1. Introduction

The Chinese personal investable assets have increased to 241 trillion at the end of 2020 and the number of Chinese HNWIs with investable assets of more than RMB 10 million has reached 2.62 million [3]. The demand for private banking by HNWIs in China is steadily increasing. Private banks in China started in 2007, with a relatively late development time and a huge number of potential customers [4]. Considering this, developing the private bank division is the most noteworthy part for most of the commercial banks in China.

China merchants bank has occupied first place in AUM of private banks divisions since 2013. Its initial AUM for the PB division was very close to ICBC, but after 2015, its AUM increased dramatically. In 2015, the annual growth rate of AUM in the PB division reached 66.37%. Chinese private banks started relatively late compared with Private banks in the USA or other European countries. So, the Chinese management modes basically were learned from these developed regions. In the previous research, people mainly focused on two types of private bank management models, the broker model in the USA and the traditional model in Europe [5]. The latter is well known for comprehensive services, often extending beyond narrowly defined financial products. However, there isn’t much research on Asia private bank management modes, especially in China, In this research, all models are divided into two new types: The centralized model and the Decentralized model. Different from ICBC and other banks in mainland China, China merchants bank is one of the very few banks that use the centralized management model. The ICBC and China merchant banks are very important commercial banks in China, and they have very similar initial customers and development backgrounds. By comparing the two, it is most likely that China Merchants Bank stands out because of its centralized management system.

Due to the relatively short development time of Chinese private banks, most Chinese banks lack private banks' development experiences and at present, there is not much research on the private bank management model system for China. But considering the rapidly increasing speed of Chinese HNWIs and the huge development potential of the Chinese private bank, optimizing the private banking management model will be very beneficial for the PB divisions' development and help the commercial banks expand HNWIs customers and get a lot of business.

By comparing the centralized with decentralized private bank management models (taking China Merchants Bank, ICBC, and the bank of China as examples), this essay will analyze the advantages of the centralized model for Chinese private banks and discuss the underlying reasons for these advantages. To further study the superiority of the centralized management mode relative to the decentralized management, and how to apply it for other private bank development, a centralized management model for the private bank will be built based on Osterwalder and Pigneur’s three divisions.

The purpose of the study is to demonstrate the superiority of the centralized management system for Chinese private banks. By analyzing the underlying reasons behind the centralized and decentralized management model for private bank division according to famous banks’ examples, accordingly, the research can help Chinese private banks to find more efficient development management methods.

2. Comparison on Private Banks’ Decentralized and Centralized Management Systems

2.1. Sample Selection

By comparing the centralized management system with the decentralized management system of the private bank, the advantages of the centralized one can be better explained. In this study, the research region mainly focuses on China, so this study uses real bank cases in China as the representatives of the centralized and decentralized private banks.

As the first bank in China to set up a private banking division, the Bank of China has an authoritative position in the Chinese private banking industry. And it is the fourth largest bank in the People's Republic of China and one of the central financial enterprises managed by the Ministry of Finance ICBC is also a State-owned large commercial bank, and it’s also one of the earliest banks to start a private bank division [6]. Considering this, the study selects the Bank of China and ICBC as the research representatives of the decentralized management system of the Private bank divisions. As the first pilot bank promoted by China, China Merchants bank is the first joint-stock commercial bank that is wholly owned by an enterprise legal person [7]. And its private bank division has taken first place in China for nearly 10 years [8]. Taking these into consideration, the study selects China Merchants banks as the research representatives of the decentralized management system of the Private bank divisions.

2.2. AUM Comparison

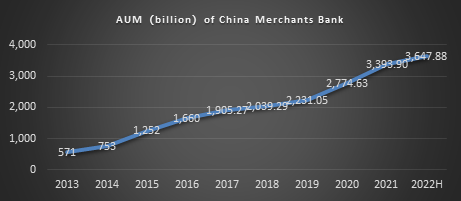

Figure 1: It illustrates the AUM (billion) of China Merchants Bank from 2013 to 2017.

China Merchants Bank has experienced rapid development since 2013. According to the line chart above, the AUM of China Merchants bank has increased by 6 times from 2013 to 2022H. By observing the slope of the line, there are two key points for China Merchants bank,2015 and 2020. Since 2015, the AUM of China Merchants bank has expanded dramatically, and till 2020, China Merchants Bank AUM expansion further accelerated. This rapid expansion didn’t start to decelerate until 2021.

China Merchants Bank has experienced rapid development since 2013. According to the line chart above, the AUM of China Merchants bank has increased by 6 times from 2013 to 2022H. By observing the slope of the line, there are two key points for China Merchants bank,2015 and 2020. Since 2015, the AUM of China Merchants bank has expanded dramatically, and till 2020, China Merchants Bank AUM expansion further accelerated. This rapid expansion didn’t start to decelerate until 2021.

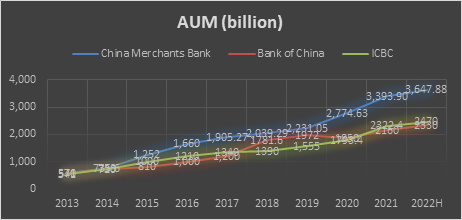

Figure 2: It illustrates the AUM (billion) of China Merchants Bank, Bank of China and ICBC, from 2013 to 2017.

This line chart illustrates the comparison among China Merchants Bank, Bank of China, and ICBC, regarding the AUM of their private bank from 2013 to 2022H. Before 2014, the AUMs of China Merchants banks, bank of China, and ICBC are very close, and their growth rates have no big differences. However, from 2015, the AUM of China Merchants bank gapped away from its competitors, and its growth rates were much larger than the other two. The gap between China Merchants Bank and the other two has always been widening. Till 2022H, the AUM of China Merchants Bank reached 3647.88 billion, but the AUMs of the Bank of China and ICBC are still less than 2500 billion. Their gap has increased from less than 400 billion to more than 1400 billion in 2022H.

2.3. Clients Comparison

2.3.1. Clients’ Number

.

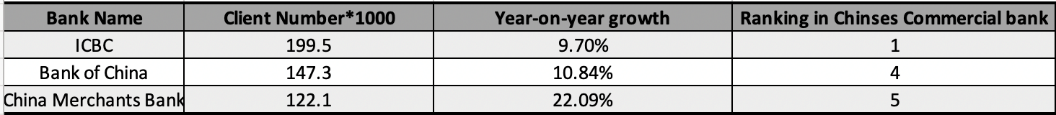

Figure 3: Illustrates the Clients' number (*1000), year-on-year growth, and ranking in the Chinese commercial bank of China Merchants Bank, Bank of China, and ICBC in 2021.

Compared with ICBC and the Bank of China, China Merchants bank doesn’t have obvious clients amount advantages over them. At the end of 2021, the clients' number of China Merchants bank only ranked 5, instead, ICBC and Bank of China ranked 1 and 4 respectively. However, China Merchants Bank has obvious advantages in growth rate. The year-on-year growth of China Merchants Banks was 12.39% higher than ICBC and 11.25% higher than Bank of China, which means clients' number of China merchants bank might increase more than the other two in long-term development.

2.3.2. Assets Per Household

.

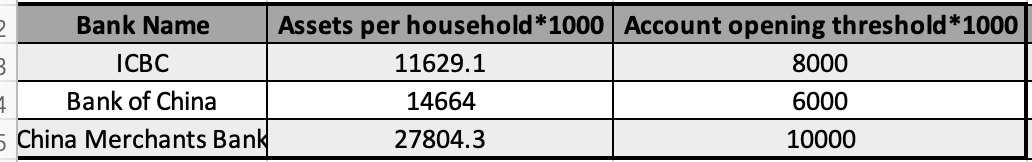

Figure 4: illustrates assets per household and account opening threshold (*1000) of ICBC, Bank of China, and China Merchants Bank.

The assets per household of China Merchants Bank were two times of ICBC and Bank of China at the end of 2021, which reached 27804.3 thousand RMB. The Chinese government's account opening requirement for private banks is 6 million RMB. The accounting opening threshold for ICBC and Bank of China is 8 million and 6 million respectively. China Merchants bank has the highest account opening threshold, which is 10 million RMB.

From the comparison above, it’s obvious that the AUM of China Merchants Bank private bank increases rapidly from 2015, and it keeps these advantages till 2022. Currently, the gap between China Merchants Bank and the other two is obvious, and its leading position is stable in the private bank field. The second fact is that, although China Merchants Bank’s private bank always takes the leading position, its clients' number only ranked 5 in 2021. However, its assets per household are much higher than the other two. The growth rate of AUM of China Merchants Bank private bank is significantly higher than that of the number of customers, indicating that the stickiness of customers has increased. At the same time, the AUM of high-net-worth customers grew faster. The number of customers of golden sunflower and above and the number of private banking customers increased by 13.8% and 17.5% compared with the beginning of the year, indicating that more existing customers have upgraded to high-net-worth customers [9].

3. Analysis of the Advantages of Centralized Management Systems Based on the 7E-CET@I Model

3.1. 7E-CET@I Model

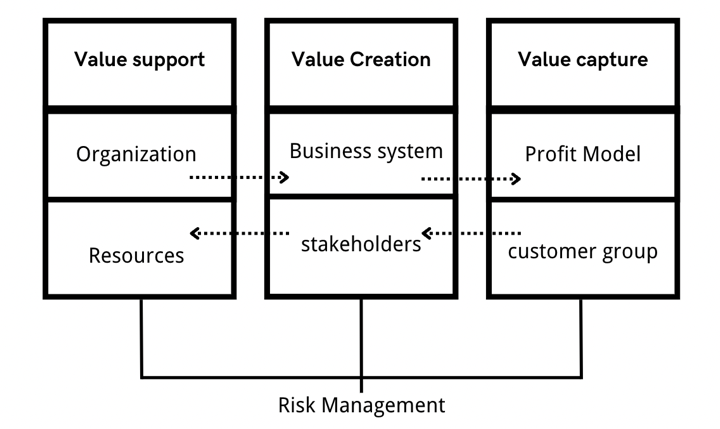

To better explain the causes, this study is based on the 7E-CET@I model proposed by Guo Sheng et al [10], according to the characteristics of commercial banks and combines it with Hagel and Singer’s three pillars of the business operations model, which was inspired by Collardi’s [11] and Hagel and Singer’s model [12], analyzes the operation of private banks from three dimensions, value support, value creation, and value capture. Based on this, this study concludes the China Merchants Bank’s centralized management system to analyze its advantages.

Figure 5: The basic outline of the 7E-CET@I model.

3.2. Application of 7E-CET@I model in China Merchants Bank

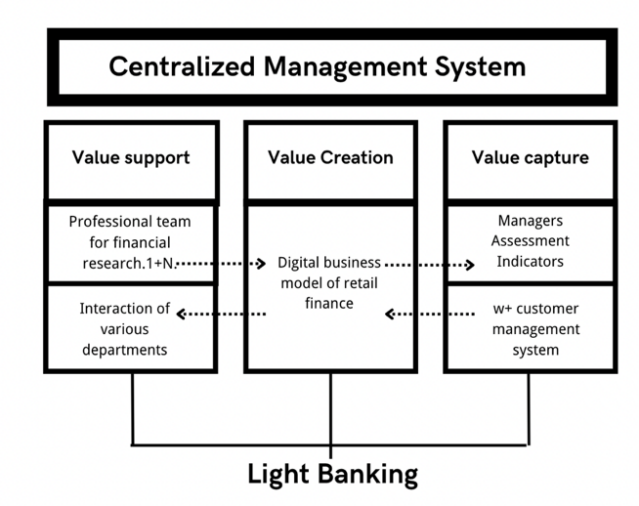

As early as 2015, China Merchants Bank proposed a light-banking development strategy [13]. The essence of light-duty banks is to achieve more efficient development and richer value returns with less capital consumption, more intensive operation methods, and more flexible adaptability [14]. Below the study will focus on intensive operation methods, to analyze the typical advantages of centralization.

Figure 6: The application of the 7E-CET@I model in Chinese Merchants Bank.

3.2.1. Value Support

The Private Bank of China Merchants Bank has a professional team of more than 200 people at its headquarters, responsible for investment market research, financial instrument research and performance tracking, investment opportunity discovery, product creation, and asset allocation research. It is said that the professional investment consultant team develops the ability to customize asset allocation. According to reports, China Merchants Bank took the lead in establishing an investment advisory team in 2008, carried out "consultant sales", and established a 1+N service model, that is, behind each customer manager, there are multiple investment, tax, and legal experts to provide support. Tailor-made asset allocation plans based on clients' assets, risk preferences, and investment objectives, which later became the industry standard. Every Client of China Merchants Private bank can be served by the top consulting team at headquarters, and their personal managers can communicate with them as soon as possible, and record the client's individual needs.

With the help of the top consulting team, to give customers a more intuitive understanding of the long-term asset allocation method system, China Merchants Bank Private Bank has compiled the "China Merchants Bank Private Banking Strategic Asset Allocation Index". The aggressive simulated investment portfolio in the index has achieved an annualized return of 8.96% since its establishment in 2012 to the middle of this year, while the return of the stock index over the same period is 7.24%, and the volatility and drawdown of the simulated investment portfolio are also significantly smaller than those of stocks index.

Product selection uses a three-level selection mechanism to discover good products for customers. China Merchants Bank Private Bank has passed strict access procedures. As of the end of September, it has observed more than 7,000 financial products in the market that have been included in the observation-level list and selected 352 products to be included in the investment-level list to focus on and try cooperation. In the end, there were only 200 Multiple products were able to enter the recommended list, which was presented to private banking clients. Behind the product list that customers see is the result of a professional team based on more than 10 years of experience in the bulls and bears, and comprehensive and due diligence of counterparty insights.

For internal management, the interaction of various departments. Through the open and integrated organizational structure, the internal department wall of China Merchants Bank is constantly broken. Although a user is only a service customer of the private banking department, its more non-personal financial needs are not. It can be solved by other departments. Such a diversified integration method allows users to run less and gain more value, which can undoubtedly help users to help China Merchants Bank through word-of-mouth marketing [15]. That’s another advantage of the centralized mode.

With the research team and 1+N mode, the client in every region in China can get the best service and the highest profits, which can increase their trust in China Merchants bank, that one of the reasons why China Merchants bank’s high-level customer stickiness. The centralization of various departments can help the China Merchants Bank provide comprehensive service to clients. The previous study has proposed that Chinese commercial banks should learn from the successful model of the United States to actively develop this business and provide personalized and comprehensive financial services to high-net-worth individuals. The active interaction of different departments can raise the clients’ satisfaction with the service. Profession and comprehensiveness are the key advantages of the centralized model in value support.

3.2.2. Value Creation

One of the most important push powers for centralization is the Fintech power. According to the 2022 semi-annual report of China Merchants Bank, which was clearly positioned as a "financial technology bank" in 2017, China Merchants Bank invested 5.36 billion RMB in information technology in the first half of 2022 year, a year-on-year increase of 6.03%, accounting for 3.26% of revenue [16]. China Merchants Bank takes "networking, digitization and intelligence" as its strategic evolution path, promotes the upgrade of the bank's 3.0 business model, accelerates the transformation of the "cloud + middle office" structure, and empowers internal and external partners [17]. The application systems of the head office, branches, and subsidiaries are fully cloud-based, greatly enhanced storage, and centralized processing of large amounts of data. Data centralization increased productivity in private banking and provided more data for investment strategies to further optimize investment portfolios

Take the Cloud Trust service as an example. The family trust, a business that was originally highly personalized and relied on offline services, has also achieved digital transformation. Family trusts are a common inheritance tool for high-net-worth individuals. In the past, relationship managers, investment advisors, and customers were required to repeatedly discuss contract terms, resulting in a lengthy process and prominent “capacity bottlenecks. The core purpose of setting up family trusts for high-net-worth individuals is to protect wealth inheritance [18]. In 2020, family trusts were mentioned by more than 30% of high-net-worth individuals, becoming the main inheritance tool used by high-net-worth individuals in China. There are more than 240,000 potential family trusts [19]. It is estimated that by 2021, the potential population can be transferred to family trust assets. will exceed 10 trillion yuan. Since last year, the Private Banking Department has carried out a digital transformation of family trusts, realized the online process of the whole life cycle, embedded professional knowledge into the system, set up 10 packages to assist decision-making, and shortened the project approval time from an average of 38 working days to the shortest 3 working days, greatly improving the customer experience, and largely increase the working efficiency.

3.2.3. Value Capture

The centralized management system for managers helps China Merchants Bank Private Bank provide better service and improve working efficiency. It has formed a unique "quantitative + qualitative" evaluation system, which combines quantitative and qualitative evaluation of managers from multiple dimensions such as investment performance, investment style, management experience, investment research team, and equity structure. To manage the Sunflower customers in the vertical business department, all the Sunflower customers served by the branch customer managers are transferred to the wealth management manager, further realizing centralized management of high-net-worth clients.

In the follow-up management of product managers, China Merchants Bank Private Bank has established a dynamic mechanism to track and control, to form sustainable competitiveness.

a) Carry out hierarchical management for existing institutions, survive the fittest, and focus on risk. prevention and control.

b) The products and managers can be checked back to form a quarterly operation report; c) Issue an annual operation report every year, conduct a comprehensive and in-depth analysis of the performance of each product, characteristics of shareholdings, sources of income, risk exposure, etc., and form a comprehensive medical report.

d) Combined with client portfolio view to dynamically optimize client positions.

Locking and recommending excellent managers is only the first step. China Merchants Bank provides customers with accompanying services covering the whole process, scene, and life cycle of pre-investment - mid-investment - post-investment [20] in different holding stages.

Based on the centralized management modes, China Merchants Banks can provide better service to clients. It includes more professional investment advice, higher working efficiency, and different holding stages services. That’s the reason why the AUM of China Merchants Bank private bank increases rapidly from 2015, keeping these advantages till 2022, and why its clients’ assets per household are two times higher than the other two banks.

4. Discussion and Suggestions

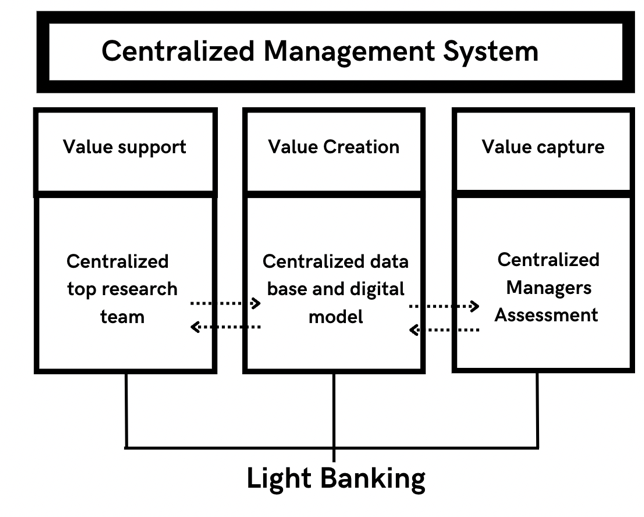

To apply the successful experiences of China Merchants’ bank to the other Chinese private banks, this study concludes the China Merchants Bank’s centralized model mentioned before into a comprehensive one.

Figure 7: Comprehensive centralized model for Chinese private bank.

To develop the advantages of Centralized management systems, the model considers three aspects, value support, value creation, and value capture. For value creation, the study found setting the top research team in the head can help every client get the best and the most professional investment advice, which can avoid the mistakes taken by individual managers. For value creation, the centralized database can increase productivity in private banking and provide more data for investment strategies to further optimize investment portfolios. For value capture, the centralized managers' assessment can eliminate the difference among branches, improve working quality and efficiency, and then the manager can serve the customers better.

Besides, the three can promote each other. The centralized database and digital model can help the research team to optimize its investment portfolio, at the same time, the research team’s experience can be used in the database. The manager's assessment process is based on the database and better management can absolutely increase value creation.

Certainly, centralized management also has some disadvantages. It has relatively high upfront investment costs and the advantages are not obvious in the short term. For staff management, there can be profit conflicts when reforming the branch structure, especially for some conventional private banks. But in the long run, the centralized management models can increase the banks’ profits and improve customer trust. ICBC has already set up Financial Technology Research Institute in 2019 and achieved Preliminary results in the construction of the Ecos[21] platform in 2022. This study suggests that further centralization reform can bring more development for Chinese private banks.

5. Conclusion

This essay compares the centralized mode chinses private banks with the decentralized ones, using China Merchants bank as the centralized representative, ICBC, and the bank of China as the decentralized representatives. It finds that the AUM and assets per household of the centralized have obvious advantages over the decentralized. From this comparison, this study finds that the centralized management model has systematic advantages over the decentralized one. It can help the AUM of private bank increase, improve the clients’ stickiness, and convert more basic clients into high-net-worth clients. By analyzing the advantages of the centralized management model in chinses private banks from three aspects, value support, value creation, and value capture based on the 7E-CET@I model, this essay concludes a comprehensive model for chinses private bank development. Based on this model, the study suggests that chinses private banks should build centralized top research teams, centralized databases, digital models, and centralized management assessments for further development.

References

[1]. China Merchants Bank and Bain Bank, China Private Wealth Report: China's Private Banking Industry has broad prospects for development, pp.3-4. (May 17, 2021).

[2]. Osterwalder, A., & Pigneur, Y. Business model generation: a handbook for visionaries, game changers, and challengers (Vol. 1). John Wiley & Sons. (2010).

[3]. China Merchants Bank and Bain Bank, China Private Wealth Report: China's Private Banking Industry has broad prospects for development, pp.6-10, (May 17, 2021).

[4]. China Banking Association PBC School of Finance, Tsinghua University Private Banking Research Group, China Private Banking Development Report (December 4, 2020).

[5]. Dufey, Gunter, Private Banking in Asia - A Survey. 22nd Australasian Finance and Banking Conference 2009, pp.3-4(August 28, 2009).Available at SSRN: https://ssrn.com/abstra ct=1463261 or http://dx.doi.org/10.2139/ssrn.1463261

[6]. Jiang Jianqing, The Internationalization Process of Large Banks—The Practice of Industrial and Commercial Bank of China [J]. China Finance, pp. 55-58 2010(19).

[7]. Ke, CHEN, Research on the Development Strategy of China Merchants Bank's Private Banking Business, pp.22-27. (May 6, 2013)

[8]. Li, W., Chen, G., & Liao, X.. Countermeasures of Chinese traditional commercial banks to meet the challenges of internet finance based on Big Data Ana lysis—evidence from ICBC. Journal of Physics: Conference Series, 1648(3),032066(2020). Available at: https://doi.org/10.1088/1742-6596/1648/3/032066

[9]. Data source from China Merchants Bank 2021 annual report. Available at: http://s3gw.cmbchina.com/lb50.01-cmbweb-prd/cmbir/20220424/1b1bc242-7481-42fb-a459-5d13d048e962.pdf

[10]. Guo Sheng, Huang Zhiguang, Zhang Jing, Yu Yi, & Ji Shangbo.. Banking Business Model: A Brief Case Study of Bank of Ningbo under Interest Rate Marketization. Science and Technology for Development, (4), pp. 440-453. (2016).

[11]. Collardi B. F. J. Private Banking: Building A Culture of Excellence[M]. Hoboken: John Wiley & Sons(2012)

[12]. Hagel, J., Hagel 3rd, J., & Singer, M. Net worth: Shaping markets when customers make the rules. Harvard Business Press. pp.286-290. (1999)

[13]. Song Li. The effect of China Merchants Bank's "light bank" is prominent. China Science and Technology Fortune, (10), pp.39-40. (2016)

[14]. Liu Tao, & Li Wanfeng. Research on the transformation strategy of light-duty banks under the background of financial technology: Taking China Merchants Bank as an example. Financial Theory and Teaching. (2021)

[15]. Liu Ting. Research on the Strategy of Developing Private Banking Business in my country (Master's thesis, Southwestern University of Finance and Economics). (2008).

[16]. Essence Securities. High growth of banking IT market from the latest annual report of the bank. Market-wide Technology Industry Strategy Report (104).

[17]. Brender, N., & Markov, I.. Risk perception and risk management in cloud computing: Results from a case study of Swiss companies. International journal of information management, 33(5), 726-733. (2013)

[18]. Ho, Lusina. Family trusts for Chinese clients. Trusts & Trustees, 20(1-2), 93-97. (2014).

[19]. China Merchants Bank ,2020 China Family Trust Report. (Dec.2020)

[20]. O'Flynn, P., & Barnett, C. Evaluation and impact investing: A review of methodologies to assess social impact. (2017).

[21]. Chen Tiegang. Creating a Leading Edge in the New Era with a New Architecture——ICBC ECOS Project Helps Transformation and Upgrading. The Banker. (2022).

[22]. Figure [1]: Data source from China Merchants Bank 2013-2022 annual report and interim report, private bank part.

[23]. Available at: http://english.cmbchina.com/cmbir/intro.aspx?type=report

[24]. Figure [2], Figure[3], Figure[4]: Data source from China Merchants Bank 2013-2022 annual report and interim report, private bank part, the Bank of China 2013-2022 annual report and interim report, private bank part and ICBC 2013-2022 annual report and interim report, private bank part. Respectively available at: http://english.cmbchina.com/cmbir/intro.aspx?type=report, https://www.boc.cn/investor/ir3/ and https://www.icbc.com.cn/ICBC/海外分行/工银伦敦网站/cn/关于我行/工银伦敦简介/年报/年报.htm

[25]. Figure [5]: 7E-CET@I model. Guo Sheng, Huang Zhiguang, Zhang Jing, Yu Yi, & Ji Shangbo. (2016). Banking Business Model: A Brief Case Study of Bank of Ningbo under Interest Rate Marketization. Science and Technology for Development, (4), pp. 440-453.

[26]. Figure [6]: the 7E-CET@I model used for the China Merchants Bank case.

[27]. Figure [7]: the comprehensive centralized model for Chinese private bank.

Cite this article

Li,Z. (2023). Research on the Private Banks’ Centralized Management Systems in China. Advances in Economics, Management and Political Sciences,14,309-318.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China Merchants Bank and Bain Bank, China Private Wealth Report: China's Private Banking Industry has broad prospects for development, pp.3-4. (May 17, 2021).

[2]. Osterwalder, A., & Pigneur, Y. Business model generation: a handbook for visionaries, game changers, and challengers (Vol. 1). John Wiley & Sons. (2010).

[3]. China Merchants Bank and Bain Bank, China Private Wealth Report: China's Private Banking Industry has broad prospects for development, pp.6-10, (May 17, 2021).

[4]. China Banking Association PBC School of Finance, Tsinghua University Private Banking Research Group, China Private Banking Development Report (December 4, 2020).

[5]. Dufey, Gunter, Private Banking in Asia - A Survey. 22nd Australasian Finance and Banking Conference 2009, pp.3-4(August 28, 2009).Available at SSRN: https://ssrn.com/abstra ct=1463261 or http://dx.doi.org/10.2139/ssrn.1463261

[6]. Jiang Jianqing, The Internationalization Process of Large Banks—The Practice of Industrial and Commercial Bank of China [J]. China Finance, pp. 55-58 2010(19).

[7]. Ke, CHEN, Research on the Development Strategy of China Merchants Bank's Private Banking Business, pp.22-27. (May 6, 2013)

[8]. Li, W., Chen, G., & Liao, X.. Countermeasures of Chinese traditional commercial banks to meet the challenges of internet finance based on Big Data Ana lysis—evidence from ICBC. Journal of Physics: Conference Series, 1648(3),032066(2020). Available at: https://doi.org/10.1088/1742-6596/1648/3/032066

[9]. Data source from China Merchants Bank 2021 annual report. Available at: http://s3gw.cmbchina.com/lb50.01-cmbweb-prd/cmbir/20220424/1b1bc242-7481-42fb-a459-5d13d048e962.pdf

[10]. Guo Sheng, Huang Zhiguang, Zhang Jing, Yu Yi, & Ji Shangbo.. Banking Business Model: A Brief Case Study of Bank of Ningbo under Interest Rate Marketization. Science and Technology for Development, (4), pp. 440-453. (2016).

[11]. Collardi B. F. J. Private Banking: Building A Culture of Excellence[M]. Hoboken: John Wiley & Sons(2012)

[12]. Hagel, J., Hagel 3rd, J., & Singer, M. Net worth: Shaping markets when customers make the rules. Harvard Business Press. pp.286-290. (1999)

[13]. Song Li. The effect of China Merchants Bank's "light bank" is prominent. China Science and Technology Fortune, (10), pp.39-40. (2016)

[14]. Liu Tao, & Li Wanfeng. Research on the transformation strategy of light-duty banks under the background of financial technology: Taking China Merchants Bank as an example. Financial Theory and Teaching. (2021)

[15]. Liu Ting. Research on the Strategy of Developing Private Banking Business in my country (Master's thesis, Southwestern University of Finance and Economics). (2008).

[16]. Essence Securities. High growth of banking IT market from the latest annual report of the bank. Market-wide Technology Industry Strategy Report (104).

[17]. Brender, N., & Markov, I.. Risk perception and risk management in cloud computing: Results from a case study of Swiss companies. International journal of information management, 33(5), 726-733. (2013)

[18]. Ho, Lusina. Family trusts for Chinese clients. Trusts & Trustees, 20(1-2), 93-97. (2014).

[19]. China Merchants Bank ,2020 China Family Trust Report. (Dec.2020)

[20]. O'Flynn, P., & Barnett, C. Evaluation and impact investing: A review of methodologies to assess social impact. (2017).

[21]. Chen Tiegang. Creating a Leading Edge in the New Era with a New Architecture——ICBC ECOS Project Helps Transformation and Upgrading. The Banker. (2022).

[22]. Figure [1]: Data source from China Merchants Bank 2013-2022 annual report and interim report, private bank part.

[23]. Available at: http://english.cmbchina.com/cmbir/intro.aspx?type=report

[24]. Figure [2], Figure[3], Figure[4]: Data source from China Merchants Bank 2013-2022 annual report and interim report, private bank part, the Bank of China 2013-2022 annual report and interim report, private bank part and ICBC 2013-2022 annual report and interim report, private bank part. Respectively available at: http://english.cmbchina.com/cmbir/intro.aspx?type=report, https://www.boc.cn/investor/ir3/ and https://www.icbc.com.cn/ICBC/海外分行/工银伦敦网站/cn/关于我行/工银伦敦简介/年报/年报.htm

[25]. Figure [5]: 7E-CET@I model. Guo Sheng, Huang Zhiguang, Zhang Jing, Yu Yi, & Ji Shangbo. (2016). Banking Business Model: A Brief Case Study of Bank of Ningbo under Interest Rate Marketization. Science and Technology for Development, (4), pp. 440-453.

[26]. Figure [6]: the 7E-CET@I model used for the China Merchants Bank case.

[27]. Figure [7]: the comprehensive centralized model for Chinese private bank.