1. Introduction

Palm oil is a tropical woody vegetable oil, currently the world’s largest in production, consumption, and international trade volume. Together with soybean oil and rapeseed oil, it is known as the "world's three major vegetable oils" with a 5,000-year consumption history; after refining and fractionation, its products (with varied melting points) are widely used in catering, food, and oil chemical industries. This study will explore palm oil’s global trade, China’s import dependence, and crisis response strategies by first grounding in key market basics. To analyze global trade, the study will focus on major producing regions (Southeast Asia and Africa, accounting for 88% of global production) and top countries (Indonesia, Malaysia, Nigeria). For China’s dependence, it will highlight China’s status as the world’s largest palm oil importer—with annual consumption of ~6 million tons (20% of total market volume)—and link this to reliance on key exporters like Indonesia and Malaysia. Finally, for crisis response strategies, the study will connect palm oil’s industrial applications and global supply layout to China’s demand, exploring ways to address supply disruptions amid high import dependence.

2. The situation of the palm oil industry in China

The majority of palm oil in China is sourced from imports. China is the world's third-largest importer of palm oil and the fourth-largest consumer, accounting for approximately 9% of the global palm oil market. The main importing countries are Malaysia and Indonesia. In 2022, the global ending stock of palm oil reached 1.674 million tons, a year-on-year increase of 5%, with Indonesia holding the largest share at 37.12%. In 2023, China's palm oil imports amounted to 4.33 million tons, an increase of 920,000 tons compared to the same period in 2022, reflecting a year-on-year growth of 27.2%.

In China's consumption structure, the demand for palm oil in the food and chemical industries accounts for as much as 70-80%, while consumption in the catering sector only makes up about 20%. In terms of pricing, the average import price of palm oil in China reached 1,200 per ton, while the average export price was 1,400 per ton, indicating a significant increase in import and export prices. In the future, as the self-sufficiency rate of edible vegetable oils in China improves, it is expected that the proportion of palm oil demand in industrial applications will continue to rise, and overall consumption will maintain steady growth.

3. Analysis of Indonesia's tariff-related policies in 2022[1]

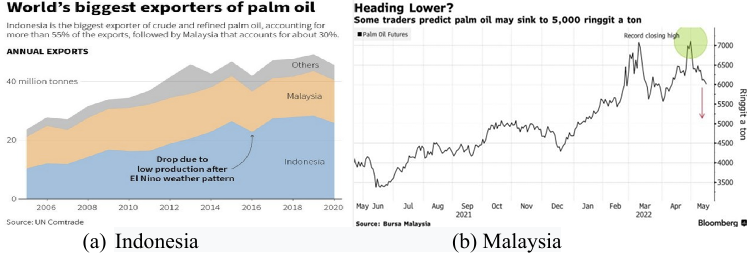

From April 28 to May 23, 2022, due to a domestic shortage of edible oil, Indonesia suspended the export of palm oil and related products, triggering fluctuations in global edible oil prices. After the lifting of the ban, Indonesia implemented an export licensing system and imposed the "Domestic Market Obligation" (DMO) tax.Figure 1 shows that during Indonesia's export ban in 2022, the export volume dropped sharply, similar as Malaysia, which indicates that China needs to explore more import sources.

As the world's largest exporter of palm oil, Indonesia has made multiple adjustments to its palm oil DMO policy and related taxes and fees. There was a major policy shift in 2022: the Minister of Trade announced the abolition of the palm oil DMO policy, replacing it with an increase in export taxes. The export tax was raised from a comprehensive upper limit of 375 USD per ton to 675 USD per ton; when the price reaches 1500 USD per ton, the highest tax rate for Crude Palm Oil (CPO) applies. The previous policy required exporters to sell a certain proportion of their planned exports of crude palm oil and refined palm oil in the domestic market at a fixed price (for example, 20% in January 2022, which was increased to 30% in March).

The Minister of Trade explained that the DMO policy was abolished because there was a price discrepancy between the DMO and market prices, and this discrepancy was improperly exploited by some parties. The subsequent adjustment of export taxes and fees aimed to achieve flexible regulation based on global crude palm oil and vegetable oil prices. When the price of crude palm oil is higher than that of other vegetable oils, export taxes and fees are reduced to enhance competitiveness; when the price is lower than that of other global vegetable oils, taxes and fees are increased. In addition, the maximum retail price of domestic edible oil has been raised (for instance, in 2024, the maximum retail price of domestic edible oil under the Domestic Market Obligation (DMO) was increased to 15,700 Indonesian rupiah per liter, up from the previous 14,000 Indonesian rupiah), in order to ease the export cost pressure on palm oil producers [2].

Significant changes then occurred in Indonesia's domestic market. Market expectations shifted rapidly, and prices of palm oil-related products fluctuated sharply. Domestic crushing plants believed that the export ban would lead to a tighter supply of crude palm oil in the domestic market, so they one after another raised their selling prices for crude palm oil. On April 25, the bidding price rose to 17,000 rupiah per kg, an increase of 600 rupiah per kg from before. In contrast, refineries, worried about disrupted raw material supply and impaired processing profits, instead lowered their purchasing prices for crude palm oil, with the bidding price dropping to 15,000 rupiah per kg. The huge divergence in the market outlook between buyers and sellers led to a stalemate in market transactions, and trading volume shrank sharply.

As time went on, inventory issues gradually became prominent. As of February 2022, Indonesia's palm oil inventory had exceeded 5 million tons, staying at a relatively high level. At that time, it was in the peak production season, with a monthly output of up to 4 million tons, while domestic monthly consumption was only 1.2-1.4 million tons (including 600,000-800,000 tons consumed in the biodiesel sector). Under the export ban, a large amount of palm oil could not be sold abroad, so inventories accumulated rapidly. Within just a few months, they neared Indonesia's storage capacity limit, exerting enormous pressure on warehousing facilities. Some enterprises even had to suspend production to alleviate the problem of inventory backlog.

3.1. Palm oil industry

The abolition of the DMO policy and the adjustment of export taxes and fees have had complex impacts on the palm oil industry. The abolition of the DMO policy means exporters are no longer required to sell part of their products at low prices in the domestic market, which has alleviated the pressure on enterprises to a certain extent [3]. The flexible adjustment of export taxes and fees can enhance the international competitiveness of products and promote exports when prices are favorable. However, the frequent changes in taxes and fees have also increased the uncertainty in business operations for enterprises. Enterprises need to invest more energy and costs to respond to policy changes and adjust production and sales plans.

3.2. Impact - palm oil market

Indonesia's palm oil DMO policy and the adjustment of export taxes and fees have had a significant impact on the global palm oil market. Policy changes directly affect Indonesia's palm oil export volume, thereby influencing the global supply-demand balance of palm oil. The impact lasted for approximately one year and showed signs of recovery by the end of 2022. For example, after the abolition of the DMO policy, the market expected a significant increase in Indonesia's palm oil export volume, which played a role in easing the then tight global palm oil market and stabilizing market price expectations.

4. Relevant data in Indonesia

According to data from the Indonesian Palm Oil Association (GAPKI), Indonesia’s total palm oil output in 2022 reached 51.248 million tonnes, a slight decrease of 0.1% year-on-year (YoY) compared with 51.30 million tonnes in 2021. Specifically, crude palm oil (CPO) output was 46.729 million tonnes (-0.34% YoY vs 2021’s 48.66 million tonnes), and crude palm kernel oil output stood at 4.50 million tonnes. This mild output decline was primarily driven by two factors: stagnant planting area and unit yield during the period, as well as the impact of natural factors (e.g., climate) on palm tree growth and fruit production. In terms of exports, Indonesia’s 2022 palm oil exports amounted to 30.803 million tonnes (-8.5% YoY vs 2021’s 33.674 million tonnes), mainly affected by the April 28–May 23 palm oil export ban; although the ban was later lifted and replaced by the Domestic Market Obligation (DMO) policy (linking export quotas to domestic sales), policy instability still exerted negative effects on exports. Nevertheless, the 2022 export value rose to 39.28 billion US dollars (vs 35.5 billion US dollars in 2021), driven by global oil supply-demand changes and growing biodiesel demand that jointly pushed up palm oil prices. Domestically, Indonesia’s 2022 palm oil consumption reached 20.96 million tonnes (+13.8% YoY vs 2021’s 18.42 million tonnes): food industry consumption (9.941 million tonnes) exceeded both the 2021 level (8.954 million tonnes) and the 2019 pre-pandemic level (9.86 million tonnes), reflecting strong demand; biodiesel-related consumption (8.842 million tonnes, +20.4% YoY vs 2021’s 7.342 million tonnes) was closely associated with Indonesia’s policy of promoting biodiesel industry development and raising biodiesel blending ratios [4].

Data from the China Commercial Industry Research Institute shows that China’s 2022 palm oil imports totaled 3.41 million tonnes, a 26.8% YoY decrease (down 1.24 million tonnes from 2021’s 4.65 million tonnes); the import value was 4.0035 billion US dollars (-3.9% YoY, down 160.623 million US dollars from 2021). Monthly data indicates that November 2022 saw the highest import volume (700,000 tonnes, +61.6% YoY, up 260,000 tonnes from November 2021) and import value (731.037 million US dollars, +64.1% YoY, up 285.644 million US dollars from November 2021), while cumulative imports and import value by November were 2.97 million tonnes (-29.3% YoY) and 3.5832 billion US dollars (-1.9% YoY), respectively. The significant import decline was attributed to multiple factors: Indonesia’s unstable palm oil export caused by policy adjustments, as well as China’s domestic oil market restructuring, enhanced substitution effects of other oils, and changes in domestic palm oil inventories and market demand. In terms of prices, despite China’s recent domestic palm oil output growth, 2022 domestic prices were significantly influenced by volatile international markets—international prices fluctuated sharply due to output changes in major palm oil-producing countries, geopolitics, energy price swings, and biodiesel policies. Domestic prices followed international trends and showed complex fluctuations (e.g., rising in line with tight global supply), and domestic output growth failed to fully offset international upward price pressure.

Food processing enterprises (e.g., instant noodle, bakery, and fried food manufacturers) are key palm oil consumers, and rising palm oil prices significantly increased their production costs. These enterprises faced two main responses: either absorbing compressed profits or adjusting product formulas (e.g., reducing palm oil proportion and increasing substitution with other vegetable oils such as soybean oil and rapeseed oil). However, substitution encountered challenges including technical adaptation issues (e.g., impacts on product taste and shelf life) and linked cost risks (as other vegetable oil prices were also affected), leading to frequent production plan adjustments that undermined production efficiency and product quality stability. Some enterprises transferred cost pressure to end products via price hikes, which reduced consumer purchasing willingness and suppressed market demand—an effect particularly evident for mass-consumption foods, where price increases more obviously impacted sales volume. This left enterprises caught in a dilemma between cost control and market share maintenance, with small and medium-sized enterprises suffering more severe impacts (some even facing operational difficulties or shutdowns), imposing short-term restructuring pressure on the industry. Below is Table 1 that demonstrate the policy changes and its specific impacts.

|

Time |

DMO Policy Changes |

Policy Impacts |

Impacts on China's Palm Oil Imports |

Impacts on China's Palm Oil Prices |

|

January 27, 2022 |

Implemented the DMO policy, requiring palm oil exporters to sell 20% of their planned export volume domestically |

Intensified the tight supply situation in the global vegetable oil market |

China's palm oil imports began to be restricted |

Drove up palm oil prices |

|

March 9, 2022 |

Increased the DMO ratio from 20% to 30% |

Further reduced the international palm oil supply. Analysts estimated that the new policy might lead to a monthly reduction of about 100,000 tons of palm oil in the global market |

The amount of palm oil that China could import further declined |

Palm oil prices rose further. The quotations of bulk palm oil in various domestic regions dropped by 540 - 640 yuan per ton |

|

March 17, 2022 |

Abolished the DMO policy and instead increased the palm oil export tax. The export tax increased from a comprehensive ceiling of 375 per ton to 675 per ton |

In the short term, the export volume might be somewhat restrained due to the increase in the export tax. However, in the long run, the policy change increased market uncertainties |

The change in imports was uncertain, and it was necessary to pay attention to subsequent export situations |

Price fluctuations intensified, and uncertainties increased |

|

December 1, 2022 |

Announced the implementation of a new DMO policy from December 1. The export quota coefficient was adjusted from 1:9 to 1:5 for six months |

Reduced Indonesia's export quota, and the international available palm oil decreased. The monthly export quota of refined palm oil was expected to decline by 40%, and Indonesia's exports were expected to decrease by about 3 million tons in half a year |

The amount of palm oil that China could import decreased |

Drove up palm oil prices, with palm oil rising by more than 3% |

5. Similar situation – Malaysian palm oil inventories hit 22-month low recently

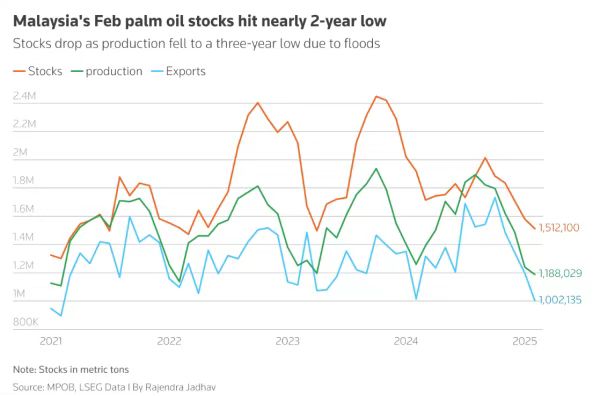

On March 10, 2025, Reuters reported that as of February 2025, Malaysian palm oil inventories had fallen for the fifth consecutive month, dropping to 1.51 million tonnes, the lowest level since April 2023. This trend has triggered market concerns about tight supply and pushed up palm oil futures prices.

As the world's second-largest palm oil producer, Malaysia's palm oil output reached 19.34 million tonnes in 2024, second only to Indonesia. According to data from the Malaysian Palm Oil Board, the country's crude palm oil production in February fell by 4.16% to 1.19 million tonnes due to the impact of floods, hitting the lowest level in nearly three years. Meanwhile, export volume decreased by 16.27% to 1 million tonnes, reaching the lowest point in four years.

Although inventories were slightly higher than market expectations, the tight supply situation has intensified due to declining production and reduced exports, driving up palm oil futures prices. In addition, the current palm oil price is higher than that of soybean oil, which has led some price-sensitive importing countries to cut their purchases, further affecting market demand. Traders expect that palm oil prices may fluctuate due to changes in demand and tight supply. It is worth noting that Indonesia, as one of the major importing countries, has recently been actively purchasing palm oil to replenish its inventories, which may provide short-term support for prices. Furthermore, Indonesia's biodiesel policy, by increasing the blending ratio of biodiesel, has significantly boosted domestic palm oil consumption, which may reduce export supply, thereby pushing up global palm oil prices and weakening the cost-performance advantage of palm oil relative to other vegetable oils.For China, a major global palm oil importer, Malaysia’s prolonged supply tightness and the knock-on effects of Indonesia’s policy adjustments have underscored the urgency of rolling out a comprehensive strategy to stabilize its palm oil supply chain [5].

6. Relevant analysis

As a "giant" accounting for 55% of global palm oil exports, Indonesia's policy changes are sufficient to trigger shocks in the global market. The export ban in April 2022 was like a boulder thrown into a lake, instantly breaking the balance between supply and demand: global palm oil futures prices soared by 18% within two weeks, and China, as the largest importer, bore the brunt. Data shows that China's palm oil imports that year plummeted by 26.8% year-on-year to 3.41 million tonnes, while the average import price rose against the trend by 14.3%, putting food processing enterprises and the chemical industry under pressure from a sharp increase in costs.

The complexity of Indonesia's policies is further reflected in subsequent adjustments. The cancellation of the DMO policy and the shift to a floating export tax, on the surface, aim to address the abuse of market price differences, but in essence, they reflect its difficult balance between domestic people's livelihood (controlling edible oil prices) and export interests. However, the side effects of frequent policy switches are significant: Indonesian domestic crushers and refineries have fallen into a trading deadlock due to divergent expectations, with inventories rapidly approaching the storage capacity limit from 5 million tonnes, and even forcing some enterprises to suspend production, highlighting the tearing effect of sudden policy changes on the industrial chain.

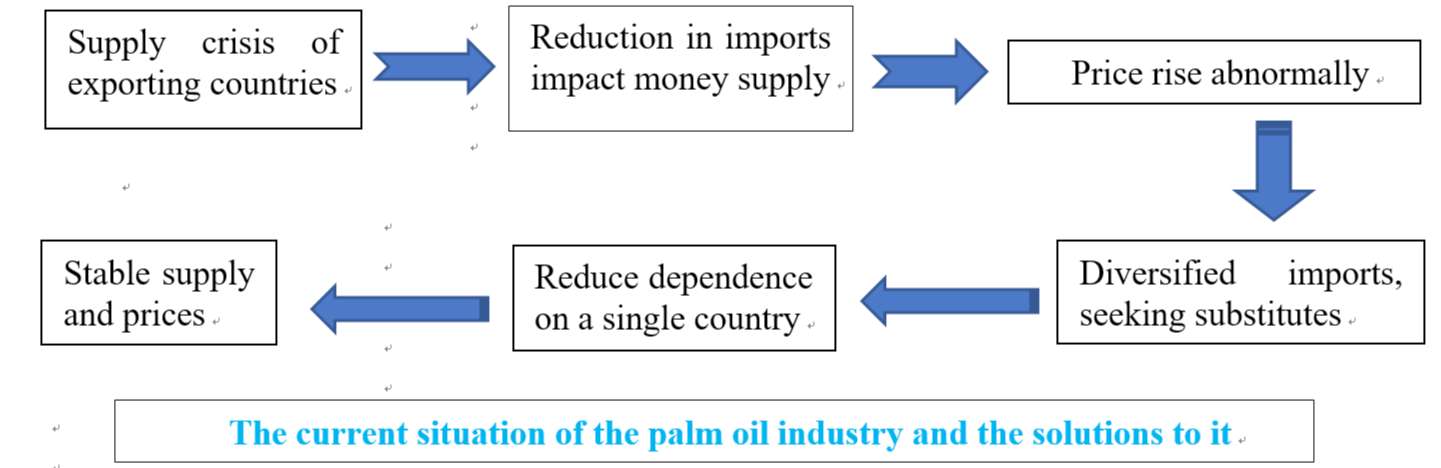

In the face of the supply chain crisis, the Chinese market has demonstrated strong market regulation capabilities, resolving the impact through a three-pronged approach of "expanding sources, reducing consumption, and avoiding risks" [6].

6.1. Restructuring the import landscape: from "dual-track dependence" to diversified layout

The Indonesian ban forced China to accelerate the adjustment of its import structure. In 2022, Malaysia's share of exports to China rose from 48% to 55%, surpassing Indonesia for the first time to become the largest supplier. A typical case is COFCO, one of China's leading grain and oil enterprises: after the 2022 ban, it quickly signed a three-year supply agreement with Malaysia's Sime Darby, increasing annual imports from the latter by 200,000 tonnes, while also partnering with Nigeria's Olam Group to build a local palm oil processing base, realizing monthly imports of 15,000 tonnes by 2023. This not only stabilized its own supply but also drove the industry's diversification process. At the same time, explorations in emerging supply sources such as Argentina and Nigeria have achieved initial results. Although the import volume in the short term is limited (for example, Argentina's share is less than 3%), it has broken the old pattern where "Indonesia + Malaysia" accounted for 90% of imports [7]. This diversification strategy once again showed its value when Malaysian inventories dropped to a 22-month low in 2025 – China increased imports from Africa and South America in advance, alleviating the impact of reduced supply from Malaysia.

6.2. Moving up the industrial chain

The 24-degree palm olein restricted by the Indonesian ban once accounted for 70% of China's imports, but domestic enterprises turned to importing crude palm oil (with import volume increasing by 37% year-on-year in 2022) and achieved product substitution using local refining and fractionation technology. This adjustment not only avoided policy restrictions but also promoted the upgrading of domestic oil processing industry: refineries in Shandong, Jiangsu and other regions improved fractionation efficiency through technological transformation, increasing the application ratio of high-melting-point palm stearin in the chemical industry from 35% to 48%, and enhancing the resilience of the industrial chain.

6.3. Escorted by financial tools: the "stabilizer" role of the futures market

The Dalian Commodity Exchange keenly captured market demand and accelerated the launch of oil option products in 2022. Data shows that the trading volume of palm oil futures options exceeded 5 million lots that year, and the proportion of enterprises using option portfolios to hedge price risks increased from 12% to 28%. A typical case is that a large food enterprise locked in the purchase cost of 20,000 tonnes of palm oil by buying put options, avoiding losses of over 10 million yuan amid international price fluctuations. The mature operation of the futures market has effectively buffered the impact of international price transmission to the domestic market.

However, in this process, the deep-seated problems exposed by the crisis cannot be ignored: China's palm oil self-sufficiency rate of less than 1% puts it in a passive position amid global supply chain fluctuations. But challenges have also spawned transformation momentum: in the food industry, the substitution ratio of soybean oil and rapeseed oil increased from 25% in 2021 to 38% in 2023; some instant noodle enterprises developed zero-palm-oil formulas, reducing the fluctuation range of product oil costs by 40%. The chemical sector has made even more breakthroughs – a biotechnology enterprise synthesized surfactants using waste oils, reducing the proportion of palm oil in detergent raw materials from 60% to 25% and opening up a new path for green substitution.

Secondly, the state has established a dynamic reserve mechanism. In 2023, the palm oil reserve scale increased by 300,000 tonnes compared with 2022, and for the first time, reserves of substitutes (such as peanut oil and soybean oil) were included in the unified regulation system. This broad "oil" reserve concept played a key role in 2024: when palm oil prices soared, 500,000 tonnes of soybean oil reserves were released simultaneously, which not only stabilized the prices of the oil sector but also avoided the limitations of single-variety regulation.

In international cooperation, through the Belt and Road Initiative, China has promoted integrated palm oil planting and processing projects in countries such as Nigeria and Sudan. By 2025, Chinese enterprises have built 12 palm oil industrial parks in Africa, with an expected annual palm oil output of 800,000 tonnes, equivalent to 13% of domestic annual consumption. This "overseas planting + domestic processing" model not only eases import pressure but also creates jobs locally, achieving a win-win situation for supply chain security and international cooperation.

7. Conclusion

Policy changes in Indonesia’s palm oil sector and production fluctuations in Malaysia have exposed China’s supply chain vulnerability from relying on a single exporter. However, China has mitigated short-term impacts by adjusting import strategies, using market tools, and promoting industrial transformation. Looking ahead, with bio-based material tech breakthroughs and deeper "Belt and Road" agricultural cooperation, China is expected to shift from a major palm oil importer to a key player in the global edible oil supply chain, while securing livelihoods, industrial safety, and advancing global agricultural cooperation.The crisis response experience here will offer valuable lessons for other bulk agricultural product supply chains. To build a more resilient edible oil supply chain, "diversified supply, market-oriented regulation, and technological substitution" remain key – and China’s efforts to strengthen palm oil supply chain resilience can serve as a model for other agricultural products. Deepening international cooperation and advancing tech innovation will achieve long-term supply chain stability, safeguarding livelihood needs and industrial security while boosting China’s international market discourse power.

References

[1]. Palm Oil: Frequent Changes in Indonesia's Export Policies - What Impact Will the New DMO Policy Have on the Market? (2022, May 24th) n.p. Sina Finance https: //finance.sina.com.cn/roll/2022-05-24/doc-imizmscu3076116.shtml

[2]. Negara, S.D., Narjoko, D.A. and Hayakawa, K. (2024), Impacts of Tariff Rates on Input Source Choice: Evidence from Indonesia. The Developing Economies, 62: 28-44. https: //doi.org/10.1111/deve.12380

[3]. Comyns, B., Meschi, P.-X., & Norheim-Hansen, A. (2023). Firms' responses to environmental misconduct accusations under the condition of contested practice complexity: Evidence from the palm oil production industry. Business Strategy and the Environment, 32(8), 5332–5348. https: //doi.org/10.1002/bse.3419

[4]. Goh, C.S. and Potter, L. (2022), Bio-economy for sustainable growth in developing countries: The case of oil palm in Malaysia and Indonesia. Biofuels, Bioprod. Bioref., 16: 1808-1819. https: //doi.org/10.1002/bbb.2381

[5]. UK Supermarkets Promote Welfare Reforms for Shrimp and Aquatic Products | US Plans to Strengthen Food Additive Regulation (2025,Mar 16th) n.p. Powerful Nation Bolsters Agriculture https: //mp.weixin.qq.com/s/UJ61r-u1p0k1cTQPDucocg

[6]. Hidalgo, L. M. G., de Faria, R. N., Souza Piao, R., & Wieck, C. (2023). Multiplicity of sustainability standards and potential trade costs in the palm oil industry. Agribusiness, 39, 263–284. https: //doi.org/10.1002/agr.21768

[7]. Purnama, I., Mutamima, A., Aziz, M., Wijaya, K., Maulida, I.D., Junaidi, J., Sari, K., Effendi, I. and Dini, I.R. (2025), Environmental Impacts and the Food vs. Fuel Debate: A Critical Review of Palm Oil as Biodiesel. GCB Bioenergy, 17: e70043. https: //doi.org/10.1111/gcbb.70043

Cite this article

Liang,F. (2025). How Can China Maintain Stable Supply of Palm Oil Amid Supply Crises in Major Importing Countries. Advances in Economics, Management and Political Sciences,225,180-188.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEMGD 2025 Symposium: Resilient Business Strategies in Global Markets

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Palm Oil: Frequent Changes in Indonesia's Export Policies - What Impact Will the New DMO Policy Have on the Market? (2022, May 24th) n.p. Sina Finance https: //finance.sina.com.cn/roll/2022-05-24/doc-imizmscu3076116.shtml

[2]. Negara, S.D., Narjoko, D.A. and Hayakawa, K. (2024), Impacts of Tariff Rates on Input Source Choice: Evidence from Indonesia. The Developing Economies, 62: 28-44. https: //doi.org/10.1111/deve.12380

[3]. Comyns, B., Meschi, P.-X., & Norheim-Hansen, A. (2023). Firms' responses to environmental misconduct accusations under the condition of contested practice complexity: Evidence from the palm oil production industry. Business Strategy and the Environment, 32(8), 5332–5348. https: //doi.org/10.1002/bse.3419

[4]. Goh, C.S. and Potter, L. (2022), Bio-economy for sustainable growth in developing countries: The case of oil palm in Malaysia and Indonesia. Biofuels, Bioprod. Bioref., 16: 1808-1819. https: //doi.org/10.1002/bbb.2381

[5]. UK Supermarkets Promote Welfare Reforms for Shrimp and Aquatic Products | US Plans to Strengthen Food Additive Regulation (2025,Mar 16th) n.p. Powerful Nation Bolsters Agriculture https: //mp.weixin.qq.com/s/UJ61r-u1p0k1cTQPDucocg

[6]. Hidalgo, L. M. G., de Faria, R. N., Souza Piao, R., & Wieck, C. (2023). Multiplicity of sustainability standards and potential trade costs in the palm oil industry. Agribusiness, 39, 263–284. https: //doi.org/10.1002/agr.21768

[7]. Purnama, I., Mutamima, A., Aziz, M., Wijaya, K., Maulida, I.D., Junaidi, J., Sari, K., Effendi, I. and Dini, I.R. (2025), Environmental Impacts and the Food vs. Fuel Debate: A Critical Review of Palm Oil as Biodiesel. GCB Bioenergy, 17: e70043. https: //doi.org/10.1111/gcbb.70043