1. Introduction

With growing awareness of climate change, the Chinese government has announced its goals of achieving carbon peaking and carbon neutrality. In pursuit of these goals, it has strengthened environmental regulation through measures such as setting stricter emission standards, promoting green approvals, and enhancing enforcement efficiency. Against the backdrop of increasingly stringent environmental protection requirements, examining their impact on housing prices is essential for assessing the broader effects of these policies. This paper investigates the impact of environmental regulation on housing prices in China using panel data regression, revealing regional differences in the strength of the correlation and offering policy recommendations. The findings provide empirical evidence to support policymakers in balancing economic growth, housing affordability, and coordinated regional development when formulating environmental regulations.

Building on previous literature, this study explores the spillover effects of environmental control from the perspective of real estate prices and examines its underlying mechanisms. It makes several marginal contributions to the field of sustainable development. While most existing studies focus on how environmental regulation affects manufacturing or heavy industry, this paper innovatively examines its impact on the real estate market. This approach directly illustrates how green policies influence living standards and offers a more comprehensive evaluation of such regulations. In addition, the study tracks trends over a long timeframe (1999–2023) and compares regional effects based on differing economic contexts, thereby adding both spatial and temporal depth to the literature. Furthermore, it highlights the unintended consequences of environmental regulation for housing markets and proposes differentiated policy strategies tailored to regional development levels, with the aim of minimising trade-offs between green governance and urban affordability.

The remainder of the paper is structured as follows. Section 2 reviews the relevant literature. Section 3 presents stylised facts through graphical analysis. Section 4 outlines the model specification and data. Section 5 discusses the empirical results and related analysis. Section 6 concludes the paper.

2. Literature review

Several studies have examined the impact of environmental regulation—defined as the process of imposing restrictions to prevent environmental harm [1]—on urban real estate prices. Much of this research concludes that the relationship is positive. On the demand side, regulations can enhance local amenities by improving air quality, reducing noise [2], and expanding urban green spaces (UGS), all of which increase nearby housing values [3, 4]. Moreover, environmental rules may encourage the agglomeration of service industries, further driving up urban housing prices [5]. On the supply side, such regulations can raise development costs by requiring sustainable materials or renewable energy, thereby constraining housing supply and pushing prices higher [6].

In contrast, other studies suggest a negative correlation. Regulations that result in the closure of polluting industries can weaken the local labor market, reduce employment opportunities, and consequently dampen housing demand and price growth [2]. From the supply perspective, some research argues that the regulatory process does not substantially increase housing costs or development timelines [7]. Streamlining environmental reviews could even reduce costs, expand housing supply, and contribute to a decline in real estate prices [6].

Drawing on the above literature, this paper hypothesises that environmental regulation is positively correlated with housing prices.

3. Stylized facts

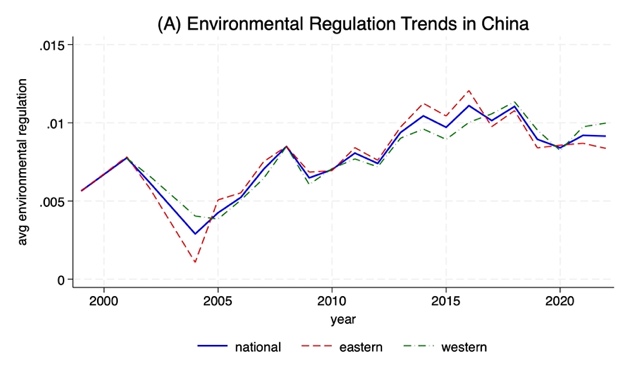

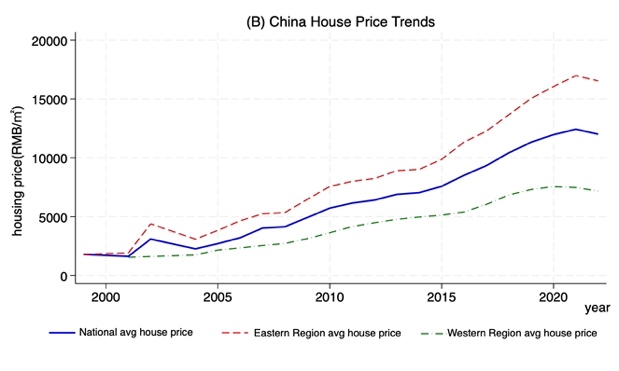

Data sources: Weighted average environmental regulation index: the proportion of environment-related terms in government work reports represents the regulation intensity, and the weight is provincial GDP;Eastern region includes: Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. Western region includes: Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.

Figure 1 (A) shows the weighted average of environmental regulation for China and its eastern and western regions from 1999 to 2023. A clear upward trend in regulatory stringency is evident across all series, particularly after 2005. The national index, for example, tripled from 0.003 to 0.009 between 2005 and 2023, reflecting China’s strengthening commitment to sustainable development. While regional differences existed in the early years, they largely converged over time. The eastern region, initially less regulated, surpassed the western region in stringency between 2010 and 2015. After 2017, both regional trends began to closely track the national average, suggesting a more uniform implementation of environmental governance across the country.

Figure 1(B) illustrates the corresponding trend in average housing prices, which rose sharply in all regions during the same period. Nationally, average prices increased from approximately ¥2,000/m² to nearly ¥12,500/m². However, substantial regional disparities remain. Prices in the eastern region consistently exceeded the national average, reaching about ¥17,000/m², while those in the western region remained significantly lower. By 2023, prices in the East were nearly double those in the West, a gap that reflects the East’s economic dominance. Notably, the rapid price acceleration observed after 2015 began to level off around 2020 in all regions.

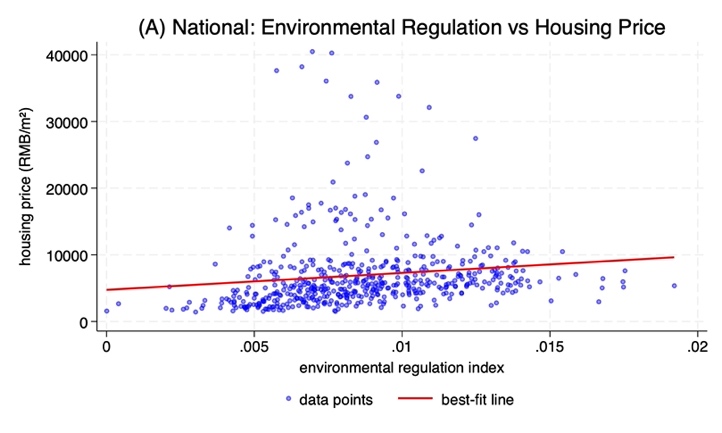

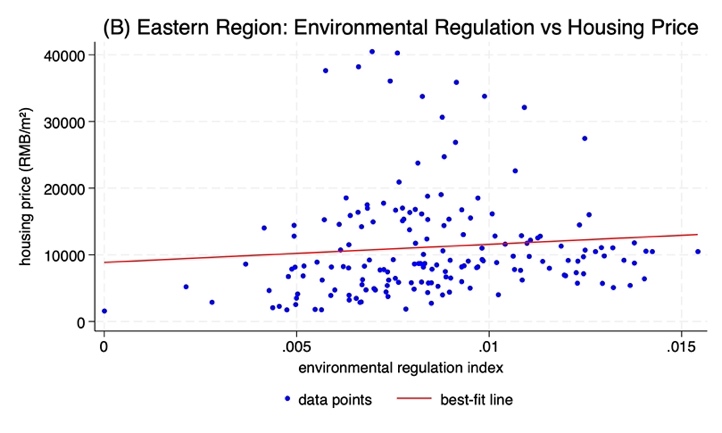

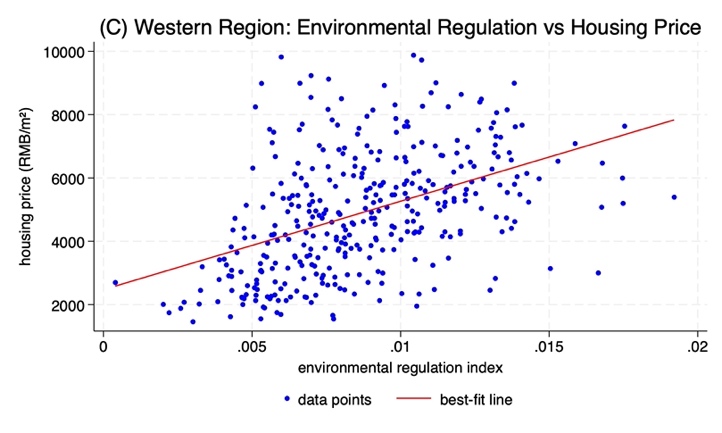

Figure 2 presents three scatterplots, each with a best-fit line, depicting the relationship between environmental regulation and housing prices at the (A) national, (B) eastern, and (C) western regional levels. At the national level (A), the slight upward slope indicates a weak positive correlation, although the wide dispersion of points reflects substantial price variance. In the eastern region (B), the nearly flat slope suggests a negligible correlation despite the overall high price level. By contrast, the western region (C) exhibits the steepest positive slope, indicating a stronger relationship in which prices, though lower, are more consistently associated with regulation. A comparison of the graphs shows that the strength of the positive correlation varies markedly by region. The eastern region, characterised by high housing prices, experiences a weaker regulatory effect, whereas the less-developed western region displays lower prices but a much stronger positive association with environmental policy. This pattern suggests that environmental regulations may exert a more pronounced influence on housing prices in developing regions, potentially by introducing additional cost constraints on construction.

4. Methodology

4.1. Model

To examine the effects of environmental regulation on housing prices, this study employs a panel data regression approach. Based on the theoretical framework and drawing on existing research, the regression model is constructed as shown in Equation (1).

where i represents individual provinces, and t represents the year. μi represents the province fixed effect, λt is the time fixed effect, and εit is the random disturbance term.

Dependent variable ln(price)it : the natural logarithm of the housing price. The average sales price of commercial buildings in the province (RMB/sq.m.) is used as a proxy indicator.

Independent variable envregit : environmental regulation intensity. The proportion of environment-related terms in provincial government work reports is calculated to measure the government’s environmental governance [8].

Control variables Xit: several variables affecting house prices, other than environmental regulations. Li et al. conclude that real estate prices are influenced by economic, social, administrative, and environmental factors [9]. In general, the advancement of the industrial structure reflects the level of economic development in a region. The greater the focus on secondary and tertiary sectors, the more attractive the area becomes to talent and capital, thereby exerting an upward pull on housing prices [5]. Moreover, enforcement of environmental regulations tends to have a greater impact on cities that rely heavily on the secondary sector, where manufacturing activity is concentrated. Yang and Pan find that human capital agglomeration has a positive long-term effect on both housing prices and economic development [10]. Government administrative intervention not only directly affects the real estate market but also shapes consumer confidence and willingness to purchase, thereby influencing housing prices. This paper uses the industry ratio as a proxy indicator for the economic factor, industryritindicates the proportion of secondary and tertiary sectors’ contribution to GDP. The population size needs to be taken to the natural logarithm, ln(population) it is a proxy indicator for the social factor. The ratio of general budget expenditure to GDP is the government's intervention capacity (govit), representing a proxy indicator for the administrative factor [5].

4.2. Data

The data sample used in this paper covers the period from 1999 to 2023 and consists of provincial-level data for 31 provinces in China. Housing price data are obtained from the China Real Estate Statistics Yearbook, while data on environmental regulation, GDP per capita, population size, and government intervention capacity are sourced from the China Statistical Yearbook.

The method for constructing the environmental regulation indicator follows the approach of Chen and Chen. First, government work reports from 31 provinces for the years 1999-2023 are collected. Second, the text of each report is processed using word segmentation. Finally, the proportion of environment-related words in the full text of each report is calculated.

The measure of government intervention capacity follows Zhang’s approach, using the ratio of provincial general budget expenditure to provincial GDP as a proxy for administrative capacity [5].

5. Empirical analysis

Based on the predictions of the theoretical model, this section conducts an empirical analysis using a panel regression model to examine the impact of environmental regulation on housing prices. The regression analysis is carried out using Model (1), and the detailed estimation results are presented in Table 1.

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

|

lnprice |

lnprice |

lnprice |

lnprice |

lnprice |

|

|

envreg |

88.916*** |

90.680*** |

51.102*** |

42.896*** |

26.908*** |

|

(6.526) |

(6.563) |

(5.838) |

(5.557) |

(5.144) |

|

|

industryr |

9.949*** |

7.841*** |

6.347*** |

||

|

(0.611) |

(0.625) |

(0.572) |

|||

|

lnpopulation |

2.206*** |

1.997*** |

|||

|

(0.263) |

(0.235) |

||||

|

gov |

2.961*** |

||||

|

(0.259) |

|||||

|

_cons |

7.868*** |

7.856*** |

-0.686 |

-16.611*** |

-14.207*** |

|

(0.097) |

(0.059) |

(0.526) |

(1.959) |

(1.758) |

|

|

ID_FE |

NO |

YES |

YES |

YES |

YES |

|

N |

533 |

533 |

533 |

533 |

533 |

|

R2 |

0.276 |

0.276 |

0.527 |

0.586 |

0.672 |

Standard errors in parentheses

* p < 0.1, ** p < 0.05, *** p < 0.01

The independent variable in the analysis is the environmental regulation index, and the dependent variable is housing prices. Control variables include the industry ratio, population size, and government intervention capacity.

In Column (1), only the environmental regulation index (envreg) is included as the explanatory variable, without controlling for individual fixed effects. The coefficient of envreg is 88.916 and statistically significant at the 1% level, indicating a positive correlation between environmental regulation and housing prices. Column (2) incorporates individual fixed effects, ceteris paribus, and the envreg coefficient remains similar at 90.680, still significant at the 1% level. This suggests that the positive relationship is robust to unobserved regional heterogeneity. Column (3) adds the industry ratio (industryr) as a control variable. The coefficient on envreg decreases to 51.102 but remains positive and statistically significant at the 1% level. The industryr variable itself has a positive coefficient, implying that cities with a higher share of secondary and tertiary sector activity tend to have higher housing prices. Column (4) introduces population size (lnpopulation) as a second control, alongside industryr. The envreg coefficient further declines to 42.896 while retaining 1% significance. The population variable is also positively associated with housing prices. Column (5) adds government intervention intensity (gov) as a third control on top of Column (4). The envreg coefficient decreases to 26.908 but remains highly significant. The gov variable is positive and strongly significant, with a coefficient of 2.961. The other control variables, industryr and lnpopulation, also remain positive and statistically significant, indicating that the advancement of industrial structure, larger population size, and stronger government intervention are associated with higher housing prices.

Across all five model specifications, the coefficient on the environmental regulation index remains positive and statistically significant, ranging from 26.908 to 90.680. This confirms that stricter environmental regulations are strongly associated with rising housing prices. Furthermore, as additional control variables are included, the explanatory power of the model improves substantially. These results highlight the robustness and consistency of the findings, providing strong empirical support for the hypothesized positive effect of environmental regulation on housing prices.

6. Conclusion

This paper concludes that environmental regulation, a key tool for promoting sustainability, has a significant unintended consequence: it increases housing prices. Our theoretical framework demonstrates that green policies affect the housing market by enhancing property quality, constraining local labor markets, and raising construction costs, resulting in a net price increase. This conclusion is supported by robust empirical analysis of Chinese data from 1999 to 2023. Panel regression results reveal a positive and statistically significant (1% level) relationship between stricter environmental regulations and higher housing prices. The core finding remains robust across multiple model specifications, even after controlling for industrial structure, population size, government intervention, and regional fixed effects. The analysis also identifies important regional differences, with the price impact being more pronounced in the less-developed western region. These results highlight the complex trade-offs policymakers face in balancing environmental objectives with housing affordability.

The findings underscore the need for holistic environmental policy design that anticipates indirect economic and social effects, particularly regarding housing affordability and regional equity. In eastern China, where the housing market is less sensitive to regulatory costs, policymakers can intensify environmental standards by targeting high-emission industries and promoting green construction technologies through performance-based incentives. In the more price-sensitive western region, a cautious, phased approach is essential to prevent housing price shocks. Policies should be differentiated—stricter in ecologically critical areas, while allowing for transition periods elsewhere—and supported by the transfer of green technologies from the East to reduce compliance costs. Finally, establishing dynamic policy evaluation mechanisms across both regions is crucial to monitor housing market responses and adjust regulations, ensuring that sustainability goals and housing affordability are pursued in tandem.

References

[1]. McManus, Phil. “Environmental Regulation.” ScienceDirect, edited by Audrey Kobayashi, Elsevier, 1 Jan. 2020, pp. 241–46.

[2]. Agarwal, Sumit, et al. “Environmental Regulation as a Double-Edged Sword for Housing Markets: Evidence from the NOx Budget Trading Program.” SSRN Electronic Journal, vol. 96, 2017.

[3]. Jim, C. Y., and Wendy Y. Chen. “Impacts of Urban Environmental Elements on Residential Housing Prices in Guangzhou (China).” Landscape and Urban Planning, vol. 78, no. 4, Nov. 2006, pp. 422–34.

[4]. Wu, Jiansheng, et al. “Impact of Urban Green Space on Residential Housing Prices: Case Study in Shenzhen.” Journal of Urban Planning and Development, vol. 141, no. 4, Dec. 2015, p. 05014023.

[5]. Zhang, R. Y. “Environmental regulation, agglomeration of producer services, and urban housing prices: An empirical study of 278 Chinese cities.” Financial Management Research, no. 1, 2023, pp. 174-195.

[6]. Braconi, Frank. “Environmental Regulation and Housing Affordability.” Cityscape: A Journal of Policy Development and Research, vol. 2, no. 3, 1996.

[7]. Nelson, Arthur C., et al. Environmental regulations and housing costs. Island Press, 2012.

[8]. Chen, S. Y., & Chen, D. K. “Smog pollution, government governance, and high-quality economic development.” Economic Research, vol. 53, no.2, 2018, pp. 15.

[9]. Li, Na, et al. “Factors Affect the Housing Prices in China: A Systematic Review of Papers Indexed in Chinese Science Citation Database.” Property Management, Apr. 2022.

[10]. Yang, Zhenshan, and Yinghao Pan. “Human Capital, Housing Prices, and Regional Economic Development: Will 'Vying for Talent’ through Policy Succeed?” Cities, vol. 98, Mar. 2020, p. 102577.

Cite this article

Fang,Y. (2025). The Price of Green: Environmental Regulation and Its Impact on China's Housing Market. Advances in Economics, Management and Political Sciences,214,22-28.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. McManus, Phil. “Environmental Regulation.” ScienceDirect, edited by Audrey Kobayashi, Elsevier, 1 Jan. 2020, pp. 241–46.

[2]. Agarwal, Sumit, et al. “Environmental Regulation as a Double-Edged Sword for Housing Markets: Evidence from the NOx Budget Trading Program.” SSRN Electronic Journal, vol. 96, 2017.

[3]. Jim, C. Y., and Wendy Y. Chen. “Impacts of Urban Environmental Elements on Residential Housing Prices in Guangzhou (China).” Landscape and Urban Planning, vol. 78, no. 4, Nov. 2006, pp. 422–34.

[4]. Wu, Jiansheng, et al. “Impact of Urban Green Space on Residential Housing Prices: Case Study in Shenzhen.” Journal of Urban Planning and Development, vol. 141, no. 4, Dec. 2015, p. 05014023.

[5]. Zhang, R. Y. “Environmental regulation, agglomeration of producer services, and urban housing prices: An empirical study of 278 Chinese cities.” Financial Management Research, no. 1, 2023, pp. 174-195.

[6]. Braconi, Frank. “Environmental Regulation and Housing Affordability.” Cityscape: A Journal of Policy Development and Research, vol. 2, no. 3, 1996.

[7]. Nelson, Arthur C., et al. Environmental regulations and housing costs. Island Press, 2012.

[8]. Chen, S. Y., & Chen, D. K. “Smog pollution, government governance, and high-quality economic development.” Economic Research, vol. 53, no.2, 2018, pp. 15.

[9]. Li, Na, et al. “Factors Affect the Housing Prices in China: A Systematic Review of Papers Indexed in Chinese Science Citation Database.” Property Management, Apr. 2022.

[10]. Yang, Zhenshan, and Yinghao Pan. “Human Capital, Housing Prices, and Regional Economic Development: Will 'Vying for Talent’ through Policy Succeed?” Cities, vol. 98, Mar. 2020, p. 102577.