1. Introduction

As the unprecedented pandemic has been raging in the world since the outset of 2020, it was apparent that many industries and sectors would inevitably take a beating as people are confined to their homes to live, play, and work [1]. The real estate sector in Singapore is no exception [2]. According to The World Bank, the COVID-19 turmoil has kicked off a global recession in more than a century [3]. On the other hand, the sector of real estate has always been playing an overarching role in an economy. In general, housing is the largest portion of households’ wealth, the mortgage loan is a major component of banks’ loan books, and the construction sector is a material contributor to economic growth. A stable real estate sector is a pillar of macroeconomic and financial stability. To salvage its economy damaged by the coronavirus, central banks in many countries have rolled out ease monetary policies over the past two and a half years, inadvertently increasing housing prices and rents in major cities worldwide such as London and New York [4]. However, none of them has established a regime that combined robust public housing and rigorous private housing systems similar to Singapore. In the meantime, capital in bulk and companies are flocking to the city-state against a backdrop of US-Sino tensions and the burgeoning South-eastern Asian economy [5]. Therefore, it is worth exploring whether Singapore's real estate, especially residential housing, would lose its resilience in the face of the disruption of the pandemic and rounds of capital injected with its stage-managed housing systems.

In real estate financing, Eugenio analyzes a dynamic correlation between the prosperity of credit and housing prices [6]. The rise of housing prices usually goes along with the dual credit boom of households and enterprises, but most of such a boom will eventually lead to an economic recession. Then, Deng found that real estate risk is negatively related to long-term investment, equity financing, and debt financing of enterprises, so he concluded that the greater the risk is, the less the external finance is [7]. Besides, in the face of the plight of the market environment, Manu tended to innovate real estate financing methods. Mortgage financing and trust fund financing (REITs) can overcome the five main factors restricting financing to some extent: law, macroeconomic environment, collateral barriers, insufficient risk assessment mechanism, and the lack of active financing channels [8]. Last, the research by Zhang and Liu suggests that Singapore's real estate sector caught by the COVID-19-induced imbalance between demand and supply prioritize its financing problem because it is a capital-intensive sector for a long cycle, a slow capital withdrawal, and a large number of quotas in investment [9, 10].

To catch a glimpse of how an epitome-like public housing system shields people from the global pandemic and to have a clue of future investment in Singapore's real estate market, this paper will concentrate on public housing, private housing, and commercial real estate, respectively. Meanwhile, to examine the market in perspective, the paper will be deployed the method of qualitative analysis, present data, go through them, and try predicting whether Singapore would ride out the situation at hand. The rest part of the paper is organized as follows. The following Section 2 will concentrate on public housing; Section 3 will be concerning private housing; Section 4 will focus on commercial real estate; Section 5 is the conclusion to the paper.

2. Public Housing

Dwellings in Singapore are categorized into two kinds, i.e., public housing and private housing. The former is home to around 80% Singaporeans, the ratio one of the highest in the world, and subsidized and regulated by the Housing and Development Boards (HDB). The HDB flats have constituted a monumental piece of Singaporean history, long being a poster child in public housing for countries and regions worldwide.

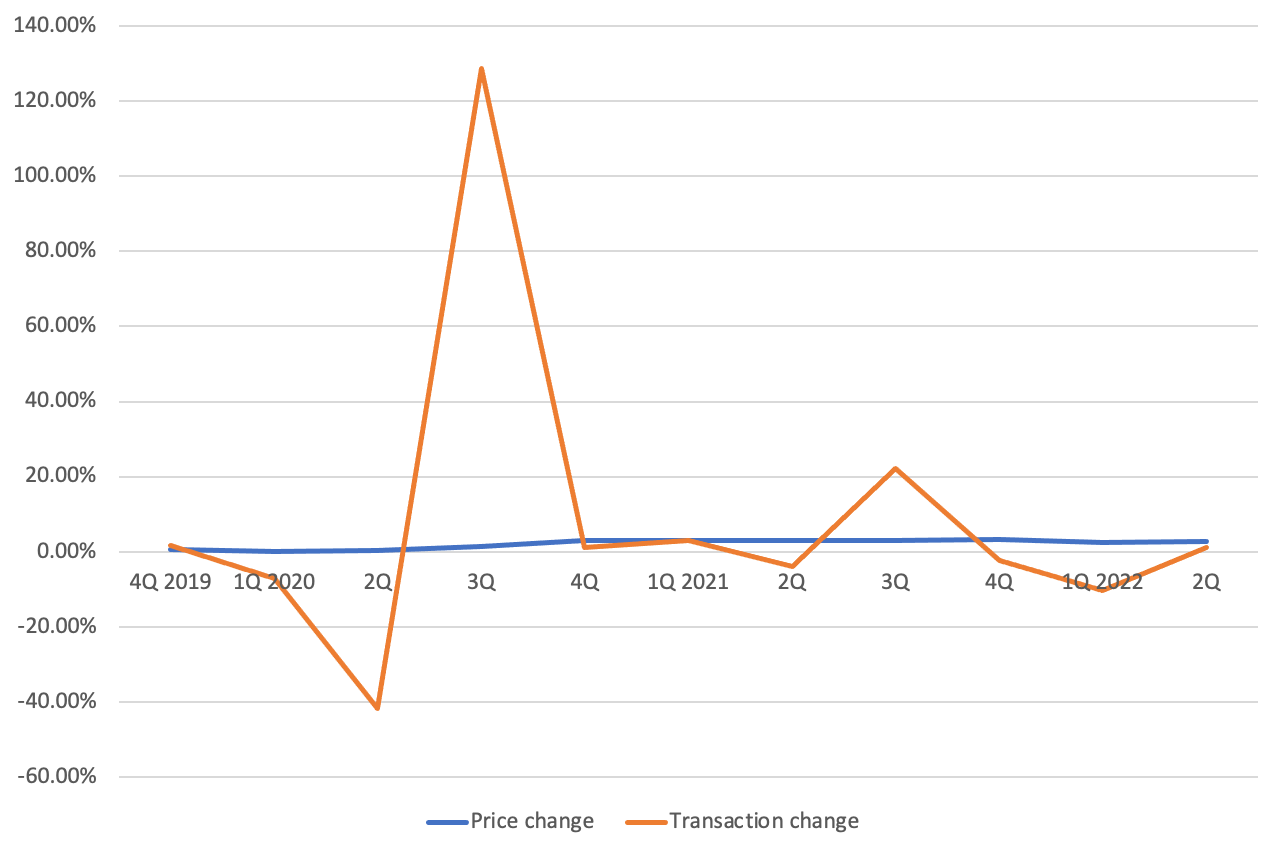

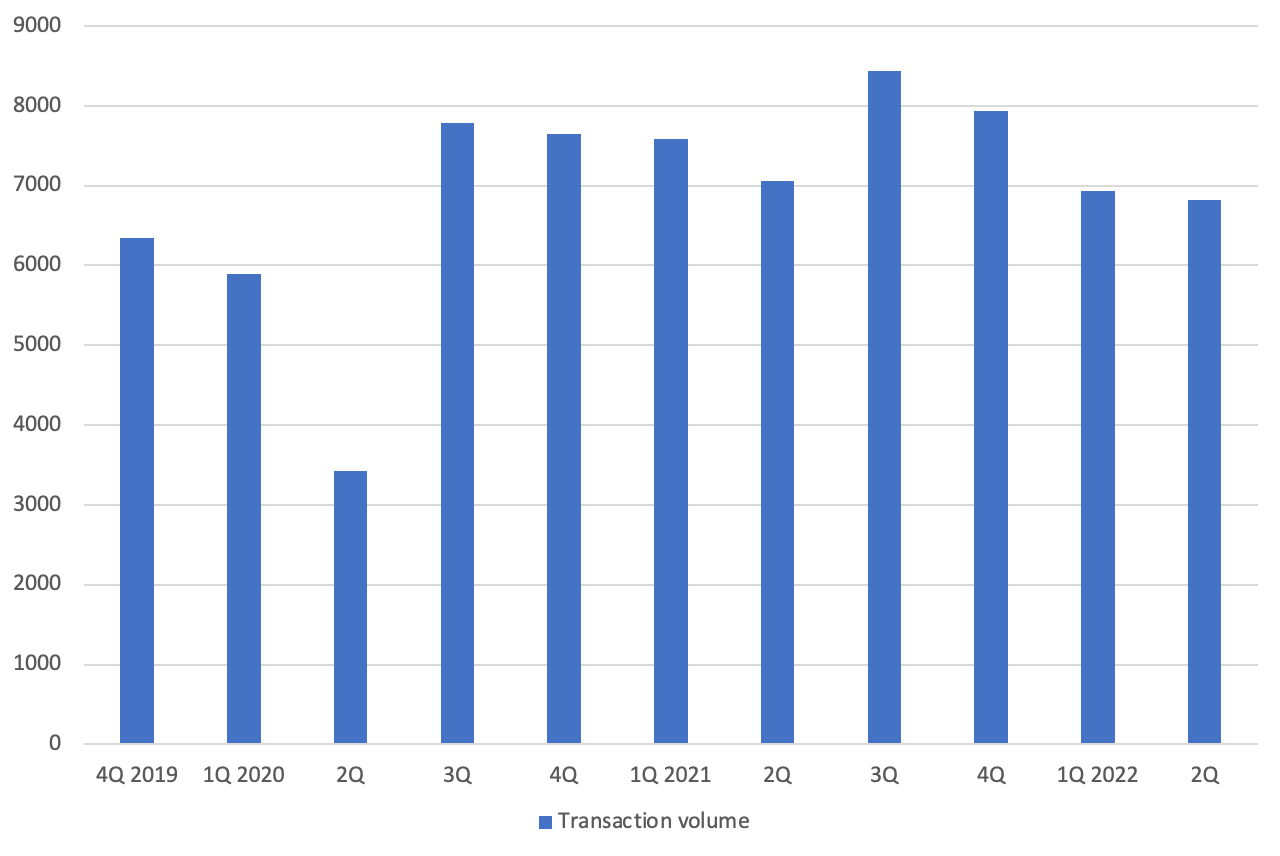

Only Singaporean citizens are eligible to apply for a brand-new HDB flat with a 99-year ownership lease. A new HDB flat is also known as Build-to-Order (BTO) flat. After a five-year minimum occupation period, the lease of a BTO flat can be transferred to other Singaporeans in the resale HDB market. In the wake of the Government’s measures in 2013, including a decrease in HDB flat loans, the resale market had been subdued since 2013 until the eve of the COVID-19 pandemic. In the third quarter of 2021, the resale HDB prices edged past those in 2013 [11]. As illustrated in Fig. 1, the resale HDB market has had a winning streak during the coronavirus pandemic, and there was a staggering rebound at the height of the plague [12]. Fig. 2 registers that the pandemic has given rise to extra transactions in the resale market.

Figure 1: Price changes and transaction changes in resale HDB market from fourth quarter of 2019 to second quarter of 2022 [12].

Figure 2: Transaction volumes in resale HDB market from fourth quarter of 2019 to second quarter of 2022 [12].

As seen from Table 1, resale HDB prices increased further in 2021 as the pandemic made inroads in the city-state. In November 2021, there was a record breaker that a whopping twenty-nine HDB flats fetched over S$1 million. Normally, a BTO flat application could be up to 4.5 years. The pandemic adds to this problem with construction project delays. Channel NewsAsia (CNA), the Singaporean state-run news outlet, reported that all completed BTO projects were delayed from six to ten months, citing border restrictions and a global supply chain crisis [13].

Table 1: Annual price change and transaction in resale HDB market from 2019 to 2021 [12].

Resale HDB market | 2019 | 2020 | 2021 |

Price change | 0.1% | 5% | 12.7% |

Transaction | 6,339 (2.7%) | 24,748 (4.4%) | 31,017 (25.3%) |

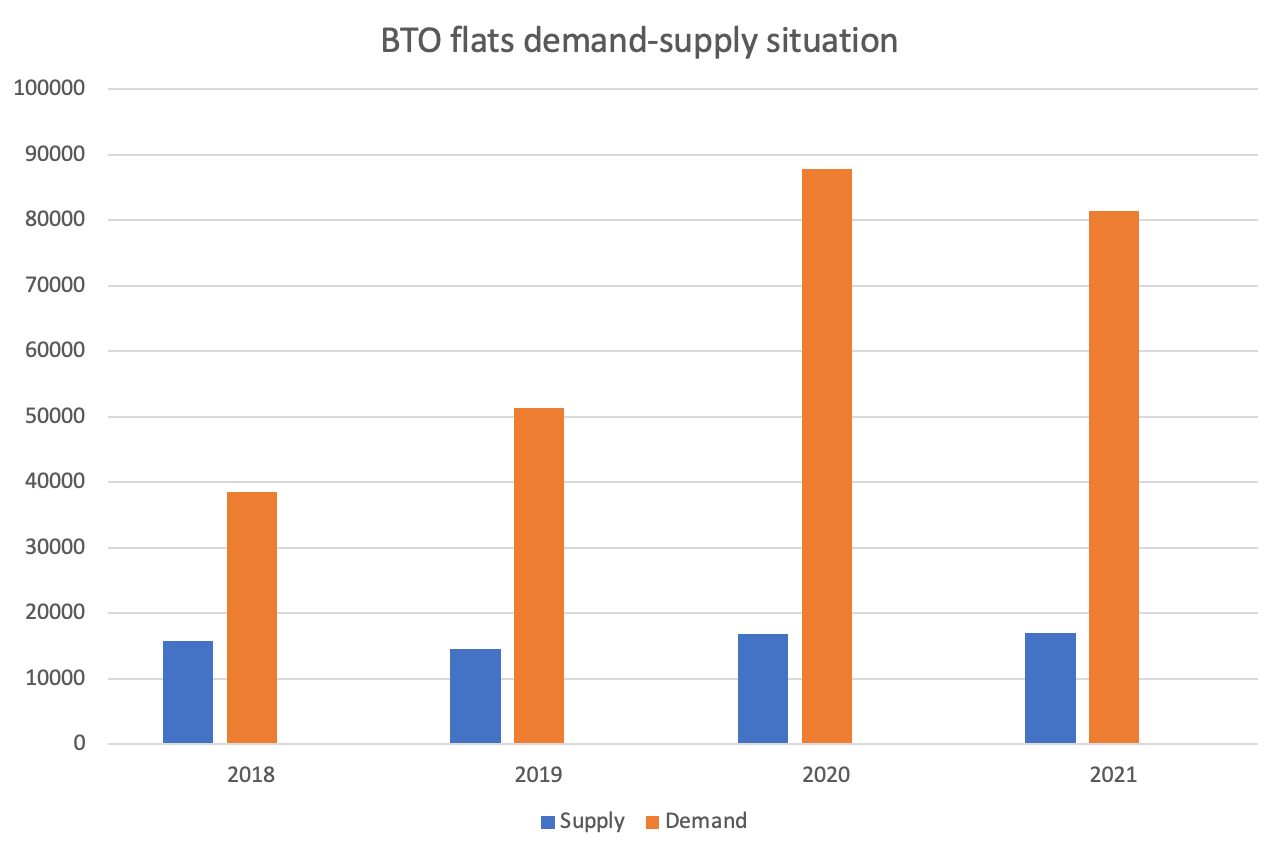

In addition, demographic changes that occurred during the pandemic contributed to the yawning gap in BTO flats between demand and supply, as displayed in Fig. 3. CNA in 2021 saw a sharp rise in the number of marriages and divorces on the back of COVID-19-related restrictions lifted [14]. Meanwhile, multigeneration living in a flat is not uncommon in Singapore, whereas the work-from-home arrangement and infection risk exposed to the elderly at home are other reasons why people crave a more spacious and well-ventilated flat. Multiple rounds of financial relief from the Government shielded against recession for people in Singapore. Therefore, many Singaporean citizens and permanent residents streamed to the resale market, pushing prices of HDB flat to a new high.

Figure 3: BTO flat supply and demand from 2018 to 2021 [15].

In 2019, the Government of Singapore rolled out a procedure-fewer housing grant, the Enhanced CPF Housing Grant (EHG), that increases income ceilings and maximum grant amount, and so forth [16]. For example, a household’s income ceiling of HDB flat was up from SG$12,000 per month to SG$14,000 per month. The new grant makes HDB flats more affordable but intensifies the competition in buying an HDB flat. The annual rise of 5% in 2020 is the steepest one since 2012, with the eight-year high transaction volume. In the following year, the momentum was even more relentless, drawing down Government’s intervention that introduced property cooling measures in December. The cooling measures increase the Additional Buyer’s Stamp Duty (ABSD), elaborated in Table 2, and tighten the Total Debt Serving Ratio (TDSR). Under the new TDSR framework, buyers can get a maximum loan equivalent to 55% of their monthly income, down from 60%, for their first dwelling. In this case, the cooling measures channel demand for a condo to an HDB flat.

Table 2: Additional buyer’s stamp duty [17].

Type of buyer | Previous rate | New rate since 16 Dec, 2021 | |

Singapore citizen | First property | 0% | 0% (no change) |

Second property | 12% | 17% | |

Third property | 15% | 25% | |

Permanent resident | First property | 5% | 5% (no change) |

Second property | 15% | 25% | |

Third property | 15% | 30% | |

Foreigner | Any property | 20% | 30% |

Entity | Any property | 25% | 35% |

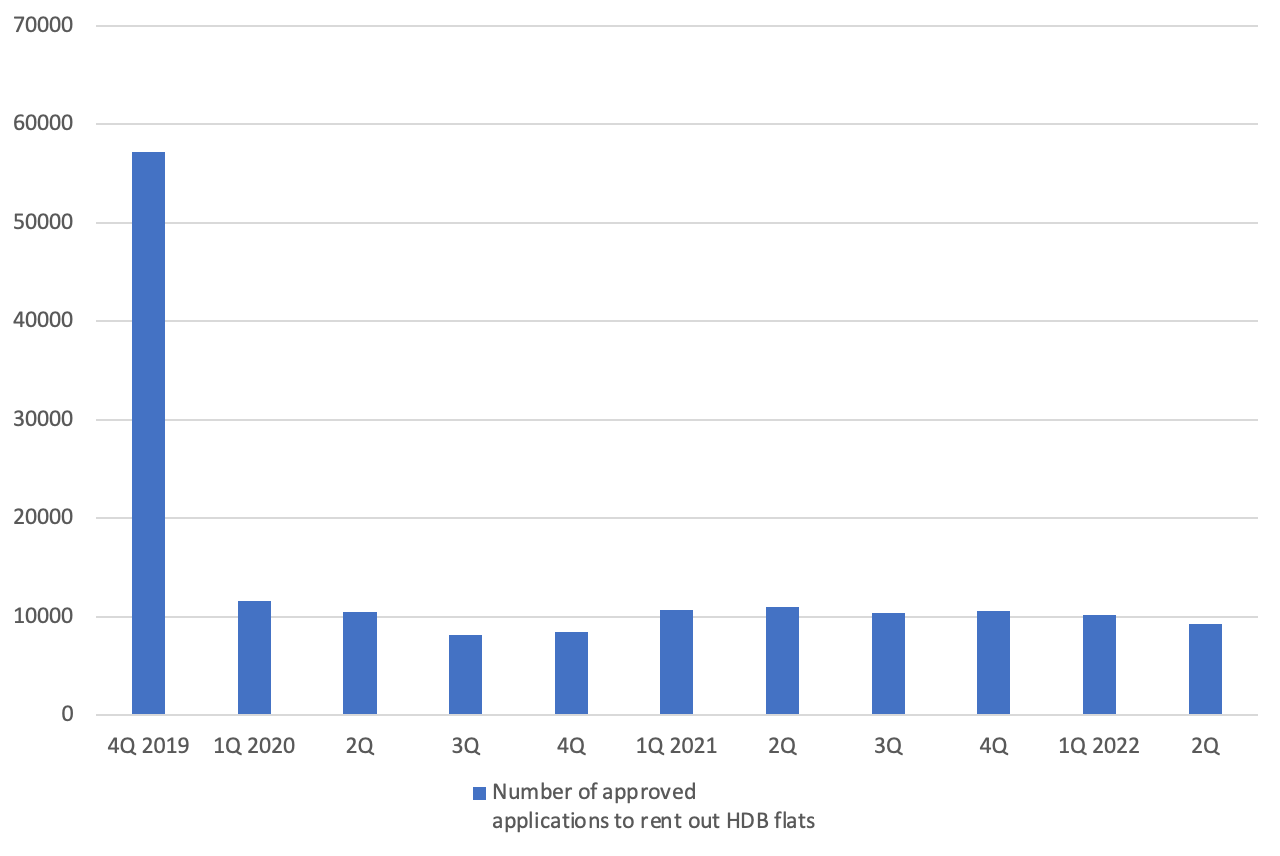

Figure 4: Number of approved application to rent out HDB flats from fourth quarter of 2019 to second quarter of 2022 [18].

On the rental market, as presented in Fig. 4, a dramatically decreased approved number of applications to rent out HDB flats since the start of the pandemic plunged rental HDB flats into a shortage. Hence, some tenants switch to purchasing an HDB flat in perspective.

In short, a backward supply, demographic changes, a new remote work lifestyle, the latest housing grant, and increased rents are among those ingredients for the out-of-the-ordinary public housing market amidst the pandemic. The subsequent property cooling measures even added fuel to it.

3. Private Housing

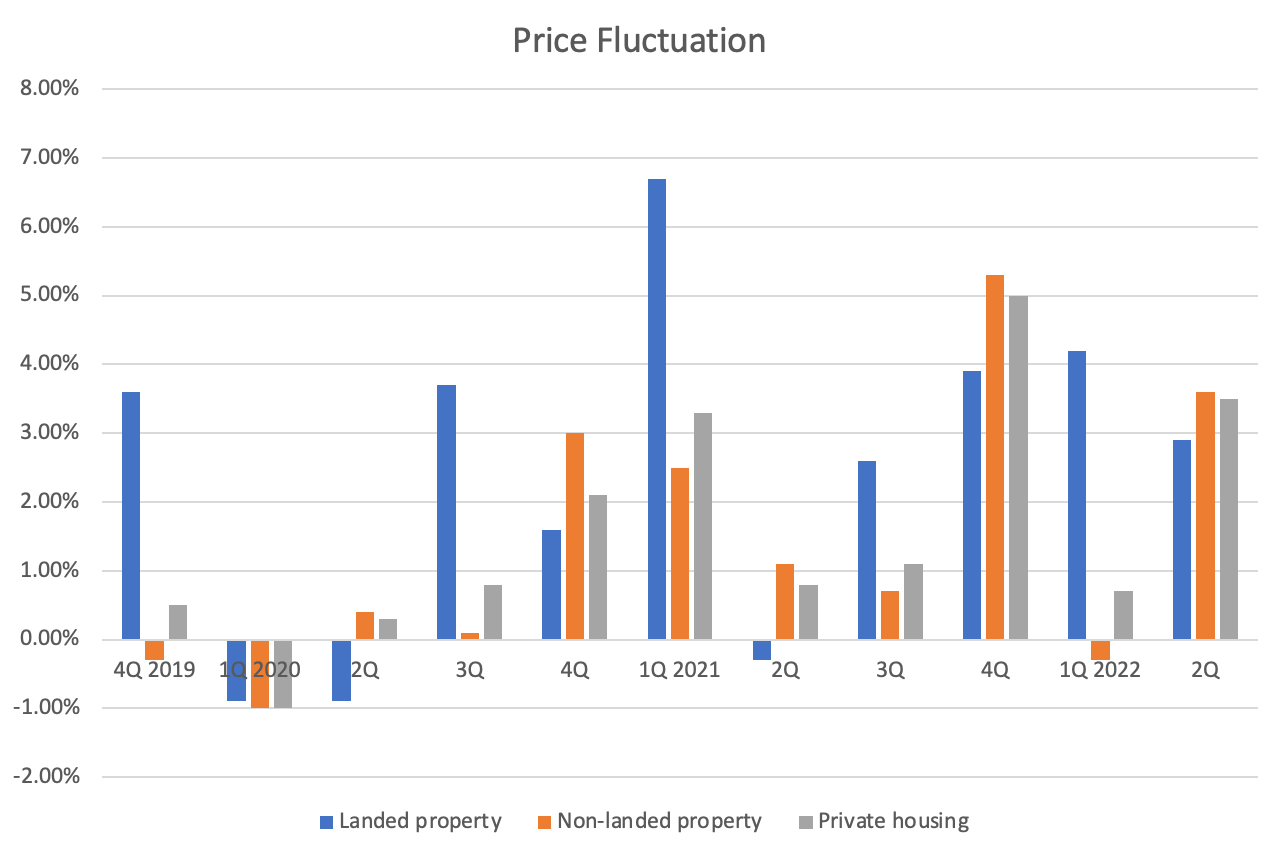

Meanwhile, Singapore’s private residential real estate defied the pandemic-induced recession. Private housing accounts for around 20% of residential real estate on the island but makes it one of the most expensive housing markets in the world. Singapore's private residential real estate consists of non-landed condos and landed houses. As presented in Fig. 5, the prices of private housing have been on a rising streak during the COVID-19 plight. Such a trend is similar to that in the HDB flats, both of which recovered from a massive drop in the first two quarters of 2020. As outlined in Table 3, the private housing leveled off in 2020. The public and private housing markets began presenting similar trends in 2021.

Figure 5: Price changes in private residential real estate from fourth quarter of 2019 to second quarter of 2022 [19].

Table 3: Annual price changes in private residential real estate from 2019 to 2021 [20].

Price | 2019 | 2020 | 2021 |

Landed property | 5.7% | 1.2% | 13.3% |

Non-landed property | 1.9% | 2.5% | 9.8% |

Private housing | 2.7% | 2.2% | 10.6% |

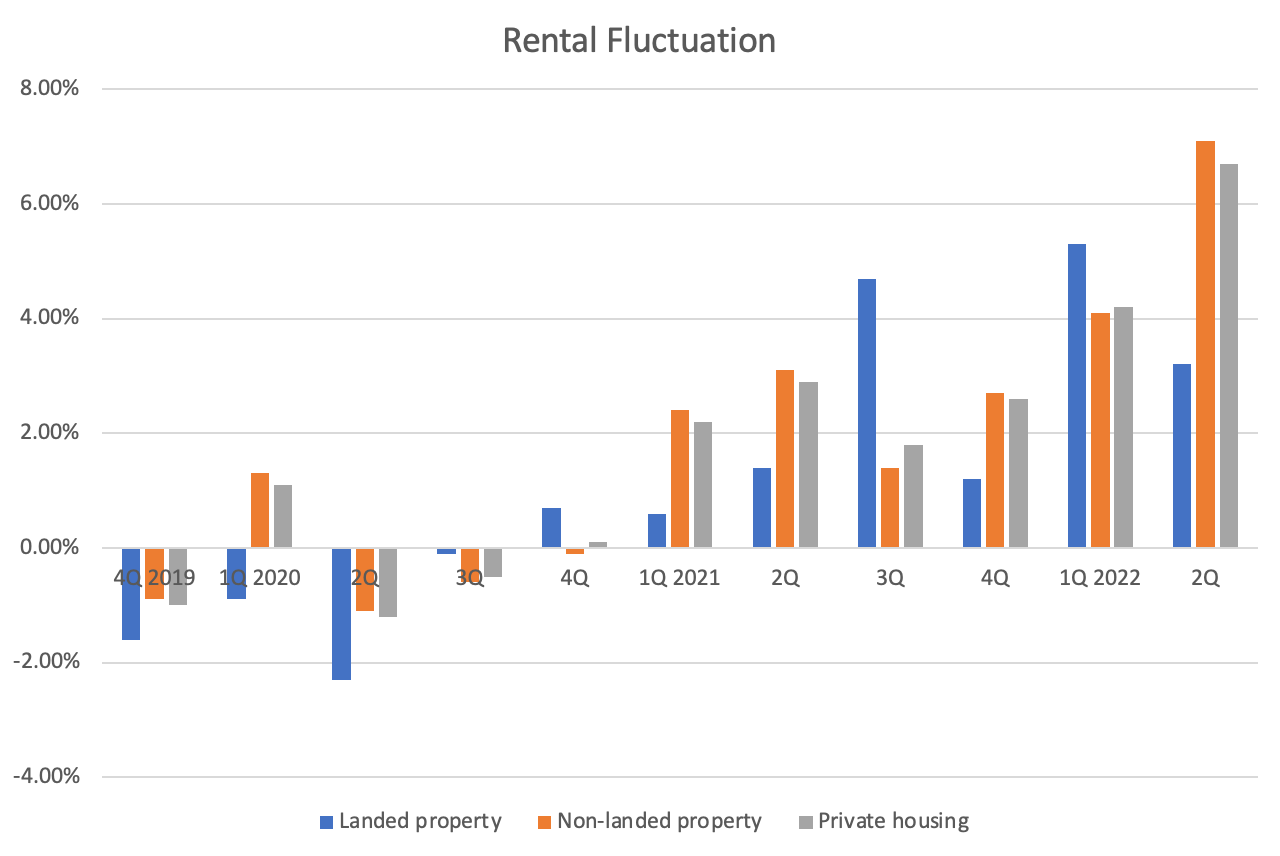

Figure 6: Rents changes in private residential real estate from fourth quarter of 2019 to second quarter of 2022 [19].

As shown in Fig. 6 and Table 4, trends of rents and prices were palpably positively correlated. In 2020, rents in private housing dramatically decreased as expatriates fled Singapore. Coupled with the inference in Section 2, rent and price interact as a real estate market is a highly dynamic market where the one-way effect is practically non-existent.

Table 4: Annual rent changes in private residential real estate from 2019 to 2021 [20].

Rental | 2019 | 2020 | 2021 |

Landed property | -3.4% | -2.7% | 8.2% |

Non-landed property | 1.9% | -0.5% | 9.9% |

Private housing | 1.4% | -0.6% | 9.9% |

During the COVID-19 pandemic, foreign buyers have usually hogged headlines for their splurges in luxury dwellings. According to Savills, a global real estate serving firm, the Asian ultra-wealthy are keener on real estate investment than their American and European counterparts are. Besides, Singapore is long well-known as a haven asset for global investors. Therefore, the hikes in home prices brought by the pandemic beg the question: are foreign buyers finger-pointing when Singapore has won brownie points in pulling off the pandemic and added appeals to international investors amid uncertainty?

Table 5: Breakdown of private residential real estate bought by singaporeans and foreigners from 2019 to first half of 2022 [21].

Singapore citizens | Permanent residents | Non- residents | Companies | Total | |

2019 | 15,495 (79.7%) | 2,852 (14.7%) | 1,017 (5.2%) | 78 (0.4%) | 19,442 |

2020 | 18,520 (82.2%) | 3,133 (13.9%) | 756 (3.4%) | 134 (0.6%) | 22,543 |

2021 | 30,958 (82.7%) | 5,147 (13.7%) | 1,135 (3%) | 193 (0.5%) | 37,433 |

H1 2022 | 10,681 (80.2%) | 2,134 (16%) | 444 (3.3%) | 52 (0.4%) | 13,311 |

According to Table 5, the transactions of foreign buyers have not resurged even after the height of the pandemic in 2020. Furthermore, the impact of cooling measures on foreign buyers seemed to be minuscule. In regional alternatives, Australia’s stamp duty for foreigners is 8%, and Hong Kong’s is 15%. Amid the slew of news regarding foreign buyers, it was easy to spot that most deals were from luxury or prime regional real estate. In other words, mass-market condos remain untouched, so local homebuyers will not be priced out by overseas bidders. Private residential real estate prices would not see a wild ride should these foreign buyers withdraw from Singapore. When the theory that foreign buyers drive up housing prices cannot hold water, the supply will be the next to examine.

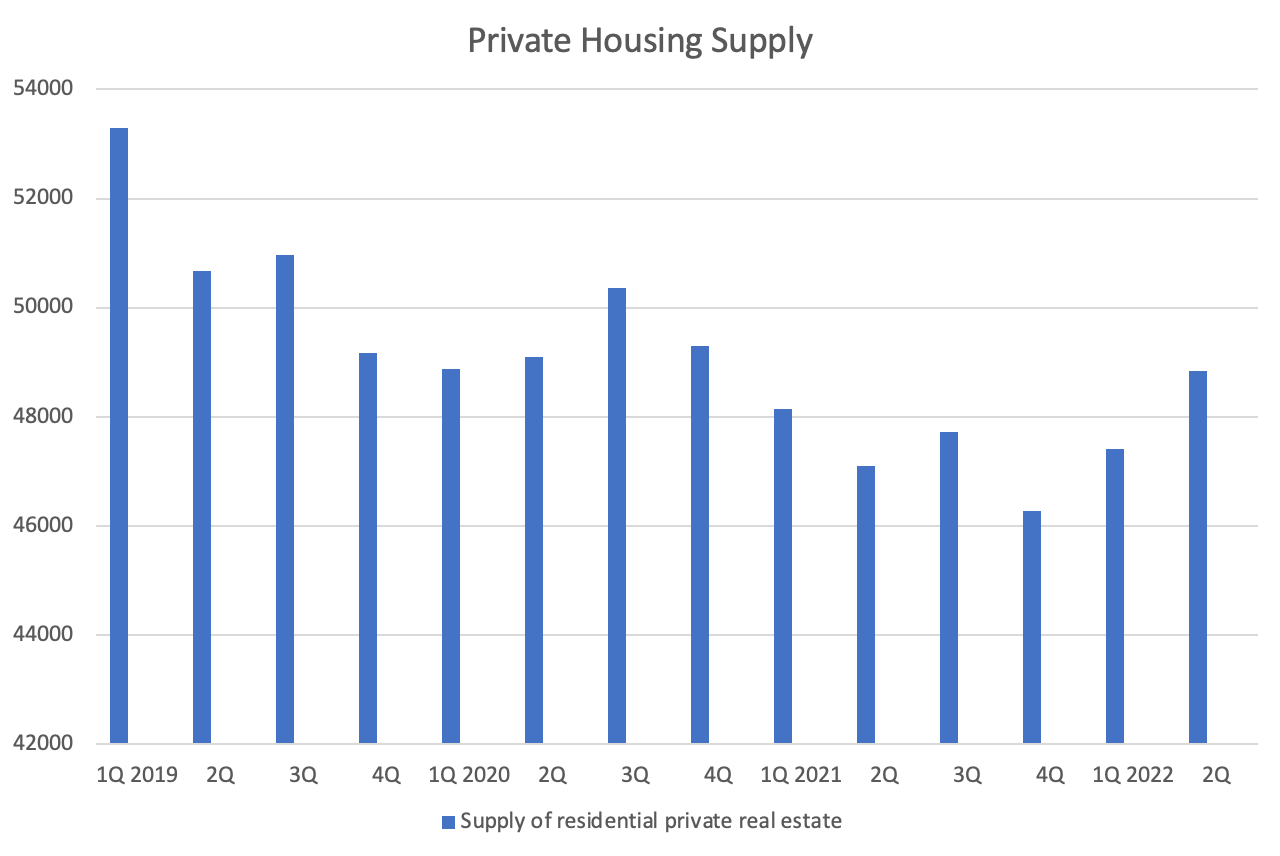

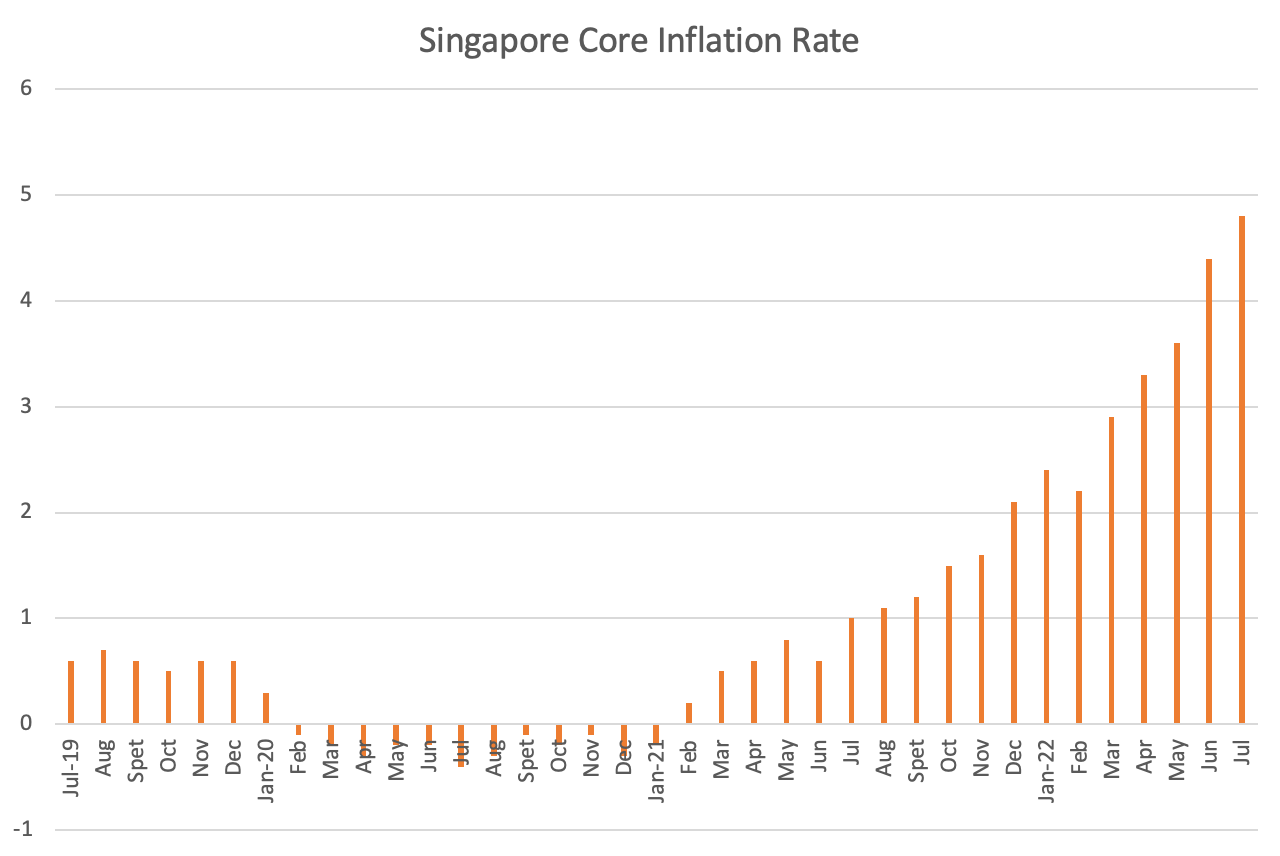

As demonstrated in Table 6, what is clear is that the dwindled supply of private residential real estate is one of the factors that elevate the prices. The cause of this problem is the same as that of the short supply in BTO flats – construction project disruptions. In addition, exceedingly low mortgage rates throughout the pandemic also contributed to the red-hot market. Central banks in many countries and regions introduced an easy monetary policy to undergird their economies because of the pandemic, so median mortgage rates across Singaporean banks were 1% from 2020 to October 2021. A housing loan rate below 2% is normally considered super cheap. The core inflation rate index in Figure 8 is a glimpse of low interest rates during the COVID-19 turbulence.

Figure 7. Supply of whole of private residential real estate from first quarter of 2019 to second quarter of 2022 [22].

Table 6: Annual supplies and their changes in private residential real estate from 2019 to first half of 2022 [23].

2019 | 2020 | 2021 | 1H 2022 | |

Supply of private housing | 204,095 | 197,634 (-3.2%) | 189,227 (-4.3%) | 96,251 (1.1%) |

Figure 8: Singapore core inflation rate from July 2019 to July 2022 [24].

In addition, the external environment plays a part in the private housing market, possibly lead up to long-term changes. In the past decade, the world has witnessed China as an Asian economic powerhouse driven by its full-fledged technology giants. After a company siphons off tremendous market shares at home, it will look overseas. To Chinese companies, Southeast Asia is a springboard considering distance, untapped markets, similar cultures, China’s influence in this region, and so forth. ASEAN has been the largest trading partner of China. Singapore, meanwhile, has been using its financial clout to position itself at the heart of Southeast Asia’s technology sector. Therefore, Alibaba in May 2020 set up a headquarters for its overseas subsidiary before Bytedance, the owner of the video-sharing app TikTok, announced its global headquarters in Singapore in September. Tencent also clambered onto the bandwagon and unveiled a Singapore plan for its regional hub in the same year. Barring from Chinese technology companies, players in other sectors in China set foot in Singapore. Wuxi Biologics‘ research-and-development center and manufacturing capabilities will settle in the island nation. The booming of start-ups in Southeast Asia has drawn down a record amount of venture funding, followed by China’s top-tier venture capital firms opening their offices in the Southeast Asian financial hub.

As Singapore’s rival in many fields, Hong Kong has been undergoing a brain drain and foreign worker exodus out of social unrest and draconian anti-COVID-19 measures. Consequently, Singapore becomes the alternative to Hong Kong’s foreign firms, which still want to have business with China but distance themselves from the country. For example, hedge fund Bridgewater founder Ray Dalio opened a family office in Singapore during the pandemic for his business in China.

At the outset of the pandemic, rents in the private housing dramatically decreased as expatriates fled the nation. As Singapore gradually lifted relevant measures and kept the pandemic at bay, it draws not only those expatriates back but the expatriates from other regions such as Hong Kong. The Financial Times reported that the demand for a place in Singapore’s international schools has bumped up in 2021 and 2022. Moreover, rent surges in the privare housing in the first and second quarters of 2022 suggest that the property cooling measures held back people from purchasing housing and left them to rent condos. Consequently, a shortage of supply and low interest rates are a drive in the private housing mania.

4. Commercial Real Estate

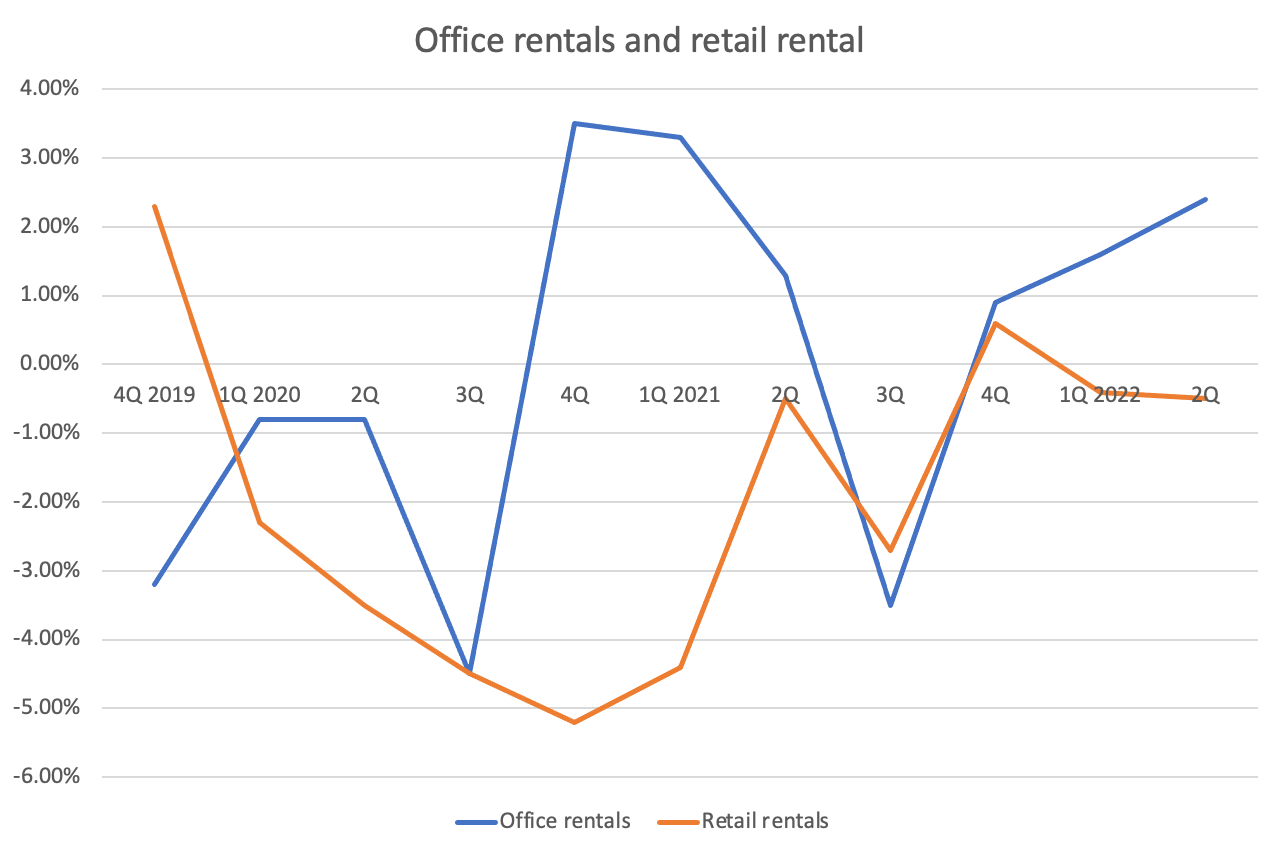

Commercial properties are sliced into office space, retail shops, and industrial real estate. According to the Financial Times, Singapore office rents have returned to the pre-pandemic level in 2022[25]. Nevertheless, downward pressure is still heaping on retail shops as the COVID-19 pandemic bites.

Fig. 8 and Table. 7 demonstrates disparate trends between office rental and retail rentals during the pandemic. In 2021, the division even more stuck out as demand for offices began increasing, while the retail shops have been bearing the most brunts among Singaporean real estate over the past two and a half years. The pandemic has changed the norm of the physical workplace, with employers citing saving rental costs, decreased commuting time, boosts to productivity. The fresh round of Chinese companies that put up their stronghold in Singapore has filled the void left by these employers, while the pandemic-induced closures of bookshops, restaurants, and others have been common to name a few. Mapletree Commercial Trust’s REIT, one of the best-performing Singaporean REITs and investing in two major shopping malls in the city-state, has decreased by around 17% [26], with Frasers Centrepoint Trust, an investor for Singaporean community malls, has seen a drop by 5% in the meantime [27]. On the one hand, the return of international tourists will salvage those major shopping malls. On the other hand, the pandemic expedites the advent of the digital economy, so retail shops will play less of a part in essential lives. Therefore, landlords of brick-and-mortar retail locations have to rethink the use and design of shops and take pains to transform them into mixed-use, experience-focused, etc.

Figure 8: Rent changes in commercial real estate from fourth quarter of 2019 to second quarter of 2022 [22].

Table 7: Annual Rent Changes from 2019 to 2021 [22].

2019 | 2020 | 2021 | |

Office rental | -0.6% | -10.7% | 1.9% |

Retail rental | 2.9% | -14.7% | -6.8% |

Table 8: Household Balance Sheets from 2015 to 2021 [28].

Year | Household assets | Household liabilities | Household net worth |

2015 | 1,837.2 | 318.4 | 1,518.7 |

2016 | 1,947.2 | 325.9 | 1,621.3 |

2017 | 2,075.2 | 341.8 | 1,733.3 |

2018 | 2,170.5 | 346.0 | 1,824.5 |

2019 | 2,334.4 | 341.1 | 1,993.2 |

2020 | 2,499.5 | 335.3 | 2,164.2 |

2021 | 2,745.5 | 359.5 | 2386.0 |

During the COVID-19 outbreak, firms around the world have increasingly harnessed cloud technologies to store information, run software, and base entire systems, for business continuity and minimalization of disruption. In the context of the digital economy, the data center could be a new growth locomotive for Singapore's commercial real estate. For instance, Keppel Date Centre REIT, the only data center REIT listed on the Singapore Exchange, has had an above-the-average-market performance during the pandemic [29].

Furthermore, in the elaboration of Table 8, Singaporean residents have seen increased household net worth in 2020 and 2021, primarily benefiting from multiple rounds of financial reliefs and increased housing value. Coupled with strict regulations, a monthly housing loan for a Singaporean family cannot exceed 60% and the bulk of liabilities for most Singaporeans is housing loans, so household liabilities in Singapore are in control.

To sum up, Singapore's commercial real estate is transforming, and foreign investment will see the commercial real estate through when the pandemic blows over.

5. Conclusion

In summary, even if the current upward in Singapore’s residential markets seems inexorable, it is lowly likely to raise bubbles in the real estate markets. On the one hand, more influx than outflux in population and capital, scarce lands, commendable infrastructures, and stable environment beef up the fundamental of Singapore’s real estate. On the other hand, Singaporeans can be shielded against the headwind with their public housing, which is essentially the wellspring of the resilience of the entire residential markets, but pre-emptive measures for spillover effects from ultra-luxe residential properties are necessary. Therefore, from the long-term perspective, it is inferred that a further increased supply of BTO flats and condos will be on the way. From the short-term point of view, as the market expects a much higher interest rate to tame inflation on track and a looming increased tax aimed at making up fiscal revenues that have decreased during the pandemic, high prices will be brought down. Among retail shops, the survivors are those who observe the changes after the pandemic and try to fit them. A retail shop will probably not stick to selling merchandise but build some sites for user experience.

Compared with the post-global financial crisis booming property market in Singapore, the pandemic-induced prosperity, for now, has not reached yet in terms of prices. However, the entire market underwent a decade-long decline. According to the analysis, the authorities will deploy more dynamic data to control supply in residential properties. On this basis, the dynamic of research data should be improved because it is an interlaced situation in which every factor is in flux.

References

[1]. World Bank Group. (2020, June 8). The Global Economic Outlook during the COVID-19 pandemic: A changed world. World Bank. Retrieved August 19, 2022, from https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world

[2]. Peeris, J.: Bookmark Bookmark Share WhatsApp Telegram Face. Virtual tours and opportunities: The Singapore property market during COVID-19. CNA. Retrieved August 18, 2022, from https://www.channelnewsasia.com/business/virtual-tours-opportunities-singapore-property-market-covid19-724186

[3]. World Bank Group. (2022, February 15). WDR 2022 Chapter 1. introduction. World Bank. Retrieved Spetember 7, 2022, from https://www.worldbank.org/en/publication/wdr2022/brief/chapter-1-introduction-the-economic-impacts-of-the-covid-19-cri-sis#:~:text=The%20COVID%2D19%20pandemic%20sent,inequality%20within%20and%20across%20countries.

[4]. Romei, V., Giles, C.: Pandemic fuels broadest global house price boom in two decades. Subscribe to read | Financial Times (2021, August 1). Retrieved August 11, 2022, from https://www.ft.com/content/491a245d-4af7-4cad-b860-6ba51b86b45f

[5]. See, S.: More capital flows into Asean amid pandemic and US-China tensions. Businesstimes.com.sg (2020, Septem-ber 16). Retrieved August 11, 2022, from https://www.businesstimes.com.sg/government-economy/more-capital-flows-into-asean-amid-pandemic-and-us-china-tensions

[6]. Eugenio, C., Jihad, D., Giovanni, D. A.: Housing Finance and Real-Estate Booms: A Cross-Country Perspective. Journal of Housing Economics, 27(38), pp. 1-13 (2017).

[7]. Deng, X., Seow, E. O., Qian, M.: Real Estate Risk, Corporate Investment and Financing Choice. The Journal of Real Estate Finance and Economics, 57(1), pp. 87-113 (2018).

[8]. Owusu-Manu, D., Edwards D. J., Badu, E. K. A., Donkor-Hyiaman, E. D. A.: Real estate infrastructure financing in Ghana:Sources and constraints. Habitat International, 40(50), pp. 35-41 (2015).

[9]. Zhang, Y.: Southeast Asia's Economy Under the Influence of the COVID-19. Southeast Asian Studies, 2021(01), pp. 64-84 (2021).

[10]. Liu, Y.: Current Situation, Problems and Countermeasures of the Real Estate Market in the Post Epidemic Period. Chinese Market, 2021(08), pp. 13-16 (2021).

[11]. Housing and Development Board. Resale statistics. HDB. Retrieved August 11, 2022, from https://www.hdb.gov.sg/residential/selling-a-flat/overview/resale-statistics

[12]. Housing and Development Board. (2022, April 22). Release of 1st quarter 2022 Public Housing Data. HDB. Retrieved August 12, 2022, from https://www.hdb.gov.sg/about-us/news-and-publications/press-releases/Release-of-1st-Quarter-2022-Public-Housing-Data

[13]. Channel NewsAsia. (2021). Two-thirds of Bto projects completed during COVID-19 delayed no more than 6 months: Hdb. YouTube. Retrieved August 19, 2022, from https://www.youtube.com/watch?v=OQbbkpPkNZc.

[14]. More marriages and divorces in Singapore in 2021 with easing of COVID-19 measures. Channel NewsAsia. (2022, July 6). Retrieved September 1, 2022, from https://www.channelnewsasia.com/singapore/more-marriages-divorces-singapore-2021-covid-19-measures-eased-2791786

[15]. Housing and Development Board. (n.d.). Committee of Supply 2022. HDB. Retrieved August 20, 2022, from https://www.hdb.gov.sg/cs/infoweb/homepage

[16]. Enhanced CPF Housing Grant (families). HDB. Retrieved September 1, 2022, from https://www.hdb.gov.sg/residential/buying-a-flat/flat-and-grant-eligibility/couples-and-families/enhanced-cpf-housing-grant-families

[17]. Ministry of National Development. (2021, December 15). Measures to Cool the Property Market. Ministry of National Development. Retrieved August 22, 2022, from https://www.mnd.gov.sg/newsroom/press-releases/view/measures-to-cool-the-property-market

[18]. Housing and Developing Board. (2020, January 23). Release of 4th quarter 2019 Public Housing Data. HDB. Retrieved September 3, 2022, from https://www.hdb.gov.sg/cs/infoweb/about-us/news-and-publications/press-releases/23012020-4q2019-public-housing-data

[19]. Urban Redevelopment Authority. (2020, January 23). Release of 4th quarter 2019 real estate statistics. URA. Re-trieved September 1, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr20-06

[20]. Urban Redevelopment Authority. (2022, April 22). Release of 1st quarter 2022 Real Estate Statistics. URA. Retrieved September 2, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr22-18

[21]. Liew, I.: Private home sales slowed in first half of 2022 as cooling measures tamped down demand. The Straits Times (2022, September 14). Retrieved September 14, 2022, from https://www.straitstimes.com/singapore/housing/private-home-sales-slowed-in-first-half-of-2022-as-cooling-measures-tamped-down-demand

[22]. Urban Redevelopment Authority. (2019, April 26). Release of 1st Quarter 2019 real estate statistics. URA. Retrieved September 4, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr19-19#:~:text=As%20at%20the%20end%20of,Annex%20E%2D24).

[23]. Urban Redevelopment Authority. (2022, July 22). Release of 2nd quarter 2022 Real Estate Statistics. URA. Retrieved September 4, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr22-30#:~:text=A%20total%20of%202%2C682%20units,remaining%202%20quarters%20of%202022.

[24]. Singapore core inflation rateseptember 2022 data - 1990-2021 historical. Trading Economics. Retrieved September 4, 2022, from https://tradingeconomics.com/singapore/core-inflation-rate

[25]. Ruehl, M.: Singapore office rents set to hit pre-pandemic levels. Financial Times (2022, August 22). Retrieved Sep-tember 1, 2022, from http://www.chineseft.com/story/001097045/en?archive

[26]. Mapletree Commercial Trust: MCT - stock price: Live quote: Historical Chart. Trading Economics. Retrieved Sep-tember 22, 2022, from https://tradingeconomics.com/mct:sp

[27]. Frasers Centrepoint Trust (J69U.SI) company profile & facts. Yahoo! Finance. Retrieved September 22, 2022, from https://finance.yahoo.com/quote/J69U.SI/profile/

[28]. Department of Statistic. (2022, August 30). Household Sector Balance Sheet (End Of Period). Department of Statistic Singapore. Retrieved September 9, 2022, from https://tablebuilder.singstat.gov.sg/table/TS/M700981

[29]. Lim, C., Tan, F., Goola Warden and Lim Hui Jie, Jie, L. H., Warden, G., Pillai, S., Chan, J., Cher, B., & Tay, V.: Kep-pel DC REIT Latest News (SGX:AJBU): SG investors.io. SG investors.io - Where SG Investors Share (2022, Oc-tober 21). Retrieved October 21, 2022, from https://sginvestors.io/sgx/reit/ajbu-keppel-dc-reit/news-article.

Cite this article

Chen,G.;Liu,X.;Yang,Y. (2023). The Impact of COVID-19 Pandemic on Singapore's Resilience in Real Estate Market. Advances in Economics, Management and Political Sciences,17,292-303.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. World Bank Group. (2020, June 8). The Global Economic Outlook during the COVID-19 pandemic: A changed world. World Bank. Retrieved August 19, 2022, from https://www.worldbank.org/en/news/feature/2020/06/08/the-global-economic-outlook-during-the-covid-19-pandemic-a-changed-world

[2]. Peeris, J.: Bookmark Bookmark Share WhatsApp Telegram Face. Virtual tours and opportunities: The Singapore property market during COVID-19. CNA. Retrieved August 18, 2022, from https://www.channelnewsasia.com/business/virtual-tours-opportunities-singapore-property-market-covid19-724186

[3]. World Bank Group. (2022, February 15). WDR 2022 Chapter 1. introduction. World Bank. Retrieved Spetember 7, 2022, from https://www.worldbank.org/en/publication/wdr2022/brief/chapter-1-introduction-the-economic-impacts-of-the-covid-19-cri-sis#:~:text=The%20COVID%2D19%20pandemic%20sent,inequality%20within%20and%20across%20countries.

[4]. Romei, V., Giles, C.: Pandemic fuels broadest global house price boom in two decades. Subscribe to read | Financial Times (2021, August 1). Retrieved August 11, 2022, from https://www.ft.com/content/491a245d-4af7-4cad-b860-6ba51b86b45f

[5]. See, S.: More capital flows into Asean amid pandemic and US-China tensions. Businesstimes.com.sg (2020, Septem-ber 16). Retrieved August 11, 2022, from https://www.businesstimes.com.sg/government-economy/more-capital-flows-into-asean-amid-pandemic-and-us-china-tensions

[6]. Eugenio, C., Jihad, D., Giovanni, D. A.: Housing Finance and Real-Estate Booms: A Cross-Country Perspective. Journal of Housing Economics, 27(38), pp. 1-13 (2017).

[7]. Deng, X., Seow, E. O., Qian, M.: Real Estate Risk, Corporate Investment and Financing Choice. The Journal of Real Estate Finance and Economics, 57(1), pp. 87-113 (2018).

[8]. Owusu-Manu, D., Edwards D. J., Badu, E. K. A., Donkor-Hyiaman, E. D. A.: Real estate infrastructure financing in Ghana:Sources and constraints. Habitat International, 40(50), pp. 35-41 (2015).

[9]. Zhang, Y.: Southeast Asia's Economy Under the Influence of the COVID-19. Southeast Asian Studies, 2021(01), pp. 64-84 (2021).

[10]. Liu, Y.: Current Situation, Problems and Countermeasures of the Real Estate Market in the Post Epidemic Period. Chinese Market, 2021(08), pp. 13-16 (2021).

[11]. Housing and Development Board. Resale statistics. HDB. Retrieved August 11, 2022, from https://www.hdb.gov.sg/residential/selling-a-flat/overview/resale-statistics

[12]. Housing and Development Board. (2022, April 22). Release of 1st quarter 2022 Public Housing Data. HDB. Retrieved August 12, 2022, from https://www.hdb.gov.sg/about-us/news-and-publications/press-releases/Release-of-1st-Quarter-2022-Public-Housing-Data

[13]. Channel NewsAsia. (2021). Two-thirds of Bto projects completed during COVID-19 delayed no more than 6 months: Hdb. YouTube. Retrieved August 19, 2022, from https://www.youtube.com/watch?v=OQbbkpPkNZc.

[14]. More marriages and divorces in Singapore in 2021 with easing of COVID-19 measures. Channel NewsAsia. (2022, July 6). Retrieved September 1, 2022, from https://www.channelnewsasia.com/singapore/more-marriages-divorces-singapore-2021-covid-19-measures-eased-2791786

[15]. Housing and Development Board. (n.d.). Committee of Supply 2022. HDB. Retrieved August 20, 2022, from https://www.hdb.gov.sg/cs/infoweb/homepage

[16]. Enhanced CPF Housing Grant (families). HDB. Retrieved September 1, 2022, from https://www.hdb.gov.sg/residential/buying-a-flat/flat-and-grant-eligibility/couples-and-families/enhanced-cpf-housing-grant-families

[17]. Ministry of National Development. (2021, December 15). Measures to Cool the Property Market. Ministry of National Development. Retrieved August 22, 2022, from https://www.mnd.gov.sg/newsroom/press-releases/view/measures-to-cool-the-property-market

[18]. Housing and Developing Board. (2020, January 23). Release of 4th quarter 2019 Public Housing Data. HDB. Retrieved September 3, 2022, from https://www.hdb.gov.sg/cs/infoweb/about-us/news-and-publications/press-releases/23012020-4q2019-public-housing-data

[19]. Urban Redevelopment Authority. (2020, January 23). Release of 4th quarter 2019 real estate statistics. URA. Re-trieved September 1, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr20-06

[20]. Urban Redevelopment Authority. (2022, April 22). Release of 1st quarter 2022 Real Estate Statistics. URA. Retrieved September 2, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr22-18

[21]. Liew, I.: Private home sales slowed in first half of 2022 as cooling measures tamped down demand. The Straits Times (2022, September 14). Retrieved September 14, 2022, from https://www.straitstimes.com/singapore/housing/private-home-sales-slowed-in-first-half-of-2022-as-cooling-measures-tamped-down-demand

[22]. Urban Redevelopment Authority. (2019, April 26). Release of 1st Quarter 2019 real estate statistics. URA. Retrieved September 4, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr19-19#:~:text=As%20at%20the%20end%20of,Annex%20E%2D24).

[23]. Urban Redevelopment Authority. (2022, July 22). Release of 2nd quarter 2022 Real Estate Statistics. URA. Retrieved September 4, 2022, from https://www.ura.gov.sg/Corporate/Media-Room/Media-Releases/pr22-30#:~:text=A%20total%20of%202%2C682%20units,remaining%202%20quarters%20of%202022.

[24]. Singapore core inflation rateseptember 2022 data - 1990-2021 historical. Trading Economics. Retrieved September 4, 2022, from https://tradingeconomics.com/singapore/core-inflation-rate

[25]. Ruehl, M.: Singapore office rents set to hit pre-pandemic levels. Financial Times (2022, August 22). Retrieved Sep-tember 1, 2022, from http://www.chineseft.com/story/001097045/en?archive

[26]. Mapletree Commercial Trust: MCT - stock price: Live quote: Historical Chart. Trading Economics. Retrieved Sep-tember 22, 2022, from https://tradingeconomics.com/mct:sp

[27]. Frasers Centrepoint Trust (J69U.SI) company profile & facts. Yahoo! Finance. Retrieved September 22, 2022, from https://finance.yahoo.com/quote/J69U.SI/profile/

[28]. Department of Statistic. (2022, August 30). Household Sector Balance Sheet (End Of Period). Department of Statistic Singapore. Retrieved September 9, 2022, from https://tablebuilder.singstat.gov.sg/table/TS/M700981

[29]. Lim, C., Tan, F., Goola Warden and Lim Hui Jie, Jie, L. H., Warden, G., Pillai, S., Chan, J., Cher, B., & Tay, V.: Kep-pel DC REIT Latest News (SGX:AJBU): SG investors.io. SG investors.io - Where SG Investors Share (2022, Oc-tober 21). Retrieved October 21, 2022, from https://sginvestors.io/sgx/reit/ajbu-keppel-dc-reit/news-article.