1. Introduction

Environmental protection is paid great attention by various countries, and the greenhouse effect resulted from carbon emissions has gradually become a world problem, for the purpose of protecting the world environment, various countries signed the United Nations Framework Convention on Climate Change, the Kyoto Protocol, and the Paris Agreement to assure the global carbon emission reduction. The scope of the impact for policy is wide-ranging. Due to this policy, the development of new energy is overwhelming. As one of the important components of new energy vehicles, his development trend will inevitably rise sharply. As the leading industry of new energy vehicles, the investment value of BYD Corporate is also gradually rising. And why BYD Corporate can be ahead of other companies in this market environment, the hidden information behind it is worth analyzing, from the perspective of investment value analysis of the new energy industry, there has been a wealth of research showing that, analyzing the investment value of the new energy industry from the micro, middle and macro perspectives, and summarizing the absolute investment value of this industry [1]. The corporate value of BYD has risen sharply from 2015 to 2019, and the new energy vehicle innovation ecosystem has helped enterprises achieve value creation. Specifically, the impact on the financial key value drivers and non-financial value drivers of BYD was reflected, and the impact on the financial key value drivers included higher operating income and operating costs, stable gross margin, and higher research and development expenses but poor improvement in total asset turnover. In respect to non-financial value drivers, it is mainly reflected that the value drivers of the new energy vehicle innovation ecosystem have an overall positive impact on the customer dimension, internal process dimension, learning and growth dimension [2]. Zhang Jincheng, Fang Weihua use the structural population environment evolution analysis framework method for constructing the innovation ecosystem of new energy vehicles from the perspective of policy change, which proves that the policy and innovation ecosystem of the new energy industry are a process of co-evolution [3]. In the meantime, Chen Liuqin baseds on the analysis of the development dynamics of the new energy industry at home and abroad, the new energy industry has important significance for the world economy and industrial structure, and is an important breakthrough in solving the energy environment in the country, and developed countries have introduced relevant policies to support the development of their new energy industry and achieved results. The dependence of new energy vehicles on scientific and technological innovation is high. The development of new energy industry has risen to the level of national strategy [4]. Therefore, the new energy will develop gradually benefiting from the powerful supports of governmental policies.

In terms of the enterprise investment value analysis, a large number of research and methods have been analyzed from the perspective of the external environment to analyze the impact of factors such as the background, development situation, and relevant national policies on the future development of enterprises, and from the perspective of intrinsic value, based on the price-to-earnings ratio, accessories output, dividend discount model, residual income model and other factors to evaluate the investment value of enterprises. [5] In light of the relevant index data of BYD, this study analyzes its investment value, and uses the PEST analysis method to analyze the external environment (political, social) and company development and technical analysis of the company, and accurately grasps the development potential of BYD. It uses the relative valuation method in investment value theory to analyze THE investment value of BYD, and also analyzes its internal financial situation from the aspects of solvency, profitability and operational ability. Through the above three levels of analysis, the investment value of BYD Corporate in the industry field is comprehensively examined, and the investment value of BYD Corporate is analyzed.

2. The Analysis on External Circumstances of BYD Corporate Based on PEST

2.1. Corporate Backdrop

BYD Co. Ltd. ("BYD") was founded in February 1995 and is headquartered in Shenzhen city, Guangdong province.

Figure 1: Awards over the years.

2.2. PEST Analysis

Political and Legal Backdrop. From the Tenth Five-Year Plan to the Fourteenth Five-Year Plan, the support policy of China for the new energy industry has evolved from “accelerating technological advance and mechanism innovation”, “acting according to circumstances and pluralistic development” to “accelerating the transformation of the new energy industry into a new development orientation”.[6]

Figure 2: The development of new energy support policies.

In September of 2020, China clearly put forward achieve the goal of peak carbon emission by 2030 and carbon neutrality by 2060. In the past few years, keywords such as “peak carbon emission, carbon neutrality, carbon emission trading, pollution reduction and carbon reduction” have become high-frequency words. New energy sources are increasingly important, driven by the goals of "carbon neutrality" and "peak carbon emissions." The New Energy Automobile Industry Development Plan from 2021 to 2035 issued by China has promoted the high-quality and sustainable development of the new energy industry in China and accelerated the construction of an automobile power. By 2025, sales of new energy vehicles will reach about 20 percent of new vehicle sales. With the strong support of the national government, for a long time BYD has enormous development potential as a leader in the new energy automobile industry. In the meantime, the government formulates relevant laws and regulations. For example, the quality law, the Sino-foreign joint venture law, the patent law and so on to provide guarantees to patented technology and external export and stipulate the quality standards.

Economic Aspects. The general economic development tendency is positive, GDP continues to rise, as the largest developing country, the demand for automobiles is gradually increasing, the high-speed development model, low unemployment, relevant policies to ensure labor employment problems. On September 27th, Buffett's investment demonstrates his appreciation for BYD's growth prospects and brand value.

Social and Cultural Aspects. In terms of the social factors, Sensibilities, always pays attention to and supports social welfare undertakings. In particular, BYD BYD has demonstrated a strong sense of love and social responsibility in supporting local education development, fighting SARS, the tsunami in Southeast Asia, flood relief in the South and the Wenchuan earthquake in Sichuan. This is also a sincere publicity for BYD, which is conducive to the company's continued healthy development.In 2007, the BYD Children Welfare Institute was established and a special working group was set up to take charge of the entire project.

In 2008, after the Wenchuan earthquake in Sichuan province, BYD donated ten million yuan in cash at the first time, removed 1,000 jacks from the new car, and urgently airlifted them through the military.

In October of 2008, BYD won the “First Charity Award of Shenzhen City—Philanthropic Enterprise Award” and the “Special Award for Earthquake Relief Donation” in Shenzhen city.

In November of 2009, BYD set up a scholarship at Central South University, investing 620,000 yuan per year, planning to set up for twenty years, with a total prize money of 12.4 million yuan.

On April 15th of 2010, BYD donated twenty million yuan to support the Qinghai earthquake area.

During the coronavirus pandemic in 2020, the price of masks rose, BYD organized a mask production line within a few days, the masks of BYD are like offering fuel in snowy weather, the first time to solve the domestic mask scarcity problem.

Love is a great entrepreneurial spirit and a noble humanistic sentiment. BYD has always taken social responsibility as an important part of promoting entrepreneurship. It adheres to its mission of giving back to society and the public good. Advocating for loving enterprises, giving as much social love as possible, and contributing to the harmonious development of Chinese society. In the face of disaster, BYD, as the representative of China's independent brand bearing the dream of national rejuvenation, selfless dedication, received praise and appreciation from all walks of life.

Social and cultural aspects: corporate culture. BYD perseveres and gradually constructed the core values of equality, pragmatism, competition, passion and innovation ''. It has always adhered to the development philosophy of technology first, innovation first and strived to keep our first heart, our first mission, find gaps and implement them ''. While ensuring a technological monopoly, various types of talent have been retained. It is the mission of the company to satisfy people's yearning for a better life with science, technology and innovation. The flip side of corporate culture is the crazy mask ethos that emerged during the coronavirus pandemic. Dare to fight: Spare no effort to push the limits and make the impossible possible. Coordinated operations: No prevarication, joint efforts to advance.

Technology. Technology has a dominant position for the high-tech industry, and the innovation, control and dedication of BYD Corporate to technology are the main factors for BYD to stand in the leading position in the fields of batteries and new energy vehicles.

With more than 35,000 technicians and 11 research institutes, BYD Group will invest more than 8.5 billion yuan in research and development by 2020, accounting for 85 percent of operating income. Up to April of 2021, the Group has filed around 32,000 patents worldwide, of which 21,000 have been granted. The patent innovation index for BYD ranks first in the new energy vehicle patents of China in terms of quantity and strength. Besides, BYD also led the formulation of the first three strong standards for electric vehicles, which represented the first time that China led the formulation of the international standard EVS-GTR—global technical regulations for the safety of electric vehicles, and won the unanimous support of the United Nations World Automobile Coordination Forum. With high product standards, BYD was rated as a corporate standard leader. The total research and development investment of company in 2020 was 8.556 billion yuan, and the ratio to operating income reached 5.46 percent.

In respect to batteries. BYD has a high level of a complete set of battery industry chain (raw materials, research and development, design, production, application and recycling), from battery technology, quality, intelligent manufacturing to production efficiency are industry benchmarks. In the field of rail transit, BYD is also one of the leading enterprises in the industry, providing customers with a full range of solutions from battery products to solar power plants to energy storage power stations. Currently, the number of new energy vehicles in the world has exceeded 100 million, of which pure electric passenger cars account for about 30 percent. In the new energy automobile industry, new energy electric vehicles occupy an absolute dominant position, so the performance requirements for power battery packs are becoming more and more stringent. On March 29th of 2020, BYD released the “blade battery” series of power batteries, which have higher safety, longer service life and a wider range of use, and are expected to become a real long-life, long-lasting power battery for new energy vehicles. The “blade battery” of BYD adopts high-safety lithium phosphate battery technology, which has improved its volume ratio and energy density, and passed the most stringent acupuncture test in the industry; “Blade battery” is a power battery technology with high integrated efficiency and safety protection, and the “blade battery” electric vehicle has a range of more than 1,000 kilometers. Compared with the traditional CTP technology, BYD CTB technology has changed from a battery “sandwich” structure to a vehicle “sandwich”, which integrates the body baseplate and the battery cover, and the “blade battery” is a honeycomb-like sandwich. The CTB battery system of BYD has increased the volume utilization rate to the original level, participated in the safety of the whole vehicle in the form of body structural parts, and doubled the torsional stiffness of the whole vehicle.

In respect to automobiles. relying on the strength of technology research and development and innovation, BYD has mastered the core technology of the new energy vehicle industry chain, including batteries, chips, motors, and electronic controls. In the new era of automobiles, the new energy automobile industry, as one of the key development industries in the “13th Five-Year Plan” of China, will usher in a period of rapid development. And this is also an industry full of competition and challenges. In this context. Who stands out? By virtue of its independent research and development and hard work, BYD has become one of the few core technologies in the industry that has new energy vehicles such as batteries, motors, electronic controls and chips.

In respect to rail transit. For the problem of city traffic, BYD hold its comprehensive innovation to broaden the industry chain in the rail transit field, develop a medium-sized multi-seater monorail "cloud rail"within five years and add a new cloud bus for small rail transport within seven years. Through the coordinated development of ``cloud rail transit "and ``cloud public transport '', we can break through the core technology of the entire industrial chain and effectively alleviate traffic congestion. BothCloud Rail Transit and cloud bus are equipped with advanced technologies such as driverless, multifunctional and deeply integrated scheduling system and face recognition. It are more safety, intelligence, adaptability, high cost, low construction cost and short construction cycle, which can provide a smarter and more easy travel experience for passengers and help improve urban transport.

In the domain of photovoltaics. With a useful life of up to 50 years and an annual attenuation rate of less than 0.3 percent, BYD PV shipped more than 10GW in a number of application environments in countries including Brazil, South Africa, Japan and the United Kingdom. It has a huge global following.

In respect to energy storage. BYD is a globally recognised provider of energy storage solutions, providing nearly 100 grid, industrial and civil grade energy storage solutions to global partners. In addition to being sold in China.

In respect to electronics. in 2007, BYD Electronics (International) Co. Ltd. landed on the main board of the Hong Kong Unified Exchange of China independently (hereinafter referred to as “the Unified Exchange”) and became a world-renowned supplier of intelligent product solutions. As an enterprise that can provide a full range of precision metal, glass, ceramics, plastic design and manufacturing solutions for precision metal, glass, ceramics and plastics on a large scale, BYD Electronics provides the top intelligent product users with all aspects of services and “one-stop” solutions from research and development to design, From manufacturing to supply chain management, it has rich experience in international co-operation, excellent product and service quality, development capabilities and industry-leading precision manufacturing capabilities.

The leading patents. strong independent research and development capabilities, incredible innovation, huge research and development team; Allowing BYD, which is a manufacturer of batteries, has dominated from various fields. the biggest competitive advantage of the new energy industry must be science and technology and innovation. With the blessing of such a frontier, future development of BYD is booming.

3. Analysis on Finance of BYD Corporate Based on Financial Indexes

3.1. Analysis of Debt Paying Ability

Analyzing the debt paying ability of BYD from 2018 to 2021 was intended to explore whether the company has the ability to use their own assets to repay debts [6]. The debt paying ability is an important indicator of the financial quality of enterprises. Through the analysis of solvency, the ability of the enterprise to continue to operate and the risks it undertakes can be observed to predict the future income of the enterprise. Dynamic and static; Statically speaking, it refers to whether the enterprise has enough funds to repay the debt, and dynamically speaking, it refers to whether the enterprise has enough to repay the debt after obtaining the income. [7,8]

Liquidity ratio and quick ratio. Liquidity ratio: Indicating whether the enterprise has sufficient current assets to repay its current liabilities. The larger this value, the stronger the short-term debt paying ability of the enterprise, usually it signifies excellent when this value is at two.

The formula is:

Liquidity ratio = Total liquidity assets / Total liquidity liabilities (1)

Quick ratio: Referring to the ability of an enterprise’s liquidity assets after liquidating the balance of prepaid accounts and inventories to repay current liabilities.

The formula is:

Quick ratio = (Liquidity assets - (inventory + prepaid accounts + amortized expenses) /

liquidity liabilities (2)

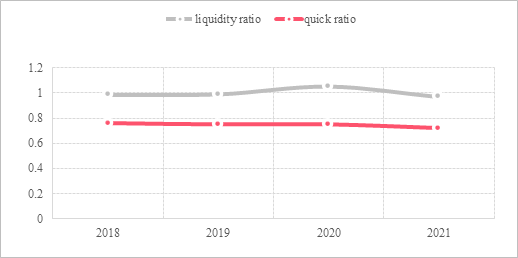

Figure 3: The liquidity ratio and quick ratio of BYD from 2018 to 2021.

Through the data collation of financial statements of BYD from 2018 to 2021, the liquidity ratio and quick ratio of company were calculated, as shown in Table 1. From the analysis of the current interest rate, the liquidity ratio of BYD is stable around 1, and none of them exceed the standard value of 2, which shows that the short-term solvency is poor. From the perspective of the quick ratio, the quick ratio in the past three years has not exceeded 1, respectively, 0.75, 0.78 and 0.82, indicating that the company is unreasonable or short-term in cash arrangements and use, and at any time it will face the crisis of insufficient current assets to pay due debts and forced to interrupt operations.

Asset-liability ratio. The asset-liability ratio. The asset-liability ratio is the percentage of total liabilities divided by total assets at the end of the period.

Asset-liability ratio = Total Liabilities / Total Assets.(3)

Manifesting is a comprehensive indicator to evaluate the level of the company’s liabilities.

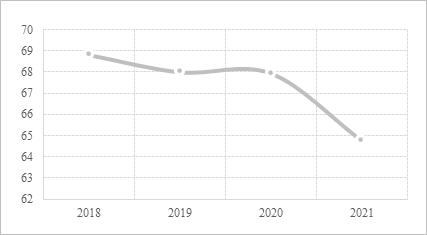

Figure 4: The asset-liability ratio of BYD from 2018 to 2021.

In the process of analyzing the long-term debt paying ability of BYD, the financial indicators of the asset-liability ratio are mainly used to analyze the solvency. From the analysis of the asset-liability ratio, the asset-liability ratio is also known as the debt-to-operating ratio, the ratio should be between 0.6 to 0.7 is more reasonable, from the data of Table 2, the asset-liability ratio of BYD Corporate from 2018 to 2021 is gradually reduced, manifesting that the company is facing financial risks itself is a reasonable state, and it is gradually getting better, the long-term debt repayment ability is relatively good.

3.2. Operation Capacity

Total asset turnover. The higher the total asset turnover rate, the stronger the enterprise's sales ability and the higher the efficiency of asset investment. [9]

Average total assets =

(Total assets at the beginning of the year + Total assets at the end of the year) / 2 (4)

Total asset turnover ratio (times) = Net operating income / Average total assets (5)

Accounts receivable turnover rate. Accounts receivable is another important item in the current assets of an enterprise besides inventory. The receivables company occupies an important position in current assets. If we can collect the accounts receivable from company in a timely manner, In general, the higher the turnover rate accounts of accounts receivable, the better, the higher the turnover rate, indicating the opening of a small number of accounts, fast collection, short age; good liquidity of assets, strong short-term solvency; can reduce bad debts, etc.

Inventory turnover. Inventory turnover are divided into two types. The first is the cost-based inventory turnover rate, that is, the ratio between the sales cost of the enterprise and the average balance of inventory in a certain period of time, which reflects the liquidity of the current assets of the enterprise and is mainly used for liquidity analysis.

The first formula: Inventory turnover on cost basis =

Cost of operations / Average balance of inventory = Cost of goods sold (6)

The second is the income-based inventory turnover rate, that is, the ratio between the operating income of the enterprise and the average balance of inventory in a certain period of time, which is mainly used for profitability analysis.

Number of inventory turnovers on the revenue basis =

Operating income / Average balance of inventory (7)

Average balance of inventories = (Opening inventories + Ending inventories) / 2(8)

Inventory at the end of the period = Liquid assets - Quick assets =

Liquid liabilities× (Liquid ratio - Quick ratio)(9)

Inventory turnover on revenue basis - Inventory turnover on a cost basis =

Gross profit / Average balance of inventory (10)

It can also be calculated by the number of days of inventory turnover.

Inventory turnover rate =

Number of days of calculation period / Number of days of inventory turnover (11)

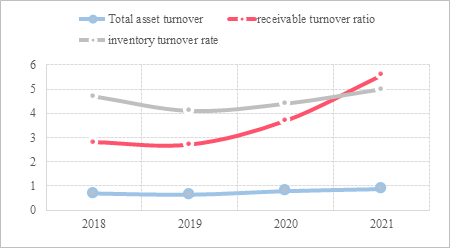

Figure 5: The total asset turnover rate, the inventory turnover rate, the receivable turnover ratio of BYD from 2018 to 2021.

The average total asset turnover rate of auto sales industry in China is between 1.15 to 1.71 from 2018 to 2021, while BYD Corporate is always below the average value, and the growth rate is very small, so the development of BYD is not very prominent in sales. The standard value set by enterprises with accounts receivable turnover ratio in the automotive industry is 3. From 2018 to 2021, BYD Corporate has gradually increased from below the average to 5.8, with fewer credits, rapid collection, and gradually enhanced asset liquidity. The inventory turnover rate of the entire industry in the automotive industry fluctuated up and down 8 to 9 times in 2018-2019, and the larger the inventory turnover rate, the better the sales situation. BYD company fluctuated at 4 to 5, below the average, BYD should be in the material shelf life and capital permitting conditions, can appropriately increase its inventory control target number of days to ensure reasonable inventory. In terms of operational capability analysis, the operating capability of BYD is not very good.

4. Analysis on Evaluation of BYD Corporate Based on the Relative Valuation Method

4.1. Results of P/E Method

The core of the relative valuation method lies to comparing a stock's price-to-earnings ratio, price-to-book ratio, and price-to-sales ratio with comparable companies and their historical price-to-earnings ratios to determine whether the stock is currently undervalued. [10] Let's talk about the price-to-earnings ratio, which is my most commonly used indicator. The price-to-earnings ratio is particularly simple when the company's stock price is divided by earnings per share:

PE=p (share price)/eps (earnings per share) (12)

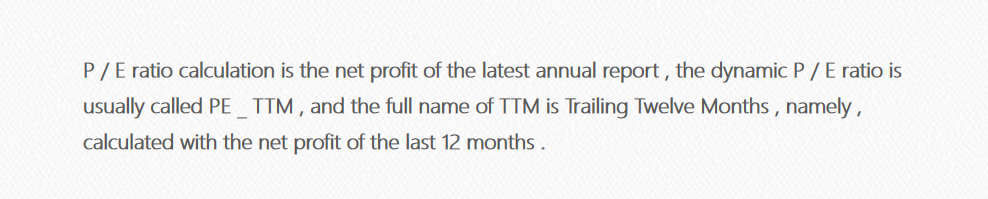

PE is further divided into static P/E ratio and dynamic P/E ratio. The net profit used in the static

Total market capitalization = Net profit × Price-to-earnings ratio. (13)

Figure 6: The trailing twelve months of BYD from 2018 to 2021.

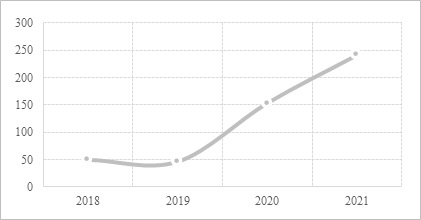

Figure 7: The total market value of BYD from 2018 to 2021.

Up to 2021, the P/E ratio industry average is 31.6, BYD P/E ratio from 2018 to 2019 has not changed much, but from 2019 to 2021 P/E ratio increased by nearly 5 times, the technical monopoly of BYD has more and more obvious advantages over competition, and the crazy growth of net profit shows that the investment value of company is very high. From the analysis of total market value, the same as the price-earnings ratio from 2018 to 2019 is not obvious, and from 2019 to 2021, the total market value of company increased by nearly 8 times, and in terms of total market value, BYD has surpassed the second place Great Wall Motor in the domestic automotive industry by about 500 billion. This shows that the development of BYD in the new energy automobile industry is very rapid.

4.2. Results of P/B Method

P/B valuation method, the price-to-book ratio is the basis for estimating the stock price of company from the perspective of the asset value of company [11].

Reasonable share price = Net assets per share × Reasonable price-to-book ratio (PB).(14)

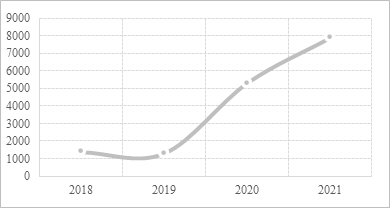

Figure 8: The reasonable share price of BYD from 2018 to 2021.

The reasonable share price of BYD has grown rapidly from 2019 to 2021, by a rate of about six times. Through the P/B valuation method, we can clearly observe that the stock value of BYD is growing rapidly.

5. Conclusion

The PEST model was applied in this study aiming at exploring the future development prospects of BYD; In respect to finance, the total capital turnover rate, accounts receivable turnover rate, and inventory turnover ratio of BYD Corporate was studied to analyze its debt paying ability; The inventory turnover rate, accounts receivable turnover rate and total asset turnover rate were used to analyze the operating capacity, and the relative valuation method was used to conduct research on the valuation of BYD. It was found that in respect to politics, China pays great attention to the new energy automobile industry and has issued many policies to promote its development. In respect to economic aspects, the domestic economic development has increased rapidly, China is the world’s largest developing country, and the good economic environment has prompted the rapid development of the new energy automobile industry. In terms of social and cultural aspects, BYD has made great contributions to society, good social reputation, and the recognition of enterprises has also increased rapidly. In terms of corporate culture, the policy of new energy vehicles is clear, dare to fight, grasp the technology in their own hands, leave talents in the corresponding posts, and firmly seize every major development opportunity, BYD Corporate as the leading enterprise of new energy vehicles, the investment value of BYD Corporate will increase rapidly in the future. In respect to the debt paying ability, the debt paying ability is poor and the cash arrangement is not reasonable enough, but the gradual decline in the asset-liability ratio shows that BYD has significantly improved its long-term solvency. In respect to operating capacity, the inventory turnover rate and total asset turnover rate of BYD are always lower than the industry average, indicating that the company’s profitability is not desirable, the turnover rate of accounts receivable gradually increases gradually exceeds the average, indicating that the liquidity of enterprise assets has gradually increased. Under the relative valuation method, the P/E ratio and total market value of BYD Corporate are analyzed, and the profit of BYD Corporate has increased rapidly, and the total market value has increased by 8 times in just two years. The P/B valuation method for the price-to-book ratio was analyzed to obtain by the reasonable stock price of BYD increased by about six times in two years. It is expected that the above information can contribute to the investment value analysis of BYD.

References

[1]. Li Ling. Research on the Investment Value of Listed Companies in New Energy Industry. 2019. Xihua University, MA thesis.

[2]. Zhou Yingyu. The Impact of BYD’s New Energy Vehicle Innovation Ecosystem on the Ability of Enterprise Value Creation [D]. China University of Mining and Technology, 2021. DOI: 10.27623/d.cnki.gzkyu.2021.002339.

[3]. Zhang Jincheng, Fang Weihua. Research on the Evolution of Innovation Ecosystem from the Perspective of Policy Change: A Case Study of New Energy Automobile Industry [J]. Science and Technology Management Research, 2022,42(11):173-182.

[4]. Chen Liuqin. Development dynamics of new energy industry at home and abroad [J]. Development Studies, 2011.

[5]. Chen Zepeng. Research on Investment Value Evaluation of Listed Enterprises of New Energy Vehicles [D]. Shandong University of Finance and Economics, 2020. DOI: 10.27274/ d.cnki.gsdjc. 2020.000901.

[6]. Zhang Haibo, and Li Yuxian. Analyzing the Development Environment of the Automotive Industry Using PEST, Automotive Industry Research 2 (2011):5.

[7]. Wang Hao, Li Bo, and Zhang Mingxuan. Solvency Analysis of Automobile Sales Industry: A Case Study of Huge Groups, Western Leather. 40.11 (2018): 2.

[8]. Qin Weilin. Analysis of Corporate Solvency, Cooperative Economics and Technology. 15(2011):3.

[9]. JiaoXueChun. "China's auto industry operation ability analysis, jianghuai automobile, for example." market modernization. 16 (2018) : 66-67. The doi: 10.14013 / j.carol carroll nki SCXDH. 2018.16.039.

[10]. Wang Houming, Sun Chunyan. Under different valuation method cross-border m&a target companies valuation analysis [J]. Journal of accounting, 2020 (18) : 116-120. The DOI: 10.16144 / j.carol carroll nki issn1002-8072.2020.18.026.

[11]. Xiao Ya.PE valuation method and PB valuation method: Based on the analysis of banking industry [J]. Times Finance,2012(15):254.

Cite this article

Zhang,Z. (2023). Analysis on the Investment Value of BYD. Advances in Economics, Management and Political Sciences,11,302-313.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li Ling. Research on the Investment Value of Listed Companies in New Energy Industry. 2019. Xihua University, MA thesis.

[2]. Zhou Yingyu. The Impact of BYD’s New Energy Vehicle Innovation Ecosystem on the Ability of Enterprise Value Creation [D]. China University of Mining and Technology, 2021. DOI: 10.27623/d.cnki.gzkyu.2021.002339.

[3]. Zhang Jincheng, Fang Weihua. Research on the Evolution of Innovation Ecosystem from the Perspective of Policy Change: A Case Study of New Energy Automobile Industry [J]. Science and Technology Management Research, 2022,42(11):173-182.

[4]. Chen Liuqin. Development dynamics of new energy industry at home and abroad [J]. Development Studies, 2011.

[5]. Chen Zepeng. Research on Investment Value Evaluation of Listed Enterprises of New Energy Vehicles [D]. Shandong University of Finance and Economics, 2020. DOI: 10.27274/ d.cnki.gsdjc. 2020.000901.

[6]. Zhang Haibo, and Li Yuxian. Analyzing the Development Environment of the Automotive Industry Using PEST, Automotive Industry Research 2 (2011):5.

[7]. Wang Hao, Li Bo, and Zhang Mingxuan. Solvency Analysis of Automobile Sales Industry: A Case Study of Huge Groups, Western Leather. 40.11 (2018): 2.

[8]. Qin Weilin. Analysis of Corporate Solvency, Cooperative Economics and Technology. 15(2011):3.

[9]. JiaoXueChun. "China's auto industry operation ability analysis, jianghuai automobile, for example." market modernization. 16 (2018) : 66-67. The doi: 10.14013 / j.carol carroll nki SCXDH. 2018.16.039.

[10]. Wang Houming, Sun Chunyan. Under different valuation method cross-border m&a target companies valuation analysis [J]. Journal of accounting, 2020 (18) : 116-120. The DOI: 10.16144 / j.carol carroll nki issn1002-8072.2020.18.026.

[11]. Xiao Ya.PE valuation method and PB valuation method: Based on the analysis of banking industry [J]. Times Finance,2012(15):254.