1. Introduction

A large number of trade frictions happened between China and the Occident in 2019. The Chinese government is not available to the accessories of the high technology devices. However, China is the most tremendous market for high technology accessories since the huge population generates a big demand. Aiming to produce high technology accessories, the Chinese government set up the STAR market to support the companies researching on high tech. Besides, the STAR market also aims to make better use of enterprises with broad prospects, optimize the structure of the science and technology innovation enterprises, enhance market inclusiveness, and strengthen market function [1]. The STAR market first appeared on the 22nd of July 2019. Before the STAR market, there is a 44% limitation of stock gains on the first day of the A-share stock market, hoping to control the first-day rise of new shares and effectively curb "speculation", but it also causes a mass of bad effects. This paper will discover and explain the two main effects of canceling the policy of 44% limitation on the first day through two main indexes, theturnover rate and stock gains, to analyze whether the investments in the STAR market are reasonable under this policy. This research would allow investors to make sense of the trading situation of a part of stock public on the first day, thus helping them enhance the rationality of investment.

2. The First-day Turnover Rate and Stock Gains of the STAR Market and A-share Market

All of the data used in this paper come from csmar (China Stock Market and Accounting Research Database), including the first-day turnover rate, opening price, and closing price of the stocks of the STAR market and A-share market, from the period of July 22nd, 2019 to December, 31st, 2019. Table 1 shows the data.

Table 1: Partial stock data of A-share market and Star market (source from China Stock Market and Accounting Research Database).

Type | Stock code | Launch day | First day opening price yuan/share | First day closing price yuan/share | Stock gains | First day turnover rate |

A share | 002957 | 2019-07-26 | 18.12 | 21.74 | 0.199779249 | 0.00133 |

A share | 002959 | 2019-08-23 | 41.1 | 49.32 | 0.2 | 0.00261 |

A share | 002960 | 2019-08-09 | 20.81 | 24.97 | 0.199903892 | 0.00128 |

A share | 002961 | 2019-09-05 | 6.68 | 8.02 | 0.200598802 | 0.00139 |

A share | 002962 | 2019-09-17 | 17.27 | 20.72 | 0.199768384 | 0.00086 |

A share | 002963 | 2019-10-28 | 28.39 | 34.07 | 0.200070447 | 0.00191 |

A share | 002965 | 2019-10-25 | 23.87 | 28.64 | 0.199832426 | 0.00218 |

A share | 002966 | 2019-08-02 | 9.43 | 11.32 | 0.200424178 | 0.00509 |

A share | 002967 | 2019-11-08 | 8.92 | 10.7 | 0.19955157 | 0.00431 |

A share | 002968 | 2019-12-03 | 32.11 | 38.53 | 0.199937714 | 0.01349 |

... | ... | ... | ... | ... | ... | ... |

Star market | 688333 | 2019-07-22 | 61 | 64.33 | 0.054590164 | 0.82554 |

Star market | 688357 | 2019-12-04 | 44 | 42.35 | -0.0375 | 0.57567 |

Star market | 688358 | 2019-12-03 | 52.4 | 51.56 | -0.016030534 | 0.67356 |

Star market | 688363 | 2019-11-06 | 78 | 85.1 | 0.091025641 | 0.74069 |

Star market | 688366 | 2019-10-30 | 149.3 | 130.7 | -0.12458138 | 0.76102 |

Star market | 688368 | 2019-10-14 | 109 | 104.36 | -0.042568807 | 0.6996 |

Star market | 688369 | 2019-10-31 | 75 | 76.9 | 0.025333333 | 0.76645 |

Star market | 688388 | 2019-07-22 | 66 | 56.66 | -0.141515152 | 0.75999 |

Star market | 688389 | 2019-11-05 | 22 | 19.63 | -0.107727273 | 0.85532 |

Star market | 688399 | 2019-12-05 | 52.33 | 54.88 | 0.048729218 | 0.74074 |

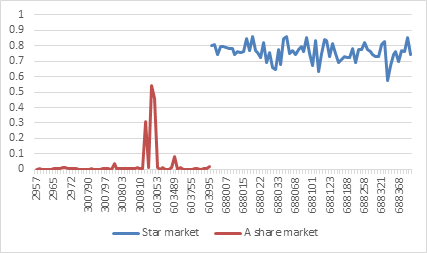

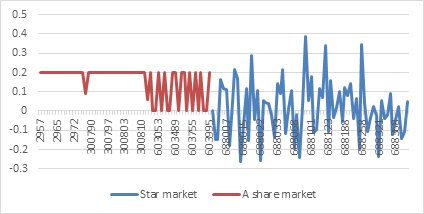

Figure 1 would be used to show the variation of different parameters in Table 1. This paper would like to calculate the differences in stock gains and exhibit the figure of turnover rate to analyze the differences of the stock from the STAR market and the A-share market. The investments will be reasonable if the differences is significant. In other words, the increase of turnover rates and volatilities and stock gains on the first day represents the composition situation of stock buyers. Diverse buyers of stocks will lead to a reasonable investment [2].

By observing Figure 1, it can be intuitively found that the first-day turnover rate of the stock in the STAR market is generally distributed in the range of 50% to 90%, and the lowest value is close to 60%. The turnover rate of other stocks in the A-share market on the first day is close to 0 as a whole, and only a small part of the turnover rate of stocks is relatively high. The highest value is close to 55%. In contrast, the turnover rate of the STAR market on the first day is completely higher than that of the A-share market. It is easy to find out that the turnover rate of stocks in the STAR market is higher than that in other types of markets, which means the liquidity of the stock in the STAR market performs well. To be more specific, the buyers of it become more diverse. Not only do big investment banks have chances to buy stocks, so do other retail investors. The stock market has become more dynamic. Additionally, it also proves the speculativeness of Chinese shareholders, who Incline to hold stocks for the short term [3] [4].

From Figure 2, it is known that the first-day gains of A shares are all positive, and the highest stock gains reaches 20 percent. Compared with A-share, the STAR market is more volatile. The stock gains are both positive and negative. The increase is larger as well. The highest is close to 40 percent, and the lowest is close to minus 30 percent. According to Figure 2, the stock gains of the STAR market on the first day are more volatile. However, it can represent the authority under the random stock market circumstance. To be more specific, stock gains may turn negative, since an increase in the types of shareholder will diminish the difficulty of stock speculation.

Figure 1: The turnover rate of the STAR market and A-share market in the same period.

Figure 2: The first-day gains of the STAR market and A-share market in the same period.

3. Discussion on Whether to Cancel the 44% Limitation Policy

3.1. The Introduction of the 44% Limitation Policy

According to the analysis above, it can be concluded that the investor types will become diverse and the composition of the stock market will become reasonable without a 44 percent limitation policy. However, based on the early Chinese stock market, it is still necessary to introduce such a policy despite of a mass of bad effects it may cause. Before 2012, there was no limit on the first day of trading. Many new shares saw their prices rising several times on the first day, only to fall by the limit from the next day. For example, Luoyang Molybdenum Co., which went public on October 9, 2012, rose 221% on the first day of listing, while Haixin Food Co. fell 8% on the first day [5]. For all of 2012, nearly 40 new shares were sold on their first day of trading. Due to this circumstance, in the early days of the system, it was analyzed that a clear limit on the rise or fall of stock on the first day of its listing would have a positive effect, such as curbing speculation on the first day of a new stock market. To prevent investors from taking risks, since January 1, 2014, new shares have been subject to restrictions on the rise or fall on the first day of listing, stipulating that the rise or fall of new shares on the first day of listing cannot exceed 20% during the bidding period. In the consecutive bidding phase, the price cannot rise more than 44 percent or fall more than 36 percent. According to the statistics of Choice, since January 24, 2014, the first day of the listing of the GuiRenNiao with 43.96%, and after 5 years, the first day of the listing of over 1000 new shares is almost 44% [6].

3.2. The Problems of the 44% Limitation Policy

The first-day performance of new listings before 2014 has been wildly different, and no matter how the stock index fluctuates, the new shares can always stand invincible. A shares have lasted for many years, and the 44% limit on the first day of the new stock market is rare in the world. It is easy to find out the problem with this policy. The 44 percent limitation on the first day of trading in the A-share market is intended to control the first-day rise of new shares and effectively curb speculation. Nevertheless, due to this policy, it is almost impossible for most people to buy new shares on the first day of trading, which inevitably leads to a series of unlimited daily limit rises for many new shares. This is because the supply of new shares on the first day is particularly limited due to the daily limit, yet there is a high demand for new shares in the stock market. Unbalanced supply and demand coupled with the impact of this policy, resulting in a higher share price, and a larger hype space. Specifically, some speculative forces in the market including institution, and investment banks, have found defects on the first day of the trading mechanism of new shares. For these defects, a set of operating methods are developed to apply to the actual combat to profiteering big windfall. The basic practice of these speculative forces is that on the first day of a new IPO, they put up a huge number of orders on the daily ceiling (sometimes more than several times the total outstanding), and take advantage of their capital advantage and certain privileges (such as VIP access) to steal all the selling orders in the market, and ordinary investors naturally cannot buy any shares. After that, continuing to block orders at the daily ceiling for the next few trading days, snatching up all the sell orders (which will naturally increase as the daily limit increases), and sending the share price soaring by 10 percent a day until the daily limit opens and all the shares are sold. For ordinary investors, they also know who can buy new shares after IPO’s successive ceiling and who can get huge profits, but they do not have the privilege, so they can only see some speculative force kept on new shares for profiteering. This has led to a lot of unbalanced ordinary investors continuing to chase the crazy open new shares, finally experiencing heavy losses [7].

3.3. The Canceling of the 44% Limitation Policy

Canceling the 44 percent limitation can solve this problem perfectly. It is hard for institutions to buy all stocks in the STAR market since the limitation has been canceled and the supply of stocks has increased. Thus, the unbalanced demand and supply relationship disappeared, monopoly behaviors decreased, and a fair market is able to be established. The cancellation of the daily limit on the first day of listing of new shares is undoubtedly conducive to the market to form a real transaction and real price signals, as well as improving the rationality of the pricing of new shares. The general direction is to release the issue of 23 times the price-earnings ratio. It is conducive to A share marketization. However, according to the experiences of stock markets all over the world, market-based measures, rather than crude administrative measures, should be used to curb speculation [8]. However, there are several reasons for not canceling the A-share limit. First, China's stock market is relatively immature and not suitable for direct domination by the capital market at present. Secondly, the 44 percent daily limit can protect the interests of small and medium investors, that is, the so-called "hit the new" must earn [9]. To make China's stock market more international, the science and technology Innovation board can be seen as a small pilot. Many new policies have been implemented here. In addition to the lifting of the first-day trading limit mentioned in this paper, new policies such as delisting reform are expected to be added [10].

4. Conclusion

This paper has shown that the shareholder would be diverse and the investment would become reasonable after canceling the 44 percent limit regulation on the first day of the STAR market. This paper has directly considered 2 direct effects factors of canceling this policy. They are the turnover rate and stock gains on the first day of the stock market. Results show that the turnover rate in the STAR market is larger than that in the A-share market, which means the composition of buyers in the STAR market is more variable. Additionally, the stock gains of the STAR market declined after canceling this policy, which means investments in the STAR market became more reasonable without this regulation. Nevertheless, it is impossible to cover all of the latest factors affecting the investments. What is clear, however, is that these two types of factors and analyses around them can conclude major reasons for judging whether investments are rational or not and Chinese stock markers are balanced or not. The main reflection is that the new stock stops unlimited limits up, and Institutions stop buying all the stocks on the first day of the STAR market. These two factors should not only be considered by experts but also by all the shareholders in the stock markets.

References

[1]. Jing, Q.: Research on lawyers' non-litigation business under the background of the implementation of Science and Technology Innovation Board. Finance and Management (2020).

[2]. Liao, L., Liang, Y., Zhang, W. Q.: Who bets on the Chinese Stock market? -- Empirical research based on trading data of individual investors. Journal of Tsinghua University 56, 677-684 (2016).

[3]. Yuan, L.: Inventory of high turnover stocks of A-share in 2013: 323 stocks with turnover rate over 1000%, and Reng Zihang were ranked first (2013).

[4]. Yan, Z.: Transformation of the Legal Regulation Mode of Delisting from the STAR Market under the Registration System: Focus on the Proper Protection of Investors. Journal of Shanghai University of Finance and Economics 23, 138-152 (2021).

[5]. Liao, Y. Z.: Inquiry system reform from the "Luoyang Molybdenum Industry Incident" (2013).

[6]. Xiao, S. J.: The impact of national policies on the stock price and long-term development of listed sports companies -- A case study of Guirenbird (603555) (2015).

[7]. Li, Y. Bull market, the fifth generation of investors "speculation, speculation" (2015).

[8]. Shen, H., Fu, Y. Y.: It is against market principles to restrict speculation by administrative means. The root cause should be thorough marketization of the new share issuance system, strict delisting system and cultivation of institutional investors (2012).

[9]. Yang, Z. Q., Zhang, C. L.: New Stock Returns and investor sentiment: an empirical study based on the number of new stock "daily limit" in the Chinese stock market (2016).

[10]. Ma, Y., Liu, G. F., Qi, C.: IPO Pricing, Investor Behavior, and IPO Underpricing of High-Tech Companies: Evidence from SSE STAR Market and Nasdaq Market. Discrete Dynamics in Nature and Society (2022).

Cite this article

Shi,S. (2023). Effects of Canceling the Policy of 44% Limitation on the First Day of Chinese Stock Market. Advances in Economics, Management and Political Sciences,12,51-56.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jing, Q.: Research on lawyers' non-litigation business under the background of the implementation of Science and Technology Innovation Board. Finance and Management (2020).

[2]. Liao, L., Liang, Y., Zhang, W. Q.: Who bets on the Chinese Stock market? -- Empirical research based on trading data of individual investors. Journal of Tsinghua University 56, 677-684 (2016).

[3]. Yuan, L.: Inventory of high turnover stocks of A-share in 2013: 323 stocks with turnover rate over 1000%, and Reng Zihang were ranked first (2013).

[4]. Yan, Z.: Transformation of the Legal Regulation Mode of Delisting from the STAR Market under the Registration System: Focus on the Proper Protection of Investors. Journal of Shanghai University of Finance and Economics 23, 138-152 (2021).

[5]. Liao, Y. Z.: Inquiry system reform from the "Luoyang Molybdenum Industry Incident" (2013).

[6]. Xiao, S. J.: The impact of national policies on the stock price and long-term development of listed sports companies -- A case study of Guirenbird (603555) (2015).

[7]. Li, Y. Bull market, the fifth generation of investors "speculation, speculation" (2015).

[8]. Shen, H., Fu, Y. Y.: It is against market principles to restrict speculation by administrative means. The root cause should be thorough marketization of the new share issuance system, strict delisting system and cultivation of institutional investors (2012).

[9]. Yang, Z. Q., Zhang, C. L.: New Stock Returns and investor sentiment: an empirical study based on the number of new stock "daily limit" in the Chinese stock market (2016).

[10]. Ma, Y., Liu, G. F., Qi, C.: IPO Pricing, Investor Behavior, and IPO Underpricing of High-Tech Companies: Evidence from SSE STAR Market and Nasdaq Market. Discrete Dynamics in Nature and Society (2022).