1. Introduction

The conventional theoretical framework indicated that the behavior of the investors tends to be logical, and can always make rational decisions. However, behavior finance has a different perspective on this issue. When the investors are facing possible loss, their emotions and feelings would be greater than in the opposite situation when the investors would be happy for the gain. This is called the bias of loss aversion, which most investors demonstrated to have, and can certainly affect the decision-making process when it comes to financial investment. This paper will conduct literature reviews seeking previous research related to the decision-making process and loss aversion bias study, and conduct survey experiments to discover the relationship between these two. Finally, a discussion will follow on the factors influencing the degree of loss aversion on the investment.

2. Literature Review

2.1. The Decision-Making Process

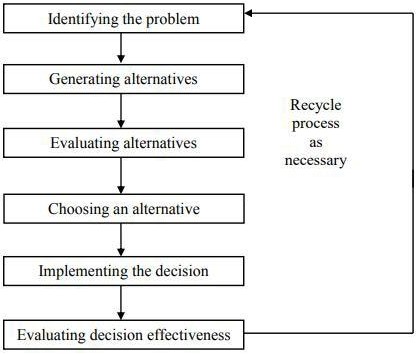

The traditional finance theory indicated that investors tend to be logical and fully rational in making investment decisions [7]. As the theory said that when people are making vital investment decisions, all available information and variables will be considered and can reflect on the share price and market [7]. However, emotions can disturb people from being reasonable in making decisions, and investors can make an irrational moves in the market. The research reveals that the decision-making process was the combined effect of mental and cognitive status, which can result in a series of behaviors in different situations [7]. That is, in investment, people can be affected not only by the cognitive and experience acquired from reasonability but also by the mental status influences. In the study of behavioral finance, the motive behind the behavior can explain that the emotional and cognitive factors can be treated as a bias that can always impose an impact on the investment decision [7]. However, the conventional finance theory tends to ignore that effect and only assumes that people can make a logical judgment over the investment. Lunenburg (2010) explained in the paper related to the decision-making process saying that there are six steps in the fundamental recycling process, and they are identifying the problem, generating alternatives, evaluating alternatives, choosing an alternative, implementing the decision, and evaluating the decision effectiveness [9].

Figure 1: The decision-making process.

Source: [9].

Anyone dealing with a problem must first understand the importance of identifying the problem and comprehending the current situation [9]. The problem should be defined by the understanding of the internal and exogenous environment. Plenty of frameworks can be used like the PESTEL or SWOT analysis to aid in the understanding of the problems and the factors influencing those problems [9]. When the problem is understood, the possible alternatives must be provided for further solution reference. For example, when an investor is considering how to deal with the losing stocks, the alternatives can be to hold, sell or bid for more chips to lower the overall price per share. When the investment is substantial for a certain individual, the alternatives should be plenty to locate the potential best solution. Each possible alternative must be seriously evaluated in a scientific mode. Grant (2011) suggested that three questions can be asked to evaluate the alternative, they are: is the alternative workable? Is the alternative an acceptable choice? And what is the possible outcome of that alternative? The three-question method can best serve as a guide to whether an individual investor can accept the alternative as a solution [5]. When the best alternative comes, the investor can choose to act on that alternative. The alternative can also sometimes perform poorly if the person does not act correctly. The same thing could apply to the investment, as investors should choose the strategies for the decision made, and each decision can derive multiple directions and methods. Finally, the effectiveness must be appraised, and the person who made the decision should compare the actual result to the desired result. According to Hicks, evaluation can be the most vital aspect in long run, and it helps in promoting the overall capability in the decision-making process [6].

On the other hand, the bounded rationality model noted that the decision-making process must base on perfect knowledge and information, where all alternatives and consequences can be retrieved by the decision maker. The actual circumstances indicated that the decision in the real world must always be made based on inaccurate or incomplete information, where only a degree of information is available to refer to. In this case, the people can not figure out the best alternative possible and produce the consequences attached to the alternatives. Therefore, the decision made by people can only be seen as an optimized or the highest winning chance alternative [14].

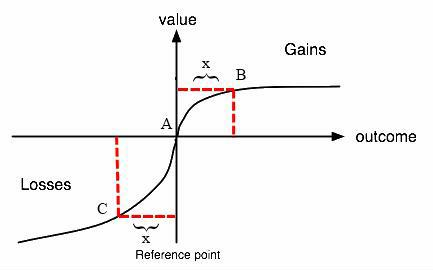

2.2. Loss Aversion Bias

As one of the anomalies being discovered and explained by prospect theory, loss aversion can happen when people prefer certainty and safety to take risks, even if the level of return and risk are compatible [12]. This bias can trigger the effect that vastly influences the investment decision, as the investors are more sensitive to losing money than profiting from the portfolio [7]. However, this bias may also demonstrate different implications for people with different demographic backgrounds. For example, female investors tend to demonstrate a stronger reaction to the loss than male roles when making financial decisions; Seniors and people who have no jobs, or are in vulnerable conditions can demonstrate a stronger loss aversion than others. Cultural values, education, and experience can all contribute to the dynamics of the loss aversion bias [7]. And it can be concluded that the loss aversion bias can negatively influence the decision made on the investment most of the time [7].

Scholars tend to explain the bias from an evolutionary perspective, mentioning that because of the domain-specific mechanism of humans, the brain tends to avoid the painful outcome. For example, when the brain learns that certain food can be poisonous, the brain will order to avoid eating that food and generate repelling reactions strongly to protect the human body and survive [8]. In the field of investment, the natural perception of risks can directly influence the investment decision-making process, as when the investors sniff a higher risk, then the following investment tends to play safe to mitigate the possible risky results [1]. Logically, the return and risk should be compatible in making a reasonable portfolio, and statistically speaking, when the return and risk enlarge at the same rate, the decision should hold, and there should be no demand for extra compensation for the return. However, many experiments demonstrated that when the investors are facing a larger risk, the return that has been enlarged can not equally compensate the risk-bearing, and the investors would tend to forgo the larger risk choice or urge for higher compensation [1]. The experiment conducted by Mahina & Muturi confirmed that the investors are loss aversion, and will phase out any possible loss, as they weigh much more on the loss than gains on the stock market [10]. To be more specific, the experiment showed that the investors may not be willing to sell the stocks they own even when the stocks are falling, and may not have a reverse outcome in the short- term, and they are more willing to sell the shares that are increasing, even though the shares may continue to outperform the falling one [10].

Figure 2: Value function in prospect theory.

Source: (Gearon, 2018).

Loss aversion could also be predicted by agency theories and expected utility, where the irrational decision can be made because of sociological and psychological effects [16]. The majority of people have an asymmetrical sensitivity to the anguish of loss and the pleasure of gain, with the agony of loss being far more acute than the pleasure of gain. Behavioral economists evaluate the veracity of this argument using a bet [16]. Let's imagine there is a coin-tossing gambling game in which the winner is chosen by which side comes up heads. If you are successful, you will get 10,000 dollars; if you are unsuccessful, you will lose 10,000 dollars. Are you willing to take a chance? Overall, the probability of winning or losing is equal; alternatively, the expected value of this game's outcome is zero; hence, the game is fair. The majority of folks, however, are hesitant to join in the game, according to the results of a huge number of research with very identical conclusions [16]. The loss aversion effect is an additional potential explanation for this phenomenon. Despite the reality that good and negative appearances are equally likely, people are more sensitive to the idea of "loss" than "gain." The risk of losing 10,000 dollars is far more upsetting than the possibility of winning 10,000 dollars. Individuals are substantially more sensitive to losses than they are to gains of the same amount, therefore they are more likely to suffer daily losses and ultimately sell their stocks, even though their stock portfolios fluctuate. Due to this "loss aversion," the average person will abandon an investment that has the potential to generate a return [16].

2.3. Overconfidence

Normal people, especially investors in command of crucial responsibilities and resources, have a propensity to be overconfident, according to research. Even though overconfidence is a common psychological trait among individuals, this is the case. According to the overconfidence hypothesis, even a devoted and educated investor would overestimate benefits and underestimate risks due to the psychological bias of overconfidence, which might result in overinvestment decisions [13].

It is usual for investors to believe that the investment decisions made by others are irrational, but their own decisions, which are based on favorable information, are sensible [13]. This is not the case, though. This cognitive bias is exacerbated by investors' attribution preference, as they ascribe accidental success to their operational competence and failing investment operations to external occurrences. This will lead to the psychological phenomenon referred to as overconfidence [13]. It refers that you have excessive confidence in your judgment. When investors make investing decisions, they often feel that they have sufficient awareness of future events and that they may influence future developments [13]. The fact that ordinary people participate in anything gives them the false impression that they may affect future events, yet this is not the case. This illusion of control is the result of overconfidence in one's skills. When individuals are driven by an excessive level of self-assurance, they tend to overestimate the accuracy of the information they get and their analytical talents [13]. Consequently, people will grasp investing objectives and make investment judgments based on one-sided information. When it comes to investing, it is easy to incur losses and set off a cascade of unfavorable occurrences [13].

Initially, it increases the number of transactions. Due to psychological causes of overconfidence, investors have a propensity to overestimate their ability to discern market trends and the veracity of the information they get, which leads to repeated trading in an attempt to maximize profits by continually "selling high and buying cheap." This might result in an overestimation of an investor's ability to evaluate market movements and the reliability of the information they get [3]. In reality, frequent trading may considerably reduce the success rate of investment decisions and increase transaction costs, which can ultimately lead to greater losses [3].

What’s more, investors are more confident in their assessments because they are more likely to accept information that corroborates their ideas and rejects information that contradicts them [3]. One of the disadvantages of excessive confidence is that it may cause one to overestimate the value of their assets. When investors are very confident in a certain investment objective, they have a propensity to exaggerate the rate of return that may be obtained on that investment, and they get narcissistic satisfaction from doing so [3]. Overconfident investors have a propensity to be stubborn and to disregard the advice of others.

On top of that, investors may overlook risk management. Investors often overlook risk management because of their overconfidence [3]. For instance, when specific sectors are exploding, it is straightforward for investors to track funds with a focus on such businesses. Investors are more inclined to engage in a herd-like manner when a market section is doing very well, and this corresponds with the period when overconfidence is most likely to strike [3]. When investors pursue funds that are presently accessible on the market, they often place a premium on the fund's short- term returns, disregard risk management, and engage in gambling-like behavior as a consequence.

Finally, a high level of confidence may readily lead to concentrated investment. As a consequence of investing a considerable amount of their wealth in volatile assets such as stocks, equity funds, and other assets, investors will lose the capacity to allocate capital across major asset classes [3]. It is unreasonable for investors to deposit the bulk of their assets in a single investment product, especially when asset portfolio management and risk reduction are considered.

3. Methodology

The research was conducted through a survey, which contains questions regarding the feelings about the betting losses and gains. The survey received 20 effective responses, and the people who receive the survey are their peers and random participants from the university.

3.1. The Survey Method

The survey was seen as one of the suitable methods for this study, as some of the key parameters are rather subjective, and can be hard to measure, like the emotions and feelings towards certain scenarios. Besides, the study may involve individual traits and background differences, where people need to state their assumed acts when dealing with a certain case. Therefore, a scale and multiple-choice questions can help determine the closest result to the true feeling of the participants. The demographic information about the participants is that the age ranged from 18-32, 8 of them are male, 10 of them are female, and the rest two respondents refused to reveal their gender. Most of them have little or some investment experience, or at least have learned the relevant subject of investing.

3.2. The Survey Questions

The survey includes the following questions with a scale answer box.

1. The demographic information about the participants

2. How much percentage of your money, that you would want to invest in the stock market in your own country?

3. Choose from 1-10, where 1 is strongly agreed, and 10 strongly disagrees, that i would like to invest in a zero-risk market, even if the return is rather small.

4. Choose from 1-10, where 1 is strongly agreed, and 10 strongly disagrees, that i would like to invest in a moderate risk and moderate return market.

5. Choose from 1-10, where 1 is strongly agreed, and 10 strongly disagrees, that i would like to invest in a highly risky and high return market.

6. State the number to represent your feeling scaled from 1-10, how happy you are when you earn 15% in investment in a month?

7. State the number to represent your feeling scaled from 1-10, how upset you are when you lose 15% in investment in a month?

8. If an investment has a 50% possibility of losing 10% of your investment, and a 50% possibility of gaining 10%, would you like to invest?

9. If an investment has a 50% possibility of losing 100% of your investment, and a 50% possibility of gaining 100%, would you like to invest?

10. If an investment has a 50% possibility of losing 80% of your investment, and a 50% possibility of gaining 100%, would you like to invest?

4. Findings

In terms of the percentage of the money that is willing to invest, the answer varied greatly from 10% to 80%, although other factors may get in the way, like the educational background, the yearly income, the stock market condition of a certain country, and the residual income that a person may have, it is still visible that people nowadays are hesitant in investing money in the stock market, with an average number acquired from the survey of 22%. To compare this number, I retrieved a report from SEC to discover the US household investment condition, which indicated that over 33% of the household have taxable accounts that are actively traded in the stock market. As for non-active trading accounts like a retirement accounts, the total household investing percentage is a little over 62%. The report further indicated that for married couples, the overall investment percentage (without a retirement account) can reach as high as 46%, and the lowest percentage would be 15% when there is a single female in the household [11]. As for the zero-risk investment, more than 80% of respondents refused or hesitated to invest,demonstrating an unfavorable attitude towards low low-return portfolios. About 50% of people are willing to accept the moderate risk and return combination, demonstrating the willingness to take risks in the market, and the desire for greater return. However, when it comes to high return and high-risk combination, the percentage dropped to 25%, as only a few can willingly accept this portfolio, showing the risk aversion attitude towards investment. The average happiness scaled from 1-10 demonstrated an average of 6 when investors are gaining 15% return in a month, and surprisingly, the average upset scaled from 1- 10 demonstrated an average of 7 when investors are losing 15% return in a month. This result concurred with the review mentioned, that people would feel much more upset when they lose money than the same level of happiness acquired when they win the same amount of money. When it comes to questioning 8, around 45% of the respondents took the investment, and when it comes to question 9, only 10% of respondents feel OK to accept the investment. As for the last question, the percentage only increases from 10% to 15%, indicating the fear of losing a substantial part of the money, even if the return is much higher.

5. Discussion

Although there are possibilities that the selection can be influenced by other factors, the outcome still follows the theoretical assumption, that we could conclude that people demonstrate a certain level of loss aversion bias in making an investment decision. The bias not only prevents the investors from accepting a fair choice of investment, it even prevents investors to accept a favorable choice of investment, as the risk is significantly lower than the return. It indicated that people tend to escape from such phenomena that would have the possibility to lose a substantial part of their equity. What’s more, the fear of losing money escalates as the percentage in the game enlarges. When it comes to a small percentage of the investment, the investors would feel less fearful and are willing to expose themselves to a higher risk to gain a higher return. When the money involved in the investment increases, the fear increases, and the desire to protect the money surpasses the desire to gain more return. It can be well explained by the effect of loss aversion on the decision-making process. A research team found out that loss aversion can influence decision-making when the person who makes the decision is at great risk [15]. To explicate risk aversion bets, prospect theory makes use of the concept of loss aversion. Individuals seem to be more concerned about the possibility of losing possessions or wealth than they are about the possibility of gaining those same things or amounts of money [15]. Individuals typically need access to a possible benefit of at least $100 to compensate for the risk of a potential loss of $50. This is because the perceived impact of losses is about twice that of profits. In a similar vein, people expect a far larger sum of money in exchange for their presents than they were willing to invest to get such things [15].

However, various factors can influence the degree of loss aversion, and a few of the major factors were believed to be age, gender, and risk-taking ability. Research demonstrates that contrasted to individuals between the ages of 25 and 40, people between the ages of 41 and 55 are more sensitive to loss [2]. This may be partially attributable to the fact that older individuals have fewer years remaining to make up for prior financial failures [2]. In addition, they do not have enough income to lose, and they are compelled to make retirement preparations [2]. Consistent with past studies on aging and loss sensitivity, the findings support the hypothesis. Researchers have shown that aversion to loss increases with age, income, and wealth, but decreases with knowledge [2]. This pattern remains the case irrespective of whether or not the work includes risky decisions. In a similar line, the present study revealed that individuals between the ages of 41 and 55 reported higher regret levels than those between the ages of 25 and 40 [2]. According to the results of this study, older individuals are more likely to experience regret and loss aversion, which reduces the amount of risk they take when making financial choices [7]. The gender of a person has a substantial impact on both the desire to prevent losses and the sense of regret [7]. Females have more loss aversion and regret than males. In addition, it was shown that female investors made less risky decisions than male investors [10]. This was shown via a comparison of the sexes. This disparity may be attributable to the tendency of females to be loss averse and underestimate the effect of regret, both of which lead to a further drop in their feeling of self-worth after an unsatisfactory investment.

6. Conclusion

This paper researches the study of loss aversion behavior in making investment decisions and concluded that loss aversion can negatively influence investment performance, and can prevent investors from making rational investment decisions. The study also reveals that multiple factors could affect the degree of loss aversion for individual investors, they are age, gender, and the ability to take the risks. When investors are elder, they tend to avoid risky investments because of the difficulties in winning over them in long term. As for the gender, females demonstrated a much higher aversion to risky investment, as the emotions and feelings for a failed investment are stronger. The ability to take risks is reasonable and is also proven in the research, that when a person is stronger in taking risks, the loss aversion is lower.

The paper addressed the loss aversion phenomenon among investors and proved its existence in the investment decision-making process. The result filled the gap of the influences imposed on the decision-making mechanisms by psychological factors like loss aversion, and the investors are not always rational in making significant financial decisions. However, there are limitations and restrictions in this research. To begin with, the number of survey respondents is relatively insufficient in making more solid results to explain the phenomenon. And the demographic differences can not lead to the result of the major factors influencing the degree of loss aversion. Besides, other variables can not be easily phased out in the research, like cultural values, national stock market efficiency, national economic performance, and average income, which can be differentiated in different nations. In the future, more experiments can be conducted regarding loss aversion in different countries.

References

[1]. Aina, N. S. N. & Lutfi, L.: The influence of risk perception, risk tolerance, overconfidence, and loss aversion toward investment decision-making. Journal of Economics, Business, & Accountancy Ventura, 401-413 (2019).

[2]. Arora, M. & Kumari, S.: Risk-taking in financial decisions as a function of age, gender: mediating role of loss aversion and regret. International Journal of Applied Psychology, 83-89 (2015).

[3]. D'Acunto, F.: Identity, overconfidence, and investment decisions. Haas School of Business, UC Berkeley (2015).

[4]. Gearon, M.: Cognitive biases: loss aversion (2018). [Online] Available at: https://uxdesign.cc/cognitive-biases-loss-aversion-925149360f46 [Accessed 15 8 2022].

[5]. Grant, R.: Contemporary strategy analysis. New York, NY: Wiley (2011).

[6]. Hicks, M. J.: Problem solving and decision making: Hard, soft, and creative. Belmont, CA: Cengage Learning (2005).

[7]. Khan, M. Z. U.: Impact of availability bias and loss aversion bias on investment decision making, moderating role of risk perception. Management & Administration, 17-28 (2017).

[8]. Li, Y., Kenrick, D. T., Griskevicius, V. & Neuberg, S. L.: Economic decision biases and fundamental motivations: How mating and self-protection alter loss aversion. Journal of personality and social psychology (2012).

[9]. Lunenburg, F. C.: The decision making process. National Forum of Educational Administration & Supervision Journal (2010).

[10]. Mahina, J. N. & Muturi, W. M.: Influence of Loss Aversion Bias on Investments at The Rwanda Stock Exchange. International Journal of Accounting, Finance and Risk Management, 131-137 (2017).

[11]. Mottola, G.: A Snapshot of Investor Households in America, s.l.: SEC (2015).

[12]. Passarelli, F. & Del Ponte, A.: Prospect Theory, Loss Aversion, and Political Behavior. Oxford Research Encyclopedia of Politics (2020).

[13]. Pikulina, E., Renneboog, L. & Tobler, P.: Overconfidence and investment: An experimental approach. Journal of Corporate Finance, 175-192 (2017).

[14]. Rubinstein, A.: Modeling bounded rationality. s.l.:MIT press (1998).

[15]. Tom, S. M., Fox, C. R., Trepel, C. & Poldrack, R. A.: The neural basis of loss aversion in decision-making under risk. Science, 515-518 (2007).

[16]. Willman, P., O'Creevy, F., Nicholson, N. & Soane, E.: Traders, managers and loss aversion in investment banking: a field study. Accounting, organizations and society, 85-98 (2002).

Cite this article

Zhou,J. (2023). A Review of the Relationship Between Loss Aversion Bias and Investment Decision-making Process. Advances in Economics, Management and Political Sciences,27,143-150.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Aina, N. S. N. & Lutfi, L.: The influence of risk perception, risk tolerance, overconfidence, and loss aversion toward investment decision-making. Journal of Economics, Business, & Accountancy Ventura, 401-413 (2019).

[2]. Arora, M. & Kumari, S.: Risk-taking in financial decisions as a function of age, gender: mediating role of loss aversion and regret. International Journal of Applied Psychology, 83-89 (2015).

[3]. D'Acunto, F.: Identity, overconfidence, and investment decisions. Haas School of Business, UC Berkeley (2015).

[4]. Gearon, M.: Cognitive biases: loss aversion (2018). [Online] Available at: https://uxdesign.cc/cognitive-biases-loss-aversion-925149360f46 [Accessed 15 8 2022].

[5]. Grant, R.: Contemporary strategy analysis. New York, NY: Wiley (2011).

[6]. Hicks, M. J.: Problem solving and decision making: Hard, soft, and creative. Belmont, CA: Cengage Learning (2005).

[7]. Khan, M. Z. U.: Impact of availability bias and loss aversion bias on investment decision making, moderating role of risk perception. Management & Administration, 17-28 (2017).

[8]. Li, Y., Kenrick, D. T., Griskevicius, V. & Neuberg, S. L.: Economic decision biases and fundamental motivations: How mating and self-protection alter loss aversion. Journal of personality and social psychology (2012).

[9]. Lunenburg, F. C.: The decision making process. National Forum of Educational Administration & Supervision Journal (2010).

[10]. Mahina, J. N. & Muturi, W. M.: Influence of Loss Aversion Bias on Investments at The Rwanda Stock Exchange. International Journal of Accounting, Finance and Risk Management, 131-137 (2017).

[11]. Mottola, G.: A Snapshot of Investor Households in America, s.l.: SEC (2015).

[12]. Passarelli, F. & Del Ponte, A.: Prospect Theory, Loss Aversion, and Political Behavior. Oxford Research Encyclopedia of Politics (2020).

[13]. Pikulina, E., Renneboog, L. & Tobler, P.: Overconfidence and investment: An experimental approach. Journal of Corporate Finance, 175-192 (2017).

[14]. Rubinstein, A.: Modeling bounded rationality. s.l.:MIT press (1998).

[15]. Tom, S. M., Fox, C. R., Trepel, C. & Poldrack, R. A.: The neural basis of loss aversion in decision-making under risk. Science, 515-518 (2007).

[16]. Willman, P., O'Creevy, F., Nicholson, N. & Soane, E.: Traders, managers and loss aversion in investment banking: a field study. Accounting, organizations and society, 85-98 (2002).