1. Introduction

Ping An is not only one of the best-run insurance companies in China but also one of the best-run comprehensive financial groups in China; it possesses all the financial licenses in China (one of the only six companies in China). As Ping An’s shadow bank and subsidiary, Lufax enjoys the advantages of being a Ping An associate that operates outside the realm of traditional banking regulation. Lufax provides diverse financial products and services, particularly to SMEs that traditional banks often ignore. Lufax has rapidly expanded its customer base by leveraging advanced technology and data analytics.

An important question is how Lufax transfers the risks endured in this process. Through a detailed case study of Lufax, the discussion will point out the challenges and responses of shadow banking in a rapidly changing economic environment.

Shadow banking refers to a system of credit intermediation operating outside of the traditional banking system [1-3]. It includes a range of institutions that perform banking-like functions but are not regulated as traditional banks, such as special purpose vehicles (SPVs), money market funds, and hedge funds [4,5]. Although the term "shadow banking" only entered public discourse in 2007, the importance and scope of this system are now widely recognized by international policymakers. Shadow banking is a system of credit creation outside traditional banks that profoundly impacts the global economy [6,7]. According to data provided by the Financial Stability Board, shadow banking accounts for over half of global banking assets and represents a third of the global financial system [8].

The shadow banking system operates by transforming short-term liabilities into long-term assets. Unlike traditional banks, shadow banks raise funds through wholesale funding markets and invest in longer-term, higher-yielding assets. This system relies heavily on securitization, where various types of debt (e.g., mortgages, and credit card receivables) are bundled together and sold as securities to investors. This process creates liquidity and redistributes risk across the financial system. While the shadow banking system plays a significant role in providing credit to the economy, its complexity and lack of transparency pose challenges for regulators and policymakers [9].

In "Shadow Banking: Scope, Origins and Theories" [10], Nesvetailova discusses the risks that shadow banking might face. Firstly, shadow banks engage in maturity and liquidity transformation similar to traditional banks, but with higher leverage and less regulatory oversight. This can lead to greater systemic risk, as seen during the 2007-09 financial crisis when the collapse of shadow banking entities contributed to a global financial meltdown [7]. Secondly, regulatory arbitrage is common in the shadow banking sector, where financial activities are structured to avoid existing regulations. This allows shadow banks to operate with fewer constraints compared to traditional banks, often leading to higher risk-taking.

Most of the previous studies have focused on risk management during Lufax's period as a P2P platform, and have not paid attention to Lufax's role as a shadow bank of PingAn. However, in recent years, Lufax has continued to make strategic adjustments, transformations and upgrades, and its risk management measures are also very different.

In this article, we will explore the risk transfer measures of shadow banks using Lufax, a shadow bank from China, as a case study. Through this research, we can explore in greater detail how shadow banks operate by transforming short-term liabilities into long-term assets and relying on securitization, thereby better revealing the complexity and uniqueness of the shadow banking system. This aids in a better understanding of where the risks in shadow banking originate and where they are transferred. Consequently, this understanding helps in comprehending its impact on the economy, leading to more informed decisions in macroeconomic policymaking.

In this article, we initially explore the relationship between Ping An and Lufax, where Lufax operates as the bank's shadow entity within this framework. Subsequently, we outline the business structure of Lufax to delve into how it facilitates shadow financing for SMEs. Additionally, we assess the various risk categories present within Lufax, examine the business dynamics between SMEs and Lufax, and scrutinize the interplay between funding investors and Lufax. Finally, we analyze Lufax's risk management strategies.

2. The relationship between Ping an and Lufax

2.1. Ping An’s control over Lufax

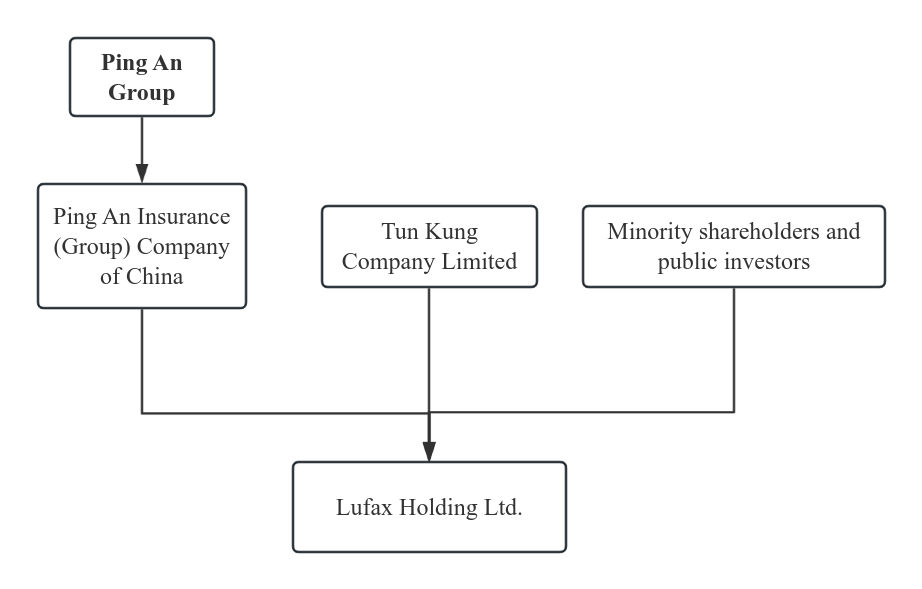

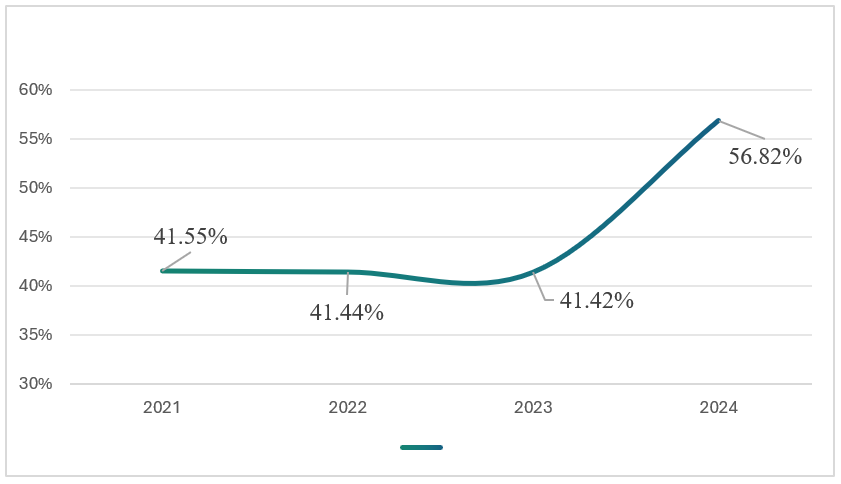

Figure 1 shows the main shareholding structure of Lufax in 2021-2023, which remained relatively stable during the three years. Its main shareholders are Ping An Group and Tun Kung Company Limited. Taking into account Lufax's annual reports for 2021-2023, in 2021, Ping An Group operates through Ping An Financial Technology and Ping An Overseas, two subsidiaries of core subsidiary Ping An Insurance (Group) Company, holds 41.55% of Lufax's equity. Ping An Financial Technology holds 24.94% through its wholly-owned subsidiary AnKe Technology and Ping An Overseas Holding holds 16.62% directly. At the same time, Tun Kung Company Limited is the second largest shareholder with a 28.44% stake. By 2022, Ping An Group’s stake had fallen slightly to 41.44% and Tun Kung Company Limited’s to 28.26%. In 2023, it fell further to 41.42% and Tun Kung Company Limited to 26.88%. By comparing the 2021 to 2023, Ping An group of Lufax indirect ownership and shareholding directly as you can see, although shares fell slightly, but the peace group, through its subsidiaries and affiliates to Lufax maintained a significant stake and control stability.

On the basis of Figure 2, stakes in the 2021 s and 2023 s remain at around 40%. As a result, Ping An Group has maintained a dominant position and strategic influence in Lufax's business. This complex ownership structure is typical of shadow banking.

In addition, according to the announcement issued by Ping An Group on July 3, 2024, Lufax Holding Ltd. will be included in the consolidated financial statements [11]. The special dividend plan of Lufax Holding resulted in Ping An Group acquiring shares in Anke Technology Ltd. and Ping An Insurance (Overseas) Holdings. Due to the selection of stock dividends by the wholly-owned subsidiaries during the special dividend distribution of Lufax, Ping An Group's stake in Lufax increased to 56.82% [11,12]. This led to the passive consolidation of Lufax and triggered a mandatory general offer under the Hong Kong Takeovers Code. This change has transformed Lufax from an associate to a subsidiary included in the consolidated financial statements, strengthening their relationship [13]. The specific impacts are reflected in the following points.

Firstly, the change in control and influence is significant. As an associate, Ping An had significant influence but not full control over Lufax. It was limited to appointing directors and participating in key decisions. As a subsidiary, Ping An now has full control. This allows it to unilaterally decide Lufax’s major policies. It ensures strategic alignment with Ping An.

Secondly, Previously, Ping An used the equity method to account for Lufax. This reflected its share of Lufax’s net profit or loss. Now, under the consolidation method, all of Lufax’s assets, liabilities, revenues, and expenses are included in Ping An's financial statements.

Thirdly, there is a significant difference in risk and return. As an associate, Ping An shared Lufax’s risks and returns proportionally. It did not bear full operational risks. As a subsidiary, Ping An assumes all operational risks. It fully enjoys Lufax’s profits and cash flows.

Lastly, strategic control and operational integration are affected. Previously, Ping An's strategic control over Lufax was limited. Lufax maintained operational independence. Now, Ping An has full strategic control. It can integrate Lufax’s resources more effectively. This achieves better resource allocation and synergies.

The transformation of Lufax from an associate to a subsidiary under Ping An Group significantly increases Ping An's control and influence. This change consolidates all of Lufax’s assets, liabilities, revenues, and expenses into Ping An's financial statements. It allows Ping An to integrate Lufax’s resources more effectively and fully control its strategy and operations. This enhances Ping An's ability to leverage Lufax’s business advantages and achieve business synergies and strategic goals.

2.2. Lufax’s impact on Ping An

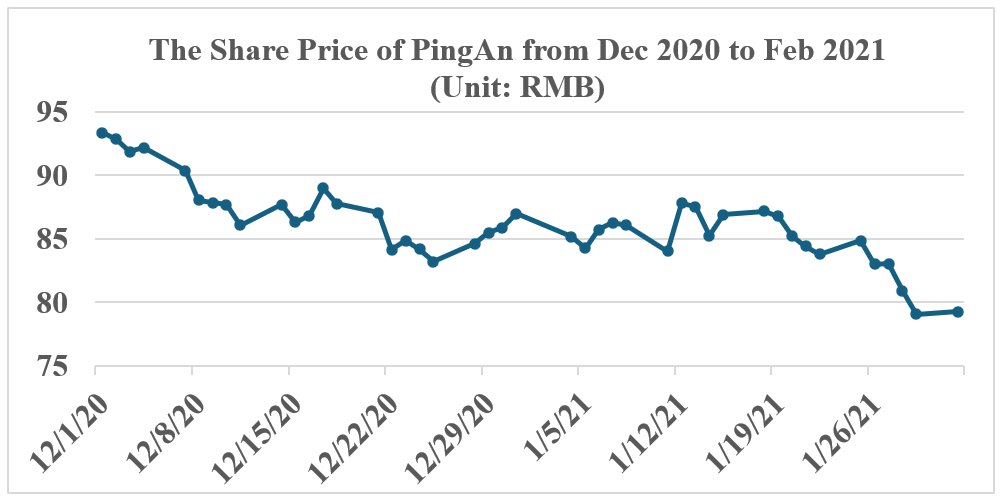

Shares of its parent company Ping An Group in 2020 have been volatile, reflecting market concerns about the potential risks of its subsidiary, Lufax. In addition to the macroeconomic impact of the epidemic and investors' risk aversion, the P2P explosion of other companies also had a significant impact on Lufax. It is remarkable to see from Figure 3 that Ping An's share price has lowered by almost 50% over this period of time.

2.3. Ping An’s brand effect

Lufax's reputation and market confidence are bolstered by its significant market position. As a fintech platform under Ping An Group, Lufax has close business cooperation with Ping An Bank. As mentioned earlier, funds from Ping An Bank flow into Lufax. These funds can provide more financial products and services to Lufax users. Ping An Bank has received high ratings from international credit rating agencies for consecutive years, demonstrating its credibility and stability in the financial market. Therefore, investors can be assured of the high confidence level they can have in the stability of Lufax's funding chain.

3. The analysis of Lufax business

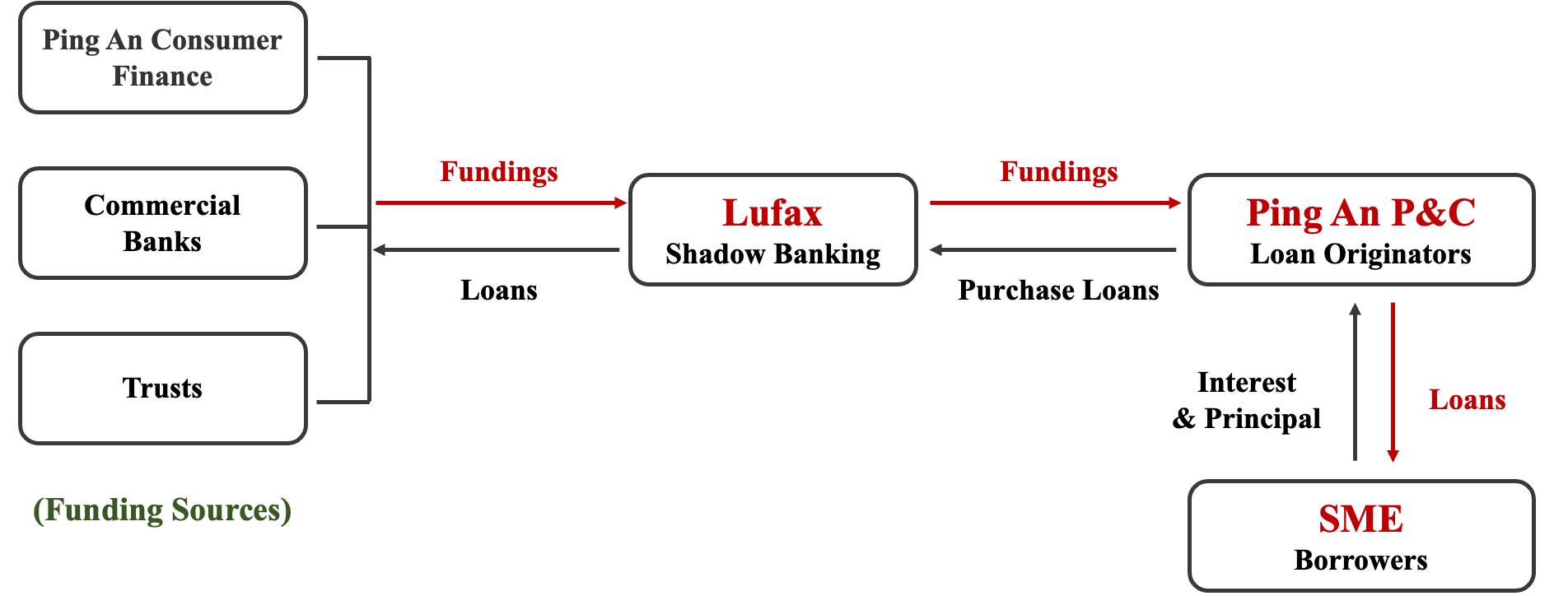

Figure 4 illustrates the flow of funds and loans within a shadow banking system involving Lufax and Ping An P&C (Ping An Property & Casualty Insurance Company of China, Ltd.). A subsidiary of Ping An Insurance Group, it offers diverse property insurance products. Funding sources, which include the Ping An Consumer Finance, commercial Banks, and trusts, provide funds to Lufax. As a shadow banking entity, Lufax receives these funds and subsequently transfers them to Ping An P&C. Ping An P&C, acting as a loan originator, uses the funds from Lufax to issue loans. Ping An P&C is part of the Ping An Group of China. Relying on its strong financial strength and risk management capabilities, it is able to provide 100% guarantee services for some of Lufax's borrowing programs. The 100% guarantee business model, cited from the financial report, is the business strategy implemented by Lufax, involving Ping An Consumer Finance providing full guarantees for Ping An P&C all newly issued loans, without relying on third-party credit enhancements.

Ping An Group of China established the Ping An P&C to separate the default risk stem from consumer loans from Lufax. These loans are then provided to the borrowers, which are mainly SMEs (Small and Medium-sized Enterprises). This process demonstrates how funds flow from various financial institutions through Lufax to Ping An P&C, and ultimately to SME borrowers as the form of loans, facilitating the financing needs of small and medium-sized businesses [14,15].

3.1. Lufax's funding sources

In the bank-funded model, third-party banks directly provide loans to borrowers. Lufax offers loan-enabling services to borrowers, allowing them to obtain loans from third-party banks. As of 2023, Lufax partnered with 79 banks, including national joint-stock, city, and rural commercial banks. Lufax stated in its 2023 financial report that its relationships with banks and trust companies are sustainable, as Lufax helps them generate interest income by providing loans to high-quality borrowers.

And in the trust model, third-party trust companies establish trust plans, with investors funding these plans through three primary sources:

(1) Private banks directly sell retail funds,

(2) Institutional funds from banks, securities, and insurance companies

(3) Funds raised in the public market

As of 2023, Lufax has partnered with six trust companies as the source of funds: China Resources SZITIC Trust Co., Ltd., Ping An Trust Co., Ltd., Hwabao Trust Co., Ltd., Zhongrong International Trust Co., Ltd., Minmetals International Trust Co., Ltd., AVIC Trust Co., Ltd..

The goal of this model is to improve loan security and ensure the rights and interests of both borrowers and investors. The implementation of this model has significantly enhanced the credibility and safety of the loans, reducing dependence on third-party credit enhancements. By 2023, Lufax successfully transitioned to the 100% guarantee model, greatly increasing customer trust and market competitiveness.

|

The Incremental Loan of Funding Sources from 2021 to 2023 (Unit: million RMB) |

|||

|

Year |

2021 |

2022 |

2023 |

|

Bank |

414.2 |

279.5 |

81.4 |

|

Trust |

208.9 |

157.3 |

55.4 |

|

Licensed Consumer Finance Subsidiary |

25.3 |

58.6 |

71.2 |

|

Total |

648.4 |

495.4 |

208 |

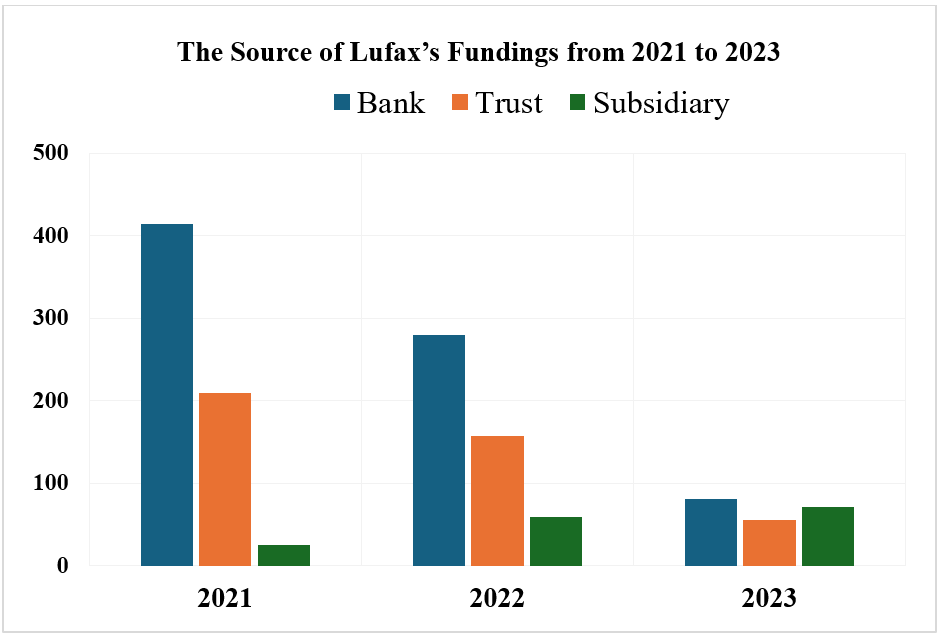

It can be seen from Figure 5 that there a significant changes in Lufax’s loan funding from 2021 to 2023, including commercial banks, trust companies, and licensed consumer finance subsidiaries. Particularly, the funding from commercial banks and trust companies has decreased substantially. The total loan funding decreased, attributed to three main reasons:

(1) Macroeconomy and Financial Environment

The economic slowdown reduced loan demand from SME owners. According to the Kansas City Federal Reserve [12], global SMEs loans decreased by 6.7% year-on-year in 2023, indicating a decline in demand.

(2) Prioritizing Asset Quality

In order to reduce losses, Lufax adjusted its loan business strategy. Lufax focused on asset quality over loan quantity. These include adjusting market segments and product portfolios, optimizing geographic presence, streamlining the direct sales team, and evaluating industry portfolios. They focused on clients with better risk profiles, exited underperforming regions, and reduced high-risk loans. The transition to a 100% guarantee model also led to stricter loan application reviews, reducing new loan issuance.

(3) Increase in Loans from the Licensed Consumer Finance Subsidiary

Structurally, the proportion of loans from banks and trust companies decreased, while those from the consumer finance subsidiary increased, leading to a more balanced loan source distribution. This trend indicates Lufax's strategy to reduce reliance on traditional bank and trust funds, diversifying its funding sources to maintain flexibility and stability in an uncertain financial environment.

(4) Credit Assessment of the Borrowers

Lufax's credit evaluation is supported by big data and artificial intelligence (AI) technology to assess customer behavior data and personal financial statements; it is managed by the Lufax risk management department. In addition to meeting basic requirements such as nationality, age, residency, and the availability of credit and other historical records, borrowers must pass Lufax's anti-fraud and credit evaluations. Once a loan application passes the credit evaluation process, Lufax will recommend the loan to its funding partners for their independent assessment of the loan application. Lufax only matches borrowers that it believes meet its partners' lending criteria, and its partners independently review all application materials before making a lending decision. Loans are disbursed directly to borrowers by the funding partners.

The AI algorithms and applications have created an around-the-clock command and control center. This system has improved post-loan processes' stability, speed, and efficiency. Data from post-loan monitoring and collection efforts are continuously fed into customer screening and credit approval algorithms, ensuring continuous model improvement and further system optimization. The deployment of AI collection assistants and collection segmentation algorithms has enhanced the ability to identify fraudulent and high-risk borrowers while improving product pricing, underwriting efficiency, and collection effectiveness.

4. Different types of risk for Lufax

4.1. Default risk

Lufax provides loans to small and medium-sized enterprises (SMEs) through its shadow banking business. However, these loans are usually of a high-risk nature.

(1)SMEs Credit Risk

SMEs have poor business stability with a weak financial position and low-risk resistance.

There is a significant risk of default on Lufax's SMEs loans, a risk that is particularly evident in 2022 and 2023. According to the financial report data, in 2022, the default risk on Lufax's SME loans rose markedly, especially in light of the heightened uncertainty in the economic environment and the impact of the epidemic [16]. The Company's credit impairment losses surged by 147.1% to RMB 6.3 billion(US $907 million) in the fourth quarter of 2022, indicating that a large number of loans may be in default or are expected to be difficult to recover.

These figures reflect Lufax's heightened challenges in facing defaults on SME loans, particularly against the backdrop of deteriorating economic conditions and increased market pressures. This rising default risk had a direct negative impact on Lufax's revenue and financial position.

4.2. Regulatory risk

The shadow banking business is usually outside the traditional banking regulatory system and may be exposed to risks arising from changes in the policy and regulatory environment.

(1) As a fintech company, Lufax mainly plays the role of a financial intermediary, connecting borrowers and investors through its platform, rather than by directly holding many loan assets. This "asset-light" platform model means that Lufax is largely a transaction broker rather than a direct participant in the credit business like a bank. Therefore, protective measures are insufficient for both the company and the investors.

(2) In order to rectify the market, the Chinese government and financial regulators have strengthened the regulation of P2P lending and shadow banking. In 2016, the supervision department required financial platforms to increase transparency, strengthen risk management, and limit high-risk businesses. While these measures helped prevent systemic financial risks, they have increased Lufax's compliance costs and operational pressure, and have limited Lufax's business expansion and revenue growth. According to Lufax's financial report for the year 2023, it was noted that total revenue decreased by 41.1% in one year, which was mainly due to a 45.3% decrease in the balance of loans empowered.

4.3. Competitive risk

Competition in the fintech sector is intense. Numerous similar platforms are offering similar financial services in the market, such as Ant Financial, JD Finance, and PPDAI. However, the biggest difference between Lufax and them is that as a subsidiary of Ping An, it also has all financial licenses. Compared to other companies, like Balance Treasure and JD Baitiao, they demonstrated a large user base and a large market share as a result of their cooperation with e-commerce platforms. Lufax, on the other hand, focuses on micro and small loans, offers longer-term loan products, and emphasizes its services for specific customer groups.

5. The relationship between SMEs and Lufax

|

Type |

Annual interest rate (%) |

|

Short-term loan |

4.35 |

|

Long-term loan (one to five years) |

4.75 |

|

Long-term loan (over five years) |

4.90 |

|

Data source: https://www.icbc.com.cn/ICBC/EN/FinancialInformation/RMBDepositLoanRate/RMBLoanRate/ Note: we use the Industrial and Commercial Bank of China (ICBC) annual loan interest rate as an example |

|

From table 2, it can be seen that the loan interest rates vary based on the loan term. Short-term loans have the lowest interest rate at 4.35%. As the loan term increases, the interest rate also rises, with long-term loans ranging from 1 to 5 years having an interest rate of 4.75%, and long-term loans over 5 years having an interest rate of 4.90%.

|

Type |

Average contract tenor |

Average APR (%) |

Highest interest rate(%) |

Lowest interest rate(%) |

|

General Unsecured Loans |

35.7 months |

20.9 |

24.9 |

10 |

|

Secured Loans |

36.5 months |

16.0 |

||

|

The actual interest rate fluctuates within a range above and below the average APR. Data source: 2023 Lufax Holding Annual Financial Report Phone interview |

||||

From the data in Table 3, it can be seen that the interest rates for unsecured loans are relatively high. In contrast, the average annual interest rate for secured loans is lower, at 16.0%. This reflects the impact of different loan types on interest rates: generally, unsecured loans have higher interest rates due to the higher risk, while secured loans have lower interest rates due to the collateral providing security, thus lowering the risk.

|

Overdue interest penalties(RMB in thousands) |

|

|

ICBC |

6.39 = 1000 * [5.9%* 130% * (30 / 360)] |

|

Lufax |

26.12= 1000 * [20.9% * 150% * (30 / 360)] |

|

Note: Overdue Days = Repayment Date - Due Date Source: Industrial and Commercial Bank of China [17] |

|

Table 4 shows the overdue interest penalties for a 1 million RMB loan overdue by 30 days from ICBC and Lufax. The overdue interest penalty from ICBC is 6.39 thousand RMB. In comparison, Lufax’s overdue interest penalty is 26.12 thousand RMB. Due to Lufax’s higher base interest rate and penalty coefficient for overdue interest, its penalty amount is significantly higher than that of ICBC.

Based on the table 1-4 above, there is a huge difference in the annual loan interest rate and overdue interest penalties charged by the ordinary commercial bank (ICBC) and Lufax. Clearly, the loan interest rates between ICBC and Lufax differ significantly, Lufax’s rates being much higher and the penalties for overdue payments are also higher with Lufax. Due to the poor credit status of borrowers (SMEs) Lufax needs to bear a higher default risk. To compensate for this risk, Lufax has increased the interest rates and the overdue interest penalty. However, the SMEs still choose to borrow money from Lufax (as shown above in the table 4).

5.1. SMEs’ financing needs

They may find it difficult to obtain loans or sufficient loan amounts from commercial banks for various reasons. For example, ordinary commercial banks often require enough collateral which SMEs might not have. According to statistics from the State Administration for Market Regulation of China, as of August 2020, there were 32.61 million small and micro enterprises registered and actively operating in the SME directory. Among them, 10.4 million enterprises had credit from banks, accounting for 31.89%, and the number of enterprises with loans was 29.4%. SMEs are eager to obtain loans, but less than one-third of SMEs are able to secure loans from commercial banks. They have to turn to Lufax [18].

Lufax, initially established as a peer-to-peer (P2P) lending platform, has now evolved into a broader financial services platform. After 2023, Lufax operates as a light-asset loan model, connecting borrowers (primarily SMEs) with institutional investors. The company generates revenue by facilitating loans and charging service fees [19].

5.2. Why Lufax is important to SMEs

SMEs are an important part of the economy [20-22]. The SMEs contribute over 50% of national tax revenue, more than 60% of national GDP, over 70% of technological innovation, more than 80% of urban employment, and accounting for over 90% of the number of enterprises. Lufax has provided a large number of SMEs with the necessary funds for development, thereby promoting overall economic development [23,24].

A commercial bank loan usually requires a lot of time and paperwork to apply for but the Lufax needn’t. Lufax’s online platform allows SMEs to apply for loans and other financial services online, significantly reducing the time and paperwork required by traditional financing methods. A loan can be disbursed in as little as 45 minutes. For SMEs, faster and more convenient financing methods help to exploit business opportunities.

Lufax provides more convenient financing channels for SMEs, addressing the common financing difficulties these businesses face. Traditional banks are often hesitant to lend to SMEs due to a lack of credit history and collateral. Lufax uses big data and other technologies to assess the creditworthiness of SMEs, thereby enabling more inclusive lending.

In times of increasing economic uncertainty, Lufax helps SMEs weather the storm and maintain operations. They can use these funds for technological innovation, market expansion, and equipment upgrades, thereby improving production efficiency and competitiveness.

Shadow banks like Lufax provide an important financing channel for SMEs, helping them grow. At the same time, it also promotes economic growth [25].

5.3. Lufax’s losses and revenues

|

The Credit Impairment (unit, billion RMB) |

|||

|

Net interest income |

Total Credit impairment losses |

Credit impairment losses from Individual Clients |

|

|

2021 |

14.17 |

6.64 |

2.44 |

|

2022 |

18.98 |

16.55 |

7.17 |

|

2023 |

12.34 |

12.69 |

6.57 |

Based on Table 5 that showing Lufax's annual reports for 2021, 2022, and 2023, we can see that the company's net interest income was 14.17 billion yuan, 18.98 billion yuan, and 12.34 billion yuan, respectively [16,26,27]. However, during the same period, credit impairment losses also increased, reaching 6.64 billion yuan, 16.55 billion yuan, and 12.69 billion yuan, respectively. Among these, customer loans accounted for 2.44 billion yuan, 7.17 billion yuan, and 6.57 billion yuan, respectively.

By analyzing these data, we find that Lufax’s net interest income could cover loan impairment losses from 2021 to 2023, but its net profit showed a downward trend. In 2021, the net profit after net interest income minus credit impairment loss was 7.53 billion yuan. In 2022, the net profit dropped to 2.43 billion yuan. However, in 2023, the net interest income was not enough to cover the credit impairment loss, resulting in a negative net profit after accounting for these losses. This trend shows Lufax’s challenge in managing loan risk. Lufax has to raise loan interest rates.

According to the 2023 annual report and quarterly financial report, Lufax's loan interest income decreased significantly, mainly due to fewer new loan sales and a lower loan balance. In the fourth quarter of 2023 [27-29], Lufax's total revenue was 6.857 billion yuan, representing a year-on-year decrease of 44.3%. The net interest income decreased by 46.8%, from 4.36 billion yuan in 2022 to 2.32 billion yuan in 2023. This decline in revenue was primarily due to lower sales of new loans and lower loan balances, partly due to increased economic uncertainty and more stringent regulatory measures.

Additionally, the deterioration of the macroeconomic environment significantly impacted Lufax's business. The economic downturn in 2022 and 2023 led to worsening conditions for small and micro enterprises, reducing their ability to repay loans and increasing default risk. Consequently, loan impairment losses continued to significantly impact Lufax's financial performance. Despite reducing total expenses, credit impairment losses remained a significant cost item. For instance, in the second quarter of 2023 [29], credit impairment losses reached 3.567 billion yuan, down 43% year-on-year, while Lufax has implemented some risk management measures, but still accounted for a large proportion of costs.

6. The relationship between investors and Lufax

6.1. Investor risks

In addition to avoiding risks themselves, shadow banks also use various means, such as concealing customer fund flow information and illegally misappropriating funds, to transfer their own risks to investors and reduce their own risks.

According to a previous study [5], trust companies are at the core of the Chinese shadow banking sector. They hold a large part of total shadow banking assets. Sichuan Trust was established on November 28, 2010. According to the 2019 financial report, the scale of the company's managed trust assets at that time exceeded 200 billion yuan.

In 2018, Sichuan Trust issued a TOT program. Transfer-Operate-Transfer (TOT) is a public-private partnership model where the government transfers the rights to operate an existing infrastructure project to a private entity. The private entity is responsible for operating, maintaining, and potentially upgrading the project for a specified period. After this period, the project is transferred back to the government, often with improved efficiency and quality due to private sector involvement. The TOT ran into trouble due to investing in a large amount of unpayable debt, resulting in the plan's inability to pay principal and interest on time.

Due to Sichuan Trust’s TOT product business failing to disclose the risks of underlying assets to investors truthfully and engaging in illegal [30-32] activities such as improper related transactions and fund misappropriation, government authorities legally halted the TOT business. In 2024, Sichuan Trust declared bankruptcy. Initially unaware of Sichuan Trust's violations. The 8,055 individual investors could only recover 40-80% of their assets. Comparing Sichuan Trust's TOT business, Lufax's asset-backed securities (ABS) and mortgage-backed securities (MBS) businesses also have similar characteristics [33]. These products involve high-risk loans, such as loans to small and micro enterprises and subprime mortgages, which may lead to a broken capital chain. If market conditions deteriorate or regulations tighten, Lufax’s capital chains may break, causing asset values to plummet and significant losses to investors. The high returns of shadow banking products come with high risks, requiring investors to assess them carefully.

6.2. Market risk

The reliance on short-term funding poses substantial risks. If market conditions deteriorate, these funding chains can easily break, leading to a sharp decline in asset values. For example, suppose the quality of Lufax's assets deteriorates or the financing market tightens. While securitization can spread risk, it also means that the quality of the underlying assets is crucial. If the loans within these securities default at higher rates, the securities' value would drop, leading to significant losses for investors.

The shadow banking system's high leverage and complexity mean that problems in one institution can quickly spread to others. This interconnectedness was evident during the 2008 financial crisis and remains a concern with institutions like Lufax and with the regulators.

6.3. Sources of investor trust

Despite these risks, the promise of high returns and the trust in Lufax's brand continue to attract investors even with market volatility and tightening financing conditions. This risk-taking behavior is driven by the lure of significant financial gains. However, the danger of massive losses when funding chains break, as seen in the Sichuan Trust collapse during the financial crisis, serves as a crucial warning.

Moreover, there are also reasons behind this high interest rate that reassure investors. Lufax utilizes users' funds to provide high-interest loans to SMEs and other enterprises. According to data, the rate for unsecured loans is as high as 20.9%. In contrast to the return rate offered to investors (8%-10%), Lufax can earn up to twice as much from these loans. Investors can clearly understand that the high returns do not result from illicit activities but rather stem from the high loan interest rates. Consequently, they feel confident entrusting their investment to Lufax.

7. The risk management of Lufax

Lufax, as a fintech company, has a variety of approaches to sharing and transferring risks and implements a comprehensive risk management strategy.

7.1. Diversification

Lufax reduces the impact of a single customer or industry default on the overall business by diversifying its loan portfolio. This includes:

(1) Customer Diversification: Lufax has diversified customer types, mainly SMEs, as well as individual borrowers and institutional investors. Spreading out loans to a large number of SMEs in different regions and industries to avoid concentration of risk.

(2) Product Diversification: providing a wide range of financial products and services to spread the risk of different types of business. It offers consumer financial products, commercial financial products, wealth management, and investment products.

7.2. Credit assessment

Lufax acquired OneConnect Company in November 2023. OneConnect, as a virtual bank, has already accumulated extensive experience in technology-driven financial services. Lufax and OneConnect overlap in terms of service objectives and customer groups, focusing on the use of technology to provide financial services to small and micro enterprises and individuals. Through the acquisition of OneConnect, Lufax can better integrate its resources, further enhance its technological capabilities, optimize its customer experience, and expand its financial services more effectively through the virtual bank model to achieve business synergies.

Lufax uses advanced credit assessment technology and risk control models to conduct strict credit audits of borrowers. This includes:

(1) Big data analysis: using big data and artificial intelligence technology to build and optimize anti-fraud models to check for identity fraud, target bad records, and check for organized fraud. Detecting borrower identity and information through cross-validation and across data sources.

(2) Scoring model: Establish and optimize a credit scoring model to assess the borrower's probability of default and set the corresponding loan interest rate and amount. There are three main models: application scoring model, risk pricing model, and loan size model.

(3) Dynamic monitoring: Monitor the borrower's credit status in real-time, identify potential risks, and take appropriate measures in a timely manner. Lufax uses behavioral monitoring technology to identify potential credit risks by analyzing behavioral data such as a borrower's online activities, borrowing habits, and spending habits. For instance, frequent applications for short-term microloans may indicate that a borrower is experiencing financial constraints, thus suggesting possible default risk. Also, utilizing online systems for efficient and effective post-loan management and loan collection.

7.3. Risk transfer

Lufax transfers part of the risk to other investors or institutions through a variety of financial instruments and market mechanisms. This includes:

Asset securitization: Packaging loans into asset-backed securities (ABS) and selling them to investors, thus partially transferring default risks to security holders [34,35]. However, in 2023, Lufax gradually stop enabling new wealth management products, and it is currently maintaining existing wealth management products until maturity.

7.4. Asset lightweight

Lufax mainly serves as a financial services platform that connects individual investors with a wide range of investment products from different financial institutions. It does not hold a large number of loan assets, but rather obtains service fees and management fees by aggregating transactions. Lufax has diversified financing channels. Its financing is provided through a variety of channels, including bank loans, bond issuance and ABS, to ensure diversified and stable sources of funding. Lufax also cooperates with a number of banks and trust companies to continuously optimize the capital mix. The ability to finance loans is not limited by the availability of capital.

7.5. Reliance on third-party credit enhancement agencies

In 2023, Lufax partnered with seven third-party credit enhancement agencies, which primarily consisted of credit insurance companies and guarantee companies, to provide credit enhancement services for its loans. Among them, Ping An of China Property and Casualty Insurance Company Limited (Ping An P&C Insurance) is one of the major partners.

The credit enhancement institution passes a detailed credit assessment and risk analysis before providing credit enhancement services for Lufax's products, and conducts regular reviews of the guaranteed projects to ensure that the risks are within control.

As of December 31, 2023, Ping An P&C provided credit enhancement for approximately 52.5% of the loan balances under the Lufax P&C brand. The cooperation between the two parties is managed through a tripartite agreement, which includes the percentage of loans insured or guaranteed and the geographic scope of the cooperation.

Although Lufax transitioned to a 100% guarantee model in the fourth quarter of 2023, the majority of the financing guarantees for outstanding loans were still provided by these third-party credit enhancement providers as of the end of 2023.

7.6. Process of securitization

Transferring part of the default risk to insurance companies through reinsurance and credit insurance products [36,37]. This is despite the fact that Lufax completed business transformation in the fourth quarter of 2023 to adopt a 100% guarantee model, under which Ping An Consumer Finance guarantees each new loan transaction without the need for a third-party credit enhancement. Ping An P&C uses risk control models and big data analysis to conduct comprehensive credit audits. This includes assessing the default risk of the borrowing program through the borrower's financial status, repayment ability, and credit history. Through this assessment, Ping An P&C is able to determine which projects are suitable for 100% guarantee.

Upon default, Ping An P&C compensates investors for the entire principal amount of their investment. After compensation, Ping An P&C may take legal action to recover the borrower's outstanding debt. This may include asset auctions, legal proceedings and other means to minimize their financial losses. Depending on market changes and Ping An P&C's own risk control standards, the guarantee program may be adjusted, including increasing or decreasing the amount of the guarantee and adjusting the rates.

Ping An P&C usually sets aside a portion of its funds as a compensation pool to ensure that sufficient funds are available for compensation in the event of default. Ping An P&C may also diversify part of its risks through reinsurance organizations to ensure that it will be able to meet its indemnity liabilities even in the event of a large-scale default.

7.7. High capital stability

Lufax includes leverage and capital adequacy ratios in its annual KPI assessments to keep risks within a controllable range. The leverage ratio measures how much a business or individual uses borrowed funds for investment. It reflects the proportion of debt financing used in an entity's assets. The leverage ratio is typically used to assess a company's financial risk and capital structure; the higher the ratio, the more debt the company uses to finance itself, and the higher the financial risk. According to data provided by Lufax in 2024, the leverage ratio of its guaranteed subsidiaries is 2.4 times, significantly lower than the regulatory limit of 10 times. The capital adequacy ratio (CAR), also known as the capital adequacy rate, is an indicator that measures the ratio of a bank's capital to its risk-weighted assets. This ratio assesses the bank's capital adequacy to ensure it has enough capital to absorb potential losses, thereby protecting depositors and maintaining financial system stability. The capital adequacy ratio of Lufax's financial companies is 15.1%, higher than the regulatory requirement of 10.5%. This indicates that Lufax maintains a relatively high capital stability while achieving high profitability.

8. Conclusion

Through the case study of Lufax, we can observe the unique characteristics of the shadow banking system in China, especially in terms of risk transfer and management. Leveraging advanced technology and its connection with its parent company, Ping An Group, Lufax has established a comprehensive risk management system. Lufax has effectively shared and transferred all kinds of risks in its business and established a comprehensive risk management system. This not only improves the company's risk resistance but also lays the foundation for the sound development of its business. Despite the inherent risks of shadow banking, such as default and regulatory risks, Lufax has successfully mitigated these risks by creating its own unique business model.

Overall, Lufax provides us with a case study on the complexities of shadow banking, highlighting the importance of effective risk management for the sustainable growth and stability of shadow banks.

Acknowledgement

Zhuolin Xu, Jiangyi Zhu, Tianyi Zhou, and Aihua Liu contributed equally to this work and should be considered co-first authors.

References

[1]. Allen, F., Gu, X., Qian, J., (2017). The People's Bank of China: History, current operations and future outlook. Unpublished SSRN Working Paper 3018506. https: //doi.org/10.2139/ssrn.3018506

[2]. Allen, F., Qian, J., Gu, X., (2015). China's financial system: Growth and risk, Foundations and Trends in Finance 9(3-4), 197-319. https: //doi.org/10.1561/0500000029

[3]. Acharya, V. V., Qian, J., Su, Y., Yang, Z., (2021). In the shadow of banks: Wealth management products and issuing banks' risks in China. Unpublished working paper, NYU Stern and Fudan University.

[4]. Allen, F., Qian, Y., Tu, G., Yu, F., (2019). Entrusted loans: A close look at China's shadow banking system. Journal of Financial Economics 133(1), 18-41. https: //doi.org/10.1016/j.jfineco.2019.01.006

[5]. Allen, F. , Gu, X. , Li, C. W. , Qian, J. Q. , & Qian, Y. (2023). Implicit guarantees and the rise of shadow banking: the case of trust products. Social Science Electronic Publishing. DOI: 10.2139/ssrn.3924888

[6]. Chen, K., Ren, J., Zha, T., (2018). The nexus of monetary policy and shadow banking in China. American Economic Review 108(12), 3891-3936. https: //doi.org/10.1257/aer.20170133

[7]. Dang, T. V., Liu, L., Wang, H., Yao, A., (2019). Shadow banking modes: The Chinese versus US System. Unpublished working paper, Columbia University. https: //doi.org/10.2139/ssrn.3491955

[8]. Kodres, L. E. (2013). What is shadow banking. Finance and Development, 50(2), 42-43.

[9]. Adrian, T. and A. Ashcraft. (2012). Shadow Banking: A Review of the Literature, Staff Report No. 380. Federal Reserve Bank of New York.

[10]. Nesvetailova, A. (2017). Shadow Banking. Scope, Origins and Theories, New York, Oxon: Routledge.

[11]. Ping An Insurance. (2024). Announcement of Ping An Insurance (Group) Company of China, Limited on the inclusion of Lufthansa Holdings Company Limited into the scope of consolidated statements of income. www.Hkexnews.Hk. Retrieved from https: //doc.irasia.com/listco/cn/pingan/announcement/sca240704b.pdf.

[12]. Dustyn DeSpain, A. V. P., & Pandolfo, J. (2024). New Small Business Lending declines as credit standards continue to tighten. Federal Reserve Bank of Kansas City. Retrieved from https: //www.kansascityfed.org/surveys/small-business-lending-survey/new-small-business-lending-declines-as-credit-standards-continue-to-tighten/

[13]. Hong Kong Exchanges and Clearing Limited. (2017). Takeovers Code (19.78-19.79) | Rulebook. https: //en-rules.hkex.com.hk/rulebook/takeovers-code-1978-1979

[14]. Hsu, S., & Li, J. (2019). China's Fintech Explosion: Disruption, Innovation, and Survival. Columbia University Press

[15]. Lee, David Kuo Chuen. (2017). Decentralization and Distributed Innovation: Catch-up and Leapfrog. Available at SSRN: https: //ssrn.com/abstract=3476510 or http: //dx.doi.org/10.2139/ssrn.3476510

[16]. Lufax Holding Ltd. (2022). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/Annual-Reports

[17]. Industrial and Commercial Bank of China. (2024). What is the interest rate for overdue loan penalty for ICBC Escrow business? https: //www.icbc.com.cn/page/721852750723055617.html

[18]. General Office of the State Council. (2020). Transcript of the State Council's Regular Policy Briefing. www.gov.cn. Retrieved from https: //www.gov.cn/xinwen/2020zccfh/22/wzsl.html

[19]. Wei, S. (2015). Internet lending in China: Status quo, potential risks and regulatory options. Computer Law & Security Review, 31(6), 793-809.

[20]. Cunningham, L. X. (2011). SMEs as motor of growth: A review of China's SMEs development in thirty years (1978–2008). Human systems management, 30(1-2), 39-54

[21]. Alkhoraif, A., Rashid, H., & McLaughlin, P. (2019). Lean implementation in small and medium enterprises: Literature review. Operations Research Perspectives, 6, 100089.

[22]. Hu, Q., Mason, R., Williams, S. J., & Found, P. (2015). Lean implementation within SMEs: a literature review. Journal of Manufacturing Technology Management, 26(7), 980-1012

[23]. National Bureau of Statistics. (2019). Rapid Growth of Small and Micro Business Enterprises - Series Report No. 14 of the Fourth National Economic Census. Retrieved from https: //www.stats.gov.cn/sj/zxfb/202302/t20230203_1900576.html

[24]. National Bureau of Statistics. (2019). Micro, Small and Medium Sized Enterprises Become an Important Force for Economic Development - Series Report No. 12 of the Fourth National Economic Census. Retrieved from https: //www.stats.gov.cn/sj/zxfb/202302/t20230203_1900574.html

[25]. Song, Na, and Isaac Appiah-Otoo. (2022). The Impact of Fintech on Economic Growth: Evidence from China. Sustainability 14, no. 10: 6211. https: //doi.org/10.3390/su14106211

[26]. Lufax Holding Ltd. (2021). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/Annual-Reports

[27]. Lufax Holding Ltd. (2023). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/image/LU+20-F+2023.pdf

[28]. Lufax Holding Ltd. (2023). Lufax reports fourth quarter and full year 2023 financial results. Lufax Holding InvestorRoom. Retrieved from https: //ir.lufaxholding.com/2024-03-21-Lufax-Reports-Fourth-Quarter-and-Full-Year-2023-Financial-Results

[29]. Lufax Holding Ltd. (2023). Lufax Lufax reports second quarter 2023 financial results. Lufax Holding InvestorRoom. Retrieved from https: //ir.lufaxholding.com/2023-08-21-Lufax-Reports-Second-Quarter-2023-Financial-Results

[30]. China Banking and Insurance Regulatory Commission. (2020). Interim Measures for Equity Management of Trust Companies. Retrieved from https: //www.gov.cn/gongbao/content/2020/content_5512565.html

[31]. China Banking and Insurance Regulatory Commission. (2020). Interim Measures for the Administration of Trust Company Funds Trusts (Exposure Draft).

[32]. China Banking and Insurance Regulatory Commission. (2020). China Banking and Insurance Regulatory Commission Measures for the Implementation of Administrative Licensing Matters for Trust Companies. https: //www.gov.cn/gongbao/content/2021/content_5585238.html

[33]. Dake, K. (2024). China Sichuan Trust unravels. Northwest Arkansas Democrat-Gazette. https: //www.nwaonline.com/news/2024/mar/14/chinas-sichuan-trust-unravels/

[34]. Schwarcz, S. (2012). Regulating Shadow Banking. Boston University Review of Banking and Financial Law.

[35]. Stein, J. C. (2010). Securitization, shadow banking & financial fragility. Daedalus, 139(4), 41-51.

[36]. Fackler, M. (2023). The Global Financial Crisis – risk transfer, insurance layers, and (lack of?) reinsurance culture. British Actuarial Journal, 28, e10. doi: 10.1017/S1357321723000120.

[37]. Sinn, H. W. (2010). Casino capitalism: How the financial crisis came about and what needs to be done now. Oxford University Press.

Cite this article

Xu,Z.;Zhu,J.;Zhou,T.;Liu,A. (2025). Risk Transfer Measures of Shadow Banks: A Case Study of Lufax. Advances in Economics, Management and Political Sciences,213,76-92.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Allen, F., Gu, X., Qian, J., (2017). The People's Bank of China: History, current operations and future outlook. Unpublished SSRN Working Paper 3018506. https: //doi.org/10.2139/ssrn.3018506

[2]. Allen, F., Qian, J., Gu, X., (2015). China's financial system: Growth and risk, Foundations and Trends in Finance 9(3-4), 197-319. https: //doi.org/10.1561/0500000029

[3]. Acharya, V. V., Qian, J., Su, Y., Yang, Z., (2021). In the shadow of banks: Wealth management products and issuing banks' risks in China. Unpublished working paper, NYU Stern and Fudan University.

[4]. Allen, F., Qian, Y., Tu, G., Yu, F., (2019). Entrusted loans: A close look at China's shadow banking system. Journal of Financial Economics 133(1), 18-41. https: //doi.org/10.1016/j.jfineco.2019.01.006

[5]. Allen, F. , Gu, X. , Li, C. W. , Qian, J. Q. , & Qian, Y. (2023). Implicit guarantees and the rise of shadow banking: the case of trust products. Social Science Electronic Publishing. DOI: 10.2139/ssrn.3924888

[6]. Chen, K., Ren, J., Zha, T., (2018). The nexus of monetary policy and shadow banking in China. American Economic Review 108(12), 3891-3936. https: //doi.org/10.1257/aer.20170133

[7]. Dang, T. V., Liu, L., Wang, H., Yao, A., (2019). Shadow banking modes: The Chinese versus US System. Unpublished working paper, Columbia University. https: //doi.org/10.2139/ssrn.3491955

[8]. Kodres, L. E. (2013). What is shadow banking. Finance and Development, 50(2), 42-43.

[9]. Adrian, T. and A. Ashcraft. (2012). Shadow Banking: A Review of the Literature, Staff Report No. 380. Federal Reserve Bank of New York.

[10]. Nesvetailova, A. (2017). Shadow Banking. Scope, Origins and Theories, New York, Oxon: Routledge.

[11]. Ping An Insurance. (2024). Announcement of Ping An Insurance (Group) Company of China, Limited on the inclusion of Lufthansa Holdings Company Limited into the scope of consolidated statements of income. www.Hkexnews.Hk. Retrieved from https: //doc.irasia.com/listco/cn/pingan/announcement/sca240704b.pdf.

[12]. Dustyn DeSpain, A. V. P., & Pandolfo, J. (2024). New Small Business Lending declines as credit standards continue to tighten. Federal Reserve Bank of Kansas City. Retrieved from https: //www.kansascityfed.org/surveys/small-business-lending-survey/new-small-business-lending-declines-as-credit-standards-continue-to-tighten/

[13]. Hong Kong Exchanges and Clearing Limited. (2017). Takeovers Code (19.78-19.79) | Rulebook. https: //en-rules.hkex.com.hk/rulebook/takeovers-code-1978-1979

[14]. Hsu, S., & Li, J. (2019). China's Fintech Explosion: Disruption, Innovation, and Survival. Columbia University Press

[15]. Lee, David Kuo Chuen. (2017). Decentralization and Distributed Innovation: Catch-up and Leapfrog. Available at SSRN: https: //ssrn.com/abstract=3476510 or http: //dx.doi.org/10.2139/ssrn.3476510

[16]. Lufax Holding Ltd. (2022). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/Annual-Reports

[17]. Industrial and Commercial Bank of China. (2024). What is the interest rate for overdue loan penalty for ICBC Escrow business? https: //www.icbc.com.cn/page/721852750723055617.html

[18]. General Office of the State Council. (2020). Transcript of the State Council's Regular Policy Briefing. www.gov.cn. Retrieved from https: //www.gov.cn/xinwen/2020zccfh/22/wzsl.html

[19]. Wei, S. (2015). Internet lending in China: Status quo, potential risks and regulatory options. Computer Law & Security Review, 31(6), 793-809.

[20]. Cunningham, L. X. (2011). SMEs as motor of growth: A review of China's SMEs development in thirty years (1978–2008). Human systems management, 30(1-2), 39-54

[21]. Alkhoraif, A., Rashid, H., & McLaughlin, P. (2019). Lean implementation in small and medium enterprises: Literature review. Operations Research Perspectives, 6, 100089.

[22]. Hu, Q., Mason, R., Williams, S. J., & Found, P. (2015). Lean implementation within SMEs: a literature review. Journal of Manufacturing Technology Management, 26(7), 980-1012

[23]. National Bureau of Statistics. (2019). Rapid Growth of Small and Micro Business Enterprises - Series Report No. 14 of the Fourth National Economic Census. Retrieved from https: //www.stats.gov.cn/sj/zxfb/202302/t20230203_1900576.html

[24]. National Bureau of Statistics. (2019). Micro, Small and Medium Sized Enterprises Become an Important Force for Economic Development - Series Report No. 12 of the Fourth National Economic Census. Retrieved from https: //www.stats.gov.cn/sj/zxfb/202302/t20230203_1900574.html

[25]. Song, Na, and Isaac Appiah-Otoo. (2022). The Impact of Fintech on Economic Growth: Evidence from China. Sustainability 14, no. 10: 6211. https: //doi.org/10.3390/su14106211

[26]. Lufax Holding Ltd. (2021). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/Annual-Reports

[27]. Lufax Holding Ltd. (2023). Annual Reports. Lufax Holding. https: //ir.lufaxholding.com/image/LU+20-F+2023.pdf

[28]. Lufax Holding Ltd. (2023). Lufax reports fourth quarter and full year 2023 financial results. Lufax Holding InvestorRoom. Retrieved from https: //ir.lufaxholding.com/2024-03-21-Lufax-Reports-Fourth-Quarter-and-Full-Year-2023-Financial-Results

[29]. Lufax Holding Ltd. (2023). Lufax Lufax reports second quarter 2023 financial results. Lufax Holding InvestorRoom. Retrieved from https: //ir.lufaxholding.com/2023-08-21-Lufax-Reports-Second-Quarter-2023-Financial-Results

[30]. China Banking and Insurance Regulatory Commission. (2020). Interim Measures for Equity Management of Trust Companies. Retrieved from https: //www.gov.cn/gongbao/content/2020/content_5512565.html

[31]. China Banking and Insurance Regulatory Commission. (2020). Interim Measures for the Administration of Trust Company Funds Trusts (Exposure Draft).

[32]. China Banking and Insurance Regulatory Commission. (2020). China Banking and Insurance Regulatory Commission Measures for the Implementation of Administrative Licensing Matters for Trust Companies. https: //www.gov.cn/gongbao/content/2021/content_5585238.html

[33]. Dake, K. (2024). China Sichuan Trust unravels. Northwest Arkansas Democrat-Gazette. https: //www.nwaonline.com/news/2024/mar/14/chinas-sichuan-trust-unravels/

[34]. Schwarcz, S. (2012). Regulating Shadow Banking. Boston University Review of Banking and Financial Law.

[35]. Stein, J. C. (2010). Securitization, shadow banking & financial fragility. Daedalus, 139(4), 41-51.

[36]. Fackler, M. (2023). The Global Financial Crisis – risk transfer, insurance layers, and (lack of?) reinsurance culture. British Actuarial Journal, 28, e10. doi: 10.1017/S1357321723000120.

[37]. Sinn, H. W. (2010). Casino capitalism: How the financial crisis came about and what needs to be done now. Oxford University Press.