1. Introduction

The global futures market thrives nowadays, but not without risks. The recent event of the China-based Tsingshan Holding Group explicitly reveals such risks.

Founded in 1988, Tsingshan Holding Group is a private enterprise specializing in mining and smelting nickel and producing stainless steel. Nickel is a globally important and strategic metal, especially given that it is the primary raw material to produce lithium-ion batteries for electric vehicles. Consequently, Tsingshan needs to have access to a reliable resource of nickel. To secure nickel supply, Tsingshan invested and opened a nickel mining business in Indonesia in 2009, and 2013. The Morowali Industrial Park, a joint-venture establishment between Tsingshan and its Indonesian partner, was established and became a local hub of nickel processing and stainless-steel production. This movement helped Tsingshan build a complete supply chain in terms of both upstream nickel mining and downstream nickel-based products. As of 2020, Tsingshan already had an 18% global nickel market share.

As the company grew larger, Tsingshan wished to gain more control in the nickel market. However, its Indonesian nickel mining did not earn Tsingshan pricing power over nickel. This was because the nickel produced there does not meet the trading criteria of LME. Tsingshan had nickel only in terms of nickel-iron alloys (10% nickel), high nickel matte (70% nickel) and other intermediate products while LME merely accepts electrolytic nickel (with a nickel content of no less than 99.8%). Despite this, Tsingshan, as the world’s biggest nickel producer and accounting for about one-fifth of the global nickel marke and believed they have bargaining power over nickel, which emboldened it to short nickel [1]. More specifically, Tsingshan made a forecast for 2022 based on its annual nickel output of 600,000 tons in 2021, and it was expected that the output will increase by 40%, with a total of 850,000 tons [2]. In addition, its Indonesian nickel mines produced nickel with costs lower than $10,000 per ton, and reports had it that Tsingshan’s leader would consider shorting nickel whenever prices went over $20,000 per ton [3].

In mid-February, most likely before the Ukrainian War, the benchmark nickel price for LME was at around $23,000 per ton, which stimulated Tsingshan to short 200,000 tons of nickel futures (the exact number was not officially released by Tsingshan, thus we are assuming that the amount shorted is 200,000 tons which were gathered from various reports.) [3]. Because Tsingshan knew that its own nickel does not meet the delivery criteria of LME, they did not intend to make delivery at all and was confident that it could swap nickel from Russia at a lower price for delivery to minimize the loss once the price dropped. Thus, such a price hedge was conducted for the purpose of Tsingshan’s own profitability through the manipulation of ‘volatile’ nickel prices. However, Tsingshan underestimated the situation between Russia and Ukraine. The war caused Europe, The United States as well as other countries to impose sanctions on Russia, limiting the trading of nickel, which caused a sharp drop in the supply of nickel in the market. This cut off the channel for Tsingshan to acquire nickel that meet the delivery criteria and led to the serial rise of nickel prices that broke historical records, putting the nickel giant into a dilemma.

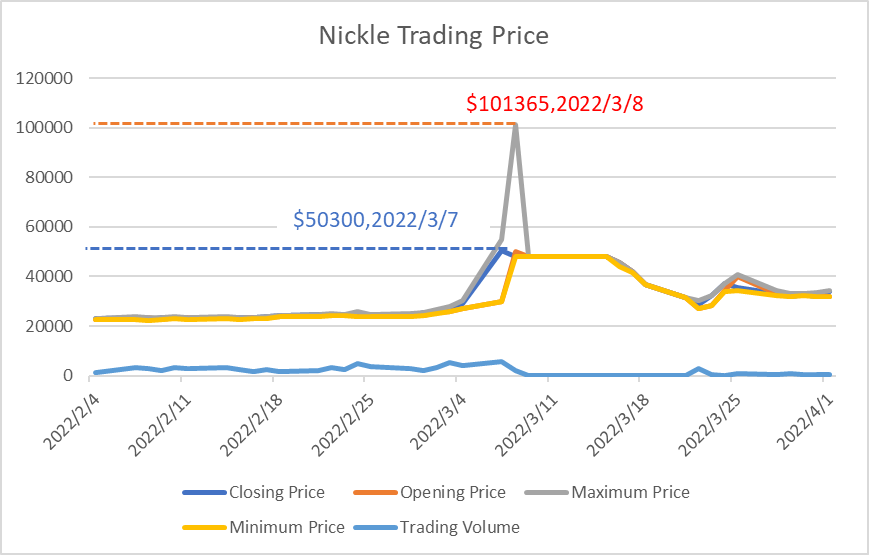

Figure1: Nickel trading price from 4th of February 2022 to 1st of April 2022 represented by Nickel’s closing price, opening price, maximum price, minimum price and trading volume [4].

On March 7, the closing price reached $50,300 per ton, which is represented by the dark blue line in Figure 1. On March 8, the LME nickel futures March contract soared greatly, rising to a record high of $101,365/ton [3]. Merely within two days, the price had witnessed the largest increase of nearly 250%. As a result, the Tsingshan futures account shrunk to -$12 billion, and if Tsingshan failed to cover margin call, they would be forced to close their position. Tsingshan had to either purchase nickel in the market at an unprecedentedly high price to make delivery or to pay liquidated damages-both directions would result in huge losses for Tsingshan.

As it turned out, Tsingshan managed to go through this crisis mainly with the aid of the Chinese government, but this very event was valuable in producing important lessons. Tsingshan’s own shorting decision was doubtlessly the main reason that contributed to the crisis. However, the involvement of the Chinese government, LME, and third-party financial organization such as CCB and JPMorgan in this crisis are crucial, which will be future explored in this paper.

2. LME’s Involvement

2.1. LME’s Involvement

The London Metal Exchange (LME), one of the world's largest metal futures exchanges, suspended nickel trading at noon on March 8, 2022, rolling back prices to the March 7 closing price and cancelling all nickel trading on March 8. In addition, the LME will allow for a delayed delivery period for nickel and said it is working on a mechanism to voluntarily reduce short positions in the market through a "netting out" of large numbers of long and short positions before the reopening. It is also actively planning to reopen the nickel market and will announce this mechanism to the market as soon as possible. There is much speculation as to the reason for the LME's suspension. Some speculate that it may be the reason for China's involvement in the decision of the LME, which was wholly acquired by the Hong Kong Stock Exchange in 2012. This explanation is unconvincing; although the LME was wholly acquired by HKEX, it is still an international exchange in the UK and is still regulated by the FSA in the UK. There is a plausible explanation that the LME decided to save itself.

2.2. The Reason of LME’s Involvement

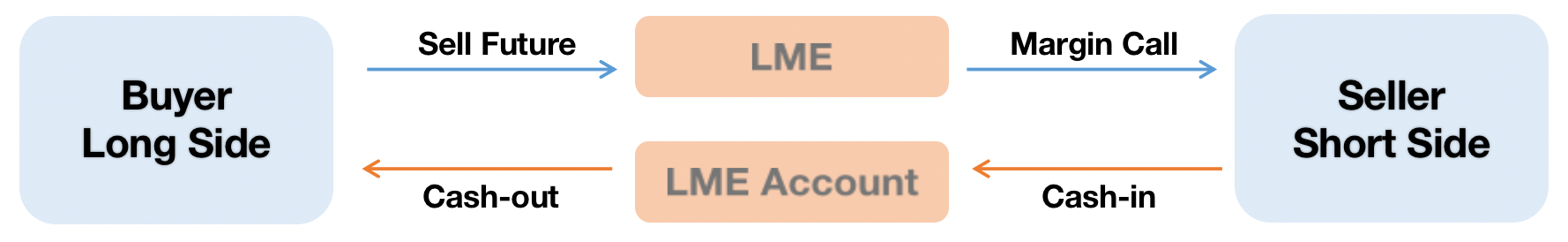

The LME is an exchange and essentially a company. It needs to make a profit and carries the risk of insolvency. The nickel incident exposed the inadequacy of curtain management and risk prevention in the LME market, which did not foresee the volatility in the market following its refusal to accept delivery of the Russian metal. In addition, the LME allows over-the-counter (OTC) trading under its trading rules. OTC transactions are not recorded; thus, it is difficult for the LME to regulate all futures transactions. This makes it difficult for the LME to regulate all transactions. With market changes such as the Russian-Ukrainian war, a short squeeze will be triggered after one side bets heavily on nickel prices. If the LME could have foreseen the situation, stopped nickel trading in advance, and increased traders' margins, this event might not have evolved so severely. A significant rise in the price of nickel futures would result in the long side closing out their nickel futures positions, converting paper gains into cash gains. In contrast, a rise of almost 250% in nickel futures would result in all nickel shorts triggering the margin mechanism and forcing their positions to close. However, such a significant increase makes it difficult to close out positions, and even if all positions on the short side are closed out, the margin cannot be made up. As a result, the LME, as an exchange of both the long side and the short side, faces a huge liquidity crisis. Figure 2 shows the role of the LME, nickel futures buyers and sellers, and the flow of funds when the price of nickel rises.

Figure 2: Trading process.

When the price of nickel futures rises, on the one hand, the short side struggles to cover its margin, and then the LME cannot get equity. On the other hand, the long side sells its futures. Equity decreases on the LME's account. Thus, the LME is only out on the account and loses liquidity. When a sharp increase in the price of nickel futures, the LME is likely to become insolvent and put itself in a default situation, leading to bankruptcy. The nature of the LME's cancellation of the nickel trade was therefore to avoid an exchange default. In short, as there is no way for the exchange to achieve a forced close-out, the exchange needs to cover the profits of the long positions with other funds. On 8 March, the LME lose liquidity on its books, and its account will not be able to support a large cash payment to the long side, leading to a collapse of the LME. As a result, during the March 8 session, the LME called an emergency halt to nickel futures trading.

2.3. The Impact of LME’s Involvement on Tsingshan Holding Group

The LME made a nickel suspension decision in the face of surging nickel futures prices, giving the Tsingshan Holding Group, which was facing devastating losses, a respite. On 7 March, Nickel futures on the LME opened from US$29,770 and surged to an all-time high of US$55,000 during the session, up 88.81% from the previous day's close. On 8 March, Nickel futures on the LME continued to surge overnight trading, breaking through US$100,000 from the US$50,000 barrier, peaking at US$101,365, up by up to 101.52% [3]. The delivery date for Tsingshan Holding Group is on 9 March. If the LME does not make a decision, Tsingshan Holding Group is faced with two options. One is to deliver on 9 March. This option is almost impossible with the LME not accepting Russian nickel. The second is to cover the margin. But facing a loss of over 10 billion, the Tsingshan Holding Group cannot afford it. Instead, the LME announced the suspension of nickel futures trading and the cancellation of all trading on 8 March local time. All trades on the 8th of March were nullified, on the day trading resumed, the rate of increase or decrease was based on the closing price on 7 March. In addition, the LME allows for late delivery of nickel. The former cancelled a $4 billion deal for Castle Hill Group. At the same time, the latter also allows Tsingshan Holding Group to be ready for delivery.

2.4. The Impact of LME’s Involvement on Other Groups

The LME's decision to suspend trading has also had an impact on multiple sides of the trading floor. The short side, represented by the Tsingshan Holding Group, was unable to close after the initial margin was lost as prices soared, leaving them in a position where they were at the mercy of many sides. This would result in a large number of brokers with clients holding nickel futures suffering a huge blow or bankruptcy. Suspensions allow the short side to avoid bankruptcy due to forced liquidation of positions due to strong price movements. Additionally, if the price of nickel is allowed to rise, it can lead to a chain of problems in subsequent trades, reducing the expectation of market stability. If the trader is also a producer, as in the case of the Tsingshan Holding Group, it would, in turn, be detrimental to stabilising the nickel price, which could lead to systemic risk. As the world's largest non-ferrous metals exchange, LME's mental future prices and mental stocks significantly impact global production and sales of non-ferrous metals. The result of non-intervention in nickel futures could be the collapse of the entire world metal chain. The LME's suspension, therefore, not only preserves the short side, represented by Tsingshan Holding Group, the brokers and itself but also protects the health of the nickel and non-ferrous metals markets.

On the contrary, the suspension of the LME's trading has to some extent harmed the long side of nickel futures, for which the LME has also been sued. US hedge fund Elliott Management sued the London Metal Exchange for over $456 million [5]. In addition, Jane Street, a US trading company, has also filed a lawsuit against the LME, Jane Street said, “Exchanges function to create an orderly market and a level playing field for investors. The LME’s arbitrary decision to cancel nickel trades during a period of heightened volatility severely undermines the integrity of the markets and sets a dangerous precedent that calls future contracts into question” [6].

3. Tsingshan’s Survival

3.1. Margin Call

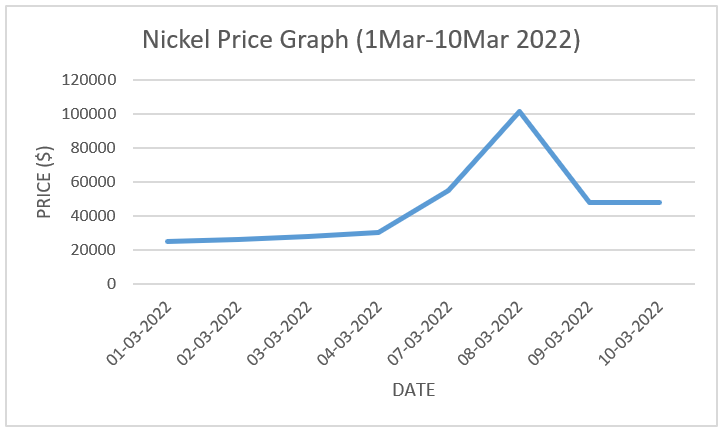

Figure 3: Nickel price graph from 1st March 2022 to 10th March 2022 [4].

The graph could be organized using a table represented below (bid price):

Table.1: Nickel price graph in Figure 3 translated.

Date | 1-Mar | 2-Mar | 3-Mar | 4-Mar | 7-Mar | 8-Mar | 9-Mar | 10-Mar |

Price | 25,400 | 26,505 | 27,970 | 30,295 | 55,000 | 101,365 | 48,063 | 48,048 |

Since we are assuming that the total amount of nickel shorted is 200,000 at roughly $20,000 per ton, we can use the above data to calculate margin calls.

\( March 1=(25.4-20)×200,000,000=$1.08 billion \)

\( March 2=(26.505-20)×200,000,000=$1.301 billion \)

\( March 3=(27.970-20)×200,000,000=$1.594 billion \)

\( March 4=(30.295-20)× 200,000,000=$2.059 billion \)

\( March 7=(55-20)×200,000,000=$7 billion \)

\( March 8=(101.365-20)×200,000,000=$16.273 billion \)

\( March 9=(48.063-20)×200,000,000=$5.6126 billion \)

\( March 10=(48.048-20)200,000,000=$5.6096 billion \)

As shown in figure 3 and the translated data in table 1, we can notice that on March 8th, nickel prices peaked at 101,365 dollars per ton which left Tsingshan with a margin call of 16.273 billion dollars to pay. We can sum up the total number of margin calls from March 1st 2022 to March 10th 2022 to around 40.5292 billion dollars. The tremendous amount of margin calls leaves Tsingshan in a difficult state, as they cannot pay their margin call which will inevitably lead to bankruptcy. However, they were saved by their vital stakeholders- China Construction Bank Corp, JP Morgan Chase & Co and most important the Chinese government.

3.2. Tsingshan’s Stakeholders

China Construction Bank Corp (CCB) - Tsingshan’s broker played a vital role in the company, where their short positions on the LME along with a sudden spike in nickel prices had left Tsingshan with hundreds of millions of dollars in margin calls which they had failed to pay. As a result, they had put CCB ‘in a bind’, where the bank had to make hefty margin calls on their own to cover the short position on the LME the following morning. As, if Tsingshan had decided to ‘walk away from its commitments’ CCB could lose billions of dollars [7]. The LME had also helped Tsingshan by providing additional time for a unit of China Construction Bank Corp- CCBI Global Markets so that they could pay the large sum of margin calls.

JPMorgan Chase & Co is the largest counterparty of the Tsingshan’s nickel ‘big short’, and had been caught in an “unprecedented short squeeze, putting the bank at the centre of one of the most dramatic moments in metals market history.” [8]. Quoting unnamed sources from a report by Bloomberg, 50,000 tonnes of Tsingshan’s total nickel short position of more than 150,000 tonnes is held through an over-the-counter position with JPMorgan. It is important to note that the over-the-counter position with JP Morgan meant that nickel trading did not occur on the LME but via the broker-dealer network. This meant that the LME had limited knowledge of Tsingshan’s nickel trading with JP Morgan, as some of Tsingshan’s nickel contracts were not directly on the LME [9]. According to LME, they expected their members such as JPMorgan to disclose details on OTC positions notwithstanding contractual confidentiality clauses, but that in countries where by law they were prevented from revealing identifying information about their clients, they could report client positions in anonymized form [9].

“Based on Tsingshan’s OTC position with JP Morgan, the tycoon’s company would have owed JPMorgan about 1 billion USD in margin on Monday. The nickel producer has been struggling to pay margin calls to its banks and brokers.” [10]. Because of this, JPMorgan has provided Tsingshan with credit promises so that they could avoid defaulting on its margin calls [10].

3.3. Beijing’s Role

Beijing is exploring a plan to rescue one of the world’s top nickel producers-Tsingshan Holding Group from billions of dollars of potential losses. Due to their inability to meet margin calls, one option under consideration is for Tsingshan to swap some of the lower-grade nickel pig iron (NPI) it produces which does not meet the LME’s quality standards for refined metal held in China’s State Reserves Bureau. According to two analysts, China is estimated to hold around 100,000 tonnes of nickel in state stocks [11]. Tsingshan could then deliver the high-grade metal against its contract on the LME, pay off its brokers and close its lossmaking position [10].

A large reason behind why Beijing needs Tsingshan to ‘stay alive’, is their role as a ‘poster child’ in Southeast Asia for China’s Belt and Road Initiative, President Xi Jinping's vast infrastructure programme [11]. According to Tsingshan Holding group, they recognize that they have actively implemented “the Belt and Road Initiative,” by “accelerating the development of international strategy, building large industrial parks in Indonesia, India, Zimbabwe and other countries, and deploying in the field of green new energy, thus marching into the ternary materials, power batteries and other relevant industries.” [12].

4. Evaluation

4.1. Tsingshan’s Risks

Prior to the increase in nickel prices, Tsingshan Holdings Group had already made a short sale in the LME and had also committed to purchasing 200,000 tons of spot nickel, along with holding OTC positions with JPMorgan. Because Tsingshan did not intend to make delivery at all and were confident that it could swap nickel from Russia at a lower price, they were unable to deliver the nickel on schedule. As a result, the main trading risks that Tsingshan faced were: first, his inability to pay attention to the unique circumstances surrounding the Russian-Ukrainian war and the possibility that it might suddenly disrupt the market's total supply. Second, is the danger of rivalry from other businesses. Third, is the potential for late delivery as a result of international disputes.

Looking back on this incident, there were undoubtedly explanations for why the LME did not update the exchange rules promptly in response to changes in economic development and shorting by foreign capital using the exchange rules. Despite this, the Tsingshan Holdings Group’s weaknesses in areas such as hedging risk control, trading strategy, liquidity management, and market acuity were all large enough risks which led to their eventual downfall.

4.2. Tsingshan’s Future

The losses from the aforementioned events may have harmed Tsingshan Holdings Group's possible investment in the nickel battery sector in the future, which could have the following negative effects. First, because the company is an industry leader or benchmark, its capital chain is impacted, which could lead to new competition and changes in the sector. Second, the production costs of upstream and downstream industries will be impacted by nickel raw materials as important raw materials for lithium batteries and nickel batteries. Price increases will cause the production costs of the key demand side to increase, which will result in price increases for many industries' key raw materials. Short-term price hikes may also result in phenomena like a shortage of raw materials, which could have an impact on how efficiently some businesses, like new energy cars, produce their products. Third, Tsingshan Holdings Group, one of China's major foreign metal trading corporations, might harm the reputation of other Chinese businesses, which would also affect the credibility of the company.

In the future for Tsingshan Holdings Group, the strategies that can be adopted are as follows: First, rationalize trading strategies to manage risk. Second, manage liquidity well to prevent delivery risk and ensure liquidity. For small varieties of commodities, ensure that there are sufficient spot sources for delivery and prevent the delivery risk under the short-selling scenario. Third, conduct adequate research on counterparties, and comprehensively collect and grasp information on all aspects of politics, economy, market inventory, and counterparties related to derivatives trading globally. Study in depth the rules of relevant derivatives exchanges, pay attention to rule changes, have a full understanding of possible loopholes in the rules that may be exploited, and make contingency plans for emergencies.

5. Conclusion

The essay is aimed to point out Tsingshan’s main risks by analyzing the whole case thoroughly. Meanwhile, the paper is devoted to providing practical advice on developing new strategies to avoid similar losses for both Tsingshan and other speculators in the market. To make it logical, the nickel incident was recalled from the perspective of three main subjects: Tsingshan Holding, LME and parties who came to Tsingshan’s rescue (JP Morgan, China Construction Bank Corp and China government), and the corresponding countermeasures and the underlying interest relationship has been discussed. LME suspended nickel trading to save itself. China Construction Bank Corp, Tsingshan’s broker, had to deal with huge margin calls on their own to cover the short position. JP Morgan provided Tsingshan with credit promises because of its unwillingness to see Tsingshan default on its margin calls. Beijing’s salvage of Tsingshan largely depended on its important role in China’s Belt and Road Initiative.

The crisis reveals underlying risks in both the regulation of LME and the management of large international companies like Tsingshan group. LME possesses enough tools to acquire information regarding over-the-counter trading related to nickel, but it did not exert such tools, which allowed nickel OTC trading to be kept invisible and nickel prices to keep climbing up to an irrational extent. In this sense, this crisis exposes LME’s insufficient regulation of OTC metal trading. LME needs to both more effectively exert tools rendered under the current rulebook and to come up with new measures to increase transparency in each aspect of metal trading. This should be prioritized in its future work to better fulfil its role in maintaining the market order. In the meanwhile, Tsingshan’s poor management of liquidity risks is another major issue that is exposed by the crisis. Given that physical resources are limited, there is always a possibility that prices will be distorted because of excessive capital chasing. This means that by controlling the flow of physical resources one could manipulate futures prices, which is indeed what is happening in the crisis. In its bold shorting decision, Tsingshan makes itself vulnerable to such manipulation and puts itself at risk. In the future, Tsingshan must learn from this crisis and pay more attention to managing liquidity. Lastly, bold speculative action as that of Tsingshan in this crisis is an existing issue that lies the seed of crisis in the futures market. Hedging is frequently used as a strategy to maintain the value of products. While rational hedging is encouraged, excessive hedging is speculation and brings risks. Noting that Tsingshan’s productive capacity of nickel that meets the trading criteria of LME is limited, Tsingshan may engage in speculation. The futures market still needs more regulations that prevent speculation and reduce risks generated by speculation.

Acknowledgement

The completion of this paper would not be possible without the guidance of Professor Martin Cherkes. We would also like to thank Ms ZiYun for her assistance.

References

[1]. Sanderson, H. (2022). Nickel drama highlights Tsingshan’s role in energy transition. China Dialogue. https://chinadialogue.net/en/business/nickel-drama-highlights-tsingshans-role-in-energy-transition/.

[2]. SINA Historical nickel futures trading price. https://vip.stock.finance.sina.com.cn/q/view/vFutures_History.php?jys=LME&pz=NID&hy=&breed=NID&type=global&start=2022-02-01&end=2022-04-01

[3]. Bloomberg, Bloomberg News |. “Analysis | Who Is the 'Big Shot' behind Nickel's Bad Short?” The Washington Post, WP Company, 12 Mar. 2022, https://www.washingtonpost.com/business/who-is-the-big-shot-behind-nickels-bad-short/2022/03/11/d04263bc-a147-11ec-9438-255709b6cddc_story.html.

[4]. SINA. London Nickel CFD (NID) Transaction History, 2022. https://vip.stock.finance.sina.com.cn/q/view/vFutures_Positions_hyjgd.php?t_shortname=%D3%C0%B0%B2%C6%DA%BB%F5.

[5]. Langley, William. “LME Hit by $450MN Lawsuit from Elliott Management Over Nickel Market Chaos.” Subscribe to Read | Financial Times, Financial Times, 6 June 2022, https://www.ft.com/content/f032093b-dc47-403e-9c9d-f2a3615dd6bf.

[6]. Langley, William. “US Trading Firm Jane Street Sues LME for Nickel Trade Chaos.” Subscribe to Read |Financial Times, Financial Times, 7 June 2022, https://www.ft.com/content/cb646552-04c5-4ecf-a720-7521228e2a6c.

[7]. Farchy, Jack. “Tycoon Shorting Nickel Reaches Deal to Avoid Further Margin Calls.” Bloomberg.com, Bloomberg, 14 Mar. 2022, https://www.bloomberg.com/news/articles/2022-03-14/nickel-s-big-short-reaches-deal-to-avoid-further-margin-calls.

[8]. Farchy, Jack, and Alfred Cang. “JPMorgan (JPM) Is Biggest Counterparty for Nickel Tycoon Guangda's Short Bets.” Bloomberg.com, Bloomberg, 11 Mar. 2022, https://www.bloomberg.com/news/articles/2022-03-11/jpmorgan-is-biggest-counterparty-for-nickel-tycoon-s-short-bets.

[9]. Farchy, Jack. “LME Will Force Disclosure of OTC Trades after Nickel Chaos.” Bloomberg.com, Bloomberg, 17 June 2022, https://www.bloomberg.com/news/articles/2022-06-17/lme-will-force-disclosure-of-otc-trades-after-nickel-chaos.

[10]. Maley, Karen. “Tsingshan Debacle Exposes Weak Underbelly of LME.” Australian Financial Review, 13 Mar. 2022, https://www.afr.com/companies/financial-services/tsingshan-debacle-exposes-weak-underbelly-of-lme-20220313-p5a47b.

[11]. Menon, Praveen, et al. “Chinese Tycoon's 'Big Short' on Nickel Trips up Tsingshan's Miracle Growth.” Reuters, Thomson Reuters, 13 Mar. 2022, https://www.reuters.com/article/lme-nickel-tsingshan-focus-idTRNIKCN2LA0LL.

[12]. Tsingshan Holding Group Co. “Tsingshan Became a Newcomer of the Fortune 500: Tsingshan Holding Group.” TSINGSHAN Became a Newcomer of the Fortune 500 | TSINGSHAN HOLDING GROUP, https://www.tssgroup.com.cn/en/tsingshan-became-a-newcomer-of-the-fortune-500/.

Cite this article

Wang,G.;Zhao,H.;Zhang,Z.;Wu,S. (2023). An analysis of Tsingshan Holding Group Co’s Big Short Position on Nickel Futures. Advances in Economics, Management and Political Sciences,17,324-332.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sanderson, H. (2022). Nickel drama highlights Tsingshan’s role in energy transition. China Dialogue. https://chinadialogue.net/en/business/nickel-drama-highlights-tsingshans-role-in-energy-transition/.

[2]. SINA Historical nickel futures trading price. https://vip.stock.finance.sina.com.cn/q/view/vFutures_History.php?jys=LME&pz=NID&hy=&breed=NID&type=global&start=2022-02-01&end=2022-04-01

[3]. Bloomberg, Bloomberg News |. “Analysis | Who Is the 'Big Shot' behind Nickel's Bad Short?” The Washington Post, WP Company, 12 Mar. 2022, https://www.washingtonpost.com/business/who-is-the-big-shot-behind-nickels-bad-short/2022/03/11/d04263bc-a147-11ec-9438-255709b6cddc_story.html.

[4]. SINA. London Nickel CFD (NID) Transaction History, 2022. https://vip.stock.finance.sina.com.cn/q/view/vFutures_Positions_hyjgd.php?t_shortname=%D3%C0%B0%B2%C6%DA%BB%F5.

[5]. Langley, William. “LME Hit by $450MN Lawsuit from Elliott Management Over Nickel Market Chaos.” Subscribe to Read | Financial Times, Financial Times, 6 June 2022, https://www.ft.com/content/f032093b-dc47-403e-9c9d-f2a3615dd6bf.

[6]. Langley, William. “US Trading Firm Jane Street Sues LME for Nickel Trade Chaos.” Subscribe to Read |Financial Times, Financial Times, 7 June 2022, https://www.ft.com/content/cb646552-04c5-4ecf-a720-7521228e2a6c.

[7]. Farchy, Jack. “Tycoon Shorting Nickel Reaches Deal to Avoid Further Margin Calls.” Bloomberg.com, Bloomberg, 14 Mar. 2022, https://www.bloomberg.com/news/articles/2022-03-14/nickel-s-big-short-reaches-deal-to-avoid-further-margin-calls.

[8]. Farchy, Jack, and Alfred Cang. “JPMorgan (JPM) Is Biggest Counterparty for Nickel Tycoon Guangda's Short Bets.” Bloomberg.com, Bloomberg, 11 Mar. 2022, https://www.bloomberg.com/news/articles/2022-03-11/jpmorgan-is-biggest-counterparty-for-nickel-tycoon-s-short-bets.

[9]. Farchy, Jack. “LME Will Force Disclosure of OTC Trades after Nickel Chaos.” Bloomberg.com, Bloomberg, 17 June 2022, https://www.bloomberg.com/news/articles/2022-06-17/lme-will-force-disclosure-of-otc-trades-after-nickel-chaos.

[10]. Maley, Karen. “Tsingshan Debacle Exposes Weak Underbelly of LME.” Australian Financial Review, 13 Mar. 2022, https://www.afr.com/companies/financial-services/tsingshan-debacle-exposes-weak-underbelly-of-lme-20220313-p5a47b.

[11]. Menon, Praveen, et al. “Chinese Tycoon's 'Big Short' on Nickel Trips up Tsingshan's Miracle Growth.” Reuters, Thomson Reuters, 13 Mar. 2022, https://www.reuters.com/article/lme-nickel-tsingshan-focus-idTRNIKCN2LA0LL.

[12]. Tsingshan Holding Group Co. “Tsingshan Became a Newcomer of the Fortune 500: Tsingshan Holding Group.” TSINGSHAN Became a Newcomer of the Fortune 500 | TSINGSHAN HOLDING GROUP, https://www.tssgroup.com.cn/en/tsingshan-became-a-newcomer-of-the-fortune-500/.