1. Introduction

SMEs are crucial to China's economy. SME flexibility, adaptability, and a wide variety of operations improve the market economy, advance technology, and boost international trade [1]. Despite their substantial contribution, SMEs have limited financial resources. SME finance is constrained in China due to the inefficient financing infrastructure, lacking related laws, and the high risk of SMEs and their immature business system [2]. Due to risk aversion, banks are wary of lending to SMEs when credit demand is high. Hence, SME financing is a pressing issue because traditional techniques are difficult to suit SME needs and protect banks. Venture money is needed because SME development is high-risk, and high reward.

Venture capital (VC) is risk money for high-return investments. China's macroeconomic performance has been good amid global economic recovery, with new industries growing, economic restructuring accelerating, and more people joining the VC market. Consequently, the rising VC market can assist Businesses to overcome financial challenges.

Several research has examined venture capitalist-venture enterprise matching. This paper will focus on SMEs and the Gale-Shapley algorithm to match SMEs and venture investors. The appropriate matching of venture capitalists and SMEs can help both sides obtain satisfactory results, which improves venture capital activity success and is crucial to the long-term cooperation and development of venture capitalists and venture firms.

2. The Gale-Shapley Algorithm in Two-sided Matching Theory

The two-sided matching theory focuses on the difficulty of matching the preferences of two entirely non-overlapping subjects. Matching between public schools and students, personnel and job matching in the human resource management field, marriage matching, and complex task-matching services in the manufacturing field are representative examples of the widespread application of research on matching models and solution algorithms in various fields.

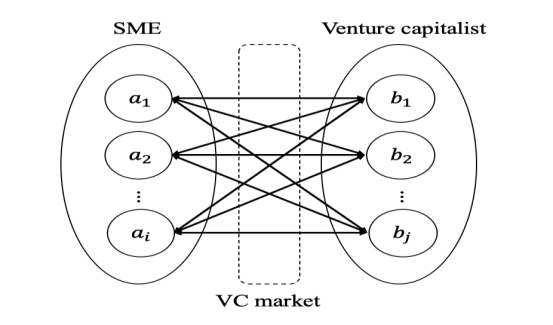

The market for venture capital is a classic two-sided market (Figure 1). In the real investment process, the preferences of the venture investor and the SME will determine which parties are selected to collaborate. The venture capitalist will make the best choice based on the strength of the applicant companies and other criteria, while the SME must consider the actual situation of the venture capitalists when deciding on financing. In such a bilateral market, the two-sided matching model can accommodate both parties' requirements.

Figure 1: Two-sided matching decision-making problem between SMEs and venture capitalists [3].

The Gale-Shapley algorithm used in this paper is a classical algorithm in the two-sided matching theory, a market mechanism devised by Gale and Shapley to find a stable match. The objects \( {a_{i }} \) on one side of the market, \( i=1,2,…, m \) , send an offer to objects \( {b_{j }}, j=1,2,…, n \) , on the other side according to their preferences. Each \( {b_{j }} \) compares the offers received, keeps the best ones, and rejects the others. The \( {a_{i }} \) whose invitation is rejected continues to send new invitations to other \( {b_{j }} \) until no \( {a_{i }} \) wants to send another invitation. At this point, each \( {b_{j }} \) finally accepts its own reserved offer. A key aspect of the algorithm is that the consensual invitations are not accepted immediately, but are only temporarily reserved from rejection, i.e., the " Deferred Acceptance (DA) algorithm ". In this paper, the algorithm is mainly used for one-to-many matching [4].

3. The Application of Two-sided Matching Theory in the Venture Capital Market

In the two-sided matching of the VC market, the SME is \( {a_{i }}, i=1,2,…, m \) , the venture capitalist is \( {b_{j }}, j=1,2,…, n \) . Each \( {b_{j }} \) can invest \( {q_{j}} \) .

3.1. Establishing the Matching Evaluation Index Systems of Both Sides

This study refines the respective preferences and creates a matching evaluation index system for mutual evaluation between venture capitalists and SMEs in order to conform to the actual investment environment and increase the matching rate. Let \( {S_{k}}, k=1, 2,…, 8 \) be the evaluation index of the venture capitalist to the SME and \( {V_{x}} \) , \( x=1, 2,… , 5 \) be the evaluation index of the SME to the venture capitalist. The index systems of both sides are showed in Table 1 and Table 2.

Table 1: Matching evaluation index system of venture capitalists to SMEs [5].

Indicator | Description |

Payback period ( \( {S_{1}}) \) | The time elapsed between the start-up of the SME' s anticipated investment project and the date when the cumulative total reaches the total investment |

Annual Return on Investment ( \( {S_{2}}) \) | The ratio of annual profit to total investment of the SME |

Technology level ( \( {S_{3}}) \) | The novelty and advancement of the technology (or product) |

Capability of risk-averse ( \( {S_{4}}) \) | The ability of SME's to hedge technology (or product) development risks and marketing risks |

Accessibility of the market ( \( {S_{5}}) \) | Technical barriers and trade barriers in the target market |

Entrepreneurship ( \( {S_{6}}) \) | SME entrepreneur's sense of responsibility, innovation, leadership and organization |

Investment Environment ( \( {S_{7}}) \) | The economic development level and investment environment of the surrounding area where the SME is located |

Tax Benefits ( \( {S_{8}}) \) | Preferential policies provided by the government |

Table 2: Matching evaluation index system of SMEs to venture capitalists [5].

Indicator | Description |

Investment amount ( \( {V_{1}}) \) | Amount of investment that venture capitalist can offer to each SME |

Investment Strength ( \( {V_{2}}) \) | The total existing capital size of venture capitalist, the number of companies it has invested in and the size of its investments |

Investment Success Rate ( \( {V_{3}}) \) | Success rate of SMEs in which investors have invested |

Prestige ( \( {V_{4}}) \) | Credit evaluation of the venture capitalist investing in other SMEs |

Entrepreneurship ( \( {V_{5}}) \) | Venture capitalist 's sense of responsibility, innovation, leadership and organization |

Both the venture capitalist and the SME assign weights to each indicator in their own evaluation system, with the venture capitalist and SME's weight being \( w \) . Lastly, for each indicator, the opposing side is ranked and substituted into the weight calculation method (1) & (2) to determine the respective ultimate preference.

For SME \( {a_{i }} \) , the final score \( {α_{ij}} \) is obtained by \( {a_{i }} \) after being ranked by venture capitalist \( {b_{j }} \) in its evaluation system is

\( {α_{ij}}=\sum _{k=1}^{8}{w_{j}}({S_{k}}){r_{ij}}({S_{k}}), \sum _{,k=1}^{8}{w_{j}}({S_{k}})=1\ \ \ (1) \)

where \( {r_{ij}}({S_{k}}) \) represents \( {a_{i }} \) 's ranking in each of the evaluation index \( {S_{k}} \) of venture capitalist \( {b_{j }} \) . The smaller the \( {α_{ij}} \) , the more popular \( {a_{i }} \) is with venture capitalist \( {b_{j }} \) .

For venture capitalist \( {b_{j }} \) , the final score \( {β_{ji}} \) is obtained by \( {b_{j }} \) after being ranked by SME \( {a_{i }} \) ,in its evaluation system is

\( {β_{ji}}=\sum _{x=1}^{5}{w_{i}}({V_{x}}){r_{ji}}({V_{x}}), \sum _{x=1}^{5}{w_{i}}({V_{x}})=1\ \ \ (2) \)

where \( {r_{ji}}({V_{x}}) \) represents \( {b_{j }} \) 's ranking in each of the evaluation index \( {V_{x}} \) of SME \( {a_{i }} \) . The smaller the \( {β_{ji}} \) , the more popular \( {b_{j }} \) is with SME \( {a_{i }} \) .

3.2. Matching Process

Step 1: After each side ranks the other side according to their respective evaluation index system to form a preference list, SME \( {a_{i }} \) applies to its favorite venture capitalist. For each venture capitalist \( {b_{j }} \) , up to \( {q_{j}} \) applicants who have the highest \( j- \) priority is tentatively assigned to venture capitalist \( {b_{j }} \) . The remaining applicants are rejected.

Step k, \( k≥2 \) : Each SME rejected from a venture capitalist at step \( k-1 \) applies to its next favorite \( {b_{j }} \) . For each venture capitalist \( {b_{j }} \) , up to \( {q_{j}} \) students who have the highest \( j- \) priority among the new applicants and those tentatively on hold from an earlier step, are tentatively assigned to \( {b_{j }} \) . The remaining applicants are rejected [6].

Once no company's application is rejected, the solicitation process concludes. Remember that all DA allocations are temporary till the final phase. Owing to the limited number of small and medium-sized enterprises (SMEs) and venture investors, this process must end after a limited number of phases. All remaining SMBs on the pre-recorded list then enter into venture capital agreements. Under such a two-sided matching model, the Gale-Shapley algorithm can achieve the stable pairing of SMEs.

4. Practical Application of the Model

Supposing that SMEs are \( A=\lbrace {a_{1}},{a_{2}},{a_{3}},{a_{4,}},{a_{5}},{a_{6}}\rbrace \) , and the venture capitalists are \( B=\lbrace {b_{1}},{b_{2}},{b_{3}}\rbrace \) , and \( {q_{1}}=2, {q_{2}}=1, {q_{3}}=2. \)

The results of assigning weights \( {w_{j}} \) and \( {w_{i}} \) to their own evaluation index system by both sides are in Table 3 and Table 4.

Table 3: Weight of each index set by venture capitalists.

\( {w_{j}}({S_{k}}) \) | \( {S_{1}} \) | \( {S_{2}} \) | \( {S_{3}} \) | \( {S_{4}} \) | \( {S_{5}} \) | \( {S_{6}} \) | \( {S_{7}} \) | \( {S_{8}} \) |

\( {b_{1}} \) | 0.19 | 0.20 | 0.1 | 0.25 | 0.06 | 0.05 | 0.067 | 0.096 |

\( {b_{2}} \) | 0.12 | 0.10 | 0.13 | 0.125 | 0.113 | 0.148 | 0.125 | 0.15 |

\( {b_{3}} \) | 0.075 | 0.125 | 0.20 | 0.125 | 0.14 | 0.10 | 0.11 | 0.125 |

Table 4: Weight of each index set by SMEs.

\( {w_{i}}({V_{x}}) \) | \( {V_{1}} \) | \( {V_{2}} \) | \( {V_{3}} \) | \( {V_{4}} \) | \( {V_{5}} \) |

\( {a_{1}} \) | 0.2 | 0.35 | 0.23 | 0.1 | 0.12 |

\( {a_{2}} \) | 0.15 | 0.3 | 0.2 | 0.2 | 0.15 |

\( {a_{3}} \) | 0.1 | 0.4 | 0.3 | 0.15 | 0.05 |

\( {a_{4}} \) | 0.3 | 0.2 | 0.25 | 0.15 | 0.1 |

\( {a_{5}} \) | 0.33 | 0.2 | 0.12 | 0.2 | 0.15 |

\( {a_{6}} \) | 0.2 | 0.2 | 0.1 | 0.3 | 0.2 |

After both sides ranked the other side according to each index, the final scores were calculated by substituting (1) & (2), and then the scores were ranked from lowest to highest; the lower the score, the higher the ranking, which indicates that the SME or venture capitalist is more popular; the results are presented in Tables 5 and 6.

Table 5: The preference lists of venture capitalists.

Rank for \( {a_{i}} \) | \( {a_{1}} \) | \( {a_{2}} \) | \( {a_{3}} \) | \( {a_{4}} \) | \( {a_{5}} \) | \( {a_{6}} \) |

\( {b_{1}} \) | 1 | 2 | 3 | 6 | 4 | 5 |

\( {b_{2}} \) | 3 | 1 | 6 | 4 | 5 | 2 |

\( {b_{3}} \) | 5 | 3 | 1 | 2 | 4 | 6 |

Table 6: The preference lists of SMEs.

Rank for \( {b_{j}} \) | \( {b_{1}} \) | \( {b_{2}} \) | \( {b_{3}} \) |

\( {a_{1}} \) | 1 | 3 | 2 |

\( {a_{2}} \) | 2 | 3 | 1 |

\( {a_{3}} \) | 1 | 3 | 2 |

\( {a_{4}} \) | 2 | 1 | 3 |

\( {a_{5}} \) | 3 | 2 | 1 |

\( {a_{6}} \) | 3 | 1 | 2 |

Based on Table 6, all SMEs will submit their financing applications to their respective most preferred venture capitalists.

\( {a_{1}}, {a_{3}}→ {b_{1}} \)

\( {a_{4}},{a_{6}}→ {b_{2}} \)

\( {a_{2}},{a_{5}}→ {b_{3}} \)

For \( {b_{1}} \) and \( {b_{3}}, \) because \( {q_{1}}=2, {q_{3}}=2, \) they will be accepting all applications for the time being. However, in Table 5, for \( {b_{2}}, {q_{2}}=1, \) and \( {a_{6}}{≻_{{b_{2}}}}{a_{4}}, \) so it will only accept \( {a_{6}} \) and reject \( {a_{4}}. \)

In the second round of application, rejected \( {a_{4}} \) submits financing application to second favorite venture capitalist \( {b_{1}} \) . For \( {b_{1}}, \) \( {a_{1}}{≻_{{b_{1}}}}{a_{3}}{≻_{{b_{1}}}}{a_{4}} \) , and \( {q_{1}}=2 \) . So, it will also reject \( {a_{4}} \) .

In the third round of application, rejected \( {a_{4}} \) submits financing application to the least favorite venture capitalist \( {b_{3}}. \) For \( {b_{3}}, \) \( {a_{4}}{≻_{{b_{3}}}}{a_{2}}{≻_{{b_{3}}}}{a_{5}} \) , and \( {q_{3}}=2 \) . Then \( {b_{3}} \) will reject \( {a_{5}} \) and remain \( {a_{2}} \) and \( {a_{4}} \) .

In the fourth round of application, rejected \( {a_{5}} \) submits financing application to its second favorite venture capitalist \( {b_{2}}. \) For \( {b_{2}}, \) \( {a_{6}}{≻_{{b_{2}}}}{a_{5}} \) , and \( {q_{2}}=1 \) . Then \( {b_{2}} \) will reject \( {a_{5}} \) and keep \( {a_{6}} \) .

In the fifth round of application, rejected \( {a_{5}} \) submits financing application to its least favorite venture capitalist \( {b_{1}} \) . For \( {b_{1}}, \) \( {a_{1}}{≻_{{b_{1}}}}{a_{3}}{≻_{{b_{1}}}}{a_{5}} \) , and \( {q_{1}}=2 \) . So, it will also reject \( {a_{5}} \) .

At this time, except for \( {a_{5}} \) , all other SMEs have found suitable venture capitalists, and each venture capitalist has no vacant seat for \( {a_{5}} \) , so the final result is as follows: \( {a_{1}}, {a_{3}}→ {b_{1}} \)

\( {a_{6}}→ {b_{2}} \)

\( {a_{2}},{a_{4}}→ {b_{3}} \)

According to the results, both parties match according to their preference lists, and the matching procedure optimizes utility. An agent or pair does not obstruct the final match, therefore it is a stable and Pareto-efficient match, resolving the problem of SME financing challenges. Simultaneously, it is strategy-proof for SMEs, protects the fairness of the investment market, raises awareness of the legitimacy of SMEs' operations, and enhances their reputation. SME-optimal stable matching respects the right of invested firms to choose and has, to some extent, increased their excitement for R&D and output, so fostering economic growth.

5. The Applicability of the Stable Matching Theory in the SME Financing Problem and Recommendations on the Venture Capital Market

5.1. Establishing a Strict Evaluation Index System

Due to the enormous number of small and medium-sized firms in China and their distribution across numerous industries, their financing requirements are bound to alter, thus they frequently employ multidimensional and hierarchical classification [7]. This indicates that the evaluation indicators of both parties are robust enough for the matching theory to be fully utilised. There are disparities in investor expectations of SMEs, from the perspective of investors. Diverse venture capitalists evaluate SME prospects according on their risk tolerance, investment horizon, and rate of return. From the perspective of small and medium-sized enterprises (SMEs), since they are in a critical period of development, the choice of venture capitalist is crucial, as it can influence the enterprise's future development to some extent [8].

5.2. Promoting Industry-finance Cooperation

The main causes of the financing difficulties of small and medium-sized companies in our country are the unbalanced allocation and low efficiency of the financial market, as well as the excessive concentration of loan funds in key enterprises, which impedes the development of small and medium-sized businesses. In recent years, however, China's Ministry of Industry and Information Technology has consistently directed financial institutions to enhance their support for small and medium-sized businesses.

Thus, the application of matching theory is the main method for resolving the structural mismatch of the financial market, enhancing the efficiency of capital allocation, and fostering the growth of inclusive finance. The matching of the financial market facilitates the financing arrangement between capital-demanding businesses and capital-supplying financial institutions [9]. Using the theory of stable matching, the benefits and characteristics of financial institutions and small and medium-sized businesses are thoroughly analysed and then integrated with the requirements to achieve the best allocation of capital supply and demand.

5.3. Policy Recommendations on the Venture Capital Market

The government should continue to improve the multi-level inclusive financial system, continuously enrich capital supply subjects, vigorously develop the financing market, improve the multi-level financing system between state-owned capital and social capital, and optimise capital matching efficiency.

To overcome the issue of information asymmetries between venture funders and businesses, a centralised matching agency should be established. Establish online matching institutions, create enterprise preference databases, enhance the matching efficiency of capital supply and demand, and prevent the non-standard development of private lending.

6. Conclusion

The fast growth of small and medium-sized enterprises (SMEs) necessitates a substantial amount of financial assistance; but, due to high business risks and poor rules and regulations, they continue to encounter several financing challenges. This paper employs the Gale-Shapley algorithm from the stable matching theory to solve the financing issues of SMEs and conducts one-to-many matching between venture capitalists and SMEs in order to make a rational choice of financing methods, prevent the capital rupture of enterprises, and ensure the health and stability of enterprises. Not only does the algorithm account for the diverse needs of both parties in the VC market, but it also achieves the ideal match. To promote the future development of SMEs, it is recommended that the government not only raise investment and reform rules and regulations but also encourage the construction of matching platforms and construct multi-level financial markets. Nevertheless, this work does not apply the model to the actual matching on the investment market; there is insufficient data support. In order to increase the model's viability, it is important to implement the algorithm in future studies and then make more improvements.

References

[1]. Shane, S., & Cable, D. Network ties, reputation, and the financing of new ventures [J]. Management Science, 2002, 48(3): 364~381.

[2]. Hellmann, T., &Puri, M. Venture capital and the professionalization of start-up firms: Empirical evidence [J]. Journal of Finance, 2002: 57(1): 169~197.

[3]. Tayfun, S. Manipulation via Capacities in Two-Sided Matching Markets.

[4]. Journal of Economic Theory, 1997(77): 197-204

[5]. Gale, D., & Shapley, L.S. College admissions and the stability of marriage [J]. American Mathematical Monthly, 1962: 69 (1):9-15.

[6]. Chen, X., & Fan, Z. Bilateral Matching between venture capitalists and venture enterprises based on Axiomatic Design [J]. Systems Engineering, 2010(6):9-16

[7]. Chen, Y., & Kesten, O. Chinese College Admissions and School Choice Reforms: A Theoretical Analysis. Journal of Political Economy, 2017:125(1), 99–139.

[8]. Zhou, X., Multi-level Characteristics of Capital Market [J]. Financial Market Research, 2013(8).

[9]. Elitzur, R., et al. Contracting, signaling, and moral hazard: a model of entrepreneurs, “Angels”, and venture capitalists [J]. Journal of Business Venturing, 2003:18 (6), 709~725.

[10]. Baum, J. a. C., & Silverman, B. S. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 2004:19(3), 411–436.

Cite this article

Zhu,Y. (2023). Application of Two-sided Matching Theory in Financing of Small and Medium-sized Enterprises. Advances in Economics, Management and Political Sciences,23,295-301.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shane, S., & Cable, D. Network ties, reputation, and the financing of new ventures [J]. Management Science, 2002, 48(3): 364~381.

[2]. Hellmann, T., &Puri, M. Venture capital and the professionalization of start-up firms: Empirical evidence [J]. Journal of Finance, 2002: 57(1): 169~197.

[3]. Tayfun, S. Manipulation via Capacities in Two-Sided Matching Markets.

[4]. Journal of Economic Theory, 1997(77): 197-204

[5]. Gale, D., & Shapley, L.S. College admissions and the stability of marriage [J]. American Mathematical Monthly, 1962: 69 (1):9-15.

[6]. Chen, X., & Fan, Z. Bilateral Matching between venture capitalists and venture enterprises based on Axiomatic Design [J]. Systems Engineering, 2010(6):9-16

[7]. Chen, Y., & Kesten, O. Chinese College Admissions and School Choice Reforms: A Theoretical Analysis. Journal of Political Economy, 2017:125(1), 99–139.

[8]. Zhou, X., Multi-level Characteristics of Capital Market [J]. Financial Market Research, 2013(8).

[9]. Elitzur, R., et al. Contracting, signaling, and moral hazard: a model of entrepreneurs, “Angels”, and venture capitalists [J]. Journal of Business Venturing, 2003:18 (6), 709~725.

[10]. Baum, J. a. C., & Silverman, B. S. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 2004:19(3), 411–436.