1. Introduction

With the increasingly clear and improved overall economic situation in China, the Chinese market has been growing rapidly, and its number of online shopping users is also increasing rapidly. Let's talk about the achievements of the Chinese retail market again: In 2010, China's e-commerce market began to flourish, and a year later, China's online retail market successfully surpassed Japan, becoming the world's second-largest e-commerce market. In addition, the purchasing power of Chinese online shoppers is also becoming stronger [1]. Through statistics, it has been found that one of the most serious social problems in China is the phenomenon of an aging society. As the average age of Chinese citizens is getting older, but their average income is also increasing, it can be predicted that there is still some room for per capita consumption of online shoppers [2].

Prior to this paper, there have been many studies on the current development of CBEC and the reasons for their failure in China, but few studies have considered that if foreign e-commerce improves policies, they may no longer fail. At present, with e-commerce becoming one of the most popular way of doing business, many foreign e-commerce companies hope to expand their business to China. For example, Amazon, Airbnb, and Google. When Amazon first came to China in 2004, it was not very successful in attracting many local customers and had been struggling in the Chinese market for many years. Data shows that in 2014, Amazon's market share in China was only 1.8%, but it had a 22% market share in the US market [2].

This article will discuss why these online giants have not successfully entered the Chinese market. And identified various factors that led to this situation, while analyzing China's environment and government, the different supply chains of CBEC, and cultural differences. This article also explores the opportunities of cross-border e-commerce and gives some suggestions for foreign e-commerce.

2. Entry mode

Due to the emergence of CBEC, traditional market entry methods have undergone changes. The market entry mode is an institutional arrangement for enterprises to enter foreign new markets [3].

Nowadays, foreign companies can directly enter the Chinese market by establishing their own business entities or through acquisitions, without the need for foreign direct investment [4]. From the perspective of transaction cost economics, this study examines the impact of the CBEC on Chinese international trade and finds that the CBEC model can only have a positive impact on China's international trade when offsetting tariffs and transportation-related costs [5]. Transaction costs can be explained by Williamson's definition of opportunistic behavior, which is "seeking personal gain through deception" [3]. The interaction between global consumers and enterprises is more accurate because these current cross-border e-commerce platforms and global Internet infrastructure have changed the traditional transaction mode [6].

3. Case study

3.1. Amazon vs Alibaba

3.1.1. Market share of Amazon

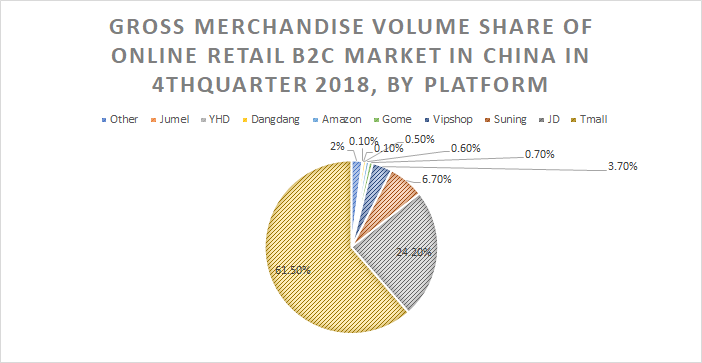

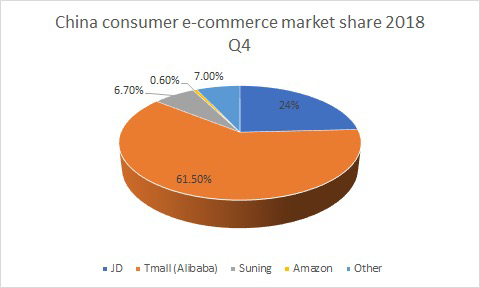

Amazon entered the Chinese market in 2004 by acquiring Kindle and media sellers. Between 2011 and 2012, Amazon's market share was around 15%, but has fallen drastically to less than 1% in 2019. Then it quit the Chinese market. Actually, a survey from Frost & Sullivan found that “over 80% of foreign e-commerce think China as a lucrative market, but just 20% of e-commerce have the confidence to succeed in the Chinese e-commerce market. So Amazon admits the failure in China.(Figure 1)

In 2018, Alibaba had more than 500 million active monthly users and had a 61.5% market share. JD is in second place with a 24.2% share. But Amazon was in sixth place with a measly 0.6%.(Figure 2) [7]

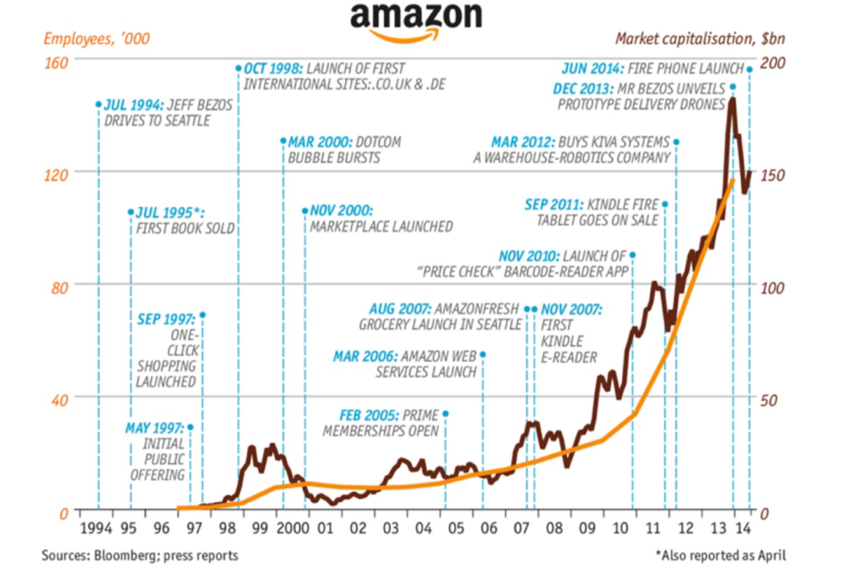

3.1.2. The development of Amazon

Amazon has been an online bookseller since 1994 and has since become one of the world's famous online shopping websites. In 2004, it acquired Zhuoyue Net, which was once a major online book distributor in China, for an investment of $75 million [8]. Then, Amazon began selling its own electronic devices, such as Kindle or Fire Phone, in 2007. Now, Amazon has established websites in over a dozen countries across different continents. In addition, Amazon Web Services (AWS) has become the largest company in the field of cloud services.(Figure 3) [9]

3.1.3. The market share of Alibaba

From Alibaba Group's announcement of quarterly and fiscal year performance for March 2024, it can be seen that, as of the quarter ended March 31, 2024, Alibaba's revenue was RMB 221.874 billion (USD 30.729 billion), a year-on-year increase of 7%. Its operating profit was RMB 14.765 billion (USD 2.045 billion), a year-on-year decrease of 3%. At the same time, adjusted EBITA (a non-GAAP financial indicator) decreased by 5% year-on-year to RMB 23.969 billion (USD 3.32 billion), mainly due to our increased investment in the e-commerce business and the retention incentives granted to rookie employees.

In the early stage of China's domestic e-commerce boom in the mid-21st century, Alibaba received a $1 billion investment from Yahoo! In exchange for 40% of the company's shares. Yahoo is a pioneer in website banners and other online adversarial technologies, which account for a significant portion of Alibaba's profits. Taobao B2C has taken the lead in learning how to register and manage merchants through the experience of operating the B2B website Alibaba. Actively and wisely market on the fastest-growing channel (mobile) and leverage the latest trends in mass sales. In 2013, Alibaba's platforms (Taobao and Tmall) alone generated over 5.75 billion US dollars in daily sales. Singles' Day on November 11th is very popular in China, and many offline retailers also hold promotional activities in their stores during this period. On this day, people's consumption will significantly increase, which is also one of the important reasons why Taobao should have a stable customer base. In the 2021 market share chart of relational database software vendors, Alibaba accounted for 42.5%.

3.1.4. The development of Alibaba

In 1999, Jack Ma and his team founded Alibaba. Then, it set up its own C2C platform that allows Chinese customers to purchase online. Alibaba's main shopping online platforms are Taobao and Tmall (B2C platforms), which have now become giants in the e-commerce industry [9]. Alibaba quickly launched new websites, such as Taobao, due to the influx of more venture capital. Taobao is a consumer-to-consumer online retail marketplace similar to eBay. Another website is Aliwangwang, which is an instant messaging tool that makes it easier for consumers to research and shop online for better transactions. And in the first decade of the new century, Alibaba found the Chinese government as a partner.

Due to the suspicion of foreign commercial investors, the Chinese government has launched a strict Internet control campaign in China. Afterward, many American e-commerce giants like Amazon were effectively blocked from the Chinese market, which helped promote Alibaba's prosperity.

3.1.5. Similarities and differences

3.1.5.1. Similarities

Similar global shopping platform. Firstly, Amazon and Alibaba have similar platforms for customers to do cross-border shopping. Alibaba used Aliexpress for global customers to make cross-border e-commerce in 2010. Meanwhile, Amazon used the international shopping service in both its mobile APP and its mobile website in 2018.

Similar target market selection reason. Amazon and Alibaba prefer to choose countries that have close relationships with their home countries. So Amazon will choose European countries because they have a cultural and business environment similar to that of Europe. Currently, the company has entered the retail market in more than a dozen countries and opened its own website, which has a large share of the e-commerce market in Europe and North America.

Furthermore, Alibaba has the same reason to choose foreign markets. China has a close connection with some Southeast Asia countries due to its history, similar culture, and geographical location. Thus, Southeast Asia has become an idealized market for Alibaba.

Other similar factors. Alibaba and Amazon are both innovative e-commerce grants. Then Amazon and Alibaba share a few things in common. For one, both e-commerce platforms dominate their respective countries, with Amazon accounting for 37.8% of the US e-commerce market and Alibaba accounting for around 47.1% of China’s market share.

3.1.5.2. Differences

Different business model. Amazon had already established its own logistics network before coming to China, but Alibaba only connects buyers and sellers, and it does not resell its own inventory or have its own logistics network.

For Amazon, most products are offered to buyers on the Amazon marketplace, with inventory stored in Amazon's own dedicated warehouses. Amazon focuses on the B2C market, enabling businesses to sell products through its website. Data shows that in 2019, Amazon's main user base was 103 million. In 2021, third-party sellers accounted for 60% of Amazon's retail sales. In addition, it also provides customers with Amazon Prime service, allowing them to quickly ship and deliver products within two days or even on the same day. Amazon holds a Prime Day event every year, offering special discounts to all subscribers.

However, Alibaba provides business-to-business (B2B) services that connect manufacturers and buyers from around the world. In addition, Taobao also provides business-to-consumer (B2C) and consumer-to-consumer (C2C) services. It can help many small businesses develop sustainable development by using their platform. The website has a unique rating system that ranks manufacturers based on delivery speed, price, sales volume, and other factors to help buyers choose the most suitable seller.

3.2. Marketing strategies & culture differences

In addition, the most critical factor leading to the failure of WIF is their inability to adapt to the business environment in China. The main reasons for WIF failure include insufficient information and the establishment of a global technology platform in China, Implementing a global business model in China; Unable to understand the Chinese market, Failed to cope with extreme competition, Failure to manage China's regulatory environment, infrastructure, and government relations; Issues related to business partners and acquisitions; Centralized organizational structure and slow decision-making [10]. The usual reasons for this are strict government censorship and control, as well as insufficient information on Chinese culture and market models [11,12]. No WIF can defeat its Chinese competitors to achieve sustainable and successful operations in China, whether from search engines, Internet content providers, or social media to e-commerce and sharing economy platforms. Why? There are several reasons for this:

3.2.1. Strict government scrutiny and control

Google faced fierce competition from Baidu and Sogou to enter the Chinese market in 2005. Google withdrew from the Chinese market in 2010 due to the debate between strict government censorship and alleged cyber attacks. Google generates revenue solely through advertising and its business model is limited to search. At the same time, it also insists on requiring advertisers to use credit cards for payment. In contrast, Baidu is more flexible because it allows the use of different payment methods and offers a range of paid services to generate additional revenue. The fierce competition in China has also brought pressure on Amazon, and the decision-making process at headquarters is often too slow. Its senior management in China lacks the autonomy to effectively compete with local competitors. In addition, in China, many strict and different laws that are considered to be ideologically sensitive will govern these Internet services. WIF services may be blocked or prohibited if they refuse to cooperate with relevant departments or refuse to comply with local laws and regulations. In the highly competitive Chinese Internet market, even temporary service interruption may bring huge advantages to competitors due to frequent changes in users.

3.2.2. The differences between Chinese and western cultures

For example, eBay lacks a deep understanding of Chinese consumer culture. Unlike eBay, its main competitor, Taobao, has a no-cost model for placing offers online. Its technology platform is specifically designed to foster trust between sellers and buyers. In China, there is a lack of effective legal protection and dispute resolution channels, making it difficult to establish trust. Taobao is an e-commerce company that originated in China, which enables it to better understand and take into account the Chinese retail culture. For example, there are many previous consumers who will give some advice or feedback to further consumers to help them determine which seller to choose for the deal, while Taobao encourages direct between buyers and sellers and embeds a useful service that can communicate timely on its platform. In addition, Taobao does not charge fees for placing offers online, which has enabled it to take over some of eBay Each Net's market share. By 2006, Taobao’s market share had surpassed that of eBay Each Net to such an extent that eBay was forced to withdraw from the Chinese market.

Arguments such as cost reduction, scaling, brand image, satisfying customer needs, and culturally bounded preferences and expectations have led to standardization or adaption along the entire continuum [13]. In the cross-border context, the creation of relational services implies customization or differentiation. Relationship services help to make websites more culturally sensitive and appeal to dream markets [14,15]. Cultural adaptation is likely to increase the effectiveness of websites. Yamin and Sinkovic argue that foreign e-commerce can adapt cultures is necessary for the interactivity of a website, which makes it easier to maintain a 'dialogue’ between buyers and sellers.

From an empirical perspective, many studies have shown that culture does indeed influence website design further provided empirical evidence [16,17].

3.2.3. Decision-making error

Although both Amazon and Alibaba have started implementing globalization strategies, There are still many differences between foreign e-commerce and domestic e-commerce. The development policies are due to their various management concepts and business models. Alibaba does not have its own brand and insists on offering the best shopping platform to consumers to make a good shopping experience in the context of CBEC. For example, it allows sellers to open flagship stores on the shopping platform to sell products and has built different platforms (Tmall Global) to satisfy the needs of different customer groups. Amazon is very different. After Jeff Bezos founded it, it attached great importance to the development of its own brand. Amazon has lots of self-developed products on its platform, such as Kindle Book. All of their proprietary products are labeled as "shipped from Amazon.com and sold by", making Amazon more like an online distributor.

In addition, Alibaba has a third well-established and popular payment system, Alipay. To solve the trust problem between consumers and producers, Alibaba launched Alipay in 2003 to simplify payments. Today, Alipay has become a large international company with businesses in a variety of areas, including payments, finance, and charity. As a result, customers conducting cross-border transactions on Alibaba's platform can seamlessly use Alipay to make payments. Unlike Alibaba, credit cards are the primary payment method for customers on Amazon's platform. Although Amazon provided its own payment system, Amazon Pay, it has not been widely adopted. In 2018, Amazon Pay had about 33 million users, about 10% of Amazon's total 300 million users.

3.3. Delivery

First of all, imported cross-border retail e-commerce refers to the activities of domestic e-commerce enterprises that sell foreign goods to domestic consumers, make transactions and payments via e-commerce platforms, and need cross-border transportation to complete the transaction. Currently, Chinese consumers have entered the phase of increasing popularity of imported cross-border retailing, but the supply chain has been an obstacle to its development.

At present, the cross-temporal and spatial characteristics of consumption complicate consumer choice behavior: 1) Cross-border retail e-commerce platforms satisfy consumers' various needs by providing high-quality products from around the world. 2) consumers need to consider more complex factors when purchasing goods across time and space. At the same time, the delivery time and price of orders under different import modes (overseas direct mail or bonded delivery) also vary greatly, so consumers have inconsistent perceptions of the value of genuine products under the two modes [18], analyzed approximately 40000 transaction data from cross-border retailers and found that express delivery services led to higher-order occurrence rates, larger order sizes, and higher cross-border transactions [19].

Ding Feng and Huo Jia Zhen pointed out that CBEC can be divided into two different logistics providers, one is cross-border, and the other is domestic when choosing logistics service providers in order to help logistics providers improve their service level [20]. Hong Guo bin and Lin Zhen Xing established a cross-border import pricing model based on cross-border trade factors and related factors. The conclusion indicates that in the case of high demand diffusion intensity, the best choice is not to rush into the sale [21].

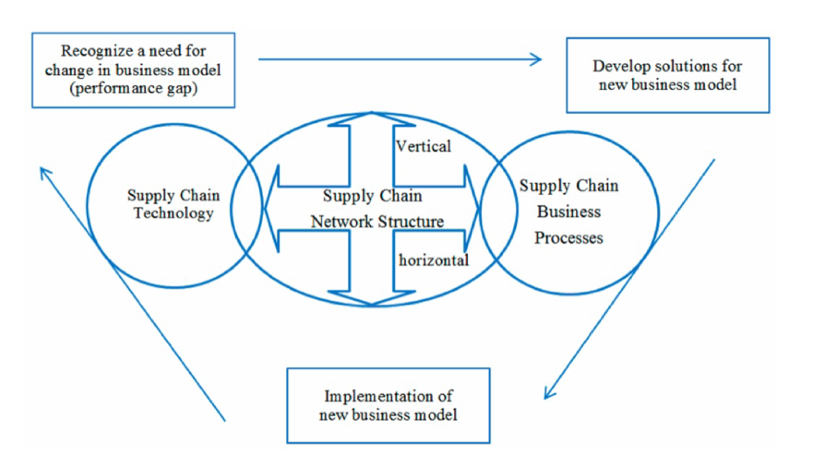

Although CBEC shares many characteristics with domestic e-commerce [22]. Since businesses and buyers can sell or buy goods and services anywhere in the world via the Internet, CBEC is more complex due to the fact that there are many uncontrollable factors. Through the "Belt and Road" initiative, more and more CBEC cooperates with China, and the number of trade is also gradually increasing [23]. China mainly offers countries that join the Belt and Road such services as infrastructure construction or services, energy facility construction, production capacity cooperation, import and export trade, and technology export [24]. Due to the regard and support of the Chinese government, CBEC is thriving in China. However, Few people think that the key element of business model innovation in the context of cross-border e-commerce is supply chain innovation (SCI) [25]. The SCI refers to the gradual or fundamental changes that may occur in the supply chain network, supply chain technology, or supply chain processes (or a combination thereof), which may occur within a company's functions, internal structure, industry, or supply chain to enhance new value creation for stakeholders. According to Arlbjørn et al., the Supply Chain Innovation (SCI) model consists of three parts: technology, business processes, and network structure (Figure 4).

Business processes are activities that create value for customers. As process management techniques refers to continuous improvement and reducing gaps in day-to-day work, their increasing use in organisations has an impact on the balance between exploratory and exploitative innovation [26]. Supply chain technology [27] has improved supply chain management, particularly in logistics capabilities [28], as well as recent blockchain technologies such as e-procurement, demand planning tools, and more [29].

Here we use Amazon and Alibaba as examples. Logistics systems are very important for CBEC companies. The two major CBEC companies, Alibaba and Amazon, use different strategies for the delivery of goods. Amazon has its own distribution department called Amazon Logistics (FBA). The company built its own warehouses where goods are stored, as well as distribution agents who collect and deliver the goods. When Amazon enters another market, FBA also enters that market, so Amazon always has a complete cross-border e-commerce delivery system, which is very convenient for consumers around the world. But unlike Alibaba, Amazon does not have its own distribution service. As a result, sellers can only work with other logistics companies for delivery services. Alibaba finally decided to team up with a number of logistics companies and, in 2013, created a new intelligent logistics platform called Cainiao. This logistics platform enables Alibaba to improve the efficiency of its cross-border exchanges with its customers.

3.4. Airbnb vs Ctrip

In 2019, Airbnb had over 6,000,000 listings worldwide but only 150,000 in China [30]. However, by the end of 2019, Airbnb had managed to increase its market share in China to over 50%, before COVID-19 forced the company to temporarily close its doors.

In March 2020, Airbnb's turnover in the Chinese city of Beijing fell by 43% compared to March 2019 [31], and the occupancy rate was below 10% [32].

In 2024, Ctrip is the largest Chinese online travel agency proudly holding the top stop in both market share by 80% and monthly active users with 400 million.

4. The opportunities of e-commerce

CBEC refers, in the broadest sense, to companies that trade with customers in other countries via the Internet, e-commerce platforms, or other means of communication. This is a new type of international trade, smaller, more frequent, and faster than in the past [22].

The current trend is the continuing and rapid development of cross-border e-commerce, which both overcomes the problem of time-space between consumers and sellers and creates new ecological models. CBEC is a new form of cross-border trade based on digitisation. It is a very recent development and offers incomparable advantages. In recent years, the rise of CBEC has attracted the attention of all sectors of the community, and the government has begun to pay attention to how China's cross-border e-commerce should develop in the future and has begun to actively support enterprises to participate in the CBEC. The rapid development of cross-border trade cannot be separated from the promotion of e-commerce platforms. The implementation and progress of CBEC can help promote policy development, while we can export abundant goods which be produced by our country and obtain resources and markets. Through these two processes, the country is promoted to enhance the international influence of its economy [33]. Nowadays, with the development of society and the advancement of technology, cross-border trade has become increasingly frequent. In today's business environment, cross-border trade has been placed at the forefront of long-term planning for businesses. At the same time, Internet technology has promoted cross-border trade to become more popular in the world. Moreover, more and more consumers prefer online shopping. The combination of these two, CBEC, has become an indispensable presence in the trade industry [9].

5. Conclusion

For foreign e-commerce coming to China, here is a list of advice:

1) Before penetrating the Chinese market, e-commerce as a whole must first understand Chinese culture, as well as Chinese buying habits, attitudes towards foreign goods, and online shopping.

2) After-sales services (e.g., returns) should also be taken into account, such as How can we reduce the return time and deal with long-distance shipping costs.

3) Use SWOT (Strengths, Weaknesses, Opportunities, Threats) to analyse the strengths and weaknesses of an event or plan and assess its feasibility. So, e-commerce can know its current situation in the Chinese market and future growth.

Now, More and more CBECs want to develop in the Chinese market. But, there were some e-commerce failures in the past, like Amazon, eBay, Airbnb, and so on. The market share of Amazon was so low that just less than 1% in 2019. Although Airbnb’s market share was 50% in 2019, it decreased dramatically after COVID-19, so it left the Chinese market. All of them met some difficulties, such as marketing strategies, delivery, and cultural differences, so they could not have a place in the Chinese market. Amazon and Alibaba have some similarities, so they are very successful, but they also have some differences, so Amazon can not be successful in China.

However, there are many opportunities of e-commerce the e-commerce has become a popular business model in the world because of the development of internet technology. As a result, other CBEC players are keen to penetrate the Chinese market, which is the largest e-commerce market in the world, accounting for almost 50% of global sales. These e-commerce players can learn from and improve on the CBEC failures of the past.

Acknowledgement

Shuning Zhao and Xinai Zhang contributed equally to this work and should be considered co-first authors.

References

[1]. Willcocks, Leslie, and Valerie Graeser. (2013). Delivering IT and eBusiness Value. Routledge. ISBN: 9781136411793

[2]. Li Jaimin. (2016) E-commerce Environment Analysis in Chinese market based on case analysis of Amazon China

[3]. Hollensen, Svend, Boyd, Britta, Ulrich, Anna Marie Dyhr. (2011) The choice of foreign entry modes in a control perspective

[4]. CROSS-BORDER E-COMMERCE AS A MARKET ENTRY MODEA CASE STUDY IN CONTEXT OF CHINA (Toni Markus Kukkonen, 2018)

[5]. Y Wang, Y Wang, SH Lee-Sustainability, 2017. The effect of cross-border e-commerce on China's international trade: An empirical study based on transaction cost analysis

[6]. Rudolf R., Mo Yamin, Matthias Hossinger. (2007) Cultural adaptation in cross-border e-commerce: A study of German Companies

[7]. Nik Martin, 2019. Why Amazon struggled to beat Alibaba in China

[8]. NISHIYAMA, SHIGERU& MANO, YOSHIKI, 2016. E-commerce Environment Analysis in Chinese Market Based on Case Analysis of Amazon China

[9]. Yutong Shao, 2019. Discuss the Similarities and Differences of Amazon and Alibaba with Respect to Cross-border E-commerce

[10]. Feng Li. (2018) Why have all Western internet firms (WIFs) failed in China?

[11]. Wang, X, & Ren, Z J. (2012) How to compete in China's e-commerce market.

[12]. Woetzel, J, Seong, J, Wang, K W, Manyika, J, Chui, M & Wong, W (2017) China's Digital Economy: A Leading Global Force.

[13]. Alashban, A. A., E.A. Hayes, G.M. Zinkhan, and A.L. Balazs, "International Brand-Name Standardization/Adaptation: Antecedents and Consequences, " Journal of International Marketing, Vol. 10, No3: 22-48, 2002

[14]. Lim, KH, K. Leung, C.L. Sia, and MK. Lee, "Is Ecommerce Boundary-Less? Effects of Individualism Collectivism and Uncertainty Avoidance on Internet Shopping, ” Journal of International Business Studies, Vol. 35, No.6: 545-559, 2004.

[15]. Lynch, P.D. and J.C. Beck, "Profiles of Internet Buyers in 20 Countries: Evidence for Region-Specific Strategies, ” Journal of International Business Studies, Vol. 32, No.4: 725-748.2001.

[16]. Cyr, D. and H. Trevor-Smith, "Localization of Web Design: An Empirical Comparison of German, Japanese, and United States Web Site Characteristics, " Journal of the American Society for Information Science and Technology, Vol. 55, No. 13: 1199-1208, 2004.

[17]. Fink, D. and R. Laupase, "Perceptions of Web Site Design Characteristics: A Malaysian/Australian Comparison, Internet Research, Vol. 10, No. 1: 44-55.2000.

[18]. Qin Lv, 2018. Supply Chain Decision-Making of Cross-BorderE-Commerce Platforms

[19]. Kim T Y, Dekker R, Hei jC, The value of express delivery services for cross-border e-commerce in European Union markets. Econometric Institute Research Papers.2016.

[20]. Ding F, Huo J Z, The Effect of Service Quality on Logistics Outsourcing Strategy in Cross-Border E-Commerce, Management Science & Engineering., no.5, pp.1-6, 2016.

[21]. Hong G B, Lin Z X, Wan X J, The pricing strategy in Cross-border imports based on platform factors, Journal ofHuaqia0UniversitySocial (Philosophy and Sciences Edition)., no.4, pp.42-51, 2016

[22]. Kawa, A.& Zdrenka, W.2016, "Conception of integrator in cross-border E-commerce", Log Forum, vol. 12, no. 1.

[23]. Jing dong Big Data Research Institute, Report on Consumption Trends of CBEC the Belt and Road; Jing dong Big Data Research Institute: Beijing, China, 2017)

[24]. Huang, Y. Understanding China's Belt & Road initiative: Motivation, framework and assessment China Econ. Rev. 2016

[25]. Supply Chain-Based Business Model Innovation: The Case of a Cross-Border E-Commerce Company (Ying Wang, Fu Jia, Tobias Schoenherr and Yu Gong, 2018)

[26]. Benner, M.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited.Acad.Manag.Rev.2003, 28, 238256.

[27]. Lee, V. - H.; Ooi, K.B.; Chong, A.Y.-L; Sohal, A. The effects of supply chain management on technological innovation: The mediating role of Guanxi. Int. J. Prod. Econ. 2018

[28]. Gligor, D.M. particularly in logistics capabilities Holcomb, M.C. Antecedents and Consequences of Integrated Logistics Capability across the Supply Chain, Transp. J.2014, 53, 211-234.

[29]. Dobrovnik, M.; demand planning tools, and more. Herold, D.; F ü rst, E.; Kummer, S. Blockchain for and in Logistics: What to Adopt and Where to Start. Logistics2018

[30]. Fast data (2019) Analysis Report on 2019 online minus booking industry development in China, retrieved on August 2, 2017 from http: //www.199it.com/archives/975961.html

[31]. Statista (2020) Year-on-year change in monthly revenue of Airbnb affected by the coronavirusCOVID-19 pandemic in Beijing, China in 1st quarter 2020, retrieved on August 2, 2020 from https: /www, statista.com/statistics/1110445/china-coronavirus-covid-19-pandemic-impact-on-airbnb-monthly-revenue-in-beijing

[32]. Xiang, Y. and Dolnicar, S.(2018) Networks in China, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 148-159

[33]. Wanxin Xue, Dandan Li and Yilei Pei, 2016. The Development and Current of Cross-border E-commerce

Cite this article

Zhao,S.;Zhang,X. (2025). Cross-border E-commerce: The Process from Entering the Chinese Market to Having a Place. Advances in Economics, Management and Political Sciences,213,1-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Willcocks, Leslie, and Valerie Graeser. (2013). Delivering IT and eBusiness Value. Routledge. ISBN: 9781136411793

[2]. Li Jaimin. (2016) E-commerce Environment Analysis in Chinese market based on case analysis of Amazon China

[3]. Hollensen, Svend, Boyd, Britta, Ulrich, Anna Marie Dyhr. (2011) The choice of foreign entry modes in a control perspective

[4]. CROSS-BORDER E-COMMERCE AS A MARKET ENTRY MODEA CASE STUDY IN CONTEXT OF CHINA (Toni Markus Kukkonen, 2018)

[5]. Y Wang, Y Wang, SH Lee-Sustainability, 2017. The effect of cross-border e-commerce on China's international trade: An empirical study based on transaction cost analysis

[6]. Rudolf R., Mo Yamin, Matthias Hossinger. (2007) Cultural adaptation in cross-border e-commerce: A study of German Companies

[7]. Nik Martin, 2019. Why Amazon struggled to beat Alibaba in China

[8]. NISHIYAMA, SHIGERU& MANO, YOSHIKI, 2016. E-commerce Environment Analysis in Chinese Market Based on Case Analysis of Amazon China

[9]. Yutong Shao, 2019. Discuss the Similarities and Differences of Amazon and Alibaba with Respect to Cross-border E-commerce

[10]. Feng Li. (2018) Why have all Western internet firms (WIFs) failed in China?

[11]. Wang, X, & Ren, Z J. (2012) How to compete in China's e-commerce market.

[12]. Woetzel, J, Seong, J, Wang, K W, Manyika, J, Chui, M & Wong, W (2017) China's Digital Economy: A Leading Global Force.

[13]. Alashban, A. A., E.A. Hayes, G.M. Zinkhan, and A.L. Balazs, "International Brand-Name Standardization/Adaptation: Antecedents and Consequences, " Journal of International Marketing, Vol. 10, No3: 22-48, 2002

[14]. Lim, KH, K. Leung, C.L. Sia, and MK. Lee, "Is Ecommerce Boundary-Less? Effects of Individualism Collectivism and Uncertainty Avoidance on Internet Shopping, ” Journal of International Business Studies, Vol. 35, No.6: 545-559, 2004.

[15]. Lynch, P.D. and J.C. Beck, "Profiles of Internet Buyers in 20 Countries: Evidence for Region-Specific Strategies, ” Journal of International Business Studies, Vol. 32, No.4: 725-748.2001.

[16]. Cyr, D. and H. Trevor-Smith, "Localization of Web Design: An Empirical Comparison of German, Japanese, and United States Web Site Characteristics, " Journal of the American Society for Information Science and Technology, Vol. 55, No. 13: 1199-1208, 2004.

[17]. Fink, D. and R. Laupase, "Perceptions of Web Site Design Characteristics: A Malaysian/Australian Comparison, Internet Research, Vol. 10, No. 1: 44-55.2000.

[18]. Qin Lv, 2018. Supply Chain Decision-Making of Cross-BorderE-Commerce Platforms

[19]. Kim T Y, Dekker R, Hei jC, The value of express delivery services for cross-border e-commerce in European Union markets. Econometric Institute Research Papers.2016.

[20]. Ding F, Huo J Z, The Effect of Service Quality on Logistics Outsourcing Strategy in Cross-Border E-Commerce, Management Science & Engineering., no.5, pp.1-6, 2016.

[21]. Hong G B, Lin Z X, Wan X J, The pricing strategy in Cross-border imports based on platform factors, Journal ofHuaqia0UniversitySocial (Philosophy and Sciences Edition)., no.4, pp.42-51, 2016

[22]. Kawa, A.& Zdrenka, W.2016, "Conception of integrator in cross-border E-commerce", Log Forum, vol. 12, no. 1.

[23]. Jing dong Big Data Research Institute, Report on Consumption Trends of CBEC the Belt and Road; Jing dong Big Data Research Institute: Beijing, China, 2017)

[24]. Huang, Y. Understanding China's Belt & Road initiative: Motivation, framework and assessment China Econ. Rev. 2016

[25]. Supply Chain-Based Business Model Innovation: The Case of a Cross-Border E-Commerce Company (Ying Wang, Fu Jia, Tobias Schoenherr and Yu Gong, 2018)

[26]. Benner, M.; Tushman, M.L. Exploitation, exploration, and process management: The productivity dilemma revisited.Acad.Manag.Rev.2003, 28, 238256.

[27]. Lee, V. - H.; Ooi, K.B.; Chong, A.Y.-L; Sohal, A. The effects of supply chain management on technological innovation: The mediating role of Guanxi. Int. J. Prod. Econ. 2018

[28]. Gligor, D.M. particularly in logistics capabilities Holcomb, M.C. Antecedents and Consequences of Integrated Logistics Capability across the Supply Chain, Transp. J.2014, 53, 211-234.

[29]. Dobrovnik, M.; demand planning tools, and more. Herold, D.; F ü rst, E.; Kummer, S. Blockchain for and in Logistics: What to Adopt and Where to Start. Logistics2018

[30]. Fast data (2019) Analysis Report on 2019 online minus booking industry development in China, retrieved on August 2, 2017 from http: //www.199it.com/archives/975961.html

[31]. Statista (2020) Year-on-year change in monthly revenue of Airbnb affected by the coronavirusCOVID-19 pandemic in Beijing, China in 1st quarter 2020, retrieved on August 2, 2020 from https: /www, statista.com/statistics/1110445/china-coronavirus-covid-19-pandemic-impact-on-airbnb-monthly-revenue-in-beijing

[32]. Xiang, Y. and Dolnicar, S.(2018) Networks in China, in S. Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries, Oxford: Goodfellow Publishers, 148-159

[33]. Wanxin Xue, Dandan Li and Yilei Pei, 2016. The Development and Current of Cross-border E-commerce