of the project Peace in Palace, causing delays in accounts receivable collection [12]. Industry studies indicate that enterprises may embellish financial statements by underestimating bad debt provisions, while auditing firms, constrained by insufficient market transparency, find it difficult to obtain sufficient evidence to verify the reasonableness of bad debt provisions [1].

Subjective judgment biases in cost accumulation and inventory valuation. Film and television production costs include diverse components such as script development rights acquisition, shooting expenses, and post-production, and the accumulation process is susceptible to manipulation [2]. Inventory valuation—such as intangible assets like script copyrights—relies heavily on management’s professional judgment, with impairment testing lacking a verifiable market reference framework [6]. Gao Xinong, in a specialized study on accounting treatment of film copyrights, systematically revealed structural deficiencies in the cost auditing system [13]. Typical case analyses show that H&R Century Pictures engaged in illegal operations by inflating production costs to facilitate fund transfers, further confirming the failure of the cost auditing mechanism [7].

Internal control failures and corporate governance deficiencies. Film and television companies generally face dual governance risks of concentrated equity structures and deficient internal control systems [8]. Wang Can’s empirical study shows that internal control defects in the industry mainly manifest as lagging construction of the internal control environment, failure of risk assessment mechanisms, communication barriers across departments, and lack of supervision in internal control execution [14]. The root causes lie in the significant coupling effect between the industry’s light-asset operation characteristics and the uncertainty of the policy environment. Zheng Jun pointed out that film and television enterprises formed through merger and acquisition expansion generally suffer from governance imbalance, prominently reflected in ineffective subsidiary control and a strong influence of personal rule [15]. Governance deficiencies directly result in the revenue recognition approval process being largely nominal, creating institutional loopholes for premature revenue recognition [10].

Financing constraints under the light-asset operation model. As typical light-asset enterprises, film and television companies build their core competitiveness on a highly integrated industrial chain system, primarily undertaking resource coordination and value enhancement functions. The core value of such companies derives from the long-term accumulation of intangible elements specific to the industry’s business model, resource allocation efficiency, and brand cultural capital. Under the light-asset operation framework, risks in the film and television industry exhibit notable particularities: first, core production factors such as copyright assets, human capital, and brand value possess highly intangible characteristics; second, the low proportion of fixed assets limits collateral financing capacity, leading to increased financing costs and exacerbating operational risks [16].

2.2. Current research on backdoor listings in the film and television industry

As an important channel for film and television companies to achieve capitalized operations, academic research on backdoor listings mainly focuses on three dimensions: driving motivations, financial fraud behaviors, and cases of audit failure.

2.2.1. Motivations for backdoor listings in the film and television industry

Given that film production projects are characterized by high capital intensity and long investment recovery cycles, enterprises commonly face significant financial pressure during their operations and urgently need financing channels to maintain normal operations and promote strategic development. The backdoor listing mechanism can provide an effective financing platform for film and television companies, effectively addressing the capital constraints encountered during their development. After listing, companies can not only gain richer industry resources and development opportunities but also strengthen their competitive advantage in the highly competitive film and television industry landscape. Compared with initial public offerings (IPOs), backdoor listings feature lower time costs and relatively simplified review processes, becoming an important path for film and television companies urgently needing capital injections to achieve rapid listing [2]. Due to the structural contradiction between urgent financing needs and the stringent IPO review process, film and television companies generally tend to choose the backdoor listing model [2,6]. However, in this process, companies may be induced to commit financial fraud to meet performance guarantee agreements, which essentially reflects the strategic conflict between short-term profit demands and long-term value creation [11].

From the perspective of the policy environment, since the "13th Five-Year Plan," the state has continuously strengthened the strategic position of the cultural industry and successively introduced policies and regulations such as the Several Opinions on Promoting the Integration of Cultural Creativity and Design Services with Related Industries, providing institutional guarantees for cultural and media enterprises to pursue backdoor listings.

2.2.2. Risks of backdoor listings in the film and television industry

The backdoor listing process may give rise to financial risks such as the deterioration of the asset - liability structure and the decline of debt - servicing ability. In the absence of an effective risk management system, these risks will directly impact the operational stability and development sustainability of the enterprise. The unique market uncertainties in the film and television industry are manifested in the rapid changes in audience aesthetic preferences and the significant fluctuations in the market acceptance of works. If the core products fail to meet market expectations after backdoor listing, the company's profitability may be impaired, potentially leading to losses or even a crisis.

2.2.3. Regulation of backdoor listings in the film and television industry

An examination of the evolutionary trajectory of China's regulatory framework for backdoor listings reveals that the continuous improvement of the regulatory system is aimed at achieving three key objectives: standardizing market conduct, safeguarding the rights and interests of investors, and promoting the healthy development of the capital market. In 2016, the China Securities Regulatory Commission (CSRC) revised the Administrative Measures for Material Asset Reorganizations of Listed Companies, establishing a more stringent regulatory framework for backdoor listings by raising financial threshold requirements and strengthening information disclosure obligations.

3. Case study of H&R century pictures

3.1. Company profile of H&R century pictures

H&R Century Pictures was established in 2006, formerly known as Zhejiang Sanhe Film & Television Culture Co., Ltd., a comprehensive film and television company engaged in investment, production, distribution of TV dramas and films, as well as artist management. In September 2011, Sanhe Film & Television was restructured into a joint-stock company and renamed H&R Century Pictures Co., Ltd.

The company’s business is extensive, covering film and television production and distribution, artist management, and derivative product development. Centered on creating high-quality content, it has established an industrialized production system and produced numerous well-known works, including TV dramas such as Under the Power and The Imperial Age, as well as co-invested films like The Battle at Lake Changjin. The company enjoys high recognition within the film and television industry and is praised as a “star-making factory” and “ancient costume drama empire.” By optimizing its artist management service platform, standardizing the integration of resources and service processes, it has improved operational efficiency and continuously advanced the H&R New Talent Program to cultivate outstanding new actors.

3.2. Overview of the backdoor listing process

The case of H&R Century Pictures’ backdoor listing is highly representative and typical within the film and television industry. The process spanned five years and experienced numerous setbacks before finally successfully completing the backdoor listing through Stellar Megaunion in 2016.

In 2011, H&R Century Pictures initiated its listing plan and, in 2012, introduced investment institutions including Enlight Media. In July 2014, it planned to backdoor list through Taiya Co., Ltd., but due to intense scrutiny, the plan was abandoned in September. After this failed attempt, H&R continued seeking listing opportunities and, in May 2015, the founder acquired 14% of the listed company *ST Stellar Megaunion’s shares, initiating preparations for a new backdoor listing plan. The main reasons H&R chose Stellar Megaunion as the shell company are as follows:

First, Stellar Megaunion’s market value was relatively low at the time. In 2016, Stellar Megaunion’s total assets amounted to only RMB 3.0837 million. A smaller market value implied a relatively lower cost of backdoor listing, and its marginal position in the capital market made it easier for H&R Century Pictures to achieve controlling interest and integration of the listed company by injecting assets valued at RMB 3 billion. This reduced the difficulty and risk of the backdoor listing, making the acquisition cost relatively manageable for H&R Century Pictures. Second, Stellar Megaunion’s poor operating performance required transformation. During its 18 years as a listed company, Stellar Megaunion experienced poor business performance, multiple changes in its stock abbreviation, ownership transfers, failed restructurings, and even bankruptcy reorganization. It urgently needed new high-quality asset injections to improve its operations. H&R Century Pictures’ backdoor listing brought new business and profit models to Stellar Megaunion.

In September 2015, *ST Stellar Megaunion officially proposed H&R Century Pictures’ backdoor listing plan. The plan involved a non-public issuance of shares to purchase 100% equity of H&R Century Pictures, while simultaneously raising RMB 1.53 billion in supporting funds from four institutions, including Stellar Megaunion. This backdoor listing was conducted through a non-public issuance of shares to purchase assets, accompanied by the raising of supporting funds. The shareholders of H&R Century Pictures converted their equity into shares of Stellar Megaunion, achieving control over Stellar Megaunion and thereby enabling H&R Century Pictures’ indirect listing.

In January 2016, the board of directors of H&R Century (the former listed company Stellar Megaunion) approved a major asset restructuring plan to acquire 100% equity of H&R Century Pictures. On July 21, the backdoor listing of H&R was approved by the China Securities Regulatory Commission (CSRC). The equity transfer was completed in November, and H&R Century Pictures became a wholly owned subsidiary consolidated into H&R Century. The transaction price for H&R Century Pictures was RMB 3 billion, accounting for more than 100% of Stellar Megaunion’s total assets of RMB 3.0837 million at the end of 2014, thereby constituting a backdoor listing.

During the backdoor listing process, H&R Century Pictures and Stellar Megaunion made performance commitments to ensure that certain performance targets would be met post-listing, thereby enhancing investor confidence. H&R Century Pictures committed to achieving specific net profit targets within a set period following the backdoor listing (e.g., from 2016 to 2018). The targets stipulated that the net profits after deducting non-recurring gains and losses for 2016, 2017, and 2018 should not be less than RMB 150 million, RMB 200 million, and RMB 250 million, respectively. If these performance commitments were not met, H&R Century Pictures would compensate Stellar Megaunion and its shareholders through share-based compensation or other means to protect investors’ interests.

4. Identification of audit risks in H&R century pictures

4.1. Risks of related-party transactions

During the backdoor listing process, related-party transactions involving H&R Century Pictures posed the following risks. These risks may not have been fully identified and assessed in advance, thereby significantly impacting the audit work.

4.1.1. Risk of related-party fund occupation

According to the administrative penalty decision issued by the China Securities Regulatory Commission (CSRC) (Document No [2022]. 15), H&R Century Pictures Co., Ltd. engaged in systematic violations of financial information disclosure in its periodic reports from 2013 to 2015 and its 2016 interim report. Specifically, the company concealed related-party non-operating fund occupations by means such as fabricating cash flows related to film projects and signing fictitious contracts, failing to fully disclose these matters as required. The amounts involved were RMB 7 million (Q2 2013), RMB 7 million (Q3 2014), RMB 30 million (transferred in five transactions throughout 2015), and RMB 30 million (circulated through three shell companies during January to June 2016). Notably, in the 2016 annual report, serious disclosure violations persisted, deliberately concealing significant transactions involving RMB 8 million of newly increased related-party fund occupation (occurred during the settlement of project final payments in Q4) and an RMB 38 million balance of fund occupation at year-end. The related transaction flows were audited by Lixin Certified Public Accountants and confirmed to be abnormal.

Through the CSRC’s in-depth and penetrative regulatory analysis, it was discovered that the controlling shareholder, the Chen family, and its related parties may have exploited their actual controlling position and decision-making authority over major matters to misappropriate listed company funds. This was allegedly done to meet their special capital needs—including but not limited to overseas asset allocation and debt repayment of related enterprises—by constructing a complex transaction structure involving “film project investment – related-party service procurement – off-balance-sheet fund circulation.” This behavior clearly violates Article 35 of the Code of Corporate Governance for Listed Companies (CSRC Announcement [2018] No. 29), which mandates that related-party transactions should be governed by the principle of “substance over form,” as well as the information disclosure obligations prescribed in Article 7 of Accounting Standard No. 36—Related Party Disclosures. It constitutes an information disclosure violation as stipulated in Article 197 of the Securities Law. According to the Measures for On-site Inspection of Listed Companies, the CSRC imposed corrective orders on the company and administratively punished the main responsible persons with market entry bans and fines totaling RMB 12 million.

4.1.2. Risk of fictitious collection of accounts receivable

As shown in Table 1, during the disclosure period of the 2015 annual report, H&R Century Pictures fabricated the collection of RMB 25.5 million in accounts receivable through related-party fund circulation, resulting in an under-provision of bad debt reserves by RMB 4.25 million, calculated at a 17% provision rate. Furthermore, during the preparation of the 2016 interim report, H&R Century Pictures used false accounting vouchers to repeatedly confirm the collection of RMB 17 million in accounts receivable from Shanghai Xuansu. By adjusting the classification of aging periods, it reduced the bad debt provision ratio, causing an under-provision of RMB 4.675 million for the period, where the originally applicable provision rate was 27.5%. These manipulations led to a cumulative overstatement of consolidated profit by RMB 8.925 million, inflating the core profit margin by 23.7 percentage points. Meanwhile, the accounts receivable turnover was artificially increased by 4.2 times, and the current ratio improved by 0.6 times, ultimately causing an asset overstatement of RMB 42.5 million on the balance sheet and a mismatch in shareholders’ equity.

Further analysis revealed that H&R Century Pictures constructed a closed-loop transaction network between “clients and suppliers,” disguising shell companies controlled by the actual controller as third-party counterparties. The company required related parties to sign “yin-yang” contracts under the guise of “joint investment in film projects,” effectively forming a capital circulation loop to deliberately evade the disclosure requirements stipulated in Accounting Standard No. 36—Related Party Disclosures. This structured arrangement artificially shortened the accounts receivable turnover days by 87 days, violating the normal 3 to 5-year project payment cycle typical in the film and television industry.

From the perspective of auditing techniques, the fraudulent methods employed by H&R Century Pictures exhibit three characteristics: First, leveraging the integrated business model of "investment, production, and distribution" in film projects, related-party transactions were embedded across 12 business stages, including project investment, filming permits, and copyright distribution. Second, the company established cross-border capital pools through offshore special purpose entities (SPEs), manipulating funds under the guise of "service fees" and "copyright procurement" to facilitate capital transfers. Third, in response to differing regulatory focuses across accounting periods, H&R dynamically adjusted its bad debt provision policies: adopting the industry’s lowest provision standards (only 5% for accounts aged 1–2 years) during the IPO performance guarantee period, while aggressively reversing previously recognized provisions during the performance fulfillment period.

Regulatory investigations revealed that the company’s finance department established two parallel accounting systems: the front-end operational system calculated bad debt provisions based on actual aging, while the back-end consolidated system implemented a provision matrix specially designed by management. This systematic fraud resulted in a cumulative asset overstatement of RMB 172 million between 2013 and 2016, accounting for 34.8% of net assets. After retrospective adjustments for related accounting errors, the company’s core profit margin plunged from the originally disclosed 22.4% to -7.3%, fully exposing the fatal flaws in audit procedures during the backdoor listing process.

In response, auditors need to strengthen the confirmation procedures and review processes related to related-party transactions, particularly conducting in-depth verification of the collection status of significant related-party accounts receivable. The authenticity of evidence materials, such as contracts and bank receipts related to related-party transactions, should be rigorously examined to prevent fictitious transactions. Additionally, attention must be paid to the flow and source of related-party funds to ensure that the substance of the transactions corresponds with their form, thereby enabling more effective identification and prevention of risks associated with fabricated accounts receivable.

|

Annual Report |

Amount of Fictitious Collected Receivables (10,000 RMB) |

Amount of Under-Provisioned Bad Debt Reserves (10,000 RMB) |

Description |

|

2015 Annual Report |

2550 |

425 |

Fictitious collection of accounts receivable resulting in under-provision of bad debt reserves |

|

2016 Interim Report |

1700 |

467.5 |

Fictitious collection of accounts receivable from Shanghai Xuansu causing under-provision of bad debt reserves |

Source: H&R Century Union (Parent Company of H&R Century Pictures), announcement on correction of prior accounting errors

4.1.3. Risk of concealing related-party relationships through multi-layered nested companies

During the audit risk identification phase, H&R Century Pictures and its related entities concealed their relationships through a complex, multi-layered corporate structure. This significantly increased the difficulty of audit work, making it challenging for auditors to identify the true transaction counterparties. For example, in the fictitious accounts receivable collection transactions between H&R Century Pictures and Shanghai Xuansu, the fund recovery path involved bank accounts controlled by Wang Xianmin, while the original source of the funds was traced back to multiple nested companies controlled by H&R Century Pictures’ actual controllers, Chen Yuan and Zhong Junyan. Such arrangements effectively obscured the related-party relationships.

Such complex related-party relationships made it difficult for auditors to identify all related parties and transactions, requiring additional time and effort for investigation and verification. This expanded the audit scope and workload, significantly increasing the audit difficulty. At the same time, these practices could conceal the company’s true financial condition and the substance of transactions, thereby elevating audit risk.

To address the aforementioned audit risks, auditors must adopt a penetrative verification approach. This requires auditors to thoroughly analyze the equity structures and capital flows at each corporate layer to uncover potential related-party relationships. Additionally, auditors should conduct comprehensive background checks on related parties, including but not limited to major shareholders, actual controllers, and details of business transactions. Furthermore, auditors need to assess whether transaction pricing between the company and related parties is fair and whether there are potential interests being transferred, thereby ensuring the comprehensiveness and depth of the audit work.

4.2. Revenue recognition risks

4.2.1. Risk of inaccurate timing in revenue recognition

During the audit of H&R Century Pictures, in accordance with the requirements of China CPA Auditing Standards No. 1301, a multidimensional systematic review was conducted, revealing accounting treatment deviations involving revenue recognition across reporting periods. As detailed in Table 2, the copyright transfer and distribution revenue of the TV series Swords of Legends recognized in December 2013 was premature. The contract’s effective date and the physical transfer of the master tape both occurred in 2014, with bank receipts showing actual funds received on January 8, 2014. Similarly, the copyright transfer revenue of V Love also exhibited timing mismatches. The contract and supplementary agreement stipulated a legal effective date of February 10, 2014, and no substantive handover documents of the master tape or acceptance confirmation from the broadcast platform were obtained at the time of revenue recognition. Such practices caused an overstatement of net profit by RMB 65 million in 2013, accounting for 34.7% of the disclosed net profit for that year. Relevant personnel admitted to subjective adjustments driven by “performance guarantee pressures,” and the company’s internal controls over the revenue cycle exhibited significant deficiencies.

Further analysis revealed that H&R Century Pictures prematurely recognized revenue to meet performance guarantee agreements, boost its stock price, and secure additional financing. For example, under the three-year cumulative net profit guarantee agreement of RMB 780 million signed during the 2014 backdoor listing, the company inflated revenues for 2013 to 2015 by recognizing income from unfinished series ahead of completion, despite an industry average profit margin below 15%. This financial manipulation not only concealed deviations between the actual project cash collection cycle and contractual terms but also presented distorted operating performance and growth prospects to investors and the market.

Disputes over revenue recognition timing are common within the film and television industry. According to a 2017 special inspection by the China Securities Regulatory Commission (CSRC), among 34 sampled film and television companies, 19 exhibited issues with revenue recognition across accounting periods, involving amounts totaling RMB 4.123 billion. The scope for financial manipulation through accounts receivable is even more concealed. H&R Century Pictures, for instance, artificially boosted accounts receivable turnover by signing guaranteed minimum distribution agreements with related parties, ultimately resulting in cumulative bad debt write-offs totaling RMB 132 million during 2016 to 2018.

From an auditing perspective, according to China CPA Auditing Standards No. 1321 — Audit of Accounting Estimates, auditors are required to independently verify the recoverability of significant accounts receivable. However, in practice, film and television companies often refuse to provide complete key evidence, such as distribution contracts and audience rating performance guarantee clauses, citing business confidentiality. Audit working papers from 2014 for H&R Century Pictures show that Grant Thornton’s confirmation response rate for the top five clients was only 43%, yet the firm still issued an unqualified opinion, exposing significant deficiencies in the execution of audit procedures over the revenue cycle.

From the perspective of regulatory and technological evolution, the 2017 revision of Accounting Standard for Business Enterprises No. 14 — Revenue by the Ministry of Finance strengthened the criteria for determining the “transfer of control.” However, the industry-specific distribution models in the film and television sector still face controversies regarding the application of these standards. For example, in the “click-through revenue sharing” model employed by online platforms, auditors must assess whether novel parameters such as effective user watch time and advertisement load rates meet the criteria for revenue recognition. The highly subjective nature of such professional judgments provides room for financial fraud.

|

TV Series Name |

Revenue Type |

Revenue Recognition Date |

Actual Agreement Effective Date |

Master Tape Delivery Date |

Revenue Amount (CNY) |

|

Swords of Legends |

Copyright Transfer Revenue |

December 2013 |

January 2014 |

July 2014 |

49056603.78 |

|

Swords of Legends |

Distribution Revenue |

December 2013 |

January 2014 |

July 2014 |

1471698.11 |

|

V Love |

Copyright Transfer Revenue |

December 2013 |

January 2014 |

Not specified |

Source: stellar megaunion (former name of H&R Century Pictures’ parent company H&R Century Union) independent financial advisor report

To address these issues, the following specific measures should be implemented: carefully examine key factors such as distribution contract terms, master tape handover records, and the effective dates of broadcasting rights to ensure that the timing of revenue recognition aligns with accounting standards and the company’s internal accounting policies; conduct in-depth inquiries regarding the timing of revenue recognition and further verify the authenticity and accuracy of revenue recognition through confirmation procedures, thereby reducing audit risks and ensuring the objectivity and fairness of the audit report.

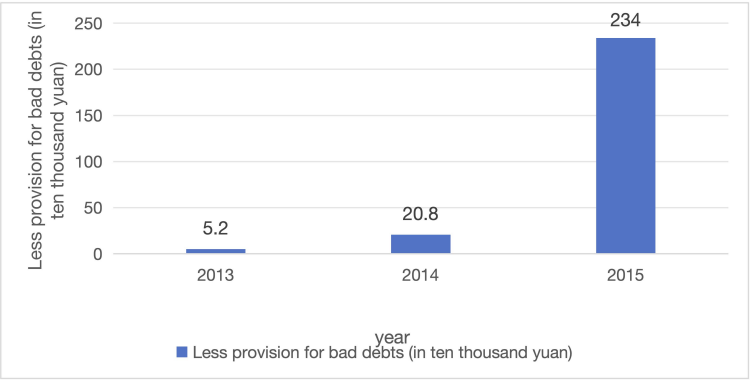

4.2.2. Risk of delayed provision for bad debts

As shown in Figure 1, the amount of under-provision for bad debts in 2013 was RMB 52,000, representing an 83% reduction compared to the amount that should have been accrued for that year. In 2014, the under-provision increased to RMB 208,000, a year-on-year growth of 300%. By 2015, the under-provision scale significantly expanded to RMB 2.34 million, surging 1,024% compared to the previous year, forming a stepped pattern of regulatory violations. Calculations indicate that the cumulative under-provision for bad debts over these three years reached RMB 2.6 million, accounting for 7.2% of the total net profit during the same period.

The company systematically delayed the provision for bad debts on accounts receivable with the intent to inflate current operating profit. This manipulation employed a layered, progressive approach: first, the aging classification ratios were artificially adjusted, with accounts receivable overdue more than 90 days being improperly classified as current receivables; then, the bad debt provision rates were lowered, reducing the industry-standard 30% provision for receivables aged 1–2 years to 5%. Through this dual manipulation, the impairment loss recognized in the current period was compressed by 68%, thereby circumventing the timeliness principle of bad debt provisioning as required by Article 32 of the Accounting Standard for Business Enterprises No. 22 — Recognition and Measurement of Financial Instruments. This effectively maintained the reported operating results for the accounting period at an inflated level. Audit retrospective adjustments indicate this behavior caused the operating profit for 2013, 2014, and 2015 to be overstated by RMB 43,000, RMB 172,000, and RMB 1.95 million, respectively.

Audit trails reveal that management established a special adjustment fund to hedge against abnormal fluctuations in accounting records. In the third quarter of 2015, certain expenses spanning multiple periods were improperly capitalized, resulting in RMB 1.2 million being recorded as assets. Notably, the company’s credit policy underwent significant revision in 2014, extending the original 60-day credit term to 180 days. However, analysis of accounts receivable migration rates indicates that the actual recovery rate for receivables overdue more than 90 days in 2015 was 42 percentage points lower than the industry average, and 38% of customer payment accounts were found to be inconsistent with the contract signatories. Regulatory investigations uncovered that the finance department maintained two distinct sets of bad debt provision parameters. The provisioning matrix disclosed externally was on average 5.7 times lower than the internal risk warning model’s coefficients, creating substantial regulatory arbitrage opportunities. This systematic financial manipulation resulted in threefold distortions in the balance sheet: accounts receivable turnover days were understated by 26 days, interest coverage ratio was overstated by 1.8 times, and the current ratio was artificially inflated by 0.3 points, significantly violating Article 12 of the Basic Accounting Standards regarding the principles of reliability and prudence.

Source: H&R Century Union annual report

4.2.3. Income source complexity leading to recognition difficulties risk

The profit model in the film and television media industry exhibits diversified characteristics, primarily including copyright licensing, product placement advertising, and derivative product development. These revenue channels show significant differences in the recognition criteria and timing requirements. Given that film and television productions involve long production cycles, large capital investments, numerous stakeholders, and complex contractual terms, the measurement basis and accounting processes for revenue recognition are highly complicated. Taking H&R Century Pictures as a typical case, its business model’s revenue recognition mechanism must comprehensively consider multiple factors such as distribution channel selection, broadcasting rights validity period, and revenue sharing clauses. This multidimensional revenue recognition feature not only significantly increases the professional difficulty and workload of audit work but also constitutes a critical focus area for audit risk identification.

The use of imprecise revenue recognition methods may induce the risk of profit inflation, causing financial statement information to deviate from the company’s true operating performance and earnings quality, thereby posing a substantive threat to the reliability of accounting information.

4.3. Inventory valuation risk

In the film and television industry, inventory includes scripts, works in progress (films or TV dramas currently under production), and finished products (films or TV dramas that have completed filming and production).

4.3.1. Risk of overvaluation of inventory

In the audit process, the evaluation and risk identification of film script value is a crucial step. The accuracy of the assessment depends not only on the quality and creativity of the script but also closely relates to key factors such as market demand for the subject matter, the cast, and the director. Currently, the film and television industry is characterized by accelerated iteration of themes—for example, policy restrictions on historical dramas and stricter censorship on contemporary themes—both of which may cause significant fluctuations in the expected value of scripts. Huanrui Pictures may have overestimated the inventory value due to overly optimistic forecasts of potential returns and market value of scripts. Specifically, this is reflected in the valuation of ancient fantasy scripts without considering tightened industry regulations, or urban emotional dramas benchmarked against outdated viewership data, still valued according to historical peak levels.

For film and television projects that are currently in production or filming, although costs continue to rise, their ultimate returns and market acceptance remain highly uncertain. During production, unforeseen risks may occur, such as negative publicity about lead actors, changes in the directing team, or adjustments to broadcast schedules—for instance, a certain historical drama was suspended due to tax issues involving its lead actor, yet its inventory value was still recorded according to the original plan. Huanrui Pictures may have been overly optimistic about the future returns of its products, which could lead to an overvaluation of inventory. This is especially evident against the backdrop of tightening financing conditions in the film and television industry, where the dual pressures of extended project repayment cycles and increased capital costs have not been adequately reflected in the inventory valuation models.

For completed film and television works, their market value is influenced by numerous factors such as release schedules, competing films, and changes in audience preferences, causing actual returns to potentially deviate significantly from expectations. For example, films released during the Spring Festival period may face screening constraints due to homogeneous competition, or web dramas may experience price reductions caused by sluggish growth in platform memberships. Huanrui Pictures may lack the necessary prudence when evaluating the value of inventory items, thereby facing risks of overvaluation. The audit process has revealed that some backlog dramas completed more than three years ago are still valued based on their initial distribution agreements, without accounting for value depreciation caused by the diminishing timeliness of their broadcast.

Such overestimation of inventory value may lead to an inflated book value of inventory on the company’s balance sheet, thereby affecting the authenticity and reliability of assets. When the inventory turnover rate persistently falls below the industry average, it may trigger liquidity risk warnings. At the same time, this behavior could obscure the company’s actual operational risks, resulting in pressure for inventory impairment in subsequent periods, which in turn affects the stability of financial statements. For example, a large-scale, concentrated provision for inventory write-downs in a certain quarter may cause abnormal fluctuations in net profit, undermining investor confidence. More seriously, if inventory valuation systematically deviates from market fair value, it could prompt regulatory authorities to question the authenticity of the financial data.

4.3.2. Risk of insufficient provision for inventory impairment

In the audit risk assessment process of the film and television industry, particular attention must be paid to the intensity of industry competition and the dynamic evolution of audience preferences. If Huanrui fails to establish an effective market response mechanism, its film and television inventory may face risks of inventory obsolescence and value impairment. Notably, the company exhibits systemic deficiencies in constructing an inventory impairment early-warning mechanism, manifested by the absence of a monitoring system for the alignment between script reserves and market demand, as well as inadequate coordination between IP incubation cycles and screening window assessments. Such deficiencies may lead to accounting recognition of asset impairment provisions that deviate from the prudence principle. Given the industry’s high sensitivity to regulatory policies—including but not limited to content censorship standards and broadcasting license systems—non-compliance issues with Huanrui’s projects could result in project suspension or restricted broadcasting. For example, when quotas on historical drama productions tighten, failure to promptly adjust the project reserve structure could cause substantial impairment along the asset value chain. The specific transmission pathways of such impairment include sunk development costs, interruption of derivative product revenues, and diminution of brand goodwill, among other multifaceted risks.

Insufficient provision for impairment leads to three major financial anomalies: First, the carrying amount of inventory assets is overstated, undermining the fairness and reliability of accounting information—particularly in the amortization and measurement of film and television copyrights, where the cannibalization effect of online streaming on theatrical revenues is insufficiently considered. Second, it conceals potential operating risks, resulting in off-balance-sheet contingent liabilities; typical cases include costs incurred from reshooting projects triggered by negative public opinion about actors and contingent expenditures arising from guaranteed minimum returns in joint investment agreements. Third, it exacerbates pressure for subsequent inventory value adjustments. When the actual broadcast revenue of a work deviates by more than 20% from expectations, retrospective adjustments to impairment provision ratios are required, causing abnormal fluctuations in the income statement. Such cross-period profit and loss adjustments not only affect current earnings per share (EPS) but also undermine the robustness of the financial reporting framework, thereby weakening investors’ trust in management’s ability to forecast financial performance accurately.

4.3.3. Risk of insufficient audit evidence for inventory valuation

In audit practice within the film and television industry, the unique characteristics of inventory present significant challenges to the identification of audit risks. Auditors face distinct professional difficulties in obtaining sufficient and appropriate audit evidence to verify inventory values. Taking screenplays and works-in-progress as examples, their valuation heavily depends on forecasts of future revenues, while objective comparable historical transaction data and reliable market reference frameworks are often lacking. This situation hinders auditors from effectively validating expected returns. Moreover, the valuation process involves numerous subjective assumptions—such as market acceptance forecasts, distribution channel assessments, and revenue-sharing models—whose complex interactions create multi-dimensional professional judgment risks, substantially diminishing auditors’ confidence in the reliability of their valuation conclusions. Therefore, at the audit risk assessment stage, it is essential to systematically consider the special attributes of film and television inventories and the inherent valuation uncertainties they cause.

5. Conclusion

This paper, through an in-depth analysis of the typical backdoor listing case of Huanrui, reveals the significant characteristics and multidimensional manifestations of audit risks in the film and television industry. Due to the diversified revenue structure and complex business models in the industry, risks such as premature revenue recognition and fictitious accounts receivable exist, resulting in distorted financial statements that conceal the actual operating performance. The concealment and complexity of related-party transactions—such as associated party fund occupation and fabricated transactions—violate information disclosure regulations and increase audit difficulty. In terms of inventory valuation, prominent issues including overestimation of inventory value and insufficient impairment provisions lead to distortion of the balance sheet, thereby undermining the reliability and stability of financial reports.

This study offers valuable insights for auditing practice in the film and television industry. Auditors need to strengthen their understanding of the industry’s complex business models, including precise determination of revenue recognition timing, thorough and penetrative examination of related-party transactions, assessment of accounts receivable collection risks, and prudent evaluation of inventory value. These measures will enable effective identification and mitigation of audit risks and improve audit quality. Film and television enterprises should enhance internal control systems and improve corporate governance structures to ensure the authenticity and compliance of financial disclosures. Regulatory authorities should further refine accounting standards and auditing guidelines specific to the film and television sector, strengthen supervision over backdoor listing enterprises, promote standardized capital operations in the industry, and protect investors’ legitimate rights and interests.

References

[1]. Jing, X. Y., Li, G. Z., & Pan, Y. L. (2021). Analysis of financial fraud case of H&R Century Pictures. Guangxi Quality Supervision Bulletin, (4), 111–112.

[2]. Li, J. (2020). Audit risks of listed companies in the film production industry (Master’s thesis, Beijing Jiaotong University).

[3]. Yu, B. C. (2019). Discussion on revenue recognition issues of film companies under the new revenue standard. Contemporary Accounting, (16), 93–95.

[4]. Xie, Y. M. (2019). Study on accounting treatment of joint investment business in the media industry’s film and television drama sector. Accounting Study, (7), 103–104.

[5]. Liu, F. D. (2019). Difficulties and countermeasures in auditing the film industry: Taking Huanrui Pictures as an example. Modern Economic Information, (21), 151–152.

[6]. Zhou, H. (2019). Motivations and performance analysis of backdoor listings in the cultural media industry (Master’s thesis, Southwestern University of Finance and Economics).

[7]. Luo, Y. (2020). Case study of financial fraud in Huanrui Pictures’ backdoor listing. (Master’s thesis, Jilin University).

[8]. Heng, J. K. (2022). Study on audit failure of Beijing Xinghua CPA firm in Huanrui Pictures’ backdoor listing. (Master’s thesis, Liaoning University).

[9]. Liu, H. M. (2020). Analysis of causes and countermeasures of audit failure in revenue recognition of listed companies: Based on experience data from CSRC penalty decisions. Accounting Communications, (13), 133–136.

[10]. Liu, Y. W. (2021). Study on audit failure and prevention of backdoor listing companies. (Master’s thesis, Tianjin University of Finance and Economics).

[11]. Xu, F. J., & Cheng, L. M. (2021). Analysis of causes and lessons of financial fraud in H&R Century Pictures. China Management Informatization, 24(19), 9–10.

[12]. Chen, Q. (2019). How H&R Century Pictures decorated the truth and yet "Chang'an". Business School, (8), 68–70.

[13]. Gao, X. N. (2017). Study on accounting issues of film copyright. (Master’s thesis, Chinese Academy of Fiscal Sciences).

[14]. Wang, C. (2019). Discussion on problems and countermeasures of internal control in film enterprises. China Market, (9), 93–95.

[15]. Zheng, J., & Wang, Y. (2011). Study on internal control of film production enterprises. Fiscal Supervision, (11), 48–50.

[16]. Dou, Y. L. (2022). Study on audit risks and prevention of listed companies in film and media industry. (Master’s thesis, Beijing Jiaotong University).

Cite this article

Qin,J. (2025). A Study on Audit Risks in Backdoor Listings in the Film and Television Industry: A Case Study of H&R Century Pictures. Advances in Economics, Management and Political Sciences,211,21-35.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jing, X. Y., Li, G. Z., & Pan, Y. L. (2021). Analysis of financial fraud case of H&R Century Pictures. Guangxi Quality Supervision Bulletin, (4), 111–112.

[2]. Li, J. (2020). Audit risks of listed companies in the film production industry (Master’s thesis, Beijing Jiaotong University).

[3]. Yu, B. C. (2019). Discussion on revenue recognition issues of film companies under the new revenue standard. Contemporary Accounting, (16), 93–95.

[4]. Xie, Y. M. (2019). Study on accounting treatment of joint investment business in the media industry’s film and television drama sector. Accounting Study, (7), 103–104.

[5]. Liu, F. D. (2019). Difficulties and countermeasures in auditing the film industry: Taking Huanrui Pictures as an example. Modern Economic Information, (21), 151–152.

[6]. Zhou, H. (2019). Motivations and performance analysis of backdoor listings in the cultural media industry (Master’s thesis, Southwestern University of Finance and Economics).

[7]. Luo, Y. (2020). Case study of financial fraud in Huanrui Pictures’ backdoor listing. (Master’s thesis, Jilin University).

[8]. Heng, J. K. (2022). Study on audit failure of Beijing Xinghua CPA firm in Huanrui Pictures’ backdoor listing. (Master’s thesis, Liaoning University).

[9]. Liu, H. M. (2020). Analysis of causes and countermeasures of audit failure in revenue recognition of listed companies: Based on experience data from CSRC penalty decisions. Accounting Communications, (13), 133–136.

[10]. Liu, Y. W. (2021). Study on audit failure and prevention of backdoor listing companies. (Master’s thesis, Tianjin University of Finance and Economics).

[11]. Xu, F. J., & Cheng, L. M. (2021). Analysis of causes and lessons of financial fraud in H&R Century Pictures. China Management Informatization, 24(19), 9–10.

[12]. Chen, Q. (2019). How H&R Century Pictures decorated the truth and yet "Chang'an". Business School, (8), 68–70.

[13]. Gao, X. N. (2017). Study on accounting issues of film copyright. (Master’s thesis, Chinese Academy of Fiscal Sciences).

[14]. Wang, C. (2019). Discussion on problems and countermeasures of internal control in film enterprises. China Market, (9), 93–95.

[15]. Zheng, J., & Wang, Y. (2011). Study on internal control of film production enterprises. Fiscal Supervision, (11), 48–50.

[16]. Dou, Y. L. (2022). Study on audit risks and prevention of listed companies in film and media industry. (Master’s thesis, Beijing Jiaotong University).