1. Introduction

The Covid-19 pandemic has brought great changes to the global economic landscape and challenges to countries and companies along with global inflation. Billions of people have been confined to their homes for many months, and those restrictions have prevented people from going to work, so this cause a direct impact on the economy. But for the U.S., as the country with the largest number of Covid-19 cases and the largest developed economy in the world, the impact of Covid-19 on the economy also cannot be ignored. According to the research, there are many areas of concern about the economic crisis in Covid-19 leading to the development of inflation. But few papers have looked at the overall response of U.S.central banks and companies to Covid-19 inflation. The plight and the response of the United States as a whole could become a model for other countries facing this inflation. Therefore, this paper will use the background of the United States to explore the causes of inflation, the central bank's strategy for a short time and long time inflation, and how inflation reflects the difficulties faced by the American companies Apple and Amazon. This paper mainly uses literature, case, and data analysis methods. Literature analysis is used to explore the Federal Reserve’s discussion on the transitory and persistent period of inflation. Case and data analysis are used to explore the problems faced by Apple and Amazon in the United States under inflation condition and their strategies used. This research could help other counties that also have an economic inflation issue as an example to make better decision policies to stabilize their economy.

2. Driving Factors of Inflation under the Covid-19

Inflation is probably one of the most familiar words in economics. The definition of inflation is that it is the rate of increase in prices over a given period. But typically, inflation is a broad measure, such as a country having an overall increase in their price level or some goods or services becoming more expansive in one year. According to the research, there are two different opinions of Americans that think on the driving factors of inflation under the Covid-19, which is the period for the inflation is Temporary or Persistence [1].

2.1. Temporary Time Period for Inflation

For people who think inflation is only a temporary event, they believe that there are two driving factors for inflation, The first one is the unbalance of demand and supply. Another one is the disruptions and misalignment of the Supply Chain. But they also believe that this unbalance and disruptions will be adjusted as the global economy recover. At the beginning of the Covid-19 period, Covid-19 causes a massive disturbance in the global supply chains. Since most people try to far away from high-flow areas to avoid infection, like in office buildings, they had to spend less time on their working time, and that causes the supply chains of many industries to break or shut down [2]. However, during this period, people were worried about their sources and products will be limited, they are fallen into a panic stockpiling and based on the panic stockpiling, the price for bulk commodities such as energy and agriculture products increased. When the supply decrease as the supply chain is broken and demand for bulk commodities increase, this caused a serious limitation for the total supply. Then, when Covid-19 temporarily stabilized, people’s demand would be rebounding, so consumers had excess saving for many daily products, which cause inflation appears. But some American believe that this is only short time inflation. As the global economy recovers from Covid-19, the supply chain’s problem would be solved and the higher demand will be balanced with the new total supply [1]. Hence, they think in the long term, the inflation rate would still be within the normal range.

2.2. Persistence Time Period for Inflation

The people who think inflation is a persistent event believe that the driving factor for this type of inflation depends on the policymakers. Based on the disruptions of the supply chain, the shortage of labor, and the increase in aggregate demand, some American economists show that the US government could adjust monetary and fiscal policies as soon as possible. This inflation rate would manageable, which means it is a short period event [1]. However, until 2021, the federal reserve and US government were denied inflation and they even didn’t cut their spending. Hence, whether this is a short-time or long-time inflation, depends on those policymakers. If those policymakers, like the US government and the federal reserve, still maintain denying the possibility of inflation, the temporary inflation may turn into a long-time persistent event. This is the reason American economists are worried that inflation has a large possibility to change into a long-term event.

3. Policies Implemented by the Central Bank

According to this debate, there is also a big shift in the strategy of the Federal Reserve, which is the Central bank of America. At the beginning shock of Covid, the U.S GDP in 2020 declined to 31.7% than before and the unemployment rate was about 9.7% until September. Both of these data are similar to the great depression in 2008[3]. This is the reason that the Federal Reserve initially used expansionary monetary policy, also known as easing monetary policy, to boost economic growth by increasing money and decreasing interest rates.

3.1. Loose Monetary Policy

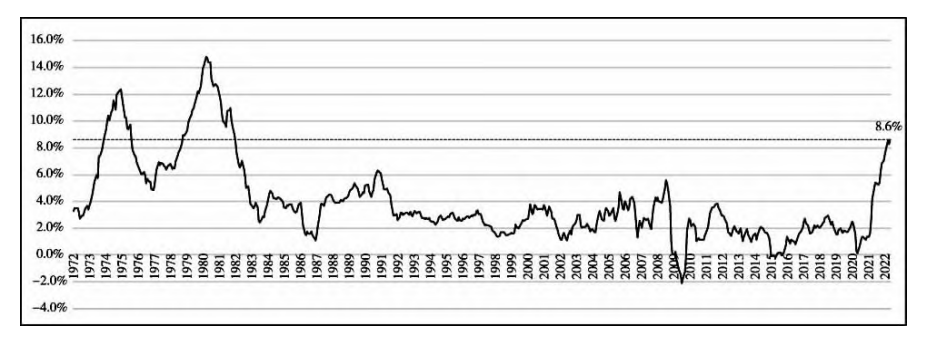

This round of monetary policy expansion began after the outbreak of COVID-19. In response to the impact of the pandemic, about 40 central banks around the world cut interest rates more than 50 times in March 2020. This policy helps Fed to lower its benchmark federal funds rate down to about zero percentage quickly and also allowed the Fed to expand its balance sheet rapidly in a short term. They have provided ample liquidity through measures such as expanding the scale of monetary policy operations or supporting liquidity facilities. Also according to central bank statistics, the Fed's balance sheet expanded to 76.8% in 2020. And one of the key tools for expansionary monetary policy is “quantitative easing”, which decided to purchase a large number of debt securities, to restore the smooth functioning of markets during a recession or inflation coming. However, by the end of 2021, more people in the debate over the inflation period start to turn to agree with the persistent opinion. This is based on the data for U.S. CPI, which is the consumer price index. It is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. According to the figure, the data for CPI in 2022 increased to 8.6 percent than before [4]. Since 1981, this is the fastest growth rate in CPI and it illustrates that the price level continues to increase. Hence, the federal reserve acknowledged that inflation persistence had exceeded expectations, so there are many risks and uncertainties in the inflation outlook and the period for inflation seems more long-term.

Figure 1: U.S. CPI monthly year-on-year growth since 1972 [4].

3.2. Tight Monetary Policy

The Fed's miscalculation of the economy and its loose monetary policy resulted that inflation has been running higher and longer than the Fed expected, while the labor market is nearing full employment. And there is a more critical factor behind this shift is a change in the Fed's understanding of the relationship between inflation and employment. Since the outbreak of Covid-19, the Fed was focused on employment as its primary objective, and they focused more on achieving full employment by keeping monetary policy loose and inflation relatively high to minimize unemployment and adopting a flexible average inflation target of 2 percent. However, this policy worked fine in a low-inflation environment, but under the runaway inflation condition, the Fed realized that high inflation does not help full employment. According to the research that the inflation rate was increasing to 7% and the unemployment rate fell to 3.9% before 2021[1]. Then, the Federal Reserve decides to change the policy to a tight monetary policy, which is to reduce a country's money supply to prevent the rise of inflation and the central bank will raise interest rates to slow down the growth of money and prices. So, in order to achieve a tight monetary policy, first, they try to increase the reserve requirement for banks. That caused, from the November of 2021, the Federal Reserve starts to reduce Treasury bonds by $10 billion and $5 billion in MBS, which is mortgage-backed securities, every month [3]. And in the same month, CPI had risen to 6.8% and the unemployment rate had fallen to 4.2%, below the natural rate of 4.4%. This illustrates that the tightened monetary policy could help to reduce the unemployment rate. Another policy is that in order to tighten the monetary policy, the Federal Reserve raises the interest rate, so it would support the appreciation of the dollar, which also depreciation of other countries' currencies. Then imports will increase since people want to use less money to buy products from other countries and it also attracts capital backflow. Therefore, the Federal Reserve uses tight monetary policy to curb rapidly rising inflation.

4. How American Companies Faced to the Inflation Issue

For U.S companies, the inflation under Covid-19 could reflect a shift in consumers’ preferences and their spending, like durable goods and delivery could replace restaurants, travel, and other services [5, 6]. Use Apple and Amazon as an example, from the two industries of electronic technology products and express retail, to find the problems they faced under the inflation of Covid-19 and the strategies they used.

4.1. American Company: Apple

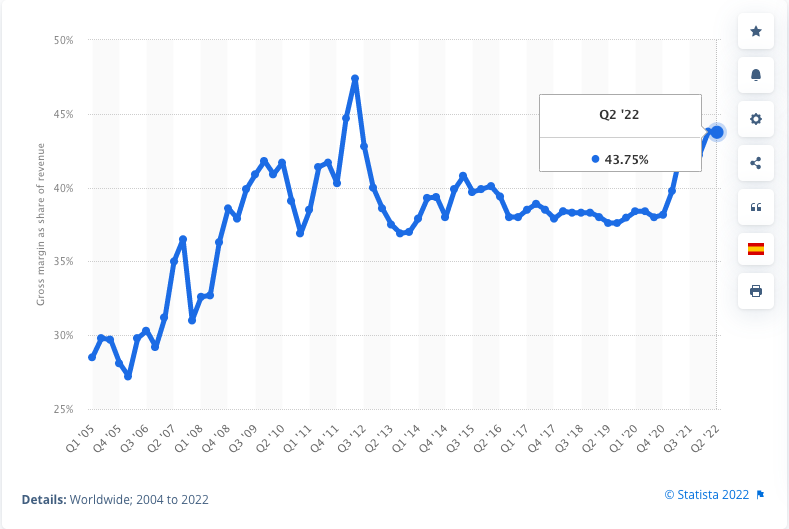

First, from Apple’s perspective, there are three main effects of inflation during the Covid-19 on electronic technology products: cost increase, labor shortage, and the supply chain has been broken. The cost increase caused this company to have two inflation on their balance sheet, which are gross profit margin and operating expenses. According to the FactSet data and figure 2, Apple's gross profit margin in 2022 reached 43.75%, and the operating expenses were $12.58 billion, which almost increase by nearly 19% than before [6]. There are two main sources of cost increase, one is the shipping cost and another is personal cost increase by a labor shortage. And in order to prevent the top technology workers leave, apple decided to raise their wages so that they can cope with inflation pressure and improve their competitiveness in the labor market. However, the disruption of the supply chain made the production of Apple slow down and this was caused when Apple announced that they will release a new keyboard for the iPad in May, and their main accessory cannot be ready immediately. They have to wait about several months to get their main accessory, so the waiting time between ordering and shipping increases. Hence, even if Apple continues to develop new products and make them available to consumers online buying, its output still remains at a low level. Moreover, the spread of Covid-19 had disrupted manufacturing in many Southeast Asian countries, which also cause parts of Apple's supply chain cannot to ship or produce and it also increases the shipping cost. Hence, in order to deal with the shortage of supply chains, Apple decided to shift its supply chain to countries or regions that have more resilient supply chains. For example, in 2021, Apple struck a deal with Chinese display company BOE to supply OLED screens [7, 8]. It has also set up eight contract factories in Apple's supply chain, including Foxconn's mobile phone assembly line.

Figure 2: Apple's gross margin as percentage of revenue from 1st quarter 2005 to 2nd quarter 2022.

4.2. American Company: Amazon

From the perspective of Amazon, they are also facing the same situation as Apple, but Amazon has become the most common way of shopping for many consumers due to its drive to provide convenience and low prices. This is because, in the early days of Covid-19, consumer preferences shifted to products such as hand sanitizers, masks, and disinfectants that could protect them from Covid-19. And through shifting their working place at home, their propensity to buy durable goods for home and office also increase. This has led them to have higher record sales orders even during the pandemic and while other industries are laying off workers, Amazon continues to hire. According to the data, Amazon added 36,400 people in the three months until June 2020, and this hiring strategy allowed them to bring their population of employees to reach to 876,800, which is up 34% than before [9]. However, under the Covid-19 prevention measures, most of the employees in Amazon cannot go back to work immediately, so even if some workers can return to work, their salaries will be increased accordingly. In order to prevent the reduction of labor, Amazon has to increase their expenditure on employee wages to maintain their labor force, so their human cost will increase too. On the other hand, the large demand for product orders also accelerated the rupture of the supply chain. And as consumer demand for nonessential goods has fallen, these goods have piled up in U.S. warehouses, then leading to both an accumulation of orders and shortages in the warehouse [10]. Hence, the strategy for amazon used is to limit the number and variety of orders. Therefore, based on apple and amazon’s facing problem and their strategies, they illustrate that American companies common have costs rise, a lack of labor, and supply chain rupture problems under the inflation of Covid-19. But according to the different industry situations, it also reflected that there is a shift in consumer preference and spending occurred from the express delivery industry has replaced the electronic technology products.

5. Conclusion

This paper explores the causes of inflation, the central bank's strategy, and how America responds to the inflation caused by Covid-19. Overall, the inflation under the Covid-19 condition is caused by supply and demand imbalances and supply chain disruptions. It is a continuing effect that has changed the operating way for central banks and American companies: the Federal Reserve was shift its monetary policy from loose to tight in order to curb inflation by raising interest rates to make dollar appreciation and for American companies, Apple is shifting their supply chains to more resilient countries, while Amazon's strategy is to limit the number and variety of orders. There are still some shortcomings in this paper. For example, in this paper, the American companies may only discuss the delivery industry and electronic technology products, but they cannot represent the same problems faced by all industries in the United States, which may be the focus of future research will summarize.

References

[1]. Zhu M, Xu Z.X, Gong B & Li C.T. (2021) .Global economic Finance in 2022: The Sword of Structural Inflation and the challenge of Central Banks. International Finance Studies(12) ,3-13. doi:10.16475/j.cnki.1006-1029.2021.12.002.

[2]. Li C.D & Zheng F.(2021)"Supply Chain Crisis" in the United States: Short-term Supply-demand Imbalance or Long-term structural Adjustment? Neutralize negative influence. Import and export manager(12), 43-45. doi:CNKI:SUN:SJJD.0.2021-12-018.

[3]. Cachanosky, N., Cutsinger, B. P., Hogan, T. L., Luther, W. J., & Salter, A. W. (2021). The Federal Reserve's response to the COVID-19 contraction: An initial appraisal. Southern economic journal, 87(4), 1152–1174. https://doi.org/10.1002/soej.12498

[4]. Li S.G,Zhang Q.S & Li Y.J.(2022).Trend of development of inflation of United States of America and influence on our country. China's prices (07), 27-30. doi:CNKI:SUN:ZGWJ.0.2022-07-009.

[5]. Huang Z.Z,Liu J & Zhang J.(2021).Analysis of the impact of COVID-19 on Moog's operating results. China's space(05),41-47. doi:CNKI:SUN:ZGHT.0.2021-05-009.

[6]. Meyer, B. H., Prescott, B., & Sheng, X. S. (2022). The impact of the COVID-19 pandemic on business expectations. International journal of forecasting, 38(2), 529–544. https://doi.org/10.1016/j.ijforecast.2021.02.009

[7]. Kif Leswing, How inflation will affect Apple, JUL 1 2022,https://www.cnbc.com/2022/07/01/wealthy-customers-will-help-apple-resist-the-effects-of-inflation.html

[8]. Wang W(2022-02-11).Apple's supply chain worries. China Electronic News,008.

[9]. Annie Palmer,How Amazon managed the coronavirus crisis and came out stronger,Sep 29 2020, https://www.cnbc.com/2020/09/29/how-amazon-managed-the-coronavirus-crisis-and-came-out-stronger.html

[10]. Qu Y.H.(2021).Research on logistics cost from the perspective of international supply chain under the epidemic -- Taking Amazon Logistics as an example. Storage and transportation in China(02),115-117. doi:10.16301/j.cnki.cn12-1204/f.2021.02.045.

Cite this article

Li,W. (2023). How America Responds to the Inflation Caused by Covid-19. Advances in Economics, Management and Political Sciences,8,125-130.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhu M, Xu Z.X, Gong B & Li C.T. (2021) .Global economic Finance in 2022: The Sword of Structural Inflation and the challenge of Central Banks. International Finance Studies(12) ,3-13. doi:10.16475/j.cnki.1006-1029.2021.12.002.

[2]. Li C.D & Zheng F.(2021)"Supply Chain Crisis" in the United States: Short-term Supply-demand Imbalance or Long-term structural Adjustment? Neutralize negative influence. Import and export manager(12), 43-45. doi:CNKI:SUN:SJJD.0.2021-12-018.

[3]. Cachanosky, N., Cutsinger, B. P., Hogan, T. L., Luther, W. J., & Salter, A. W. (2021). The Federal Reserve's response to the COVID-19 contraction: An initial appraisal. Southern economic journal, 87(4), 1152–1174. https://doi.org/10.1002/soej.12498

[4]. Li S.G,Zhang Q.S & Li Y.J.(2022).Trend of development of inflation of United States of America and influence on our country. China's prices (07), 27-30. doi:CNKI:SUN:ZGWJ.0.2022-07-009.

[5]. Huang Z.Z,Liu J & Zhang J.(2021).Analysis of the impact of COVID-19 on Moog's operating results. China's space(05),41-47. doi:CNKI:SUN:ZGHT.0.2021-05-009.

[6]. Meyer, B. H., Prescott, B., & Sheng, X. S. (2022). The impact of the COVID-19 pandemic on business expectations. International journal of forecasting, 38(2), 529–544. https://doi.org/10.1016/j.ijforecast.2021.02.009

[7]. Kif Leswing, How inflation will affect Apple, JUL 1 2022,https://www.cnbc.com/2022/07/01/wealthy-customers-will-help-apple-resist-the-effects-of-inflation.html

[8]. Wang W(2022-02-11).Apple's supply chain worries. China Electronic News,008.

[9]. Annie Palmer,How Amazon managed the coronavirus crisis and came out stronger,Sep 29 2020, https://www.cnbc.com/2020/09/29/how-amazon-managed-the-coronavirus-crisis-and-came-out-stronger.html

[10]. Qu Y.H.(2021).Research on logistics cost from the perspective of international supply chain under the epidemic -- Taking Amazon Logistics as an example. Storage and transportation in China(02),115-117. doi:10.16301/j.cnki.cn12-1204/f.2021.02.045.