1. Introduction

Since 2020, the global economy has seen many changes under the influence of Covid-19. Among them, energy and international relations issues due to the war in Russia and Ukraine have taken the lead as a source of leading stock market volatility, while the U.S., which has raised interest rates several times in response to uncontrollable inflation, has also been implicated in the turmoil of the economic system. One of the most notable events among them was Twitter's acceptance of Musk's $44 billion acquisition deal in April 2022. When the news of this acquisition was released, the media and stock market all exploded. The agreement also caused Twitter's stock price to skyrocket within a week, while at the same time Musk's Tesla's stock value fell, saying it was preparing for the acquisition of Twitter. The takeover fiasco had a notable impact on overall market volatility, though Twitter's shares slid about 13 percent in the month since reaching a yearly high in late April, with an overall difference of more than $9 billion in market value, because investors were concerned the deal would not be completed [1]. As a result, we were able to see a lot of volatility in the stock market as a result, with the stock prices of companies like Tesla and Twitter being particularly volatile. So, what do mergers and acquisitions of companies bring in the course of a market economy? How do they have a substantial impact on the stock market? Through the study, we will have a clearer grasp of corporate M&A itself and the impact it brings to the stock market, so that we can have a deeper knowledge of the link between corporate M&A transactions and stock market volatility as well as the risks and find better returns.

2. Impact Between M&A and Stock Market

Mergers and acquisitions are an important strategic approach to the growth of a company, and a convenient means to help companies expand their scale, consolidate their core competitiveness, and maximize the interests of shareholders.

When the listed company's M&A plan becomes mature, it often has to choose different ways to carry out the M&A based on the amount of its own capital, the good or bad development prospects and the good level of the manager, in order to ensure the smooth implementation of the transaction. In the concept of economics, the impact of exchange is not only instantaneous but also long-term. During this period the stakes of the impact itself are well worth digging deeper into. When it comes to corporate mergers and acquisitions, there are a number of scenarios that break out, and the first one to talk about is the series of impacts that lie under the explicit corporate merger plans of large companies. In general, the impact of such mergers and acquisitions on the stock market and the companies involved is mostly positive.

The Nobel laureate economist Stigler once noted that there is not a single major American company that has not grown through some degree or fashion of mergers and acquisitions [2]. Mergers and acquisitions are an important strategy for companies seeking their own growth and industry leadership. And it is also an essential choice for companies to take the initiative in the market, especially in the stock market. Recently, oil and energy issues have received much attention. Because the world and geopolitical issues have attracted the attention of many investors. As the price of oil has risen, oil stock prices have been volatile in waves. But, after nearly a century of economic development, there is an oil tycoon, Mr. Rockefeller, who has spent less than a decade controlling 90% of the nation's oil market. From an oil refinery with a registered capital of $1 million at the time of its founding to a trust with $70 million in assets that controls 90% of the U.S. oil supply, Rockefeller has provided future generations with a perfect preview of "industrial integration through corporate mergers" [3]. The journey of corporate acquisitions executed by Mr. Rockefeller has been so successful that it can be said that without several acquisitions being made, his oil tycoon and the formation of his rising stock price would not have been possible. Its acquisition path originated with the goal of controlling the refining industry, seeing the right market moment in Cleveland and easily taking down numerous target companies with its own advantages. And then he acquired crude oil plants in oil-producing areas by cleverly setting traps, a move that took the source supply problem to the root. On this basis, Rockefeller searched for and used his talents to carry out in-depth mergers in the refining industry in the oil-producing regions of Pennsylvania, and he further acquired oil transportation companies on this basis [3]. The entire process was intertwined and made each acquisition serve to promote the industry. This clear corporate development plan led many talented people to join the wave of mergers and acquisitions. Therefore, mergers and acquisitions can help companies grow rapidly and contribute greatly to the expansion of their production lines and the improvement of their industrial processes.

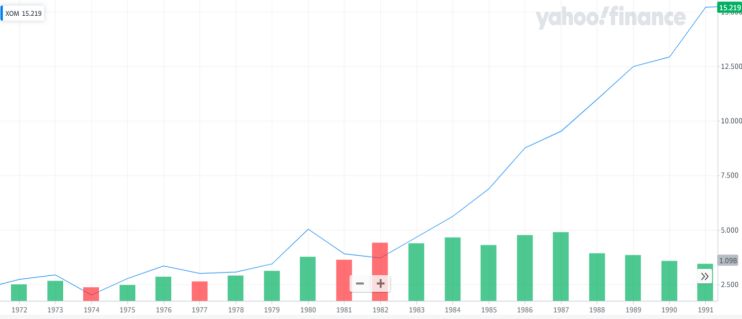

Figure 1: XOM’s stock price growth.

Figure. 1 is the change in the stock price of Rockefeller's Mobil Oil over the last century, from which we can see that its stock price has been steadily increasing since the beginning of the corporate merger. So we can see from this that a good case of an M&A process is one in which the company has a clear corporate development plan and objectives, based on which the supply and quality of the products are guaranteed, the risks are avoided while ensuring the steady development of the company, and the impact of this M&A policy on the stock market is bound to be positive. For investors, an M&A deal with a company that has a stable product output and a clear development plan is a guaranteed investment. This will also attract more attention from investors, and the stock price will naturally rise slowly.

In the event of a merger or acquisition, stock price volatility can correspondingly increase a firm's propensity to merge. And when certain firms face uncertainty, they usually make over-investment decisions [4]. So is there a negative impact of corporate mergers and acquisitions on the stock market? The answer is absolutely yes. For some listed companies, mergers and acquisitions are sometimes not a means to promote the company's development, but a phenomenon to expand the market scope or blindly follow the trend. In today's globalized economy, the increasingly fierce business competition makes more and more companies choose mergers and acquisitions as an effective channel to increase company value and enhance core competitiveness. However, due to the blind pursuit of synergistic effects, three major M&A problems, namely excessive payment premium, lack of understanding of the target company, and cultural clash, frequently lead to M&A failure.

In the historical development of corporate M&A, there have been several influential M&A trends. One of these was the sixth wave of M&A following the 2001 recession. When the economy returned to growth, large amounts of dollars flooded the market and the Federal Reserve kept interest rates low to stimulate the economy [5]. Low-interest rates also contributed to the growth of private equity funds as leveraged buyouts became cheaper, which also contributed to the stock market boom. This wave has led to a large amount of available capital and an extremely favorable environment. In a market environment of high liquidity and cheap capital, M&A deals increased exponentially, but also created distortions. Due to massive speculation and a lack of perceived risk, many M&A deals ended up being overvalued, leading to massive resources directed to "rotten" assets [5]. The result was the subprime mortgage crisis in 2007, which plunged the world into recession.

During this time, a number of not-so-successful M&A events took place. In May 2007, CIC spent about $3 billion to buy nearly 10% of BlackRock's stock at $29.605 per share. However, this investment did not pay off well for the company. As the international financial environment deteriorated, CIC's investment in BlackRock reached a loss of $2.5 billion by October 2008 [6]. At the end of 2007, CIC purchased $5.6 billion in face value of Morgan Stanley's mandatory convertible bonds, accounting for 9.86% of Morgan Stanley's equity at the time. As a result of the escalating financial crisis and mergers and acquisitions, Morgan Stanley's share price fell sharply and the trading book was floated with a loss of about $3 billion [6]. This caused the share price of CIC to fall again and again at that time, and also drove the share price of the acquired company to produce great ups and downs. In the financial crisis environment, it was clear that M&A was not the best way to save the company and make it prosperous.

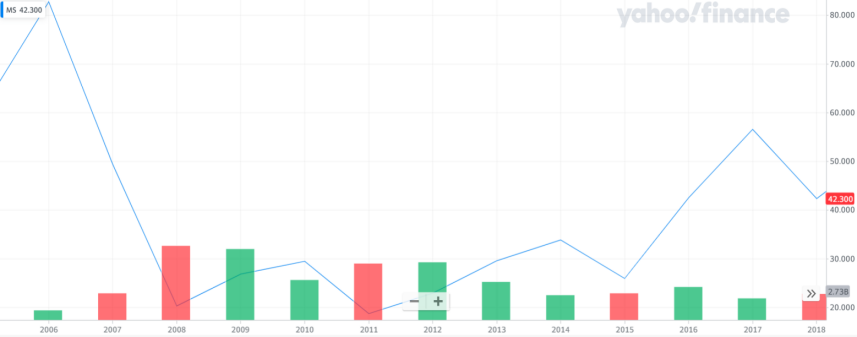

Figure 2: CIC's share price fluctuations since 2007.

Figure 3: Morgan Stanley's share price fluctuations since 2007.

Through Figure 2 and Figure 3, we can see that its own stock market sentiment has not improved much since CIC made its stock takeover in 2007 and has declined all the way in the latter half of 2007. Morgan Stanley's share price also fell severely because of the M&A deal and the overall market economic downturn.

Following this merger, in November 2008, Ping An Insurance Company of China announced that it had become a single shareholder in Fortis Group, an international financial services provider operating mainly in the banking and insurance business, by purchasing 95.01 million shares, or approximately 4.18% of its total share capital, at a cost of approximately 1.81 billion euros [7]. The news of this merger made many investors brighten up. However, due to the lack of experience in forecasting Fortis' net assets, especially in estimating the impact of the financial crisis on Western financial institutions, the investment eventually resulted in serious losses for Ping An. Soon after Ping An acquired Fortis, Fortis Group collapsed. Ping An Insurance Company of China was left with less than 30% of its investment and its share price plummeted.

In fact, the reason for these negative situations is that the company does not have a good value measurement and analysis of its own situation and position when making M&A transactions. First of all, when implementing M&A plans, companies should first focus on the future direction of the market economy and measure the direction of the company's own development. Influenced by managers' controlling habits of thinking, some companies are accustomed to analyzing and examining the financial results of completed, unchanged, past activities, rather than analyzing and communicating with the present and the future in mind [8]. Financial analysis that does not serve the future will only reveal past problems and be satisfied with what has been achieved, making mergers and acquisitions occur blindly. Secondly, when measuring M&A transactions, companies sometimes have unclear strategies or strategies that do not translate into actionable criteria, as well as a lack of external clarity about industry competition and a failure to find external benchmarks, which also prevent companies from seeing opportunities and threats [8]. Since the main issue between M&A transactions and stock price movements is the company's finances, another reason why M&A makes stock prices fall is that companies do not consider the risk or are too conservative in their financial analysis. In the case of Ping An Insurance, it can be concluded that some companies lack the necessary risk awareness and do not perform risk analysis when making decisions. This kind of financial analysis never or seldom considers risks for enterprises, especially for mergers and acquisitions of foreign-funded enterprises. The result of the analysis is not a risk adjustment, which also leads to the decision-making of the enterprise not to see the future development risk of the enterprise. This also leads to a situation where the company cannot see the abyss ahead when the M&A transaction takes place, until the risk becomes a loss and the company's stock price plunges into a situation that is difficult to revive.

3. Conclusion

This paper focuses on the impact of corporate mergers and acquisitions on stock market volatility and explores the link between corporate mergers and acquisitions and stock market volatility by reading and analyzing the literature and cases. We can see that whether a company's M&A share price will go up or down is really a case-by-case decision. If the acquired company is a mess, with poor performance, no future, and heavy debts, then it is a piece of negative news for the company making the offer. The company's performance will be dragged down and the share price may fall as a result. However, if the company has a good outlook and is helpful to the company making the offer, it is good news and the company's stock price may rise. But sometimes, M&A rumors are more likely to affect stock price volatility than the M&A deal itself. Usually the stock price of listed companies with M&A rumors in the market will be affected by the rumors. Because investors want to focus on companies with merger and acquisition rumors, most stock prices will rise at first. After the announcement of a merger or acquisition, the upward trend in stock prices usually tapers off or even reverses to a decline due to the end of the merger or acquisition and other factors. The Rockefeller oil company's M&A history and the Twitter acquisition fiasco show that, in general, the stronger the M&A firm and the better the industry it belongs to, the more likely it is that the M&A will cause the stock price to rise, while the opposite is likely to cause the stock price to fall. Among the many waves of corporate mergers and acquisitions, hybrid mergers and acquisitions have the greatest impact on the stock price volatility of the acquiring firm because of their broad coverage and the longer M&A journey they undergo. Of course, the literature and case studies covered in this paper are only a small part of the picture; in a changing market economy, there are still many variables in M&A transactions, and corporate mergers and acquisitions are not limited to affecting stock market volatility. Based on the analysis of the impact of M&A on stock market volatility, in the future we can also analyze the link between stock market volatility and the occurrence of M&A from the reverse perspective. On this basis, the market reaction of both parties to the M&A can be further explored. It is also possible to further investigate whether corporate M&A transactions have a positive or negative impact on other development factors in the overall market.

References

[1]. Safak, V. (2022, May 16). Elon Musk's Twitter takeover: Politician accounts. arXiv.org. Retrieved August 4, 2022, from https://arxiv.org/abs/2205.08491

[2]. Bruner, R. F., & Levitt, A. (2009). Deals from hell M&A lessons that rise above the Ashes. Wiley.

[3]. Gan, chun hui. (2006). Da Bing Gou: 30 ge Shi Jie Zhu Ming Qi Ye Bing Gou Jing Dian an li. Shang hai ren min chu ban she.

[4]. G. Zhu, W. Hu, S. Che and D. Yang, "Stock Price Volatility, Equity Balance and Corporate M&A," 2020 39th Chinese Control Conference (CCC), 2020, pp. 7695-7700, doi: 10.23919/CCC50068.2020.9188929.

[5]. The seventh M&A wave - camaya partners. (n.d.). Retrieved August 4, 2022, from https://camayapartners.com/the-seventh-ma-wave/

[6]. Xiao, Y. (n.d.). Top 9 overseas M&A failures. Overseas M&A 9 major failure cases- M&A restructuring. Retrieved from http://www.lawyer-win.com/article-detail/b05kMVEB

[7]. Li, Q. (2019). Analysis of Risk Management Strategies for Equity Investment in State-Owned Enterprises. Economics, 2(6). https://doi.org/10.32629/ej.v2i6.300

[8]. Financial analysis of M&A cases - Financial traps that cannot be ignored. (n.d.). Retrieved August 4, 2022, from http://www.invest-data.com/eWebEditor/uploadfile/20190225212924971720.pdf

Cite this article

Yu,Z. (2023). Analysis of the Influence of Enterprise Mergers and Acquisitions on the Stock Market. Advances in Economics, Management and Political Sciences,8,48-53.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Safak, V. (2022, May 16). Elon Musk's Twitter takeover: Politician accounts. arXiv.org. Retrieved August 4, 2022, from https://arxiv.org/abs/2205.08491

[2]. Bruner, R. F., & Levitt, A. (2009). Deals from hell M&A lessons that rise above the Ashes. Wiley.

[3]. Gan, chun hui. (2006). Da Bing Gou: 30 ge Shi Jie Zhu Ming Qi Ye Bing Gou Jing Dian an li. Shang hai ren min chu ban she.

[4]. G. Zhu, W. Hu, S. Che and D. Yang, "Stock Price Volatility, Equity Balance and Corporate M&A," 2020 39th Chinese Control Conference (CCC), 2020, pp. 7695-7700, doi: 10.23919/CCC50068.2020.9188929.

[5]. The seventh M&A wave - camaya partners. (n.d.). Retrieved August 4, 2022, from https://camayapartners.com/the-seventh-ma-wave/

[6]. Xiao, Y. (n.d.). Top 9 overseas M&A failures. Overseas M&A 9 major failure cases- M&A restructuring. Retrieved from http://www.lawyer-win.com/article-detail/b05kMVEB

[7]. Li, Q. (2019). Analysis of Risk Management Strategies for Equity Investment in State-Owned Enterprises. Economics, 2(6). https://doi.org/10.32629/ej.v2i6.300

[8]. Financial analysis of M&A cases - Financial traps that cannot be ignored. (n.d.). Retrieved August 4, 2022, from http://www.invest-data.com/eWebEditor/uploadfile/20190225212924971720.pdf