1. Introduction

With natural disasters and global warming occurring more frequently around the world, more and more people are becoming aware of the importance of protecting the environment. The Intergovernmental Panel on Climate Change (IPCC) and more than 1,300 scientists from around the world predicted in 2016 that future temperatures would rise by 2.5 to 10 degrees Fahrenheit over the next century [1]. In 2004, the United Nations Environment Programme (UNEP) first introduced the concept of ESG investing, which focuses on the environmental, social, and governance aspects of business investment. In addition, other countries such as China, Germany, and the United States are experiencing an alarming increase in industrial volumes to meet the growing demand for consumer goods worldwide, accelerating the depletion of global oil reserves. Given the unsustainability of oil-dependent economic development, the rapid depletion of oil increases the call for renewable and diversified energy sources [1]. Then, the government begins to strongly encourage the emergence of environmentally friendly products such as bicycle sharing and new energy cars instead of gasoline cars.

In response to the government's initiative, ESG has gradually become an emerging investment idea and corporate action guide in financial circles in recent years. Compared to the original traditional investment philosophy, investors now consider not only the factors that generally influence investment decisions, such as the company's financial statements, market share, and growth prospects, but also the ESG aspects of the company, such as whether the company's products are environmentally friendly, whether the company contributes anything to society, and whether there is corruption in the company's management class. Another reason investors have started to focus on investments in ESG companies is that according to the report, during the Great Recession, the stock of companies with higher ESG ratings had higher returns, lower return volatilities, and higher trading volumes than that of companies with lower ESG rating [2]. Therefore, investors want to add the higher ESG investment option to diversify their portfolio risk and earn more return.

Driven by this trend, more and more companies in different industries are also focusing on their environmental, social, and corporate governance aspects development. As a result, the automotive industry's development is also receiving much attention. This article will analyze the differences in the ESG scoring system between new energy vehicle companies represented by Tesla Inc. and gasoline vehicle companies represented by Ford Inc. in the U.S. automotive industry and point out several possible directions for the future development of the (new energy) automobile manufacturing industry.

2. MSCI’s ESG Rating System

This article uses the ESG rating system from MSCI Company to evaluate the ESG rating from the new energy automobile industry and the fuel automobile industry in the United States. MSCI is a US-based indexing company headquartered in New York City. It is a global provider of ESG equity, fixed income, hedge fund, and equity market indices. MSCI indices are among the most used benchmark indices by portfolio managers worldwide.

Based on the ESG rating system from MSCI Inc., A company's ESG rating can be categorized into seven levels, from high to low, AAA, AA, A, BBB, BB, B, CCC. The AAA and B levels represent the company's leadership in managing ESG risks and opportunities compared to other companies in the industry. Secondly, the grades of A, BBB, BB represent the company's mediocre performance in managing ESG risks with its peers in the industry. Finally, ESG ratings of CCC and B mean that the company is lagging far behind its peers in managing this risk.

MSCI's ESG scoring system covers ten themes and 35 key risk questions. The Environmental aspects are mainly considered from the four themes of climate change, natural capital, pollution & waste, and environmental opportunity. The Social aspect focuses on human capital, product liability, stakeholder opposition, and social opportunity. Finally, corporate governance and behavior are the two main topics evaluated in the Governance pillar.

Table 1: MSCI ESG environment evaluation framework.

Environment Pillar | |||

Climate Change | Natural Capital | Pollution & Waste | Environment Opportunities |

Carbon emission | Water stress | Toxic emission & waste | Clean tech. |

Financing environmental impact | Biodiversity & Land use | Packaging material & waste | Green building |

Product carbon footprint | Raw material sourcing | Electronic waste | Renewable energy |

Climate change vulnerability | |||

Table 2: MSCI ESG social evaluation framework.

Social Pillar | |||

Human Capital | Product Liability | Stakeholder Opposition | Social Opportunities |

Labor management | Product safety & quality | Controversial sourcing | Access to communication |

Health & Safety | Chemical safety | Community relations | Access to finance |

Human capital development | Consumer financial protection | Access to health care | |

Supply chain labor standards | Privacy & Data security | Opportunities in nutrition and health | |

Responsible investment | |||

Insuring health & demographic risk | |||

Table 3: MSCI ESG governance evaluation framework.

Governance | |

Corporate Governance | Corporate Behaviour |

Board | Business ethics |

Pay | Tax transparency |

Ownership | |

Accounting | |

3. ESG Evaluation and Comparison of Tesla and Ford Company

3.1. Overview of Tesla Inc. & Ford Motor Company

Tesla Incorporation is an American multinational electric vehicle and clean energy company headquartered in Austin, Texas. The company's major product businesses focus on three segments: electric vehicles, solar panels, and energy storage devices. According to the MSCI ESG scoring system, Tesla company is evaluated as A among 42 companies in the automobile industry.

Ford Motor Company is a famous American automobile company headquartered in Dearborn, Michigan. Ford is one of the world's top 500 companies. The company's core business includes designing, manufacturing, and selling high-quality cars, SUVs, trucks, and electric models. Based on the data from MSCI ESG scoring system, Ford Motor Company is evaluated as B among 42 companies in the automobiles industry.

3.2. Evaluation of Environment Pillar

Tesla Inc. plays a leadership role in both Climate Change and Environment Opportunities. According to Tesla Inc.'s 2021 Impact report, Tesla achieved a cumulative 8.4 million tons of CO2-equivalent emissions reductions from using its cars and solar panels worldwide in 2021, equivalent to the carbon sink generated by more than 3,400 acres of forest in one year. Tesla is trying to reduce its carbon footprint by constantly improving its factories and products. In terms of factory improvements, for example, at the Gigafactory in Texas, Tesla chose to use highly efficient, insulated, low-radiation Windows to reduce the building's heating and cooling needs. On the other hand, Tesla has designed all its new factories to be covered in solar panels. By the end of 2021, the company had installed 21,405 kilowatts of solar panels [3]. On the product side, as an electric vehicle company, battery upgrades are certainly at the core of Tesla's research. Hence, the company manufacturer unveiled a new way to produce battery sheets using a dry electrode process at Tesla Battery Day 2020. According to the company's latest analysis, the new process allows a direct transition from cathode or anode powder to electrode film, reducing energy consumption by more than 70 percent throughout the battery manufacturing step [3].

In contrast to Tesla Inc., Ford Motor Company is lagging behind the rest of its industry in the environment pillar. According to Ford's ESG Data Book, Ford Motor Company has improved its global greenhouse gas emissions in this area, dropping from 2.96 million in 2020 to 2.59 million in 2021. However, the data from his ESG Data Book shows that CO2 emissions per passenger car are increasing in all countries. For example, in 2021, Ford's CO2 emissions per light commercial vehicle in the EU rise from 166g/km in 2020 to 202.16g/km. On the bright side, Ford has embarked on developing and researching new energy vehicles. In addition, they plan to increase their electrification investment to over $22 billion in 2025. In 2021, Ford sold almost 30,000 electric vehicles worldwide, and they are committed to selling all passenger cars in Europe as electric vehicles by 2030. Although Ford's 2022 Sustainability report states that they will achieve a 76% reduction in greenhouse gas emissions in Scope 1 and Scope 2 by 2035, as well as carbon neutrality by 2050, current data shows that Ford still ranks in the top three of all U.S. autos companies in terms of greenhouse gas emissions. It still has a long way to go in terms of sustainability.

3.3. Evaluation of Social Pillar

In the social pillar, Tesla is in the middle of its industry. On the bright side, according to Tesla's 2021 Impact report, Tesla Inc. will provide very comprehensive benefits for its employees. For example, they offer free medical, dental, and vision plan contributions for employees and their family members. In addition, their company has a rich ethnic diversity of employees and has directly created nearly 100,000 jobs in 10 years. For society, based on the news, Elon Musk, the CEO of Tesla Inc., donated nearly $ 6 million in Tesla shares to the charity in November 2021. On the other hand, Tesla has at least two issues with its labor management and product safety and quality. First, during COVID-19, Tesla President Elon Musk said employees could stay home if they feel uncomfortable. Two of its employees chose to stay home for two days for the safety of their families, after which they received termination reports from Tesla. The two employees claimed that Tesla did not establish any protective measures and disinfection in its factories, nor did it inform employees of the hazards of COVID-19, and did not consider the health and safety of its employees first [4]. Second, according to news reports, Tesla recalls nearly 500,000 Model S and Model 3 electric cars for safety issues. Its main problems come from the rearview camera and the trunk, which increase the crash risk. For example, NHTSA says, "The rearview camera harness in the Model 3 sedan can be damaged by the opening and closing of the trunk lid, which prevents the rearview camera image from being displayed [5]." So, if Tesla wants to achieve a high rating in this area of society, they have much room for improvement.

For employees, Ford also provides employees with basic health insurance, retirement insurance, accident insurance, vacation, and so on. Like Tesla, Ford has done a lot for society. First, they have branches in 43 countries and solve the job problems of nearly 183,000 people. Second, in Ford's 2022 sustainability report, they donated 1.3 billion to disaster relief efforts around the world and 120 million masks to at-risk communities in all 50 U.S. states in response to COVID-19. Engineers at Ford and Tesla assembled different versions of the ventilator using parts from their respective models to relieve the pressure on the hospital ventilator caused by COVID-19 [6]. Ford has also donated $74.4 million to communities worldwide to improve their quality of life or living environment. However, Ford Motor Co. still has some hidden product safety concerns. According to news reports, Ford recalled 39,000 vehicles in May 2022 after five more fires were reported due to 16 fire reports. Ford then announced another recall of 27,000 U.S. vehicles to address the risk of under-the-hood fires in the 2021 Ford Expedition and Lincoln Navigator SUV [7]. Additionally, in terms of labor management, in 2022, Ford laid off about 3,000 employees and contract workers, especially at Ford in the United States, Canada, and India [8]. Thus, while Ford has made many contributions to society, social issues cannot be ignored, leading him to be in the middle of the pack among the American car companies in his industry.

3.4. Evaluation of Governance Pillar

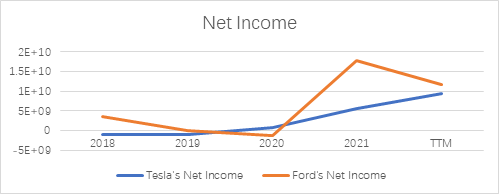

In the governance pillar, based on the evaluation of MSCI, Tesla Inc. becomes better in corporate behavior than corporate governance. The most significant issue from corporate governance is related to Tesla's board of directors. First, Tesla was also fined by investors for having too few independent directors on its board [9]. Shareholders believe that having too few independent directors makes them make investment decisions that are not necessarily made with the best interests of investors in mind. For example, in 2016, Musk acquired his cousin's company, SolarCity, which was in a severe financial crisis. Many investors believed that Musk made this decision for the sake of kinship rather than putting the interests of investors first. Second, in 2018, Tesla's board approved an unusual compensation package for CEO Elon Musk. If all goals are met, Musk will receive $55 billion in equity value, the highest compensation for any CEO in the history of corporate America. On the other hand, Musk uses a corporate structure that reduces the friction of hierarchy and creates an organizational culture that encourages flexibility and fluid communication to get the job done. Based on Tesla's income statement, as shown in Figure1, we can also see that the company's profitability has been increasing yearly, which shows that the company's top management has set the right strategic development direction.

Figure 1: Net income from Tesla Inc. and Ford Motor company (https://finance.yahoo.com/quote/F?p=F).

Ford Motor Company is in the middle of the industry in both corporate behavior and governance performance, representing that Ford still needs to figure out some problems in the governance pillar. First, Ford had some problems with business ethics. According to news reports, Ford needs to pay a $19.2 million fine to settle allegations that the company falsely advertised the fuel economy of some of its hybrid vehicles and the payload capacity of some of its pickup trucks. Ford exaggerated to consumers the distance they could travel on a single tank of gas, claiming that driving differently would not affect the actual fuel economy of the vehicles [10]. Third, Ford's financial situation looks more 'anxious' than Tesla's. Based on Ford's net income for 2018, Ford's profits have fluctuated a lot which is not a good signal for the company. Even in 2020, net income is surprisingly negative. This can show that when it comes to corporate governance to set strategic goals, Ford's top management does not have the same strategic goals that Tesla's top management has set to better suit their company's growth. Ford needs to pay more attention to corporate governance, and many aspects need to improve.

4. Conclusion

In general, U.S. electric car companies led by Tesla are doing better than U.S. gasoline cars led by Ford Motor Company in terms of ESG development. The U.S. auto industry also shows a trend of developing electric vehicles and reducing gasoline vehicle production. Based on the ESG analysis of Tesla and Ford, we found that the auto industry is currently focusing on developing environmental aspects while neglecting improving society and governance. Even though Tesla is already the ESG leader in the U.S. auto industry, many social and corporate governance issues exist, such as product safety issues and board 'dictatorship'. As for the environment, although the current trend of the overall automotive industry is to develop new energy sources, at the same time, automotive companies need to avoid pollution other than greenhouse gases, such as water pollution and pollution from hazardous chemicals. However, these issues in the automotive industry, while still present, are overall progressing toward high ESG scoring standards.

References

[1]. Bilbeisi, Khamis M., and Moulare Kesse. "Tesla: A successful entrepreneurship strategy." Morrow, GA: Clayton State University 1.1 (2017): 1-18.

[2]. Albuquerque, Rui A. and Koskinen, Yrjo J and Yang, Shuai and Zhang, Chendi, Love in the Time of COVID-19: The Resiliency of Environmental and Social Stocks (April 2020). CEPR Discussion Paper No. DP14661, Available at SSRN: https://ssrn.com/abstract=3594293

[3]. Fox, Eva. “Tesla Is Reducing Carbon Footprint by Even Further Improving Its Factories & Products.” TESMANIAN, TESMANIAN, 14 May 2022, www.tesmanian.com/blogs/tesmanian-blog/tesla-reducing-carbon-footprint-even-further-improving-its-factories-products.

[4]. Siddiqui, Faiz. “Tesla Gave Workers Permission to Stay Home Rather than Risk Getting Covid-19. Then It Sent Ter-mination Notices.” The Washington Post, WP Company, 25 June 2020, www.washingtonpost.com/technology/2020/06/25/tesla-plant-firings/.

[5]. Jin, Hyunjoo. “Tesla Recalls Almost Half a Million Electric Cars over Safety Issues.” Reuters, Thomson Reuters, 31 Dec. 2021, www.reuters.com/business/autos-transportation/tesla-recalls-over-475000-electric-vehicles-2021-12-30/.

[6]. J. P. Trovao, "Automotive Electronics Under the COVID-19 Shadow [Automotive Electronics]," in IEEE Vehicular Technology Magazine, vol. 15, no. 3, pp. 101-108, Sept. 2020, doi: 10.1109/MVT.2020.2998710.

[7]. Shepardson, David. “Ford Recalls 100,000 U.S. Vehicles for Fire Risks, Expands Earlier Recall.” Reuters, Thomson Reuters, 8 July 2022, www.reuters.com/business/autos-transportation/ford-issues-new-fire-risk-recall-expands-earlier-call-back-2022-07-08/.

[8]. Delhi, New. “Ford Fires 3,000 Employees as Part of Restructuring.” Edited by Ankita Garg, India Today, India Today, 24 Aug. 2022, www.indiatoday.in/technology/news/story/ford-fires-3-000-employees-as-part-of-restructuring-1991871-2022-08-24.

[9]. Ádám, Tamás. The relationship of corporate governance and pay-for-performance, through the example of Tesla Inc. Diss. BCE, 2020.

[10]. Clark, Kendra. “Ford to Pay $19.2M in False Advertising Settlement over Fuel Efficiency Claims.” The Drum, The Drum, 24 May 2022, www.thedrum.com/news/2022/05/24/ford-pay-192m-false-advertising-settlement-over-fuel-efficiency-claims.

Cite this article

Yang,R. (2023). ESG Evaluation in Automobile Industry --Take Ford Motor Company and Tesla Company as Example. Advances in Economics, Management and Political Sciences,17,246-252.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bilbeisi, Khamis M., and Moulare Kesse. "Tesla: A successful entrepreneurship strategy." Morrow, GA: Clayton State University 1.1 (2017): 1-18.

[2]. Albuquerque, Rui A. and Koskinen, Yrjo J and Yang, Shuai and Zhang, Chendi, Love in the Time of COVID-19: The Resiliency of Environmental and Social Stocks (April 2020). CEPR Discussion Paper No. DP14661, Available at SSRN: https://ssrn.com/abstract=3594293

[3]. Fox, Eva. “Tesla Is Reducing Carbon Footprint by Even Further Improving Its Factories & Products.” TESMANIAN, TESMANIAN, 14 May 2022, www.tesmanian.com/blogs/tesmanian-blog/tesla-reducing-carbon-footprint-even-further-improving-its-factories-products.

[4]. Siddiqui, Faiz. “Tesla Gave Workers Permission to Stay Home Rather than Risk Getting Covid-19. Then It Sent Ter-mination Notices.” The Washington Post, WP Company, 25 June 2020, www.washingtonpost.com/technology/2020/06/25/tesla-plant-firings/.

[5]. Jin, Hyunjoo. “Tesla Recalls Almost Half a Million Electric Cars over Safety Issues.” Reuters, Thomson Reuters, 31 Dec. 2021, www.reuters.com/business/autos-transportation/tesla-recalls-over-475000-electric-vehicles-2021-12-30/.

[6]. J. P. Trovao, "Automotive Electronics Under the COVID-19 Shadow [Automotive Electronics]," in IEEE Vehicular Technology Magazine, vol. 15, no. 3, pp. 101-108, Sept. 2020, doi: 10.1109/MVT.2020.2998710.

[7]. Shepardson, David. “Ford Recalls 100,000 U.S. Vehicles for Fire Risks, Expands Earlier Recall.” Reuters, Thomson Reuters, 8 July 2022, www.reuters.com/business/autos-transportation/ford-issues-new-fire-risk-recall-expands-earlier-call-back-2022-07-08/.

[8]. Delhi, New. “Ford Fires 3,000 Employees as Part of Restructuring.” Edited by Ankita Garg, India Today, India Today, 24 Aug. 2022, www.indiatoday.in/technology/news/story/ford-fires-3-000-employees-as-part-of-restructuring-1991871-2022-08-24.

[9]. Ádám, Tamás. The relationship of corporate governance and pay-for-performance, through the example of Tesla Inc. Diss. BCE, 2020.

[10]. Clark, Kendra. “Ford to Pay $19.2M in False Advertising Settlement over Fuel Efficiency Claims.” The Drum, The Drum, 24 May 2022, www.thedrum.com/news/2022/05/24/ford-pay-192m-false-advertising-settlement-over-fuel-efficiency-claims.