1. Introduction

In recent years, geopolitical tensions have been a significant factor in affecting the strategies and decision-making of international companies. A clear example is shown in the U.S.-China tech conflict, where China and the U.S. adopted different policies in the tech industry, turning the markets into battlegrounds. The U.S. CHIPS and Science Act of 2022, which offered billions in subsidies for domestic semiconductor production while also restricting tech exports to China, exemplifies this shift. In response, China banned American memory chipmaker Micron from critical infrastructure in 2023, charging the company with national security risks. These moves by the Chinese and U.S. governments indicate a trend of using policies as a weapon, forcing companies to adjust their strategies for global expansion under high pressure.

Because of this turbulence, international companies may choose to retreat from hostile markets to avoid losses, or sustain their business and even expand despite the risks. Many companies decisively choose to contract their businesses in hostile markets to cut losses to the maximum extent, yet Micron is an exception. Just a few weeks after China banned its chips in 2023, the company announced a $600 million expansion in Xi’an. This paradox raises the question of why a company would invest so heavily in a market that has just restricted it? What are the justifications for the investment that the company explains to its stakeholders? Meanwhile, although scholars have extensively studied how companies justify their actions in sustaining or retreating the business under geopolitical risk by analyzing political capabilities [1], strategic silence [2], or corporate diplomacy [3], there is a critical puzzle that they overlook: why do some firms choose expansion over retreat even when there is high restriction in the market, and how do they legitimize this choice. We have limited knowledge about the reasons to justify doubling down on the investment when logic suggests pulling back.

Our research will focus on this gap by analyzing Micron’s controversial actions under the pressures of both the U.S. and Chinese governments. We explore how Micron legitimized this paradox by examining its communication strategies, how it copes with different governments, and how it convinces stakeholders about its decision. Moreover, beyond Micron’s case, the study also provides suggestions for international companies that may encounter geopolitical tensions when expanding into global markets about the possibility of turning risks into opportunities.

2. Literature review and theoretical framework

2.1. Mnes under geopolitical tensions

Studies have focused on how multinational companies (MNEs) take risk evaluation and adjust their management strategies under geopolitical uncertainties. Stephanie Tonn Goulart Moura proposes two main aspects: political skills and investment flexibility [1]. The former implies the firm’s ability to work with government and regulatory actors to interpret and negotiate policy changes, and the latter suggests supply chain management and asset redeployment [1].

Moreover, diplomatic theory is incorporated into MNEs’ risk management [4]. Christopher Andrew Hartwell redefines the idea of 'corporate diplomacy,’ to the extent that companies are encouraged to actively observe and analyse diplomatic changes for making their decisions [4]. It is to say that MNEs are not only economic actors but also diplomats who deal with state actors and match their strategies with wider geopolitical trends [4].

2.2. Legitimizing strategies

Others have studied how firms legitimatise their decisions and operational strategies. Three types of legitimacies are suggested: pragmatic legitimacy allows stakeholders to see direct benefits from the operations, like job creation or economic growth; moral and cognitive legitimacies explain the social values of the operations, like sustainability or human rights, and show the firm’s actions as unavoidable in the given context [5].

Furthermore, silence is considered a communication tool [2]. Instead of responding immediately to the shock, companies may choose to stay silent during early crisis to avoid confrontation meanwhile wait how the circumstances will develop and formulate a thoughtful action at the right time to respond [2].

2.3. The semiconductor industry

The semiconductor industry provides a context to study how MNEs react to geopolitical challenges. The U.S. CHIPS and Science Act of 2022 forced U.S. semiconductor firms to stop dependence on foreign chip manufacturing. As a result, MNEs might change their investments in countries like China. This policy change suggests that firms must strengthen operational flexibility with management strategies in order to survive in an increasingly nationalism-driven global economy.

Yadong Luo and Ari Van Assche suggest four strategies for MNEs in facing rising techno-geopolitical uncertainties. First, firms shift their operations to politically favored places in order to keep subsidies or regulatory benefits [6]. Second, restructuring supply chains based on geography decreases risks associated with limited access [6]. Third, resilience measures, such as dual sourcing and warehousing critical components, allow businesses to continue running despite restrictions [6]. Lastly, corporate diplomacy encourages negotiations with politicians to improve the regulatory environment in ways that suit business interests [6].

2.4. Theoretical framework

Most existing studies on MNE strategies under geopolitical tensions focus on how firms reply to challenges, but there is a lack of research on how they can pursue sustained expansion, particularly in high-risk regions. Some studies communication strategies for managing geopolitical risks, they rarely show how firms justify their expansion into contested or politically sensitive areas. This study seeks to fill these gaps by conducting a context-specific review of a US firm’s expansion into China amidst US-China tech tensions.

Theoratically, the idea of corporate diplomacy highlights long-term relationship building with stakeholders, such as governments, NGOs, and civil society, in order to minimize political risks and protect credibility in unpredictable environments. In the context of rising techno-geopolitical uncertainty, corporate diplomacy is refined as a core strategy alongside geo-strategy, reconfiguration, and resilience. It has developed from a reactive, risk-oriented approach to a more proactive tool for shaping the external environment, coordinating across global governance levels, and navigating techno-nationalist policies.

While corporate diplomacy usually seeks to work with external groups like governments, regulators, and local communities, it often overlooks the communication with shareholders. In sensitive geopolitical circumstances, shareholders may be cautious or concerned about reputation and finances, therefore corporations must diplomatically justify such initiatives as long-term moves. As a result, our research broadens the definition of corporate diplomacy to include shareholder engagement, a critical aspect of managing global expansion.

3. Methodology

This research draws upon a qualitative single-case study design with a focus on the American semiconductor firm, Micron Technology. The reason for choosing Micron stems from the research objective on how the firm sustains competitive survival and growth for the business with some strategic choices and narratives done in the midst of the China and United States geopolitical clashes.

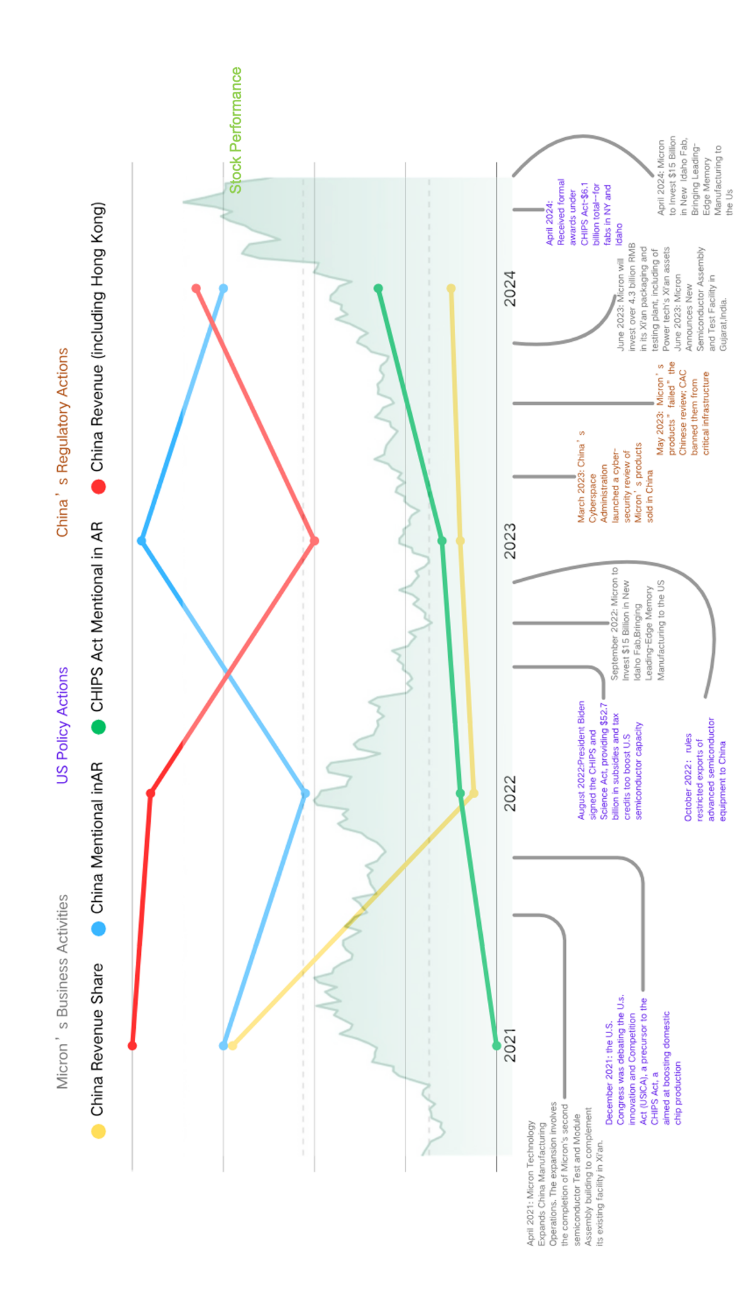

For the purposes of the research, firm-level data covering the years 2021-2024 were collected for the pre-crisis, early-crisis, mid-crisis, and post-crisis phases. The annual reports, SEC filings, proxy statements, press releases, media articles, and transcripts/decks of the earnings calls form the data. Such sources cumulatively yield a holistic perspective of Micron’s business and public relations activities during the period. The data collection procedure was consolidated into a single composite graph to systemically illustrate the process (Figure 1).

Additionally, a combination of techniques is employed in data analysis. The first form of narrative analysis consists of theme coding in which narratives on the firm’s strategy are identified for various timelines, for instance, prior and subsequent to the bans, and during the investment and decision making processes regarding the factories. This aids the analysis of how the firm diffuses political resistance oppositions. Temporal comparison is used to examine the time sequences of Micron’s activities against geopolitical developments, determining its strategic responsiveness and policy-dodging agility.

4. Findings

4.1. Strategic framing of business activities

Based on the data collected, we identify two major shocks—the CHIPS Act in 2022 and the CAC ban in 2023—along with Micron’s corresponding actions and official justifications, which are summarized as follows:

|

Shock |

Business Activity |

Communication and Justification |

|

CHIPS and Science Act in 2022 |

Micron announced expansion of leading-edge memory manufacturing in the United States through over $150 billion in planned investments including $15 billion to build a leading-edge memory fab in Idaho and up to $100 billion over 20+ years for a megafab in New York. |

Policy Alignment and Public Legitimization: Micron positioned its $100 billion megafab investment in Central New York as aligned with the CHIPS and Science Act’s goals of restoring U.S. semiconductor leadership, strengthening supply chains, and advancing inclusive growth—enforced through a $500 million Community Investment Framework and high-profile stakeholder engagement with President Biden. |

|

Maintaining the status quo in China. |

Strategic silence: Micron has noticeably reduced references to China in its annual reports, press releases, and other official statements, from 45 times in 2021 before CHIPS Act to 32 times in 2022 during CHIPS Act. This can be seen as a form of strategic silence, aiming to minimize political scrutiny and maintain its operational status quo in China amid escalating U.S.–China tensions. |

|

|

Market Significance: Earnings reports and SEC filings highlight China's key role in the company's financial performance. For example, Micron claims in its 2022 10-K filing those sales to customers in Mainland China and Hong Kong account for more than 25% of overall revenue, making the region one of the company's largest single markets. |

||

|

Non-commitment Disclosure: Micron mentioned China and related risks in its 2022 10-K filing yet made no mention of operational changes, instead presenting China in a neutral tone alongside other markets, "our business, operations, and sales are… subject to risks associated with domestic and international operations, including in China…". |

||

|

CAC ban in 2023 |

Micron began construction on a new leading-edge memory manufacturing fab in Idaho, with a $15 billion investment and a $75 million commitment to workforce and community development. |

Policy-Driven Expansion: Micron explicitly mentioned CHIPS policy: "Micron’s Idaho investment plans will be enabled by the anticipated grants and credits provided by the CHIPS and Science Act…" (press release) framing the expansion as part of a national strategic initiative, not just a business decision. |

|

Incentive-based Financial Justification: "We expect to benefit from government grants and investment tax credits related to the U.S. CHIPS and Science Act as we expand our manufacturing footprint in the United States." (2023 10-K filing) Micron presents CHIPS Act incentives as expected financial benefits through grants and tax credits that will offset the high capital costs of U.S. expansion, reduce investment risk, and improve long-term return on investment. |

||

|

Local Impact Communication: emphasis on job creation: “over 17,000 new Idaho jobs… 2,000 Micron direct jobs.” |

||

|

A significant expansion of Micron’s assembly and packaging operations in China with $600 million investment in Xi’an operations, which includes purchasing assembly equipment from Powertech Semiconductor Xi’an and constructing a new building at the site. |

Financial Dependence: "Micron’s revenue with companies headquartered in mainland China and Hong Kong, including direct sales as well as indirect sales through distributors, accounts for approximately a quarter of Micron’s worldwide revenue and remains the principal exposure." (Q4-23 Earnings Deck) |

|

|

Resilience and Relationship Reassurance: Micron emphasized its commitment to serving unaffected customer segments in China, leveraging long-standing relationships and technological leadership, while positioning its China presence as critical to sustaining global market share amid near-term regulatory challenges. (Q4-23 Earnings Deck) |

||

|

Leadership Appointment: Micron appointed Betty Wu as General Manager of Micron China, tasking her with aligning local operations with global strategy, strengthening partnerships, and advancing the company’s presence in China’s tech ecosystem. |

||

|

Local Embeddedness and Workforce Commitment: Micron highlights its local economic contribution through job creation and retention, offering new contracts to 1,200 Powertech Xi’an employees and adding 500 new positions to expand its workforce to over 4,500. |

||

|

Executive-Level Commitment: Micron President and CEO Sanjay Mehrotra stated that the new investment reflects the company’s unwavering commitment to its China business and team, highlighting its 20-year presence and strong customer relationships in the country. |

||

|

Corporate Social Responsibility: Micron donated ¥1 million to flood relief in China and highlighting past charitable efforts, Micron signals long-term commitment to Chinese society beyond commercial interests. It frames itself as a responsible, embedded actor in the community. |

||

|

Leadership Appointment: Micron appointed Jeff Li as Head of Government Affairs in China, signaling its intent to strengthen ties with Chinese authorities, ensure policy alignment, and reinforce its long-term commitment to the market. |

||

|

Corporate Social Responsibility: By funding STEM education for over 600 disadvantaged children in China, Micron reinforces its social embeddedness, aligning with the UN Sustainable Development Goals and showing commitment to local community development beyond profit-making. |

||

|

Diplomatic Engagement and Stakeholder Alignment: Micron CEO Sanjay Mehrotra met with China’s Minister of Commerce Wang Wentao to discuss Micron’s investment expansion in Xi’an and reaffirm the company’s long-term commitment to China through deeper collaboration with government, industry, and local communities. |

4.2. Communication strategies across four dimensions

Micron’s expansion efforts and communication strategies can thus be grouped into four key dimensions: government and stakeholder engagement, shareholder diplomacy, policy alignment, and communicative balancing.

4.2.1. Government and stakeholder engagement

First, government and stakeholder engagement are essential for building external legitimacy, which is particularly crucial for maintaining trust and credibility among Chinese stakeholders. Although the CAC decision remained unclear and evolving at the time, some Micron customers, including mobile device manufacturers, were approached by Chinese government representatives or Critical Information Infrastructure (CII) operators regarding the continued use of Micron products. In June 2023, the CAC cited a cybersecurity review to justify banning Micron’s memory products from use in critical infrastructure applications in China [7] While the ban applies only to a narrow range of applications, Chinese buyers may perceive it as a broader government signal to cease all purchases, despite official claims that the restriction is targeted and limited in scope [8].

In response, Micron made a concerted effort to strengthen its ties with Chinese leaders and communities. This includes a high-profile meeting between CEO Sanjay Mehrotra and China’s Minister of Commerce, signaling diplomatic intent and a willingness to cooperate. To enhance local engagement, Micron appointed Betty Wu as General Manager and Jeff Li as Head of Government Affairs in China, both tasked with aligning company operations with domestic governance structures and stakeholder expectations. On the ground, Micron demonstrated commitment by retaining and expanding its workforce in Xi’an and launching community-focused corporate social responsibility initiatives, such as flood relief donations and STEM education programs for underprivileged children. These efforts strengthen Micron’s external legitimacy in China. The company presents itself as responsible, locally embedded, and willing to collaborate. This image is especially important under intense geopolitical scrutiny.

4.2.2. Shareholder diplomacy

Second, shareholder diplomacy builds internal legitimacy with investors. Micron faces both regulatory risk and potential revenue loss. To maintain investor confidence, the company must justify its expansion in China with clear financial reasoning and consistent strategy. It uses targeted communication to secure shareholder support. In its 2023 10-K filing, Micron pointed to expected CHIPS Act tax credits. The company framed these credits as a way to reduce capital risk and improve long-term returns. Simultaneously, Micron underscores the economic indispensability of the Chinese market, responsible for roughly 25% of its global revenue, thus portraying continued engagement as financially necessary. To avoid provoking political sensitivity while sustaining investor reassurance, the company uses resilience messaging to affirm its commitment to “unaffected” customer segments in China, and adopts a form of strategic silence by reducing explicit references to China in public-facing documents. In its risk disclosures, China is framed in neutral, non-alarmist terms alongside other global markets. Collectively, these strategies enable Micron to diplomatically justify its China presence as a rational, value-generating choice, while managing reputational and regulatory risk through calibrated ambiguity and controlled messaging.

4.2.3. Policy alignment and public legitimation

Third, policy alignment with the U.S. government balances dual-market legitimacy. Because the U.S.–China tech conflict is fundamentally shaped by both states’ political agendas, Micron must reassure American stakeholders that its China operations do not undermine U.S. national interests. Micron framed its U.S. expansion—especially the $100 billion megafab in New York—as aligned with the CHIPS and Science Act and the Biden administration’s goal of restoring U.S. semiconductor leadership. The company did not present this as a purely commercial move. It described the project as a contribution to national strategy and public value. Micron reinforced this message by highlighting job creation and regional economic growth. These claims strengthened its political capital at home. By presenting itself as cooperative and policy-compliant in the U.S., Micron created political cover to continue global operations, including in China. This balancing act was crucial in an era of techno-nationalist scrutiny.

4.2.4. Communicative balancing

Fourth, communicative balancing helps dual market legitimacy. To this end, Micron adjusted its official language and expression to fit the expectations of both the U.S. and Chinese governments and markets. It emphasized the expansion sponsored by the CHIPS Act, meanwhile, it reassures China of its long-term commitment. This dual narrative inhabited into the two juxtaposed audiences: in the U.S., Micron emphasizes national alignment; in China, it promotes commitment and operational continuity.

Moreover, strategic silence reduces political and public attention during sensitive moments. At the height of the CHIPS Act, Micron limited its direct mentions to China. In official filings, it used neutral language, placing China alongside other markets without singling it out. It lowered political visibility while creating space for observing developments before committing a position.

Micron’s responses also corresponded to the evolving dynamics of the US-China tech war. During early-crisis, it aligned with US industrial policy by announcing significant domestic expansion. Whereas, towards the Chinese market, Micron applied strategic silence signaling a wait-and-see stance rather than an immediate reaction. Since geopolitical tensions are, by definition, shaped by the shifting diplomatic relations between states, they carry an inherent sense of temporality and incompleteness. Micron appeared to recognize this, timing its public re-engagement with China only after China’s own policy response had become clearer. It suggests that for multinational corporations, even under geopolitical tensions, decisions in investing or expanding in high-risk environments are not necessarily rejected, but strategically delayed until the diplomatic landscape becomes more legible.

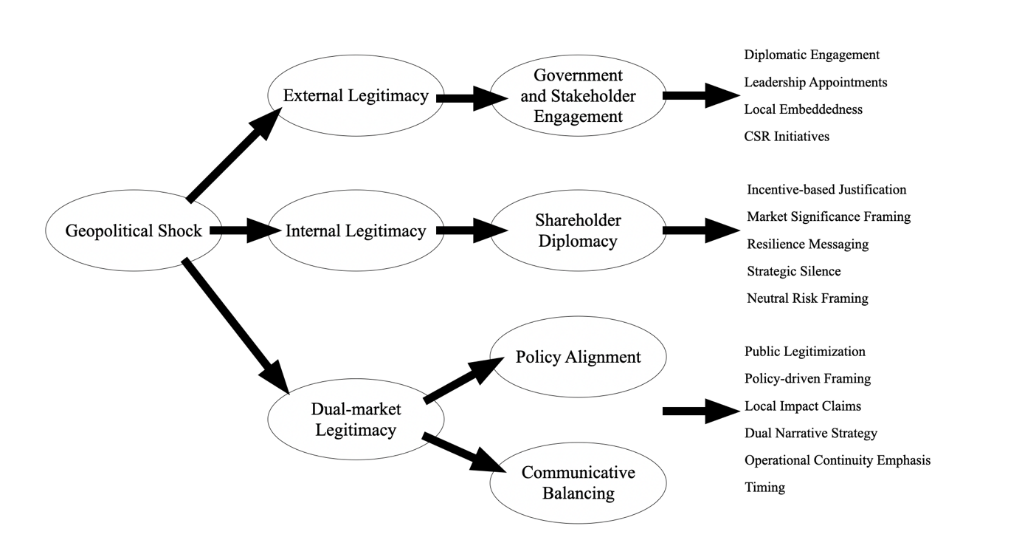

4.3. Legitimacy-building model for international expansion under geopolitical shock

Based on the findings presented in 4.1 and 4.2, a model was developed to show how firms build and maintain legitimacy during geopolitical shocks (Figure 2). The model identifies three key aspects—external legitimacy, internal legitimacy, and dual-market legitimacy—and each associated with distinct communication strategies. Firstly, external legitimacy requires government and stakeholder engagement, including diplomatic ties, leadership appointments, local embeddedness, and CSR initiatives. Secondly, internal legitimacy depends on shareholder diplomacy including justifying the importance of the market, resilience messaging, strategic silence, and neutral risk language, and etc. Finally, dual-market legitimacy contains policy coordination and communicative balance. It needs public credibility, policy framing, local effect claims, dual narratives, and precise timing. In general, the model examines how corporations overcome legitimacy difficulties using communication strategies and continue to expand internationally in the face of geopolitical instability.

5. Discussion

5.1. Conclusion

The geopolitical fractures presented by the U.S.-China conflict have posed significant challenges for multinational companies. However, Micron’s expansion strategy during the tension set up an excellent example. As our analysis shows, Micron responded to China’s ban with a clear expansion under multifaceted legitimacy. The company established relationships with stakeholders in China through diplomatic activities and social investments, framing the expansion as a financial imperative and therefore a policy-driven initiative to maintain investor confidence. The narrative balancing act was complicated across both markets, as it involved appearing wholly compliant with U.S. interests while maintaining a neutral position in China.

Micron thus fills a significant gap in current research, which often focuses on either stakeholder management or investor relations, but rarely brings the two together. This is what the case of Micron teaches: to gain a well-founded face of legitimacy while expanding amid geopolitical tensions, a company needs to have structured legitimacy on three levels: social engagement, financial justification, and systemic balance. Moreover, this study demonstrates that for multinational companies, geopolitical risk can be leveraged as an opportunity by effective communication with external stakeholders, appropriate reasoning to convince internal shareholders, and, most crucially, collaboration with a diverse range of interest-related parties. Ultimately, the research reframes corporate expansion in an era of techno-nationalism as an act that builds legitimacy rather than a simple risk-taking endeavor.

5.2. Implications

The model presents a multi-layered framework of corporate legitimacy under geopolitical tension. Stakeholder engagement works at the societal and regulatory level. Shareholder diplomacy functions at the financial and communicative level. Dual-market legitimacy operates at the systemic level. These are not separate strategies. They interact and reinforce one another. External engagement shapes political acceptance. Shareholder diplomacy builds investor confidence and secures capital. Dual-market legitimacy balances between two geopolitical systems.

Micron’s case shows that corporate actions face scrutiny from economic, political, and symbolic perspectives. So legitimacy has to be built across public, investor, and geopolitical spheres at the same time. This also marks a clear shift. Companies go from defensive risk management to active legitimacy-building.

References

[1]. Tonn Goulart Moura, S., Lawton, T. C., & Tobin, D., Cork University Business School & Brunel Business School. How do multinational enterprises respond to geopolitics? A review and research agenda [J]. Multinational Business Review, 2023, 1-21.

[2]. Pang, A., Jin, Y., Seo, Y., Choi, S. I., Teo, H., Le, P. D. & Reber, B. Breaking the sound of silence: explication in the use of strategic silence in crisis communication [J]. International Journal of Business Communication, 2021, 59(2), 219–241.

[3]. Steger, U. & International Institute for Management Development (IMD). Corporate diplomacy [M]. John Wiley & Sons Ltd., 2003.

[4]. Hartwell, C. A. & Ursprung, D. Diplomacy and MNE strategy: how international relations can influence international business [J]. Multinational Business Review, 2024, 32(2), 226-240.

[5]. Suchman, M. C. Managing legitimacy: strategic and institutional approaches [J]. The Academy of Management Review, 1995, 20(3), 571–610.

[6]. Luo, Y. & Van Assche, A. The rise of techno-geopolitical uncertainty: implications of the United States CHIPS and Science Act [J]. Journal of International Business Studies, 2023, 54(8), 1423–1440.

[7]. Olcott, E. & Sevastopulo, D. China bans Micron’s products from key infrastructure over security risk [J]. Financial Times, 2023-05-21. https: //www.ft.com/content/e6a8e034-cbc2-4267-9b41-b7670db7d130

[8]. Chorzempa, M. & Peterson Institute for International Economics. How US chip controls on China benefit and cost Korean firms [J]. Peterson Institute for International Economics Policy Brief 23-10, 2023, 1-13.

Cite this article

Feng,J.;Zhang,Y.;Liu,H.;Li,S. (2025). How Do International Companies Justify Expansion amid Geopolitical Tension: A Case Study of Micron. Advances in Economics, Management and Political Sciences,224,83-91.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tonn Goulart Moura, S., Lawton, T. C., & Tobin, D., Cork University Business School & Brunel Business School. How do multinational enterprises respond to geopolitics? A review and research agenda [J]. Multinational Business Review, 2023, 1-21.

[2]. Pang, A., Jin, Y., Seo, Y., Choi, S. I., Teo, H., Le, P. D. & Reber, B. Breaking the sound of silence: explication in the use of strategic silence in crisis communication [J]. International Journal of Business Communication, 2021, 59(2), 219–241.

[3]. Steger, U. & International Institute for Management Development (IMD). Corporate diplomacy [M]. John Wiley & Sons Ltd., 2003.

[4]. Hartwell, C. A. & Ursprung, D. Diplomacy and MNE strategy: how international relations can influence international business [J]. Multinational Business Review, 2024, 32(2), 226-240.

[5]. Suchman, M. C. Managing legitimacy: strategic and institutional approaches [J]. The Academy of Management Review, 1995, 20(3), 571–610.

[6]. Luo, Y. & Van Assche, A. The rise of techno-geopolitical uncertainty: implications of the United States CHIPS and Science Act [J]. Journal of International Business Studies, 2023, 54(8), 1423–1440.

[7]. Olcott, E. & Sevastopulo, D. China bans Micron’s products from key infrastructure over security risk [J]. Financial Times, 2023-05-21. https: //www.ft.com/content/e6a8e034-cbc2-4267-9b41-b7670db7d130

[8]. Chorzempa, M. & Peterson Institute for International Economics. How US chip controls on China benefit and cost Korean firms [J]. Peterson Institute for International Economics Policy Brief 23-10, 2023, 1-13.