1. Introduction

With the support of China's policy environment, with the continuous development of technology and the improvement of consumer market demand, China's Internet consumer finance represented by Ant Finance has been widely used, and the market scale has continued to expand. In the current epidemic environment, China has become the only economy in the world to achieve positive economic growth, and Internet finance provides contactless financial services for the market. While fighting the epidemic and ensuring public safety, it has also mitigated the impact of the epidemic on the financial industry. It is necessary to study China's Internet finance under the COVID-19 epidemic. The average household income of China has grown steadily, people's living standards have improved significantly, consumption upgrading has continued to advance, and the demand for financial markets has continued to expand. Now, due to the impact of the coronavirus pandemic, the global economy has stagnated or even regressed, and the domestic economy has also been affected, and in this environment, the income of many Chinese households has fluctuated. Compared with traditional financial institutions, Ant Finance has great advantages, so with the help of Ant Finance, it can optimize the allocation of household assets, promote effective and high-yield investment, and then create greater value for families. Taking the pandemic as a starting point, I analyzed it as a vulnerability, opportunity, threat (SWOT).

"China's Internet finance is facing threats such as uncertainty, huge market competition pressure, and guarantee services that rely on big data"[1]. "The advantages of China's Internet finance are the strong awareness of technological innovation, the disadvantages of low innovation of financial products, and the establishment opportunities of Internet Finance Associations.” [2]. Based on their research, I conducted new research on finance from several new perspectives, such as users and policy. I collected a lot of data from the official website of the China Bureau of Statistics and the China Statistical Yearbook. I found that the most important point on the street is to provide citizens with an online financial trading platform without settlement, which can effectively interrupt the spread of the epidemic, reduce risks, and facilitate people's lives and consumption needs. In addition, its own characteristics are as follows: lack of legal supervision and guarantees, model innovation is difficult to fit, security risks involve everyone, and risks come from the financial market. The opportunistic nature of Internet finance includes large market demand, rich products, perfect systems, continuous innovation, and national policy support. The threat to them is fourfold: security risk, credit risk, liquidity risk and legal risk. And a number of recommendations are made that may be effective for the characteristics.

2. Literature Review

Ant Financial's main businesses are payment business (Alipay), wealth management business, personal and SME financing, and insurance business. With the vision of "making credit equal to wealth", Ant Financial is committed to building an open ecosystem, helping financial institutions and partners accelerate their transition to "Internet +" through the "Internet Booster Program" and providing inclusive financial services for small and micro enterprises and individual consumers. Ant Financial's main business covers wealth management, banking, payment, lending, credit investigation, crowdfunding, financial cloud services and many other sectors, from the strategic layout, it has full license advantages, and has the qualifications and ability to extend product lines to various fields. Zhaowen Gan once pointed out that ant Financial uses its cloud computing operating advantages to develop a comprehensive Internet financial system, with better platform user stock resources, wider service coverage and small audience, which is the representative of China's Internet finance. [3]

It takes payment + e-commerce as the core, strong technical barriers and consumption scenarios provides growth space for the innovation of internal product modules and gives birth to high-tech products such as intelligent customer service, personalized insurance, and intelligent risk control. Externally, Ant Financial makes up for the shortcomings of traditional finance by opening up technical components such as big data and cloud computing to financial institutions.

3. SWOT Analysis

SWOT analysis method, that is, situation analysis. It is to list the main internal advantage disadvantages and external opportunities and threats closely related to the research object, etc., through the investigation, and arrange it in the form of a matrix, and then use the idea of systematic analysis to match various factors to analyze, from which a series of corresponding conclusions can be drawn, using this method, the research object can be comprehensive, systematic and accurate research, so as to formulate corresponding development strategies, plans and countermeasures according to the research results.

This analysis method is often used in corporate strategy formulation, competitor analysis, etc. By analyzing various major internal strengths, weaknesses, and external opportunities and threats closely related to the research object. This leads to the conclusion that this conclusion usually has a certain decision-making character. After the analysis, we can formulate corresponding development strategies, plans and countermeasures based on the research results. For example, Ziqi Liu used the SWOT model to study the retail giant Walmart and make feasible recommendations for the company [4].

3.1. Strengths

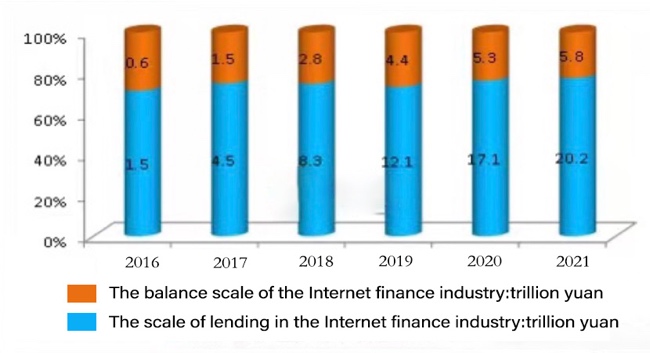

Table 1: Scale chart of Internet finance industry.

The above figure is a relative proportion of the balance size (orange) and lending scale (blue) of China's Internet consumer finance industry. A number of policy support, the scale of lending expanded. Since 2013, Internet consumer finance has developed rapidly, a number of policies have been introduced to support the development of consumer finance business, and the industry has developed rapidly. With the online organization of the consumer finance business of traditional financial institutions, the lending scale of China's Internet consumer finance industry will reach 20.2 trillion yuan in 2021, and the balance scale will reach 5.8 trillion yuan. It can be seen that China's Internet finance industry has a lot of stone strength in the context of the epidemic.

Firstly, it meets the demand for "contactless" financial services during the pandemic. The new coronavirus is highly contagious with respiratory droplets and close contact as the main transmission channels, making close contact with offline financial services such as business outlets and cash payment transactions have a high risk of epidemic infection. The online and mobile Internet financial model that has emerged in the past decade has met the special needs of all parties in society for "contactless" financial services during the epidemic. On August 31, 2022, the China Internet Network Information Center (CNNIC) released the 50th Statistical Report on China's Internet Network Development in Beijing. According to the report, as of June 2022, the number of Internet users in China was 1.051 billion, and the Internet penetration rate reached 74.4%. In December 2021, 19.19 million new Internet users were added, and the Internet penetration rate increased by 1.4 percentage points compared with December 2021. Comprehensively strengthen the construction of rural Internet infrastructure, realize "village broadband access" in China's existing administrative villages, and promote the rural Internet penetration rate to increase by 1.2 percentage points from December 2021, reaching 58.8%. In 2017, 2018, 2019 and January-June 2020, Ant Group achieved operating income of 65.396 billion yuan, 85.722 billion yuan, 120.618 billion yuan and 72.528 billion yuan respectively, with an average annual compound growth rate of 35.81% from 2017 to 2019. During the reporting period, the revenue of digital fintech platforms was 28.993 billion yuan, 40.616 billion yuan, 67.784 billion yuan and 45.972 billion yuan respectively. During the epidemic, Ant Financial relied on artificial intelligence, big data, biometrics, video connection and other technological means to quickly carry out identity authentication, qualification review, risk management, contract handling, customer service consultation and other businesses through online service channels such as portals, mobile apps, and mini programs, and provided customers with diversified financial services such as the Internet. Timely inquiry of payment, Internet lending, Internet insurance, Internet financial management, and Internet credit investigation. In these business areas, the risk of people gathering and face-to-face contact attracting attention has been greatly reduced.

Secondly, it gives full play to online advantages to provide remote epidemic prevention and control services. After the outbreak of the epidemic, Alipay and Ali Health quickly launched an "online medical consultation platform" to fight pneumonia, gathering more than 1,000 practicing doctors to give priority to providing online medical consultation services to Hubei users. Alipay has set up an "epidemic service zone", which covers designated hospital inquiries, online consultations, epidemic prevention questions and answers, confirmed patients with the same itinerary inquiry, national and local real-time epidemic data broadcasting, epidemic-related production and life information, rumor identification, authoritative expert interpretation, door-to-door medicine delivery and other main information on epidemic prevention and control. Alipay has opened the intelligent statistics function of online "health check-in" to more than 50 colleges and universities, and college students can complete the health declaration through the Alipay APP, and the whole process takes no more than 10 seconds. This has effectively helped universities improve the efficiency of information collection, summary analysis and reporting during the epidemic.

Thirdly, launching of new products in response to the pandemic is a big chance. Ant Insurance United Insurance Company launched anti-new crown health protection products for different groups of people to support epidemic prevention and control. Provide free health security funds for medical staff across the country, and medical staff can receive them online for free through the Alipay APP. If medical staff are unfortunately infected with new coronary pneumonia in the fight against the epidemic, they can apply for a maximum of 100,000 yuan after diagnosis, and the death benefit reaches 500,000 yuan. Since its launch on January 27, more than 1.62 million healthcare workers have applied for the product. The "anti-new crown protection fund" is open to the whole people, and Alipay real-name domestic users aged 16 to 70 can apply for it for free, and accumulate the protection amount through the daily "health check-in", up to 20,000 yuan. Once the user is unfortunately infected with the new crown pneumonia, he can get a corresponding proportion of compensation according to the severity of the diagnosis of the disease. Since the product went live on February 1, more than 8.5 million users have claimed it. Ant Financial's serious illness mutual aid plan Mutual Treasure set up new crown special protection", if a member dies due to new crown pneumonia, members of the serious illness mutual aid plan can apply for 100,000 yuan of care security fund, elderly cancer prevention plan members can apply for 50,000 yuan, all insurance expenses are borne by Ant Financial.

3.2. Weaknesses

First of all, it lacks legal supervision and guarantees. As we all know, ant finance is a new type of industry, China's financial laws and regulations supervision objects are mainly in the traditional financial field, because it can not cover many aspects of Internet finance, nor can it fit the uniqueness of Internet finance, is bound to cause certain legal drawbacks. "After the outbreak of the new crown epidemic, due to the insufficient resumption of work of many financial regulatory departments, the practitioners of regulatory departments have resumed work one after another, and the regulatory system may also appear instability caused by incomplete information technology resources, which is easy to aggravate the lack of original financial supervision resources and further aggravate the problem of "regulatory arbitrage" in the field of Internet consumption finance" [5]. For example, there are currently no detailed and clear legal regulations for enterprise access standards, legality of operation methods, and identity authentication of traders in the Internet financial market. Internet finance enterprises are prone to hovering between legal blind spots and regulatory loopholes, carrying out illegal operations, and even illegally absorbing public deposits, illegal fundraising, etc., accumulating a large number of risks. Netizens will face legal deficiencies in the process of providing or enjoying financial services through the Internet.

Secondly, the resources available are limited. Looking back at the online model of Ant Financial Digital Bank, although it is theoretically feasible, there will be various drawbacks in the actual operation process, the biggest flaw is the vague continuous profit model and excessive reliance on external financial institutions such as banks. Digital banks take the form of collecting commissions from banks online to earn profits, which is equivalent to directly handing over control of the source of profits to banks; The loan approval and issuance process is completed by the bank, and the initiative is in the hands of the bank, and it is difficult to obtain a large voice; Formal financial institutions have adopted a strategy of suppressing the Internet lending industry, resulting in a serious lack of online profitability. In addition, the scale of downstream users has limited growth, and customers who have successfully borrowed are likely to directly connect with the bank when they apply for a loan the next time, making digital banks lose their business support online. It can be seen that the uncertainty faced by Internet financial institutions is very large, if a certain original model is too innovative or insufficient innovation, does not meet economic reality, does not meet customer needs, will not be able to achieve sustainable profitability, even if the conditions are good, it will fail because of the risk of model innovation.

Thirdly, security risks involve everyone. Jia Zheng once said that there are technical security risks in the operation mode of online small loans [6]. The technical risks of the Internet are obvious. Computer viruses can spread and spread rapidly through the Internet. Once a program is infected by a virus, the entire computer and even the entire trading Internet can be threatened by the virus. In traditional financial business, computer technology risk will only bring local impact and loss, in Internet finance business, technical risk may lead to systemic risk of the entire financial system, which in turn leads to the collapse of the system. In addition, due to technical defects, Internet financial platforms cannot cope with large-scale transactions in a short period of time due to technical defects, which will also have adverse consequences. This risk mainly exists in traditional e-commerce discount promotion days such as "Qixi", "Double 11", and "Christmas". Since the massive online transactions are concentrated at a certain point in time and the amount of data far exceeds the daily benchmark amount, it is very easy to have problems such as system instability and server failure. Taobao, Juhuasuan, JD.com, Dangdang.com, etc. are the main e-commerce companies directly involved in one-day promotions, and in the past few years, large-scale promotions have seen page crashes, order systems that cannot be opened, and bank payment systems that are congested.

3.3. Opportunities

After most bank branches were forced to close due to the epidemic, Ant Financial Group ushered in a golden period of demand, and a large number of Chinese banks used the company's digital technology to keep their business flowing. The company said that in the past two months to April2020, the number of paying users who asked Ant Financial to assist in developing mobile applications and providing cloud computing capabilities increased by 175%. Currently, the company is working with more than 200 banks. During this period, the number of inquiries about cooperation increased by 400 per cent. Ant Financial broke into the banking sector, sounding the alarm for 4,500 banks. Two years ago, the company also tried to provide services to banks. Despite the lackluster response so far, the pandemic has presented opportunities for Ant Financial to attract at least most of the country's small and regional banks.

For Ant Financial, open banking is crucial. In addition to selling technology to banks, the company has a consumer lending platform and launched an online bank, MYbank. According to people familiar with the matter, Ant Financial is expected to increase revenue from these services to 65% by 2021. The pandemic has made life even more difficult for China's already struggling small banks. These banks have been plagued by loan losses over the past few years. According to China's banking regulator, 800 bank branches had been permanently closed as of May 4 this year.

Shenzhen Rural Commercial Bank is a new user of Ant Financial this year. By partnering with Ant Financial, the bank was able to reduce the app's loading time to 2.5 seconds when 15 million retail investors flocked to the platform to transfer money, view investments and buy wealth management products online. Banks say that during the pandemic, almost all transactions were conducted online. At the same time, Ant Financial is also actively establishing partnerships with large banks.

3.4. Threats

First, user complaints have increased. Kun Zhao pointed out that consumer financial litigation disputes have shown an exponential growth trend in recent years [7]. Affected by the epidemic, many people's economic situation is not very good, and Alipay has also responded to the question of whether it can be postponed to repay and borrow. Alipay's official customer service said that during the epidemic, credit reports affected by overdue Huabei and borrowing can contact customer service to delete the overdue record, so it will not have an impact on credit investigation. However, this response did not positively answer the questions of whether users can apply for an extension and how to apply for an extension, so the complaints on the complaint platform about applying for Huabei and borrowing delayed repayment are still gradually increasing. According to the statistics of the Ju Complaint platform, the number of complaints from Ant Financial has been increasing month by month since February 2019, climbing to the highest point in December, compared with the rising number of complaints, the complaint rate has shown a downward trend month by month. According to the statistics of the poly complaint platform, Ant Financial had 5840 complaints in the previous year, ranking 24th.

Secondly, users hope that Huabei can defer repayment during the epidemic. After the new coronary pneumonia affected the normal economic life of the masses, the people with financial difficulties wanted to alleviate the economic pressure by applying for deferred repayment such as huabei and borrowing. Since February, complaints about such issues with Ant Financial have gradually increased. Complaints are an important indicator of user satisfaction with products and services, and although Ant Financial had 773 complaints in January this year, down from December last year, the number of complaints was still high considering the Spring Festival holiday target. Most of the recent complaints against Ant Financial revolve around the pneumonia epidemic affecting work and income, hoping to defer repayment.

Thirdly, ABS issuance continued to decline. The original rights holder of Huabei corresponds to Chongqing Ant Small and Micro Loan Co., Ltd., which issued a total of 106.3 billion yuan of corporate ABS in 2019, 8.86 times its registered capital, and the total number of issuances in 2017 and 2018 was 162.281 billion yuan and 116.9 billion yuan. The total amount of corporate ABS issued in 2019 was 11.5 billion yuan, which was 2.88 times its registered capital, and the number of issuances amounts in 2017 and 2018 was 149.759 billion yuan and 55.5 billion yuan respectively. It can be seen that the decline of Ant small loans is much higher than that of ant small and micro loans. Huabei and borrowing are the two important pillars that constitute Ant Financial's profits, and its financing channels have always attracted the attention of the industry. With Alibaba's completion of the purchase of a 33% stake in Ant Financial in September 2019, it is also seen as Ant Financial's preparation for listing. The regulatory rectification of online loans may be one of the possible reasons for the significant reduction of ABS by Ant small loan enterprises. According to the 2012 Interim Measures for the Supervision of Financing of Chongqing Microfinance Companies, the financing leverage ratio of Chongqing Microfinance Companies is 2.3 times the net capital of the company. Among them, the capital transfer business and credit of banking financial institutions in the form of financing and repurchase shall not exceed 1 time the net capital amount.

4. Suggestions

4.1. Promote the Establishment of a Social Credit System and Improve Financial Infrastructure

As fintech companies build a new financial ecosystem and open up multiple scenarios such as life and consumption, fintech companies have a wider range of information acquisition channels, among which multi-faceted user behavior data can more effectively supplement traditional credit data. Especially for residents in rural areas, due to the lack of rural information industry and insufficient infrastructure, there are many residents' information missing, and relying on behavioral data and a small number of payment consumption data can alleviate and supplement the lack of information. At the same time, in lending, because the online small loan platform can only rely on its own algorithm program model and accessible data to evaluate users, the incomplete data will increase a certain risk cost, and this part of the cost will eventually be passed on to the borrower by the small loan company in the form of high interest rates Therefore, in order to better safeguard the interests of borrowers, a vulnerable group, it is very necessary to strengthen the establishment of a social credit system.

Therefore, the state can encourage financial technology enterprises represented by Ant Financial to open search, e-commerce, social networking and other behavioral data exchange, and establish a compliant data market operation system, including data asset evaluation, Registration, transactions, etc., to ensure that the ownership of data is clear, the use is controllable, and then it will be public Integrate common credit information and financial data information to build a unified data open platform. This will optimize the rating mechanism of online small loan platforms, reduce credit risk, and reduce the possibility of borrowers being passed on to high interest rates; At the same time, the regulatory authorities can clarify the responsibility of fintech enterprises to enforce information disclosure by formulating regulatory rules and the content of disclosure, so as to integrate the credit reporting system of the internet. This will effectively reduce information asymmetry and improve the cross-domain and cross-platform credit collection mechanism, better cultivate the third-party credit data service industry, and help the healthy development of more industries. At the same time, in addition to promoting the establishment of a credit system, it is also necessary to improve the construction of financial infrastructure, to adapt to the rapid development of finance.

4.2. Encourage Scientific and Technological Innovation and Promote Common Development

Technology supports financial development, Ant Financial, as the "unicorn" of Internet financial enterprises, with the technical oligarchy, occupies a dominant market position in basic services, whether their financial business has systemic importance, although it is difficult to judge by accurate quantification, but due to the wide range of users, strong user dependence, and social public interests, it already has the characteristics of important financial infrastructure, has irreplaceability, and may have systemic importance in the future. Therefore, the regulatory authorities should uphold a prudent attitude to improve regulatory standards, encourage innovation, and supervise Internet financial platforms to strengthen compliance awareness and abide by bottom-line rules. In terms of supervision, because the development of supervision cannot keep up with the process of financial innovation, regulatory technology lags behind the regulated party for a long time, so that the financial regulatory department has been in a passive position, which will cause the possibility that the supervised party has the ability to hide risks and thus the supervision fails.

Considering the advantages and irreplaceability of Internet finance enterprises in technology oligarchy and the long-term technological disadvantages of regulators, the government can encourage enterprises to carry out financial technology innovation while strengthening cooperation with Internet finance enterprises, give financial support and industrial preferences for corresponding technological development, synchronize Internet financial technology with the technical system of regulatory departments through joint establishment of technology research laboratories and other measures, use advanced digital technology to drive the development of regulatory technology, ensure the timeliness of regulatory technology, form effective supervision, and improve the infrastructure and technical development of regulatory technology. The construction of technology platforms and business platforms will provide stable basic resource support for future financial development, jointly improve the construction of social financial infrastructure, and weaken the irreplaceability of Internet financial enterprises.

4.3. Improve the Legal System and Standardize the Development of Platforms

Yicheng Chen proposed that the supervision and management of shadow banking should be strengthened [8]. Microfinance companies (such as Ali Microloan) are a manifestation of shadow banking. Regarding the various risks existing in Ant Financial, the most important measure for the state is to strengthen legislation and law enforcement. After discovering leaks, improve laws and regulations in a timely manner, and strengthen supervision and supervision. First of all, the Ministry of Supervision on the leverage ratio of online small loan platforms, the capital contribution ratio of joint loans, and the restrictions on loan use. The door should have clear legal limits. At the same time, it is of great necessity to limit the scale of the Internet financial platform and limit the scale of its available market funds. Prevent the disorderly expansion of fintech companies. Second, establish an appropriate data market operation system to make the ownership of data asset transactions clear. The use of controllable, prevent the sale of data and information for personal gain, etc., and prevent and stop Vicious competition between industries. Finally, it is necessary to strengthen synergy and cooperation between different regulatory agencies. The organic synergy between the supervision of the subject of the guarantee and the supervision of behavior, and the incongruity of the supervision of separate industries are avoided Sexual leaks improve regulatory efficiency. Moreover, strengthen the forward-looking and timeliness of risk management of regulatory institutions Normalized, real-time supervision, one day finance Innovation activities touch the red line of financial regulation or exceed the existing regulatory basis Regulatory departments need to respond in a timely manner to maintain the stability and long-term stability of the industry Development.

5. Conclusions

Through a comprehensive SWOT analysis of Ant Financial, I found that it has obvious advantages and new opportunities under the epidemic situation, but if it wants to achieve long-term development, it must overcome the inherent shortcomings and hidden dangers of Internet finance itself and actively respond to various challenges and threats, as mentioned above. In my opinion, Ant Financial's development prospects are still very good.

References

[1]. Lihong Li.: SWOT Analysis of Internet Finance. Dossier 2015(11), 303–304 (2015).

[2]. Lei Zhou.: SWOT Analysis of Internet Finance in China. Modern Marketing 2019(3), 36–37 (2019).

[3]. Zhaowen Gan.: Analysis of the operational characteristics of Ant Financial. Special Zone Economy 2017(7),111-114 (2017).

[4]. Ziqi Liu.: A Study on Retail Enterprises Based on SWOT Model and 4Ps Strategy------Taking Wal-Mart as an Example. China Business Review 2022(5), 10-12 (2022).

[5]. Zhentao Yin., Xuejun Cheng.: Research on the impact of the new crown pneumonia epidemic on the industrial chain of Internet consumer finance and countermeasures. Journal of Chongqing University of Technology 35(3), 44–55 (2021).

[6]. Jia Zheng., Sijie Chen., Siting Chang, et.al.: Risk identification and regulatory suggestions for Ant Financial’s online microloan. China Collective Economy 2022(27), 89–90 (2022).

[7]. Kun Zhao.: Analysis of the development trend of Internet consumer finance in the post-epidemic era. China Market 2022(19), 1–3 (2022).

[8]. Yicheng Chen.: The comparative advantages of Internet finance from the perspective of Ant Financial. Modern Marketing 2020(1), 35–36 (2020).

Cite this article

Lin,C. (2023). SWOT Analysis of China’s Internet Finance under the Background of the Epidemic ——Take Ant Finance as an Example. Advances in Economics, Management and Political Sciences,28,21-29.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lihong Li.: SWOT Analysis of Internet Finance. Dossier 2015(11), 303–304 (2015).

[2]. Lei Zhou.: SWOT Analysis of Internet Finance in China. Modern Marketing 2019(3), 36–37 (2019).

[3]. Zhaowen Gan.: Analysis of the operational characteristics of Ant Financial. Special Zone Economy 2017(7),111-114 (2017).

[4]. Ziqi Liu.: A Study on Retail Enterprises Based on SWOT Model and 4Ps Strategy------Taking Wal-Mart as an Example. China Business Review 2022(5), 10-12 (2022).

[5]. Zhentao Yin., Xuejun Cheng.: Research on the impact of the new crown pneumonia epidemic on the industrial chain of Internet consumer finance and countermeasures. Journal of Chongqing University of Technology 35(3), 44–55 (2021).

[6]. Jia Zheng., Sijie Chen., Siting Chang, et.al.: Risk identification and regulatory suggestions for Ant Financial’s online microloan. China Collective Economy 2022(27), 89–90 (2022).

[7]. Kun Zhao.: Analysis of the development trend of Internet consumer finance in the post-epidemic era. China Market 2022(19), 1–3 (2022).

[8]. Yicheng Chen.: The comparative advantages of Internet finance from the perspective of Ant Financial. Modern Marketing 2020(1), 35–36 (2020).