1. Introduction

The pharmaceutical industry is undergoing changes under the close integration of technology and life, and doing a good job in the identification and prevention and control of financial risks of listed companies is conducive to maintaining market stability. At present, there are few studies on the change of risk of Special Treatment (ST) pharmaceutical enterprises in academia, and there are few studies on the gradual increase of risk of ST pharmaceutical enterprises in the context of financial fraud. The Z-score model is a classic quantitative model of financial risk, which can effectively identify the bankruptcy risk of enterprises through a series of variables such as the current ratio and asset turnover rate as independent variables.

ST Suwu is a private traditional Chinese medicine enterprise covering the retail, wholesale, import and export of drugs and medical devices, medical beauty services, Research and Development (R&D) and innovation, etc., listed in Jiangsu in April 1999, as of March 31, 2025, Suzhou Wuzhong Investment Holdings Co., Ltd. holds 17.24% of the shares as the largest shareholder, and the number of shareholders increased by 24,065 from the end of 2024 to March 31, 2025, the largest in the same period of the previous year. From 2020 to 2024, its three subsidiaries and Zhejiang Younod Trading Co., Ltd. and its affiliates committed financial fraud through trade transactions, and from 2020 to 2023, the balance of non-operating occupied funds of related parties increased year by year to 1.693 billion yuan, accounting for 96.09% of the net assets in the same period, and was not disclosed in the annual report, and the supervision and audit institutions did not raise objections, with a cumulative inflated revenue of 1.772 billion yuan, costs of 1.695 billion yuan, and profits of 76 million yuan. Therefore, this paper selects ST Su Wu as the research object, the company issued a risk warning announcement on July 14, 2025 that may be forced to delist due to financial fraud, the essence of financial management risk warning is to formulate risk prevention and control plans according to the details and requirements of financial management at different stages, judge the current capital flow and hidden dangers in the process of financial management in advance, and issue early warnings in time when problems arise [1]. Thus, it can effectively avoid property losses or project problems caused by risks [2]. Therefore, the financial data and violations of the enterprise are sorted out, the reasons for the occurrence of the enterprise are analyzed and corresponding preventive measures are proposed, supplementing the gaps in the case study of financial risks of ST pharmaceutical enterprises, helping enterprises avoid risks, and providing theoretical support for the regulators to propose to strengthen the early warning of risks of ST pharmaceutical enterprises.

2. Risk warning of ST Suwu traditional Chinese medicine development Co., Ltd. based on the Z-score model

2.1. Model introduction

|

code |

Z-score model metrics |

meaning |

|

X1 |

Working capital/total assets |

Measures asset liquidity, size, and short-term solvency |

|

X2 |

Retained earnings/total assets |

Measure the age and profitability of the business |

|

X3 |

EBIT/total assets |

Measure the operational efficiency of the enterprise |

|

X4 |

Shareholders' Equity/Bonds |

Measure the characteristics of the financial structure of the enterprise |

|

X5 |

Total sales revenue/total assets |

Measure the capital turnover capacity of enterprises |

Table 1 shows the Z-Score metric meaning and calculation method. The Z-score model proposed by Altman has far-reaching effects. As a typical model of a multivariate linear index financial crisis early warning model, the model is constructed with 33 failed enterprises and 33 successful enterprises as samples. The model selects 5 financial indicators and establishes a linear formula: Z = 1.2X₁ + 1.4X₂ + 3.3X₃ + 0.6X₄ + X₅. By calculating the Z-value, it can simplify the determination of the financial risk of the enterprise, clarify the crisis or not, and its research has verified that the Z-Score model can be used to analyze and predict the financial failure or bankruptcy risk that the enterprise may face, and when the Z-Score value is low, the enterprise faces the risk of bankruptcy [3]. The specific criteria are: when Z≤1.8, the degree of financial crisis of the enterprise is deep; when Z<≤625 is 1.8, the enterprise is in the transition range between financial crisis and good condition; When Z > 2.625, the enterprise operates well and the possibility of financial crisis is low [4].

In the study of Ossman, Bell, Swartz, and Turtle, the logistic regression model was used to analyze 105 bankrupt enterprises and 2058 normal enterprises from 1970 to 1976 as samples, which further verified the effectiveness and applicability of the logistic regression model in financial risk research. Results Analysis The calculation results of various indicators of ST Suwu Pharmaceutical Company from 2018 to 2024are shown in Table 2

|

year |

X1 |

X2 |

X3 |

X4 |

X5 |

Z-value |

|

2018 |

0.1572 |

0.0487 |

-0.0413 |

1.5177 |

0.3686 |

1.3983 |

|

2019 |

0.158 |

0.0738 |

0.032 |

1.0896 |

0.5383 |

1.5884 |

|

2020 |

0.2929 |

-0.0586 |

-0.1198 |

1 |

0.5054 |

0.9774 |

|

2021 |

0.263 |

-0.0591 |

0.0272 |

0.9976 |

0.4724 |

1.3917 |

|

2022 |

0.2235 |

-0.0763 |

0.0375 |

0.8741 |

0.5183 |

1.3258 |

|

2023 |

0.1438 |

-0.0856 |

0.0332 |

0.6866 |

0.5177 |

1.0897 |

|

2024 |

0.2385 |

-0.0754 |

0.0325 |

0.9056 |

0.4022 |

1.232 |

Data source: Flush; Giant tide information

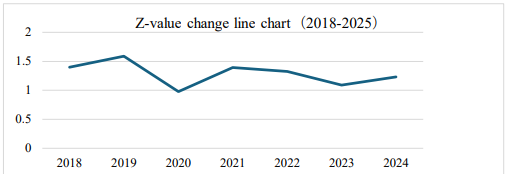

Taking the Z-value calculated by the Z-Score model in Table 1, it can clearly show the comprehensive Table 1 and Figure 1 of ST Suwu's Z-value changes in the past 7 years, and the Z-value has changed non-steadily in each year, from 1.9383 in 2018 to 1.5884 in 2019, and then continued to fall back in 2020, and fluctuated again in 2021. This volatility fully illustrates the lack of stability in ST Suwu Pharmaceutical's comprehensive operations and financial situation before receiving the "Notice of Case Filing" from the China Securities Regulatory Commission on February 26, 2025, due to suspected violations of information disclosure laws and regulations [5]. There is no single trend of continuous rise or decrease in the Z-value over seven years, fluctuating between 0.9774 and 1.5884. It reflects the uncertainty of enterprises in risk control and business strategy management and execution, and the Z-value is lower than 1.8, indicating that ST Suwu enterprises have greater financial risks, and the possibility of bond default and bankruptcy is also relatively high [6].

3. Analysis of ST Suwu's solvency

According to Table 3, ST Suwu's current ratio increased by 0.34 from 2018 to 2020, and although it decreased year by year from 2020 to 2023, it remained stable above 1, indicating that current assets have the basic coverage ability of current liabilities [7]. However, its overall solvency was weak, with the current ratio falling from 1.68 to 1.26. In terms of the quick ratio, it increased significantly by 0.56 from 2018 to 2019, continued to decline from 2020 to 2023, and rebounded to 1.46 in 2024, reflecting a weakening trend in the asset protection ability of short-term debt repayment. During this period, the cumulative balance of non-operating occupied funds of ST Suwu's related parties reached 4.756 billion yuan, accounting for 6.88% of the disclosed net assets in the current period, which may weaken the company's solvency, as the occupation of funds will cause inflated current assets [8].In addition, the company's inflated operating income and profit in the 2020-2023 annual report, and its failure not disclose it in advance, may lead to the whitewashing of solvency indicators, such as inflated accounts receivable in current assets. The asset-liability ratio fluctuated and rose between 2018 and 2023, and in 2023, it is close to the industry warning line of 60%, and if the pressure of centralized pharmaceutical procurement is superimposed, there is a risk of debt default. The solvency analysis is based on the financial statements of the enterprise, but the financial accounting loopholes, the selectivity of accounting methods, and other factors limit it and cannot truly reflect the situation of the enterprise. Coupled with insufficient social education and capital's pursuit of profit, the financial statements are exacerbated. Therefore, in order to make up for the shortcomings of the income statement profit and static balance sheet assets under the accrual method, it is particularly important to analyze the solvency of enterprises in combination with cash flow [9].

|

index |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

liquidity ratio |

1.3 |

1.44 |

1.68 |

1.58 |

1.47 |

1.26 |

1.53 |

|

Quick ratio |

0.53 |

1.09 |

1.51 |

1.39 |

1.3 |

1.2 |

1.46 |

|

Asset-liability ratio/% |

47.85% |

39.71% |

50.00% |

50.06% |

53.36% |

59.29% |

52.48% |

Source: Straight flush

4. Analysis of ST Suwu's profitability

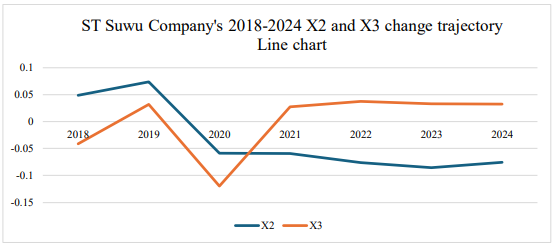

In the analysis of profitability, the changes of X2 and X3 indicators have important reference value, and the following will extract the data of X2 and X3 in Table 1 and study their change trends to evaluate profitability. According to Figure 2, the trajectory of the X3 indicator can be divided into three stages: in 2018, the value of the indicator was -4.13%; By 2020, its value has further decreased to -11.98%; In the following three years, the indicator showed a slight recovery trend and stabilized at around 3%, compared to only 3.25% in 2024. From the perspective of the overall trend, the X3 indicator has always fluctuated slightly around the 0 value, and its value has been below the industry average. Taking Hengrui Pharma and Fosun Pharma as examples, Hengrui Pharma's X3 indicator in 2023 is 8.5%, and Fosun Pharma's X3 indicator is 3.32%, compared to the company's profitability competitiveness at the bottom of these two companies.

This trend reflects the company's weak profit base. The asset-liability ratio of enterprises is negatively correlated with the profitability of enterprises, and when the return on assets is negative, it means that the operating income of the enterprise cannot cover its cost of capital [10]. At the stage of the rebound of the X3 indicator, its recovery is very limited, and there is a lack of momentum for sustained growth, which shows that the profitability of the company's main business has not been substantially restored.

The potential risks are mainly reflected in the following aspects: once the revenue growth rate of enterprises slows down or costs rise rapidly, the X3 indicator is easy to fall into the negative range again. The X3 indicator falls into the negative range, which will lead to insufficient EBIT coverage of interest, which will compress retained earnings and push up financial leverage, and finally form a negative cycle of "low profitability-high debt-limited financing", which will undoubtedly increase the possibility of corporate bankruptcy.

In addition, the X2 indicator is mainly used to measure the profitability and operational efficiency of a business. The higher the value of this indicator, the stronger the profitability of the enterprise. The larger the value of the X2 indicator, the more considerable the expected income of the enterprise and the smaller the risk it faces in the process of operation. In addition, if the indicator can remain relatively stable for five years, it indicates that the profitability of the enterprise during this business cycle is relatively stable. However, the company's X2 indicator showed a downward trend from 2019 to 2023, with only a slight increase in 2018 (from 0.0487 to 0.0738) and 2024 (from -0.0856 to -0.0754), a phenomenon that indicates a downward trend in the company's profitability and erratic performance.

5. ST pharmaceutical's financial risk prevention and control measures

5.1. Establish a financial verification mechanism

Establish an independent financial verification team, including internal senior financial personnel and external financial experts. Conduct in-depth reviews of the company's financial accounts regularly, focusing on verifying the authenticity of revenue, costs, and profits, as well as the compliance of capital transactions. For example, in response to financial fraud caused by no commercial substantive trade business, the team should review each trade contract, transaction voucher, and capital flow in detail to judge the authenticity of the business. Rectify the problems found manner, hold relevant personnel accountable, and report the verification results to the board of directors and regulatory authorities.

5.2. Optimize fund management

Strict fund approval process: Set up a multi-level fund approval system to clarify the approval authority for different amounts of fund expenditure. For example, the expenditure of funds below 500,000 yuan shall be approved by the head of the department and the financial manager; 5000002 million.

Yuan needs to oversee the vice president and the chief financial officer for approval; more than 2 million yuan shall be approved by the general manager and the board of directors. Priority should be given to ensuring the capital needs of R&D, production, and sales of core pharmaceutical businesses, and avoiding excessive capital flow to high-risk or non-core business areas, such as reducing investment in non-core projects, such as real estate, that occupy a large amount of capital.

5.3. Strict information disclosure management

A special information disclosure management position should be set up, and personnel with professional quality and a strong sense of responsibility should be selected to undertake relevant work, and by clarifying job responsibilities and standardized work processes, it is necessary to ensure that information can meet the requirements of timeliness, accuracy and completeness in all aspects of collection, review and disclosure. Information disclosure personnel need to establish a regular communication mechanism with various departments of the company to obtain information on major matters in real time, and when major contracts are signed, major investment projects are launched, important personnel changes occur, etc., they must take the initiative to report relevant information to the information disclosure personnel within the specified time limit. Before the official disclosure of information, the financial department, legal department, and secretary of the board of directors should jointly participate in the review, focusing on verifying the authenticity, compliance, and completeness of the information, to prevent the occurrence of false records, misleading statements, and major omissions.

6. Conclusion

In this study, the Z-score model is applied to the pre-event financial risk analysis of the whole chain of "financial fraud risk amplification forced delisting" of pharmaceutical ST enterprises. Through the model calculation of the company's financial data from 2018 to 2024, its Z value is always lower than 1.8 and shows the characteristics of violent fluctuations, indicating that the company's financial risk is high and the probability of bankruptcy is high, which is related to the company's unstable operating and financial situation and financial fraud incidents. From the perspective of solvency, although the current ratio remains above 1 and can cover current liabilities, the overall solvency is weak; In addition, the dual impact of non-operating capital occupation and financial fraud by related parties has further weakened the solvency, and the asset-liability ratio is close to the industry warning line, and there is a risk of debt default. In terms of profitability, the X3 indicator continues to be lower than the industry average, and the X2 indicator shows a downward trend year by year and is not stable, reflecting the weak profit foundation of enterprises, and is easy to fall into the negative cycle of "low profitability-high debt-limited financing".

Given the above risk characteristics, the prevention and control measures proposed in this study, such as a financial verification mechanism, fund management optimization, and information disclosure standards, can provide practical reference for enterprise risk avoidance. In addition, the determination of false records in the 2020-2023 annual report in the Advance Notice of Administrative Penalties provides an empirical basis for the determination of ST Suwu's financial risk in this study, which not only fills the gap in case studies in the field of "dynamic evolution of financial risks of ST pharmaceutical enterprises", but also provides theoretical support for regulatory authorities to carry out risk early warning work.

References

[1]. Gao, W. (2025) ST Suwu May Be Subject to Mandatory Delisting Due to Major Violations. Economic Information Daily, 3, 6-12.

[2]. Liu, Z. X., Wang, H. M., & Wang, H. (2025) Research on the feasibility of listing of new third board enterprises based on Z-score model. National Circulation Economy, 10, 181-184.

[3]. Cui, W. J., & Zhang, C. R. (2025) ST Suwu involved in 1.7 billion yuan fraud over four years, may face mandatory delisting due to major violations. 21st Century Business Herald, 10, 11-14.

[4]. Huang, X. B., Duan, W. L., & Jing, Y. (2018) A review of the research on the impact of diversified operations of listed companies on financial risks. China Agricultural Accounting, 10, 6-9.

[5]. Gao, W. (2025) Inflated revenue and profits for many years ST Su Wu may touch major violations and forced delisting. Economic Information Daily, 6, 6-12.

[6]. Aaidana, B., Chen, C. M. (2022) Research on financial risk early warning of the manufacturing industry in Northwest China based on Z-value and EMS model. Frontier Economy and Culture, 7, 42-45.

[7]. Wang, Y. N., Song, X. (2025) Financial risk analysis of new energy vehicle enterprises based on Z-score model: Taking S Group as an example.

[8]. Guaranteed Accounting Online School. (2025) The disadvantages of too much current assets. Economic Information Daily, 5, 8-12

[9]. Yang, C. H. (2021) On the improvement and construction of the enterprise solvency analysis index system. China Agricultural Accounting, 8, 8-10.

[10]. Li, Z. H., Shang, G. F. (2025) An empirical study on the influencing factors of capital structure of listed companies in our country. Proceedings of the 3rd China Financial Forum.

Cite this article

SUN,Y. (2025). Analysis of Financial Risk Prediction and Prevention Countermeasures Based on the Z-score Model. Advances in Economics, Management and Political Sciences,224,76-82.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gao, W. (2025) ST Suwu May Be Subject to Mandatory Delisting Due to Major Violations. Economic Information Daily, 3, 6-12.

[2]. Liu, Z. X., Wang, H. M., & Wang, H. (2025) Research on the feasibility of listing of new third board enterprises based on Z-score model. National Circulation Economy, 10, 181-184.

[3]. Cui, W. J., & Zhang, C. R. (2025) ST Suwu involved in 1.7 billion yuan fraud over four years, may face mandatory delisting due to major violations. 21st Century Business Herald, 10, 11-14.

[4]. Huang, X. B., Duan, W. L., & Jing, Y. (2018) A review of the research on the impact of diversified operations of listed companies on financial risks. China Agricultural Accounting, 10, 6-9.

[5]. Gao, W. (2025) Inflated revenue and profits for many years ST Su Wu may touch major violations and forced delisting. Economic Information Daily, 6, 6-12.

[6]. Aaidana, B., Chen, C. M. (2022) Research on financial risk early warning of the manufacturing industry in Northwest China based on Z-value and EMS model. Frontier Economy and Culture, 7, 42-45.

[7]. Wang, Y. N., Song, X. (2025) Financial risk analysis of new energy vehicle enterprises based on Z-score model: Taking S Group as an example.

[8]. Guaranteed Accounting Online School. (2025) The disadvantages of too much current assets. Economic Information Daily, 5, 8-12

[9]. Yang, C. H. (2021) On the improvement and construction of the enterprise solvency analysis index system. China Agricultural Accounting, 8, 8-10.

[10]. Li, Z. H., Shang, G. F. (2025) An empirical study on the influencing factors of capital structure of listed companies in our country. Proceedings of the 3rd China Financial Forum.