1. Introduction

In 2006, the Accounting Standards for Business Enterprises clearly defined the concept of investment real estate for the first time, which can be divided into fixed assets, intangible assets, and investment real estate according to different purposes of use in housing and land use rights. The leased land use right, the house sold after appreciation and the land use right that will generate income for the enterprise shall be accounted separately as the investment real estate in the asset account. At the same time, the accounting standards give a choice for the measurement mode of investment real estate [1]. The enterprise can judge whether it meets the requirements of the accounting standards according to the actual situation. When it meets the requirements, it can choose the fair value mode, not just the cost mode. The introduction of fair value measurement can better reflect the real value of investment real estate, improve the relevance of accounting information, and make China's accounting standards in line with international standards. In 2014, the fair value measurement standards began to be implemented, making up for the standard gaps in fair value measurement in China. However, most enterprises in China still choose the cost model to measure investment real estate. The purpose of introducing the fair value measurement model in China is to enable listed companies to provide more relevant and comparable accounting information, but the true application of the fair value measurement model in China deviates from it. Fair value is a new model for measuring asset value in the development of market economy. There is both room for asset appreciation and possibility of asset impairment. In the case of fluctuations in the market value of real estate, the adoption of fair value measurement does not require annual depreciation and amortization, which is more in line with the requirements of accounting relevance and consistency, and more comprehensively reflects the assets and liabilities of the enterprise and the overall income. Therefore, it is of great practical significance to study the application of fair value measurement to investment real estate in the new stage [2].

2. Key Concepts

2.1. Fair Value

Fair value refers to the price received by market participants from selling an asset or paid for transferring a liability in an orderly transaction on the measurement date. Generally, the fair value is evaluated by a third-party asset evaluation agency in actual use [3]. The application scope of fair value in China is stricter than that in international accounting standards, and can only be applied when the following two conditions are met. First, there is an active trading market; Secondly, enterprises can obtain prices in asset related trading markets. When using the fair value model to measure investment real estate, it is necessary to comprehensively consider the enterprise's own situation and market conditions. For example, the use of the fair value model will increase the profit and tax burden of the enterprise. The standard requires that the enterprise choose by itself rather than force. When enterprises use fair value for accounting treatment, they have higher requirements for the quality of accounting information, and then select the corresponding valuation technology according to the actual situation to make the fair value of the measured object accurate. When selecting valuation techniques, consideration should be given to both the enterprise's own conditions and external conditions, including the enterprise's asset liability structure and market situation. An enterprise shall consider the rationality of various valuation techniques, and select the valuation techniques that can most accurately evaluate the fair value of the relevant assets to measure the fair value. Common methods include market method, cost method and income method [4].

2.2. Investment Real Estate

In order to obtain economic benefits, the houses and land use rights leased or transferred by enterprises are investment real estate. Investment in real estate mainly includes leased land use right, land use right held and transferred for appreciation and leased houses. Specifically, it can be divided into three types: leased buildings, leased land use rights, and land use rights held for transfer after appreciation. Investment real estate includes buildings that have property rights and are leased by means of operating lease. The key to identify whether a building belongs to investment real estate is whether the building has property rights. If the land use right is subleased to other listed companies by operating lease, it cannot be regarded as investment real estate. A listed company leasing shall provide appropriate assistance services to the lessee according to the agreement reached. If the service is not critical in the contract, it will be recorded as investment real estate; If the service is critical, it cannot be regarded as investment real estate, that is, service provision is regarded as a key business mode. Some of the real estate is for the purpose of obtaining rent or increasing capital value, while others are for the purpose of producing goods, operating management, or providing corresponding labour services. Those that can be appraised and sold separately for the purpose of obtaining rent or increasing capital value shall be deemed as investment real estate; The investment real estate that cannot be separately appraised and sold for the purpose of obtaining rent or increasing capital value cannot be defined as investment real estate [5].

3. Current Situation of Fair Value Measurement of Investment Real Estate

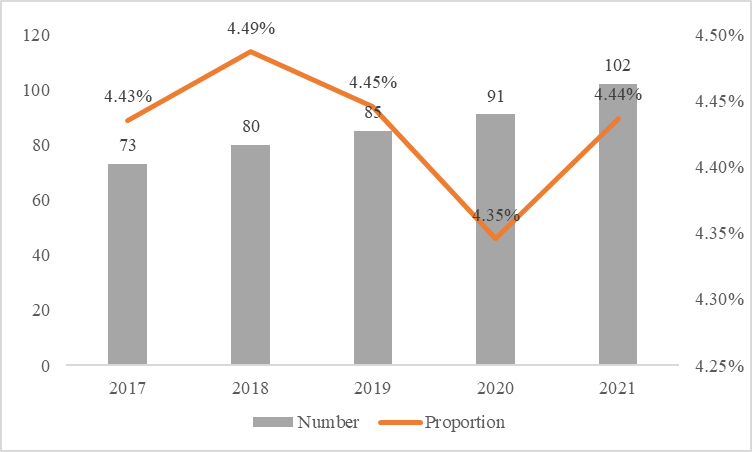

Table 1 shows the listed companies with investment real estate industry and enterprises measured at fair value from 2017 to 2021. Figure 1 shows the contents of Table 1 visually. From Table 1 and Figure 1, we can see that the number of listed companies in China will increase from 3494 to 4630 from 2017 to 2021, with a very fast growth rate. The number of investment real estate owned by listed companies has increased significantly from 1646 to 2299 in the past five years, but the number of investment real estate measured by fair value in listed companies has only increased by 29 in the past five years, and the increase is also very slow year by year. As can be seen from the above figure, the proportion of investment real estate in listed companies has increased slightly year by year from 2017 to 2021; It can be seen from the proportion of fair value in investment real estate that there is a trend of gradual recovery. Although there is fluctuation, the fluctuation range is small. Fair value measurement has been rising in listed companies. It can be seen from the above table that although all the proportions seem to be rising, the proportion of enterprises using the fair value measurement model is still very low, and most enterprises still use the cost model. According to the above analysis, although enterprises tend to invest in investment real estate in recent years, the number of enterprises using the fair value model to measure investment real estate is still small. Although more and more listed companies gradually turn their investment direction to investment real estate, which increases the number of listed companies that own investment real estate, the listed companies that adopt fair value measurement of investment real estate grow slowly.

Table 1: Current situation of fair value measurement of investment real estate.

Year | Listed company number in Chinese A stock market | Companies owning investment real estate | Companies measured by fair value | ||

Number | Proportion | Number | Proportion | ||

2017 | 3494 | 1646 | 47.1% | 73 | 4.43% |

2018 | 3587 | 1783 | 49.7% | 80 | 4.49% |

2019 | 3793 | 1912 | 50.4% | 85 | 4.45% |

2020 | 4241 | 2094 | 49.4% | 91 | 4.35% |

2021 | 4630 | 2299 | 49.7% | 102 | 4.44% |

Figure 1: Number and proportion of companies measured by fair value in the companies owning investment real estate (figure credit: original).

4. Reasons for Limiting the Use of Fair Value Measurement Model

4.1. Strict Requirements

Although China is a powerful economy in the forefront of the global economy, the emerging market has yet to mature, so it does not have a certain degree of market activity [6]. In order to avoid the occurrence of financial fraud and other events using fair value when formulating the standards, strict restrictions are proposed to avoid this risk. The real estate market in the place where the investment real estate owned by the enterprise is located should be very active to ensure that the real estate held by the enterprise can be traded and circulated with high quality and speed. We can obtain market related information of real estate with similar conditions in this active market to ensure that the fair value of its investment real estate is reliable, effective, true, and fair. The so-called "similar real estate" refers to that the geographical location of the real estate should be similar, and the availability of the real estate, including depreciation and structure type, should be similar. However, considering the current market situation in China, the real estate market meeting the above standards is very limited. A series of unsolvable problems, such as how to obtain the accurate valuation of real estate in this imperfect market, how to establish a perfect and active trading market, and how to find reliable information about similar real estate, are the most critical factors that cause most enterprises, especially listed companies, to be reluctant to adopt the fair value measurement of investment real estate.

4.2. Impact on Return on Net Assets

Some operating ratios related to the enterprise will also be greatly affected by the fair value. When using the new accounting system, the difference between the fair value of the investment real estate and the book value of the investment real estate should be included in the capital reserve, that is, the original value-added amount should be included in the profits, so the net assets and total assets of the enterprise will increase accordingly, the ROE of the enterprise will decrease, and the ROE growth rate will also decrease. However, in the current market, the ROE of enterprises is an important standard to show the strength of enterprises and assess the management ability of managers. The use of fair value measurement model to measure investment real estate will enlarge the fluctuation range of net profit and owner's equity. When the real estate used by oneself is transferred to the investment real estate, the change in the fair value will increase, which will have a greater impact on the owner's equity in this accounting period. If the real estate market situation is good, the real estate price will rise more, and the appreciation of the fair value will rise with it, so the profits of the enterprise will also increase. However, if the real estate market is not in good condition, and there is little room for house prices to rise or even there may be a decline, then the reduction of fair value will also lead to a decline in the enterprise's profit indicators, which will affect the enterprise's ROE and other data [7].

4.3. Inaccurate Valuation

The accounting standards point out that the listed company's investment real estate should meet the following requirements when it is measured in the fair value mode: the trading market atmosphere where the enterprise's investment real estate is located is good [8]. The real market price and some other information can be obtained from the real estate market, thus making the fair value valuation of investment real estate more reasonable and real. However, China has a vast territory, and there are significant differences in the development of the market economy environment in different regions. At the same time, the prices of real estate are also different. This poses a greater challenge for enterprises to determine the fair value of investment real estate. The Standards do not mandatorily stipulate the ways and means of obtaining the fair value of enterprises. In practical application, the fair value is mainly determined by market price method, reference to similar or similar projects and valuation method. One mode is to obtain the corresponding fair value data according to the investigation of professional evaluation institutions. This mode means that listed companies shall be subject to the data obtained by professional evaluation institutions, and the appraisers must obtain relevant national professional certificates. In the process of evaluation, relevant regulations shall be followed without violating the principle. This approach is the main method of fair value valuation, because the data obtained through this approach is recognized by information users and has high authority and accuracy [9].

4.4. Imperfect System Criteria

At present, the relevant supervision mechanism of the fair value measurement model in China is not complete, and the corresponding rules and regulations and punishment system are also not perfect, which makes it easier for enterprises to reduce the cost of violations to drill loopholes. Some listed companies use relevant standards to whitewash their statements and forge relevant earnings information of companies. According to the current relevant accounting standards, listed companies of investment real estate can decide which measurement model to use independently. When they choose the fair value model for measurement, listed companies also have the right to choose which valuation techniques to use and which methods to use to obtain the fair value. China lacks a platform to summarize official real estate market information and release relevant data. It is difficult for regulators to verify whether its fair value is the same as the market price at that time. This creates an opportunity for listed companies to manipulate them, so that managers can achieve the purpose of fraud by changing corporate profits.

5. Suggestions of Fair Value Measurement of Investment Real Estate

5.1. Improve Real Estate Trading Platform

As a high-yield and high-risk industry, the real estate industry is easily affected by the market environment, policies and regulations issued by the government and other factors. The real estate market has strong regional characteristics. Once the regional market environment conditions change, the price of the real estate industry will inevitably fluctuate. As we all know, a perfect and standardized market environment is the guarantee for the use of fair value. However, in consideration of China's national conditions, the football like economic structure and the unbalanced economic development status quo make the economic differences between the central, eastern, and western regions too large. The permanent population is mainly concentrated in the third and fourth tier cities with opaque and immature markets. It is not easy to obtain the fair value of real estate. If the fair value measurement is different from the traditional cost method, this method increases the external risk impact. A complete real estate transaction network system shall be established by relevant departments and professional intermediate evaluation institutions to collect transaction information, handle formalities, provide management services and supervise. We will work with real estate intermediaries to create a nationwide real estate information network trading platform, which is like the stock trading market, and will open trading information, trading volume, trading price, etc. on the same day. Senior experts can make authoritative price predictions based on the real estate price trend. It will be more authoritative to use such a platform to be dominated by the government [10]. At the same time, government departments can also grasp the market dynamics at any time, comprehensively control the market, and promote the application of fair value in the real estate market.

5.2. Reduce Enterprise Tax Appropriately

Compared with the cost model, the fair value measurement model has higher requirements, but the accounting measurement model is relatively simple. Neither impairment nor depreciation is considered in accounting measurement. In this way, retroactive adjustment is required when accounting changes. Through the change of the company's measurement model, we can see that retroactive adjustment increases corporate income tax, virtually increasing corporate tax burden. In addition, the real estate industry itself is a high-risk and high-yield industry. Once the measurement mode is changed, if the market is unstable and the profit fluctuates significantly, the risk will increase accordingly [11]. No matter what kind of measurement mode an enterprise adopts, the tax base of investment real estate in tax treatment should be the cost obtained at the beginning, and the tax base will not increase with the increase of the price of investment real estate in the holding period. During the period when the company holds investment real estate, the state's provision that the increase in its fair value is not taxed reduces the outflow of capital and makes the capital relatively balanced. Therefore, it is suggested that the government and the national tax department can appropriately reduce the tax burden, encourage the transformation of the measurement model of real estate enterprises, and promote the development of fair value measurement in China based on the lending policy for the real estate industry.

5.3. Standardize Information Disclosure

The normative application of fair value is also one of the main purposes of CAS39 launched by the Ministry of Finance. However, as far as the present situation is concerned, there is no clear requirement on the content, method, and principle of information disclosure of investment real estate in China. The detailed and standardized disclosure of financial data is conducive to protecting the interests of stakeholders, and can also reduce the control of corporate executives on economic interests in order to achieve personal performance. Although the Company has separately disclosed the main accounting indicators and financial data brought about by its subsequent measurement mode change in the notes to the annual report, it has not explained the disclosure process and reasons. After reviewing the Company's annual report, the fair value measurement of the Company's investment real estate is only a disclosure of valuation techniques. The Company shall make supplementary disclosure. In combination with the changes in the land market price and the real estate market price in recent years, explain whether the changes in the fair value of the company in recent years and the growth rate are reasonable. Explain whether the rapid growth of the company's profits is sustainable, and carry out risk warning and control. Disclose the evaluation institution, evidence source, evaluation model, input value source and the basis for each method, and the specific determination process; This can make the determination of fair value more reasonable and transparent, and make the financial data more scientific, standardized, and reliable [12].

5.4. Optimize the Rules and Regulations

The real estate industry, as one of the important pillars of China's economy, is accompanied by the continuous improvement of per capita income and the rapid development of urbanization, as well as the new residential demand of the population due to the national promotion of the two-child policy. It is the source power for the rapid development of China's real estate market. At the same time, in order to promote the steady and healthy development of the real estate industry, in recent years, the country has adjusted the real estate industry policy in a timely manner according to the changes in the market environment. As a fair value measurement model, it should also be constantly improved in the investment real estate. By consulting the CAS3 standard, we can see that the standard is not rigorous. The standard has shortcomings in the degree of activity of the real estate market environment: there is no specific division of the degree of activity of the real estate market, which allows enterprises to exploit loopholes and artificially adjust the level division. It is suggested that the determination method of fair value should be classified and unified. To strengthen market supervision, we should constantly improve the standards for fair value measurement and relevant systems, and suggest further improvement of the standards. In China, there is no two-way conversion between the two measurement models in the real estate industry. Once the real estate industry is converted to the fair value measurement model, it cannot be reversed. It is suggested that CAS3 allow the two measurement models to be converted to each other in the future, so that China's accounting standards can be in line with international standards. This is also an effective way to relax policies and encourage enterprises to convert to the fair value measurement model.

6. Conclusion

This paper combs the relevant theories of fair value and investment real estate, explores the use of the fair value measurement model of investment real estate, and puts forward suggestions, mainly including Improving the real estate trading platform, reducing enterprise tax appropriately, standardizing information disclosure and optimizing the rules and regulations, to better promote the fair value model. Applying the fair value measurement model to investment real estate not only meets the development requirements of the market, but also helps enterprises to reasonably record the actual situation of their own assets. At this stage, China still has some shortcomings in choosing the fair value model to measure the investment real estate, and there are many areas that need to be improved. There are still many problems in its specific application, but the society is progressing and the market is changing. By strengthening the management of relevant institutions, enterprises should strengthen management according to the actual situation, so that the fair value can be well applied in investment real estate and gradually improved, making more contributions to the development of China's real estate industry.

References

[1]. Fei L, Wang H, Chen L, et al. A new vector valued similarity measure for intuitionistic fuzzy sets based on OWA operators[J]. Iranian Journal of Fuzzy Systems, 2019, 16(3): 113-126.

[2]. Glover S M, Taylor M H, Wu Y J, et al. Mind the gap: Why do experts have differences of opinion regarding the sufficiency of audit evidence supporting complex fair value measurements?[J]. Contemporary Accounting Research, 2019, 36(3): 1417-1460.

[3]. Pupentsova S, Livintsova M. Qualimetric assessment of investment attractiveness of the real estate property[J]. Real Estate Management and Valuation, 2018, 26(2): 5-11.

[4]. Waldron R. Capitalizing on the state: The political economy of real estate investment trusts and the ‘resolution’of the crisis[J]. Geoforum, 2018, 90(11): 206-218.

[5]. Tsou W L, Sun C Y. Consumers’ choice between real estate investment and consumption: A case study in taiwan[J]. Sustainability, 2021, 13(21): 11607.

[6]. Triani N, Tarmidi D. Firm value: impact of investment decisions, funding decisions and dividend policies[J]. International Journal of Academic Research in Accounting, Finance and Management Sciences, 2019, 9(2): 158-163.

[7]. Sanfelici D, Halbert L. Financial market actors as urban policy-makers: the case of real estate investment trusts in Brazil[J]. Urban Geography, 2019, 40(1): 83-103.

[8]. Fan J, Zhou L. Impact of urbanization and real estate investment on carbon emissions: Evidence from China's provincial regions[J]. Journal of cleaner production, 2019, 209(1): 309-323.

[9]. Pires A S C, Ferreira F A F, Jalali M S, et al. Barriers to real estate investments for residential rental purposes: mapping out the problem[J]. International Journal of Strategic Property Management, 2018, 22(3): 168-178.

[10]. Aalbers M B. Financial geography II: Financial geographies of housing and real estate[J]. Progress in Human Geography, 2019, 43(2): 376-387.

[11]. Zhang D, Cai J, Liu J, et al. Real estate investments and financial stability: evidence from regional commercial banks in China[J]. The European Journal of Finance, 2018, 24(16): 1388-1408.

[12]. Tien N H, Thuan T T H. Analysis of Strategic Risk of Domestic and Foreign Real Estate Enterprises Operating in Vietnam's Market[J]. International journal of commerce and management research, 2019, 5(5): 36-43

Cite this article

Liu,C. (2023). Research on Fair Value Measurement of Investment Real Estate. Advances in Economics, Management and Political Sciences,18,226-233.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fei L, Wang H, Chen L, et al. A new vector valued similarity measure for intuitionistic fuzzy sets based on OWA operators[J]. Iranian Journal of Fuzzy Systems, 2019, 16(3): 113-126.

[2]. Glover S M, Taylor M H, Wu Y J, et al. Mind the gap: Why do experts have differences of opinion regarding the sufficiency of audit evidence supporting complex fair value measurements?[J]. Contemporary Accounting Research, 2019, 36(3): 1417-1460.

[3]. Pupentsova S, Livintsova M. Qualimetric assessment of investment attractiveness of the real estate property[J]. Real Estate Management and Valuation, 2018, 26(2): 5-11.

[4]. Waldron R. Capitalizing on the state: The political economy of real estate investment trusts and the ‘resolution’of the crisis[J]. Geoforum, 2018, 90(11): 206-218.

[5]. Tsou W L, Sun C Y. Consumers’ choice between real estate investment and consumption: A case study in taiwan[J]. Sustainability, 2021, 13(21): 11607.

[6]. Triani N, Tarmidi D. Firm value: impact of investment decisions, funding decisions and dividend policies[J]. International Journal of Academic Research in Accounting, Finance and Management Sciences, 2019, 9(2): 158-163.

[7]. Sanfelici D, Halbert L. Financial market actors as urban policy-makers: the case of real estate investment trusts in Brazil[J]. Urban Geography, 2019, 40(1): 83-103.

[8]. Fan J, Zhou L. Impact of urbanization and real estate investment on carbon emissions: Evidence from China's provincial regions[J]. Journal of cleaner production, 2019, 209(1): 309-323.

[9]. Pires A S C, Ferreira F A F, Jalali M S, et al. Barriers to real estate investments for residential rental purposes: mapping out the problem[J]. International Journal of Strategic Property Management, 2018, 22(3): 168-178.

[10]. Aalbers M B. Financial geography II: Financial geographies of housing and real estate[J]. Progress in Human Geography, 2019, 43(2): 376-387.

[11]. Zhang D, Cai J, Liu J, et al. Real estate investments and financial stability: evidence from regional commercial banks in China[J]. The European Journal of Finance, 2018, 24(16): 1388-1408.

[12]. Tien N H, Thuan T T H. Analysis of Strategic Risk of Domestic and Foreign Real Estate Enterprises Operating in Vietnam's Market[J]. International journal of commerce and management research, 2019, 5(5): 36-43