1. Introduction

The Securities and Exchange Commission (SEC) enacted the Sarbanes-Oxley Act of 2002 (SOX) as a response to some severe accounting scandals (e.g., the WorldCom fraud, the Enron fraud); and with this act, the Public Company Accounting Oversight Board (PCAOB) was founded to regulate and inspect both the domestic and the foreign audits of public companies listed in U.S. exchanges. Though the inspection is deemed to be beneficial (e.g. it can improve global financial reporting comparability) [1], this regime does not always work properly as it is supposed to because of some inter-country conflicts. For example, in China, PCAOB is not allowed to inspect the audit working papers that are required to be inspected, as China and the United States share different requirements in cross-border audit supervision, law enforcement, and the sharing of audit working materials. If Chinese companies provide working documents without governmental authorization, they will be penalized [2].

This departure from the inspection regime was believed to give a signal of lack of supervision and have an impact on the investor's sentiment as a whole. Prior research found that when fraud allegations against Chinese companies became public, a negative spillover effect existed as the stock prices of non-fraudulent Chinese companies witnessed a dramatic decline, and the effect enhanced when investors became pessimistic [3]. Given the wide implication, US-listed Chinese companies were once examined as a group to find whether their frauds are outliers or are parts of an iceberg from the perspective of board independence, because of the recent happened Luckin Coffee fraud case [4]. However, it is still irrational to assume that Chinese companies all have low disclosure quality. Different results were found that whether inspected by PCAOB or not will not make a significant difference in audit quality between US-listed Chinese companies and US companies if auditors try to exert more effort to bridge the gap [5]. Furthermore, considering the bonding hypothesis that companies from places with less mature disclosure requirements listing in the US imply that they are subject to US regulations, investors' confidence may be enhanced, and the stock prices of US-listed Chinese companies may witness a growth. Either of the two factors contributing to different directions of stock change may exist, or they can exist at the same time.

These arguments may well witness a change as the PCAOB reached an agreement of protocol with the China Securities Regulatory Commission and the Ministry of Finance of the PRC on August 26th, 2022. According to PCAOB, this agreement is deemed to be the first step toward inspection access to accounting firms in mainland China and Hongkong [6]. As the impact of this agreement remains unknown, this paper aims to research its influence on investors' reactions towards US-listed Chinese companies and the potential spillover effect on US-domestic listed companies with the same auditors that Chinese companies have. Our findings demonstrate the market reactions towards the agreement achieved between US and China authorities and show some market implications for the prospect of audit cooperation between these two countries in the foreseeable future. This topic is important because it is unlikely that all the listed companies are inferior; otherwise, the China Concept Stock becomes a 'lemon market'. In this sense, investors may miss some great investment opportunities due to their irrational sentiment.

Collecting data from 282 Chinese US-listed companies and 3986 U.S. companies with the same auditors as those Chinese companies, this paper conducted a t-test separately and contrasted the results after the necessary data cleaning process. By comparing the average stock return of U.S.-listed Chinese companies and the U.S. companies from July 27th, 2022 to Aug 29th, 2022, we found that U.S. companies have higher average stock return in the previous 21-day period, and in the 3-day announcement window, the difference of stock return between U.S.-listed Chinese companies and U.S. companies is not material.

The rest of this paper is structured as follows. Background information and theoretical development for PACOB inspections, the bonding hypothesis, and the spillover impact coupled with the U.S.- China audit effect are provided in Section 2. Section 3 illustrates the sample selection process and statistical analysis, and section 4&5 advances the discussion and highlights the limitations respectively.

2. Background & Hypothesis Development

2.1. PCAOB’s Audit Inspection

In order to safeguard investors' interests and advance the public good, the Sarbanes Oxley Act of 2002 established the Public Company Accounting Oversight Board (PCAOB), a private and nonprofit organization that aims at ensuring that auditors of public companies produce informative, fair, and independent audit reports. The PCAOB has four central program areas——registration, inspection, standards development, and enforcement——among which inspection is considered the most significant part [7]. The inspection not only involves random selections of audit clients' business review audit working papers, but also includes the review of auditor quality control, such as partner compensation arrangements, customer acceptance processes, and auditor overall quality control [8].

In the early period of this post-SOX system, though the board was under critique for being inefficient and dysfunctional with respect to its oversight model [9], several benefits of such inspection are discovered and studied later. For instance, the inspection urges more attention to be attached to smaller and growing audit companies, thus enhancing audit quality and demonstrating the perceived risk of inspection to the audit service market [10]. This result exists in both domestic and foreign US-listed companies [11-13]. Other researchers find that the quality of internal control is also increased in this process because auditors are motivated to correct the flaws [14]. Though the PCAOB inspection regime is for a good purpose as a whole, it is not always executed as it is supposed to because of some conflictions concerning legislation and politics, especially in China where PCAOB was not permitted to inspect the audit working papers of those audit firms that audit US-listed Chinese firms, who have a total market capitalization of over $1.3 trillion in 2022 [15]. Hence, it is then believed that those companies do not share the benefits brought by the inspection, as one research indicates that inspected audit firms deliver higher audit quality in comparison to foreign auditors who are not [16]. These foreign companies with their auditors inspected also can receive a lower cost of capital than their peers that are not subject to the PCAOB inspections by around 0.6% [17].

2.2. U.S.-China Audit Conflicts

China and the US have long been in dispute concerning the PCAOB's right in accessing audit documents of U.S.-listed Chinese companies. However, such conflict had not been severe until 2009 when the China Securities Regulatory Commission (CSRC) published a document that specified the procedure for ensuring the confidentiality of sensitive information when a Chinese company goes listing in a foreign market. Other legislations enacted later, such as The State Secrets Law of 2010 which prohibits transferring any document or other item containing state secrets overseas, continued to be introduced and further aggravated contradictions [18]. Even though conflicts seemed to turn around on 10 May 2013, as the PCAOB, CSRC, and the Chinese Ministry of Finance signed a Memorandum of Understanding on Enforcement Cooperation [19], in which a cooperative framework was established between these two countries concerning how to produce and exchange audit documents [20], the disagreement still continued.

It was later confirmed that the actual effect of that memorandum was considerably limited. PCAOB expected the Chinese counterpart would permit their access to audit documents on par with other jurisdictions, whereas Chinese authorities only meant to allow for discretionary access on a case-by-case basis [21]. Additionally, the PCAOB even stated that the Chinese authorities obstruct and impede its inspection and investigation of registered public audit firms for more than a decade (ibid.). Eventually, the conflict reached its peak in 2020 when several severe financial frauds took place, especially Luckin Coffee which fabricated its sales figures for nearly 2.2 billion RMB [22]. In response, the SEC passed the “Holding Foreign Companies Accountable Act” (HFCAA) in May 2020. According to the HFCAA, if a foreign company fails to meet the inspection requirements of the PCAOB about their accounting firms for three consecutive years, its securities are prohibited from trading in the US [23]. Furthermore, on December 2, 2021, the SEC perfected the HFCAA, requiring foreign firms listed in the US to disclose whether they are owned or controlled by government entities and to provide corresponding audit inspection evidence which are still prohibited from disclosuring by Chinese authorities. Consequently, confronting with these pressures, five companies—PetroChina, Sinopec, Chinalco, Shanghai Petrochemical Co. Ltd.—announced their plan to delist from the New York Stock Exchange, seemingly implying a bleak future for the U.S. listed Chinese companies [24]. These doctrines of precedents are believed to show a stressful market attitude towards US-listed Chinese companies. Considering the past fraud cases and the distrust of Chinese companies, investors' confidence may be impaired by the announcement of the U.S.-China Audit Agreement as they would fear the uncovering of hidden fraud cases and shadow areas through inspections, and thus the stock prices of Chinese companies may decline in this sense.

Hypothesis 1. a: With the releasement of the U.S.-China Audit Agreement, US-listed Chinese firms will experience a decline in stock prices.

2.3. Bonding Hypothesis

The bonding hypothesis explains why firms domiciled in weak institutional environments, choose to cross-list in a more stringent institutional environment, for example, the U.S. [25]. Preceding literature explains that companies from countries with less developed legal and financial systems and lower investor protection are credibly committed to a more rigorous disclosure standard and stringent monitoring due to the host country’s comprehensive laws and regulations through the overseas listing [26-28]. These foreign requirements "bond" managers to improve corporate governance, reduce the expropriation of firm resources and minority investors, and not take excessive personal benefits; in this sense, investors' trust and investment confidence are enhanced, leading to a lower cost of capital of these listed companies. The rationale is confirmed by many other researchers [29,30]. Statistics also showed that Tobin's q ratio (the measurement of firm value) of foreign companies that cross-listed in the U.S. was 16.5% higher than that of non-cross-listed firms from the same country [31].

Inevitably, though being the second largest economy in the world, China—as legal and financial systems are relatively less mature compared to those of other well-established international stock exchanges, such as NYSE, NASDAQ, and Amex in the US, where PCAOB inspection plays a role—is believed that its companies should follow the bonding hypothesis [32-34]. Hence, based on the bonding theory, it could be expected that overseas listing in the US for Chinese firms will enjoy some benefits brought by the bonding effect, that is, enhanced investors' confidence, lowered cost of capital, and increased stock prices. However, because of the conflicts between China's requirements for data protection and the US's requests for disclosure transparency, the fact that China and the US have not reached a formal agreement concerning the supervision of PCAOB-registered audit firms of the US-listed Chinese companies from mainland China and Hong Kong leaves a question mark towards the investors' perception of these firms' information quality and risk. Given the situation, as these companies are not subject to a stricter inspection system, the benefits of the bonding hypothesis may not obviously take place unless the conflicts are settled.

Hypothesis 1. b: With the releasement of the U.S.-China Audit Agreement, US-listed Chinese firms will experience a growth in stock prices.

2.4. Spillover Effect

The spillover effect, originally defined as the impact that a seemingly unrelated event happened in one country has on the economy of other countries, has now been extended to the study of accounting information. For example, prior research papers illustrate that the corporate disclosures released by one company have a spillover effect on the stock prices of its peers in the market [35-36]. As the U.S.-China audit agreement, having implications for the audit quality of financial disclosure, targets the audits of US-listed Chinese companies, what is not implicated in the agreement is the domestic listed companies with the same audit firms that Chinese peers have. Theoretically, the release of the agreement is deemed as an independent issue concerning the US-listed Chinese companies; thus, no market reaction will happen toward domestic companies as they are irrelevant. However, if the new rights by PCAOB to inspect the audit working papers of Chinese firms have some potential implications for US peers, investors may show reactions that will be implied by the change in stock prices. In this sense, these audit firms are regarded as the channel of the possible spillover effect and the influence can permeate to them because they share the same auditors with their Chinese peers.

The extent of the spillover effect is associated with the sentiment of investors, as their expectations and assessments can change if emotions alter. Thereby the stock prices will change. This mechanism is confirmed by much previous research [37-39]. When investors are not stressed about the US-listed Chinese Companies, they will make rational decisions and the stock price of Chinese companies, following the bonding hypothesis, will increase, while the price of US companies is not obviously affected. By contrast, if investors' emotions are pessimistic and regard Chinese Concept Stocks as a minefield because they doubt the audit quality and are concerned about potential fraud, they may show a negative attitude toward companies, leading to a general decline in stock prices; and if they cast doubt on the quality of audit work provided by the audit firms, stock prices of US-listed domestic companies may also witness a decline through the spillover channel.

Hypothesis 2: With the releasement of the U.S.-China Audit Agreement, the stock prices of US-listed domestic companies that share the same audit firms with Chinese peers will experience a change.

3. Data

3.1. Sample Selection

The stock return data of 282 Chinese US-listed firms and 3986 US domestic firms with the same auditors as those Chinese firms was obtained from the Wind database. Detailed information about these companies, such as total assets, market value, total liabilities, and North American Industry Classification code for the year 2021, was retrieved from Compustat North America Fundamentals Annual. The sample period for our stock return data begins from July 27, 2022, to Aug 29, 2022.

We first began constructing the sample by matching US-listed Chinese firms to US-domestic firms with the same NAICS code (that is, they are in the same industry) and similar market value. This procedure eliminated a number of firms, and 242 US-listed Chinese firms with their matched domestic firms remained in the data set. To further make the data prepared, considering the fact that the mean numbers of total assets and market value of Chinese firms in our sample are generally larger than that of their matched US firms and the difference is material, we limited the difference of the market value of these US-CN company pairs to less than 20m. The remained US-listed Chinese companies in the sample are then matched with their domestic listed peers with their stock return data from the period July 27, 2022, to Aug 29, 2022 (past 21 days prior to the releasement of the audit agreement and 3-day event window); and 196 firms remained. Data of 2 firms are also dropped in this process because the stock return data is missed. The final analysis of stock returns is based on 194 observations (97 Chinese US-listed firms and 97 matched firms).

Table 1: Matching variables.

Obs | CHN | US | Diff | T value | P value | |

Total Asset | 97 | 1652.728 | 1181.313 | 471.4149 | 0.5398 | 0.5906 |

Total Liabilities | 97 | 943.3304 | 865.1997 | 78.13072 | 0.1117 | 0.9113 |

Market Value | 97 | 708.0338 | 708.7066 | -.6727808 | -0.8205 | 0.4140 |

Price-to-book Ratio | 97 | 4.590486 | 5.324267 | -.733781 | -0.1421 | 0.8873 |

Table 1 provides the descriptive statistics for matching variable and financial fundamentals of Chinese and US firms in the sample. As is shown in Table 1, there is no significant difference in the mean values of market value, total assets, total liabilities, and the price-to-book ratio between the Chinese firms and the matched control firms. The result indicates that our matching procedure is effective.

Table 2: Daily stock return summary statistics.

N | Std. Dev. | 25% | Mean | 75% | |

Chinese Firm | 2281 | 4.728 | -2.484 | -.08 | 2.073 |

US Firm | 2281 | 5.092 | -1.931 | .342 | 2.135 |

Table 2 presents the descriptive statistics for variables used in our analyses. On average, Chinese firms in our sample have a lower daily stock return (-.08%) compared to US firms (0.342%) (See Table 2).

3.2. Statistical Analysis

3.2.1. Hypothesis 1 Testing.

To test the hypothesis regarding investors' confidence level in Chinese US-listed company's information quality after the audit agreement, we performed two sets of t-tests for the sample mean difference.

Table 3: Stock returns by EVENT (Indicator).

Summary Statistics: US Firm Sample | |||||

EVENT | N | SD | 25% | 50% | 75% |

0 | 1993 | 5.2 | -1.826 | .439 | 2.283 |

1 | 288 | 4.217 | -2.815 | -.33 | 1.379 |

Summary Statistics: Chinese Firm Sample | |||||

EVENT | N | SD | 25% | 50% | 75% |

0 | 1993 | 4.653 | -2.386 | -.046 | 2.126 |

1 | 288 | 5.216 | -2.922 | -.313 | 1.704 |

Table 4: Two-sample t-test of stock return on Chinese firm sample by EVENT_t.

Event=0 | Event=1 | Mean1 | Mean2 | Diff | t-Stat | p-Value | |

Stock Returns (Chinese Firms) | 1993 | 288 | -0.046 | -.313 | .267 | 0.9 | 0.37 |

We first performed an independent group t-test on Chinese firms' stock return data given the sample period and generated dummy variable EVENT_t =1 to indicate if the observation falls in the three-day event period (August 25th, August 26th, August 29th), and EVENT_t =0 to indicate if it falls in the prior 21-day period. We trimmed the stock return data of Chinese firms at a 0.5% cutoff at the left tail and 99% at the right tail to satisfy the test's normal distribution and equal variance assumptions. Table 3 shows the statistics of stock returns by indicator EVENT_t for the Chinese and US samples, and the difference in variance is immaterial when grouped by the event indicator. Furthermore, the result in Table 4 shows the mean of stock returns between the 3-day event window has no significant difference from returns in the pre-event 21-days period.

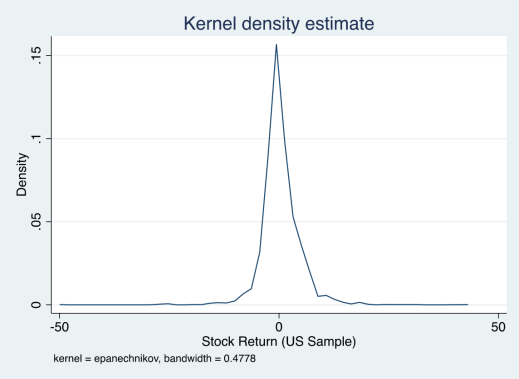

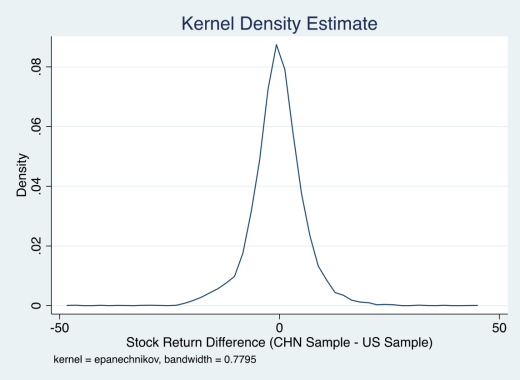

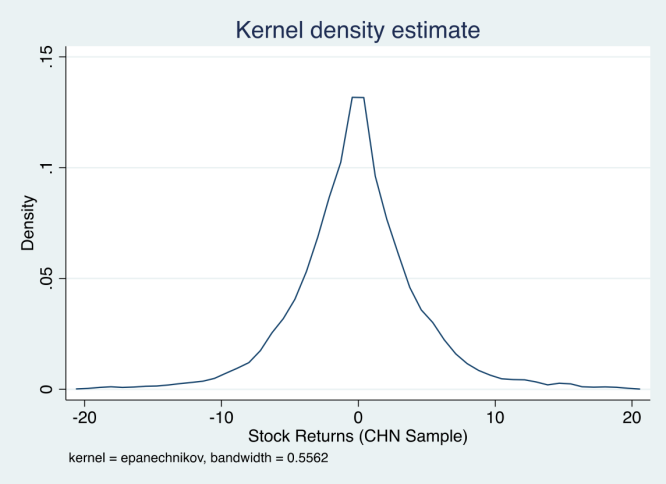

Figure 1: Kernel density plot of stock returns.

Table 5: Paired t-test of difference in mean (US sample stock return - CHN sample stock return).

Obs | US Firm | CHN Firm | DifF | t Value | p Value | |

EVENT_t=0 | 1993 | .439 | -0.046 | .485 | 3.15 | .002*** |

EVENT_t=1 | 288 | -.33 | -0.313 | -.017 | -.05 | .963 |

Then, we performed 2 paired t-tests separately in the period from July 27th, 2022 to Aug 24th, 2022 (previous 21 days), and from August 25th to August 29th (3-day window). In each time period, we compare the sample mean to the difference between Chinese and US firms. The kernel density plots show the difference between the stock return values of the two groups satisfies the normality assumption for the paired t-test (See Figure1). The result, in Table 5, shows that in the previous 21-day period, the mean stock return of the US firm sample is statistically higher than that of the Chinese firm sample. However, in the 3-day announcement window of the event, the difference between sample US firm stock returns and Chinese firm stock returns becomes statistically insignificant.

3.2.2. Hypothesis 2 Testing.

Table 6: Two-sample t-test of stock return on US firm sample by EVENT_t.

Event=0 | Event=1 | Mean1 | Mean2 | Diff | t-Stat | p-Value | |

Stock Returns (US Firms) | 2037 | 291 | 0.442 | -.327 | .768 | 2.4 | .015*** |

Whether investors' attitudes towards Chinese inspected firms can permeate to their US peers or not is analyzed by conducting an independent group t-test on US firms sample for the [-24, -2] day period and [-1,1] event window. The statistics find a significant decrease in mean returns after the agreement signing (See Table6). It implies that our analysis approach found investors' reactions to US-China Audit Agreement are not restricted to Chinese firms, but also are priced in stock returns of their US peers with similar industry and financial backgrounds.

4. Discussion

Generally, our analysis shows it is a legitimate concern that PACOB's limitation to conduct an inspection in institutionally less developed countries (China in this case) hinders managers to be bonded by higher responsibility and corporate governance standards. As shown in Table1 and Table2, we can observe that Chinese firms in our sample have higher average assets and liabilities, while they are consistently having lower valuations (as shown by their market value and stock price) relative to domestic public firms in the US territory. This can be also seen by the sample mean test (See Table5) that prior to the agreement signing, stock returns of Chinese firms are significantly lower than their US peers.

As shown by comparing means of US stock returns before and after the agreement, in Table 6, our results add credence to Hypothesis 1.a., the release of the US-China Audit Agreement brings panic to the investors (worries of potential uncovered fraud cases) to the extent that stock returns would decline as a result. We didn't find a significant change in Chinese firms' stock returns after the agreement releasement (See Table4). Our hypothesis development can provide an explanation for this discrepancy in US firms' and Chinese firms' stock returns within the sample period: it might be possible that Chinese companies are also affected by negative investor sentiments in terms of stock returns, yet the successful reach of US-China audit cooperation is effective signaling of Chinese firms' commitment to higher audit quality, more rigorous disclosure standard, and thus investors' increased confidence positively influenced the stock return of Chinese firms and offset the negative impact. Due to the limitation in our research design at this stage, a more sophisticated design and causal identification procedure can unravel more deeply about the underlying mechanism finally bringing the statistical results we obtained, and our findings can be open to many explanations. Yet overall, our results prove that the US-China audit cooperation is effective in transferring the benefits of the bonding hypothesis (Hypothesis 1.b.) from domestic companies to foreign companies as PACOB gains access to audit working papers of foreign firms for inspection. The statistical results on US domestic firms' stock return (See Table6) variations provide evidence that the market reaction of this Audit Agreement could permeate to non-inspected firms in US domestic markets.

5. Conclusion

In this paper, we provide evidence that the release of US-China Audit Agreement will cause panic to the investors (worries of potential uncovered fraud cases) to the extent that stock returns would decline as a final consequence. We also find that increased investor confidence has had a positive impact on the stock returns of Chinese companies, offsetting the negative impact because of the US-China audit cooperation. More importantly, it is possible that the market reaction of this Audit Agreement could permeate to non-inspected firms at US domestic markets.

Nevertheless, the process by which we generate the result does have some potential limitations. First of all, numerous factors might contribute to the changes in stock prices. Even though we focus on the [-1,1] interval, potential noise studies may still alter the result, and longer time-span studies may have different discoveries; moreover, more potential econometric models may well be employed to help better analyze and illustrate the phenomena. Secondly, the financial accounting theories we employed to generate the hypothesis are not universally accepted. Many other different opinions existed and may have a better ability to illustrate the market reactions. Thirdly, investor sentiment towards the market is difficult to quantify. The hypothesis development of investors' emotions in this paper is based upon prior papers concerning the investors' worries and stress towards US-listed Chinese firms, but this may not represent a common belief.

Acknowledgement

Yinuo Zhang, Yang Chen, Zirui Wang, Jiayi Gong contributed equally to this work and should be considered co-first authors

References

[1]. Ege, M., Kim, Y. H., and Wang, D. (2021). Do PCAOB Inspections of Foreign Auditors Affect Global Financial Reporting Comparability? Contemporary Accounting Research, 38(4), 2659–2690. https://doi.org/10.1111/1911-3846.12701

[2]. Chan, R. S. Y., and Ho, J. K. S. (2015). Could complying with China’s secrecy laws be an excuse for auditors not to provide their working papers of auditing Chinese companies? Recent cases in the United States and Hong Kong. King’s Law Journal, 26(1), 99–128. https://doi.org/10.1080/09615768.2015.1035129

[3]. Darrough, M., Huang, R., and Zhao, S. (2020). Spillover Effects of Fraud Allegations and Investor Sentiment. Contemporary Accounting Research, 37(2), 982–1014. https://doi.org/10.1111/1911-3846.12541

[4]. Xi, C., and Huang, Y. (2021). Are US-Listed Chinese Firms a Minefield? A Board Perspective. A Board Perspective (May 8, 2021). Chao Xi & Yurong Huang,‘Are US-Listed Chinese Firms a Minefield.

[5]. Krishnan, G. V, Yang, Y., and Li, Z. (2022). Do Blockades to PCAOB Inspections Suggest Lower Audit Quality? The Case of Chinese Companies Listed in the US. The Case of Chinese Companies Listed in the US (March 11, 2022).

[6]. Fact Sheet: China Agreement. 26 Aug. 2022, https://pcaobus.org/news-events/news-releases/news-release-detail/fact-sheet-china-agreement.

[7]. Gunny, K. A., and Zhang, T. C. (2013). PCAOB inspection reports and audit quality. Journal of Accounting and Public Policy, 32(2), 136–160. https://doi.org/10.1016/j.jaccpubpol.2012.11.002

[8]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[9]. Glover, S. M., Prawitt, D. F., and Taylor, M. H. (2009). Audit standard setting and inspection for U.S. public companies: A critical assessment and recommendations for fundamental change. Accounting Horizons, 23(2), 221–237. https://doi.org/10.2308/acch.2009.23.2.221

[10]. Lamoreaux, P. T., Mauler, L. M., and Newton, N. J. (2020). Audit Regulation and Cost of Equity Capital: Evidence from the PCAOB’s International Inspection Regime. Contemporary Accounting Research, 37(4), 2438–2471. https://doi.org/10.1111/1911-3846.12599

[11]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[12]. Löhlein, L. (2016). From peer review to PCAOB inspections: Regulating for audit quality in the U.S. Journal of Accounting Literature, 36, 28–47. https://doi.org/10.1016/j.acclit.2016.05.002

[13]. Mohapatra, P. S., Elkins, H., Lobo, G. J., and Chi, W. (2022). The impact of PCAOB international registration on audit quality and audit fees: Evidence from China. Journal of Accounting and Public Policy, 41(4), 106947. https://doi.org/10.1016/j.jaccpubpol.2022.106947

[14]. DeFond, M. L., and Lennox, C. S. (2011). The effect of SOX on small auditor exits and audit quality. Journal of Accounting and Economics, 52(1), 21–40. https://doi.org/10.1016/j.jacceco.2011.03.002

[15]. Chinese companies on U.S. Stock Exchanges - uscc.gov. (2022, March 31). Retrieved January 31, 2023, from https://www.uscc.gov/sites/default/files/2022-03/Chinese_Companies_on_US_Stock_Exchanges.pdf

[16]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[17]. Lamoreaux, P. T., Mauler, L. M., and Newton, N. J. (2020). Audit Regulation and Cost of Equity Capital: Evidence from the PCAOB’s International Inspection Regime. Contemporary Accounting Research, 37(4), 2438–2471. https://doi.org/10.1111/1911-3846.12599

[18]. Chan, R. S. Y., and Ho, J. K. S. (2015). Could complying with China’s secrecy laws be an excuse for auditors not to provide their working papers of auditing Chinese companies? Recent cases in the United States and Hong Kong. King’s Law Journal, 26(1), 99–128. https://doi.org/10.1080/09615768.2015.1035129

[19]. 2013 China-US MoU

[20]. Huang, R. H. (2021). The U.S.-China Audit Oversight Dispute: Causes, Solutions, and Implications for Hong Kong. International Lawyer, 54, 151–199.

[21]. Huang, R. H. (2021). The U.S.-China Audit Oversight Dispute: Causes, Solutions, and Implications for Hong Kong. International Lawyer, 54, 151–199.

[22]. Kukreja, G. (2021). The Spillover of The Coffee: Material Misstatements at (UN) Luckin Coffee Inc. Indian Journal of Finance and Banking, 5(2), 106-114. https://doi.org/10.46281/ijfb.v5i2.1058

[23]. Fact Sheet: China Agreement. 26 Aug. 2022, https://pcaobus.org/news-events/news-releases/news-release-detail/fact-sheet-china-agreement.

[24]. Person. (2022, August 12). Five Chinese state-owned companies, under scrutiny in U.S., will delist from NYSE. Reuters. Retrieved January 31, 2023, from https://www.reuters.com/business/finance/several-chinese-state-owned-companies-delist-nyse-2022-08-12/

[25]. Peng, M. W., and Blevins, D. P. (2012). Why Do Chinese Firms Cross-List in The United States? (A. A. Rasheed & T. Yoshikawa (eds.); pp. 249–265). Palgrave Macmillan UK. https://doi.org/10.1057/9781137029560_12

[26]. Coffee Jr., J. C. (2005). Privatization and Corporate Governance: The Lessons from Securities Market Failure. In SSRN Electronic Journal. https://doi.org/10.2139/ssrn.215608

[27]. Jindra, J., Voetmann, T., and Walkling, R. A. (2017). Private Class Action Litigation Risk of Chinese Firms Listed in the US. Quarterly Journal of Finance, 7(1), 8–25. https://doi.org/10.1142/S2010139216500208

[28]. Stulz, R. M. (1999). Globalization of equity markets and the cost of capital. National Bureau of Economic Research Cambridge, Mass., USA.Stulz, R. M. (2009). Securities laws, disclosure, and national capital markets in the age of financial globalization. Journal of Accounting Research, 47(2), 349–390. D

[29]. Djankov, S., La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008). The law and economics of self-dealing. Journal of Financial Economics, 88(3), 430–465. https://doi.org/https://doi.org/10.1016/j.jfineco.2007.02.007

[30]. Karolyi, G. A. (2012). Corporate governance, agency problems and international cross-listings: A defense of the bonding hypothesis. Emerging Markets Review, 13(4), 516–547. https://doi.org/https://doi.org/10.1016/j.ememar.2012.08.001

[31]. Doidge, C., Karolyi, G. A., and Stulz, R. M. (2004). Why are foreign firms listed in the U.S. worth more? Journal of Financial Economics, 71(2), 205–238. https://doi.org/https://doi.org/10.1016/S0304-405X(03)00183-1

[32]. Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. Journal of Financial Economics, 77(1), 57–116. https://doi.org/https://doi.org/10.1016/j.jfineco.2004.06.010

[33]. Berkman, H., Cole, R. A., and Fu, L. J. (2010). Political Connections and Minority-Shareholder Protection: Evidence from Securities-Market Regulation in China. Journal of Financial and Quantitative Analysis, 45(6), 1391–1417. https://doi.org/DOI: 10.1017/S0022109010000608

[34]. Liu, L. X., Jiang, F., and Sathye, M. (2017). Does bonding really bond? Liability of foreignness and cross-listing of Chinese firms on international stock exchanges. Research in International Business and Finance, 41, 109–124. https://doi.org/https://doi.org/10.1016/j.ribaf.2017.04.033

[35]. Beatty, A., Liao, S., and Yu, J. J. (2013). The spillover effect of fraudulent financial reporting on peer firms’ investments. Journal of Accounting and Economics, 55(2–3), 183–205. https://doi.org/10.1016/j.jacceco.2013.01.003

[36]. Gleason, C., Jenkins, N., and Johnson, W. B. (2005). Financial statement credibility: the contagion effects of accounting restatements. Accounting Review, 83(1), 83–110.

[37]. Baker, M., and Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. Journal of Finance, 61(4), 1645–1680. https://doi.org/10.1111/j.1540-6261.2006.00885.x

[38]. Cevik, E., Kirci Altinkeski, B., Cevik, E. I., and Dibooglu, S. (2022). Investor sentiments and stock markets during the COVID-19 pandemic. Financial Innovation, 8(1). https://doi.org/10.1186/s40854-022-00375-0

[39]. Mbanga, C., Darrat, A. F., and Park, J. C. (2019). Investor sentiment and aggregate stock returns: the role of investor attention. In Review of Quantitative Finance and Accounting (Vol. 53, Issue 2). https://doi.org/10.1007/s11156-018-0753-2

Cite this article

Zhang,Y.;Chen,Y.;Wang,Z.;Gong,J. (2023). The Impact of US-CN Audit Agreement on US-listed Chinese Companies and Its US Peers. Advances in Economics, Management and Political Sciences,20,47-56.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ege, M., Kim, Y. H., and Wang, D. (2021). Do PCAOB Inspections of Foreign Auditors Affect Global Financial Reporting Comparability? Contemporary Accounting Research, 38(4), 2659–2690. https://doi.org/10.1111/1911-3846.12701

[2]. Chan, R. S. Y., and Ho, J. K. S. (2015). Could complying with China’s secrecy laws be an excuse for auditors not to provide their working papers of auditing Chinese companies? Recent cases in the United States and Hong Kong. King’s Law Journal, 26(1), 99–128. https://doi.org/10.1080/09615768.2015.1035129

[3]. Darrough, M., Huang, R., and Zhao, S. (2020). Spillover Effects of Fraud Allegations and Investor Sentiment. Contemporary Accounting Research, 37(2), 982–1014. https://doi.org/10.1111/1911-3846.12541

[4]. Xi, C., and Huang, Y. (2021). Are US-Listed Chinese Firms a Minefield? A Board Perspective. A Board Perspective (May 8, 2021). Chao Xi & Yurong Huang,‘Are US-Listed Chinese Firms a Minefield.

[5]. Krishnan, G. V, Yang, Y., and Li, Z. (2022). Do Blockades to PCAOB Inspections Suggest Lower Audit Quality? The Case of Chinese Companies Listed in the US. The Case of Chinese Companies Listed in the US (March 11, 2022).

[6]. Fact Sheet: China Agreement. 26 Aug. 2022, https://pcaobus.org/news-events/news-releases/news-release-detail/fact-sheet-china-agreement.

[7]. Gunny, K. A., and Zhang, T. C. (2013). PCAOB inspection reports and audit quality. Journal of Accounting and Public Policy, 32(2), 136–160. https://doi.org/10.1016/j.jaccpubpol.2012.11.002

[8]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[9]. Glover, S. M., Prawitt, D. F., and Taylor, M. H. (2009). Audit standard setting and inspection for U.S. public companies: A critical assessment and recommendations for fundamental change. Accounting Horizons, 23(2), 221–237. https://doi.org/10.2308/acch.2009.23.2.221

[10]. Lamoreaux, P. T., Mauler, L. M., and Newton, N. J. (2020). Audit Regulation and Cost of Equity Capital: Evidence from the PCAOB’s International Inspection Regime. Contemporary Accounting Research, 37(4), 2438–2471. https://doi.org/10.1111/1911-3846.12599

[11]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[12]. Löhlein, L. (2016). From peer review to PCAOB inspections: Regulating for audit quality in the U.S. Journal of Accounting Literature, 36, 28–47. https://doi.org/10.1016/j.acclit.2016.05.002

[13]. Mohapatra, P. S., Elkins, H., Lobo, G. J., and Chi, W. (2022). The impact of PCAOB international registration on audit quality and audit fees: Evidence from China. Journal of Accounting and Public Policy, 41(4), 106947. https://doi.org/10.1016/j.jaccpubpol.2022.106947

[14]. DeFond, M. L., and Lennox, C. S. (2011). The effect of SOX on small auditor exits and audit quality. Journal of Accounting and Economics, 52(1), 21–40. https://doi.org/10.1016/j.jacceco.2011.03.002

[15]. Chinese companies on U.S. Stock Exchanges - uscc.gov. (2022, March 31). Retrieved January 31, 2023, from https://www.uscc.gov/sites/default/files/2022-03/Chinese_Companies_on_US_Stock_Exchanges.pdf

[16]. Lamoreaux, P. T. (2016). Does PCAOB inspection access improve audit quality? An examination of foreign firms listed in the United States. Journal of Accounting and Economics, 61(2–3), 313–337. https://doi.org/10.1016/j.jacceco.2016.02.001

[17]. Lamoreaux, P. T., Mauler, L. M., and Newton, N. J. (2020). Audit Regulation and Cost of Equity Capital: Evidence from the PCAOB’s International Inspection Regime. Contemporary Accounting Research, 37(4), 2438–2471. https://doi.org/10.1111/1911-3846.12599

[18]. Chan, R. S. Y., and Ho, J. K. S. (2015). Could complying with China’s secrecy laws be an excuse for auditors not to provide their working papers of auditing Chinese companies? Recent cases in the United States and Hong Kong. King’s Law Journal, 26(1), 99–128. https://doi.org/10.1080/09615768.2015.1035129

[19]. 2013 China-US MoU

[20]. Huang, R. H. (2021). The U.S.-China Audit Oversight Dispute: Causes, Solutions, and Implications for Hong Kong. International Lawyer, 54, 151–199.

[21]. Huang, R. H. (2021). The U.S.-China Audit Oversight Dispute: Causes, Solutions, and Implications for Hong Kong. International Lawyer, 54, 151–199.

[22]. Kukreja, G. (2021). The Spillover of The Coffee: Material Misstatements at (UN) Luckin Coffee Inc. Indian Journal of Finance and Banking, 5(2), 106-114. https://doi.org/10.46281/ijfb.v5i2.1058

[23]. Fact Sheet: China Agreement. 26 Aug. 2022, https://pcaobus.org/news-events/news-releases/news-release-detail/fact-sheet-china-agreement.

[24]. Person. (2022, August 12). Five Chinese state-owned companies, under scrutiny in U.S., will delist from NYSE. Reuters. Retrieved January 31, 2023, from https://www.reuters.com/business/finance/several-chinese-state-owned-companies-delist-nyse-2022-08-12/

[25]. Peng, M. W., and Blevins, D. P. (2012). Why Do Chinese Firms Cross-List in The United States? (A. A. Rasheed & T. Yoshikawa (eds.); pp. 249–265). Palgrave Macmillan UK. https://doi.org/10.1057/9781137029560_12

[26]. Coffee Jr., J. C. (2005). Privatization and Corporate Governance: The Lessons from Securities Market Failure. In SSRN Electronic Journal. https://doi.org/10.2139/ssrn.215608

[27]. Jindra, J., Voetmann, T., and Walkling, R. A. (2017). Private Class Action Litigation Risk of Chinese Firms Listed in the US. Quarterly Journal of Finance, 7(1), 8–25. https://doi.org/10.1142/S2010139216500208

[28]. Stulz, R. M. (1999). Globalization of equity markets and the cost of capital. National Bureau of Economic Research Cambridge, Mass., USA.Stulz, R. M. (2009). Securities laws, disclosure, and national capital markets in the age of financial globalization. Journal of Accounting Research, 47(2), 349–390. D

[29]. Djankov, S., La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (2008). The law and economics of self-dealing. Journal of Financial Economics, 88(3), 430–465. https://doi.org/https://doi.org/10.1016/j.jfineco.2007.02.007

[30]. Karolyi, G. A. (2012). Corporate governance, agency problems and international cross-listings: A defense of the bonding hypothesis. Emerging Markets Review, 13(4), 516–547. https://doi.org/https://doi.org/10.1016/j.ememar.2012.08.001

[31]. Doidge, C., Karolyi, G. A., and Stulz, R. M. (2004). Why are foreign firms listed in the U.S. worth more? Journal of Financial Economics, 71(2), 205–238. https://doi.org/https://doi.org/10.1016/S0304-405X(03)00183-1

[32]. Allen, F., Qian, J., and Qian, M. (2005). Law, finance, and economic growth in China. Journal of Financial Economics, 77(1), 57–116. https://doi.org/https://doi.org/10.1016/j.jfineco.2004.06.010

[33]. Berkman, H., Cole, R. A., and Fu, L. J. (2010). Political Connections and Minority-Shareholder Protection: Evidence from Securities-Market Regulation in China. Journal of Financial and Quantitative Analysis, 45(6), 1391–1417. https://doi.org/DOI: 10.1017/S0022109010000608

[34]. Liu, L. X., Jiang, F., and Sathye, M. (2017). Does bonding really bond? Liability of foreignness and cross-listing of Chinese firms on international stock exchanges. Research in International Business and Finance, 41, 109–124. https://doi.org/https://doi.org/10.1016/j.ribaf.2017.04.033

[35]. Beatty, A., Liao, S., and Yu, J. J. (2013). The spillover effect of fraudulent financial reporting on peer firms’ investments. Journal of Accounting and Economics, 55(2–3), 183–205. https://doi.org/10.1016/j.jacceco.2013.01.003

[36]. Gleason, C., Jenkins, N., and Johnson, W. B. (2005). Financial statement credibility: the contagion effects of accounting restatements. Accounting Review, 83(1), 83–110.

[37]. Baker, M., and Wurgler, J. (2006). Investor sentiment and the cross-section of stock returns. Journal of Finance, 61(4), 1645–1680. https://doi.org/10.1111/j.1540-6261.2006.00885.x

[38]. Cevik, E., Kirci Altinkeski, B., Cevik, E. I., and Dibooglu, S. (2022). Investor sentiments and stock markets during the COVID-19 pandemic. Financial Innovation, 8(1). https://doi.org/10.1186/s40854-022-00375-0

[39]. Mbanga, C., Darrat, A. F., and Park, J. C. (2019). Investor sentiment and aggregate stock returns: the role of investor attention. In Review of Quantitative Finance and Accounting (Vol. 53, Issue 2). https://doi.org/10.1007/s11156-018-0753-2