1. Introduction

The asymmetric-dominance effect, commonly referred to as the decoy effect or the attraction effect, was initially postulated by Huber et al. in 1982 [1]. It is an effect caused by consumer decision-making bias that may lead to a clear preference of consumer choices among targets and competitors when a less attractive decoy option is presented [1]. Businesses usually offer three options with different superiority: targets, competitors, and the decoy. The competitor and the target have advantages in different aspects; the target is the final product that the merchant expects the consumer to choose; the decoy introduced is similar to the target choice but slightly worse than the target when considering one or some dimensions. Since it was first proposed, the decoy effect has been one of the most often discussed and referenced topics in the literature on context effects within behavioral economics.

From a business or economics perspective, companies seek to maximize profits and are motivated to nudge customers toward higher-margin goods [2]. Empirical evidence has shown that a helpful marketing tool to achieve this objective is employing the decoy effect strategy to nudge consumers away from two competition products and steer customers towards the desired target [3].

The decoy effect is a market strategy created to " force" customers to select companies' desired products [4]. This study of the decoy effect under behavioral economics allows for a better understanding of consumer choice and, thus, a better application to real-world marketing strategies. This paper uses secondary sources to explain the decoy effect and cites relevant experimental cases to demonstrate the practical application of the decoy effect in influencing consumer choice and firm revenue maximization.

2. Literature Review

Huber et al. formally identified and described the decoy effect (sometimes referred to as the consequence of asymmetric dominance) in a paper that sought to evaluate existing choice models in 1982. According to the authors, the decoy effect is a type of context-dependent choice in which the "attraction effect" is generated by including a weaker decoy product option in the choice set, leading to an increase in the purchase of the target option [1][5]. Under this effect, the seller is required to provide a minimum of three different products, of which at least two must have prices that are comparable to one another. Both of the products that have the same price should be the more expensive option, and one of the products should have a lower perceived value than the other [6]. As a result of this tactic, consumers will weigh the relative merits of the two identically priced options, ultimately increasing demand for the more appealing one [6]. In addition, Huber et al. also suggested that the decoy effect was more pronounced when the decoy was closer to the target option [1].

Khan et al. looked into how the decoy effect might be used as a perceptual tool to affect consumer decision-making while considering context influences [7]. The research results show that the decoy effect is more potent in shaping consumer decisions when high-choice constructs are included [7]. Attribute-level trade-offs between two choice domains can be mitigated if consumers have a more nuanced understanding of choice at the category level [7]. Besides this, a case study of potential lake environmental management strategies shows that the asymmetric dominance decoy effects commonly seen in the psychological and commercial literature also materialize in decisions involving non-market environmental products [3].

The limitations of the decoy effect have also been explored in several studies. The decoy effect, as described in a paper by Frederick et al., is only detectable in a controlled setting where two products with two traits (usually the quantitative dimensions like price and quality) are added to the option set for evaluation alongside a third, less alluring decoy product [8]. Additionally, it has been demonstrated that the decoy effect is mitigated, and the dominant option's market share is reduced when product features are depicted through verbal descriptions and visual representations [8].

3. The Effects of Decoys on Consumers’ Preference Shifts

Consumers make choices based on their assessment of the value of a particular set of products; when people perceive one option to be superior to the second option in some respects and not in all aspects, there is a contrast between them, leading to choosing difficulties [9]. Human decisions are susceptible to the context in which they are presented [10]. The decoy effect describes the economic phenomenon in which customers' preferences between two choices change when a third asymmetrically dominant decoy option is introduced [4] [7]. When the perceived value in terms of quantity, price, or quality is considered, asymmetric advantage indicates that the decoy product tends to make one of the two options in the choice set more attractive.

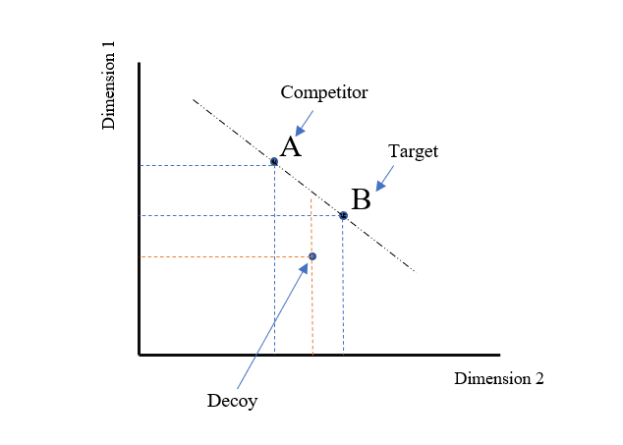

Figure 1: Decoy compared with competitor and target in two dimensions.

When considering a decision between a target and a competitor, some authors claim that the ratio of choice is around 50/50 when no decoy is present [3]. (For example, in Figure 1: choice A is better than choice B in dimension 1, while choice B is better than choice A in dimension 2; thus, it is difficult to make a choice). Since decoys are often closer to targets than rivals, countering the similarity effect, those studies also reveal that after introducing a decoy, consumers showed a more marked preference for the original two options (A and B) [1]. The decoy is dominated by the target option (B) along both dimensions simultaneously [11]; it is worth noting that A is not very useful at this point, as the decoy is more comparable to the target. Furthermore, the decoy only impacts if the target product is superior to the decoy and the competitor is not superior to the target product [1].

Furthermore, author Frederick is worried about the bounds of the decoy effect; thus, he suggests that it may only apply to stylized product representations where all product dimensions can be expressed numerically [8]. Whereas perceptual representations of attributes do not support a decoy effect (e.g., the taste of food or the comfort level of furniture) [8]. Nevertheless, most researches that have been done in the past continue to show that the decoy effect is an efficient marketing tactic in the field of behavioral economics that can steer customers in the direction of a company's intended decision and, as a result, increase revenues [3] [12].

4. Decoy Effect in Practice

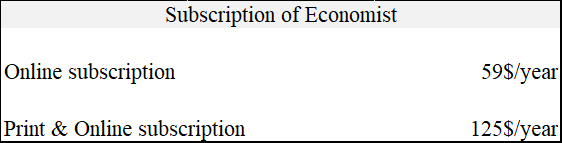

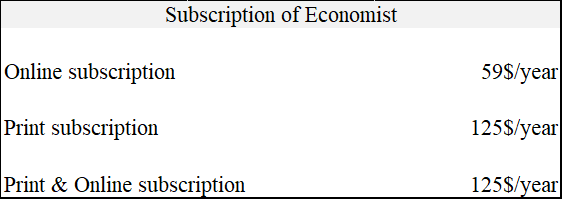

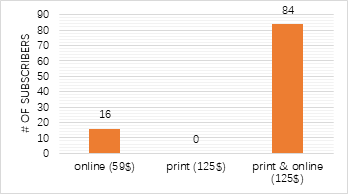

For better understanding, this article will present one case study, a well-known example from the book "Predictably Irrational: The Forces That Shape Our Decisions." The authors' study sought to determine how consumers made their subscription decisions across the three options regarding print, online, and print & online of The Economist magazine [1] [13]. This experiment includes a control group and an experimental group, as shown in Figures 2 and 3 below, respectively; Figures 2 and 3 show different subscription combinations for The Economist magazine; Figure 2 includes two standard subscription options, and Figure 3 includes two standard subscription options and a decoy option [1]. In Figure 3, competitor is "online subscription"; decoy is "print subscription"; and target is "print & online subscription". The study investigated how the decoy effect could be employed altered consumer decision-making when a third option, "print subscription" (decoy for a seemingly irrelevant option because just as expensive ($125) as the "print & online subscription), was introduced, as shown in Figure 3 [1].

Figure 2: Subscription Combo 1.

Figure 3: Subscription Combo 2.

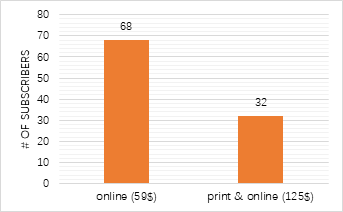

Figure 4: Corresponding to figure 2.

Figure 5: Corresponding to figure 3.

The researchers recorded the differences in consumer preferences regarding options presented in the two figures. The two bar graphs above show the number of participants selected for each option. Figure 4 shows that before the decoy (print subscription), most people opted for the cheaper online subscription. Compared to Figure 4, Figure 5 shows that the more expensive option (print & online subscription) becomes more attractive for consumers after introducing the decoy option (print subscription). The decoy changed the selection preferences of 52 participants. In this experiment, participants may not have known whether the $59 online version was superior to the $125 paper version. However, everyone should be aware that a package that includes both the paper and online versions and costs $125 is superior to a single subscription to the print version that costs the same amount. This choice set contains a decoy in the form of the "print subscription" option. This choice is considered to be asymmetrically dominated by the "print & online subscription" option because the "print subscription" option costs the same amount of money ($125); however, it does not provide access to the online. The introduction of this distraction gave the impression that the "print & online subscription" was more appealing than it was. Figure 5 shows that a much higher percentage of participants in Figure 5 was persuaded to buy this option after seeing the decoy option compared to Figure 4 [1][12].

In other words, from the three options in Figure 3, neither the target nor the rival alternatives give customers any discernible advantage. In spite of the fact that the target and decoy choices are identical in terms of cost, the target choice's content is more varied than the decoy choice's, making it a more obvious choice for consumers to make. With this, businesses may increase their earnings by selling a package of both digital and physical copies.

This case provides a clear example of the decoy effect in practice, as consumers who initially preferred the online subscription were influenced to alter their preferences towards the target option that businesses want the consumer to choose, which can be seen from the comparison of consumer choices in Figures 4 and 5. Moreover, it is evident that the company tried and succeeded in using the decoy effect to increase its business revenue [2]. In addition, more support for the influence of the decoy effect on firm earnings is provided by the findings of another piece of market study. This study verified and quantified the effect size of the decoy effect in various market segments for the first time. It also demonstrated the decoy effect's substantial impact on profits through an analysis of diamond pricing and sales data from an online jewelry retailer in the United States [9]. Other research has found that if a decoy is present alongside consumer search, the decoy will act as a "loss leader," assisting the supplier in achieving higher expected profits from the dominant (targeted option).

5. Conclusion

The "decoy effect" is a manifestation of behavioral economics. Behavioral economics is strongly related to psychology, and the presence of a "decoy" influences the initial frame of reference of the consumer, which leads to a more attractive target option. The "decoy effect" usually leads consumers to be compelled by the bait to engage in irrational consumer behavior.

In general, empirical and literature evidence indicates that the introduction of a decoy product option affected consumers' choices. The findings from this study can provide relevant insights into consumer behavior and rationality regarding its effectiveness in steering consumer decision-making and its applications in business and marketing. The possibility that marketers can alter consumer preferences opens up opportunities for business owners to leverage the decoy effect to maximize profits, for instance, by offering decoy product options that make the firm's target products appear more attractive than competitors. The study contributes to an understanding of the impact of the decoy effect on consumers' choices across different choice sets and discusses how companies apply this concept to maximize revenue. The limitation of this paper is that it is based solely on existing studies and not confirmed by further experiments; the selected cases are relatively simple, and therefore, no excessive consideration of the limitations of the decoy effect is required. Although the decoy effect has been widely documented in many pieces of literature, it remains to be tested whether it is equally effective across different scenarios, different products, and even more than two attribute dimensions, given the limitations mentioned in the article.

Acknowledgment

To begin, I would like to extend my gratitude to everyone who has assisted me while conducting research and producing this report.

This dissertation would not have been possible without the help and encouragement I received from many people. First and foremost, I want to express my deepest gratitude and admiration to Miss Hu, whose advice and support have helped me immensely throughout my study. I also want to thank all the people who helped me, cared about me, and wished me the best.

Finally, I want to express my deep appreciation to everyone who has taken the time to read this thesis and offer helpful suggestions for my future research.

References

[1]. Huber, J, J W Payne, C Puto. 1982. Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis. Journal of consumer research 9(1) 90–98.

[2]. Jeong, Y., Oh, S., Kang, Y., & Kim, S. (2021). Impacts of Visualizations on Decoy Effects. International Journal of Environmental Research and Public Health, 18(23).

[3]. Bateman, I. J., Munro, A., & Poe, G. L. (2008). Decoy effects in choice experiments and contingent valuation: Asymmetric dominance. Land Economics, 84(1), 115-127.

[4]. Grasset, G. (2015). Decoy Pricing Definition. https://www.lokad.com/decoy-pricing-definition#Compromise_Effect_0.

[5]. Parrish, A. E., Evans, T. A., & Beran, M. J. (2015). Rhesus macaques (Macaca mulatta) exhibit the decoy effect in a perceptual discrimination task. Attention, Perception, & Psychophysics, 77(5), 1715–1725.

[6]. Alibabu, & Omprasad Reddy. (2018). PRICING STRATEGIES IN BUSINESS. International Journal of Logistics & Supply Chain Management Perspectives, 7(01), 3302-3306.

[7]. Khan, Uzma, Meng Zhu, Ajay Kalra. 2011. When Trade-Offs Matter: The Effect of Choice Construal on Context Effects. Journal of Marketing Research 48(1) 62–71.

[8]. Frederick, Shane, Leonard Lee, Ernest Baskin. 2014. The limits of attraction. Journal of Marketing Research 51(4) 487–507.

[9]. Park, J., & Kim, J. (2005). The Effects of Decoys on Preference Shifts: The Role of Attractiveness and Providing Justification. Journal Of Consumer Psychology, 15(2), 94-107.

[10]. Hu, J., & Yu, R. (2014). The neural correlates of the decoy effect in decisions. Frontiers In Behavioral Neuroscience, 8.271.10.3389/fnbeh.2014.00271.

[11]. Yang, Sybil, Michael Lynn. 2014. More evidence challenging the robustness and usefulness of the attraction effect. Journal of Marketing Research 51(4) 508–513.

[12]. Wu, Chunhua & Cosguner, Koray. (2020). Profiting from the Decoy Effect: A Case Study of an Online Diamond Retailer. Marketing Science. 39. 974-995.

[13]. Ariely, D. Predictably Irrational, Revised and Expanded Edition: The Hidden Forces That Shape Our Decisions, 1st ed.; Harper Perennial: London, UK, 2010.

Cite this article

Sun,H. (2023). Behavioral Economics: The Decoy Effect. Advances in Economics, Management and Political Sciences,13,46-51.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Huber, J, J W Payne, C Puto. 1982. Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis. Journal of consumer research 9(1) 90–98.

[2]. Jeong, Y., Oh, S., Kang, Y., & Kim, S. (2021). Impacts of Visualizations on Decoy Effects. International Journal of Environmental Research and Public Health, 18(23).

[3]. Bateman, I. J., Munro, A., & Poe, G. L. (2008). Decoy effects in choice experiments and contingent valuation: Asymmetric dominance. Land Economics, 84(1), 115-127.

[4]. Grasset, G. (2015). Decoy Pricing Definition. https://www.lokad.com/decoy-pricing-definition#Compromise_Effect_0.

[5]. Parrish, A. E., Evans, T. A., & Beran, M. J. (2015). Rhesus macaques (Macaca mulatta) exhibit the decoy effect in a perceptual discrimination task. Attention, Perception, & Psychophysics, 77(5), 1715–1725.

[6]. Alibabu, & Omprasad Reddy. (2018). PRICING STRATEGIES IN BUSINESS. International Journal of Logistics & Supply Chain Management Perspectives, 7(01), 3302-3306.

[7]. Khan, Uzma, Meng Zhu, Ajay Kalra. 2011. When Trade-Offs Matter: The Effect of Choice Construal on Context Effects. Journal of Marketing Research 48(1) 62–71.

[8]. Frederick, Shane, Leonard Lee, Ernest Baskin. 2014. The limits of attraction. Journal of Marketing Research 51(4) 487–507.

[9]. Park, J., & Kim, J. (2005). The Effects of Decoys on Preference Shifts: The Role of Attractiveness and Providing Justification. Journal Of Consumer Psychology, 15(2), 94-107.

[10]. Hu, J., & Yu, R. (2014). The neural correlates of the decoy effect in decisions. Frontiers In Behavioral Neuroscience, 8.271.10.3389/fnbeh.2014.00271.

[11]. Yang, Sybil, Michael Lynn. 2014. More evidence challenging the robustness and usefulness of the attraction effect. Journal of Marketing Research 51(4) 508–513.

[12]. Wu, Chunhua & Cosguner, Koray. (2020). Profiting from the Decoy Effect: A Case Study of an Online Diamond Retailer. Marketing Science. 39. 974-995.

[13]. Ariely, D. Predictably Irrational, Revised and Expanded Edition: The Hidden Forces That Shape Our Decisions, 1st ed.; Harper Perennial: London, UK, 2010.