1. Introduction

In the mobile Internet era, with the development of the global economy and the intensification of market competition, the business environment of enterprises has undergone drastic changes [1]. Faced with severe operational pressure, traditional media enterprises have accelerated the pace of transformation to the Internet and new media [2]. The global media industry is at a critical turning point of digital transformation, which is reshaping the competitive landscape and business model of the entire industry with unprecedented depth and breadth. From 2020 to 2022, the global streaming media market scale expanded at a compound annual growth rate of 24.5%, while the number of traditional cable Television (TV) users showed a continuous downward trend. Against this backdrop of industrial transformation, media giants have successively restructured their business territories through vertical mergers and acquisitions. The traditional transaction cost theory holds that achieving integration through vertical mergers and acquisitions is an effective means for enterprises to reduce supply chain risks and enhance supply chain resilience [3].

Both WarnerMedia and Discovery are important participants in the global media industry, and each has its own characteristics in core business, development history, and market position. Warner Bros. has many well-known film and television IPs launched on famous film and television platforms, with remarkable achievements. Discovery aims to provide high-quality documentary entertainment programs, in line with a global perspective. In May 2021, American telecommunications giant AT&T announced the merger of its subsidiary WarnerMedia with Discovery, aiming to integrate content resources to cope with streaming media competition. On April 8, 2022, the two parties officially completed the transaction, and the new company was named Warner Bros. Discovery (WBD). After the merger, WBD underwent multiple strategic reorganizations. In the early stage of the merger, WBD showed certain synergistic effects in the market [4]. Its market position was also initially improved. However, as time went on, after the merger, the two companies encountered conflicts in cultural conflicts, brain drain, and decision-making errors, which had certain adverse impacts on their market position, stock price changes, and financial data. This is the focus of the following research in this paper.

Faced with the tide of the global economy, with the continuous breakthrough and wide application of digital technology, the era of the digital economy has arrived at an accelerated pace [5]. Vertical mergers and acquisitions of media enterprises also face some unique strategic risks. For the discussion of such risks, this paper takes the 2022 merger case of WarnerMedia and Discovery as an example, focuses on some characteristics of this merger case, and analyzes the vertical integration risks of content production and platform operation, the conflicts of different corporate cultures and their impacts on mergers and acquisitions, and the particularity of the market's response mechanis.

2. Analyzing risks and conflicts of WBD through case study method

Focusing on the typical case of the merger of WarnerMedia and Discovery, this paper deeply explores the key information before and after the merger. On the one hand, it sorts out the respective financial status of the two companies before integration to clearly present the merger basis; on the other hand, it focuses on analyzing the problems, such as cultural conflicts and brain drain, after the merger into Warner Bros. Discovery. By summarizing the multiple reasons for the success and failure of mergers and acquisitions, it explores the risk laws of vertical mergers and acquisitions in the media industry, providing a basis for understanding the complex influencing factors of media mergers and acquisitions. After the merger of WarnerMedia and Discovery, the risks of brain drain and cultural conflicts gradually emerged in daily operations.

2.1. Cultural conflicts

Cultural collisions are particularly prominent. Cultural conflict is the primary factor affecting corporate mergers and acquisitions [6]. Warner has long been immersed in a "creativity-oriented" atmosphere, and the team is accustomed to carrying out content creation driven by inspiration. For example, in the early stage of film and television projects, open brainstorming is often used to generate ideas, and the decision-making chain is relatively flexible. Discovery, on the other hand, emphasizes "goal orientation" more. Its content production relies on market research and process specifications. Each project needs to be promoted according to fixed nodes, emphasizing efficiency and cost control. This difference directly leads to collaboration frictions: Warner's screenwriting team hoped to add experimental plots to a certain drama series, but was rejected by Discovery's management because "it deviates from the audience research results". The two parties were deadlocked, and finally, several senior screenwriters who had participated in the creation of classic IPs chose to resign.

2.2. Risk of brain drain

The impact of brain drain has spread. Some core planners familiar with Warner's IP operation logic switched to other film and television companies because they found it difficult to adapt to the new approval process; while the backbones of Discovery in charge of documentary content production also chose to leave because they were dissatisfied with the limited creative freedom. These changes hindered the originally planned progress of content integration, and communication barriers frequently occurred during cross-team collaboration. For example, Warner's entertainment content and Discovery's documentary content were supposed to jointly develop derivative projects, but they were repeatedly shelved due to the lack of tacit understanding between the two teams, which indirectly affected the exertion of synergistic effects after the merger. At present, Warner is facing a situation where high-end talents cannot be recruited, excellent talents cannot be retained, and existing talents are not motivated [7]. Warner has carried out severe layoffs. According to statistics, the advertising sales team after the merger of WarnerMedia and Discovery Channel will be reduced by about 30%. In 2024, it decided to lay off approximately 750 employees for the second time, accounting for 13% of the company's total employees. This layoff is part of the company's strategic reorganization plan, aiming to cope with economic challenges and optimize operational efficiency. It is worth noting that this is already the second layoff of Warner Music Group this year. As early as February 2024, the company had laid off 600 employees, accounting for about 10% of the total number of employees at that time. Brain drain is affected by various factors [8]. m to media mergers and acquisitions

3. Analyzing risks and conflicts of WBD through event study method

With the help of stock price fluctuation data and financial statement data, this paper quantitatively analyzes the impact of merger risks, specifically divided into short-term and long-term parts:

3.1. Short-term risk

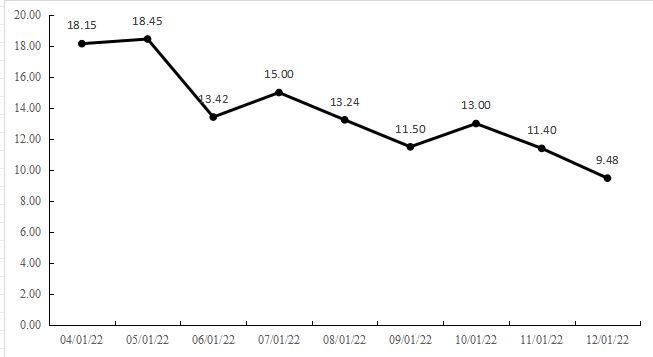

Figure 1 takes April 8, 2022, the announcement date of the merger, as the core research node and selects the stock data of Warner Bros. Discovery after the merger. In the theoretical research of finance, stock price changes are one of the reference bases for affecting capital market economic decisions.

It can be known from the figure 1 that after the company announces the merger transaction, it is often accompanied by the risk of severe market fluctuations. To discuss by cases, if the stock price rises after the merger, it will not have an impact on the company. But if the stock price falls, investors will further consider the company, and the company will be more willing to cancel the merger [9]. According to the analysis of the chart, from April to December 2022, the stock price of WBD showed an overall downward trend. In April 2022, the initial stock price was 18.5, but by December 2022, the stock price had dropped to 9.8, with a significant cumulative decline.

Based on the data analysis and combined with specific facts, it can be found that the short-term stock price decline of Warner Bros. Discovery (WBD) mainly stems from the following points: The market has initial concerns about integration risks. Although the market and investors expected synergistic effects in the early stage of the merger, because WarnerMedia focuses on the development of film and television IP and Discovery focuses more on documentary content, the two companies have different business models and differences in operational logic, which made investors full of concerns in the initial stage. In the short term after the merger, to promote the technical integration, content adjustment, and personnel adjustment of the streaming media platforms (HBO Max and Discovery Plus), the company's initial investment cost far exceeded the budget. At the same time, layoffs and reorganizations also generated additional expenses, resulting in a significant increase in initial costs. This directly affected the market's expectations for short-term cash flow and profit margins, thereby triggering stock price fluctuations.

3.2. Long-term risks (more than one year)

Combined with key indicators such as revenue and profit margin in the financial statements, this paper comprehensively compares the financial performance and market position of the enterprise before and after the merger, and deeply analyzes the continuous impact of the merger on the enterprise in the long-term dimension.

3.2.1. Comparison of financial indicators

|

Financial Statements Indicators |

2021 Before the Merger of Time Warner and Discovery |

2022 Full Year After the Merger |

2023 Full Year |

|

Operating Income |

12.186 billion |

33.817 billion |

41.325 billion |

|

Net Profit |

1.022 billion |

-7.371 billion |

-3.126 billion |

|

Net Profit Margin |

839 million |

-2.18 billion |

-756 million |

|

Net Debt |

985 million |

34.648 billion |

28.688 billion |

|

Free Cash Flow |

2.425 billion |

3.317 billion |

6.161 billion |

As shown in Table 1, through the financial data of Time Warner Discovery before and after the merger from 2021 to 2023, this paper can deeply analyze the impact of the merger on the long-term profitability, debt structure and cash flow quality of the enterprise.

In the early stage of business integration between Warner and Discovery, the revenue growth did not meet expectations. For example, before the merger, Warner had stable income in the field of film and television production and distribution, and Discovery had unique advantages in documentary content and the international market. However, after the merger, due to obstacles in business synergy, some market shares were lost, leading to slow revenue growth. In the international market, for instance, Discovery originally had an extensive distribution channel, but due to poor internal communication during the integration period, content promotion was hindered, and revenue did not increase due to the merger [10].

After the merger, to integrate businesses and optimize processes, a large amount of funds was invested in technological upgrading and personnel adjustment, resulting in a significant short-term increase in costs. For example, in the process of merging streaming media platforms, the investment in the transformation of technical architecture and content integration exceeded the budget, compressing the profit space. At the same time, the cost of layoffs and reorganizations caused by personnel integration also increased the financial burden.

In terms of operating income, before the merger in 2021, the operating income of Time Warner Discovery was 12.186 billion. After the merger, it jumped to 33.817 billion in 2022 and further increased to 41.325 billion in 2023 (as shown in the table). On the surface, the operating income shows a scale effect, but when examining the nature of the growth, it is more of a simple superposition of the original businesses rather than "organic growth" driven by business synergy. For example, the collaborative development of cross-business IP has not been effectively implemented. In 2023, the advertising revenue in the North American market still lagged behind competitors such as Disney, indicating that the merger has not reversed the competitive disadvantage in the core market, and the "gold content" of revenue growth is quetionable.

The profit data shows a significant deterioration trend: the net profit before the merger in 2021 was 1.022 billion, which suddenly turned into a loss of -7.371 billion in 2022, and narrowed to -3.126 billion in 2023 (as shown in the table), but the loss situation has not changed. The core cause lies in the out-of-control synergy costs. In 2022, one-time integration costs such as layoffs, system integration, and brand reorganization exceeded 5 billion, directly eroding profits. At the same time, long-term content investment has not been converted into profits, and the mismatch between revenue and costs is prominent. The net profit margin deteriorated from 839 million in 2021 to -2.18 billion in 2022 and -756 million in 2023, reflecting that cost control lags far behind revenue expansion.

The net debt data shows a "first increase then decrease" characteristic: it was 985 million in 2021, soared to 34.648 billion after the merger in 2022, and dropped to 28.688 billion in 2023 (as shown in the table). The sharp increase in debt in 2022 was due to large-scale financing for the merger transaction, mainly short-term debt, leading to a sudden increase in financial pressure. The net debt fell in 2023. Although the company optimized the structure by selling non-core assets and converting short-term debt to long-term debt, the long-term debt scale is still high, with annual interest burden exceeding 2 billion, which continues to squeeze the profit improvement space.

The free cash flow shows positive signals: it was 2.425 billion in 2021, increased to 3.317 billion in 2022, and further rose to 6.161 billion in 2023 (as shown in the table). This is due to the enterprise's efforts in cost control and asset operation - by reducing ineffective content investment and accelerating accounts receivable recovery, it promoted the improvement of operating cash flow. However, it should be noted that the current free cash flow is still difficult to cover the annual interest expenses and content investment needs, and the cash flow "blood supplement" capacity has not yet formed a sustainable closed loop.

In summary, the long-term value of Time Warner Discovery after the merger did not meet expectations. Although the revenue growth and cash flow improvement in 2023 released positive signals, problems such as profit deterioration, high debt, and lagging business synergy still restrict its development. In the future, it is necessary to focus on whether the enterprise can achieve a closed loop of merger value through the implementation of content synergy, refined cost control, and optimization of debt structure.

3.2.2. Insights from user behavior data

In the 1-2 years after the merger, user behavior data showed that the streaming media platform suffered serious user loss. Users were dissatisfied with the content integration and interface design of the new platform after the merger of HBO Max and Discovery Plus, leading some users to cancel their subscriptions. After the merger was completed in early 2023, by the end of 2023, the number of subscribed users decreased by 8%, about 5 million users were lost. At the same time, the cost of acquiring new users increased. In 2023, the cost of acquiring new users increased by 30% compared with 2022, but the growth rate of new users was only 2%, showing slow growth.

Users' preferences for content changed due to the platform merger, and the original content recommendation algorithm was no longer accurate. From the tracking of user behavior data, in the first quarter of 2024, the click-through rate of the original Max users on the documentary content pushed by the new platform was less than 5%, while the interaction rate of the original Discovery Plus users on the pushed film and television content was lower than 10%, which seriously affected user stickiness and activity. The average user usage time in the first half of 2024 was 20 minutes shorter than that in the same period of 2022.

3.2.3. Reasons for the decline in stock price after the merger

Unmet market expectations: Investors had high hopes for the synergistic effects and growth potential after the merger, but the company failed to achieve the expected business integration and performance growth within 1-2 years, leading to a setback in market confidence. The company once expected that through cost control and market expansion after the merger, the net profit in 2023 could reach 500 million US dollars, but the actual net loss in 2023 reached 1.2 billion US dollars. Affected by this, the stock price fell by 30% compared with the early stage of the merger.

Intensified industry competition: In the 1-2 years after the merger, competition in the media industry became increasingly fierce. Competitors such as Netflix and Disney continued to launch high-quality content and innovative services to attract users. In the first half of 2024, Netflix's newly launched original drama series received a lot of user praise and added 10 million subscribed users, while Warner Bros. Discovery lost users during the same period. Its market share in the streaming media market dropped from 15% in 2022 to 10% in 2024, and the stock price also fell, with a cumulative decline of 40% in 2024 compared with 2022.

4. Conclusion

Through in-depth analysis of the merger case between Warner Media and Discovery, as well as a comparison of Warner's successful acquisition of Comics, it can be concluded that mergers and acquisitions in the media industry need to pay attention to soft factors such as cultural integration and talent retention, while using event analysis to quantify the risk impact. Successful mergers and acquisitions require emphasis on complementarity, long-term strategic synergy, and creative independence assurance. For media companies, merger and acquisition decisions should comprehensively consider short-term market reactions and long-term development strategies, and reasonably plan resource investment and risk management. Research on the Impact of Stock Market Yield Decline on the Completion of Mergers and Acquisitions Transactions.

Based on the summary and generalization of the previous text, the core inspiration for vertical mergers and acquisitions in the media industry can be extracted. The merger of Warner Media and Discovery has certain synergies in business, as they have core advantages in the production of film and television IP content and documentary entertainment content, respectively. After the merger, theoretically, the company's competitiveness in the media industry can be enhanced through the integration of content resources, forming complementarity in content. This is also the fundamental value of business synergy in vertical mergers. Although there was some synergy in the initial stage, in actual integration, the company failed to demonstrate its own strength in the later stage due to cultural conflicts, personnel conflicts, and improper cost control.

The company needs to pay attention to the cost of the merger and make more detailed plans for the implementation path of synergies in the early stages of the merger. The company should clarify the significance of integration and make more detailed plans for specific integration steps and time nodes. At the same time, strict cost control can not only be achieved through early evaluation and analysis of peers in the market, but also by avoiding personnel redundancy and reducing redundant costs caused by job duplication.

At the level of cultural integration, companies need to strengthen internal communication and integration. Although both companies belong to the media industry, Warner focuses on artistic creativity and Discovery focuses on specialized production of documentary content. There are differences in corporate culture and style between the two, which lead to low communication efficiency in the later stage and even talent loss. This also confirms that cultural integration has a direct impact on the effectiveness of mergers and acquisitions.

Authors contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Pay, Q. (2018) Research on the Business Model of Transformation of Beijing Yichang Media Technology Co., Ltd. (Master's thesis, University of International Business and Economics).

[2]. Ji, T. N. (2009) Organizational Culture Change in the Transformation of Traditional Media Enterprises: A Case Study of Media Enterprise C Company (Master's thesis, Beijing University of Posts and Telecommunications).

[3]. Lan, F. Q., Hu, X. M., Guo, W. T. et al. (2025) The Mystery of Enterprise Supply Chain Risk and Vertical Mergers and Acquisitions Decision. Quantitative Economics and Technical Economics Research, 42(1), 116-135.

[4]. Zhang, Q. & Qiu, Y. Y. (2024) Analysis of the Synergy Effect of Enterprise Mergers and Acquisitions. Brand Research (28), 154-156.

[5]. Liang, W. J. (2024) Research on the Motivation, Path and Effect of Digital Transformation of Media Enterprises - Taking Focus Media as an Example (Master's thesis, Southwest University of Finance and Economics).

[6]. Bian, Y. F. (2021) Research on Cultural Conflict and Integration of HR Company's Merger and Acquisition of YS Company (Master's thesis, Hebei University of Economics and Business).

[7]. Wu, W. F. (2018) Stimulating the Vitality of Transformation and Innovation and Consolidating the Construction of Propaganda Team - A Preliminary Discussion on How Traditional Media Can Integrate and Develop to Solve the Problem of Talent Loss. Comparative Research on Cultural Innovation, 2(29), 69-70.

[8]. Zhou, L. (2018) Analysis of Talent Loss in Traditional Media. Media Forum, 1(4), 96-97.

[9]. Cui, H. (2022) A Study on the Impact of Stock Market Yield Decline on the Completion of Mergers and Acquisitions Transactions (Master's thesis, Beijing Jiaotong University).

[10]. Gu, J. (2024, November 27) Warner Bros. Exploration Reports Growth in Streaming Business but Decline in Cinema Business. China Film News, 014.

Cite this article

Lin,L.;Wang,Y.;Zhang,Y. (2025). Mergers and Acquisitions in the Media Industry - Taking the Merger of WarnerMedia and Discovery as Examples. Advances in Economics, Management and Political Sciences,220,65-71.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Pay, Q. (2018) Research on the Business Model of Transformation of Beijing Yichang Media Technology Co., Ltd. (Master's thesis, University of International Business and Economics).

[2]. Ji, T. N. (2009) Organizational Culture Change in the Transformation of Traditional Media Enterprises: A Case Study of Media Enterprise C Company (Master's thesis, Beijing University of Posts and Telecommunications).

[3]. Lan, F. Q., Hu, X. M., Guo, W. T. et al. (2025) The Mystery of Enterprise Supply Chain Risk and Vertical Mergers and Acquisitions Decision. Quantitative Economics and Technical Economics Research, 42(1), 116-135.

[4]. Zhang, Q. & Qiu, Y. Y. (2024) Analysis of the Synergy Effect of Enterprise Mergers and Acquisitions. Brand Research (28), 154-156.

[5]. Liang, W. J. (2024) Research on the Motivation, Path and Effect of Digital Transformation of Media Enterprises - Taking Focus Media as an Example (Master's thesis, Southwest University of Finance and Economics).

[6]. Bian, Y. F. (2021) Research on Cultural Conflict and Integration of HR Company's Merger and Acquisition of YS Company (Master's thesis, Hebei University of Economics and Business).

[7]. Wu, W. F. (2018) Stimulating the Vitality of Transformation and Innovation and Consolidating the Construction of Propaganda Team - A Preliminary Discussion on How Traditional Media Can Integrate and Develop to Solve the Problem of Talent Loss. Comparative Research on Cultural Innovation, 2(29), 69-70.

[8]. Zhou, L. (2018) Analysis of Talent Loss in Traditional Media. Media Forum, 1(4), 96-97.

[9]. Cui, H. (2022) A Study on the Impact of Stock Market Yield Decline on the Completion of Mergers and Acquisitions Transactions (Master's thesis, Beijing Jiaotong University).

[10]. Gu, J. (2024, November 27) Warner Bros. Exploration Reports Growth in Streaming Business but Decline in Cinema Business. China Film News, 014.