1. Introduction

With the continuous development of the Internet, modern logistics and big data technology have provided a wide space for the development of new coffee retailing. Under this background, Luckin Coffee has seized the opportunity to quickly open up China's mid-range consumer market. By the end of 2021, the total number of Luckin Coffee stores in China has reached 6024, surpassing Starbucks, which has 5557 stores in China, to become the largest coffee chain in China [1]. During Luckin Coffee's meteoric rise over the past few years, there have been numerous papers on Luckin Coffee. However, there is a lack of research on its stable growth in the medium term. This paper will discuss the stable operation performance of Luckin Coffee from the beginning of its establishment to the present market and analyze the reasons on marketing and industry chain perspective. In this paper, we will conduct a search and review of relevant literature based on Porter's five forces theory. At the same time, this paper hope to summarize the leading operating methods in the coffee market under the new retail model through the study of Luckin Coffee.

2. Marketing Tools

2.1. Brand Marketing

The brand color of Luckin Coffee is blue, with blue as the main color to highlight the vitality and energy of young people, this move also aims to target young consumers, especially the urban white-collar workers. In terms of branding, they combined the English word "luck" and created the English name "Luckin Coffee," which means the luck that comes from drinking coffee. Through the analysis of Chinese and English and the brand logo, it is easy to see that Luckin Coffee is not only limited to the domestic consumer market but also has consideration for the international market [2].

2.2. Brand Communication

In the direction of brand communication, Luckin Coffee uses a combination of online and offline multi-channel approaches. Online advertising is mainly promoted through the WeChat Location-Based Service platform, which contains information on hot deals, stores, and offers to attract consumers in the surrounding area [3]. In addition, Luckin Coffee also promotes its high -quality coffee brand culture to potential consumers through WeChat video, Tiktok video and official applications. Off-line advertising consists mainly of placing billboards with celebrity endorsements in central areas of core cities, such as at large office buildings, metro and subway stations, and large supermarkets. Besides, for the store advertising is also endless, from the store entrance paste the small blue deer conspicuous target recognition, to the ordering table in front of high-quality coffee beans and coffee master publicity, to the store display screen of the promotional film, all highlight the importance of the brand display.

2.3. Advertising Accurately Targeted to Consumers

In the early stage of development of Luckin Coffee, they chose two famous actors Tang Wei and Zhang Zhen, who have a literary atmosphere and treat people with low profile and serious and strict characteristics. These two stars were chosen because of their excellent business ability in the film and TV drama industry and their generous, low-key personality characteristics. Such a temperament is the type preferred by white-collar groups in society, and it also promotes a brand positioning of "high-quality commercial coffee" to the public. At the same time, they put such advertisements on subways, elevators and publicity walls in first-tier cities, using such high exposure to attract the attention of potential consumers. At the same time, Luckin Coffee focused on cooperation with advertising and media companies in buildings, and carried out a screen spread in and out of elevators, quickly rooting this brand in the hearts of many people. In the online application, Luckin Coffee uses spokesperson photos to design gift cards and encourage consumers to give coffee (gift cards) to others; it also carries out signed photos on Weibo, celebrity live greetings and signed coffee cups for lucky draws, etc. The coffee cups are also differentiated according to each spokesperson's characteristics, for example, Tang Wei corresponds to the white professional coffee cup, which is a symbol of female habit with outstanding temperament, and Zhang Zhen promotes the mature personality with the classic version of black coffee cups for mature and stable men. After the success of the first wave of marketing, Luckin Coffee is planning to attract a younger wave of customers, that is, the 18–25-year-old youth group. They chose Chinese flow stars Liu Haoran and Xiao Zhan, and through the purchase of the "Meet Haoran" series of handicraft blind boxes and the joint flow star “Xiao Zhan Cup" campaign to arouse consumers' curiosity and desire to collect them, thus attracting fans to buy and spread the traffic. The microblogging topic of Liu Haoran's endorsement of Luckin Coffee reached 295,000 discussions and even ranked No. 1 on the microblogging hot search list [4]. If Tang Wei and Zhang Zhen's endorsement helped Luckin Coffee to open up awareness and establish a good brand image, then after Liu Haoran and Xiao Zhan were selected as brand spokespersons, Luckin Coffee gradually focused on the interaction and promotion with young people and fans in the rice circle. Focusing on current affairs hotspots, Luckin Coffee found Gu Ailing, a dynamic female snow skill athlete under 20 years old, who got two gold medals for China, as the spokesperson after the 2022 Beijing Winter Olympics, and the energy and passion burst out again on the small blue deer.

2.4. Digitizing the Entire Industry Chain

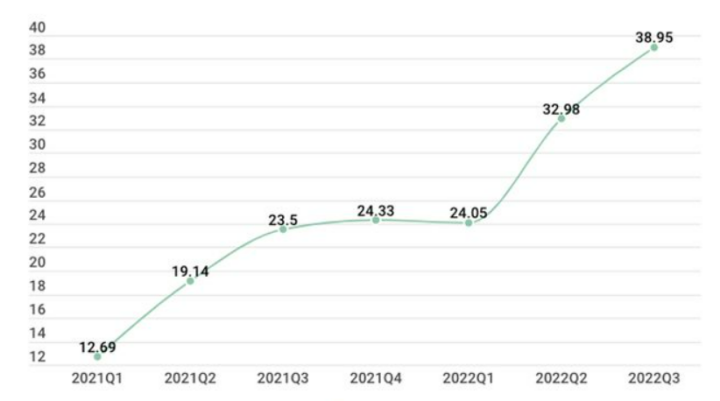

Figure 1: Change in quarterly revenue for Luckin Coffee (Unit: billion yuan).

Table 1: Luckin Coffee quarter-on-quarter growth rate table in 2022.

Quarter in 2022 | Q1 | Q2 | Q3 |

Quarter-on-quarter growth rate | 89.5% | 72.3% | 65.7% |

Table 2: Quarter’s comparative growth on moving base.

Quarter | 2021Q2 | 2021Q3 | 2022Q2 | 2022Q3 |

Comparative growth on moving base | 50.8% | 22.8% | 37.1% | 18.1% |

Table 3: Number of new freshly made drinks in 2020 and 2021.

Year | 2020 | 2021 |

Number of new freshly made drinks | 77 | 113 |

The data in the table 1 demonstrates that going into 2022, Luckin Coffee has had three consecutive quarter-on-quarter growth rate growth of more than 65% [1]. As seen in figure 1, the rapid growth of Luckin Coffee has experienced two key climbs. The first one started in Q1 2021 and lasted for two quarters. The second time started in Q2 2022 and also lasted for two quarters.

To explore the support force behind these two high growths, it must have to start with a raw coconut latte, which was put on the shelves on April 6, 2021, just like any other new product. Since then, it has created one sales miracle after another: "sold out in 1 second," "the whole network rush," "almost out of supply," "sold 100 million cups in 1 year " and so on. With raw coconut latte hot sales, Luckin Coffee 2021 Q2 revenue growth rate of more than 37.1%, quarter-on-quarter growth rate of more than 50.8%, coconut cloud latte single week sales broke 4.95 million cups in april according to table 2. Two and a half months later, Coconut Cloud Latte sold 24 million cups, with an average monthly sale of 10 million cups. It is also with the hot sales of Coconut Cloud Latte that Luckin Coffee's turnover growth rate surged again in Q2 2022. Meanwhile, according to table 3, looking ahead to 2021, Luckin Coffee launched a total of 113 new ready-made beverages, up 47% from 77 in 2020. Meanwhile entering 2022, Luckin Coffee's success rate of pop-ups has further improved [1].

A pop-up may have a lucky component, but when pop-ups appear in large quantities, this must have some kind of necessary ability. In the same way, if you look at Luckin Coffee's two climbs from a different perspective, the first time was mainly due to the explosive driving force, but the second time continued to hit the boundary of the normal high-speed growth, thanks to the continuous precipitation of digital capabilities [5].

In the traditional perception, many businesses will use the expression "sweet and sour" plus the degree to describe its taste. Although it is obvious and intuitive, it is difficult to accurately determine the subtle differences in taste and customer preference. But numbers can solve all this. Digital definitions allow for the development of an infinite number of coffee styles, breaking the boundaries of traditional beverage taste. Today’s Luckin Coffee can create more than a hundred new products a year, and in the future, there can be more, because there is no ceiling for numbers. At the same time, the digital definition of taste can do infinite creation of new products, and through the digital process of the big wave to strictly eliminate the new products that do not meet the standard, so as to optimize the style menu. Especially for a consumer company experiencing growth, user data often speaks louder than any other metric [6].

In the traditional perception, many businesses will use the expression "sweet and sour" plus the degree to describe its taste. Although it is obvious and intuitive, it is difficult to accurately determine the subtle differences in taste and customer preference. But numbers can solve all this. Digital definitions allow for the development of an infinite number of coffee styles, breaking the boundaries of traditional beverage taste. Today’s Luckin Coffee can create more than a hundred new products a year, and in the future, there can be more, because there is no ceiling for numbers. At the same time, the digital definition of taste can do infinite creation of new products, and through the digital process of the big wave to strictly eliminate the new products that do not meet the standard, so as to optimize the style menu. Especially for a consumer company experiencing growth, user data often speaks louder than any other metric [6].

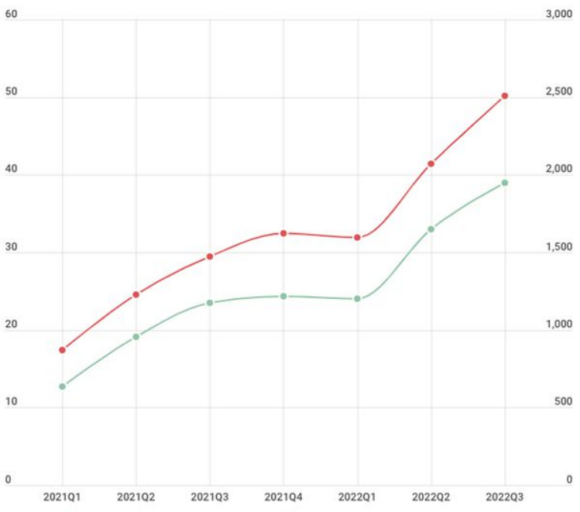

Figure 2: Luckin Coffee quarterly revenue and monthly customer number (Unit: Ten thousand people) comparison.

Figure 2 adds quarterly monthly customer number data to the revenue data. It is easy to see the striking consistency of the two curves. In a way, it is the high growth of users that fuels the high growth of results [5]. Certainly, the most attractive products in the drink store are the ones that attract customers.

Another important factor is the increase in the number of Luckin Coffee stores. It is generally believed that the increase of offline stores can shorten the consumption radius and thus gather more consumers. However, an easily overlooked detail is the low foot traffic at the beginning of the new stores, which may cause the problem of not contributing much to the performance. However, Luckin Coffee uses big data and takeaway heat map to identify the location of the customer base, and selects the location with the support of digital technology, which is a good way to achieve "store looking for people" instead of "people looking for store". As the number of stores continues to grow, after surpassing Starbucks at the end of 2021, Luckin Coffee is expanding the number of its own stores at an ever-increasing rate in 2022, and now it has more than 8,000, further strengthening its leading position [1].

To sum up, digitalization has had a huge impact on Luckin Coffee. It has allowed Luckin Coffee to achieve a perfect interaction between the demand side (closest to the user's feelings) and the supply side (closest to the flow of the crowd), breaking the traditional increase in boundaries.

3. Industry Chain Perspective

Porter's Five Forces model tells us that a company's competitiveness needs to actively address the threat of competitors in the industry, the threat of potential entrants, and the threat of substitutes by having better bargaining power with suppliers and bargaining power with purchasers.

Luckin Coffee has a very clear logic for this. At the front end, Luckin Coffee pays great attention to brand marketing capacity building to maintain the competitiveness of the consumer market. Through the differentiated positioning of "professional, young, fashionable and healthy", Luckin Coffee has captured a large number of young users. The distinctive feature of young users is that in addition to high growth speed, they also love to share good stores and good products. In addition, Luckin Coffee uses digital technology to gain insight into users' needs, so as to create explosive products, combined with coupon subsidies, application back end operation and other strategies to quickly achieve rapid growth in turnover [7]. At the middle end, with flexible store operation strategies, they achieve efficient arrangement and automated management. From store site selection to subsequent operation management, Luckin Coffee fully utilizes the total quality management theory of "people, raw materials, methods and environment" to ensure product quality and service quality through an intelligent management and automated production system, complemented by an efficient Internet operation system [8]. These are also good to ensure the user's consumption experience. At the back end, the supply chain serves as a back-up guarantee to ensure sales, and Luckin Coffee has paid a tough time keeping this basic disk. In 2021, the supply of raw materials for Luckin Coffee was under great pressure due to the over-expected hot sales of raw coconut lattes. The continued sold-out status in most stores across the country also posed a significant challenge to back-end supply. In April 2021, Luckin Coffee invested 210 million yuan to build the leading automated intelligent baking base with full production lines in China [1]. After this, the development direction of Luckin Coffee continued to extend upstream of the industry chain, creating an advanced back-end with high quality raw materials and long-term stable supply. Only in 2021, Luckin Coffee accumulated 15,808 tons of imported coffee beans, becoming one of the largest raw bean importers in China. Luckin Coffee also announced that the total amount of raw beans purchased in Ethiopia in 2022 would exceed 6,000 tons, and on September 7, 2022, Luckin Coffee reached a strategic cooperation agreement with Xiamen C&D, Asia's largest raw coffee bean trader Mitsui & Co. 45,000 tons of coffee beans in the next three years. This does not include the strategic layout of Luckin Coffee in Yunnan, Colombia and other core coffee bean producing areas [1].

At the same time, Luckin Coffee emphasizes mutual assistance while each of the front end, middle end, and back end has its role to play. The middle end Internet operation system can open stores in the form of big data to help the front end’s customer acquisition link. In the opposite direction, the front end is plotting to make the next product by transmitting the user experience it gets to the middle end. The front end and back end’s interaction is even more obvious, with the raw coconut latte mentioned above tightening up the supply chain as a good example. Instead, the stable supply chain at the back end paves the way for the development of quality and safety, quantity assurance and cost advantages for the whole industry chain [9].

In this year's fast-growing coffee industry, the market pattern has basically been determined, and the head brands have established a full range of advantages from scale, supply chain, branding to product operations, greatly squeezing the development space of small and medium size coffee brands [10]. Throughout the coffee machines industry, we have seen too many companies trying to catch up or imitate. Catching up is difficult to make new breakthroughs in all aspects, while imitators often imitate nothing successfully, or even go the wrong way. With such an excellent whole industry chain, Luckin Coffee has achieved a unique existence in China's coffee consumption market.

4. Conclusion

The reason why Luckin Coffee's can quickly spread the brand in the coffee market, thanks to its outstanding brand design and shaping, brand communication, accurate advertising targeting close to current events with consumers, and data-driven entire industry chain. Luckin Coffee is well on its way to achieving a strong consumer-centric strategy. They enhance the overall value of the brand and its ability to compete in the market by maintaining product innovativeness, building brand flow, ensuring coffee quality, improving user satisfaction and loyalty by increasing user perceived value. As the largest coffee chain brand in China, Luckin Coffee has led the development trend of new retailing in the coffee drink market with the convenience and efficiency of the Internet, and has achieved continuous and stable growth of social and corporate benefits. In the meantime, Luckin coffee has won the respect of the market in the present, which also indicates that the future will go up step by step.

In the paper, due to the wide range of topics are selected, the relevant literature may not be understood deeply enough, resulting in the inadequate analysis of each item. In the future, this paper will continue to interpret and summarize the marketing strategies of Luckin Coffee, and explore the different marketing methods adopted by Luckin Coffee in the face of various challenges and the methods to adjust the industrial chain.

References

[1]. Luckin Coffee (2023) Luckin Coffee. https://www.lkcoffee.com/

[2]. Wei Wang, & Shiwei Hu (2022) Research on Commercial design of Luckin Coffee Brand, Creative Design Source, 2022 (2): 59-66.

[3]. Huizhen, Lai (2022) Research on the marketing strategy of restaurant app based on brand loyalty - Take "Luckin Coffee" App as an example, China Academic Journal Electronic Publishing House.

[4]. Yang, Zhou & Jialan Tang (2020) Luckin Coffee Brand Marketing Strategy. Cooperative Economics, Science and Technology, 2020 (20): 104-105.

[5]. Hui, Cheng & Xia, Zhou (2022) Luckin Coffee business model and profitability analysis, China Academic Journal Electronic Publishing House.

[6]. Jianpeng, Gao, Mengyuan Hu & Wenying Li (2020) Research on coffee industry based on "Internet + New retail" model - taking Luckin Coffee as an example, Business News, 2020 (20): 1-3.

[7]. Xiaoli Peng, Yonghong Gao & Zichu Zhang (2022) Comparison and enlightenment of Luckin Coffee and Starbucks' competitiveness based on Five Forces Model, Time-honored brand marketing, 2022 (17): 9-11.

[8]. Xixi Zhao (2021) Research on the business operation and management of Luckin Coffee based on SWOT- Porter's Five Forces Model, Modern Economic Information, 2021 (3): 30-32.

[9]. Yazi, Li (2022) Research on Marketing Model of Hema Fresh Food under new retail, Henan Agriculture, 2022 (3): 61-62.

[10]. Yifei Shen et al (2020) Comparative analysis of marketing models of coffee industry under the mode of "new retail": A case study of Starbucks and Luckin Coffee, Modern Business, 2020 (29): 17-18.

Cite this article

He,Y. (2023). Research on the Ways of Luckin Coffee to Capture the Chinese Coffee Market from a Marketing and Industry Chain Perspective. Advances in Economics, Management and Political Sciences,20,247-253.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Luckin Coffee (2023) Luckin Coffee. https://www.lkcoffee.com/

[2]. Wei Wang, & Shiwei Hu (2022) Research on Commercial design of Luckin Coffee Brand, Creative Design Source, 2022 (2): 59-66.

[3]. Huizhen, Lai (2022) Research on the marketing strategy of restaurant app based on brand loyalty - Take "Luckin Coffee" App as an example, China Academic Journal Electronic Publishing House.

[4]. Yang, Zhou & Jialan Tang (2020) Luckin Coffee Brand Marketing Strategy. Cooperative Economics, Science and Technology, 2020 (20): 104-105.

[5]. Hui, Cheng & Xia, Zhou (2022) Luckin Coffee business model and profitability analysis, China Academic Journal Electronic Publishing House.

[6]. Jianpeng, Gao, Mengyuan Hu & Wenying Li (2020) Research on coffee industry based on "Internet + New retail" model - taking Luckin Coffee as an example, Business News, 2020 (20): 1-3.

[7]. Xiaoli Peng, Yonghong Gao & Zichu Zhang (2022) Comparison and enlightenment of Luckin Coffee and Starbucks' competitiveness based on Five Forces Model, Time-honored brand marketing, 2022 (17): 9-11.

[8]. Xixi Zhao (2021) Research on the business operation and management of Luckin Coffee based on SWOT- Porter's Five Forces Model, Modern Economic Information, 2021 (3): 30-32.

[9]. Yazi, Li (2022) Research on Marketing Model of Hema Fresh Food under new retail, Henan Agriculture, 2022 (3): 61-62.

[10]. Yifei Shen et al (2020) Comparative analysis of marketing models of coffee industry under the mode of "new retail": A case study of Starbucks and Luckin Coffee, Modern Business, 2020 (29): 17-18.