1. Introduction

The Sino-US trade friction has hampered China's exports to the US, causing difficulties for some export-oriented enterprises and putting downward pressure on the Chinese economy. Some labor-intensive industries (such as textiles and furniture) and industries involving supply chain security concerns have begun to relocate to Southeast Asia and other regions in order to avoid high tariffs. Some US manufacturers that rely on Chinese intermediate products and components are facing higher production costs, which is weakening their global competitiveness. China's agricultural futures market has formed a market system covering major agricultural products, with active trading and steady growth in scale. Its product range is becoming increasingly comprehensive, trading volumes continue to expand, internationalization is steadily advancing, and participants are becoming more diverse and professional.

Although existing research has achieved certain results, most studies have not conducted an in-depth analysis of the correlation between tariffs and Chinese agricultural futures prices, but have only studied one of them individually. For example, Wu et al. focused solely on the impact of cotton futures on the international market on China's futures market [1]. Liu and Gao mainly studied the price fluctuations of soybean futures and did not conduct an in-depth study of the correlation between tariffs and soybean futures prices [2,3]. Existing literature has noted that the Chinese soybean market is susceptible to the influence of international trade, and that the implementation of trade protection measures will be transmitted to the soybean markets of both China and the United States through various channels, causing significant fluctuations in Chinese soybean market prices. However, no comprehensive research has been conducted on Chinese agricultural futures prices, with most studies focusing on individual agricultural products, and there has been no in-depth analysis of the systemic impact mechanism of tax prices on agricultural futures prices [4,5].

This paper primarily employs quantitative analysis methods to quantify the impact of Sino-US trade friction on agricultural futures prices in the context of economic globalization. The platform primarily relies on the Dalian Commodity Exchange to collect market data and trading parameters for futures such as soybeans and cotton. Additionally, reference was made to a series of important policy documents, including the “Announcement by the State Council Tariff Commission on the Imposition of Additional Tariffs on Certain Imported Goods Originating in the United States” and the “Joint Statement of the China-US Economic and Trade Talks in Geneva,” to enhance the credibility of the research, ensure its timeliness, and maintain its relevance. In addition, all prices are converted to RMB to reduce interference caused by currency differences. Quantitative analysis has the following two significant advantages. First, quantitative analysis is highly objective and can effectively avoid interference from personal experience and emotional preferences in research. In addition, quantitative analysis methods are highly verifiable. This study relies on publicly available and transparent data for analysis, and the data sources and processing procedures are clearly traceable, allowing other researchers to conduct verification studies based on the same data set.

2. The impact of trade frictions on agricultural futures

2.1. Soybean futures: policy-sensitive commodities experience increased volatility

From January 2025 to August 2025, the price of the main contract for soybeans on the Dalian Commodity Exchange showed a clear right-skewed distribution, with a mean of 4,856 yuan/ton and a median of 4,820 yuan/ton. The median is lower than the mean, indicating that the price distribution is skewed to the right. The frequent occurrence of high-price anomalies has raised the overall price, reflecting a temporary increase in soybean futures prices. With the increase in U.S. soybean import tariffs to 28% in August 2025, cost pressures and import uncertainties have intensified, leading to a significant 39.4% increase in soybean price volatility compared to previous periods. This clearly indicates that tariff policies have exacerbated market supply-demand instability and may potentially fuel market risk-aversion and speculative sentiment.

This high volatility stems mainly from two core factors: one the one hand, the cost of tariffs is almost entirely borne by consumers and importers. Once tariffs rise, they will directly and rapidly push up the actual cost of imported goods, exacerbating the uncertainty of agricultural futures prices. On the other hand, there is a strong expectation of a supply shortage in the market—China has not yet purchased US soybeans for the 2025 and 2026 seasons, leading to a huge supply gap in imports in the fourth quarter, which further amplifies market tensions and price volatility risks.

2.2. Rapeseed meal futures: extreme volatility amid policy shocks

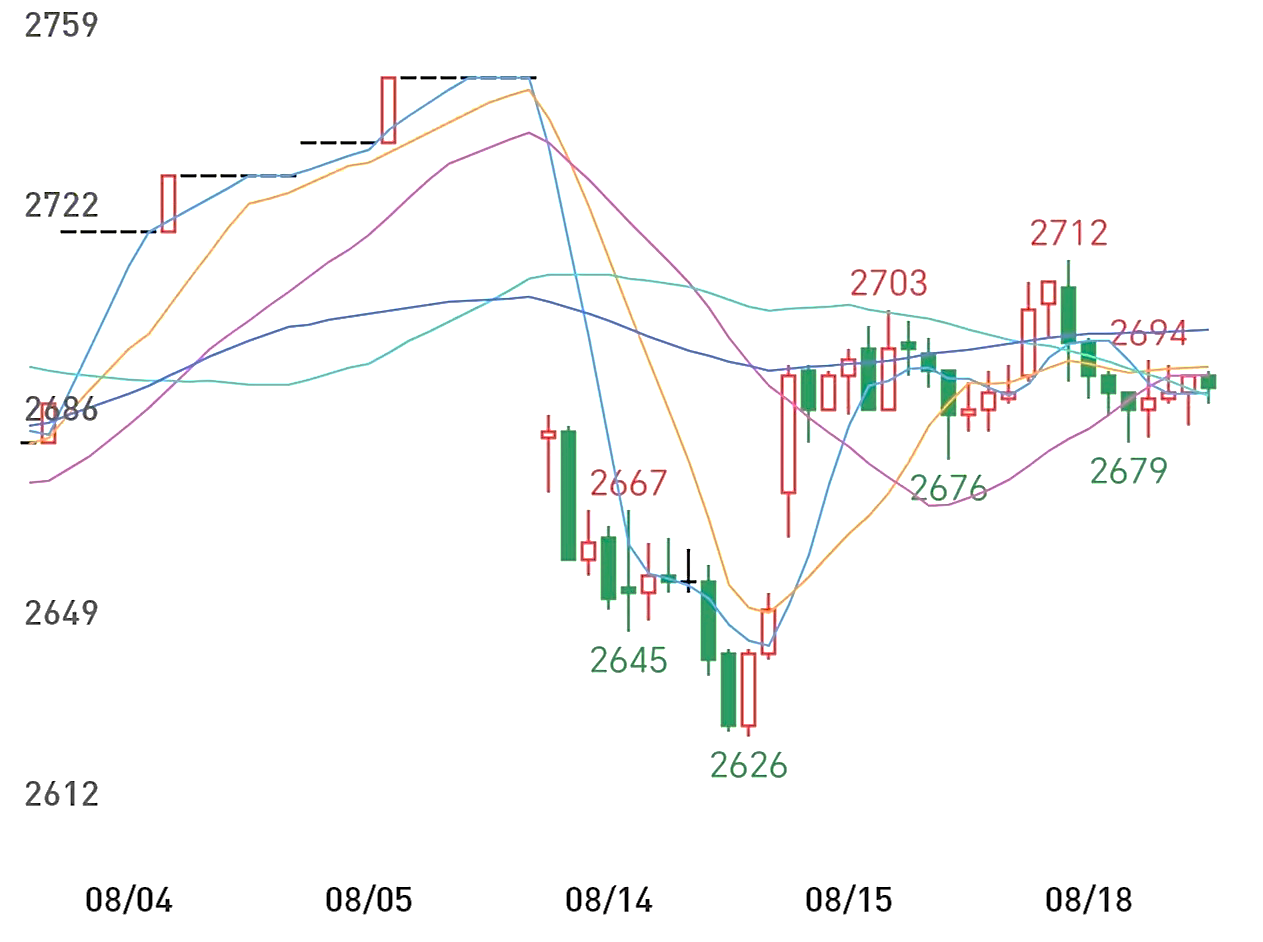

Starting March 20, 2025, China will impose a 100% tariff on Canadian rapeseed meal. On August 12, China imposed a 75.8% anti-dumping deposit on Canadian rapeseed, triggering abnormal fluctuations in rapeseed meal futures prices. The key statistical indicators show abnormal values: The daily range reached 217 yuan/ton, setting a new record. The variance expansion rate reached 160% (the value rose from 1,850 to 4,810). The median deviation reached 3,030 yuan, becoming the new price anchor point, an increase of 18% compared to before the event. The price fluctuation trajectory of continuous RM7777 in Figure 1 clearly and accurately matches the abnormal data changes described above.

Such extreme price volatility is mainly due to the Chinese rapeseed meal market's high dependence on imports—currently, more than 75% of rapeseed meal imports come from Canada. The combined impact of tariff policy adjustments and anti-dumping duties has led to a sharp rise in the landed cost of Canadian canola meal, a significant contraction in import profits, and a notable decline in Chinese buyers' willingness to purchase. Although Canada has expressed its willingness to ease trade tensions through negotiations, there remains significant uncertainty regarding the future direction of import policies during the critical policy window period (August 2025 to February 2026). This uncertainty continues to push up market risk premiums, keeping the forward contracts for rapeseed meal at a strong premium, reflecting the Chinese rapeseed meal futures market's continued expectation of medium- to long-term supply shortages.

2.3. Corn futures: stability of weak transmission varieties

Unlike the soybean and rapeseed meal markets, which are highly sensitive to trade policies, Chinese corn futures prices have shown strong resistance to interference during trade disputes. After China imposed a 15% tariff on US corn in March 2025, the Chinese corn futures market reacted relatively calmly, with a single-day increase of only 1.2% and a 30-day volatility increase of only 12.3% (as shown in Table 1). This mild reaction contrasts sharply with the sharp fluctuations in Chinese soybean futures prices. From a statistical perspective, the standard deviation and variance of corn futures prices are significantly lower than those of soybeans, indicating that corn prices are less volatile and the market is more stable. This difference is mainly due to China's relatively low dependence on corn imports and the fact that the Chinese market has a more independent supply and demand structure, with limited transmission effects of policies and external shocks on prices [6].

The stability of corn market prices is mainly due to the combined effect of a triple buffer mechanism, which effectively isolates the impact of external shocks on the domestic market. First, China's dependence on corn imports is relatively low. Taking 2024 data as an example, imported corn accounts for only 9.2% of the total domestic supply, which is much lower than that of soybeans and other varieties. This structure significantly weakens the direct impact of international price fluctuations and changes in trade policies. Second, there is an adequate supply of policy control tools. China has more than 100 million tons of corn reserves, which can be released in an orderly manner when supply and demand are tight, promptly filling market gaps, effectively curbing speculative behavior and excessive price fluctuations, and enhancing short-term price control capabilities. Third, downstream consumption shows strong resilience. Feed demand accounts for more than 65% of total domestic corn consumption. It is large in scale and stable, and is not easily affected by short-term market fluctuations, providing a solid demand floor for the market.

|

Statistical indicators |

Values |

Comparison with soybeans Differences |

|

Mean |

2420 |

-23.11% |

|

Standard deviation |

18.7 |

-37.41% |

|

Variance |

349.7 |

-60.81% |

3. Discussion

Through in-depth research on agricultural futures prices throughout all stages of the Sino-US trade friction, it was found that changes in China's agricultural futures prices were significantly affected by Sino-US trade friction, and that tariff intensity was positively correlated with futures volatility. When tariff intensity increases, it means that imported goods incur higher tax costs when entering the domestic market. Regardless of the type of product, any increase in tariffs will lead to a rise in the domestic price of imported goods, significantly increasing the cost of importing goods for importers [7]. High tariffs will dampen importers' willingness to purchase, leading to a reduction in import volumes. When import volumes cannot meet actual domestic demand, a supply gap will emerge in the market, resulting in an imbalance between supply and demand [8]. The widening supply gap directly drives up spot prices. This has led to a reluctance to sell and competition among buyers in the market, which in turn has driven up spot prices gradually. The rise in spot prices will further spread to the futures market, causing futures prices to rise and generating speculation and hedging activities in the futures market. This will further amplify the upward momentum of futures prices. Ultimately, under the chain reaction triggered by the increase in tariff intensity, futures prices showed a clear upward trend.

In addition, when tariff intensity increases, policy changes are often accompanied by ambiguity and unpredictability, which sends risk signals to the market. In an environment of trade policy uncertainty (such as the possibility of the US imposing high tariffs on Chinese goods), companies will make corresponding strategic changes, causing changes in market supply expectations [9]. For example, significantly increasing inventory to mitigate potential supply shortages or securing procurement channels in advance to avoid cost surges. However, these measures would further increase the implicit costs of commodities, creating a “risk premium” component in prices and thereby giving rise to a “policy uncertainty premium”. The existence of policy uncertainty premiums makes it easy for spot market prices to rise beyond reasonable expectations. Spot prices, which might have risen moderately due to increased import costs, are amplified by market concerns about policy risks. As a result, the new city experienced “panic demand”, and the combined forces of supply and demand pushed spot prices away from their normal rate of increase, significantly increasing the volatility of soybean futures prices [10]. The price has shown an unexpected upward trend. The unexpected rise in spot prices will further spread to the futures market, driving a significant increase in futures prices.

4. Conclusion

This study uses empirical analysis of data from the Dalian Commodity Exchange to clearly reveal a significant positive correlation between tariff intensity and Chinese agricultural futures prices during the US-China trade friction period. Tariffs adjustments, whether upward or downward, have had varying degrees of impact on the prices of different types of agricultural futures. For commodities such as soybeans and rapeseed meal, which are highly dependent on imports, price fluctuations are significantly affected by tariff policies. Meanwhile, Corn is less dependent on imports and is supported by policy regulation and strong consumer demand, so its price is relatively stable. In addition, the study further revealed the systemic impact mechanism of tariffs on futures prices. The escalation of tariffs amid Sino-US trade friction will increase import costs, dampen import demand, and lead to supply shortages. It will also generate risk premiums due to policy uncertainty, pushing up spot prices and transmitting to the futures market, causing futures prices to rise significantly and volatility to increase. When formulating tariff policies, policymakers should fully consider the potential impact on agricultural futures markets and conduct comprehensive risk assessments and contingency planning. Strengthen trade negotiations with other countries, reduce uncertainty in trade policy, and stabilize agricultural import channels and price expectations. Continue to improve agricultural support policies, enhance the risk-resistance capabilities of domestic agricultural production, and ensure a stable supply of domestic agricultural products. Market participants are closely monitoring international political and economic developments and tariff policy trends, enhancing their sensitivity to market risks and their ability to anticipate future trends. Through diversified procurement and other means, reduce the impact of tariff fluctuations on its own operations. Strengthen industry self-regulation, avoid irrational trading behavior caused by market panic, and jointly maintain the stable order of the agricultural futures market.

Although quantitative analysis methods are objective and verifiable, this paper cannot directly prove the causal relationship between Sino-US trade friction and changes in futures prices, which may lead to a certain degree of deviation between the research results and the actual situation. Furthermore, the study is primarily based on data related to key events during the Sino-US trade friction and existing policy documents, and the completeness of the data has certain limitations. Future research could further deepen the analysis of the mechanisms by which Sino-US trade friction affects agricultural futures prices, incorporating more non-quantitative factors such as market participant psychology and the macroeconomic environment to construct a more comprehensive analytical framework. At the same time, based on the research results, targeted policy recommendations are put forward to help participants in the agricultural futures market better cope with the risks brought about by trade frictions, improve the risk management system of the agricultural futures market, and promote the stable and healthy development of the market.

References

[1]. Wu Z. M., Wang L., Wu Q. J., & Wang B. (2021). A Study on the Perception and Transmission of Import Prices, Futures Prices, and Spot Prices After the Implementation of Double Tariffs on Cotton: Based on the VAR Model. Mathematical Practice and Recognition, 51(5), 74-84.

[2]. Liu C., Du J. R. & Mao W. Q. (2022). Characteristics of Soybean Futures Price Volatility in China: An ARCH-Type Model Study from the Perspective of US-China Trade Friction. Journal of Hebei Agricultural University (Social Sciences Edition), 24(3), 120-128.

[3]. Gao R., & Lu J. X. (2021). An Empirical Study on the Correlation of Soybean Futures Markets Under US-China Trade Frictions: Based on the Copula-GARCH Model. Journal of Sichuan University of Light Industry: Natural Science Edition.

[4]. Li T. H. (2019). The Impact of US-China Trade Frictions on China's Soybean Futures Prices. Capital University of Economics and Business.

[5]. Zou C. (2021). A Study on the Transmission Effects of Agricultural Futures and Spot Prices Between China and the United States Under Trade Frictions: Taking Soybeans as an Example. Guizhou University of Finance and Economics.

[6]. Fajgelbaum, P. D., Goldberg, P. K., Kennedy, P. J., & Khandelwal, A. K. (2020). The Return to Protectionism. Amit Khandelwal (1).

[7]. Handley, K., & Limo, N. (2013). Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the U.S. CEPR Discussion Papers, 107(9), 2731-2783.

[8]. Handley, K., & Limão, Nuno. (2012). Trade and investment under policy uncertainty: theory and firm evidence. CEPR Discussion Papers, 7(4).

[9]. Wheeldon, H. (2017). The return of protectionism. Aerospace international, 44(3), 10-11.

[10]. Wen, T., Li, P., Chen, L., & An, Y. (2023). Market reactions to trade friction between China and the United States: evidence from the soybean futures market. Journal of Management Science & Engineering, 8(3).

Cite this article

Wang,J. (2025). Impact Analysis of Tariffs on Chinese Agricultural Futures Prices in the Context of Economic Globalization. Advances in Economics, Management and Political Sciences,220,109-114.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wu Z. M., Wang L., Wu Q. J., & Wang B. (2021). A Study on the Perception and Transmission of Import Prices, Futures Prices, and Spot Prices After the Implementation of Double Tariffs on Cotton: Based on the VAR Model. Mathematical Practice and Recognition, 51(5), 74-84.

[2]. Liu C., Du J. R. & Mao W. Q. (2022). Characteristics of Soybean Futures Price Volatility in China: An ARCH-Type Model Study from the Perspective of US-China Trade Friction. Journal of Hebei Agricultural University (Social Sciences Edition), 24(3), 120-128.

[3]. Gao R., & Lu J. X. (2021). An Empirical Study on the Correlation of Soybean Futures Markets Under US-China Trade Frictions: Based on the Copula-GARCH Model. Journal of Sichuan University of Light Industry: Natural Science Edition.

[4]. Li T. H. (2019). The Impact of US-China Trade Frictions on China's Soybean Futures Prices. Capital University of Economics and Business.

[5]. Zou C. (2021). A Study on the Transmission Effects of Agricultural Futures and Spot Prices Between China and the United States Under Trade Frictions: Taking Soybeans as an Example. Guizhou University of Finance and Economics.

[6]. Fajgelbaum, P. D., Goldberg, P. K., Kennedy, P. J., & Khandelwal, A. K. (2020). The Return to Protectionism. Amit Khandelwal (1).

[7]. Handley, K., & Limo, N. (2013). Policy Uncertainty, Trade, and Welfare: Theory and Evidence for China and the U.S. CEPR Discussion Papers, 107(9), 2731-2783.

[8]. Handley, K., & Limão, Nuno. (2012). Trade and investment under policy uncertainty: theory and firm evidence. CEPR Discussion Papers, 7(4).

[9]. Wheeldon, H. (2017). The return of protectionism. Aerospace international, 44(3), 10-11.

[10]. Wen, T., Li, P., Chen, L., & An, Y. (2023). Market reactions to trade friction between China and the United States: evidence from the soybean futures market. Journal of Management Science & Engineering, 8(3).