1. Introduction

By 2025, it is projected that geopolitical tensions, including trade sanctions and regional conflicts, in conjunction with climate change factors, such as extreme weather and carbon emission regulations, will progressively exert an influence on global supply chains [1]. The occurrence of recurrent natural disasters, occasioned by climate change, compounded by tariff barriers or shipping disruptions emanating from geopolitical tensions, poses unprecedented challenges to the stability of cross-border logistics networks for e-commerce. This study builds upon extant research on the individual impacts of extreme weather and geopolitics on global supply chains. It investigates the potential moderating impact of sporadic short-term extreme weather events on cross-border e-commerce supply chain risks. It considers the prolonged influence of geopolitical factors amid escalating geopolitical conflicts by 2025. The data collection employed a 7-point Likert scale questionnaire survey method, and structural equation modelling was utilised to analyse the relationships among geopolitics, climate change, their moderating effects, and cross-border e-commerce supply chain risks. This study elucidates the intricate interplay between geopolitics and climate change, demonstrating their collective impact on supply chain logistics risks. It thereby addresses a theoretical deficiency in the literature, which primarily emphasizes isolated risk factors. In light of the escalating geopolitical tensions and the increasing prevalence of extreme weather events, this framework aims to enhance the comprehension of multidimensional risk interactions and to provide pragmatic risk management insights for cross-border e-commerce businesses. In view of the geopolitical tensions and recurrent extreme weather events, businesses can refine their supply chain design, bolster the resilience of their logistics networks, and formulate more effective risk response strategies informed by this research.

2. Literature review

2.1. Existing research and research gaps

Geopolitical risks refer to potential threats arising from political, military, economic, or social conflicts, policy shifts, or instability between nations or regions, which may impact investments, market operations, or international relations [2]. Specific manifestations include warfare, terrorism, trade sanctions, diplomatic tensions, regime change, or policy uncertainty. These risks are typically sudden and unpredictable, exerting significant influence on economic actors' decision-making and the global market environment. Extreme weather risks refer to potential threats triggered by abnormal or extreme weather events (such as hurricanes, floods, droughts, extreme heatwaves, or cold snaps), which may cause significant damage to human life, infrastructure, economic activities, and the ecological environment [3]. Supply Chain Risks refers to the potential risk of disruption or loss during supply chain operations caused by external or internal factors, which may affect the flow of goods, services, or information [4].

Existing literature predominantly focuses on traditional risks (e.g., studies on impacts of logistics delays and tariffs) or single-dimensional risks (e.g., studies on economic and legal risks) [5,6]. While the individual impacts of extreme weather and geopolitics on global supply chains have been examined, the interactive effects of geopolitics and climate change as dynamic drivers of cross-border e-commerce supply chain risks remain understudied [7,8].

2.2. Research hypotheses

Research indicates that both geopolitics and climate change are significant drivers of supply chain risks [9]. Geopolitics directly impacts supply chain stability through trade barriers, shipping restrictions, or regional conflicts, such as increased tariff costs or disrupted shipping routes. Therefore, this study proposes the following hypothesis:

H1: Geopolitics exerts a significant positive influence on logistics risks within cross-border e-commerce supply chains.

As an environmental factor, extreme weather further exacerbates supply chain risks by damaging logistics infrastructure or prolonging transportation times [10]. Therefore, this study proposes the following hypothesis:

H2: Extreme weather has a significant positive impact on logistics risks in cross-border e-commerce supply chains.

This paper proposes that extreme weather may amplify or mitigate the impact of geopolitics on cross-border e-commerce supply chain risks through a moderating effect. For instance, when geopolitical tensions restrict shipping routes, extreme weather may further degrade logistics efficiency, thereby intensifying risks. Based on the above definitions and relationship analysis, the following hypothesis is proposed:

H3: Extreme weather significantly moderates the relationship between geopolitical factors and logistics risks in cross-border e-commerce supply chains.

3. Research methodology

3.1. Data collection

This study employed a questionnaire survey methodology for data acquisition. The dissemination of the questionnaire and the data collection adhered rigorously to ethical standards and scientific protocols. Surveys were sent and gathered via online channels. Prior to participation, all respondents received a detailed research information paper defining the study's aims, substance, and promises to data confidentiality. Participation was entirely voluntary. This study has particular restrictions in data collection, as respondents were primarily located in the provinces of Guangdong, Zhejiang, Jiangsu, and Hebei areas where Chinese cross-border e-commerce firms and their supply chain organizations are generally found. Nonetheless, specific regions continue to lack representation. The questionnaire comprised two main sections: One is basic demographic information, including age, gender, years of experience in the cross-border e-commerce industry, and company size; Another is 23 observational indicators constructed around three key dimensions: geopolitical risks, extreme weather risks, and supply chain risks. These indicators were derived from observational variables and established scales in relevant literature, as shown in Table 1. Responses were scored using a 7-point Likert scale. A total of 260 questionnaires were distributed, yielding 255 valid responses—a response rate of 98.1%. Analysis of basic demographic information is presented in Table 2.

|

Factor name |

Observed variable |

|

Geopolitical risk [11] |

Political instability Trade dispute risk Regulatory change risk Supply chain disruption risk Cybersecurity risks Risk of economic recession Geopolitical tension risk |

|

Extreme weather risks [7] |

Probability of disaster occurrence Exposure level Vulnerability index Duration of disruption Economic impact Adaptive capacity |

|

Cross-border e-commerce supply chain risks [9] |

Market information misjudgment risk Information distortion risk Information security risks Risk of delayed Information-sharing Policy control risk Weather disaster risk Logistics management system instability risk Customs clearance risk Cash flow risk Supply chain performance |

|

Name |

Option |

Frequency |

Percentage(%) |

Cumulative percentage(%) |

|

1. Your gender is |

Male |

122 |

47.84 |

47.84 |

|

Female |

133 |

52.16 |

100 |

|

|

2. How many years of experience do you have in the cross-border e-commerce industry? |

1~3Years |

28 |

10.98 |

10.98 |

|

4~6Years |

78 |

30.59 |

41.57 |

|

|

7~10Years |

94 |

36.86 |

78.43 |

|

|

11~15Years |

42 |

16.47 |

94.9 |

|

|

Above 15Years |

13 |

5.1 |

100 |

|

|

3. What is the size of your company? |

Microenterprises(<50 employees) |

18 |

7.06 |

7.06 |

|

Medium-sized enterprises(51~250 employees) |

74 |

29.02 |

36.08 |

|

|

Medium-to-large enterprises(251~1000 employees) |

123 |

48.24 |

84.31 |

|

|

large enterprises(>1000 employees) |

40 |

15.69 |

100 |

|

|

4. What is the primary business type ofyour company? |

B2C |

115 |

45.1 |

45.1 |

|

B2B |

68 |

26.67 |

71.76 |

|

|

Both |

72 |

28.24 |

100 |

|

|

Total |

255 |

100 |

100 |

|

3.2. Selection and model construction

Latent variables and observable variables are two fundamental components in structural equation modeling. Latent variables are not directly observable and necessitate observed variables for their measurement. In the analysis, observable variables quantitatively represent the magnitude of latent variables. Table 1 illustrates that geopolitical events, harsh weather, and disruptions in cross-border e-commerce supply chains are regarded as latent variables. Each factor is further categorized into: disruption duration, economic impact, adaptability, risk of misinterpreting market information, risk of information distortion, information security risk, risk of delayed information dissemination, regulatory policy risk, meteorological disaster risk, logistics management system instability risk, customs clearance risk, capital flow risk, and supply chain performance. The outcomes for the observed variables were obtained by the analysis of data gathered from questionnaires.

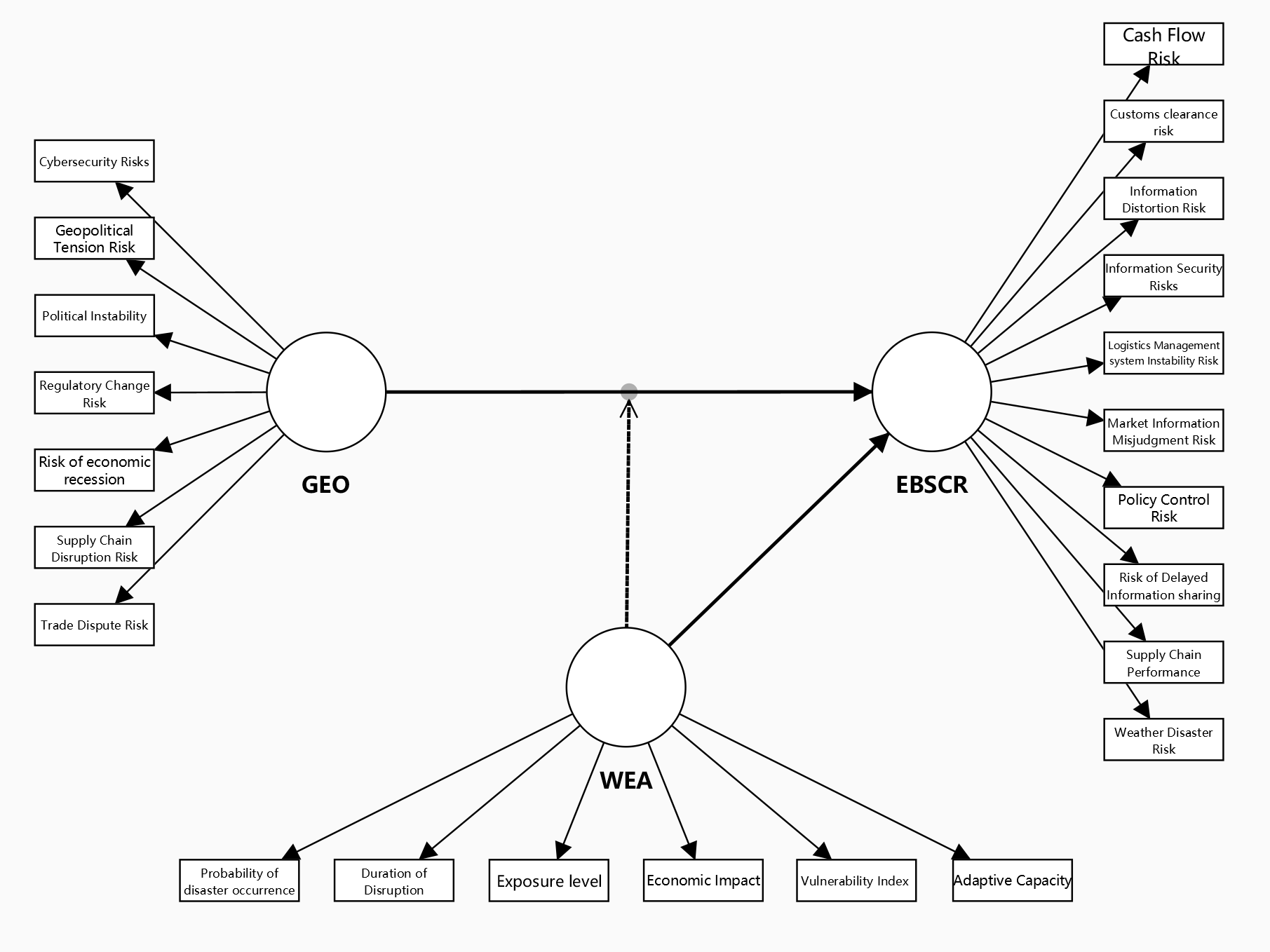

Structural equation modelling (SEM) is a complex framework designed to examine relationships among latent variables while describing the pathways through which these variables interact. This approach not only analyzes which explanatory variables influence others but also explores the mechanisms or pathways through which such influences occur. Furthermore, it enables the assessment of the multifaceted and context-dependent nature of these effects. Building upon the preceding section, structural equation modelling is conducted. Hypothesis H1 posits that geopolitical factors (GEO) exert a positive influence on cross-border e-commerce supply chain risks (EBSCR). Similarly, Hypothesis H2 suggests that extreme weather events (WEA) exert a positive influence on cross-border e-commerce supply chain risks (EBSCR). Hypothesis H3 posits that Extreme weather acts as a moderator variable, regulating the extent of GEO's influence on EBSCR. In this process, the interaction between GEO and WEA generates the interaction term WEA × GEO, reflecting the combined effect. The structural path is illustrated in Figure 1.

4. Empirical findings

4.1. Sample reliability test

4.1.1. Reliability testing

To assess the internal consistency reliability of the scale, this study calculated Cronbach's α coefficients for each latent variable. According to the literature, Cronbach's α coefficients greater than 0.7 are generally considered to indicate good reliability [12]. Results show that Cronbach's α coefficients for all latent variables reached or exceeded 0.9, indicating high internal consistency reliability of the scale. To further validate the scale's reliability, this study calculated the composite reliability (CR) for each latent variable. A CR value above 0.7 typically indicates good composite reliability for latent variables [13]. Results showed that all latent variables had CR values exceeding 0.7, indicating high measurement reliability for the scale. Specific results are presented in Table 3.

|

Cronbach's alpha |

Composite reliability(rho_a) |

Composite reliability(rho_c) |

Average variance extracted(AVE) |

|

|

EBSCR |

0.932 |

0.936 |

0.942 |

0.621 |

|

GEO |

0.922 |

0.926 |

0.937 |

0.68 |

|

WEA |

0.901 |

0.903 |

0.924 |

0.669 |

To further validate the indicator reliability of the scale, this study examined the Outer loadings of each measurement indicator. According to Outer loadings greater than 0.7 indicate strong explanatory power of the indicator for the latent variable. Results show that most indicators had outer loadings above 0.7, indicating overall good indicator reliability for the scale [12]. Specific results are presented in Table 4.

|

EBSCR |

GEO |

WEA |

|

|

Adaptive capacity |

0.836 |

||

|

Cash flow risk |

0.79 |

||

|

Customs clearance risk |

0.801 |

||

|

Cybersecurity risks |

0.813 |

||

|

Duration of disruption |

0.816 |

||

|

Economic impact |

0.822 |

||

|

Exposure level |

0.828 |

||

|

Geopolitical tension risk |

0.803 |

||

|

Probability of disaster occurrence |

0.821 |

||

|

Information distortion risk |

0.782 |

||

|

Information security risks |

0.752 |

||

|

Logistics management system instability risk |

0.762 |

||

|

Market information misjudgment risk |

0.797 |

||

|

Policy control risk |

0.803 |

||

|

Political instability |

0.849 |

||

|

Regulatory change risk |

0.821 |

||

|

Risk of delayed information sharing |

0.78 |

||

|

Risk of economic recession |

0.829 |

||

|

Supply chain disruption risk |

0.822 |

||

|

Supply chain performance |

0.815 |

||

|

Trade dispute risk |

0.818 |

||

|

Vulnerability index |

0.803 |

||

|

Weather disaster risk |

0.795 |

To detect potential multicollinearity issues in the scale, this study calculated the variance inflation factor (VIF) for each indicator. According to a VIF value below 3 indicates no severe multicollinearity problems [12]. Results show that all indicators' VIF values are below 3, indicating no significant multicollinearity issues in the scale, making it suitable for subsequent structural equation modelling analysis. Specific results are presented in Table 5.

|

VIF |

|

|

Adaptive capacity |

2.382 |

|

Cash flow risk |

2.207 |

|

Customs clearance risk |

2.378 |

|

Cybersecurity risks |

2.539 |

|

Duration of disruption |

2.189 |

|

Economic impact |

2.141 |

|

Exposure level |

2.307 |

|

Geopolitical tension risk |

2.111 |

|

Probability of disaster occurrence |

2.446 |

|

Information distortion risk |

2.12 |

|

Information security risks |

2.037 |

|

Logistics management system instability risk |

2.094 |

|

Market information misjudgment risk |

2.229 |

|

Policy control risk |

2.268 |

|

Political instability |

2.553 |

|

Regulatory change risk |

2.286 |

|

Risk of delayed information sharing |

2.219 |

|

Risk of economic recession |

2.4 |

|

Supply chain disruption risk |

2.323 |

|

Supply chain performance |

2.459 |

|

Trade dispute risk |

2.356 |

|

Vulnerability index |

2.068 |

|

Weather disaster risk |

2.221 |

|

WEA x GEO |

1 |

4.1.2. Validity testing

To assess the convergent validity of the scale, this study calculated the average variance extracted (AVE) for each latent variable. Following the recommendation, an AVE value greater than 0.5 indicates that the latent variable adequately explains the variance of its indicators, demonstrating good convergent validity [13]. Results show that the AVE values for all latent variables exceeded 0.5, confirming the scale's strong convergent validity. Specific results are presented in Table 3. To assess discriminant validity, this study employed the HTMT (heterogeneity-to-monotonicity ratio) method. According to HTMT values below 0.85 (or below 0.9 under stricter conditions) indicate good discriminant validity between latent variables [14]. Results show that HTMT values for all latent variable pairs were below 0.85, confirming the scale's good discriminant validity. Specific results are presented in Table 6.

|

EBSCR |

GEO |

WEA |

|

|

EBSCR |

|||

|

GEO |

0.341 |

||

|

WEA |

0.473 |

0.383 |

|

|

WEA x GEO |

0.328 |

0.255 |

0.162 |

4.2. Structural modelling analysis

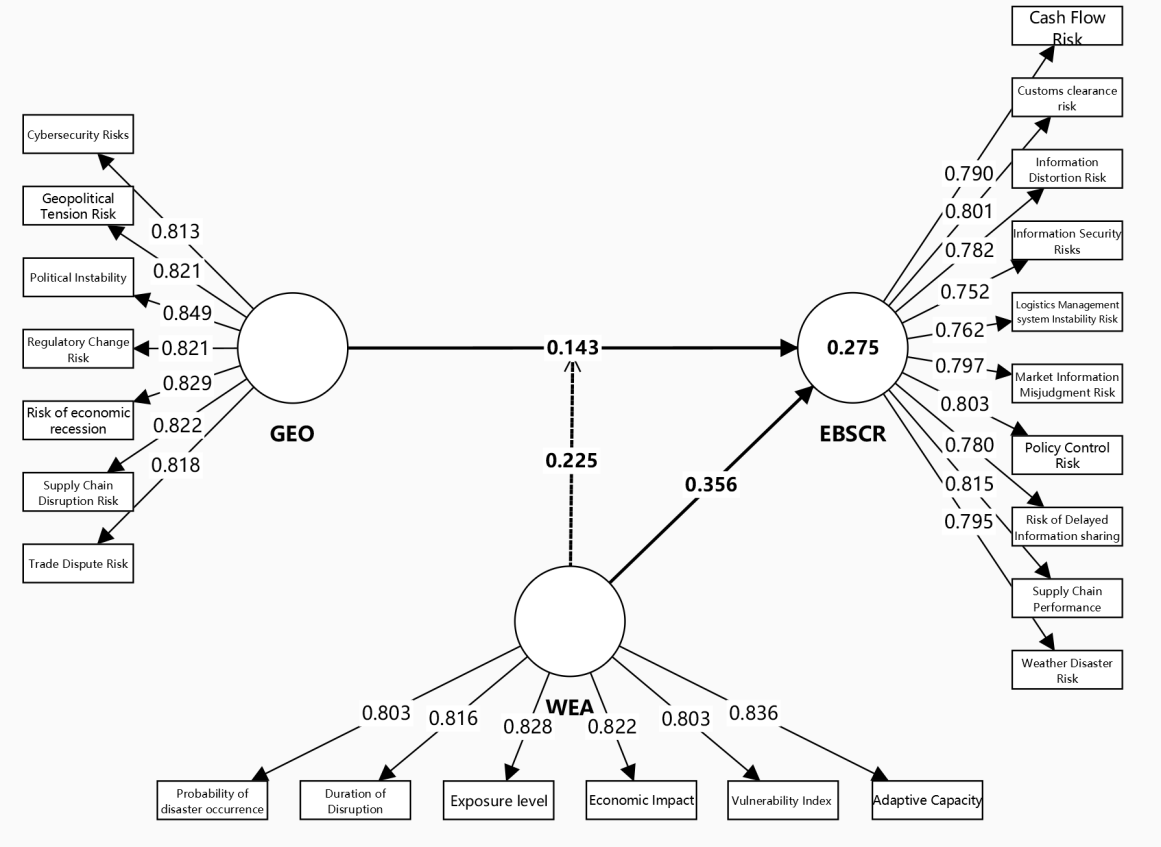

Path relationships in the structural equation model were tested for significance using Bootstrap and two-tailed tests (significance level set at 0.05). Specific path analysis diagrams and coefficient significance are shown in Figure 2 and Table 7.

|

Original sample (O) |

Sample mean (M) |

Standard deviation (STDEV) |

T statistics (|O/STDEV|) |

P values |

|

|

GEO -> EBSCR |

0.143 |

0.149 |

0.052 |

2.733 |

0.006 |

|

WEA -> EBSCR |

0.356 |

0.359 |

0.053 |

6.726 |

0 |

Findings demonstrate that geopolitical risks have a substantial beneficial impact on cross-border e-commerce supply chain risks, evidenced by a path coefficient of 0.143 (P < 0.01), hence validating hypothesis H1; Extreme weather has a substantial beneficial impact on cross-border e-commerce supply chain risks, evidenced by a path coefficient of 0.356 (P < 0.01), hence validating hypothesis H2;

This study assessed the predictive validity and explanatory strength of the structural equation model by Q² and f² tests (refer to Tables 8 and 9). The Q² value was initially computed employing the blind prediction method to assess the model's predictive significance. A Q² value exceeding 0 signifies predictive importance, with thresholds of 0.02, 0.15, and 0.35 denoting low, medium, and high predictive relevance, respectively. The results indicate that the Q² values for all latent variables are larger than 0 and surpass 0.35, demonstrating significant predictive relevance of the model. The explanatory contribution of each exogenous latent variable to endogenous latent variables was evaluated using the effect size f², with values of 0.02, 0.15, and 0.35 indicating small, medium, and high effect sizes, respectively. Results demonstrate that extreme weather has a moderate predictive capacity for the satisfaction component, whereas the predictive capacity of the interaction term between geopolitics and GEO-WEA is minimal.

|

SSO |

Sum of squared errors (SSE) |

Q² (=1-SSE/SSO) |

|

|

EBSCR |

2550 |

1441.43 |

0.435 |

|

GEO |

1785 |

976.553 |

0.453 |

|

WEA |

1530 |

866.65 |

0.434 |

|

EBSCR |

|

|

GEO |

0.024 |

|

WEA |

0.152 |

|

WEA x GEO |

0.067 |

5. Analysis and discussion

5.1. Analysis of moderation effects

Moderation analysis investigates the interaction between independent variables and moderator variables concerning the dependent variable, assuming that both independent and dependent variables are preset. To assess the moderating influence of harsh weather on geopolitical risks and cross-border e-commerce supply chain hazards, a PLS-SEM analysis was performed in two stages: Step 1 evaluates the primary effects of the model, focusing on the correlation between each independent variable and the dependent variable without considering interaction effects; Step 2 investigates the interaction effect between the moderator and independent factors on the dependent variable. Previous findings indicate that geopolitical risks significantly enhance cross-border e-commerce supply chain risks (path coefficient: 0.143, P < 0.01), whereas extreme weather significantly exacerbates these risks (path coefficient: 0.356, P < 0.01). The analysis of their interaction (refer to Table 10) reveals that the path coefficient for "extreme weather × geopolitical risk" attained a significant level, signifying a beneficial moderating influence. The hypothesis H3 is corroborated.

|

Original sample (O) |

Sample mean (M) |

Standard deviation (STDEV) |

T statistics (|O/STDEV|) |

P values |

|

|

WEA x GEO -> EBSCR |

0.225 |

0.222 |

0.049 |

4.617 |

0 |

To examine and quantify the strength and direction of the moderating variable's influence on the main effect relationship, this study employed a simple slope analysis using SmartPLS 4.0, with results presented in Figure 3. The figure reveals: When WEA is at +1 SD, GEO exhibits a positive correlation with EBSCR; When WEA is at the mean, GEO maintains a positive correlation with EBSCR, but the slope is significantly lower than when WEA is at +1 SD; When WEA is at -1 SD, GEO is negatively correlated with EBSCR. The slopes of the three lines are markedly different, indicating that GEO's influence on EBSCR varies with changes in WEA levels. This is a classic characteristic of a moderating effect.

6. Discussion of special points

6.1. Analysis of slope changes

It can be observed that when the moderator variable WEA is at a low level, it alters the direction of the independent variable GEO's effect on the dependent variable EBSCR. Analysis and interpretation follow.

The equation for the moderation effect is as follows:

Y represents the dependent variable in this study, namely cross-border e-commerce supply chain risk; X denotes the independent variable, geopolitical factors; M signifies the moderating variable, extreme weather; X×M is the interaction term. b1, b2, and b3 are the effect coefficients for the independent variable, moderating variable, and interaction term, respectively. The slope of the independent variable X on the dependent variable Y can be derived by taking the partial derivative with respect to M, yielding the following equation:

It is evident that the slope is jointly determined by b1, b3, and the moderator variable M. As shown in Tables 7 and 10, b1 = 0.143 and b3 = 0.225. b3>b1 . Therefore, when M is at the 1SD level,b3M is a large negative value, resulting in a negative final slope.

6.2. Discussion of causes

While it is scientifically established that increased geopolitical risks elevate overall supply chain risks when extreme weather risks are at average or higher levels, the observation that increased geopolitical risks reduce cross-border e-commerce supply chain risks when extreme weather risks are below average is an anomalous and noteworthy phenomenon. This study examines the interaction of these factors within the context of supply chain dynamics, aiming to provide insights into why increased geopolitical risks may mitigate certain risks in cross-border e-commerce supply chains under specific conditions (low WEA).

6.2.1. Strong adaptability of the cross-border e-commerce industry

In regions with below-average WEA (relatively stable climates), the risk of physical supply chain disruptions is lower. At such times, increased GEO (e.g., interregional trade restrictions or geopolitical conflicts) accelerates companies' efforts to diversify supply chains, seek alternative suppliers, or shift to more resilient logistics routes [15]. Mature enterprises directly mitigate risks by adjusting supply chain geography,such as relocating warehouses or selecting more stable transport routes. Such flexible adjustments are easier to implement when WEA is low, as the absence of extreme weather disturbances allows for greater redundancy and adaptability within logistics networks.

6.2.2. Stable market

This study focuses on China's cross-border e-commerce sector. Given China's status as the world's largest exporter, most cross-border e-commerce enterprises concentrate on export services. Global dumping means that escalating geopolitical risks in a single region impact overall export operations far less than losses from major domestic natural disasters [16]. In some real-world cases, such risks may not even affect sales volume. (e.g., following the 2025 U.S. tariff policy, many European and East Asian countries imported products previously purchased from the U.S. before tariff hikes and resold them to the U.S. to profit from the price differential; similarly, during the Russia-Ukraine conflict, Russia exported oil and natural gas banned by European countries to India, which then resold these resources to Europe).

6.2.3. China's irreplaceability as a manufacturer

This study focuses on China's cross-border e-commerce sector. Given China's status as the world's largest exporter, most cross-border e-commerce enterprises concentrate on export services. Global dumping means that escalating geopolitical risks in a single region impact overall export operations far less than losses from major domestic natural disasters [17]. In some real-world cases, such risks may not even affect sales volume. (e.g., following the 2025 U.S. tariff policy, many European and East Asian countries imported products previously purchased from the U.S. before tariff hikes and resold them to the U.S. to profit from the price differential).

7. Conclusion

This study develops and evaluates a moderation effect model that includes geopolitical risks, extreme weather, and their interaction terms to investigate their influence on the risks associated with China's cross-border e-commerce supply chain. The results indicate that both geopolitical threats and Extreme weather significantly raise cross-border e-commerce supply chain risks, with their interaction further intensifying these risks. Significantly, while extreme weather risks are minimal, heightened geopolitical threats may counterintuitively diminish supply chain risks, owing to the industry's robust adaptability and consistent market demand attributes.

This study presents significant conclusions regarding the interplay between geopolitical risk, extreme weather risk, and cross-border e-commerce supply chain risk; yet, it is not without limits. The geographical dispersion of data sources is limited. The questionnaire study largely targeted provinces with a high concentration of cross-border e-commerce firms, including Guangdong, Zhejiang, Jiangsu, and Hebei, excluding enterprises from other regions of China, particularly the central and western areas. This may limit the national representativeness of the results. The qualifications of the questionnaire respondents differed considerably. Although the sample comprised participants with diverse years of experience and from organizations of varying sizes, some respondents may have possessed insufficient comprehension of geopolitical or extreme weather concerns, potentially adding bias to their responses. Future studies should improve the universality and representativeness of findings while further investigating the linkages between various external or internal factors, such as digital transformation, policy stability, or changes in consumer behavior, as well as geopolitical and extreme weather threats. This would aid in the development of a more complete risk management framework for cross-border e-commerce supply chains.

References

[1]. Niu, Y., Werle, N., Cohen, M., Cui, S., Deshpande, V.and Ernst, R. (2025) Restructuring Global Supply Chains: Navigating Challenges of the COVID-19 Pandemic and Beyond. Manufacturing & Service Operations Management, 27(4), 1025-36.

[2]. Lee, C.C., Zhang, J., Yu, C.H. and Fang, L. (2023) How Does Geopolitical Risk Affect Corporate Innovation? Evidence from China-listed companies. Emerging Markets Finance and Trade, 59(7), 2217-33.

[3]. Huang, Q., Tian, L., Chen, Y. and Zhang, Q. (2024) The impact of extreme weather on corporate debt financing costs: evidence from China, Applied Economics, 1-19.

[4]. Gurtu, A. and Johny, J. (2021) Supply Chain Risk Management: Literature Review. Risks, 9(1).

[5]. Chen, J. and Liu, J. (2025) Pricing and Logistics Strategies for Cross-Border E-Commerce Exporters by Considering Tariff. Arabian Journal for Science and Engineering.

[6]. Liu, C.Y., Dong, T.Y. and Meng, L.X. (2022) The Prevention of Financial Legal Risks of B2B E-commerce Supply Chain. Wireless Communications and Mobile Computing. , 2022(1), 6154011.

[7]. Pankratz, N.M.C. and Schiller, C.M. (2023) Climate Change and Adaptation in Global Supply-Chain Networks. The Review of Financial Studies, 37(6), 1729-77.

[8]. Bednarski, L., Roscoe, S., Blome, C. and Schleper, M.C. (2025) Geopolitical disruptions in global supply chains: a state-of-the-art literature review. Production Planning & Control, 36(4), 536-62.

[9]. Yan, H. (2023). Research on Risk Factors of China's Cross-Border E-commerce Supply Chain. Nan fang jing ji.

[10]. Bag, S., Rahman, M.S., Chan, H.L. and Sharma, J. (2025) Effect of Supply Chain Flexibility and Supply Chain Endurance on Supply Chain Resilience in Extreme Weather Events: An Empirical Study. IEEE Transactions on Engineering Management, 72, 2150-64.

[11]. Rasshyvalov, D., Portnov, Y., Sigaieva, T., Alboshchii, O. and Rozumnyi, O. (2024) Navigating geopolitical risks: Implications for global supply chain management. Multidisciplinary Reviews, 7.

[12]. Jr, J.F.H., Matthews, L.M., Matthews, R.L. and Sarstedt, M. (2017) PLS-SEM or CB-SEM: updated guidelines on which method to use %J Int. J. of Multivariate Data Analysis, 1(2), 107-23.

[13]. Fornel, C.l. and Larcker, D.F. (1981) Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39-50.

[14]. Henseler, J., Ringle, C.M. and Sarstedt, M. (2015) A new criterion for assessing discriminant validity in variance-based structural equation modelling. Journal of the Academy of Marketing Science, 43(1), 115-35.

[15]. Lin, Y., Fan, D., Shi, X. and Fu, M. (2021) The effects of supply chain diversification during the COVID-19 crisis: Evidence from Chinese manufacturers. Transportation Research Part E: Logistics and Transportation Review, 155, 102493.

[16]. Rose, N. (2023). Exogenous impacts on retailing and consumer behaviours: The impact of weather and the COVID-19 pandemic: University of Liverpool.

[17]. Wu, J. (2025). The Rise of China: A Key Player in the Supply Chain. In: Wu J, editor. Global Trends in Manufacturing Supply Chains. Singapore: Springer Nature Singapore.

Cite this article

Yang,Z. (2025). Risks in Cross-Border E-Commerce Supply Chains Due to the Interactive Impact of Geopolitical and Extreme Weather Factors: A Basic Moderating Effect Model. Advances in Economics, Management and Political Sciences,229,141-154.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Niu, Y., Werle, N., Cohen, M., Cui, S., Deshpande, V.and Ernst, R. (2025) Restructuring Global Supply Chains: Navigating Challenges of the COVID-19 Pandemic and Beyond. Manufacturing & Service Operations Management, 27(4), 1025-36.

[2]. Lee, C.C., Zhang, J., Yu, C.H. and Fang, L. (2023) How Does Geopolitical Risk Affect Corporate Innovation? Evidence from China-listed companies. Emerging Markets Finance and Trade, 59(7), 2217-33.

[3]. Huang, Q., Tian, L., Chen, Y. and Zhang, Q. (2024) The impact of extreme weather on corporate debt financing costs: evidence from China, Applied Economics, 1-19.

[4]. Gurtu, A. and Johny, J. (2021) Supply Chain Risk Management: Literature Review. Risks, 9(1).

[5]. Chen, J. and Liu, J. (2025) Pricing and Logistics Strategies for Cross-Border E-Commerce Exporters by Considering Tariff. Arabian Journal for Science and Engineering.

[6]. Liu, C.Y., Dong, T.Y. and Meng, L.X. (2022) The Prevention of Financial Legal Risks of B2B E-commerce Supply Chain. Wireless Communications and Mobile Computing. , 2022(1), 6154011.

[7]. Pankratz, N.M.C. and Schiller, C.M. (2023) Climate Change and Adaptation in Global Supply-Chain Networks. The Review of Financial Studies, 37(6), 1729-77.

[8]. Bednarski, L., Roscoe, S., Blome, C. and Schleper, M.C. (2025) Geopolitical disruptions in global supply chains: a state-of-the-art literature review. Production Planning & Control, 36(4), 536-62.

[9]. Yan, H. (2023). Research on Risk Factors of China's Cross-Border E-commerce Supply Chain. Nan fang jing ji.

[10]. Bag, S., Rahman, M.S., Chan, H.L. and Sharma, J. (2025) Effect of Supply Chain Flexibility and Supply Chain Endurance on Supply Chain Resilience in Extreme Weather Events: An Empirical Study. IEEE Transactions on Engineering Management, 72, 2150-64.

[11]. Rasshyvalov, D., Portnov, Y., Sigaieva, T., Alboshchii, O. and Rozumnyi, O. (2024) Navigating geopolitical risks: Implications for global supply chain management. Multidisciplinary Reviews, 7.

[12]. Jr, J.F.H., Matthews, L.M., Matthews, R.L. and Sarstedt, M. (2017) PLS-SEM or CB-SEM: updated guidelines on which method to use %J Int. J. of Multivariate Data Analysis, 1(2), 107-23.

[13]. Fornel, C.l. and Larcker, D.F. (1981) Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39-50.

[14]. Henseler, J., Ringle, C.M. and Sarstedt, M. (2015) A new criterion for assessing discriminant validity in variance-based structural equation modelling. Journal of the Academy of Marketing Science, 43(1), 115-35.

[15]. Lin, Y., Fan, D., Shi, X. and Fu, M. (2021) The effects of supply chain diversification during the COVID-19 crisis: Evidence from Chinese manufacturers. Transportation Research Part E: Logistics and Transportation Review, 155, 102493.

[16]. Rose, N. (2023). Exogenous impacts on retailing and consumer behaviours: The impact of weather and the COVID-19 pandemic: University of Liverpool.

[17]. Wu, J. (2025). The Rise of China: A Key Player in the Supply Chain. In: Wu J, editor. Global Trends in Manufacturing Supply Chains. Singapore: Springer Nature Singapore.