1. Introduction

For many small and medium-sized enterprises (SME), one challenge they faced is lack of access to capital [1]. Proper use of Supply chain finance (SCF) is particularly important to provide SME with the necessary cash flow at a reasonable cost. Without supply chain finance, there will be illiquid asset and cash flow will be tie up in account receivable, and SME will have to borrow from banks at a higher cost. Supply chain finance can allow suppliers or buyers to use their respective advantages to reduce the cost of doing and generate more profit, which create a win-win situation. Supply chain finance can benefit the entire ecosystem, buyers can secure inventory and suppliers can plan early for these forward orders [2]. Also, recurring purchases can generate consistent cash flow and facilitate trust between supplier and buyer. An effective supply chain finance can give competitive advantages to all parties in the same value chain and improve efficiency while reduce the cost of transaction due to lack of funding source. In this paper, I will discuss about some common practices of SCF nowadays and their applications.

Supply chain financing comes with several benefits as well as potential risks. Supply chain finance can help SMEs with its tight cash flow, while helping large firms generating interest on their large cash flow. Supply chain finance often create a win-win situation for all companies in the value chain. Large companies can also have commitment from these SMEs for better planning. Also, different financing methods can help companies with different needs. For example, factoring is used in a way that suppliers not only sell goods or services to buyers, but also extend large amount of credit to relieve their financial stress. Although informational structure can be costly, it will benefit companies in the long-term for both analytics and future financing. Depends on the supply chain financing method used, collateral may be used.

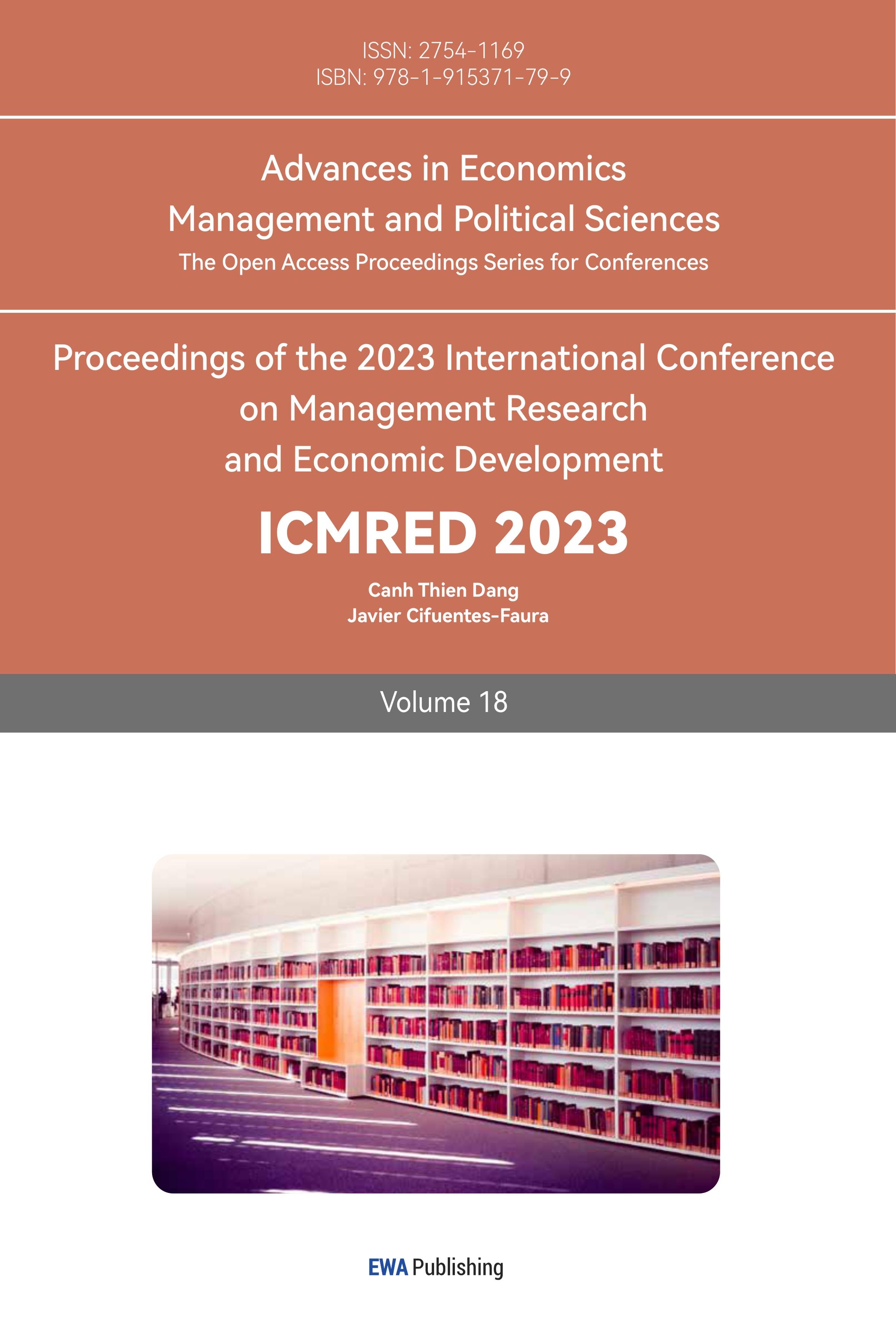

2. In-kind Finance

In-kind finance is one of the common practices used in SCF. Suppliers not only sell goods and services but extend large amounts of credit as well [3]. Trade credit exists when monitoring cost is high and informational asymmetries exist [4]. One advantage of in-kind finance over the banks is that suppliers can obtain information about the borrower at almost no cost, while it comes with a cost for others. Usually, suppliers have more information about buyer’s financial health that might come with a cost for banks, and suppliers can have more information that banks might not have. Under this circumstance, no cash will be disbursed, and trade credit can only be used at the sole suppliers who extend credit to SME. In addition, the increase of trade credit can also increase the amounts from banks [3]. Thus, bank credit and trade credit would help the company to increase their debt capacity and in turn remove the constraint of tight money. Higher debt capacity can facilitate the growth and investment can be made to expend capacity for future orders from the same supplier.

In-kind Finance is particularly useful in countries where legal protection of creditors is weak because it would be as difficult to divert input as to cash [3]. Typically, In-kind finance is used when wealthy firms provide a cushion through which firms insure poorer firms against the consequences of tight money. Trade credit has seen it as a form of financing that can overcome traditional impediments in financing. Large supplier may act as liquidity providers, insuring buyers against liquidity shocks that could endanger their survival. Larger firms should also take advantage for early payment if discount is offered. One drawback for trade credit it will be easily diverted once it becomes liquified [3]. Also, trade credit usually has shorter maturity than bank credit [3].

Trade credit can also be used in price discrimination, and powerful clients can receive several benefits, which facilitate trading between two companies [5]. Offering trade credit can increase the volume and trading frequency and enhancing relationship between both parties. Also, a study suggested some multi-national firms also use trade credit and have large payable in their account [6], and it can be inferred that trade credit is a cheaper alternative way of financing than bank credit. In addition, trade credit can ensure product quality for buyers [7], and buyers can wait until product is sold and the condition meets criteria. Long suggested that firms producing products that are hard to assess are also more likely to give trade credit to buyers to ensure product quality. Conversely, small suppliers can also offer early payment discount to encourage buyers to make early payment [5]. Incentives can also minimize risk for suppliers since it shortens the payment period.

The contract terms are decided by several factors including the contract size, net days, discount days, discount, and currency. The size of the buyer and the worthiness of investment are determinant factors for suppliers to provide the opportunity of in-kind finance. The lack of demand would risk suppliers to retrieve cash from buyers, which will incur extra cost. However, penalty should be stated at the contract for late payment.

In conclusion, in-kind finance should be used in the following conditions (1) buyers who are in tight cash and only can access to finance with high interest rate; (2) suppliers who are willing to offer buyers with low interest rate compared to banks and longer payment term; Also, SMEs suppliers should also take advantage of early payment at a discount to wealthy firms for cash. Some advantages include: (1) strengthen relationship between buyer and supplier; (2) minimize cost of obtaining bank credit for SME buyers (3) warrant product quality before payment is made (4) illiquid asset will prevent buyers diverting the cash.

Figure 1: In-kind finance.

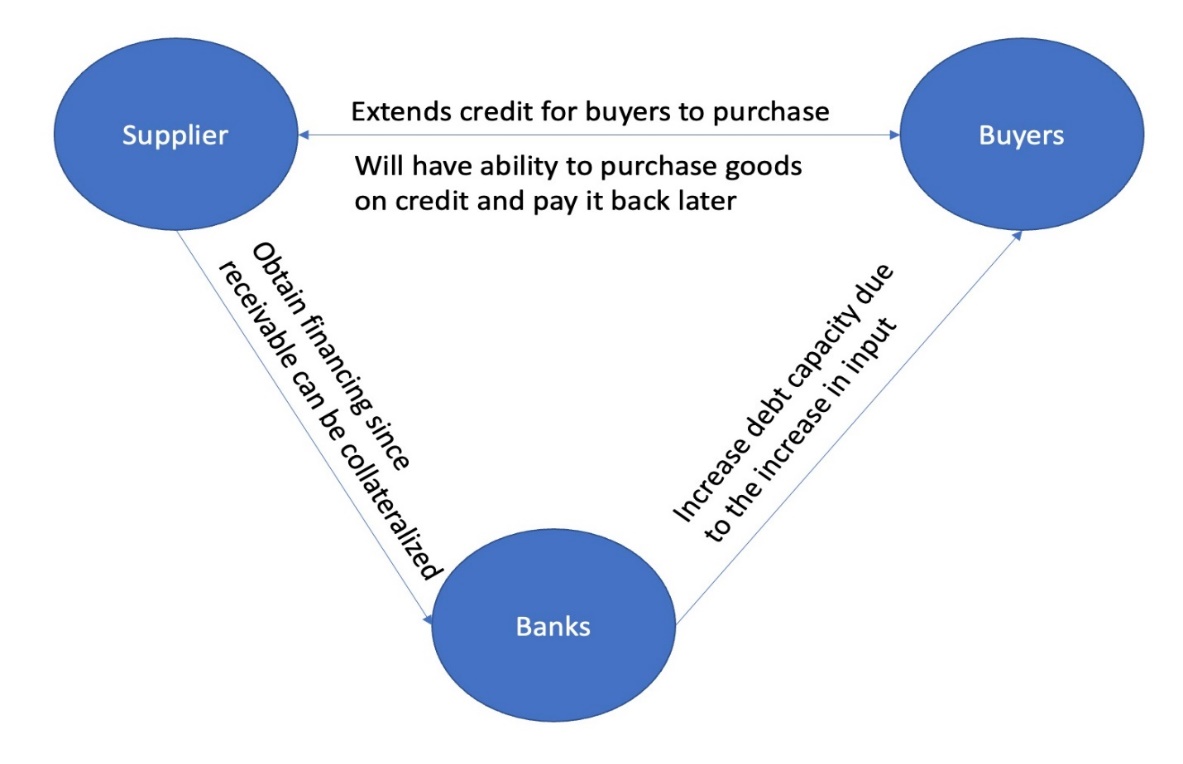

3. Factoring and Reverse-Factoring

The other approach for SCF is factoring and reverse factoring. Factoring is a type of supply chain finance in which suppliers can sell their creditworthy accounts receivable at a cost to a third party for immediate cash [1]. Factoring can help small businesses by providing immediate cash in addition to minimize risk to accounts receivable. Factoring can be done in both “without recourse” or “recourse”. “Without recourse” means lenders will assume all the risk and it will be removed from the seller’s book. Non-recourse factoring means the factor assumes all the risk and no payment will be made by seller despite default by suppliers, and the factor will need to go after the buyer in this scenario. Recourse factoring is famous in developing countries where it relies on people’s own creditworthiness, while non-recourse factoring developed countries where credit information is complete and accessible [1]. Having multiple customers in the portfolio can help reduce the risk for factors, and factoring is particularly useful in countries where credit information is available, but contract enforcement is weak. The service fees and interest incurred are the main revenue for the factor.

Another feature of factoring is that you can either notify the buyer about their payable is sold to a factor [1]. Buyer will provide the factor new documents suggesting the new liability is to the factor rather than the supplier, and the supplier should remove this from their accounts receivable since they sold it to a factor. The factor also assumes the responsibility of assessing credit and collection. Before the factor decided to take the receivable, factor should first assess if the risk is acceptable for them to do so. After the ownership is transferred to the factor, the factor needs to collect the payment once it is matured.

Usually, small suppliers use factoring to receive early payment for its much-needed cash flow. The seller’s accounts receivable will be purchased by the factor at a discount rate, and seller will receive the remaining amount minus service fees. An advantage for factoring is that a preset formula can quickly calculate and assess the risk to disburse the cash [1].

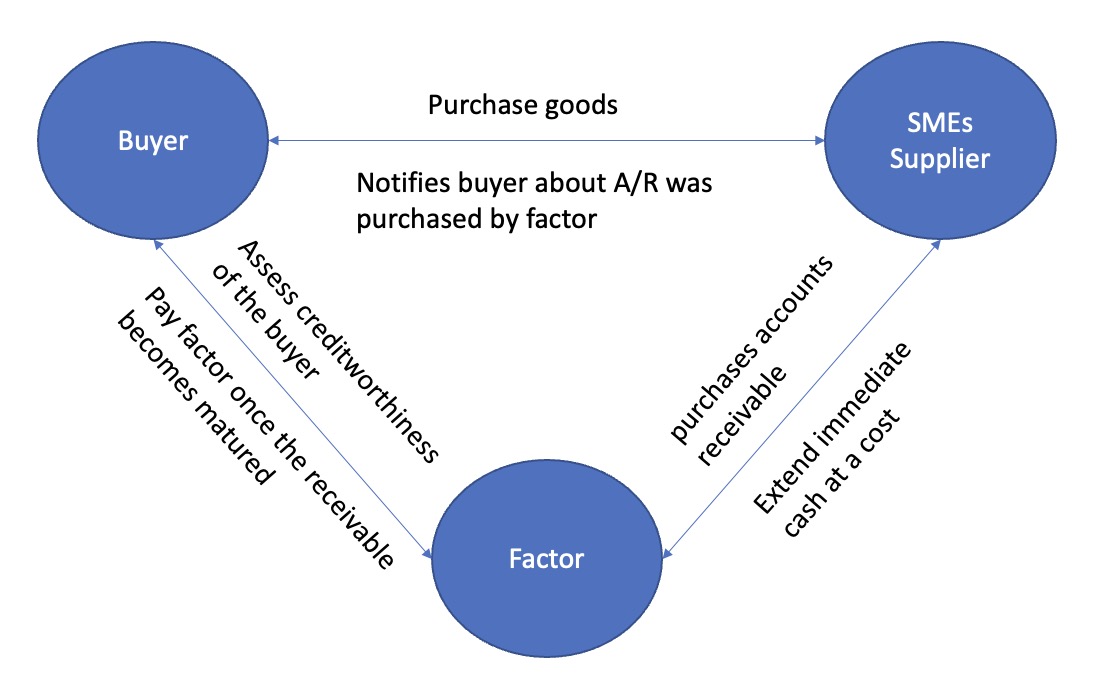

Reverse factoring is another type of supply chain finance in which the lenders only purchase invoices from high quality buyers. The lender will need to collect information about the buyer for their credit risk. Thus, the risk for reverse factoring equals to default risk to these high-quality customers rather than SMEs [1]. One of the advantages for reverse factoring is that it allows lender and buyer to build relationship and lender can build a credit history on the buyer and eventually will lead to lower rate and more borrowing.

Also, assessing the risk for factoring and reverse factoring can be critical for both parties. For borrower, factoring could cause them to hand their invoicing and cash collection to third party, this could be particularly risky for building relationship with suppliers. Also, this may bring a bad perception to suppliers that the borrower has an unhealthy cash flow. It can also affect their bottom line if their profit margin is low. For lender, they could potentially face default from borrower’s supplier. It would be risky if both parties are small businesses, and it would be hard for them to have a guarantor for this money.

Factoring does not apply to those who use in-kind finance. Factoring means that selling the accounts receivable to a third party at a discounted rate. In comparison, in-kind finance is illiquid assets, and buyer pays the supplier after a period so that expensive bank credit will not be used.

Figure 2: Factoring.

Figure 3: Reverse factoring.

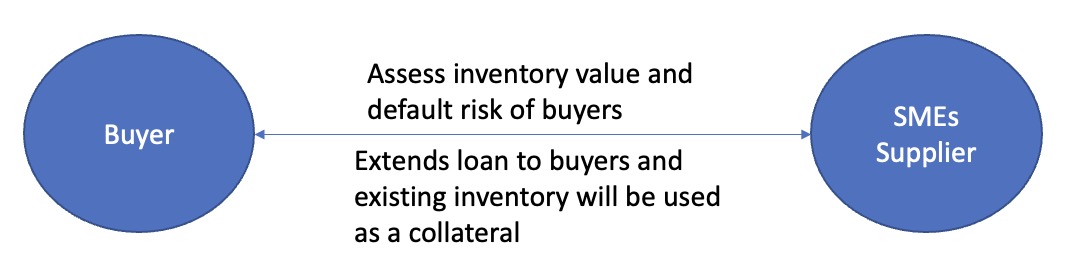

4. Inventory-Based Financing

Inventory-based financing (IBF) is used for small retailers using their inventory as collateral to banks and banks provide loans based on the inventory value [8]. IBF can provide an alternative way of cash financing to these small firms who have limited cash flow. A limitation of IBF is that banks usually do not have ownership of the inventory before the loan is due, and the salvage value is low in the event of bankruptcy [8]. However, large retailers who do have more experience and data could extend loan to these smaller retailers who sell on their platform, as the inventory can still create similar values under large retailers. When the small borrower defaults, their collateral will be in possession of large retailers, and large retailers can utilize the existing channel to sell the inventory [8]. This would lower the interest rate for small businesses, and it is less risky for lenders to extend such a loan while increasing their loan limit, which will offset bank’s advantage in obtaining such channel. Thus, it is advantageous for buyers to provide IBF to small businesses since they do have more leverage over the inventory, where banks only can sell it at a low salvage value. As large retailers obtain historical information and make prediction on their future demand, they can extend loans based on the demand and inventory. In case of bankruptcy, small business’ inventory will be confiscated and the forecasted demand by big retailer can estimate the selling rate for confiscated inventory.

IBF is beneficial for suppliers who need immediate cash and unable to get loans at a low interest rate from banks. It is particularly useful when small businesses are stockpiling from their suppliers. Existing stocks level can assure big retailers of repayment ability. It will create win-win situation for all parties in supply chain. Large retailers will benefit from sufficient stock which results in less stock out. Large retailers’ profit will be maximized by the growth of small retailers. In addition, a growing small retailers can imply an increase of future order quantity. Small retailers’ profit will be maximized by the cheaper loan option. Thus, they can dedicate their profit into future expansion plan.

Figure 4: Inventory-Based Financing.

5. Limitation

As around 80 percent of eligible trade does not benefit from better supply chain finance [2], it provides huge opportunity for companies to increase their profit by financing efficiently. The benefit of Supply chain finance can help buyers to purchase inventory early and suppliers can also secure orders. However, the complexity and lack of understanding of supply chain finance has prevented companies from implementing it. According to Botta et., four greatest obstacle of supply chain finance are fragmentation of delivery, fragmentation of the underlying assets, limited credit and expertise, and geopolitical turmoil.

First, companies are slow in technology transformation. Without effective ERP system and digitalization, manual process and long bureaucracy within the company could lead to ineffective financing process. Only a handful of companies uses enterprise resource planning (ERP) software, which caused information asymmetric across the organization. It can be costly to obtain information and manual tracking of orders can create mistakes. Lacking a company-wide process will disable companies from efficient process flows which results in numerous mistakes due to the complexity in supply chain finance. In addition, fragmented data sharing and inability to share timely data across different organization will cause delay and the cost of understanding and cleansing the database can also be costly. Further, slow onboarding and credit decisions can be another obstacle that prevent people from doing supply chain financing. SCF can sometimes go through a long cycle, and it becomes less useful if the approval process took months, which inhibits companies to access much needed capital. Training can also be time-consuming and costly if the employee turnover rate is high.

Second, fragmentation of underlying assets could be costly for companies who are interested in doing supply chain finance. Only high-value invoices benefited from supply chain finance since it generated more profit. Invoices are varied in terms, durations, and underlying creditworthiness make companies unwilling to assess the risk due to complexity. Variable invoices from small and medium size firms are usually struggling in access to supply chain finance as many firms believe it will not produce the value for them to do so. It would be time-consuming and costly to assess all the underlying assets of these companies as the cost could potentially outweigh the benefits.

Third, the experience and expertise level can be different across different organizations. Some small medium-size firms don’t have the knowledge of supply chain finance and don’t know how to use them. Many organizations do not offer full range of supply chain finance due to lack of knowledge and processes. Unless it is lucrative, companies will not be willing to invest into hiring supply chain finance professionals to form the necessary processes and systems.

Fourth, the shift in global trade can be troublesome for supply chain finance. Majority of demand has shifted to developing countries like China and emerging countries are expected to consume two-third of goods by 2025. In addition, developing countries are building their own comprehensive supply chain which reduce the need of cross-border supply chain. Also, the landscape can be reshaped by the emergence of artificial intelligence and automation.

6. Outlook

New technology such as blockchain will overcome many of the limitations. Blockchain can be a game-changer by enabling cost-efficient delivery of products, enhancing products’ traceability, improving coordination between partners, and aiding access to financing [9]. Blockchain can enable anonymous trading partners to make transaction privately and securely with one another without an intermediary. Blockchain can increase the visibility of a supply chain and different parties who need to know certain information can access the information without blind spot. For example, all assets such as inventory, orders, and loans will be given unique identifiers to prevent human errors. Every single step within a process will be recorded as a block and transfer to next one. With a comprehensive record, all parties within the value chain can gather relevant information for decision-making and it facilitate bureaucratic process as it can be easily visualized. Blockchain used in supply chain comprised of information flow, inventory flow, and finance flow. For example, by evaluating all the trading and financing information, a factor can make better decisions by looking at all different transactions for a buyer and charge the most reasonable fee. In addition, no steps will be ignored through blockchain since a block cannot be added before previous action was completed.

By enhancing traceability using blockchain, a company can immediate detect a faulty product and recall it [9]. For example, once a company discovered a defective product, they can immediately track the whole batch of order and immediately start a recall. It enables faster reaction from manufacturers and prevent potential further damage. In addition, blockchain can increase efficiency and avoid production disruption [9]. As data becomes centralized, different firms in the supply chain can make their own decisions based on the complete information. They could purchase addition inventory form third party or expedite early if necessary. Real time data-sharing can help companies to track their shipment to avoid potential delay. Blockchain can also be an aid to financing. Blockchain can eliminate lots of excessive process in estimating the potential risk and all the recent and necessary information will be recorded in the blockchain. Also, payments will be automatically wired without human intervention to reduce error. In addition, cross border trade will become easier as all the necessary documents and processes will be stored in the blockchain. For example, customs can trace all the information about this shipment and obtain all the relevant information to increase accuracy and process efficiently, and this will reduce paperwork and administrative cost related to processing.

Appendix

In-kind Finance | Factoring | Reverse factoring | Inventory-Based Financing | |

Definition | Suppliers not only sell goods and services but extend large amounts of credit as well. | Firms sell their credit-worthy accounts receivable at a discount and receive immediate cash. | The lender only purchases accounts receivables only from specific informationally transparent, high-quality buyers. | Asset-based lending, inventory-based financing is increasingly adopted by high-growth retailers. |

Benefit | It benefits buyers with cheaper financial option, while benefiting suppliers with more sales. | SMEs can receive immediate cash under financial distress | Factor can minimize their risk by pooling several accounts receivable together | Big retailers can loan cash to smaller retailers and use their inventory as a collateral. |

Risk | High interest rate and may encourage defer payments, default risk | Fee associated selling the account receivable, default risk | Fee associated with selling the account receivable | Inaccuracy in predicting future demand, default risk |

Lender | Big firms | Factor | Factor | Big retailers |

Borrower | SMEs | Supplier | Supplier | Small retailers |

Information Infrastructure | Required | Required | Required | Required |

Due date | Short | Depends on the terms | Depends on the terms | Long |

Collateral requirement | No | Yes/No | Yes/No | Yes |

References

[1]. L. Klapper, 2006, “The role of factoring for financing small and medium enterprises,” Journal of Banking & Finance, vol. 30, no. 11, pp. 3111–3130,

[2]. A. Botta, R. Holl, R. Jain, N. Shah, and L. Tan, 2020, “Supply Chain Finance: A case of convergent evolution?”, The 2020 McKinsey Global Payments Report, pp19-26

[3]. M. Burkart, T. Ellingsen, 2004, “In-kind Finance: A theory of Trade Credit”, American Economic Review, pp569-589

[4]. C. Smith and R. Smith, 1999, “Evidence on the Determinants of Credit Terms Used in Interfirm Trade”, Journal of Finance, pp. 1109-1128

[5]. L. Klapper, L. Laeven, and R. Ragan, 2011, “Trade Credit Contracts”, Oxford University Press, pp.838-867

[6]. Brennan, M., V. Maksimovic, and J. Zechner, 1988, Vendor Financing. Journal of Finance, pp.43:1127–41.

[7]. Long, Michael S., Ileen B. Malitz, and S. Abraham Ravid, 1993, Trade credit, quality guarantees, and product marketability, Financial Management 22, pp. 117-127.

[8]. H. Chen and W. Zhu., 2021, "Retailer Initiated Inventory-Based Financing." Available at SSRN 3974181

[9]. V.Gaur and A. Gaiha, 2020, “Building a Transparent Supply Chain.” Harvard Business Review, https://hbr.org/2020/05/building-a-transparent-supply-chain

Cite this article

Lin,W. (2023). Supply Chain Finance: Brief Introduction of In-kind Finance and Factoring. Advances in Economics, Management and Political Sciences,18,306-313.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. L. Klapper, 2006, “The role of factoring for financing small and medium enterprises,” Journal of Banking & Finance, vol. 30, no. 11, pp. 3111–3130,

[2]. A. Botta, R. Holl, R. Jain, N. Shah, and L. Tan, 2020, “Supply Chain Finance: A case of convergent evolution?”, The 2020 McKinsey Global Payments Report, pp19-26

[3]. M. Burkart, T. Ellingsen, 2004, “In-kind Finance: A theory of Trade Credit”, American Economic Review, pp569-589

[4]. C. Smith and R. Smith, 1999, “Evidence on the Determinants of Credit Terms Used in Interfirm Trade”, Journal of Finance, pp. 1109-1128

[5]. L. Klapper, L. Laeven, and R. Ragan, 2011, “Trade Credit Contracts”, Oxford University Press, pp.838-867

[6]. Brennan, M., V. Maksimovic, and J. Zechner, 1988, Vendor Financing. Journal of Finance, pp.43:1127–41.

[7]. Long, Michael S., Ileen B. Malitz, and S. Abraham Ravid, 1993, Trade credit, quality guarantees, and product marketability, Financial Management 22, pp. 117-127.

[8]. H. Chen and W. Zhu., 2021, "Retailer Initiated Inventory-Based Financing." Available at SSRN 3974181

[9]. V.Gaur and A. Gaiha, 2020, “Building a Transparent Supply Chain.” Harvard Business Review, https://hbr.org/2020/05/building-a-transparent-supply-chain