1. Introduction

Food is the most basic need for human survival. From the initial formation of human tribes to the current social form, food has developed from the initial self-sufficiency to the birth of many catering enterprises today, forming the catering industry, which has become one of the most important parts of the tertiary industry.

At the recently held Beijing Restaurant Brand Conference (China), the top ten brands of Beijing restaurants in 2022 were released, which, surprisingly, included the American fast food brand McDonald's, in addition to Chinese restaurant brands. As an international restaurant brand, McDonald's is renowned all over the world, which makes people curious about their business model and what made them success.

Business model, financial analysis and valuation are aspects to analysis the evolution of a corporation. As Magretta, creating a business model is a lot like writing a new story. Meanwhile, all new business models are variations on the generic value chain underlying all businesses [1]. Liu analysis Toyota’s business model by analysis the value chain and got to know that their success came from cooperative localization, total quality management, brand location, etc [2]. Chen illustrates that technology innovation and business model innovation have an interaction between them [3]. With the evolution of era and technology, business models are also influenced and refined by the wave of digitalization. Genzorova analysis the transport industry and get to know that employees should take part in digitalization actively and, by using the data, increases the communication with the business models [4]. Sarasini illustrate that vehicle manufacturers BMI applied new business models which can make use of innovations developed in multiple niches, imbuing user practice with new meanings and either require or facilitate the development of new competences [5].

Wei discussed about the financial analysis of Wangfujing Department Store, applying the framework proposed by Harvard professor Palepu K.G., Healy P.M. and Bernard V.L, which divides financial statement analysis into four logically connected steps: strategic analysis, accounting analysis, financial analysis, and outlook analysis [6]. Almazari measures the financial performance of the Jordanian Arab commercial bank by using the DuPont system of financial analysis which is based on analysis of return on equity model and find out the indicators performance that make the financial performance steady [7]. Fatema has explored the financial position of textile companies and acknowledged that much of the growth of the sector and its role as an economic powerhouse for the country is attributed to the availability of cheap labor [8].

Ke selects two analysis methods, absolute valuation method and relative valuation method, and conducts a comprehensive comparison and analysis of the valuation of science and technology-based companies with Huaxi Bio as an example through the price-to-earnings ratio method, price-to-sales ratio method, price-to-earnings growth method, and discounted free cash flow method, respectively [9]. Cooper, Priestley use the NBER Manufacturing Industry Productivity Database to calculate investment returns at the aggregate industry level and get to know that the valuations of private and public industries are largely similar, as are the cross-sectional distributions of q [10].

2. Background of McDonald

The McDonald brothers, Maurice and Richard, launched the worldwide fast-food company that bears their name in the 1940s. The original McDonald's, which was converted into a drive-through barbecue restaurant, was situated in San Bernardino, California. When it originally opened, McDonald's offered its shakes, fries, and hamburgers at a discount to rival businesses. The brothers installed a self-service counter rather than relying on waiters and servers. Additionally, they provided prepared meals that was kept warm by powerful heat lamps. In this way, McDonald's lowered their selling price and costs, which allowed them acquire a significant advantage over its conventional rivals.

The McDonald's Corporation may have been started by Ray Kroc, who admired the McDonald Brothers and supplied the restaurant as a kitchen appliance dealer, even though the McDonald Brothers were responsible for the name and the first McDonald's restaurant. He transformed the distinctive eatery's San Bernardino location into a mass-market business. By 1961, Kroc had completely absorbed the business's founders and taken over control.

McDonald's has been in business for many years at this point. McDonald's strived to build its brand and business over that time, and today it has over 30000 locations spread across more than 110 nations, making it one of the biggest fast-food restaurant chains.

However, a number of fast-food chains, including Burger King, Domino, and KFC, have emerged as McDonald's strongest rivals, capturing market share and driving away customers. Additionally, there are now complaints within the business. On the one hand, McDonald's sales are being held back by the labor shortage. Finding personnel is the largest issue restaurants are having as a result of the epidemic, 75% of restaurant operators agreed in a survey conducted by the National Restaurant Association (NRA). The majority of the polled owners acknowledged that they don't have enough staff to manage the business, which led to several dining rooms closing. This also applies to McDonald's. McDonald's, on the other hand, appears to be advancing the strategy of becoming a low-employee, high-technology, and self-service firm in order to save costs. This is evident from the corporation's acquisition of an artificial intelligence startup. Without a doubt, these initiatives increased McDonald's profit margins. However, over the past ten years, a fall in customer satisfaction and an increase in employee turnover have been considered as indicators of customers' and employees' displeasure.

In accordance with the summary above, this study focuses on three issues related to the growth of McDonald's. First, what market share does McDonald's now hold and what steps could be made to increase it? What should administrators do in addition to resolve the labor disputes? In addition, this paper also analyses their financial status and what type of information we can glean from it before, during, and after Covid-19.

3. Market Analysis & STP

3.1. Market Share Analysis

Market share is the portion of a business that accounts for all of the sales or revenue in a certain market. As a measurement of internal sales growth and one of the most significant business objectives since it is less dependent on the macro environment, market share is a key indicator in assessing performance relative to the growth of the market.

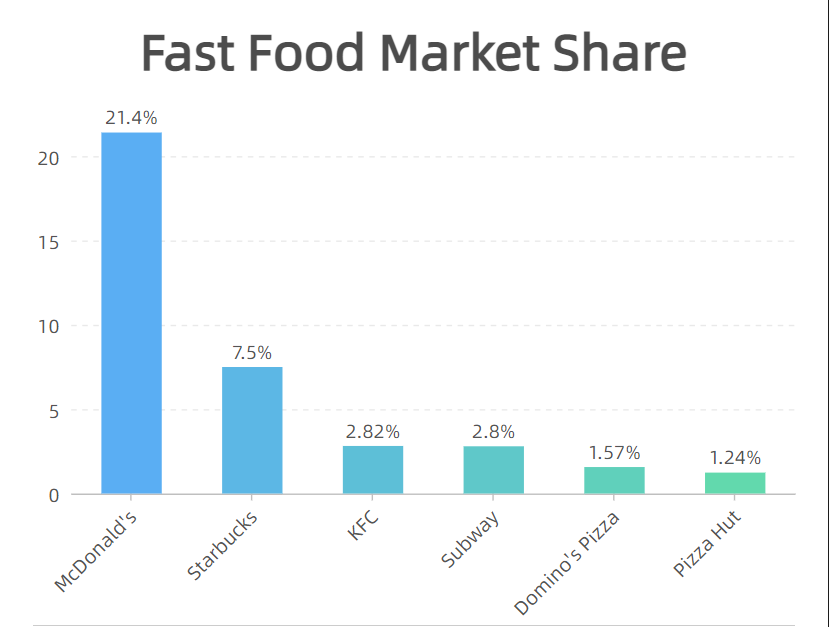

The market share of fast-food brand and the segment of McDonald’s in the global market share in 2019 is shown in figure 1. McDonald's dominates the fast-food industry, with a market share that is more than twice that of second-place Starbucks in 2019 (which accounted for 21.4% of the entire global market).

Figure 1: Fast-food market share.

Despite having the greatest market share in the fast-food sector, McDonald's market share appears to be declining. McDonald's is being shaken up by the fierce competition as new fast-food businesses emerge and more inventive and delicious goods are made, stealing customers from McDonald's. Although Burger King has already started offering a new barbecue rib sandwich for $1, McDonald's still sells the McRib, and Wendy, another fast-food chain, has recently begun serving smoky chipotle burgers and chicken sandwiches for around the same price. McDonald's does not, however, have a fresh product in the same category to compete with them. Other brands are also actively looking for their own orientation at the same time. In instance, Wendy's is providing high-end customers with premium products like Brioche Buns and Pretzel Bacon Cheeseburgers, two of the most popular limited-edition deals in recent memory.

3.2. STP Analysis

A technique known as STP analysis can assist a business in identifying several buyer groups, choosing one or more of them as its target market, and using the proper marketing mix to concentrate on providing for the target market's needs. STP evaluates your product offering and the manner in which you convey its advantages and worth to particular audiences. STP marketing consists of three steps: Market segmentation (S); Target market selection (T); Market positioning (P).

Market segmentation. Market segmentation is a method used by marketers to categorize the overall market for a product into different consumer groups based on variations in customer requirements and desires, buying behavior, and purchasing habits. Each consumer group constitutes a market sector, which is a collection of consumers with comparable demand trends. Different variables, such as location, demographics, psychology, or behavior, can be used to segment consumer markets. The writers in this instance examine the geographic and demographic market segmentation of McDonald's. McDonald's serves both the domestic and international markets, and they are aware that regional differences in taste exist both within the United States and among different nations. They perform admirably in this regard. For instance, people in the east and west of the country have varied tastes in coffee, hence McDonald's sells several coffee items in various parts of the country.

Additionally, they learn about the possibilities available on the global market for each nation's appetite. For instance, the McDonald's Group has obtained access to information on their customers' food preferences and food culture by developing a greater understanding of the Chinese market and Chinese consumers. In order to attract Chinese customers, McDonald's China introduced goods like the McSpicy Chicken Fillet Burger and Spicy McWings. For instance, evidence and data show that Chinese people favor chicken in their choice of meat products and that they enjoy savory and spicy flavors. These two items' strategic development and introduction proved to be quite astute, and they quickly rose to prominence among Chinese consumers, with the McSpicy Chicken Fillet Burger even surpassing other burgers in sales at McDonald's China in 2020.

Target market selection. The target market is clarified through market segmentation, and the needs of the chosen target market are met through the use of marketing tactics. In other words, the enterprise's preparedness to offer the corresponding goods and services as a result of market segmentation is the target market selection. A key approach for the business in marketing operations is choosing the target market, making clear which types of people the organization should serve, and identifying which of their needs to meet. Three target market selection tactics can be taken into consideration: undifferentiated marketing, intensive marketing, and differentiated marketing. The last option, differentiated marketing, was chosen by McDonald's. Consider three unique client groups that McDonald's targets with various marketing techniques: children and their families, young people, and minorities. Children dining in McDonald's restaurants occasionally receive balloons bearing the McDonald's emblem as a surprise gift. There are Ronald McDonald Clubs at McDonald's in China that provide space for frequent activities and kid's birthday celebrations. Children in China now want to celebrate their birthdays at McDonald's because to this type of marketing. Young individuals pick up a lot of information from their environment, and when they reach a certain level of self-awareness, they become interested in a wide range of IPs, including video games, books, movies, anime, and other media. Administering a restaurant, management teams can gain a lot of support from youthful fans by collaborating with certain well-known, fan-based IPs and releasing special foods or presents that are tied to those IPs. McDonald's does not appear to engage in much of this type of marketing, in contrast to KFC, a rival. Many young people will purchase KFC's limited-edition products in order to own the relics or peripherals of their preferred IPs. In the United States, McDonald's has taken action to support minorities. For example, Spanish-language ads featuring Hispanic or non-American culture have been broadcast on Hispanic cable networks.

Market Positioning. Market positioning is a term used to describe a marketing strategy developed by a business to appeal to the psychology of potential customers, to instill in the minds of target customers a particular perception or personality trait of the product, brand, or business, to maintain a strong impression and a distinctive position, and thereby to gain a competitive advantage. As a fast-food establishment, McDonald's upholds the idea of offering a quick, simple, and clean dining experience. Quick, self-selecting, combo style is the hallmark of McDonald's ordering, and they're sticking to it. They also offer prepared food in a warm box, self-service ordering machines, and various packages with a choice of food and number of diners.

4. Labor Analysis on McDonald’s

The fast-food business, particularly McDonald's, is experiencing a labor shortage as a result of the Covid-19 outbreak. Due to a scarcity of workers to staff these outlets, many fast-food companies, including McDonald's and Wendy's, are reducing their operating hours and even closing some of their locations.

In the current environment, reducing working hours, raising hourly pay, employing young students for part-time work, and further incorporating AI and automated gear to replace employees are preferable options.

First, in order to maintain the service provision in line with demand as much as possible, a qualified employer must first sacrifice some of its own benefits, i.e., by reducing the working hours and raising the salary level in order to retain the current employees and ensure their rights as workers, and second, hire part-time teenage students with high turnover and irregular working hours as a temporary supplement, if it is legal.

Additionally, even though McDonald's has become increasingly high-tech over the past ten years, or even "on its way to becoming a vending machine," there is no better solution in this environment than the use of AI and machinery, such as the voice recognition systems that some McDonald's drive-thrus already have to help make drive-thrus operations faster, easier, and more convenient. While the imagination is usually beautiful, reality is frequently subpar. The existing AI technology will inevitably have certain issues because of its slow response times and inability to solve complex problems as well as humans can. As a result, customer happiness will suffer to some extent. However, the world is still grappling with the new pandemic, so in the absence of artificial circumstances to guarantee that the basic service meets the requirements, only the relatively unimportant service experience can be chosen to be sacrificed. Additionally, because it is fast food, the number of customers for the dining experience will be lower than for senior French or Michelin star restaurants. The good news is that the pre-pandemic state has gradually been restored, and the domestic restaurant business in the United States is also gradually recovering. I predict that this will somewhat alleviate the employee shortage.

5. Financial Analysis on McDonald’s

5.1. Risk Analysis

This study collects the financial indicators from the website of McDonald’s and the data is summarized in table 1. Revenue is the total amount of income which generated by the sale of goods and services related to the primary operations of the business. Operating income is the remaining revenue that remains after operating expenses and cost of goods sold (COGS) have been subtracted from net sales or revenue for the day, month, or year. Net income is the profit that remains after deducting all expenses from sales revenue for the period. If all convertible securities were converted, a company's earnings per share would be calculated using diluted earnings per share (diluted EPS). The abbreviations for increase and reduction are Inc and Dec.

The Covid-19 pandemic that began in late 2019 to early 2020 hit hard with the McDonald's group, with McDonald's revenues shrinking significantly in 2019 to 2020. By the end of 2021, however, McDonald's revenue levels have returned to pre-pandemic Covid-19 levels and were even higher than they were before the outbreak, due to the positive response and policy support from McDonald's executives. McDonald's had drive-thrus to meet people's needs for a contactless diet while the epidemic was still in full effect.

Table 1: Financial indicators of McDonald’s.

2021 | Inc/(Dec) Excluding Currency Translation | 2020 | Inc/(Dec) Excluding Currency Translation | 2019 | |

Revenues | $23222.9 | 18% | $19207.8 | (10)% | $21364.4 |

Operating Income | 10356.0 | 38 | 7324.0 | (20) | 9069.8 |

Net Income | 7545.2 | 56 | 4730.5 | (22) | 6025.4 |

Earnings Per Share-diluted | $10.04 | 56 | $6.31 | (20)% | $7.88 |

From the table 2 it shows that the Total Assets is larger than the Total Liability in three years. This indicates their difficulty in repayment and limits business growth. Total Current Assets is increasing year by year, which indicates that the current ratio is increasing, and the short-term solvency is increasing. At the same time, it can be seen that the cost of goods sold has decreased, which demonstrates that good management and financial decisions can enhance the company's financial performance.

Table 2: Risk indicators of McDonald’s.

2021 | Inc/(Dec) | 2020 | Inc/(Dec) | 2019 | |

Total Current Assets | 7148.5 | 905.3 14.50% | 6243.2 | 2685.3 75.47% | 3557.9 |

Total Long-term Assets | 46705.8 | 322.2 0.69% | 46383.6 | 2430.7 5.53% | 43952.9 |

Total Assets | 53854.3 | 1227.5 2.33% | 52626.8 | 5116 10.77% | 47510.8 |

Total Current Liability | 4020 | (2161.2) (34.96%) | 6181.2 | 2560.2 70.70% | 3621 |

Total Liability | 58455.3 | (1996.4) (3.30%) | 60451.7 | 4730.6 8.49% | 55721.1 |

Shareholders’ Equity | -4601 | 3223.9 (41.20%) | -7824.9 | 385.4 (4.69%) | -8210.3 |

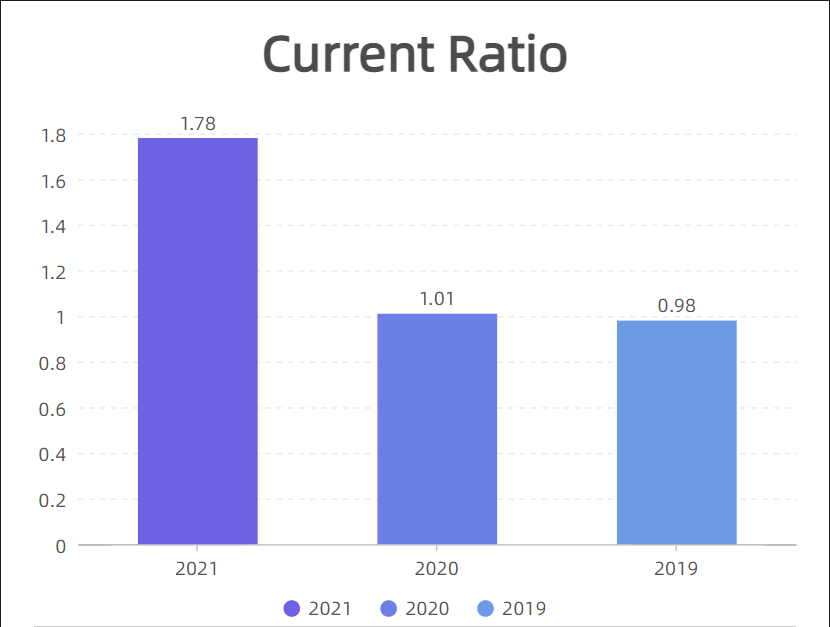

Liquidity ratios are a gauge of a company's capacity to settle its short-term obligations. It contains Current Ratio and Quick Ratio.

A technique to evaluate a company's capacity to fulfill its immediate obligations is the current ratio. Through the liquidity analysis of McDonald's Corporation, current liabilities are slightly higher than current assets based on the records of 2019, which is generally interpreted as difficulty in meeting short-term obligations, but after 2020, current assets reversing over current liabilities indicates that short-term obligations can be met.

\( Current Ratio=\frac{Current Assets}{Current Liability} \) (1)

Figure 2: Current ratio.

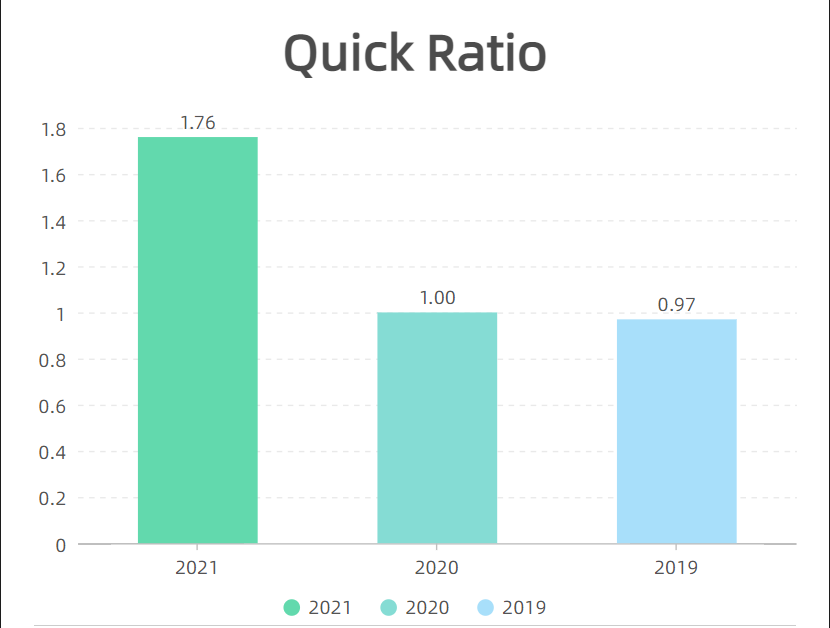

The quick ratio only takes into account assets that can be used to settle current liabilities right away, making it a more accurate gauge of a company's liquidity (e.g., cash, cash equivalents, accounts receivable and short-term investments). The corporation is currently unable to pay its existing creditors if the quick ratio is less than 1. From the table, it seems that McDonald's is gradually reversing this.

\( Quick Ratio=\frac{Current Assets - Inventory}{Current Liability}\ \ \ (2) \)

Figure 3: Quick ratio.

5.2. Profitability Analysis

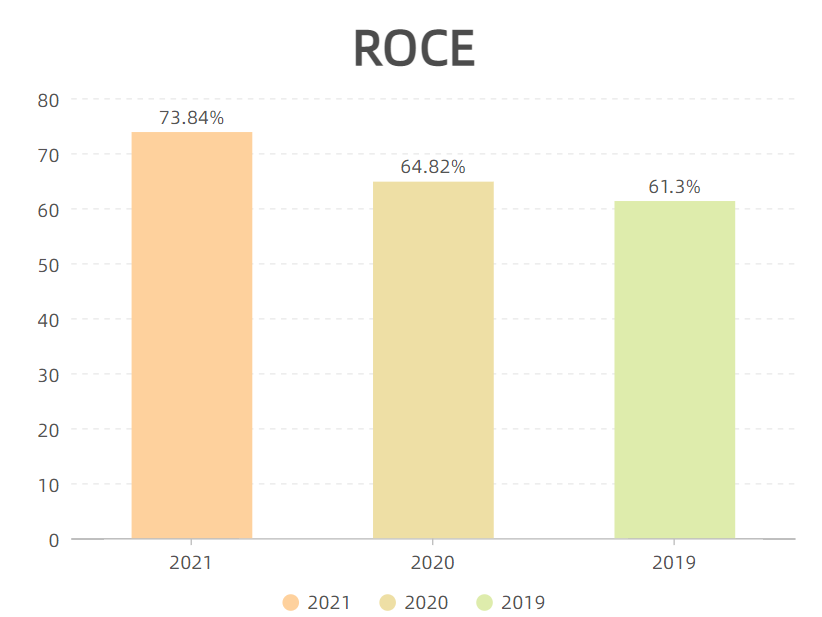

The profitability ratio measures a company's ability to generate profits from ongoing business operations, which is essential for survival and growth and at the same time is a significant signal for all stakeholders. In this essay, we will contrast the amount invested and the amount earned using the Return on Capital Employed (ROCE) ratio.

\( ROCE=\frac{Earnings Before Interest and Tax}{Capital Employed}*100 \) or \( ROCE=\frac{Profit Margin}{Asset Turnover} \) (3)

Due to the focus on long-term tendencies, ROCE did not fluctuate significantly due to the pandemic, but still rose annually according to the trend. This illustrates the positive level of profit generation from McDonald's assets over the long term, which is performing well.

Figure 4: ROCE.

\( Gross Profit Margin=\frac{Gross Profit}{Revenue} \) (4)

\( Net Profit Margin=\frac{Net Profit}{Revenue} \) (5)

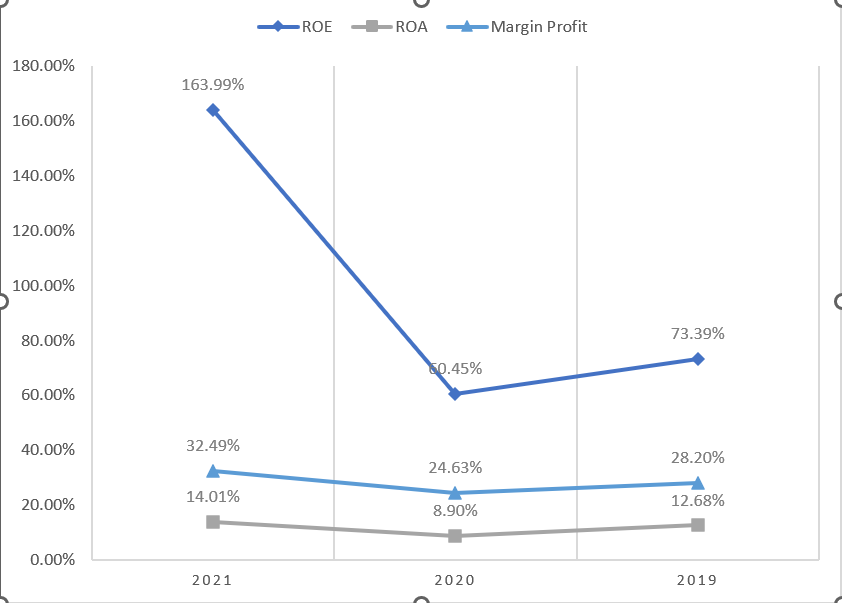

32.49% of sales revenue eventually became profit, which is the highest percentage achieved since 2019, and the low margin can be explained by McDonald's sales price, which is specific to the fast-food industry. Return on assets represents the return on assets for stock and debt holders, with 2020 recording the lowest return on assets since 2019. Return on net assets is an important financial indicator of the efficiency of the use of shareholders' money, which is a full indication of the profitability of the company. 2021 saw McDonald's recover its profitability after the epidemic eased a bit, and due to the depression of the Covid-19 pandemic in 2020, people went even more wild in spending, making the restaurant even more profitable than it was before the epidemic.

Figure 5: Folding line graph of ROE, ROA and margin profit.

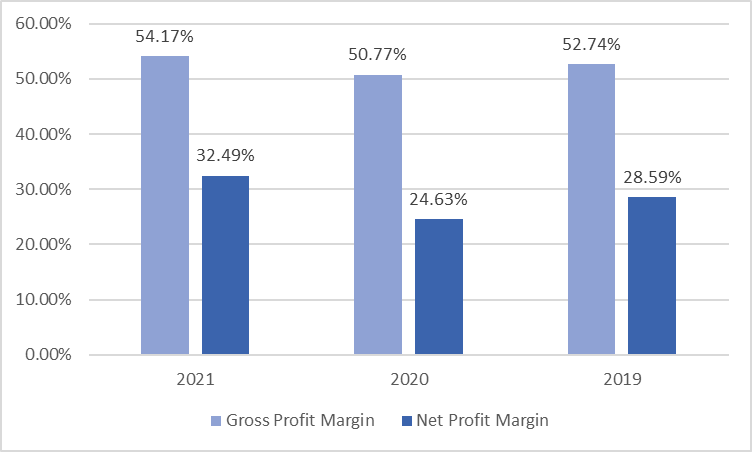

The percentage of a good that adds value after it has gone through the internal system of production transformation is represented by the gross margin. In other words, as value is added, gross profit will correspondingly rise. The net profit margin is used to determine the profit per dollar of sales after expenses and taxes, and the gross profit margin is used to determine the percentage of profit above manufacturing costs. It is clear that the pandemic has an impact on gross and net profit margins, which both recover to their prior levels in 2021. The value added and net profit of the goods produced by the McDonald's group are impacted by Covid-19. Inspiring businesses to focus on enhancing management and profitability while increasing sales is possible by examining changes in net sales margin.

Figure 6: Bar chart of gross profit margin & net profit margin.

6. Conclusion

This paper investigated McDonald’s corporation in terms of marketing strategy, labor issues and financial Status.

The main conclusions obtained include that, firstly, the number one spot in the global fast-food business is still held by McDonald's, and it won't be challenged anytime soon, since its market share far exceeds that of his rivals. But there is increasing competitiveness in the fast-food industry. Secondly, in a time of pandemic, lack of employees is a common problem in the fast-food industry and even in the service industry, and McDonald's executives have made decisions to alleviate this problem. It is believed that as the pandemic slowly leaves, the labor problem will be alleviated. Thirdly, although the impact of Covid-19 has rippled through McDonald's operations and business, and certain financial indicators have fluctuated from their original trends. However, in the long term, McDonald's is in a good financial position and is following a growth trend.

Through the findings of this paper, there are several Suggestions. On one hand, since competitors are taking steps to capture more market share, McDonald's can make some wise moves if it wants to keep this position or increase its market share. Based on survey results, McDonald's can actively follow trends or create popular new goods to draw people in with novelty. McDonald's executives should employ several marketing strategies for various consumer segments through market segmentation and target market analysis. McDonald's can efficiently serve its own customer base and develop its own brand positioning at the same time. On the other hand, the better solutions to the employee shortage, in the current environment where the pandemic hasn't yet been eradicated, involve cutting back on employees' working hours and raising their hourly wages, supplemented by hiring teenage students on a part-time basis, and further introducing automated machines to take the place of human workers. In the long run, the issue of a lack of workers can only be resolved by raising employee salaries, boosting automation, or striking a balance between the two approaches. Overall, McDonald's still has a way to go before deciding on a hiring approach.

References

[1]. Magretta Joan.: Why business models matter. Harvard business review 80(5), 86-92, 133 (2002).

[2]. Zhiguo Liu.: Deconstruction of enterprise business model from the perspective of value chain: The case study of Toyota Motor Corporation. China management informationization 25(11), 167-170 (2022).

[3]. Peijia Chen, Yike Wang, Fanying Chen, Mingxia Tang.: Synergistic innovation of technology strategy, business model and catching up of latecomers in the context of transition economy: The case of NIO automotive. Economic & Trade Update 19(07), 87-89 (2022).

[4]. Tatiana Genzorova, Tatiana Corejova, Natalia Stalmasekova.: How digital transformation can influence business model, Case study for transport industry. Transportation Research Procedia 40(C), 1053-1058 (2019).

[5]. Sarasini Steven, Langeland Ove.: Business model innovation as a process for transforming user mobility practices. Environmental Innovation and Societal Transitions 39, 229-248 (2021).

[6]. Mingliang Wei, Xue Wang, Jingming Li.: Financial Statement Analysis of Department Store Industry under Harvard Framework: The case of Wangfujing Department Store (600859). Friends of Accounting (07), 82-86 (2016).

[7]. Almazari A A.: Financial performance analysis of the Jordanian Arab bank by using the DuPont system of financial analysis. International Journal of Economics and Finance 4(4), 86-94 (2012).

[8]. Kaniz Fatema et al.: Financial Analysis of Textile Sector in Bangladesh: A Study on Selected Textile Companies. European Journal of Business and Management 10(35), 32-38 (2018).

[9]. Yanggu Ke.: Valuation methods for science and innovation-based enterprises under the innovation-driven strategy and their applications. Dynamics of Social Sciences (09), 47-52 (2022).

[10]. Ilan Cooper, Richard Priestley.: The expected returns and valuations of private and public firms. Journal of Financial Economics 120(1), 41-57 (2016).

Cite this article

Zhao,X. (2023). Research on the Risk and Profitability of McDonald’s. Advances in Economics, Management and Political Sciences,11,245-254.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Magretta Joan.: Why business models matter. Harvard business review 80(5), 86-92, 133 (2002).

[2]. Zhiguo Liu.: Deconstruction of enterprise business model from the perspective of value chain: The case study of Toyota Motor Corporation. China management informationization 25(11), 167-170 (2022).

[3]. Peijia Chen, Yike Wang, Fanying Chen, Mingxia Tang.: Synergistic innovation of technology strategy, business model and catching up of latecomers in the context of transition economy: The case of NIO automotive. Economic & Trade Update 19(07), 87-89 (2022).

[4]. Tatiana Genzorova, Tatiana Corejova, Natalia Stalmasekova.: How digital transformation can influence business model, Case study for transport industry. Transportation Research Procedia 40(C), 1053-1058 (2019).

[5]. Sarasini Steven, Langeland Ove.: Business model innovation as a process for transforming user mobility practices. Environmental Innovation and Societal Transitions 39, 229-248 (2021).

[6]. Mingliang Wei, Xue Wang, Jingming Li.: Financial Statement Analysis of Department Store Industry under Harvard Framework: The case of Wangfujing Department Store (600859). Friends of Accounting (07), 82-86 (2016).

[7]. Almazari A A.: Financial performance analysis of the Jordanian Arab bank by using the DuPont system of financial analysis. International Journal of Economics and Finance 4(4), 86-94 (2012).

[8]. Kaniz Fatema et al.: Financial Analysis of Textile Sector in Bangladesh: A Study on Selected Textile Companies. European Journal of Business and Management 10(35), 32-38 (2018).

[9]. Yanggu Ke.: Valuation methods for science and innovation-based enterprises under the innovation-driven strategy and their applications. Dynamics of Social Sciences (09), 47-52 (2022).

[10]. Ilan Cooper, Richard Priestley.: The expected returns and valuations of private and public firms. Journal of Financial Economics 120(1), 41-57 (2016).