1. Introduction

This year is not kind to the equities market that even Apple Inc. has dropped for 25% YTD [1], people formed different opinions about whether to keep buying the Apple Inc. Some believes that it is time to buy the stock while the others take a dim view. In this way, a comprehensive analysis report is necessary for those investors to make the decisions.

Apple Inc., an Information technology company that includes both software and hardware which forms an ecology in people’s daily life. The customers of Apple are mainly targeted to those to seek for the aesthetically pleasing while guarantee the quality of their production [2]. Since Apple was in a highly competitive market, they tend to use their special system in their product to differentiate their products, for example, the famous iPhone system IOS and Mac system MacOS. By keeping developing their product with innovate accessories, they become the top tier Information technology company.

Doing financial analysis for a particular company is what people usually do during their daily stock choosing. There is existing abundant of essays that talk about how to do the analysis while several are using the example of Apple Inc. Those papers are helpful to investors about making decision for investing Apple.inc. With different analysis approach, the result may have a significantly difference. Only considering about the financial statement with different ratio metrics analysis is not enough for the complicated stock market. To provide a more accurate and comprehensive analysis, this paper uses the SWOT analysis to see whether this company is worth to invested, and also uses activity ratio and profitability ratio to conduct a financial situation analysis. This paper contains both quantitative and qualitative analysis for the Apple Inc. stocks, hoping it will help the investors make a well-considered decision.

2. SWOT Analysis of the Apple Inc

This chapter will be discussed using qualitative method to analysis the Apple Inc. The main way this paper used is SWOT Analysis.

2.1. Strength

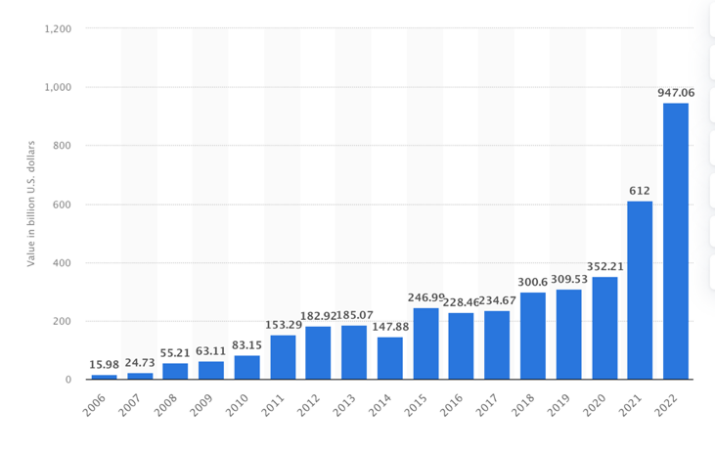

The significant strength is its valuable brand. Not only does Apple Inc. has a great reputation in the United States, but it also has a good reputation globally. According to Statista from Figure 1, it shows that since 2006, the global value of Apple Inc. has a prominent increasing trend, especially from 2021 to 2022, the global value has increased for 330 billion US dollars. According to the research conducted by the Kantar BrandZ, Apple Inc. has become the world’s number one most valuable brand [3].

Aside from the brand value, the high loyalty rate also makes Apple a strong company. According to the research conducted by the Consumer Intelligence Research Partners (CIRP) in 2021, over 90% of iPhone users remain loyal to the brand for past three years [4]. This data reflects Apple's high brand stickiness and consumers' recognition of Apple Inc. which can be seen as the internal strength of the Apple Inc.

Figure 1: Apple's global brand value from 2006 to 2022 [3].

2.2. Weakness

However, there is still some weakness internally of the Apple Inc. The prominent weakness of Apple Inc. is about the products’ high price. According to the data from BayStreet Research, there are a large amount of Apple products raising their price faster than the inflation [5]. This data shows that being loyal to Apple Inc. can be an expansive choice. The high price setting with the increasing price set a bundle prevent some people from getting the iPhone. In this case, the increase in the price leads a decrease in the demand of the new product.

Aside from the high price, the incompatibility also bothers the user tremendously. Since Apple Inc. has its own ecosystem, the system running on Apple products are quite different from other products. In this way, some applications cannot be running on the Apple product due to the incompatibility. For example, a useful Microsoft in adobe called Microsoft Access that can only running on windows is not fit for install in Mac. In this way, when people are heavily relying on the Access, they could not use the Macbook, instead, they must buy a windows computer. Aside from the application, since Apple’s product have their unique design and system, customers are hard to switch their product from Android or Windows base to the Apple product. Microsoft Excel, a daily used application that have many shortcuts key on windows cannot use on Mac. For those people that are pursing in dealing the excel fast by using shortcut key will be eager to change their computer to Windows base computer. Due to the incompatibility, it prevents some customer from buying the Apple product.

2.3. Opportunity

Though the weakness is dominant, Apple Inc. still come with some opportunities that may help them enlarge their business. The creation of new product line gives the opportunity for Apple Inc. to improve. With the significant increase in the technology, there are more possibility of the accessary can be achieved. For example, instead of building the computer and phone, Apple Inc. has published the apple TV, the airpods, etc. Those accessories provide Apple a new way to refine their ecosystem by importing the Apple products into people’s life. Wearing the Apple products will provide people with the experience of “1+1>2”. For example, by wearing Apple watch and taking Iphone, they can form a linkage that makes you feel more efficient. Every time when Apple introduce a new product line, it makes the marginal even larger since the new linkage of the product will accurate the data they have and make your life more intelligent. In this way, every time when a new product is going out, it makes the fans of apple being crazy about that.

The reliance of technology also forms opportunity for Apple Inc. Nowadays, people have increasing demand of using technology. According to Pew Research Center, more than eight-in-ten Americans watch news from digital devices [6]. The news was used to printed on the newspaper, however, since the technology evolution, there is increasing demand of using the digital devices for watching the news. Watching news is just a function of using a mobile phone, and with the development of technology, more and more functions can be achieved by using digital devices. One significant function is daily paying. Apple pay, a function that being used in the apple devices, is widely used worldwide. According to the Statista's Global Consumer Survey, five out of ten U.S respondents indicated they have used Apple Pay in a store or restaurant with an addition two out of ten respondents using Apple pay for online shopping between August 2020 to August 2021 [7]. These data show the rise of digital payments and the growing reliance on technology. With the increasing using of the digital payments, people may rely more on the safety of the phone since safety of a phone may prevent their property losses. According to the five most secure smartphones on ITPro, Iphone 13 pro max is ranked at the second one. The latest IOS 15 operating system brings has broad selection of securities and privacy features which increase the level of security for the phone. In this way, there will be increasing demand for the phone which brings the opportunity for Apple Inc.

2.4. Threats

Though the market for the Apple is bright, there are still potential threaten. One of the most significant threaten is the aggressive competition in the market. There are many strong rivals to Apple Inc. in the electronic equipment market like HUAWEI and Samsung. Every time Apple decides to hold a launch event to launch a new product, these companies also launch their flagship products to tap Apple's potential customers. Huawei is the world’s No.1 telecommunication provider and No.2 phone manufacture. Though Huawei is facing a catastrophe applied by the United States government, the help hand providing by the Chinese company still making Huawei a strong competitor for Apple Inc. Recently, Huawei has announced to publish Huawei mate 50 series one day before the Apple Iphone 14 series. According to Dao Insights, this launch event is being seen as an opportunity to Huawei to reclaim the premium smartphone segment [10]. In this way, it will threaten the sales amount of Apple product. According to the Statcounter, for Mobile Vendor Market Share Europe from July 2021 to July 2022, competition between Apple and Samsung is fierce in the Europe market. Especially from May 2022 to June 2022, they almost share the same market value [9]. In the highly competitive market, the competitor forms a huge threaten to Apple.

Aside from highly competitive market, there is also potential risk in accusation for apple product. Recently, according to Input, the Department of Justice is ready to serve Apple a hefty antitrust lawsuit [11]. This lawsuit covers many aspects of the Apple product from the App Store to Air tags, to Apple Pay. The Epic games has sued Apple for its tight control of the Apple store and Tile sued Apple for using its ecosystem to dominant the market. According to the Politico, the U.S. Department of Justice lawyers are looking to frame a case that was about Apple’s mobile OS more broadly. Since the investigation requires time and effort of the Apple Inc. employee, this will give its competitors the opportunity to profit from it. Aside from that, the huge penalty that Apple may face will largely affect the operation of Apple products. In this way, it will be helpful to let Apple quickly settle the investigation.

To conclude, Apple’s valuable brand customer loyalty is the strength that Apple have. The continuous of creating new product lines and reliance of technology in the society helps Apple to enlarge its business. What they need to improve is its high price and incompatibility. Apple may use the strategy of price discrimination solve the high price problem. For the incompatibility, Apple may go to seek more cooperation with those companies. They also need to be alert about competing with its competitors and avoid accusations.

3. Financial Situation Analysis

3.1. Activity Ratios

To examine the activity ratios, the fixed assets turnover is calculated with below formula (1):

\( Total Assets Turnover=Turnover Total Assets \) (1)

According to the quarter report for June 30, 2022, the turnover(sales) for Apple Inc. is $82.959B and the Total Assets $336.309B. Hence, the Total Assets Turnover is 0.2467 [13]. However, the average in Electric & Wiring Equipment industry asset turnover ratio is 1.3 for Jun 30, 2022. The Fixed assets turnover shows how well the company is using its fixed assets to generate sales. Since Apple Inc. has much lower total assets turnover than industry average, it indicates that Apple need to either increase its turnover or decrease its total assets.

3.2. Profitability Ratios

3.2.1 Net Profit Margin

After examining the activity ratio, we begin to figure out the profitability ratios. The first ratio we calculate is Net Profit Margin. The net profit margin measaures how much net profit is generated as the revenue.

\( Net Profit Margin=Net ProfitTurnover*100 \) (2)

Since the Net Profit of Apple Inc. is $19.4 billion and the turnover is $82.959 billion, the net profit margin is 23.39%. Comparing with Electric & Wiring Equipment Industry Profitability Ratios of 8.07%, it shows that it is much higher than the average of industry [14]. The percent of profit earned by Apple Inc. is made more from sales than the industry average. This data has signaled a good condition for the Apple Inc.

3.2.2 Return on Assets

Aside from the Net Profit Margin, the investors may also want to investigate Return on Assets. This ratio indicates how profitable a company is in relation to its total assets.

\( Return on Assets= Net ProfitTotal Assets \) (3)

As mentioned above, the net profit is $19.4 billion and the total asset is $336.309 billion, the return on assets is 5.78%. Of the average of Electric & Wiring Equipment Industry, the return on assets is 9.77% which is higher than Apple Inc. In this way, it indicates that Apple Inc. does not as efficient as others for using the assets to generate the profit.

3.2.3 Return on Investment

The return on investment or compare the efficiency or profitability of the company’s investment.

\( Return on Investment=Net incomecost of investment \) (4)

The Net income of Apple reported on June 25, 2022, is $ $118.33 billion and the cost of investment on June 25, 2022 is $152.81 billion. Hence, the ROI for Apple Inc. is 77.44%. Comparing the ROI of electric and wiring equipment industry (33.71%) [15], it is lower than the ROI of Apple Inc.

3.2.4 Price-Earnings Ratio

After calculating the ROI, we would calculate the price-earning ratio. The price-earnings ratio is using current share price relative to its earnings per share.

\( Price-Earnings ratio (P/E ratio) =price/earnings per share \) (5)

The Apple Inc. earning per share (Diluted) is $6.06 for the quarter ending June 30, 2022. According to the price of Apple in August 31 (157.22), the P/E ratio is 25.94 [16]. By comparing P/E ratio of Apple Inc. with the P/E ratio of whole electric and wiring industry (27.75) for June 2022, Apple Inc. has relatively lower ratio which need to be adjusted to improve.

To conclude, though comparing with the whole industry, Apple Inc. may have a relatively lower performance than others, Apple Inc. still has opportunities to improve its data by the publish of new product in September.

4. Conclusion

Results of this study advance people’s knowledge about the Apple Inc. with both qualitative and quantitative aspects. Before this research, it can be figured out that there are different opinions appeared on different platform of whether to invest in the technology companies. This paper takes Apple as an example to conduct the case study to figure out whether it is worth to invest in the Apple. After doing the research with different ratio calculation, it figures out it is worth to invest in the Apple Inc. However, this research finds that there are some problems that need to be adjusted with Apple Inc., such as the accusation and low efficiency return rate on assets. In this way, if the Apple Inc. solves the problems to increase the efficiency of the assets and avoid the accusation, the value of Apple Inc. would increase. However, during our research, since this paper does not have the specific item name of how each part of the financial statement is built by, it can not have accurate data with the match resolution to increase the Apple valuation. Aside from that, since people do not know how heavy the accusation might be, and how well might the new publication of Apple product be, people could not precisely estimate about the performance of Apple Inc. Though there are still many things unsure, Apple Inc. still need to be focused and researched by other investors, how Apple Inc. discovered its potential is a valuable topic worthy of study in future investigation.

References

[1]. Bernard Z. Buy Apple Stock in July? July 5, 2022. https://www.thestreet.com/apple/stock/buy-apple-stock-in-july.

[2]. Abdulla Aljafari, Apple Inc. Industry Analysis Business Policy and Strategy, International Journal of Scientific & Engineering Research, Volume 7, Issue 3, March 2016, pp.406-441.

[3]. Statista Research Department, Apple: brand value 2006-2022, Jun 17, 2022, https://www.statista.com/statistics/326052/apple-brand-value/.

[4]. AppleInsider Staff, Apple has most loyal smartphone customers in US, study finds, Oct 29, 2021.https://appleinsider.com/articles/21/10/29/apple-has-most-loyal-smartphone-customers-in-us-study-finds.

[5]. Geoffrey F. and Andrew D., Your Apple products are getting more expensive. Here’s how they get away with it. December 6, 2018. https://www.washingtonpost.com/technology/2018/12/06/your-apple-products-are-getting-more-expensive-heres-how-they-get-away-with-it/.

[6]. ELISA S., More than eight-in-ten Americans get news from digital devices, January 12, 2021. https://www.pewresearch.org/fact-tank/2021/01/12/more-than-eight-in-ten-americans-get-news-from-digital-devices/

[7]. Raynor B. Apple Pay - statistics & facts, Dec 13, 2021. https://www.statista.com/topics/4322/apple-pay/#dossierKeyfigures.

[8]. Rene Millman, The five most secure smartphones, Mar 11, 2022. https://www.itpro.com/mobile/mobile-phones/360024/5-most-secure-smartphones.

[9]. Statcounter, Mobile Vendor Market Share Europe Aug 2021 - Aug 2022, August 2022. https://gs.statcounter.com/vendor-market-share/mobile/europ.

[10]. Dao, Apple&Huawei go head-to-head for China’s premium smartphone market, August 26, 2022.https://daoinsights.com/news/apple-huawei-go-head-to-head-for-chinas-premium-smartphone-market/

[11]. Matt Wille, The Department of Justice is ready to serve Apple a hefty antitrust lawsuit, August 30, 2022. https://www.inputmag.com/culture/apple-antitrust-lawsuit-department-justice-app-store.

[12]. Josh Sisco, Apple faces growing likelihood of DOJ antitrust suit, August 26, 2022. https://www.politico.com/news/2022/08/26/justice-department-antitrust-apple-00053939.

[13]. Macrotrend, Apple Financial Ratios for Analysis 2009-2022 | AAPL, https://www.macrotrends.net/stocks/charts/AAPL/apple/financial-ratios?freq=Q.

[14]. CSIMarket, Electric & Wiring Equipment Industry Profitability, 2022. https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=411.

[15]. CSIMarket, Electric & Wiring Equipment Industry Management Effectiveness Information & Trends, 2022.https://csimarket.com/Industry/industry_ManagementEffectiveness.php?ind=411.

[16]. GURUFOCUS, Apple PE Ratio: 25.50 (As of Today), June 2022. https://www.gurufocus.com/term/pettm/AAPL/PE-Ratiottm/Apple.

[17]. Bernard Z. Buy Apple Stock in July? July 5, 2022. https://www.thestreet.com/apple/stock/buy-apple-stock-in-july.

[18]. Abdulla Aljafari, Apple Inc. Industry Analysis Business Policy and Strategy, International Journal of Scientific & Engineering Research, Volume 7, Issue 3, March 2016, pp.406-441.

[19]. Statista Research Department, Apple: brand value 2006-2022, Jun 17, 2022, https://www.statista.com/statistics/326052/apple-brand-value/.

[20]. AppleInsider Staff, Apple has most loyal smartphone customers in US, study finds, Oct 29, 2021.https://appleinsider.com/articles/21/10/29/apple-has-most-loyal-smartphone-customers-in-us-study-finds.

[21]. Geoffrey F. and Andrew D., Your Apple products are getting more expensive. Here’s how they get away with it. December 6, 2018. https://www.washingtonpost.com/technology/2018/12/06/your-apple-products-are-getting-more-expensive-heres-how-they-get-away-with-it/.

[22]. ELISA S., More than eight-in-ten Americans get news from digital devices, January 12, 2021. https://www.pewresearch.org/fact-tank/2021/01/12/more-than-eight-in-ten-americans-get-news-from-digital-devices/

[23]. Raynor B. Apple Pay - statistics & facts, Dec 13, 2021. https://www.statista.com/topics/4322/apple-pay/#dossierKeyfigures.

[24]. Rene Millman, The five most secure smartphones, Mar 11, 2022. https://www.itpro.com/mobile/mobile-phones/360024/5-most-secure-smartphones.

[25]. Statcounter, Mobile Vendor Market Share Europe Aug 2021 - Aug 2022, August 2022. https://gs.statcounter.com/vendor-market-share/mobile/europ.

[26]. Dao, Apple&Huawei go head-to-head for China’s premium smartphone market, August 26, 2022.https://daoinsights.com/news/apple-huawei-go-head-to-head-for-chinas-premium-smartphone-market/

[27]. Matt Wille, The Department of Justice is ready to serve Apple a hefty antitrust lawsuit, August 30, 2022. https://www.inputmag.com/culture/apple-antitrust-lawsuit-department-justice-app-store.

[28]. Josh Sisco, Apple faces growing likelihood of DOJ antitrust suit, August 26, 2022. https://www.politico.com/news/2022/08/26/justice-department-antitrust-apple-00053939.

[29]. Macrotrend, Apple Financial Ratios for Analysis 2009-2022 | AAPL, https://www.macrotrends.net/stocks/charts/AAPL/apple/financial-ratios?freq=Q.

[30]. CSIMarket, Electric & Wiring Equipment Industry Profitability, 2022. https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=411.

[31]. CSIMarket, Electric & Wiring Equipment Industry Management Effectiveness Information & Trends, 2022.https://csimarket.com/Industry/industry_ManagementEffectiveness.php?ind=411.

[32]. GURUFOCUS, Apple PE Ratio: 25.50 (As of Today), June 2022. https://www.gurufocus.com/term/pettm/AAPL/PE-Ratiottm/Apple.

Cite this article

Li,L. (2023). Analysis on the Stock Valuation of Apple Inc. Advances in Economics, Management and Political Sciences,27,51-56.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bernard Z. Buy Apple Stock in July? July 5, 2022. https://www.thestreet.com/apple/stock/buy-apple-stock-in-july.

[2]. Abdulla Aljafari, Apple Inc. Industry Analysis Business Policy and Strategy, International Journal of Scientific & Engineering Research, Volume 7, Issue 3, March 2016, pp.406-441.

[3]. Statista Research Department, Apple: brand value 2006-2022, Jun 17, 2022, https://www.statista.com/statistics/326052/apple-brand-value/.

[4]. AppleInsider Staff, Apple has most loyal smartphone customers in US, study finds, Oct 29, 2021.https://appleinsider.com/articles/21/10/29/apple-has-most-loyal-smartphone-customers-in-us-study-finds.

[5]. Geoffrey F. and Andrew D., Your Apple products are getting more expensive. Here’s how they get away with it. December 6, 2018. https://www.washingtonpost.com/technology/2018/12/06/your-apple-products-are-getting-more-expensive-heres-how-they-get-away-with-it/.

[6]. ELISA S., More than eight-in-ten Americans get news from digital devices, January 12, 2021. https://www.pewresearch.org/fact-tank/2021/01/12/more-than-eight-in-ten-americans-get-news-from-digital-devices/

[7]. Raynor B. Apple Pay - statistics & facts, Dec 13, 2021. https://www.statista.com/topics/4322/apple-pay/#dossierKeyfigures.

[8]. Rene Millman, The five most secure smartphones, Mar 11, 2022. https://www.itpro.com/mobile/mobile-phones/360024/5-most-secure-smartphones.

[9]. Statcounter, Mobile Vendor Market Share Europe Aug 2021 - Aug 2022, August 2022. https://gs.statcounter.com/vendor-market-share/mobile/europ.

[10]. Dao, Apple&Huawei go head-to-head for China’s premium smartphone market, August 26, 2022.https://daoinsights.com/news/apple-huawei-go-head-to-head-for-chinas-premium-smartphone-market/

[11]. Matt Wille, The Department of Justice is ready to serve Apple a hefty antitrust lawsuit, August 30, 2022. https://www.inputmag.com/culture/apple-antitrust-lawsuit-department-justice-app-store.

[12]. Josh Sisco, Apple faces growing likelihood of DOJ antitrust suit, August 26, 2022. https://www.politico.com/news/2022/08/26/justice-department-antitrust-apple-00053939.

[13]. Macrotrend, Apple Financial Ratios for Analysis 2009-2022 | AAPL, https://www.macrotrends.net/stocks/charts/AAPL/apple/financial-ratios?freq=Q.

[14]. CSIMarket, Electric & Wiring Equipment Industry Profitability, 2022. https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=411.

[15]. CSIMarket, Electric & Wiring Equipment Industry Management Effectiveness Information & Trends, 2022.https://csimarket.com/Industry/industry_ManagementEffectiveness.php?ind=411.

[16]. GURUFOCUS, Apple PE Ratio: 25.50 (As of Today), June 2022. https://www.gurufocus.com/term/pettm/AAPL/PE-Ratiottm/Apple.

[17]. Bernard Z. Buy Apple Stock in July? July 5, 2022. https://www.thestreet.com/apple/stock/buy-apple-stock-in-july.

[18]. Abdulla Aljafari, Apple Inc. Industry Analysis Business Policy and Strategy, International Journal of Scientific & Engineering Research, Volume 7, Issue 3, March 2016, pp.406-441.

[19]. Statista Research Department, Apple: brand value 2006-2022, Jun 17, 2022, https://www.statista.com/statistics/326052/apple-brand-value/.

[20]. AppleInsider Staff, Apple has most loyal smartphone customers in US, study finds, Oct 29, 2021.https://appleinsider.com/articles/21/10/29/apple-has-most-loyal-smartphone-customers-in-us-study-finds.

[21]. Geoffrey F. and Andrew D., Your Apple products are getting more expensive. Here’s how they get away with it. December 6, 2018. https://www.washingtonpost.com/technology/2018/12/06/your-apple-products-are-getting-more-expensive-heres-how-they-get-away-with-it/.

[22]. ELISA S., More than eight-in-ten Americans get news from digital devices, January 12, 2021. https://www.pewresearch.org/fact-tank/2021/01/12/more-than-eight-in-ten-americans-get-news-from-digital-devices/

[23]. Raynor B. Apple Pay - statistics & facts, Dec 13, 2021. https://www.statista.com/topics/4322/apple-pay/#dossierKeyfigures.

[24]. Rene Millman, The five most secure smartphones, Mar 11, 2022. https://www.itpro.com/mobile/mobile-phones/360024/5-most-secure-smartphones.

[25]. Statcounter, Mobile Vendor Market Share Europe Aug 2021 - Aug 2022, August 2022. https://gs.statcounter.com/vendor-market-share/mobile/europ.

[26]. Dao, Apple&Huawei go head-to-head for China’s premium smartphone market, August 26, 2022.https://daoinsights.com/news/apple-huawei-go-head-to-head-for-chinas-premium-smartphone-market/

[27]. Matt Wille, The Department of Justice is ready to serve Apple a hefty antitrust lawsuit, August 30, 2022. https://www.inputmag.com/culture/apple-antitrust-lawsuit-department-justice-app-store.

[28]. Josh Sisco, Apple faces growing likelihood of DOJ antitrust suit, August 26, 2022. https://www.politico.com/news/2022/08/26/justice-department-antitrust-apple-00053939.

[29]. Macrotrend, Apple Financial Ratios for Analysis 2009-2022 | AAPL, https://www.macrotrends.net/stocks/charts/AAPL/apple/financial-ratios?freq=Q.

[30]. CSIMarket, Electric & Wiring Equipment Industry Profitability, 2022. https://csimarket.com/Industry/industry_Profitability_Ratios.php?ind=411.

[31]. CSIMarket, Electric & Wiring Equipment Industry Management Effectiveness Information & Trends, 2022.https://csimarket.com/Industry/industry_ManagementEffectiveness.php?ind=411.

[32]. GURUFOCUS, Apple PE Ratio: 25.50 (As of Today), June 2022. https://www.gurufocus.com/term/pettm/AAPL/PE-Ratiottm/Apple.