1. Introduction

The transmission of investor sentiment influences the volatility in different stock market environments. Market dynamics, encompassing bullish, bearish, and volatile conditions, significantly influence investor sentiment and actions. Bull markets tend to foster optimism, potentially inciting a propensity for chasing returns. Conversely, bear markets can induce panic, exacerbating selling pressure. In volatile markets, the ambiguity of trends may result in erratic emotional fluctuations among investors.

These emotional fluctuations exert differentiated impacts on market volatility through various channels such as capital flows and trading frequencies. Based on literature research and case analysis methods, this paper focuses on the characteristics of investors' emotions in different market environments and their correlation mechanisms with volatility. It explores how emotional factors shape market stability and provides a new perspective for understanding the irrational fluctuations in the financial market.

2. Investor sentiments in a bull market condition

2.1. The definition and characteristics of a bull market

A bull market is a situation where the core index continues rising over a specific period (with a 20% increase as the threshold) and lasts for a considerable time. During this interval, market efficiency is pronounced, information dissemination occurs rapidly, and we observe an augmentation in trading volume and turnover rate, coupled with a sustained influx of capital [1].

Based on the analysis of sentiment indicators, the market sentiment is dominated by optimism and greed. The risk tolerance of investors has significantly increased. Investors tend to engage in the behavior of chasing higher prices. The market sentiment is positive, and capital continues to flow in. It presents a fluctuating pattern of "steady rise + minor correction".

2.2. A typical case of emotional changes during a bull market

Since 2010, the Shangzheng Index in China has experienced significant growth and a prolonged period of upward trend, which is widely recognized as a bull market: From July 2014 to June 2015, the Shanghai Composite Index rose by 148.9% (from 2050 points to 5178 points). The volatility of the stock market is determined by the amplitude of the Shanghai Composite, or Shangzheng Index, which is calculated as the difference between the highest and lowest points during the period divided by the lowest point multiplied by 100% [2]. The total stock market volatility reached 153% during this period, and the weekly average volatility was 3.1%.

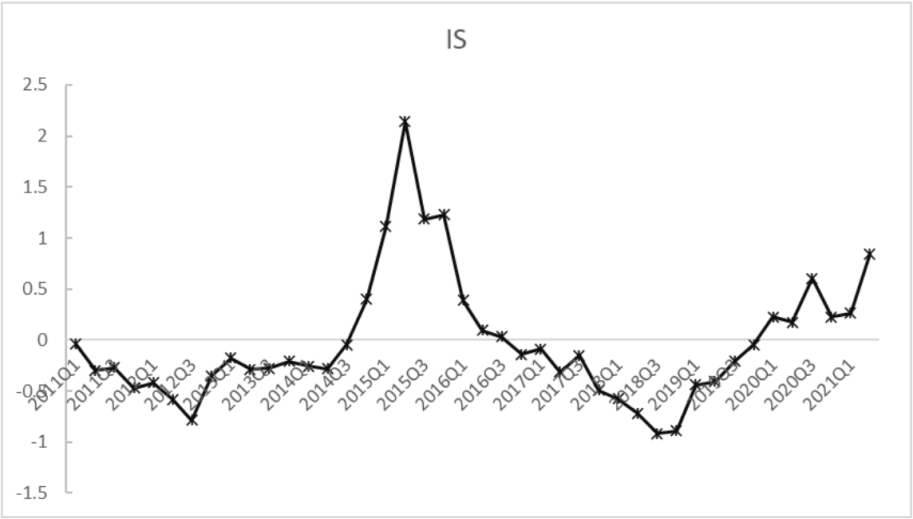

To gauge the fluctuations in investor sentiment, I employ the methodology of Baker and Wurgler, utilizing seven proxy variables: new investor count (NA), initial public offering volume (NIPO), initial public offering first-day return (RIPO), closed-end fund discount (DCEF), turnover rate (TURN), average drawdown (ADL), and the consumer confidence index (CCI). These are synthesized into a composite index of investor sentiment (IS) using the formula: IS = 0.187* NA+ 0.218*NIPO+ 0.221*RIPO + 0.118* DCEF +0.193*TURN + 0.184*ADL+ 0.036*CCI [3]. As shown in Figure 1, IS peaked in 2010 and in June 2015, exceeding 2.1. The upward trend of large-cap stocks and the hype from all parties led to a high level of investor sentiment, and all of the investors followed to invest, or in other words, speculate, further pushing the stock market bubble to its peak.

2.3. Path analysis in the optimistic scenario

During a bull market, investor sentiment is optimistic, and the policy catalysts (such as loose fiscal and monetary policies) lead to a large influx of funds. Morhachov's analysis indicates that the appreciation rate of equities in a bull market surpasses the currency's growth rate [4]. Investors, due to excessive confidence, develop a greedy mood and thus ignore risks. Subsequently, stock prices accelerate their rise and form a bubble. The herd effect precipitates unthinking conformity within a group [5]. In the Chinese stock market, retail investors hold a dominant position [2,6]. Due to retail investors' lack of investor expertise, they often do not learn from the lessons of previous bubbles [5]. They will succumb to the bandwagon effect, engaging in a cycle of "buying high and selling low," mimicking institutional investors in a speculative relay race. The profit effect will intensify investors' irrational emotions (such as excessive optimism and greed), leading to irrational trading behaviors and further exacerbating market volatility [6,7].

3. Investor sentiments in a bear market condition

3.1. The definition and characteristics of a bear market

A bear market is a situation where the core index continues to decline (with a 20% decline as the threshold) for a specific period. During this interval, market efficiency is suboptimal, information dissemination is impeded, and we observe a contraction in trading volume coupled with sustained capital efflux [1].

Based on the analysis of emotional indicators, the market sentiment is dominated by pessimism and panic. Investors' risk tolerance has declined and they have engaged in panic selling. Volatility often exhibits the characteristic of "sudden sharp drop", with frequent extreme fluctuations. Later, it shows the characteristic of "persistent downward trend", and the market's vulnerability has significantly increased.

3.2. A typical case of emotional changes during a bear market

From June 2015 to January 2016, due to the government's emergency contraction of market liquidity and reduction of financial leverage, the Shangzheng Index plummeted from 5,178 to 2,638 within nine months, with a decline of 47.01%. The comprehensive indicator of investor sentiment, IS, experienced a decrease from its apex of 2.1 to approximately 0.5. The aggregate stock market volatility attained a level of 96.3%, with a corresponding weekly mean volatility of 2.9% [2,3].

3.3. Path analysis in the pessimistic scenario

The market sentiment cooled, and policies began tightening and reducing liquidity. When the downward trend formed, institutions were the first to start taking stop-loss measures [8]. The decline in investor confidence precipitated herd behavior, characterized by panic selling, which significantly impaired the efficiency of information transmission within the market [1]. This further worsened the sentiment [7]. Some financial institutions could even manipulate the emotions of retail investors [9], and according to the research by Li Buhua et al., 90% of price fluctuations were caused by investor sentiment [10]. Eventually, the stock prices plummeted [2]. Furthermore, the inevitable bursting of the bubble, triggered by the failure to realize optimistic expectations, would precipitate a liquidity crisis. Consequently, the nascent stages of the bear market were characterized by pronounced volatility [11]. Conversely, Dai Chenyu's article posits that the protracted decline characteristic of the late-stage bear market, exacerbated by systemic risks emanating from interconnected markets like commodities, precipitates passive portfolio management. This risk aversion, in turn, attenuates market volatility during the terminal phase of the bear cycle [3]. Subsequently, the sentiment reversed, and the stock market entered a volatile state or a new bull market.

4. Investor sentiments in a volatile market condition

4.1. The definition and characteristics of a volatile market

A volatile market is when the core index shows no significant upward or downward trend over a specific period. Instead, it exhibits a repetitive oscillation within a specific range, fluctuating trading volumes and frequent sector rotations [1].

Market expectations are divided, and investors tend to wait and stay out of the market. Sentiment rapidly shifts between optimism and panic, and the price fluctuates within a specific range.

4.2. A typical case of emotional changes in a volatile market

From July 2013 to July 2014, the liquidity shortage incident in the Shangzheng Index impacted market liquidity. Investors were concerned about the economic outlook, and the policy aspect was in a stage of adjustment and observation. From 1966 to 2059 points, the market experienced a volatile trend, registering a 4% increase. The investor sentiment index, a holistic measure of investor sentiment, exhibited stability, fluctuating between -0.2 and -0.3. Aggregate market volatility reached 16.7%, while the weekly average volatility was a mere 0.3% [2, 3].

4.3. Analysis of the pathway in the rational scenario

In a volatile market, sector rotation is frequent, the profit effect is weak, and there is no clear sector to make money. Hence, investor sentiment stays rational continuously, most investors are waiting for a clear trend, and the herd effect is weak [10]. Furthermore, the subdued policy uncertainty and marginal divergence in market expectations foster rational investor behavior and facilitate efficient information dissemination, thereby mitigating susceptibility to systemic shocks originating from other markets, such as bonds or commodities [1]. Irrational emotions are the leading cause of market bubbles [10], while in a volatile market, market investors are less disturbed by irrational emotions. Hence, index prices are relatively stable, and volatility is low.

5. Conclusion

Based on the above three market states, the following conclusions can be drawn: Firstly, investor sentiment can affect stock market volatility, and the transmission mechanisms vary in different markets (bull market, bear market, and volatile market). Secondly, increasing stock market volatility will amplify investors' original optimistic or pessimistic sentiments, continuously forming a positive or negative cycle and constantly expanding the original market conditions. Because high returns or losses are accompanied by high irrational emotional fluctuations, irrational emotions significantly increase the stock market's volatility.

Thirdly, the overall volatility shows that the volatile market is lower than the bear and bull markets, while the overall volatility of the bull and bear markets is similar. The reason is that institutional and retail investors are irrational traders in the bull and bear markets, and irrational emotions will significantly intensify stock market volatility. In contrast, in the volatile market, rational emotions dominate investors’ minds, and rational emotions can inhibit the generation of fluctuations, thus having a minor impact on stock market volatility.

Finally, this study was conducted solely based on case studies and existing literature, without involving empirical analysis, so it has limitations. Future research will assemble high-frequency market data and granular sentiment proxies to estimate the quantitative nexus between investor emotions and stock-return volatility.

References

[1]. Ling Meijun. (2024). Research on the Efficiency Spillover Effects and Forecast of China's Financial Market under Different Market Conditions (Doctoral Dissertation, Nanjing University of Information Science and Technology). Doctor

[2]. Liang Yucong. (2022). Research on the Impact of Investor Sentiment on Stock Market Volatility (Master's Thesis, Beijing Jiaotong University). Master's Degree

[3]. Dai Chenyu. (2022). Research on the Impact of Economic Policy Uncertainty on Fund Herd Behavior (Master's Thesis, Southwestern University of Finance and Economics). Master's Degree

[4]. Morhachov, I., Chorna, O., Oleksandr, O., Martynov, A., Ovcharenko, I., Khandii, O., & Ivchenko, Y. (2022). The reasons for the growth of the US stock market. "European Journal of Sustainable Development", 11 (1), 124-124.

[5]. Agarwal, V., Taffler, R. J., & Wang, C. (2025). Investor emotions and market bubbles. Review of Quantitative Finance and Accounting, 64(1), 339-369.

[6]. Zou Xinyang & Wang Jifan. (2024). Quantitative Trading, Investor Sentiment and Market Volatility - An Analysis of Sentiment in Weibo Posts on Eastmoney Stocks. Contemporary Financial Research, 7(07), 53-69.doi: 10.20092/j.cnki.ddjryj.2024.07.005.

[7]. Thirumala, M., Verma, V., Dhanya, K. A., Mate, R., & Hota, C. K. (2023). Investor sentiment and stock market volatility: A behavioral finance perspective. Eurasian Chemical Bulletin, 3466-3477.

[8]. Yin Zhongli (2024). How to Enhance the Intrinsic Stability of China's Stock Market. Tsinghua Finance Review, (11), 47-50. doi: 10.19409/j.cnki.thf-review.2024.11.004.

[9]. Liu Xiaochen. (2024). Research on the Correlation between Investor Sentiment and Stock Market Volatility (Master's Thesis, Wuhan University of Technology). Master's Degree

[10]. Li Bo-hua, Zhao Bao-fu, Jia Kai-wei & Wu Jin-jin. (2023). Who Controls the "Rise and Fall"? — An Analysis of the Impact of Investors' Rational Changes on Stock Market Volatility. Operations Research and Management, 32(09), 193-199.

[11]. Feng, Z. (2024). Research on the impact of investor sentiment on stock volatility: An empirical analysis based on the Shanghai and Shenzhen 300 Index. Old Brand Marketing, (10), 49-51.

Cite this article

Yu,G. (2025). The Impact of Investor Sentiment on the Volatility of Different Stock Market Environments. Advances in Economics, Management and Political Sciences,225,168-172.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ling Meijun. (2024). Research on the Efficiency Spillover Effects and Forecast of China's Financial Market under Different Market Conditions (Doctoral Dissertation, Nanjing University of Information Science and Technology). Doctor

[2]. Liang Yucong. (2022). Research on the Impact of Investor Sentiment on Stock Market Volatility (Master's Thesis, Beijing Jiaotong University). Master's Degree

[3]. Dai Chenyu. (2022). Research on the Impact of Economic Policy Uncertainty on Fund Herd Behavior (Master's Thesis, Southwestern University of Finance and Economics). Master's Degree

[4]. Morhachov, I., Chorna, O., Oleksandr, O., Martynov, A., Ovcharenko, I., Khandii, O., & Ivchenko, Y. (2022). The reasons for the growth of the US stock market. "European Journal of Sustainable Development", 11 (1), 124-124.

[5]. Agarwal, V., Taffler, R. J., & Wang, C. (2025). Investor emotions and market bubbles. Review of Quantitative Finance and Accounting, 64(1), 339-369.

[6]. Zou Xinyang & Wang Jifan. (2024). Quantitative Trading, Investor Sentiment and Market Volatility - An Analysis of Sentiment in Weibo Posts on Eastmoney Stocks. Contemporary Financial Research, 7(07), 53-69.doi: 10.20092/j.cnki.ddjryj.2024.07.005.

[7]. Thirumala, M., Verma, V., Dhanya, K. A., Mate, R., & Hota, C. K. (2023). Investor sentiment and stock market volatility: A behavioral finance perspective. Eurasian Chemical Bulletin, 3466-3477.

[8]. Yin Zhongli (2024). How to Enhance the Intrinsic Stability of China's Stock Market. Tsinghua Finance Review, (11), 47-50. doi: 10.19409/j.cnki.thf-review.2024.11.004.

[9]. Liu Xiaochen. (2024). Research on the Correlation between Investor Sentiment and Stock Market Volatility (Master's Thesis, Wuhan University of Technology). Master's Degree

[10]. Li Bo-hua, Zhao Bao-fu, Jia Kai-wei & Wu Jin-jin. (2023). Who Controls the "Rise and Fall"? — An Analysis of the Impact of Investors' Rational Changes on Stock Market Volatility. Operations Research and Management, 32(09), 193-199.

[11]. Feng, Z. (2024). Research on the impact of investor sentiment on stock volatility: An empirical analysis based on the Shanghai and Shenzhen 300 Index. Old Brand Marketing, (10), 49-51.