1. Introduction

The wave of digitalization further pushes the digital transformation of enterprises, and family firms will intensively step into an important period of dual challenges of succession and transformation [1]. Based on this, this study intends to investigate the impact on business performance when the wave of family business succession overlaps the wave of corporate digital transformation. Based on resource orchestration theory, family branding and principal-agent theory, this paper conducts an empirical study on 547 listed family firms during 2015-2020 and conducts descriptive statistics and regression analysis with the help of Stata 17.0 statistical software to construct a “digital transformation-intergenerational inheritance and de-familization balance-firm performance” analytical framework. This thesis can help families to make their companies pass through the succession period smoothly with a rational understanding of the power handover in the windy global digital wave, and enrich the theories and literature related to family businesses.

2. Theories and Hypotheses

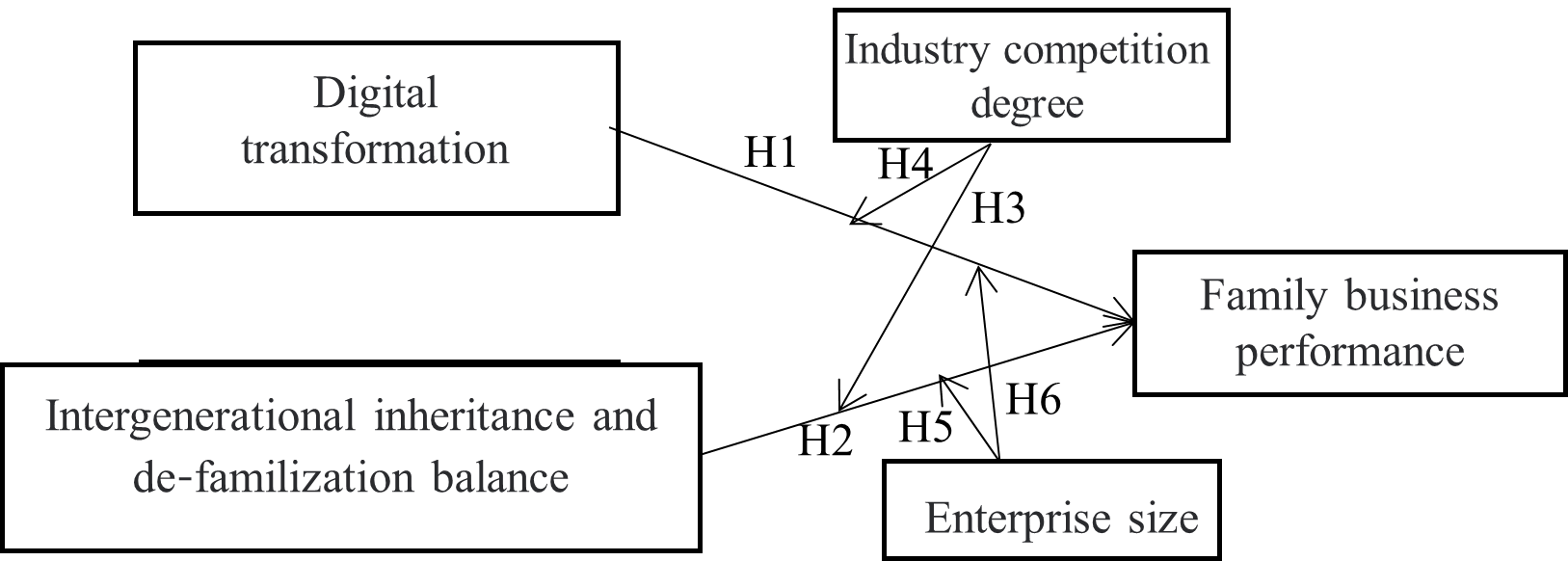

Based on resource orchestration theory, family branding and principal-agent theory, the paper explores the impact of digital transformation, intergenerational inheritance and de-familization balance on family firm performance, respectively, and considers the moderating effects of external industry competition and internal firm production scale, and proposes the following six hypotheses.

2.1. Digital Transformation and Family Business Performance

Digitization is a way and method for enterprises to use digital technologies and capabilities to drive business model innovation and business ecosystem reconfiguration in order to achieve innovative business growth, and its core lies in the use of digital technologies and the reconfiguration of enterprise business, processes and organizations [2]. According to resource orchestration theory, enterprises can achieve optimal allocation of internal resources, improve productivity, and thus enhance corporate performance by relying on their innovation and information access advantages and coordinating resources in the process of digital transformation [3]. However, when resource characteristics by themselves are not sufficient to ensure that firms gain competitive advantage, an effective resource orchestration strategy is required to convert resource potential into realistic performance gains [4]. Therefore some scholars consider that the impact of changes brought about by digitization on the firm may be negative or uncertain since the firm cannot effectively use these resources initially. There may be high costs that constrain the willingness of enterprises to digital transformation and upgrading; the level of technology is difficult to meet the needs of enterprises' digital transformation and upgrading; and the lack of talent pool is the bottleneck of enterprises' digital transformation and upgrading. Yudong Qi et al. found that digitization affects firm performance through two paths: management activities and sales activities, and the effects of these two paths cancel each other out, resulting in an insignificant total impact of the degree of digitization on performance [5]. It was further noted that the performance enhanced by digitization through business model innovation was offset by managerial dysfunctions.

In summary, family firms use digital technology to achieve digital transformation to reorganize and optimize their production processes and organizational structure, but when family firms undergo power handover while undergoing digital transformation, it can result in management changes, and such turbulence may offset the positive effects of digital transformation, which is ultimately detrimental to firm performance improvement. Therefore, hypothesis 1 is proposed in this study.

H1: Digital transformation of family firms has a significant negative effect on firm performance.

2.2. Balance of Intergenerational Inheritance and De-familization and Performance of Family Enterprises

There is no consensus among academics on the topical issue of the intergenerational inheritance model of family-oriented family firms. The intergenerational inheritance studied in this paper is that the children are the successors and the second generation receives part of the equity and holds positions in the company. Some scholars believe that the family will pay more attention to the long-term interests of the company and the interests of the family's descendants, and thus adopt a partial de-familization approach to maintain control of the company, and that this de-familization approach will help the company gain more economic benefits. Some scholars insist that intergenerational succession of power may bring fresh vitality to family firms for sustainable development and help family firms to grow forever. Chen Mengyuan and other scholars analyzed in detail the difference between the relational and non-relational succession of family firms and the relationship between succession and firm performance with respect to the characteristic Confucian culture in China and found that succession related to family ties was associated with higher firm performance correlated [6].

According to principal-agent theory, intergenerational succession in family businesses can reduce the first type of agency costs and help improve corporate performance to a certain extent, but the human resource changes and uncertainties brought by the handover of power between the first and second generations can be destructive. De-familization plays an important role in avoiding the generation of type II agency costs and reducing information asymmetry. However, de-familization brings problems such as trust crisis and regulatory costs, so some scholars insist that internal than external inheritance is more conducive to improving post-transit firm performance. Combined with previous research results, family firms can achieve a balance between intergenerational inheritance and de-familying if they try to adopt appropriate de-familying strategies in intergenerational inheritance, and finally achieve improved corporate performance. Therefore, if the balance model places too much emphasis on intergenerational inheritance or too much de-familization, it is not conducive to corporate performance; on the contrary, if a balance between the two is found, it can promote corporate development. Based on the above analysis, hypothesis 2 is proposed.

H2: The balance between intergenerational inheritance and de-familization of family firms helps to improve the performance of family firms.

2.3. The Moderating Effect of Industry Competition and Firm Size

The external environment is a factor that any organization has to consider when making strategic decisions. To further investigate the role of the external environment on family firms, this paper introduces the industry competitiveness variable to observe the changes in the balance of intergenerational inheritance and de-familization of family firms under different industry competitions. Industry competition degree refers to the intensity of competition in the market in a firm's industry, which comes from the grabbing of resources by a large number of competitors. Stigma theory explains the importance of the external environment, and scholars have found that the industry boom exerts a moderating effect on the relationship between second-generation growth history and portfolio entrepreneurship [7]. Under highly competitive industries, family firms can give full play to the synergistic effect of familial management to achieve a long-term layout of strategy and gain a new round of efficiency growth. At this time, the balance between intergenerational inheritance and de-familization is no longer important for performance, and the main goal of family firms is to improve their technological strength through digital transformation, so as to gain core competitiveness, and the negative impact of digitalization on firm performance will be diminished. However, within the low-competition industry, family firms face fewer competitors, the firms' profitability is saturated, and the market is mostly rigid, the impact of family firms on firm performance will be enhanced no matter how they choose to develop their model. Based on the above analysis, hypotheses 3 and 4 are proposed.

H3: Industry competition degree plays a weakening moderating role between the balance of intergenerational inheritance and de-familization on the impact of family firm performance.

H4: Industry competition degree plays a weakening moderating role in the effects of digital transformation of family firms on firm performance.

The size of an enterprise is the wealth accumulated since its establishment, which determines the ease of access to resources and the advantages and disadvantages of the enterprise. According to the principal-agent theory, family enterprises are small in scale at the beginning, and the "parents" hold the ownership and management rights of the enterprise, so the first type of agency costs are low, and the intra-family members are closely connected, so the decision-making transaction costs are low. As the family business grows, the shareholding is gradually dispersed, making it more difficult for the owner to control the company, which makes it easier for the management to move out. This, coupled with the increase in size, makes the enterprise more demanding of management talent. Large-scale family firms have more radical choices during the power transition period, and the balanced model of intergenerational inheritance and de-familying will have less impact on the firm. Moreover, the expansion of organizational structure requires the firm to manage more with the help of digitalization, which will incur greater cost expenditure and therefore enhance the negative impact of digital transformation on firm performance. Based on the above analysis, hypotheses 5 and 6 are proposed.

H5: Enterprise size plays a weakening moderating role between the effects of the balance between intergenerational inheritance and de-familization on firm performance.

H6: Enterprise size plays an enhanced moderating role in the effects of digital transformation of family firms on firm performance.

Figure 1: Research model of the dual impact of digitization and power transitions on performance.

3. Methodology

According to the research objectives and hypotheses of this paper, the following variables and models are designed to verify the effects of digital transformation and the balance between intergenerational inheritance and de-familization of family firms on firm performance, as well as the moderating effects of industry competitiveness and firm production scale.

3.1. Research Design

3.1.1. Data Sources.

The data in this paper include digital transformation index, family business performance, and related financial data mainly from the China Listed Family Business Research Database (CFF or Family Business Database) and the Enterprise Digital Transformation Database under CSMAR Data Service Center. Among them, the definition of family members and related information are obtained from the annual reports, interim announcements and IPO announcements disclosed by Juchao Information, which are authoritative and stable data sources and can present complete and objective data related to family enterprises. A total of 547 family enterprises listed on the main board, small and medium-sized board and GEM in Shanghai and Shenzhen from 2015 to 2020 were selected as the research sample of this paper, covering multiple industries such as information transmission, software and information technology services, manufacturing, leasing and business services, and electricity, heat, gas and water production and supply.

3.1.2. Variable Design.

a. Independent variable: Digital Transformation Index of family companies. The digital transformation index used in this paper comes from the digital transformation research database of Chinese listed companies under the CSMAR database, which is jointly developed by the CSMAR team and the research team of the Department of Business Administration of the College of Business Administration of East China Normal University, includes strategic leadership, technology-driven, and organizational empowerment at the listed company level, digital achievements and applications, and environmental support at the medium and macro levels, and finally constructs a comprehensive digital transformation index.

The balance between intergenerational inheritance and de-familization (CO). The balance is the Intergenerational ownership of family businesses and the decline in family members' heir control during de-familation, which in essence measures the change in heir ownership and management control.

In this paper, we refer to the calculation method used by Schulze in his study of equity distribution in family firms to calculate the intergenerational inherited ownership concentration (IOD), considering the total voting power of family members in the firm [8]. The smaller the IOD, the lower the intergenerational inherited ownership concentration of family members.

\( IOD={\sum (IOi)^{2}}={\sum (\frac{shi}{\sum shi})^{2}}\ \ \ \) (1)

The concentration of heir control (HCD) of family members is measured by the type of position in the family-listed company and its corresponding rank coefficient (poi), where the position rank coefficient is referred to the research of Xiaogang He and Yanling Lian, and the highest position rank coefficient score is taken and finally measured by using the Herfindahl index formula [9]. If the HCD is smaller, the concentration of control of family members is lower.

\( HCD={\sum (HCi)^{2}}=\sum {(\frac{poi}{\sum poi})^{2}} \) (2)

Therefore, the equilibrium structure of intergenerational inheritance and de-familation is chosen to measure the degree of separation between intergenerational inheritance ownership and family members' control, referred to as CO, by summing the absolute values of the size of the difference between the relative ownership and the relative management of each family member, and then doing a ratio operation between the summation result and the number of members to obtain the desired target. If the CO is smaller, the lower the degree of separation is. The specific calculation formula is shown in equation (3).

\( CO=\frac{\sum (|IOi-HCi|)}{n} \) (3)

b. Dependent variable: Tobin's Q is taken in the measurement of corporate performance. A high Tobin's Q indicates a high return on investment, greater profitability for shareholders, and an increase in the value of a firm's stock in the market implies an increase in value and performance of the firm. Compared to common financial indicators to measure corporate performance, Tobin's Q has the advantage of reflecting the dynamic performance changes of a company, which can be fed back the future value direction of a company through the future expectations of stock market changes and is not easily manipulated.

C. Moderating variable: Industry competition degree (HHI). In this paper, the Herfindahl-Hirschman Index (HHI index) and the industry's main business income are used to measure the HHI, which can more completely represent the intensity of the market structure within the industry, and from another perspective can reflect the high or low level of competition in each industry.

\( {X_{t}}=\sum {x_{it}} \)

\( HHI={\sum (\frac{{x_{it}}}{{X_{t}}})^{2}} \) (4)

Enterprise size (Size). Considering the differences in production size within each family business and that the size of business production reflects the accumulation of assets and other wealth of the business, as the size of the family business increases, the growth strategy of the family business will be adjusted accordingly, so size affects the impact of digital transformation and the balance between intergenerational inheritance and de-familization on performance.

\( Size=ln{(TA)}\ \ \ \) (5)

d. Control variables: This study introduces factors that may have an impact on the performance of family firms, specifically: level of corporate risk (LEV), the board size, the proportion of independent directors, year, and industry.

3.2. Data Analysis

3.2.1. Descriptive Statistics and Correlation Analysis.

A descriptive analysis was conducted on the main variables involved in this paper and the results were obtained as shown in Table 1. As can be seen from the table, the mean value of Tobin's Q for the performance of family firms is 2.971, indicating that family firms have better overall performance and dominate in business expansion and investment; the minimum value is 0.293 and the maximum value is 31.565, indicating that there are large differences in the effectiveness of family firms, which is closely related to the business governance of the firms. The mean value of digital transformation index of family enterprises is 38.892, which indicates that most family enterprises have recognized the importance of digital transformation and entered the early stage of digital transformation. The mean value of the balance of intergenerational inheritance and de-familization of family firms is 10.109, with a standard deviation of 11.469, which indicates that family firms' decisions to choose intergenerational inheritance or de-familization during the power transition period are widely varied and more fragmented.

Table 1: Descriptive statistical analysis results of variables.

Variable Name | Variable Symbol | Variable Definition | Mean Value | Standard Deviation | Observed Value |

Enterprise Performance | TQ | Tobin's Q value | 2.971 | 2.364 | 3282 |

Digital transformation index | Dig | Weighting of each segment | 38.892 | 10.575 | 3282 |

Balance of intergenerational inheritance and de-familization | CO | Separating extent of ownership and controlling right | 10.109 | 11.469 | 3278 |

Industry competition Degree | HHI | HHI index of main business revenue | 0.817 | 0.387 | 3282 |

Production Scale | Size | The natural log of total assets | 22.080 | 1.053 | 3282 |

Enterprise risk level | LEV | Asset-liability ratio | 0.379 | 0.183 | 3282 |

Board size | Bsize | Total number of members of the board | 8.117 | 1.436 | 3282 |

Ratio of independent directors | Ind | Number of independent directors/total number of directors | 0.380 | 0.054 | 3282 |

Correlation analysis was performed between the dependent, independent, and control variables, and covariance diagnosis was performed to ensure that the variables were independent of each other. Table 2 of the correlation coefficients shows that the digital transformation index is negatively correlated with firm performance. There is a positive relationship between the balance of intergenerational inheritance and de-familization and business performance at 0.05 significance level, a significant negative relationship between gearing, a measure of corporate risk, and business performance, a negative and significant relationship between board size and business performance, a positive relationship between independent directors and business performance, and a low correlation coefficient between the independent and control variables. The mean value of variance inflation factor (VIF) is 1.36, and 1/VIF is greater than 0.5, so there is no problem of multicollinearity among variables.

Table 2: Correlation analysis results.

VIF | TQ | Dig | CO | LEV | Bsize | Ind | |

TQ | 1.0000 | ||||||

Dig | 1.01 | -0.0188 | 1.0000 | ||||

CO | 1.03 | 0.1449* | 0.0314 | 1.0000 | |||

LEV | 1.02 | -0.3710* | 0.0336 | -0.1429* | 1.0000 | ||

Bsize | 1.69 | -0.0748* | -0.0649* | -0.0838* | -0.0258 | 1.0000 | |

Ind | 1.69 | 0.0530* | 0.0502* | 0.0833* | 0.0279 | -0.6369* | 1.0000 |

3.2.2. Main Effects and Moderating Effects.

In order to test the hypothesis, the sample was created as panel data within Stata, the sample was balanced panel data, and Stata 17.0 was used to test the model, first testing the individual effect, P<0.05, indicating that the fixed effect was better than the mixed OLS model, and then testing the time effect, the result random effect was also better than the mixed OLS model, P<0.05, indicating that the random effect was significant, and finally Hausman test was conducted on the fitting results, and the results rejected the original hypothesis, so the fixed-effects model was chosen as the research model in this paper. In this paper, the main and moderating effects are tested by multilevel regression, while the dummy variables of time (Year) and industry (Ind) are controlled to absorb the fixed effects as much as possible. In this paper, the total regression model to be tested is set as follows.

\( TQ={α_{1}}+{α_{2}}Dig+{α_{3}}CO+∑Controls+∑Year+∑Ind+ε\ \ \ \) (6)

Model 1 tests the direct effect of the balance of intergenerational inheritance and de-familization with the dependent variable firm performance, and it can be seen that in the first column of Table 3, the balance of intergenerational inheritance and de-familization(CO) is significantly and positively associated with firm performance(TQ) at the 1% level. After adding control variables for hierarchical regression, the results remain unchanged, which indicates that the balance between intergenerational inheritance and de-familization has a positive impact on business performance, thus testing hypothesis 2. Model 2 tests the direct impact of digital transformation on the dependent variable family business and the dependent variable business performance, and digital transformation is significantly negatively correlated with business performance at the 1% level, which indicates that digitalization has a negative impact on business performance, thus verifying hypothesis 1. Model 3 constructs a multiple linear regression to test the results of digital transformation and CO simultaneously on firm performance, demonstrating that digital transformation has a negative impact on firm performance while CO is beneficial to firm performance ( \( {α_{2}}=-0.104{,α_{3}} \) =0.046).

For the test of moderating effects, the independent variables digital transformation and CO are centered with the moderating variables industry competitiveness(HHI) and firm production size, respectively, to construct interaction terms. The model design of the moderating effect is as follows.

\( TQ={β_{1}}+{β_{2}}cCO+{β_{3}}cHHI+{β_{4}}cCO×cHHI+{β_{5}}LEV+{β_{6}}Bsize+{β_{7}}Ind+ε \)

\( TQ={ω_{1}}+{ω_{2}}cDig+{ω_{3}}cHHI+{ω_{4}}cDig×cHHI+{ω_{5}}LEV+{ω_{6}}Bsize+{ω_{7}}Ind+ε \)

\( TQ={γ_{1}}+{γ_{2}}cCO+{γ_{3}}cSize+{γ_{4}}cCO×cSize+{γ_{5}}LEV+{γ_{6}}Bsize+{γ_{7}}Ind+ε \)

\( TQ={θ_{1}}+{θ_{2}}cDig+{θ_{3}}cSize+{θ_{4}}cDig×cSize+{θ_{5}}LEV+{θ_{6}}Bsize+{θ_{7}}Ind+ε\ \ \ \) (7)

Table 3: Regression analysis of main effects and moderating effects.

TQ | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | ||||

CO | 0.060*** (0 .009) | 0.053*** (0 .009) | 0.046*** (0.009) | 0.024*** ( 0.004) | -0.004 (0.004) | ||||

Dig | -0.132*** (0.009) | -0.106*** ( 0.009) | -0.104*** (0.009) | -0.020*** (0.005) | -0.013*** (0.004) | ||||

cHHI | -0.264* (0.145) | 2.767*** (0.414) | |||||||

cCO \( × \) cHHI | -0.033*** ( 0.010) | ||||||||

cDig \( × \) cHHI | -0.086*** ( 0.010) | ||||||||

cSize | -0.979*** (0 .064) | -1.892*** (0.169) | |||||||

cCO \( × \) cSize |

| -0.033 *** (0.004) | |||||||

cDig \( × \) cSize | 0.018*** ( 0.004) | ||||||||

LEV | -6.585*** (0.408) | -5.848*** (0.408) | -5.754*** (0 .407) | -5.267*** (0.271) | -5.309*** ( 0.270) | -2.279 *** (0.296) | -2.352*** (0.296) | ||

Bsize | -0.0176 ( 0.070) | -0.018 (0.068) | -0.003 (0.068) | -0.093** (0.044) | -0.118*** (0 .044) | 0.021 (0.043) | 0.025 ( 0.043) | ||

Ind | -1.181 ( 1.564) | -1.064 ( 1.531) | -0.955 (1.531) | -0.182 (1.130) | -0.094 (1.126) | 0.045 (1.082) | 0.540 (1.081) | ||

year | control | control | control | control | control | control | control | control | control |

Industry | control | control | control | control | control | control | control | control | control |

\( {R^{2}} \) | 0.0138 | 0.1000 | 0.0004 | 0.069 | 0.084 | 0.1143 | 0.151 | 0.3047 | 0.227 |

Prob > chi2 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

N | 3,278 | 3,278 | 3,282 | 3,282 | 3,278 | 3,278 | 3,282 | 3,278 | 3,282 |

(Note: *, **, *** indicate significant at the 10%, 5% and 1% levels, respectively, with standard errors in parentheses, as below.)

Model 4 examines the moderating role of industry competitiveness between the impact of the balance of generational inheritance and de-familization on firm performance, and the moderating role of industry competitiveness between digital transformation and firm performance. The balance between intergenerational inheritance and de-familization is significantly negatively correlated with the cross-product of the centrality variable cCO \( × \) cHHI of industry competitiveness at the 1% level (β=-0.033), indicating that industry competitiveness plays a negative moderating role, thus hypothesis 3 is tested. The cross product of digital transformation and industry competition cDig \( × \) cHHI is significantly negatively correlated at the 1% level ( \( ω \) =-0.086), suggesting that industry competition plays a negative moderating role, and hypothesis 4 is confirmed. With the increase of external industry competition, the negative effect of digital transformation on firm performance decreases, and the positive effect of the balance of intergenerational inheritance and de-familization on the performance of family firms will weaken, because under the fierce industry competition, family firms pay more attention to the need to occupy the core competitive advantage in the market, when they will ignore the balance of internal intergenerational inheritance and de-familization.

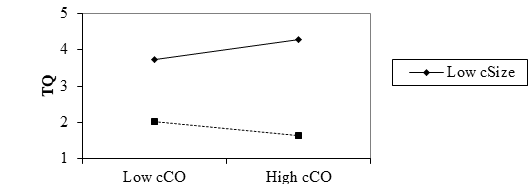

Model 5 examines the moderating effect of firm production size between the impact of the balance intergenerational inheritance and de-familization on performance, as well as the moderating effect of firm production size on the impact of digital transformation on performance. The cross-product cCO \( × \) cSize following the centrality of intergenerational inheritance and de-familization to firm production size is significantly negatively correlated at the 1% level ( \( γ \) =-0.033), indicating that firm production size plays a weakening moderating role, i.e., as firm production size increases, the positive impact of the balance of intergenerational inheritance and de-familization on the performance of family firms will subsequently diminish. The cross product term cDig \( × \) cSize following the digital transformation of family firms and the centrality of the firm's production size is significantly positively correlated at the 1% level ( \( θ \) =0.018), indicating that the firm's production size plays a positive moderating role. Thus hypotheses 5 and 6 are supported. The growth of the production scale of family firms makes firms pursue to establish a full range of systematic management system, monolithic property rights will no longer be suitable, CO is gradually broken, and the positive impact of CO on performance in this era is weakened, while technology enhancement and digital transformation become one of the core factors affecting firm performance, however, the initial stage of digital transformation will bring a large amount of investment, enhancing the negative impact on firm performance. In Figure 2, It can be seen that a larger scale will show the weakening influence of CO on enterprise performance.

Figure 2: Moderating effect diagram of enterprise production Size.

4. Conclusion

This paper takes a sample of 547 family firms listed on the Shanghai and Shenzhen A-shares in China from 2015 to 2020 to analyze the impact of digital transformation, intergenerational inheritance and de-familization balanced structure of family firms on firm performance, taking into account the moderating effects of external industry competition factors and firm production scale characteristics, and obtains through empirical analysis that digital transformation negatively affects firm performance, and the balance of intergenerational inheritance and de-familization can promote the improvement of firm performance. Under high industry competition, the positive effect of CO on performance is weakened, and the negative effect of digitalization is also weakened. As the size of family firms increases, the positive effect of CO on firm performance diminishes, but the negative effect of digital transformation on firm performance increases, probably due to the firm's emphasis on technology, which in turn increases the cost of technology investment. Therefore, this paper suggests that family firms should find a balance between internal power handover and de-familization approaches to improve the equity structure and internal governance mechanisms. At the same time, family firms should seize the opportunities brought by digital transformation, actively respond to the challenges posed by digitalization to their businesses, and make realistic decisions from the perspective of long-term corporate development. The family enterprises studied in this paper are only systematically defined, and in the future, they can be further subdivided, such as the origin history of family enterprises and the blood concentration among family members.

References

[1]. Saer Su. Research on the digital transformation of family enterprises promoted by new generation entrepreneurs in Ningbo[J]. Ningbo Economy(Three Rivers Forum),2022(01):3-5+13.

[2]. Kohtamoki M..The Relationship Between Digitalization and Servitization:The Role of Servitization in Capturing the Financial Potential of Digitalization[J].Technolifical Forecasting and Social Change,2020,151(2):1-9.

[3]. C.B. Yang, Y.S. Dong, L.Q. Yang. Digitalization, servitization and firm performance of manufacturing firms--a study based on a moderating mediator model [J]. Enterprise Economics, 2021(2):35-43.

[4]. Yu Deng. "Doing the right thing versus doing the right thing": a resource orchestration perspective on entrepreneurial firm performance[J]. Foreign Economics and Management, 2021, 43(5): 34-46.

[5]. I.D. Qi, C.W. Cai. A study on the multiple effects of digitalization on the performance of manufacturing firms and its mechanism[J]. Learning and Exploration,2020(07):108-119.

[6]. Chen Mengyuan,Xiao Jason Zezhong,Zhao Yang. Confucianism, successor choice, and firm performance in family firms: Evidence from China[J]. Journal of Corporate Finance,2021,69.

[7]. Wei-Ning Li, Shi-Hao Xu & Wei. Li. Second-generation growth experiences and family firm portfolio entrepreneurship: based on a branding theory perspective. Foreign Economics and Management [J].2021(07):126-140.

[8]. Schulze W S, Lubatkin M H, Dino, R N. Exploring the agency consequences of ownership dispersion among the directors of private family firms [J]. Academy of Management Journal,2003,46(2): 179-194.

[9]. Xiaogang He, Xinchun Li, Yanling Lian. Power concentration of family members and firm performance--a study of family listed companies[J]. Journal of Management Science,2011,14(5):86-96.

Cite this article

Cheng,H. (2023). Technology Enables Sustainable Development: Family Business Succession under Digital Transformation. Advances in Economics, Management and Political Sciences,20,15-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Saer Su. Research on the digital transformation of family enterprises promoted by new generation entrepreneurs in Ningbo[J]. Ningbo Economy(Three Rivers Forum),2022(01):3-5+13.

[2]. Kohtamoki M..The Relationship Between Digitalization and Servitization:The Role of Servitization in Capturing the Financial Potential of Digitalization[J].Technolifical Forecasting and Social Change,2020,151(2):1-9.

[3]. C.B. Yang, Y.S. Dong, L.Q. Yang. Digitalization, servitization and firm performance of manufacturing firms--a study based on a moderating mediator model [J]. Enterprise Economics, 2021(2):35-43.

[4]. Yu Deng. "Doing the right thing versus doing the right thing": a resource orchestration perspective on entrepreneurial firm performance[J]. Foreign Economics and Management, 2021, 43(5): 34-46.

[5]. I.D. Qi, C.W. Cai. A study on the multiple effects of digitalization on the performance of manufacturing firms and its mechanism[J]. Learning and Exploration,2020(07):108-119.

[6]. Chen Mengyuan,Xiao Jason Zezhong,Zhao Yang. Confucianism, successor choice, and firm performance in family firms: Evidence from China[J]. Journal of Corporate Finance,2021,69.

[7]. Wei-Ning Li, Shi-Hao Xu & Wei. Li. Second-generation growth experiences and family firm portfolio entrepreneurship: based on a branding theory perspective. Foreign Economics and Management [J].2021(07):126-140.

[8]. Schulze W S, Lubatkin M H, Dino, R N. Exploring the agency consequences of ownership dispersion among the directors of private family firms [J]. Academy of Management Journal,2003,46(2): 179-194.

[9]. Xiaogang He, Xinchun Li, Yanling Lian. Power concentration of family members and firm performance--a study of family listed companies[J]. Journal of Management Science,2011,14(5):86-96.