1. Introduction

Now the impact of the new crown epidemic in the world has caused many entities to be in trouble. In China, whenever a city finds that someone is infected with COVID-19, it will implement closed management. Although this has played a great role in stopping the spread of the new crown epidemic, the negative impact on physical businesses is very large. Investing in stocks in this environment requires investors to have a lot of professional knowledge and strong psychological qualities, and can keenly find business opportunities in the unstable stock market, so that they can obtain benefits in the stock market. When investors suffer losses because they choose the wrong stocks or make wrong judgments, investors must be calm and choose the most correct way to minimize their losses, which is the quality that every investor should have.This article will focus on the differences between the long strategy and the combination of long and short, and will combine the combination of investors using the long strategy and the combination of long and short in different industries, and finally compare the results for analysis.

2. Literature Review

Chinese stock market has been taken as the research object and empirical analysis as the main method, this paper analyzes the price fluctuation characteristics of the Chinese stock market by constructing the long-short group indicators that can reflect the long-short behavior of the Chinese stock market group, and the group behavior of the market long and short market and their impact on the market yield fluctuation [1]. This strategy is used for both long and short positions, financial derivatives or statistical models to hedge the systemic risk (beta coefficient) of the portfolio due to market fluctuations, with the goal of pursuing absolute returns (alpha coefficient) independent of the market trend. A market neutral strategy fund is a fund that uses a market neutral strategy in its portfolio [2]. The CSI 800 constituent stock data from January 15, 2007 to June 29, 2012 was used to test the effect of the average yield method, compares with the traditional method of dividing stocks by equal amount, and detects the momentum and reversal effect of China's stock market with different research objects, so as to construct the investment model, through the modification of the model, the use of long-short 150/50 strategies, and achieved better return results [3]. The purpose of this article is to discuss the arbitrage behavior of H-share index derivatives in a complete way, consider the characteristics of H-share prices that are highly correlated with the performance of A+H-shares in the Shanghai and Shenzhen markets, further incorporate the long-short factors in the spot market of the Mainland, and use the multiple regression model to explore the correlation between the difference in information flow rate, the market long-short factor and the arbitrage profit [4]. In order to maximize subjective value, high-risk stocks were bought by investors when "chasing up" and sell low-risk stocks when "killing down", resulting in asymmetric risk returns. Further, six types of price reference points were selected, and empirical research was conducted from the perspective of short, medium and long cycles [5]. Markowitz's assumption in CAPM was adjusted that shorting will gain resources to invest in other securities [6]. Stock Running Trend Analysis and Operational Techniques Book. It is mainly through the analysis and judgment of the long-short conversion points in the stock operation to determine its operating trend, so as to summarize a set of practical stock operation techniques [7]. An active Treasury bond portfolio management strategy is proposed, and the long-short hedging portfolio and unilateral long-term combination constructed by obtaining the predicted value of the theoretical price of the Treasury bond can obtain significant returns [8]. By focusing on the prediction of the stock's earnings for the next month, it is possible to build a combination of bulls and bears to obtain returns [9]. In practical operations, investors pay more attention to changes in credit spreads was made by the combination of long and short credit bonds and interest rate bonds [10]. The performance of the machine learning nonlinear pricing model is better than that of the traditional linear pricing model in terms of out-of-sample prediction accuracy and grouped long-short strategies [11].

3. Strategy

This paper investigates long short and long only to analyse different trades.

Long operation refers to the fact that investors judge the market as an upward trend, buy financial products and hold them, wait for the rise and sell, and earn the middle spread.

Shorting is the opposite of long, if investors expect the market to fall, they will sell the chips in their hands and buy after the price falls; Simply put, it is to sell first and buy later.

3.1. Long Only Strategy

There are several advantages of long only strategy. First, Commodities have a cost price, and the risk of falling near the cost price is limited and the benefits are unlimited. Second, as long as there is more money, investors can maintain the position. Third, less margin is required to go long. But it also has some drawbacks disadvantages, such as too single, more risky.

3.2. Long Short Strategy

The long-short stock strategy is to go long in the market that believes that there is room for price increase (bullish, buy first and then sell), and at the same time, the market that believes that the price will fall is short (bearish, sell first and then buy), through both long and short, offset some of the uncertainty of the long and short market, reduce market risk.

This type of strategy is often used in the stock market, and sometimes in other different markets such as interest rates and commodities.

3.2.1. Advantages of Long Short Strategy

There are several advantages of long short strategy. First, excess pay can be created by shorting stocks, which means that there are more options that are likely to create alpha. Second, short-selling is not limited to selecting stocks that have fallen less, but can be shorted for stocks that have fallen more to achieve better performance. Third, let the pay curve create more possibilities, with the possibility of higher Sharpe rates.

3.2.2. Disadvantages of Long Short

The rate of return is only above the level of the risk rate of return. But it also has some drawbacks disadvantages. First, it is usually necessary to use functions such as leverage and margin trading, and it is necessary to pay more interest and handling fees, which is more costly. Second, national regulations and practices usually have restrictions on shorting, and many bearish targets are actually difficult to perform shorting operations, and the operation is very limited. Moreover, the operation is more difficult, testing the ability to select stocks. Third, there may be misjudgments about excess pay, for example, the original idea is that there is a high alpha excess pay (thinking that there is more or less fall), but in fact it is only beta larger (it turns out that it is a big rise and a big fall). What's more, generally, only some hedge funds offer this type of strategy, and investors have little opportunity to use this type of strategy unless they operate on their own.

4. Data

4.1. The First Portfolio Is Formed by Li Ning COMPANY LIMITED (Li Ning) and ANTA, Which Is in Sports Industry

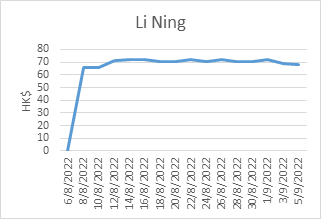

Figure 1: Stock price of Li Ning.

Source: Sina finance [12]

Li Ning: Founded in 1990, after 20 years of development, it has become an international leading sports brand company representing China and has unique oriental attributes.

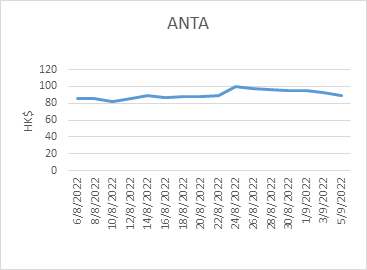

ANTA: The second firm is ANTA. ANTA is a professional sporting goods brand positioned by the public, and ANTA focuses on providing the most cost-effective professional sporting goods for the broadest number of ordinary consumers.

Figure 2: Stock price of ANTA.

Source: Sina finance [12]

4.2. The Second Portfolio Is Formed by KWEICHOW MOUTAI CO. (Moutai Company) and GUJING, Which Is in Liquor Industry

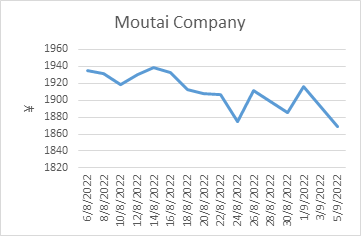

Moutai Company:The third firm is KWEICHOW MOUTAI CO. Moutai Group with Guizhou Moutai Liquor Co., Ltd. as the core enterprise, the number of employees more than 40,000 people , with 38 wholly-owned, holding and shareholding companies, involved in industries including liquor, health wine, wine, securities, insurance, banking, cultural tourism, education, real estate, ecological agriculture and liquor upstream and downstream industries, etc., the total assets of the enterprise exceeded 230.4 billion yuan, and it has been selected as one of brand top 500 global brand value enterprises of BrandZ for many times.

Figure 3: Stock price of Moutai Company.

Source: Sina finance [12]

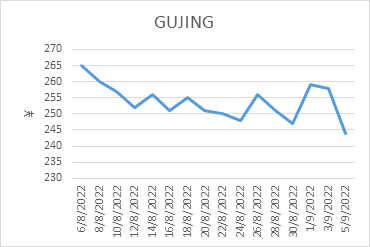

GUJING GROUP: The fourth company is GUJING Group. GUJING Group is One of the eight famous liquor companies in China and the first liquor listed company in China to issue two shares at the same time, A and B.

Figure 4: Stock price of GUJING.

Source: Sina finance [12]

4.3. The Third Portfolio Is Formed by Tencent and Power Assets Holdings Limited, Which Is in Technology Industry

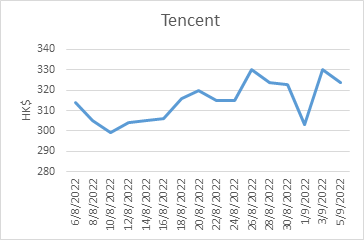

Tencent:The fifth company is Tencent. Tencent is one of the world's leading Internet technology companies that enhances the quality of life of people around the world with innovative products and services.

Figure 5: Stock price of Tencent.

Source: Sina finance [12]

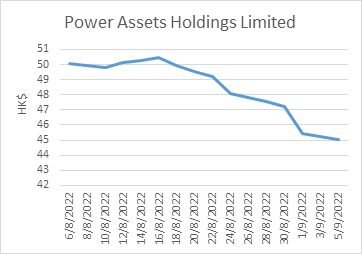

Power Assets Holdings Limited:The sixth company is Power Assets Holdings Limited. Power Assets Holdings Limited is an international energy investment company with investments in power generation and transmission and distribution, renewable energy, waste-to-energy and gas distribution businesses.

Figure 6: Stock price of Power Assets Holdings Limited.

Source: Sina finance [12]

5. Results

5.1. Li Ning and Anta

In this sections, investors will compare the performance of two different strategies.

The first analysis is based on sport industry, for only long Li Ning.

Because Li Ning has made significant progress in research and development, the invented technology is very suitable for basketball and running, such as Beng techlonogy, and the focus of Li Ning's development also happens to be these two aspects, which makes me full of confidence in its stock. This deal gave me a 5.27% return.

Then in order to reduce the underlying risk, the long short strategy is considered. Long Li Ning and short ANTA is a good choice. Because ANTA focused its efforts on the publicity side, didn't launch a new product for several years, and consumers weren't happy with the company's products. A company that specializes in sports brands does not focus on research and development, which is in stark contrast to Li Ning, which is unacceptable to our consumers. The portfolio return is 10.45%.

The benefits brought by portfolio investment are more than only going long Li Ning.

Table 1: Long Li Ning and short ANTA.

Panel A: Long only | |||||

Firms | Positions | Quantity | Price Paid | Percentage Return | Total Return |

Li Ning | Long | 10 | 66.4HK$ | 5.27% | 5.27% |

Panel B: Long Short Strategy | |||||

Anta | Short | 10 | 112HK$ | 13.5% | 10.45% |

Li Ning | Long | 10 | 66.4HK$ | 5.27% | |

5.2. Moutai Company and GUJING

In this sections, investor will compare the performance of two different strategies.

The first analysis is based on consumer industry, for only long Moutai Company.

The long Moutai Company is because it is the leading stock in Chinese stocks and has great stability. The buying philosophy is to buy low-risk stocks, which are now very flat on the price. Going long this stock doesn't seem to give me much of a profit. This deal gave me a -1.48% return.

Then in order to reduce the underlying risk, the long short strategy is considered. Long Moutai Company and short GUJING is a good choice. In recent years, the liquor industry has been fiercely competitive, and GUJING has not had the same popularity as Maotai, resulting in people's consumption of it declining. The portfolio return is -0.32%.

The benefits brought by portfolio investment are more than only going long Maotai.

Table 2: Long Maotai and short GUJIJNG.

Panel A: Long only | |||||

Firms | Positions | Quantity | Price Paid | Percentage Return | Total Return |

Maotai | Long | 10 | 1898¥ | -1.48% | -1.48% |

Panel B: Long Short Strategy | |||||

GUJING | Short | 10 | 265¥ | 7.92% | -0.32% |

Maotai | Long | 10 | 1898¥ | -1.48% | |

5.3. Tencent and Power Assets Holdings Limited

In this sections, investor will compare the performance of two different strategies.

The first analysis is based on technology industry, for only long Tencent.

The long Tencent is because it's the best of the Chinese game companies, and people are bullish on it. But recently, the value of Tencent's stock has declined slightly. This deal gave me a -2.5% return.

Then in order to reduce the underlying risk, the long short strategy is considered. Long Tencent and short Power Assets Holdings Limited is a good choice. Because the demand for electricity is not as great as it used to be, but the international environment is that the demand for electricity has also increased due to the sharp rise in oil prices, which has led to an increase in the value of its company's stock. The portfolio return is -2.38%.

The benefits brought by portfolio investment are more than only going long Tencent.

Table 3: Long Tencent and short Power Assets Holdings Limited.

Panel A: Long only | |||||

Firms | Positions | Quantity | Price Paid | Percentage Return | Total Return |

Tencent | Long | 10 | 320HK$ | -2.5% | -2.5% |

Panel B: Long Short Strategy | |||||

Power Assets Holdings Limited | Short | 10 | 49.8HK$ | -1.6% | 2.38% |

Li Ning | Long | 10 | 320HK$ | -2.5% | |

Both the first group of trades and the second group of trades were added to the original long trades with a set of short strategies, which made the original gains go up a lot. The short strategy in the third group of trades reminds people that not all combination strategies can increase profits.

The first set of trades is a comparison between only going long Li Ning and going long Li Ning and shorting ANTA. Only going long Li Ning brought in a profit of 5.27%, but by shorting ANTA at the same time, the profit margin rose from 5.27% to 10.45%. The rate of increase in profit margins is very fast, which shows that the choice of stocks this time is correct.

The second set of trades is a comparison between only going long Moutai and going long Moutai and shorting GUJING. Only going long Moutai brought a profit margin of -1.48%, causing some damage to investors, but by shorting the ancient well at the same time, the damage was reduced from 1.48% to 0.32%, alleviating the financial pressure of investors.

The third set of transactions is to make a comparison between only going long Tencent and going long Tencent and shorting power industries. Only going long Tencent caused investors 2.5% damage, and in order to alleviate this damage, investors also shorted the power industry at the same time. However, because the stock selection did not see the current international situation and policy changes, the damage to the stocks further increased. This combination amply illustrates that a long-short combination is likely to cause greater damage to investors.

6. Result

Long only is to buy first and then sell, investors judge the market as an upward trend, buy the target and hold, and then sell after rising. This strategy is most commonly used by investors, if investors buy at the low point of the price, sell at the high point to make a profit. But if the prediction is wrong, it will produce losses and cannot be profitable.

The long-short equity strategy is very similar to the market-neutral strategy, and participates in the long-short market at the same time, usually a 130 (long)/30 (short) strategy. It mitigates the risks of a bear market decline in a timely manner, and a stable reward is possible if the forecast is correct. But it also has to bear the corresponding risks, and the systemic risk to be borne is higher (beta) compared to the market-neutral strategy.

7. Conclusion

Long only and long short strategy are two different investment models. In the stock market, investors will encounter certain risks when investing, how to choose investment methods, how to avoid greater risks, these are for investors to choose.

In Sina Finance, Investors obtained stock information on Li Ning, ANTA, Maotai, GUJING, Tencent and Power Assets Holdings Limited. Investors divided these stocks into three groups, and implemented a long-only strategy and a long-short combination strategy for them, and the final result made investors know that the long-short combination can alleviate some of the damage caused by only long, but at the same time, it may bring more pressure to investors. In Sina Finance, investors selected 6 stocks, namely Li Ning, ANTA, Maotai, GUJING, Tencent and Power Assets Holdings Limited. Investors divided them into three groups, each of which invested in a combination of long and long and short, and then compared the results of the investment, and finally came to a series of conclusions. To sum up, a combination of long and short can compensate for the singularity of a strategy that is only long. When investors make mistakes in choosing stocks when using the only long strategy, this will bring great investment pressure and economic losses to investors. But investors choose to short another stock while going long, so that if there is a problem with the stock that is long, the investor also has a short stock to reduce losses. But this requires investors to have some experience, so as to bring greater returns.

References

[1]. Yang M. An empirical study on price fluctuations in China's stock market[D]. Southwest Jiaotong University.Author, F., Author, S.: Title of a proceedings paper. In: Editor, F., Editor, S. (eds.) CONFERENCE 2016, LNCS, vol. 9999, pp. 1–13. Springer, Heidelberg (2016).

[2]. Marlene. Crossing bulls and bears: The full demystification of market neutral strategies[C]// 2018 Trust Industry Research Report. 2020.

[3]. Zeng J. Based on the study of the momentum of China's stock market and the combination of inverted long and short in China's stock market based on the CSI 800 Index[C]// 2016 International Conference on Modern Management, Educational Technology and Social Sciences. 0.

[4]. Lü J. Information flow rate difference, market long-short factors and arbitrage profit[J]. National Circulation Economy, 2015(8).

[5]. Chiao-Yi C, Hong-Ru Lin. Research on the risk value of stock price index return in long-short market[J]. Business Management Science and Technology Quarterly, 2010, 11(1):77-107.

[6]. WANG L. Criteria for judging long and short securities under the condition of short margin[D]. Fudan University.

[7]. Luo S. Exploration of long buying point in stock market[M]. Haitian Press, 2012.

[8]. Yan H, Zhang Zili. Interest Rate Maturity Structure Forecast, Treasury Bond Pricing and Treasury Bond Portfolio Management[J]. Statistical Research, 2018, 35(3):15.

[9]. Zhou G, Wu Wenfeng. The Chinese Investor Focus Effect: Investor Perception or Transaction Barriers? [J]. Shanghai Finance, 2016(7):9.

[10]. ZHU M. Research on the influencing factors of corporate bond credit spread in China's interbank bond market[D]. Southwestern University of Finance and Economics, 2013.

[11]. Pan S. Big Data, Machine Learning and Asset Pricing[J]. Modern Management Science, 2019(2):4.

[12]. Sina finance

Cite this article

Lu,Y. (2023). Comparison of Long-term Strategies Versus Long-short Combination Strategies in Different Industries. Advances in Economics, Management and Political Sciences,14,241-249.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Yang M. An empirical study on price fluctuations in China's stock market[D]. Southwest Jiaotong University.Author, F., Author, S.: Title of a proceedings paper. In: Editor, F., Editor, S. (eds.) CONFERENCE 2016, LNCS, vol. 9999, pp. 1–13. Springer, Heidelberg (2016).

[2]. Marlene. Crossing bulls and bears: The full demystification of market neutral strategies[C]// 2018 Trust Industry Research Report. 2020.

[3]. Zeng J. Based on the study of the momentum of China's stock market and the combination of inverted long and short in China's stock market based on the CSI 800 Index[C]// 2016 International Conference on Modern Management, Educational Technology and Social Sciences. 0.

[4]. Lü J. Information flow rate difference, market long-short factors and arbitrage profit[J]. National Circulation Economy, 2015(8).

[5]. Chiao-Yi C, Hong-Ru Lin. Research on the risk value of stock price index return in long-short market[J]. Business Management Science and Technology Quarterly, 2010, 11(1):77-107.

[6]. WANG L. Criteria for judging long and short securities under the condition of short margin[D]. Fudan University.

[7]. Luo S. Exploration of long buying point in stock market[M]. Haitian Press, 2012.

[8]. Yan H, Zhang Zili. Interest Rate Maturity Structure Forecast, Treasury Bond Pricing and Treasury Bond Portfolio Management[J]. Statistical Research, 2018, 35(3):15.

[9]. Zhou G, Wu Wenfeng. The Chinese Investor Focus Effect: Investor Perception or Transaction Barriers? [J]. Shanghai Finance, 2016(7):9.

[10]. ZHU M. Research on the influencing factors of corporate bond credit spread in China's interbank bond market[D]. Southwestern University of Finance and Economics, 2013.

[11]. Pan S. Big Data, Machine Learning and Asset Pricing[J]. Modern Management Science, 2019(2):4.

[12]. Sina finance