1. Introduction

In 2020, due to the outbreak of Covid-19 in China, almost all cities were blocked and stagnated, and the first country hit by the pandemic. Because of the lockdown, most offline stores closed, and logistics were heavily affected. The luxury industry lost 30% of its revenue in the first quarter of 2020. With China's strict prevention policy and effective control, the economy went into recovery. China's luxury market recovered unexpectedly and achieved high growth following the depressed first quarter in 2022.

Thus, by analyzing market reports and relevant industry reports, this paper aims to find possible reasons for the rapid recovery and growth of China's luxury market followed a short downturn under the Covid-19 pandemic, which are consumer returns, digital transformation, the rise of new generation customers, and duty-free policy in China. In addition, this paper displays methods and strategies, which are changes in marketing and sale channels online and combining China cultures, and caring for environmental factors, that international luxury brands have taken to deal with the pandemic. Finally, this paper expresses confidence in the future development of China's luxury market and gives suggestions to luxury brands and investors for further development in China.

2. Current Situation of China Luxury Market in 2020 -2022 under the Covid-19

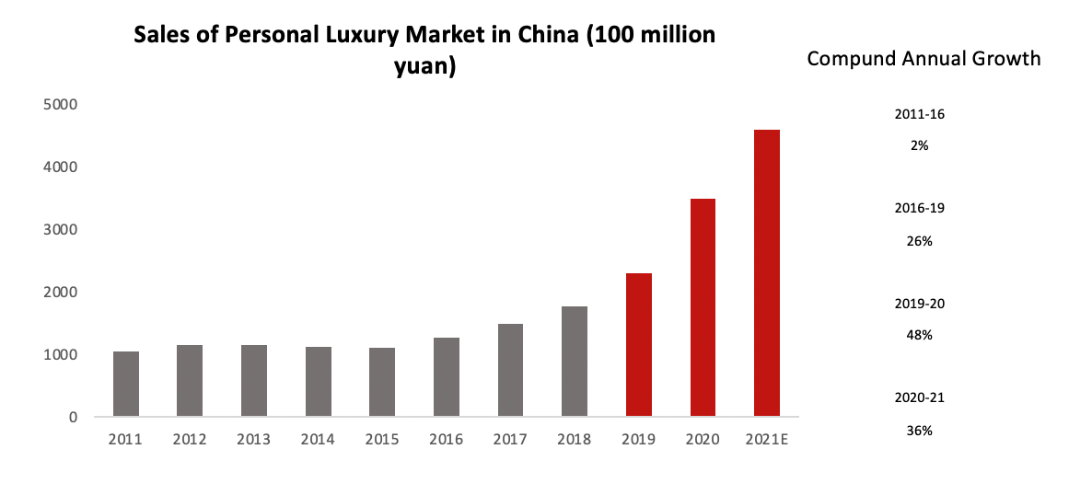

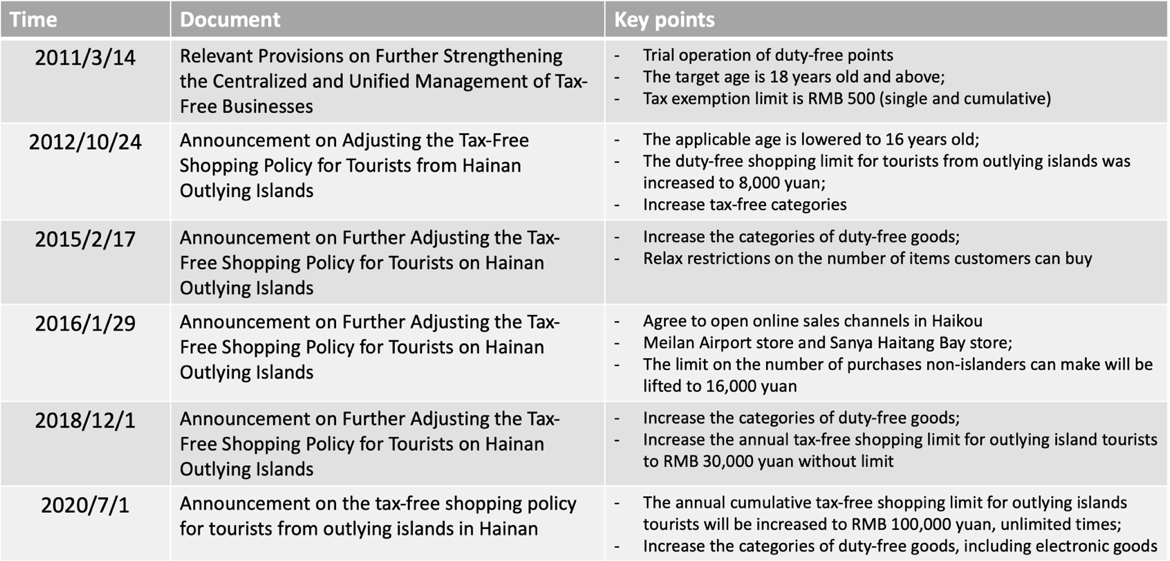

In 2020, due to the impact of Covid-19, the global luxury market suffered a severe downturn, and the size of the global personal luxury market decreased by 22.78% compared to the previous year [1]. In 2022, according to the 2021 China Luxury Market Report released by Bain & Company, as shown in figure 1, which is a consulting firm, sales increased by 48% year on year in 2020, and the scale of China's personal luxury market doubled in 2021 compared to that in 2019. The reports also expected that the sales grow by 36% year on year to nearly $73.6 billion in 2021 [2].

Figure 1: Sales of personal luxury market in China [3].

Source: Bain & Company & LT <China Luxury Market Report 2021>

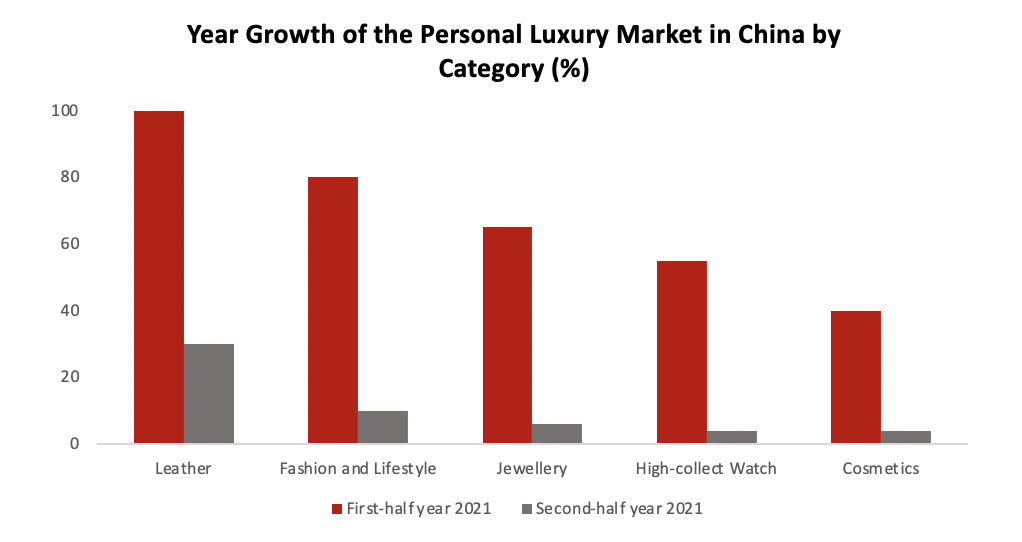

According to figure 2, there is a significant difference in the increasing scale in China ‘s luxury market between brands, in which the growth rate ranges from 10% to more than 70%. Leather products topped the list with a growth rate of about 60%, followed by fashion and lifestyle products with a growth rate of about 40%. Jewelry has a growth rate of about 35%, even though that is slower than in 2020, while high-collect watches and luxury cosmetics expect to grow by about 30% and 20%, perspectly [2].

Figure 2: Year growth of the personal luxury market in China by category [2].

Source: Bain & Company & LT <China Luxury Market Report 2021>

Despite the strong growth tendency in China's luxury market in 2021, there is a polarized situation between the first and second half of the year. Based on the collected data from the representative brands, the strong growth trend shows in significant categories in the first half year of 2021, with the growth rate ranging from 40% to 100%. However, the growth rate in the second half year in 2021 decreased from 0% to 25%. Several factors may cause such a difference in the growth rate:

First, the comparison base for the second half year of 2020 is very high, which means high sales data [2].

Second, there is the control of covid-19 in sporadic cities in China from June 2021 [2].

Third, The cooled stock and property market lead to more conservative spending behavior [2].

Forth, New regulations on KOL or internet celebrities have cut marketing spending for many luxury brands [2].

However, under the complex economic environment, China's luxury market is in the recovery trend and has a development trend. The new world environment, consisting of the pandemic, also brings a new consumption environment and a new consumption tendency, which provide the impetus for further development of the luxury market in China [4].

3. Reasons for Rapid Development of China Luxury Market in 2020 -2022 under the Covid-19

3.1. Consumer Return

"Consumer return" is a keyword for the change in China's consumption post-pandemic period. Since 2020, although the global luxury consumption market has been depressed due to the covid-19 pandemic, a large amount of consumption has returned to the domestic market in China, and the market size has grown against the global trend due to the improvement of the shopping environment in the mainland and factors of restrictions on going abroad.

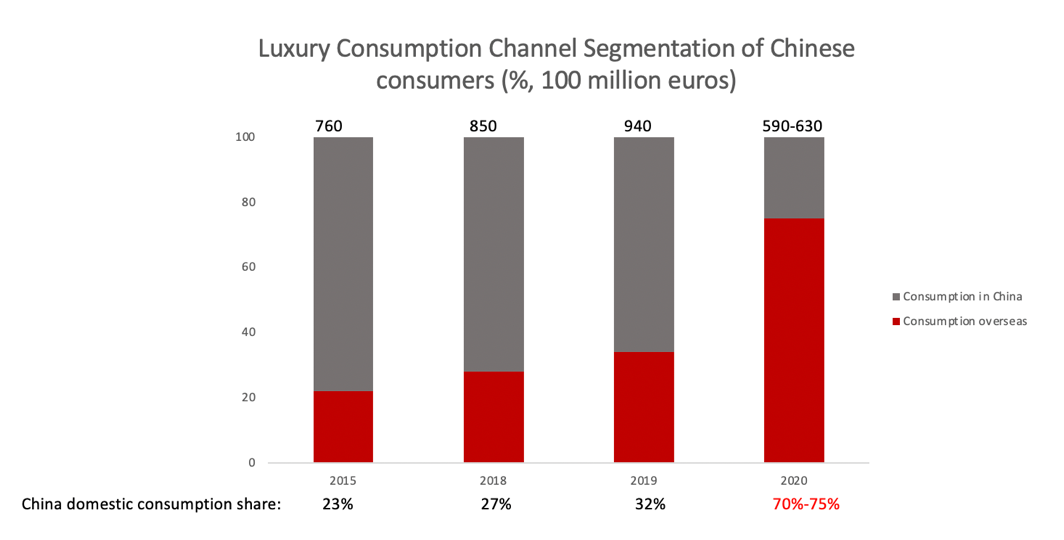

Ziqiang Xing, Morgan Stanley's chief economist in China, pointed out in a dialogue with CBN's chief countermeasures in 2020 that in the past five years, Chinese consumers spent $260 billion US dollars overseas every year, and estimates that the average annual return of $130 billion US dollars in the future. According to the data compiled by iResearch, shown in figure 3, overseas consumption of luxury goods by Chinese consumers from 2015 to 2019 accounted for about 68% to 77% of China's total luxury goods consumption. This situation changed grammatically in 2020. The proportion of overseas luxury consumption has dropped from 25% to 30%, and the proportion of overseas and domestic luxury consumption has almost changed compared with previous years. In 2020 alone, the domestic market accounted for 70% to 75% of the global luxury consumption of Chinese consumers due to the blocked outbound travel caused by the pandemic [3].

Figure 3: Luxury Consumption Channel Segmentation of Chinese Consumers [2].

Source: 2020 Bain - Italian Luxury Association Global Luxury Report; Bain analysis

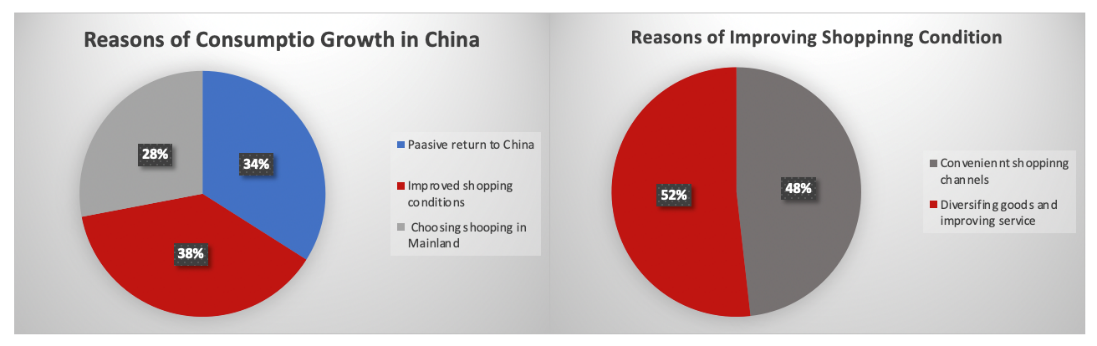

According to the consumer research data released by Tecent Marketing Insight, displaying figure 4, there are reasons why consumers increased their luxury consumption in the Chinese mainland in 2021:

First, 34% chose domestic consumption due to the passive return of the pandemic [5].

Second, 38% chose to shop back in China due to improving shopping conditions on the mainland [5].

Third, 67% of consumers say that the mainland has abundant products and improved personal services [5].

Forth, 72% chose domestic consumption due to more convenient shopping channels [5].

Figure 4: Reasons for consumer return [5].

Source: Forward Industry Research Report

Besides these, the number of consumers who actively choose China market for their first luxury purchase accounts for 28%. In the second half year of 2020, the pandemic spread rapidly and influenced countries worldwide; many schools were closed and switched to online courses, which caused many Chinese students to return to China. Since one of the characteristics of China's luxury market is that the consumers are younger than in other countries, which includes the group of overseas students, the returned students bring the consumer return to China market [4].

3.2. Digital Transformation

The level of digitalization in China market has experienced high growth, coupled with increased screen time during the pandemic, and the digital market is accelerating the process. According to iResearch, the average Gen Z consumers in China spent about 5 hours per day on mobile devices in 2020, which is 10% higher than the overall average [6]. Therefore, although offline stores remain the primary channel for brand building and purchase conversion, many brands gradually move their marketing and consumer operational activities online. This phenomenon explains why online luxury sales are growing faster than offline.

Under the covid-19, the Head brands of luxury accelerate their digital transformation, and the core of the process is accumulating information on online models in China and Chinese consumers. Brands use the WeChat applet online store to maintain existing consumers and develop new consumers. Sales tend to use the app to remotely communicate with customers, with the "cloud shopping" model to introduce products to customers and promote purchases. This shopping model also takes advantage of online payment and rapid-and-fully developed express service to deliver products to customers. Such an excellent convenience shopping method favors more and more customers.

2020 is the big year for luxury brands to enter the China online market, with the primary strategy of set the official website as the core coupled with multi-platform interaction. Online penetration of luxury sales in China grew from about 13% in 2019 to 23% in 2020, with overall online sales growing by around 150%. Online sales of luxury brands in China grew 88%, accounting for 21% of the market, up to $14.1 billion [5]. In 2021, the online luxury market in China further developed at high speed, with a growth rate of 75% and accounting for 26% of the market, reaching $24.7 billion [7].

Online channels are also becoming more diversified, and digital stores and retailers have become the main development direction of luxury brands. In 2022, salesforce influencers will be one of the critical strategies for all luxury brands to conduct digital retail. External part-time marketing personnel, especially lifestyle KOLs, stars, and core consumer representatives with a certain number of fans, will establish cooperation with many luxury brands and play an essential role in the marketing and promotion of luxury brands. MDZ report believes that the "ResearchOnline, PurchaseOnline" sales channel will account for more than 30%, contributing more than half of the market increment [6]. It is expected to support half of the luxury retail industry in the next few years, completely changing the situation that luxury brand retail is mainly offline.

3.3. The Rise of a New Generation of Consumer Groups

With the changing luxury market in China from generation to generation, the post-90s generation has gradually become the leading force in the market. Their purchasing behavior is different from that of mature consumers. Millennials, about 320 million born between 1980 and 1995, are rising in the market since they have gained a foothold in the workplace, increasing their disposable income. At the same time, this generation of consumers is more "willing" to spend money than the previous generation because of changes in the environment they grew up in, which lead them to hold a positive attitude toward luxury goods [3]. In this context, the current luxury market in China is also experiencing changes in the age structure of consumption [6]. According to the research paper from Tmall: millennials account for more than 70% of Tmall's luxury fashion and lifestyle market, and their number grew more than 100% year on year in 2020[3]. It can be said that millennials would like to spend more money on luxury consumption and will continue to occupy the primary position in the luxury market in China.

Although Chinese millennials are the majority of luxury consumers in China, Gen Z consumers (born after 1995, some 80 million of whom are 20 and older) are emerging as a new demographic, driving market growth and having a significant impact on brands' digitalization drive. Gen Z consumers were born and raised in a digital world. Those shoppers' preferences continue to drive the digitalization of the luxury market. For example, online shopping accounts for 35% of Gen Z's monthly spending on FMCG, compared with 27% for the rest of the population [10]. With the increasing influence of consumers in Gen Z, it is not difficult to find that many brands quickly catch the new generation's heart and emphasize individuality to promote sales through co-branded products, limited products, and personalized, customized products [10]. According to the report "China Luxury Market 2020: Unstoppable" released by Bain & Company, from January to October this year, the consumption of the post-1995 generation in luxury and limited brands surged by 300-400% [3].

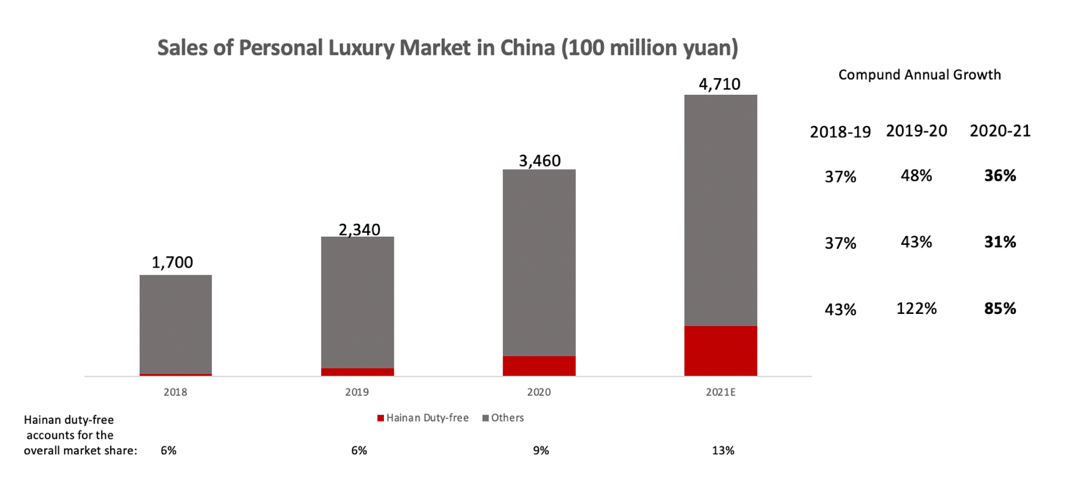

3.4. Duty-free Policy in Hainan Island

The outlying island tax exemption policy allows travelers traveling by plane, train, ship, and other outlying islands to purchase goods without import duties, such as limited types and amounts [14]. Consumers could enjoy preferential tax policies in duty-free shops on outlying islands. Since the spread of Covid-19 and its correlated changed policies, the famous duty-free market of South Korea has gone due to the sharply declined numbers of foreign tourists. Thus, the importance of the duty-free market in China is gradually being realized. For example, Louis Vuitton closed four stores in South Korea after 2021[15]. However, the increasing purchase volume in China during the pandemic brings the importance of duty-free exemption in China [3]. Top luxury brands will gradually attach importance to China and have the opportunity to land duty-free regions in Hainan.

Figure 5: Table of key documents of Hainan outlying islands duty-free policy [8].

Source: Ernst & Young & LT; China Retail & Consumer Goods Industry 2021 Review and Future Outlook & GT.

From the above policies in figure 5, it can be seen that in the ten years since the pilot, the country has continuously relaxed the restrictions on the tax exemption policy of the outlying islands of Hainan Island, which has greatly benefited the development of duty-free shopping in the island. The accelerated return of consumption under the influence of the pandemic has also stimulated the rapid growth of duty-free businesses in the outlying islands of Hainan Island in the post-pandemic period. In 2020, the sales growth rate exceeded 120%. In 2021, sales of duty-free stores in Hainan were expected to grow by around 85% to around $10 billion, accounting for around 5% points of the total sales growth of the luxury goods market within China. Personal luxury goods account for about 95% of Hainan duty-free shops, with more than 50% of sales coming from luxury beauty products [18].

On January 1, 2000, THE Relevant Provisions on Further STRENGTHENING the Centralized and Unified Management of DUTY-FREE Business were promulgated, formally forming the basic policy and standard of the duty-free industry. On March 14, 2011, the Ministry of Finance issued the Announcement on Carrying out the pilot Policy of Duty-free Shopping for Tourists in Hainan Outlying Islands. Since 2011, China has adjusted the tax exemption policies of the outlying islands of Hainan Island successively [8].

Figure 6: Sales of personal luxury market in China [3].

Source: 2021 Bain - Italian Luxury Association Global Luxury Report; Bain analysis

As of 2021, there are five duty-free operators and ten duty-free shops in Hainan's outlying islands [12]. As the government improves tax policy and pandemic factors such as limiting consumption abroad, Hainan's outlying island's duty-free shops attract high net worth individuals’ tourism consumption. Thus, many luxury brands actively prepare in Hainan to encourage consumers to buy luxury goods. Under the encouragement of Hainan, duty-free sales totaled about $3.4 billion, up 98% from a year earlier [3]. Many international brands have arranged the duty-free market in Hainan's outlying islands to provide more goods for duty-free shops in Hainan to stimulate consumption. There are also more and more luxury brands proposing to cooperate with Hainan Duty-Free shop to expand the scale of the Chinese market.

4. China Luxury Market Response Plan 2020-2022 under the COVID-19 Pandemic

4.1. Channel Changes as Each Brand Accelerating the Online Channel Layout

China's efforts to curb the spread of the virus by clamping down on the movement of people have led to an increase in online shopping, spurning further growth in e-commerce. Particularly live streaming has developed into a powerful internet marketing, communication, and commerce tool. From the standpoint of luxury buyers' purchasing channels, the structure of those channels has changed since the pandemic in 2020. On the one hand, customers went to the internet because stores were closed during the pandemic. The share of the internet channel increased from 12% in 2019 to 32% in 2020 due to the pandemic's acceleration of multi-brand online channel structure [12]. On the other hand, there has been a significant decline in luxury goods consumption abroad. With the proportion of channels increasing from 32% in 2019 to 59% in 2020, home consumption has changed into the primary market for luxury products [6].

Considering the changing channels, luxury brands take three main actions below to deal with the post-pandemic China market:

1.Luxury brands should take the current market situation as an opportunity to complete the all-channel construction of sales and brands, improving the online shopping platform [6]. The online channels or applet could trace consumers' shopping habits and recommend personalized products after data analysis to ensure that customers can thoroughly and efficiently learn about product information and complete the purchase behavior online. Offline stores, otherwise, should pay more attention to upgrading in service and feelings so that customers in offline stores can meet a more personalized and unique shopping experience different from online shopping.

2.Brands designed with Chinese elements. One of the reasons for the enduring popularity of luxury brands is that they will transmit their development history and culture in their products so that customers will not only buy the products but also buy the culture transmitted by the brand. In recent years, Chinese consumers also tend to purchase the design of luxury products integrated with Chinese cultures, such as the new-year collection with the zodiac animals. Luxury brands have also begun to produce co-branded styles with local brands or designers in China, as well as limited collections launched according to traditional Chinese festivals, such as Spring Festival and Qixi Festival. The accessible consumer groups have been expanded through social media dissemination to stimulate consumption in China [12].

3.There is the rising of an online fashion show called "Cloud show." Fashion shows, an essential cultural export and a way to maintain customer relations with luxury brands, have gradually changed from offline to online with the changes of the pandemic period [12]. For the Chinese market, the show's venue is selected in a prominent place in China, integrating and displaying Chinese elements, then propagandized through social media popular among Chinese people. This "cloud show" maintains the show's meaning to transmit brand culture and gain more views, which can attract more potential customers and stimulate purchase behavior.

4.2. Attention to Environmental Factors

As the sudden outbreak of COVID-19 hit the market, people paid more attention to our world, that we should protect our environment from being a Greenland. This changing opinion causes a change in purchase behavior. The social responsibility of luxury brands has gradually become a concern of consumers. Luxury brands, burdened with social responsibility, are also paying more attention to environmental protection while recovering the market. All luxury brands have gradually taken "sustainability" as the goal of their continued development and incorporated this goal into their products. Euromonitor's Top 10 global consumption trends published in January 2021 show that 61% of respondents worldwide are concerned about climate change, 48.9% buy sustainable packaging, and 36.4% want to reduce carbon emissions [16].

Consumers are increasingly paying attention to the impact of their consumption behavior on the environment and expressing their ongoing concern about the carbon emissions of consumer goods. 58.8% of respondents said they would choose recyclable products, and 57.2% trusted recyclable brands more [16]. This means that to maintain the vitality and strong growth trend of the market, luxury brands should pay more attention to "sustainable" products and arrange a part of the budget to invest in sustainable actions. Caring about environmental factors is not only the brands' duty but also helps them to maintain a part of the existing customers and attract more potential customers.

5. Suggestions for Future China Luxury Market

5.1. Future Forecast

In 2021, the online business of China's luxury market will further develop at high speed based on 2020. In 2022, the Internet celebrity of sales staff will be one of the essential strategies for all luxury brands to carry out digital retail. In addition, a new generation of consumers – millennials and Gen Z -- has become the backbone of luxury spending. In 2019, they contributed 35% of total global luxury consumption; by 2025, they are expected to increase to 45%. However, the younger generation, Gen Z, is likely to make up 40% of luxury consumers by 2035 and behave differently from past generations.

According to Key Research Institute, the online sales of luxury brands will exceed 220 billion yuan in 2022, and sales channels will account for more than 30%, contributing more than half of the market increment [11]. "The global luxury market has continued to grow modestly this year, in line with Bain's 'new normal,' driven mainly by Asia, especially Chinese consumers," said Bruno Lannes, Bain's global partner. "Luxury consumers are increasingly proactive and rewriting the rules of the game, and brands need to find a new business model to meet their buying, using, and communicating needs" [17]. China's luxury market is expected to grow to $441 billion by 2025, making it the most prominent luxury market in the world, according to projections by Bain & Company senior global partner and co-authors of the report Bruno and McKinsey.

5.2. Recommendations for Marketing in China Luxury Market

China's luxury market is currently shining and occupying the top place in the world's different regional markets. China's luxury market is a market worth investing because of its strong growth tendency. International luxury brands need to pay attention to the rising China luxury market and better integrate into the China market:

First, it needs to cater to the consumption habits of Chinese consumers: accelerate the improvement of online sales channels and increase investment in social media promotion.

Secondly, brands can incorporate Chinese elements into their product designs to attract the attention of Chinese consumers.

Finally, it is better to pay attention to the development of young consumers, millennials and Gen Z, while maintaining the primary consumers of the post-80s generation. We should use a variety of online marketing and offline activities to enhance customer stickiness, collect and analyze the needs and pain points of consumers of different ages, and design products for different needs of all ages to achieve comprehensive coverage.

6. Conclusion

In the face of the sudden COVID-19 pandemic and its vast impact on the entire economy and market, China's luxury market recovered rapidly after a brief downturn. It showed a strong growth trend during the pandemic period of 2020-2022. By analyzing and collecting relevant market and industry reports, this paper finds that consumption return, digital transformation, the rise of the new generation of consumer groups, and Hainan's preferential duty-free policy can be the four reasons for the rapid recovery and growth. This paper further studies the strategies of international luxury brands to cope with the pandemic, such as changing marketing and sales channels while integrating Chinese elements into their products and incorporating environmental factors into their development plans. Finally, this paper displays the optimistic view of the industry in China through the data that forecast the Chinese luxury market performance during the pandemic. At the same time, the paper gives luxury brands and investors suggestions for future development by integrating local cultural elements into their goods, keeping up with the digital transformation, and paying attention to the rise of the new generation of consumer groups. In this paper, while analyzing the reasons, the opinions and suggestions are also helpful for the China luxury market to face uncertain factors in the future.

References

[1]. INSIGHT AND INFO. (n.d.): Global and Chinese Luxury Industry Development Status annd Market size Statistics2016-2021(2022)https://www.chinabaogao.com/detail/604415.html

[2]. Yingyiru.: China’s luxury spending jumped 36 percennt year-on-year to 471 billion yuan in 2021. (2022, January 25). https://wallstreetcn.com/articles/3650594

[3]. Lannes, B., & Zhang, J. (n.d.).: China’s unstoppable 2020 luxury market - bain.cn. (2020)https://www.bain.cn/pdfs/202012160302262674.pdf

[4]. Murray, T. (n.d.).: New genneration, new atmosphere—Current situation of luxury retail market in China. CEIBS.https://cn.ceibs.edu/gemba/story/20933

[5]. Huang, S.: Analysis of the Development status and Market size of China luxury industry in 2022 connsuption return boosts the countertrend growth of Mainnland luxuy market. Forward Industry Research Report. (2022, January 29).https://www.qianzhan.com/analyst/detail/220/220129-67a6f93d.html

[6]. From the digital prespective: China luxury market is recovering. Monstarlab | Digital Consulting and Product Development. (2022, August 3). https://www.monstar-lab.com.cn/expertinsights/wre-luxury-market-trend-dx/

[7]. Global Times.: The pandemic has made China the World’s Largets Luxury Market (2022, January 19). http://hqsxw.net/2022011913977.html

[8]. EY.: China Retail and Consumer Goods Industry 2021 Review and Future Outlook. (2022).https://assets.ey.com/content/dam/ey-sites/ey-com/zh_cn/topics/consumer-products/ey-overview-of-chinas-consumer-products-retail-industry-in-2021-zh.pdf

[9]. Chen, Y.: Analysis of global and China luxury goods market status and trend in 2021, and stronng high-end consumer demnad resilience. (2022, August 23). https://m.huaon.com/detail/830224.html

[10]. Fashion, F.: China Luxry Report 2020-2021—China is the world’s largest luxury market.(2022,January,19).https://www.163.com/dy/article/GU2OGVSH05385ELK.html

[11]. Hualizhi.: 2022 China Luxury Marketing Report: How to seize the private sector position? (2022, July, 13).https://www.163.com/dy/article/HC587ERS0519FFAI.html

[12]. Qinshuo.: 2020 Global Luxury Industry Trends (2020 China Luxury Consumption data). (2022, August, 23).https://www.msn19.cn/post/5071.html

[13]. Deloitte. (n.d.).: Future of automotive sales and aftersales impact of current industry ...https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/consumer-business/deloitte-cn-cb-future-of-auto-sales-en-210113.pdf

[14]. Tax-free Policy for Outlying Island-BaiduBaike. (n.d.). https://baike.baidu.com/item/%E7%A6%BB%E5%B2%9B%E5%85%8D%E7%A8%8E%E6%94%BF%E7%AD%96/9811931?fr=aladdin

[15]. Guanghui X.: Report on Duty-free Industry: In the Post-pandemic era, How to make Luxury Brands Duty-free in China?.Financial Headlines. (2022, August 5). https://t.cj.sina.com.cn/articles/view/7426890874/1baad5c7a001013zqm

[16]. Huanran Z., Kuibai L., &Terrance L.: Global Consumer Insights 2020 China Market. (2020).https://www.pwccn.com/zh/retail-and-consumer/gcis-china-report-sep2020.pdf

[17]. China Luxury Market Continues to Grow Strongly, and Gen Z will Be the Main Consumer in the Future. (2020, January 8). https://www.bain.cn/news_info.php?id=1013

[18]. Li M.: The Covid-19 pandemic has reshaped the global luxury market. Financial News China. (2022, August 23). https://www.financialnews.com.cn/hq/sc/202208/t20220823_253967.html

[19]. Monstarlab.: Industry Insight: A Digital Perspective on China Luxury Market Recovery and Growth. (2021, August 2). https://www.monstar-lab.com.cn/expertinsights/wre-luxury-market-trend-dx/

[20]. Achille, A., & Zipser, D.: Survive the present and recreate the future -- Thinking on "anti-epidemic" in luxury industry. McKinsey Greater China. (2022).https://www.mckinsey.com.cn/%E7%86%AC%E8%BF%87%E5%BD%93%E4%B8%8B%EF%BC%8C%E5%86%8D%E9%80%A0%E6%9C%AA%E6%9D%A5-%E5%A5%A2%E4%BE%88%E5%93%81%E8%A1%8C%E4%B8%9A%E6%8A%97%E7%96%AB%E6%80%9D%E8%80%83/

Cite this article

Lin,J. (2023). China Luxury Market Consumption under the Covid-19 Pandemic. Advances in Economics, Management and Political Sciences,11,373-383.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. INSIGHT AND INFO. (n.d.): Global and Chinese Luxury Industry Development Status annd Market size Statistics2016-2021(2022)https://www.chinabaogao.com/detail/604415.html

[2]. Yingyiru.: China’s luxury spending jumped 36 percennt year-on-year to 471 billion yuan in 2021. (2022, January 25). https://wallstreetcn.com/articles/3650594

[3]. Lannes, B., & Zhang, J. (n.d.).: China’s unstoppable 2020 luxury market - bain.cn. (2020)https://www.bain.cn/pdfs/202012160302262674.pdf

[4]. Murray, T. (n.d.).: New genneration, new atmosphere—Current situation of luxury retail market in China. CEIBS.https://cn.ceibs.edu/gemba/story/20933

[5]. Huang, S.: Analysis of the Development status and Market size of China luxury industry in 2022 connsuption return boosts the countertrend growth of Mainnland luxuy market. Forward Industry Research Report. (2022, January 29).https://www.qianzhan.com/analyst/detail/220/220129-67a6f93d.html

[6]. From the digital prespective: China luxury market is recovering. Monstarlab | Digital Consulting and Product Development. (2022, August 3). https://www.monstar-lab.com.cn/expertinsights/wre-luxury-market-trend-dx/

[7]. Global Times.: The pandemic has made China the World’s Largets Luxury Market (2022, January 19). http://hqsxw.net/2022011913977.html

[8]. EY.: China Retail and Consumer Goods Industry 2021 Review and Future Outlook. (2022).https://assets.ey.com/content/dam/ey-sites/ey-com/zh_cn/topics/consumer-products/ey-overview-of-chinas-consumer-products-retail-industry-in-2021-zh.pdf

[9]. Chen, Y.: Analysis of global and China luxury goods market status and trend in 2021, and stronng high-end consumer demnad resilience. (2022, August 23). https://m.huaon.com/detail/830224.html

[10]. Fashion, F.: China Luxry Report 2020-2021—China is the world’s largest luxury market.(2022,January,19).https://www.163.com/dy/article/GU2OGVSH05385ELK.html

[11]. Hualizhi.: 2022 China Luxury Marketing Report: How to seize the private sector position? (2022, July, 13).https://www.163.com/dy/article/HC587ERS0519FFAI.html

[12]. Qinshuo.: 2020 Global Luxury Industry Trends (2020 China Luxury Consumption data). (2022, August, 23).https://www.msn19.cn/post/5071.html

[13]. Deloitte. (n.d.).: Future of automotive sales and aftersales impact of current industry ...https://www2.deloitte.com/content/dam/Deloitte/cn/Documents/consumer-business/deloitte-cn-cb-future-of-auto-sales-en-210113.pdf

[14]. Tax-free Policy for Outlying Island-BaiduBaike. (n.d.). https://baike.baidu.com/item/%E7%A6%BB%E5%B2%9B%E5%85%8D%E7%A8%8E%E6%94%BF%E7%AD%96/9811931?fr=aladdin

[15]. Guanghui X.: Report on Duty-free Industry: In the Post-pandemic era, How to make Luxury Brands Duty-free in China?.Financial Headlines. (2022, August 5). https://t.cj.sina.com.cn/articles/view/7426890874/1baad5c7a001013zqm

[16]. Huanran Z., Kuibai L., &Terrance L.: Global Consumer Insights 2020 China Market. (2020).https://www.pwccn.com/zh/retail-and-consumer/gcis-china-report-sep2020.pdf

[17]. China Luxury Market Continues to Grow Strongly, and Gen Z will Be the Main Consumer in the Future. (2020, January 8). https://www.bain.cn/news_info.php?id=1013

[18]. Li M.: The Covid-19 pandemic has reshaped the global luxury market. Financial News China. (2022, August 23). https://www.financialnews.com.cn/hq/sc/202208/t20220823_253967.html

[19]. Monstarlab.: Industry Insight: A Digital Perspective on China Luxury Market Recovery and Growth. (2021, August 2). https://www.monstar-lab.com.cn/expertinsights/wre-luxury-market-trend-dx/

[20]. Achille, A., & Zipser, D.: Survive the present and recreate the future -- Thinking on "anti-epidemic" in luxury industry. McKinsey Greater China. (2022).https://www.mckinsey.com.cn/%E7%86%AC%E8%BF%87%E5%BD%93%E4%B8%8B%EF%BC%8C%E5%86%8D%E9%80%A0%E6%9C%AA%E6%9D%A5-%E5%A5%A2%E4%BE%88%E5%93%81%E8%A1%8C%E4%B8%9A%E6%8A%97%E7%96%AB%E6%80%9D%E8%80%83/