1. Introduction

Business performance has always been a perennial management practice concern. Many studies on the elements affecting firm success have been conducted in the past, but this appears to be an intriguing entry point from the perspective of CEO turnover. Similarly, in recent years, as a result of the drastic changes in the global macroeconomic environment and the impact of various factors such as the company's own business decisions, CEO changes have become more frequent throughout the world, and the growth rate of CEO resignation events in China is also substantially higher than in the past. After a CEO change, the selection of his replacement is also crucial for the company's future growth. The succession issue is the underlying reason of low productivity, bad corporate performance, and power struggle. Thus, the effect of CEO succession type on firm performance is likewise a topic worthy of investigation.

This research develops an economic model, employs descriptive statistical analysis and multiple regression analysis to examine the influence of CEO changes on firm performance, and employs the PSM-DID model to verify the model's robustness. In addition, this article investigates the effect of CEO succession type on post-resignation company performance. This paper's potential contribution is to provide more rigorous research on the effect of CEO turnover on corporate performance. Simultaneously, CEO succession is divided into internal succession and external succession in order to examine their association with corporate performance. This study can also serve as a source of ideas and inspiration for firms with CEO succession issues, aid in the development of an appropriate CEO replacement mechanism, and mitigate a number of negative effects produced by CEO change. The study concludes with practical advice for enterprise management based on the findings of the investigation.

2. Literature Review

As for the causes for the change in CEO, the majority of studies cite a reduction in company performance as a primary factor, i.e., the poorer the firm's performance, the greater the likelihood of a CEO departure [1]. Yet, a few academics hold divergent views. After analyzing the CEO turnover data, Vancil discovered that the majority of companies changed CEOs due to the retirement of former CEOs, whereas poor performance accounted for only around 10% of CEO turnover.

There is also no consensus on the effect of CEO turnover on business performance. Some individuals assume that a change in the CEO will have a detrimental effect on the performance of the company [2]. Khan et al.'s study of 409 firms in South Korea revealed that the greater the frequency of CEO turnover, the poorer the company's performance [3]; nevertheless, some argue that it can greatly boost performance. Zhu Qi noted that organizations that have replaced their senior leaders have greatly improved their business performance, and that this increase is primarily attributable to a rise in market performance [4]. Some say there is no substantial influence [5]. Ma Lei feels that the change in management rights will have little impact on the operating performance of the company [6]. Chang and Wong observed that when a firm is profitable, the change of senior management has nothing to do with the company's performance; but, for loss-making businesses, the mandatory change will ruin the company's performance [7]. In addition, there are numerous research on the influence of succession sources. In the 1960s, Carlson and Grusky distinguished between internal and external sources of succession. Lazear and Rosen favor internal succession because they believe the CEO selected through internal succession is better familiar with the organization and the expense of picking talent from inside is cheaper [8]. Yet, some researchers argue that external succession offers unique benefits over internal succession. Harris et al. concluded that, in comparison to internal successors, external CEOs possess more unique knowledge and skills [9].

3. Methodology

3.1. Data Sources

For the sake of timeliness, this paper studies the situation of listed companies in recent ten years. This paper selects the data of A-share listed companies in Shanghai and Shenzhen from 2010 to 2019 as the primary sample, and conducts the following screening according to the research needs:

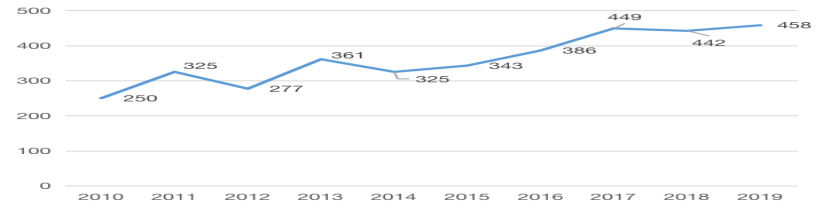

First, excluding the sample of the financial insurance industry, the particularity of the financial insurance industry makes its relevant indicators incomparable with other industries; Second, remove samples with missing data; Third, the sample with multiple CEO changes within one year is excluded. In this paper, 24555 sample observations were finally obtained, including 3610 observation samples with CEO changes. CEO changes and related financial data used in this paper are from the CSMAR database. This paper winsorize all continuous variables at 1% and 99% levels. The paper made preliminary statistics on the resignation and succession of listed companies in China from 2010 to 2019, as shown in Figure 1.

Figure 1: Number of CEO changes [2].

As can be seen from Figure 1, the number of CEO changes of listed companies in China is generally on the rise. Since 2014, there has been a trend of rapid growth. By 2019, the number of CEO changes in these five years increased by 40.92%. This shows that China's listed companies begin to use CEO change more to achieve the goal of corporate governance.

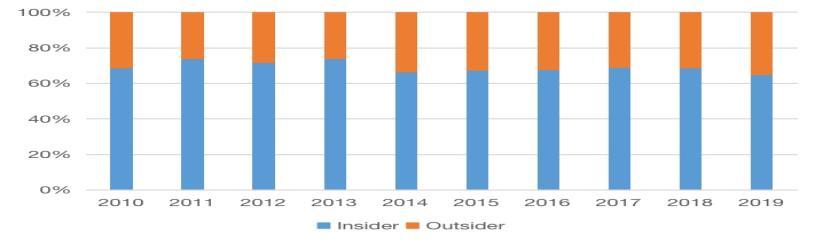

Figure 2: Proportion of different CEO succession types (original).

It can be seen from Figure 2 that from 2010 to 2019, compared with external successors, the proportion of internal successors has been showing an overwhelming trend, maintaining more than 60%. It shows that most of the enterprises that have experienced CEO changes recognize the ability of internal CEOs and believe that CEOs selected from within can bring better development to enterprises, so they are more inclined to select successors from within. However, the proportion of external successors has also increased in recent years, which indicates that enterprises are gradually paying attention to the external manager market and hope to introduce new wisdom from the outside to achieve a certain breakthrough.

3.2. Variable Description

This paper takes earnings per share (EPS) as the evaluation index of the company's performance. EPS reflects the profitability and development ability of the enterprise. In previous studies, some scholars also used EPS. For example, Puffer and Weintrop used EPS to measure corporate performance. The listed companies in China lack a clear definition of the CEO position, so this paper uses the research of other scholars for reference to define the CEO as the general manager of the company, and the confirmation standard of CEO change is whether there is a change of the general manager. In order to control the impact of other factors, this paper refers to the practices of other scholars, and selects company size, debt ratio, growth and equity concentration as control variables. See Table 1 for the definition of each variable:

Table 1: Variable description (original).

Variable name | Symbol | Description |

Earnings per share | EPS | Company i's after-tax profit/total common equity in year t-1 |

CEO change | CEO | The value is 1 in case of CEO change; Otherwise it's 0 |

Company size | SIZE | Natural Logarithm of Total Assets of Company i at the end of the Period [10] |

Debt ratio | LEV | Total liabilities/total assets |

Corporate growth | Growth | Average operating revenue growth over the past three years |

Equity concentration | Largest | Shareholding ratio of the largest shareholder |

3.3. Model Establishment

The test model of this paper is as follows:

\( EPS={a_{0}}+{a_{1}}CEO+{a_{2}}SIZE+{a_{3}}LEV+{a_{4}}Growth+{a_{5}}Largest+{a_{6}}\sum IND+{a_{7}}\sum YEAR+ε \)

Among them, EPS represents earnings per share and measures the company's performance level. The larger the EPS, the better the company's performance; CEO indicates whether the company's CEO has changed in the current period. If the change occurs, the value is 1, otherwise, 0.

4. Results and Analysis

4.1. Descriptive Statistics

According to the results in Table 2, the average value of CEOs is 0.147, which means that during 2010-2019, the sample of CEO changes accounted for 14.7% of the total sample. The average earnings per share index measuring the company's performance is 0.290, the highest value is 1.899, the lowest value is -1.261, and the standard deviation is 0.433, which indicates that the overall performance level of listed companies in China is average in recent years, and the level gap between companies is large. In the control variables, the overall average shareholding ratio of the company's largest shareholder is 34.5%, and the highest shareholding ratio is 74.7%; The average size of the company after logarithmic processing is 22.12, and the standard deviation is 1.3, indicating that the selected sample size has a large gap and is representative.

Table 2: Descriptive statistics.

Variables | count | mean | sd | min | max | p25 | p50 | p75 |

EPS | 24555 | 0.290 | 0.433 | -1.261 | 1.899 | 0.069 | 0.229 | 0.463 |

CEO | 24555 | 0.147 | 0.354 | 0.000 | 1.000 | 0.000 | 0.000 | 0.000 |

SIZE | 24555 | 22.117 | 1.304 | 19.430 | 26.071 | 21.191 | 21.954 | 22.864 |

LEV | 24555 | 0.439 | 0.216 | 0.052 | 0.972 | 0.267 | 0.430 | 0.599 |

Growth | 24555 | 0.255 | 0.593 | -0.316 | 4.727 | 0.035 | 0.140 | 0.283 |

Largest | 24555 | 0.345 | 0.149 | 0.086 | 0.747 | 0.228 | 0.324 | 0.447 |

4.2. Analysis of Multiple Regression Results

4.2.1. Impact of CEO Change on Company Performance

Table 3 shows the impact of CEO change on company performance. Regression results show that CEO change is significantly negatively correlated with EPS, a measure of corporate performance, at the level of 1%, that is, CEO change will have a negative impact on corporate performance in general. Some relationships can also be seen from the control variables. The company size, growth and ownership concentration are significantly positively correlated with the company performance at the level of 1%; Corporate debt ratio is negatively correlated with corporate performance at the level of 1%.

Table 3: Correlation analysis results.

Variables | EPS | |

CEO | -0.080*** | (-10.41) |

SIZE | 0.123*** | (22.26) |

LEV | -0.718*** | (-28.15) |

Growth | 0.043*** | (7.66) |

Largest | 0.247*** | (7.57) |

_cons | -2.222*** | (-19.26) |

IND | Yes | |

YEAR | Yes | |

N | 24555 | |

adj. R-sq | 0.199 | |

Note: (1) * * *, * * and * represent significant at 1%, 5% and 10% levels respectively | ||

CEO change may be affected by the company's own characteristics, so there may be endogenous problems or self selection errors between CEO change and company performance. In order to avoid the impact of these problems, this paper will use the Heckman two-stage model to test again. According to the research of Zhu Xingwen et al, this paper adds the following variables to the original model as explanatory variables. The situation of two concurrent positions is expressed by dummy variable. If the general manager concurrently serves as the chairman, 1 is taken; Otherwise, 0 is taken.

\( CEO={a_{0}}+{a_{1}}Duality+{a_{2}}BS+{a_{3}}NBM+{a_{4}}NI+{a_{5}}SIZE+{a_{6}}LEV+{a_{7}}Growth+{a_{8}}Largest+{a_{9}}\sum IND+{a_{10}}\sum YEAR+ε \)

Table 4: Explanatory variables for CEO changes.

Variable name | Symbol | Description |

Board size | BS | Number of directors |

Number of board meetings | NBM | Number of board meetings |

Net profit growth rate | NI | Net profit/net profit of the previous period - 1 |

Concurrent employment | Duality | Whether the chairman and general manager are held by the same person |

Table 5 shows the regression results of Heckman model. It can be seen from the test results in the first stage that the more meetings of the board of directors, the more likely CEO changes will occur. However, the size of the board of directors and the two concurrent positions are significantly negatively related to CEO change at the level of 1%, indicating that the size of the board of directors and the two concurrent positions restrict the behavior of the board of directors to dismiss CEO. In the second stage, the inverse Mills ratio (IMR) constructed is added to the model as a control variable. According to the regression results, CEO change and corporate performance (EPS) are significantly negatively correlated at the level of 1%. The test results show that CEO change still has a negative impact on company performance after the endogeneity or self selection error of the control sample.

Table 5: Heckman two-stage estimation.

Phase I CEO | Phase II EPS | |

main | ||

CEO | -0.031*** (-4.63) | |

SIZE | -0.007 (-0.60) | 0.105*** (18.25) |

LEV | 0.250*** (3.57) | -0.430*** (-16.47) |

Phase I CEO | Phase II EPS | |

Growth | 0.077*** (4.65) | 0.034*** (6.56) |

Largest | 0.066 (0.81) | 0.199*** (6.33) |

Duality | -0.409*** (-14.27) | |

BS | -0.018*** (-2.63) | |

NBM | 0.033*** (11.33) | |

NI | -0.009*** (-2.82) | |

lambda | 0.106*** (4.88) | |

_cons | -1.052*** (-4.23) | -2.002*** (-14.93) |

IND | Yes | Yes |

YEAR | Yes | Yes |

N | 22321 | 22321 |

adj. R-sq | 0.159 | |

Note: (1) * * *, * * and * represent significant at 1%, 5% and 10% levels respectively | ||

4.2.2. Influence of Successor Source on Company Performance

After the CEO changes, will the type of successor have an impact on the company's performance? This paper divides CEO succession sources into internal succession and external succession. In the traditional sense, external successors are defined as people who do not work in the enterprise, while internal successors are or have been employees of the enterprise. Set dummy variable SUC to add to the model. If it belongs to external succession, the SUC takes 1, otherwise it takes 0. The test results show that there is a significant negative correlation between external successors and corporate performance. After the change of CEO, the company performance of the listed company with external successor is lower than that of the listed company with internal successor. The influence of successor sources on company performance is shown in Table 6.

Table 6: Influence of successor source on company performance.

Variable | EPS | |

SUC | -0.046*** | (-2.85) |

SIZE | 0.123*** | (14.03) |

LEV | -0.761*** | (-16.44) |

Growth | 0.021*** | (2.49) |

Variable | EPS | |

Largest | 0.368*** | (6.30) |

_cons | -2.309*** | (-12.41) |

IND | Yes | |

YEAR | Yes | |

N | 3616 | |

adj. R-sq | 0.219 | |

Note: (1) * * *, * * and * represent significant at 1%, 5% and 10% levels respectively | ||

4.2.3. Robust Test

This paper uses the propensity score matching method (PSM) to screen and match the samples according to the control variables to obtain the control group and the control group. Then, the double difference model (DID) is used to test the robustness of the previous research results. The results are shown in Table 7. CEO change and company performance are still significantly negatively correlated at the level of 1%, and the test results have not changed. This shows that the results of this study are robust.

Table 7: Robustness test results.

Variable | EPS | |

CEO | -0.037*** | (-4.00) |

SIZE | 0.149*** | (12.92) |

LEV | -0.724*** | (-16.69) |

Growth | 0.060*** | (5.98) |

Largest | 0.452*** | (7.01) |

_cons | -2.681*** | (-10.24) |

IND | Yes | |

YEAR | Yes | |

N | 15150 | |

adj. R-sq | 0.158 | |

Note: (1) * * *, * * and * represent significant at 1%, 5% and 10% levels respectively | ||

5. Conclusion

This paper investigates the connection between CEO turnover, CEO succession type, and corporate performance based on a sample of listed Chinese companies from 2010 to 2019. It indicates that a change in CEO will result in a drop in corporate performance. In addition, the performance of publicly traded corporations with external successors is inferior to that of publicly listed corporations with internal successors. The findings of this paper's research on CEO change may have the following consequences for management practice: Changes in the chief executive officer have an effect on the continuity of the company's business plan, and frequent replacements can lead to business turmoil. Hence, businesses cannot rely significantly on CEO dismissal to improve business conditions. When hiring CEOs, organizations should do their best to assure tenure stability. In order to reduce the potential negative consequences of CEO changes, organizations must also provide a CEO succession model and succession training plan based on their own particular conditions, so that the successor CEOs can engage in corporate management more effectively and expeditiously. The selection of the CEO's successor following departure is a second issue that requires careful thought. Selecting a successor from inside the organization is more conducive to ensuring the stability of the business environment, which will have a good effect on the performance of the organization. Thus, it is vital to carefully evaluate the candidates' comprehensive competencies and other personal traits.

This paper also has room for improvement. Secondly, in terms of the control variables focused on the influencing aspects of corporate performance, the paper did not investigate the influencing factors of the CEO, including gender, age, tenure, etc.; Second, the motivation of CEO transition is not investigated. Will the effects of normal vs unorthodox modifications on corporate performance vary? When the PSM-DID model was utilized for testing, the results of the balancing test and the test of the common support hypothesis were not displayed. This study will be enhanced regularly in the future.

References

[1]. Song Deshun, Song Fengming. State-owned holding, operator change and company performance [J]. Nankai Management Review, 2005 (01): 10-15+34.

[2]. Martin J. Conyon and Lerong He. CEO turnover in China: the role of market-based and accounting performance measures[J]. The European Journal of Finance, 2014, 20(7-9) : 657-680.

[3]. Youngsang Kim et al. Frequent CEO Turnover and Firm Performance: The Resilience Effect of Workforce Diversity[J]. Journal of Business Ethics, 2020, 173(prepublish) : 1-19.

[4]. Zhu Qi. Has the change of controlling shareholders and executives of listed companies improved corporate performance? [J] Journal of Management Engineering, 2010,24 (01): 10-16.

[5]. Chen Xuan, Li Shiming, Zhu Xiaoning. State-owned holding, company performance and general manager change: the difference of government control [J]. Application of system engineering theory and method, 2006 (05): 425-435.

[6]. Ma Lei, Xin Liguo, Ma, etc Company performance, characteristics of the board of directors and senior management replacement [J] Industrial Economic Review, 2008.

[7]. Eric c. Chang, Sonia M. L. Wong. Governance with Multiple Objectives:Evidence from Top Executive Turn-over in China[J].Journal of Corporate Finance, 2009,15:230-244.

[8]. Edward P. Lazear, Sherwin Rosen. Rank-Order Tournaments as Optimum Labor Contracts[J].Journal of Political Economy, 1981, 89:5:841-864.

[9]. Harris D, Helfat C E.Specificity of CEO Human Capital and Compensation[J].Strategic Management Journal, 1997, 18(11):895-920.

[10]. Xie Shengwen, Liu Yanghui. Auditor change, tenure of former auditors and comparability of accounting information [J]. Audit Research, 2016, No.190 (02): 82-89.

[11]. Zhang Jiruo. Research on the impact of EO changes on the comparability of accounting information [J]. Accounting Research, 2017, No.361 (11): 52-57+96.

Cite this article

Tang,S. (2023). The Impact of CEO Change on Enterprise Performance. Advances in Economics, Management and Political Sciences,22,118-126.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Song Deshun, Song Fengming. State-owned holding, operator change and company performance [J]. Nankai Management Review, 2005 (01): 10-15+34.

[2]. Martin J. Conyon and Lerong He. CEO turnover in China: the role of market-based and accounting performance measures[J]. The European Journal of Finance, 2014, 20(7-9) : 657-680.

[3]. Youngsang Kim et al. Frequent CEO Turnover and Firm Performance: The Resilience Effect of Workforce Diversity[J]. Journal of Business Ethics, 2020, 173(prepublish) : 1-19.

[4]. Zhu Qi. Has the change of controlling shareholders and executives of listed companies improved corporate performance? [J] Journal of Management Engineering, 2010,24 (01): 10-16.

[5]. Chen Xuan, Li Shiming, Zhu Xiaoning. State-owned holding, company performance and general manager change: the difference of government control [J]. Application of system engineering theory and method, 2006 (05): 425-435.

[6]. Ma Lei, Xin Liguo, Ma, etc Company performance, characteristics of the board of directors and senior management replacement [J] Industrial Economic Review, 2008.

[7]. Eric c. Chang, Sonia M. L. Wong. Governance with Multiple Objectives:Evidence from Top Executive Turn-over in China[J].Journal of Corporate Finance, 2009,15:230-244.

[8]. Edward P. Lazear, Sherwin Rosen. Rank-Order Tournaments as Optimum Labor Contracts[J].Journal of Political Economy, 1981, 89:5:841-864.

[9]. Harris D, Helfat C E.Specificity of CEO Human Capital and Compensation[J].Strategic Management Journal, 1997, 18(11):895-920.

[10]. Xie Shengwen, Liu Yanghui. Auditor change, tenure of former auditors and comparability of accounting information [J]. Audit Research, 2016, No.190 (02): 82-89.

[11]. Zhang Jiruo. Research on the impact of EO changes on the comparability of accounting information [J]. Accounting Research, 2017, No.361 (11): 52-57+96.