1. Introduction

Under the macro guidance of the "dual-carbon" strategy, the green transformation of the supply chain has become a key issue in the development of the new energy vehicle industry—driven by this, the industry is entering a critical phase of transformation efforts. As the supply chain of new energy vehicles falls into the key field of carbon emission control, the advancement of low-carbon development across its entire chain is not only a mandatory task for enterprises to respond to the national strategy, but also undertakes the core mission of enhancing the overall green competitiveness of the industry. The effectiveness of this transformation, however, can be measured primarily through three categories of core outcome variables: the reduction in total carbon emissions of the supply chain, the increase in the proportion of green products, and the optimization of low-carbon operation efficiency throughout the chain. The performance of these variables directly determines the implementation quality of the dual-carbon goals at the industrial level.

The "collaborative practice" discussed in this article refers to the ESG collaborative actions initiated by BYD, as a core enterprise, to promote supply chain response to the "dual carbon" goal and involve upstream and downstream suppliers. The core enterprises, relying on their resource integration and network dominance advantages in the supply chain, have promoted ESG collaborative practices, which have become the key to solving the problem of decentralized emission reduction in the supply chain. Taking BYD as an example, such core enterprises inject systematic emission reduction power into the supply chain through ESG collaborative practices such as developing unified supplier ESG management standards, promoting upstream and downstream low-carbon technology sharing, and establishing supply chain green cooperation mechanisms, which are the leading variables driving the low-carbon transformation of the entire chain.

Although existing research has recognized the importance of core enterprises in supply chain ESG collaboration, there are still significant shortcomings. On the one hand, there is a lack of research on the correlation between supply chain ESG collaboration, and most studies focus on the ESG performance of enterprises themselves without further in-depth research. Core enterprises force all upstream and downstream employees of the supply chain to pay attention to ESG governance and achieve collaboration through measures such as green access; On the other hand, existing achievements mostly discuss the low-carbon transformation of the supply chain from a macro theoretical perspective, without combining specific enterprise cases, lacking in-depth analysis of the specific practical scenarios of top enterprises, and presenting the implementation logic and practical effects of ESG collaboration from the perspective of carbon management related practical operations.

Against this backdrop, the core question of this study focuses on how BYD can promote supply chain ESG collaboration practices according to various ESG standards under the dual carbon target? Starting from carbon management related operations, how can these practices promote the low-carbon transformation of the supply chain? Are there any problems or areas that can be optimized during the practical process?

This study adopts a single case study method, with BYD' s supply chain as the research object. BYD, as a core enterprise in new energy vehicles, has research significance and actively discloses ESG reports. In the face of the wave of sustainable development, BYD has become the world's first car company to achieve the production of its 10 millionth new energy vehicle. By collecting official ESG reports, supplier cooperation standards, publicly available information on sustainable development, as well as social responsibility reports from upstream and downstream suppliers and industry third-party analysis data from BYD, the specific measures for ESG collaboration are systematically sorted out. Combined with practical operations related to carbon management such as carbon footprint tracking and low-carbon procurement, the logic and effectiveness of practical implementation are analyzed.

The significance and contribution of this study are mainly reflected in: firstly, enriching practical cases, using BYD as a sample, for the first time systematically presenting the specific path of ESG collaboration in the supply chain of new energy vehicle core enterprises, providing reference practical samples for the industry; Secondly, from the perspective of innovative analysis, the ESG collaborative logic is analyzed from the perspective of carbon management related operations, which makes up for the lack of attention to practical details in existing research and makes the collaborative model more operable; Once again, we will extract industry experience and summarize the supporting role of core enterprise led supply chain ESG collaboration in achieving the dual carbon goals, providing practical and feasible references for the transformation of supply chain ESG collaboration practices in the new energy vehicle and other manufacturing industries.

2. Core theoretical support

2.1. Theoretical support for supply chain ESG collaboration

2.1.1. Stakeholder theory

Freeman explicitly proposed the stakeholder management theory in 1984 and coined the term "stakeholder" [1]. The enterprise pursues the overall interests of stakeholders, not just the interests of certain subjects. Sahut and Pasquini-Descomps believed that if a company ignores the demands of certain stakeholders, it is likely to be punished by those stakeholders [2].

Quan, X. F. and Xiao, H. J. believed that disclosing more special information about a company's environment, society, and governance to external investors can help them understand the company's sustainable development situation and reduce the degree of information asymmetry [3]. Strong ESG performance enables enterprises to reduce corporate risks by enhancing their ability to acquire resources from stakeholder channels [4]. BYD carries out supply chain ESG collaboration, considers the demands of suppliers, society and other stakeholders, actively performs ESG performance, not only drives upstream and downstream enterprises in the supply chain to pay attention to ESG, but also proactively discloses ESG information other than financial reports to meet the expectations of stakeholders, balance the interests of all parties, and promote sustainable development.

2.1.2. Supply chain synergy theory

Supply Chain Collaboration refers to a management model in which upstream and downstream enterprises within the supply chain share information, resources, and plans to maximize overall efficiency, minimize costs, and enhance customer satisfaction. From the perspective of the synergy theory, different resources within an enterprise exhibit complementary relationships and achieve a mutually reinforcing effect [5]. The synergy theory has gradually expanded from the internal level of enterprises to the strategic level between enterprises, with its connotation becoming more abundant and extensive [6].

Chen believed that supply chain collaboration has become a strategic issue for companies aiming to achieve their economic, social, and environmental sustainability goals [7].

BYD collaborates with supply chain partners to carry out ESG practices from the perspectives of environment, society, and governance, and integrates resources to achieve overall optimization.

2.1.3. Sustainable development theory

The core idea of the sustainable development is to protect resources and the ecological environment while developing the economy in a coordinated manner [8]. Huang Shizhong believes that the theory of sustainable development is gradually formed through people's continuous reflection on the environmental and social problems brought about by the anthropocentric thinking mode in their concepts, and their vigilance against excessive industrialization in their actions [9]. At present, this theory not only focuses on the protection of natural resources and climate change issues, but also emphasizes the balance between economic growth, social responsibility, and environmental protection.

Under the dual carbon target, Chinese automobiles have also entered a critical period of transition from traditional manufacturing to green and low-carbon manufacturing. BYD's supply chain ESG collaborative practice focuses on low-carbon management throughout the entire chain, pursuing coordinated development of economy, environment, and society.

2.1.4. Theoretical limitations

Stakeholder theory, supply chain collaboration theory, and sustainable development theory provide important guidance for BYD' s supply chain ESG collaboration, but they have limitations. For example, stakeholder theory requires balancing the interests of shareholders, employees, suppliers, and other parties, while the interests of all parties in supply chain ESG collaboration are prone to conflict, making it difficult for BYD to find a global balance point.

2.1.5. Theoretical framework for subsequent arguments

The stakeholder theory clarifies the participating entities and interest-driven logic of BYD's supply chain ESG cooperation, the supply chain collaboration theory provides an ESG integration mechanism for information, production, and other aspects, and the sustainable development theory establishes the goal direction of economic, social, and environmental balance. The three theories mutually support each other and jointly constitute the theoretical framework of BYD's supply chain ESG collaboration, providing a systematic perspective for analyzing its practice, challenges, and effectiveness.

3. BYD case introduction

3.1. Enterprise overview and supply chain layout

3.1.1. Company development history and supply chain layout

BYD Co., Ltd. was established in February 1995 and is headquartered in Shenzhen, Guangdong Province. In terms of its automotive business, BYD has consistently upheld the ethos of independent innovation and research, keeping up a steady pace of innovation.The effectiveness of carbon emission reduction is directly related to the promotion of energy conservation and new energy vehicles, which is constrained by various factors such as automobile manufacturing costs, infrastructure support, power grid construction, and transportation structure transformation [10]. According to Table 1, it can be seen that BYD' s car sales were far ahead in the first half of 2025, with outstanding performance in the new energy vehicle industry market, and its market share and influence continued to expand, injecting new momentum into BYD' s sustainable development with ESG system standards.

|

serial number |

Manufacturer/Brand |

June |

June month on month |

Year on year in June |

Accumulated from January to June |

Year on year from January to June |

|

1 |

BYD (passenger) |

377628 |

0.2% |

11.0% |

2113271 |

31.5% |

|

2 |

Geely (ride) |

122367 |

-11.3% |

85.5% |

725151 |

126.5% |

|

3 |

Hongmeng Zhixing |

52747 |

18.7% |

/ |

||

|

4 |

Leapmotor |

48006 |

6.5 |

138.7 |

221664 |

155.7% |

|

5 |

The Great Wall |

36405 |

11.5% |

39.5% |

160414 |

21.2% |

Data source: Announcement from various car companies

3.1.2. Characteristics of BYD's supply chain system

Driven by the "dual carbon" goal, BYD has built a full chain low-carbon management system covering upstream and downstream with supply chain ESG collaboration as the core focus. Its supply chain covers links such as batteries, components, vehicle manufacturing, and recycling, with carbon emissions mainly concentrated in the stages of raw material production, component processing, and logistics transportation. In order to comply with the national promotion of green lifestyle, BYD has announced the complete cessation of production of fuel vehicles since 2022, mainly focusing on the field of new energy vehicles.

3.2. BYD ESG rating status

3.2.1. ESG

The concept of ESG performance can be traced back to the investment field in the early 20th century. In 2013, Caplan required companies to consider ESG issues when evaluating their value in the United Nations Principles for Responsible Investment [11]. ESG stands for Environmental, Social, and Governance, which refers to the establishment of important theories for the economic value of enterprises through the evaluation of environmental, social, and corporate governance performance,Cao Qun and Xu Qian believed that it is an important indicator for evaluating the sustainable development of enterprises [12]. Tantow's viewpoint was that the public disclosure of ESG information can convey a sense of corporate social responsibility while meeting the expectations of stakeholders, and guide companies to participate in behaviors that meet social expectations [13].

Under the constraints of ESG, more and more companies are paying attention to their ESG performance. Although there is no unified standard for disclosing ESG reports in China, BYD has been releasing social responsibility reports for several consecutive years since 2010, and is also one of the earliest automotive companies to disclose ESG information.

Huazheng' s rating system is evaluated based on three pillars, sixteen themes, and forty-four key indicators. BYD has developed supplier ESG admission standards that cover core ESG indicators such as carbon reduction, in order to coordinate ESG evaluation criteria with the supply chain. These standards regulate upstream and downstream emission reduction behaviors from the source, effectively play a driving role, and promote self-restraint and healthy cooperation among various departments of the supply chain from the perspectives of environment, society, and governance.

|

Year |

Composite rating |

Overall Score |

|

2013 |

CC |

64.47 |

|

2014 |

B |

71.17 |

|

2015 |

BB |

76.89 |

|

2016 |

BB |

76.44 |

|

2017 |

BBB |

80.04 |

|

2018 |

BB |

79.71 |

|

2019 |

BBB |

80.76 |

|

2020 |

BBB |

83.46 |

|

2021 |

BBB |

80.09 |

|

2022 |

BBB |

82.43 |

|

2023 |

BB |

78.56 |

|

2024 |

BB |

79.48 |

Data source: Huazheng Database

From the scores and ratings in Table 2, it can be seen that BYD's ESG governance in the supply chain is conducive to improving the overall ESG rating of the company. By implementing the "dual carbon" policy in line with the national trend, timely green transformation, and overall improvement in governance dimensions.

4. BYD supply chain ESG collaborative practice path

4.1. Huazheng index evaluation system

Shanghai Huazheng Index Information Service Co., Ltd. (hereinafter referred to as "Huazheng Index") is a professional company engaged in comprehensive services of index and index investment, established in September 2017.

The Huazheng Index refers to mainstream international methods and practical experience, draws on the core principles of international ESG, and combines China's national conditions and capital market characteristics to construct the Huazheng ESG rating system, providing the market with rating results on the environmental, social, and corporate governance dimensions of Chinese A-share and Hong Kong stock issuers.Huazhong ESG Rating gives the evaluated subject a nine level rating of "AAA-C". The ESG total score, first level indicator, second level indicator, and third level indicator scores are all standard scores ranging from 0 to 100. The higher the score, the better the performance of the evaluated subject on that indicator. Table 3 shows the indicators related to the supply chain part of the Huazheng ESG rating system.

|

Pillar |

Theme |

Key metrics |

|

Environment(E) |

Climate change |

Greenhouse gas emissions, carbon reduction strategies, addressing climate change, sponge cities, green finance |

|

Environmental Management |

Sustainable certification, supply chain management - E, environmental penalties |

|

|

Social(S) |

Supply chain |

Supplier risk and management, supply chain relationships |

|

corporate governance (G) |

Governance structure |

ESG governance, risk control, board structure, management stability |

|

Quality of information disclosure |

ESG external verification, information disclosure credibility |

BYD has established a supply chain ESG collaborative practice path through the three dimensions of "environment, society, and corporate governance".

4.2. Environmental dimension collaboration

4.2.1. Climate change

Under the "environment" pillar and in response to the theme of "climate change", BYD has proposed new goals, with 2023 as the benchmark, to reduce its own operational carbon emissions intensity by 50% by 2030, and strive to achieve full value chain carbon neutrality by 2045. More than 410 new energy-saving projects were added throughout 2024, contributing over 210000 tons of carbon dioxide equivalent to carbon emissions reduction.

4.2.2. Customized supplier admission standards

According to the BYD Supplier Guidelines, BYD has put forward clear requirements for all suppliers at the level of sustainable development: suppliers must refer to the international social responsibility standard SA8000, fulfill their ecological and environmental protection obligations, and promote sustainable development management of the entire upstream and downstream value chain, corresponding to the key indicators of "Supply Chain Management E" in the "Environmental Management" theme.

4.3. Social dimension collaboration

4.3.1. Supplier social responsibility evaluation system

Under the "social" pillar, BYD regularly conducts social responsibility assessments and surveys of suppliers in response to the "supply chain" theme. Including but not limited to: BYD conducts on-site audits of suppliers' social responsibility performance, and promotes continuous improvement of suppliers by following up on rectification and closure processes for non compliant items; Suppliers who fail to meet the rectification requirements within the prescribed period will have their cooperation terminated depending on the actual situation. Meets the indicator of 'Supplier Risk and Management'.

4.4. Synergy in corporate governance dimensions

4.4.1. Improve the governance framework for sustainable development

Under the pillar of "corporate governance", BYD has included climate change issues in the scope of sustainable development governance of the board of directors. We have established a climate change governance structure consisting of a board of directors, a strategic and sustainable development committee, an ESG management committee, an ESG and carbon emissions management group, and various business groups and units, with members covering various functions and production business units of the company. At the same time, according to the BYD Supplier Guidelines, as a core component of the supply chain, suppliers also need to bear corresponding governance responsibilities: on the one hand, they should establish a sustainable development management system and carry out low-carbon governance work, and on the other hand, they need to promote the implementation of sustainable development governance by subordinate suppliers.

In addition, suppliers have a dual obligation in due diligence: to cooperate with BYD in conducting relevant investigations, and to establish their own supply chain due diligence system and implement investigations. On this basis, it is necessary to promote the sustainable development of the next level suppliers and require them to conduct due diligence simultaneously, ultimately achieving sustainable governance of the entire supply chain. Corresponding to the key indicators of "ESG governance" and "board structure" in the theme of "governance structure".

5. The low carbon transformation effectiveness of collaborative practice

5.1. BYD supply chain emission reduction effect

Shen Hongtao believes that under the "dual carbon" target, carbon data will become an important component of national and corporate data competitiveness [14]. Liu Jiexian believes that carbon information is the basis for investors to evaluate the risks and opportunities of sustainable development of enterprises when making decisions, and it is the basis for consumers to judge the expected utility of products and services when making decisions [15], improving the quality of carbon information disclosure has a significant promoting effect on enterprise value creation.

Through the collaboration of "standards technology data", BYD's supply chain carbon management capabilities have been significantly enhanced: by developing supply chain carbon reduction plans and integrating carbon management requirements into supplier lifecycle management, BYD can promote "cooling down" actions upstream of the value chain through its own influence.

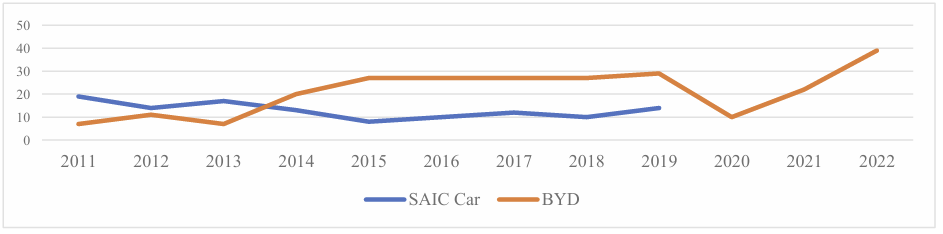

Data source: CSMAR database

From the carbon disclosure data presented in Figure 1, BYD, as a representative of new energy vehicle companies, has shown outstanding performance in improving carbon emission decomposition indicators and other related aspects. The sharing of carbon data is also gradually developing. Compared with traditional car company SAIC Sedan, BYD's carbon disclosure related data is complete and presents different development trends, especially after 2020, with a more obvious trend of change. The penetration rate of low-carbon technology among suppliers exceeds 60%, which is higher than the industry average of 35%. This improvement stems from the resource integration capability of core enterprises, which reduces supplier emission reduction costs through technology sharing and solves the problem of "difficult carbon emission accounting" through data platforms, in line with the transmission logic from "collaborative practice" to "capability enhancement".

Initial manifestation of dual carbon effect: According to BYD's 2023 ESG report, the carbon emissions per unit output value of the supply chain have decreased by 22% compared to 2020. Combined with carbon disclosure data, BYD's 2023 carbon disclosure index has significantly optimized compared to 2020. The proportion of green component procurement has increased to 78%; Overseas orders increased by 30% due to carbon compliance advantages. This validates the correlation between "carbon management capability" and "low-carbon transformation", reflecting the effectiveness of the core enterprise led model.

6. Existing problems and optimization strategies

6.1. Main problem analysis

6.1.1. Gradient difference in collaborative coverage

Top suppliers such as CATL, due to their strong technological foundation, can quickly respond to ESG requirements. However, small and medium-sized component enterprises are limited by funding and technology, and their low-carbon transformation progress lags behind, resulting in a gap in supply chain emissions reduction.

For example, Xi'an BYD Auto Parts Co., Ltd. once built a production line with an annual output of 400000 sets of small parts stamping and welding, interior products, and other products. The project started construction without undergoing energy-saving review as required. Although it was shut down for rectification later on, it still reflects problems in low-carbon transformation such as energy conservation. This may be due to limitations in funding and technology as a component company, making it difficult to respond quickly to ESG requirements like top suppliers.

6.1.2. Insufficient long-term incentive mechanism

Although BYD has taken active measures such as setting standards and strict access requirements in supply chain ESG governance, there are significant deficiencies in the incentive mechanism. This will weaken the inherent motivation of suppliers to participate in emission reduction, making them only meet basic requirements to avoid being eliminated, rather than actively optimizing environmental performance. In the long run, this will limit the depth and effectiveness of supply chain ESG governance, which is not conducive to promoting the sustainable development of the upstream ecosystem.

6.2. Optimization path design

6.2.1. Implement a hierarchical collaborative strategy for "gradient differences"

For top suppliers: Focus on "deep collaboration" and jointly carry out advanced projects such as battery recycling and zero carbon factory construction, with the goal of achieving "zero carbon production" of key components by 2025;

For small and medium-sized suppliers: Launch a "Low Carbon Empowerment Plan" and provide phased transformation guidance, such as prioritizing the replacement of high energy consuming equipment and collaborating with financial institutions to provide emission reduction special loans to reduce transformation costs

6.2.2. Optimizing the integration mechanism of incentives and constraints

Establish a linkage system of "emission reduction effectiveness order allocation": for suppliers whose carbon emission intensity has decreased to meet the requirements, increase a certain proportion of order share tilt; Establish relevant awards, select technology breakthrough projects annually and provide research and development subsidies to strengthen proactive emission reduction efforts.

In addition to BYD's own positive incentive mechanism, the government has also introduced relevant subsidy policies to enhance the enthusiasm for the transformation of the new energy vehicle industry. The government not only focuses on economic benefits, but also pays attention to the benefits brought by environmental, social responsibility, and corporate governance, promoting the high-quality development of the new energy vehicle industry.

7. Conclusion

Research shows that BYD has built a "standard technology data" model based on ESG three-dimensional collaboration to promote the low-carbon transformation of the supply chain. It has taken corresponding measures in the dimensions of environment, society, and governance. In practice, carbon emissions per unit of output value have decreased by 22%, and green procurement accounts for 78%, reflecting the ESG collaborative effect of the supply chain. Although there are problems such as lagging transformation of small and medium-sized suppliers, it confirms the effectiveness of the core enterprise leadership model.

In theory, it enriches the research on supply chain ESG cooperation from the perspective of carbon management and provides empirical support. In practice, the experience of hierarchical cooperation provides transformation solutions for related industries, helping to achieve the "dual carbon" goals and policy formulation.

In the future, the scope of cases can be expanded to explore differences in enterprise collaboration models. Enterprises need to deepen the empowerment of small and medium-sized suppliers, jointly build an ecosystem, and improve incentive mechanisms. With the advancement of the "dual carbon" goal, supply chain ESG cooperation will extend to the entire value chain. Core enterprises need to make breakthroughs in technology and other fields to achieve an upgrade from compliance to value creation.

References

[1]. Freeman, R.E. (1984). "Strategic management: A stakeholder theory." Journal of Management Studies 39(1), 1-21.

[2]. Sahut, J.M. and Pasquini-Descomps, H. (2015) "ESG impact on market performance of firms: International evidence." Management international 19(2), 40-63.

[3]. Quan, X.F. and Xiao, H. J. (2016) "A Study on the Impact of Corporate Social Responsibility Disclosure on Stock Price Crash Risk: Based on the Mediating Mechanism of Accounting Conservatism." China Soft Science, (6), 80-97.

[4]. Tan, J.S., Huang, R.Y. and Zhang, J.X. (2022) ESG performance and corporate risk: An explanation from the perspective of resource acquisition. Journal of Management Science, 35(05), 3-18.

[5]. Kabue, W.L. and Kilika, M.J. (2016) Firm resources, core competencies and sustainable competitive advantage: An integrative theoretical framework. Journal of Management and Strategy, 1, 98-125.

[6]. Wang, T.Y. (2019). A literature review on the theory of synergy effect. Economic Research Guide, (31), 11-24.

[7]. Chen, L. (2017). "Supply chain collaboration for sustainability: A literature review and future research agenda." International journal of production economics 194, 73-87.

[8]. Keeble, B.R. (1988). "The Brundtland report: 'Our common future’." Medicine and war 4(1), 17-25.

[9]. Huang, S.Z. (2021). "The Three Core Theoretical Pillars Supporting ESG." Finance and Accounting Monthly, (19), 3-10.

[10]. Chang, W. (2021). "Development Trends of the Automotive Industry Under the 'Dual Carbon' Goal." Automotive Review, (8), 31-35.

[11]. Caplan, D. (2013). "Corporate social responsibility initiatives across the value chain." Journal of Corporate Accounting & Finance 24(3), 15-24.

[12]. Cao, Q. and Xu, Q. (2019) "A Study on the Construction of the Financial 'Environmental, Social and Governance (ESG)' System." Financial Regulation Research, (4), 95-111.

[13]. Tantow, D. (2012). "Urban improvement districts in urban restructuring–first results of the German ESG research initiative." Urban Research & Practice 5(3), 342-352.

[14]. Shen, H.T. (2022). "A Study on Carbon Information Disclosure in China Under the 'Dual Carbon' Goal." Friends of Accounting.

[15]. Liu, J.X. (2022). The Impact Mechanism of Carbon Information Disclosure Quality on Corporate Value Creation Based on the ESG Concept (Doctoral Dissertation, Hefei University of Technology).

Cite this article

Tian,J. (2025). ESG Collaborative Practice in Core Enterprise Supply Chain under the Dual Carbon Goals - Taking BYD Supply Chain as an Example. Advances in Economics, Management and Political Sciences,229,107-117.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Freeman, R.E. (1984). "Strategic management: A stakeholder theory." Journal of Management Studies 39(1), 1-21.

[2]. Sahut, J.M. and Pasquini-Descomps, H. (2015) "ESG impact on market performance of firms: International evidence." Management international 19(2), 40-63.

[3]. Quan, X.F. and Xiao, H. J. (2016) "A Study on the Impact of Corporate Social Responsibility Disclosure on Stock Price Crash Risk: Based on the Mediating Mechanism of Accounting Conservatism." China Soft Science, (6), 80-97.

[4]. Tan, J.S., Huang, R.Y. and Zhang, J.X. (2022) ESG performance and corporate risk: An explanation from the perspective of resource acquisition. Journal of Management Science, 35(05), 3-18.

[5]. Kabue, W.L. and Kilika, M.J. (2016) Firm resources, core competencies and sustainable competitive advantage: An integrative theoretical framework. Journal of Management and Strategy, 1, 98-125.

[6]. Wang, T.Y. (2019). A literature review on the theory of synergy effect. Economic Research Guide, (31), 11-24.

[7]. Chen, L. (2017). "Supply chain collaboration for sustainability: A literature review and future research agenda." International journal of production economics 194, 73-87.

[8]. Keeble, B.R. (1988). "The Brundtland report: 'Our common future’." Medicine and war 4(1), 17-25.

[9]. Huang, S.Z. (2021). "The Three Core Theoretical Pillars Supporting ESG." Finance and Accounting Monthly, (19), 3-10.

[10]. Chang, W. (2021). "Development Trends of the Automotive Industry Under the 'Dual Carbon' Goal." Automotive Review, (8), 31-35.

[11]. Caplan, D. (2013). "Corporate social responsibility initiatives across the value chain." Journal of Corporate Accounting & Finance 24(3), 15-24.

[12]. Cao, Q. and Xu, Q. (2019) "A Study on the Construction of the Financial 'Environmental, Social and Governance (ESG)' System." Financial Regulation Research, (4), 95-111.

[13]. Tantow, D. (2012). "Urban improvement districts in urban restructuring–first results of the German ESG research initiative." Urban Research & Practice 5(3), 342-352.

[14]. Shen, H.T. (2022). "A Study on Carbon Information Disclosure in China Under the 'Dual Carbon' Goal." Friends of Accounting.

[15]. Liu, J.X. (2022). The Impact Mechanism of Carbon Information Disclosure Quality on Corporate Value Creation Based on the ESG Concept (Doctoral Dissertation, Hefei University of Technology).