1. Introduction

With the improvement of the quality of my country's economic development, the focus of economic growth has begun to shift to a green, low-carbon, sustainable direction [1]. Economic development requires enterprises to have more and more comprehensive capabilities. During this process, the development model and concept of ESG came into being. Environmental, social and governance capabilities of enterprises. ESG is currently a popular indicator for measuring corporate financial performance, including environmental factors (E), social factors (S) and governance indicators (G). With the gradual popularization of the concept of ESG, ESG has been widely tested, practiced and promoted in the field of practice, which has aroused the interest of scholars and economists around the world. The growing popularity of ESG stems from the immediate benefits it brings to investors.

An increasing amount of ESG data is available from data providers such as Refinitiv. Collect ESG-related information for a wide range of companies. This process combines a wide range of information sources with cutting-edge analytics to extract detailed ESG-related information from these sources. Since ESG principles were formally proposed in 2004, they have been actively practiced in developed countries such as Europe and the United States. The establishment of a series of achievements such as the ESG evaluation system, ESG information disclosure standards, and ESG indicator system has promoted the development and maturity of the environment, society, governance factors, and ESG as a whole. These factors are forming a new pattern of sustainable development.

The ESG composite score is not calculated from one dimension or one variable, but multiple composite variables, so ESG disclosure issues are interrelated; therefore, considering only one dimension may be problematic. When testing the impact of ESG on financial performance, attention needs to be paid to ESG at all scales [2]. Furthermore, there is a lack of research that does not directly relate to ESG and financial performance.

China's green financial policy is of great significance for optimizing resource allocation, reducing financial risks, creating investment opportunities, and strengthening opening up. In the future, China will further improve the green financial standard system, establish an environmental information disclosure system, increase financial and technical support for green industries, and guide financial institutions and enterprises to enhance climate resilience. However, China is a bit later than Europe in disclosing ESG data; therefore, everything is relatively new. In this case, my country should deeply explore the relationship between ESG comprehensive score and corporate financial performance.

Therefore, in this paper, we use a least-squares regression model and a dataset from Refinitiv to look for the significance level of the relationship between ESG composite scores and a firm's Tobin's Q, return on assets, and return on equity. In this way, we can directly use the ESG comprehensive scoring data set to examine the financial performance of companies in different industry sectors.

2. Literature Review

2.1. Research on ESG

Environmental, social and governance (ESG) criteria are a set of corporate operating criteria that socially conscious investors use to screen potential investments, a set of measures that measure the non-financial impact of specific investments and companies [3].

ESG is a measure that is now being rolled out globally, and companies around the world are increasingly using it to run their businesses, but it still varies by region. ESG comes from the investment philosophy of sustainable development, which shows how much investors attach importance to the index.

The three categories of ESG refer to the three main factors that affect the sustainable development of enterprises, and these factors are increasingly integrated into investment analysis, process and decision-making. Companies working hard to achieve ESG have seen the returns increase over time. The "E" stands for energy efficiency, carbon footprint, greenhouse gas emissions, deforestation, biodiversity, climate change and pollution mitigation, waste management and water use. Environmental issues are especially important now. The "S" includes labor standards, wages and benefits, workplace and board diversity, racial justice, pay equity, human rights, talent management, community relations, privacy and data protection, health and safety, product safety and quality, and consumer protection. "G" includes "E" and "S" Governance - it is concerned with the way the company is run, the board of directors, the distribution of compensation, the management of corporate executives, and even the rights of shareholders [3].

When investors choose investment projects, they often consider how the company will deal with the social environment and needs in the next few decades. Han et al. (2016b) report that scoring indicators for environmental activities, social responsibility, and governance mechanisms are critical to businesses and stakeholders. For long-term interests, investors are more inclined to invest in companies that can take ESG indicators into consideration. In this case, issues such as global warming or plastic pollution require companies to confront these phenomena and change the way they do business. This led them to rethink their value chain structure, reimagine governance mechanisms, and innovate business models in order to maintain a long-term profitable company.

In the first year of the COVID-19 pandemic, ESG funding increased from 27.3% to 55%. In June 2020, traditional US equity funds fell 8.7%, while sustainable funds lost only 4.8%, even as the market recovered from the sharp decline caused by COVID [4]. This means that from this decade on, ESG issues start to become critical in business and investment decisions [5].

Environmental, social and governance factors cover a wide range of activities related to a particular business and its performance and potential positive impacts on the community or wider society. These indicators need to be refined. As such, prudent public companies will find it best to establish their own criteria for determining the scope and content of ESG disclosures in order to mitigate legal risks and identify future opportunities ESG offers in terms of growth and differentiation [6].

According to Pedersen et al. (2021), ESG scores serve two fundamental roles in determining a company's financial performance: 1) It may reveal company fundamentals that traditional indicators cannot fully and thoroughly price the market, for example, a higher ESG score can serve as a clear signal of company fundamentals. 2) May affect investor preferences, so different investors may choose different portfolio strategies. In turn, this affects the relationship between ESG scores and a company's financial performance.

At the same time, investors' perceptions of ESG are well integrated into their investment decisions. Van Duren et al. (2015) found that asset managers have adopted ESG information to manage responsible investing through three strategies: 1) negative screening to exclude specific companies or industries; 2) active screening to focus on specific companies with high ESG scores, and 3) most Best Investments to select companies with the highest ESG scores.

First, infrastructure investors are advising their loan managers to report on ESG impacts. Partners with financiers are forcing a more holistic focus on the general impact of investment decisions, as evidenced by the number of signatories to sustainable development initiatives such as the United Nations Principles for Responsible Investment. Marissa Szczepaniak of Vantage Infrastructure said: “Increased [ESG] awareness has completely changed the conversation in the infrastructure community...Nowadays, investors expect ESG integration.”

There is growing evidence that ESG determinants are associated with financial performance [7]. There is a growing recognition that ESG alignment is a major form of risk management that can lead to higher risk regulatory returns throughout the process [8].

2.2. ESG’s Impact Assessment

Several cited reasons for concern that ESG could have negative impacts on business and society. Some investors exaggerate corporate ESG information, leading to ESG momentum effects. In the long run, ESG momentum will reverse. Investors overreact to environmental factors compared to social or governance factors. In addition, investors are particularly concerned about mitigating investment risks arising from corporate ESG controversies. Nirino et al. (2021) demonstrate negative and statistically significant effects between corporate disputes and financial performance. This relationship may vary across firms with substantial heterogeneity [9].

To some extent, however, controversy scores and ratings don't tell investors which firm has more control over controversy than the other. First, ESG Disclosure Controversy scores lack consistency. Individual dispute cases are scored based on a combination of severity, type (unstructured or structured), and status (in progress). For cases of a given severity, ongoing cases score lower than closed cases, and structured cases score lower than unstructured cases. For example, a comparison between MSCI [MSCI: U.S.] and ISS, the two most extensive rating providers, found that only seven companies were flagged as controversial in both datasets. The reason is that they are scored differently, measured differently, and prioritized differently. Thus, a company may appear on the disputed list of one rating agency but not on the disputed list of other rating agencies.

Also, the Controversy Score is backward looking, not a risk prediction. Scores reflect only typical hot spots, ignoring lower violations. However, some inconspicuous breaches in the supply chain can turn out to be great dangers behind the surface. This also creates some deficiencies in the ESG Controversy Score that need to be considered. In addition, quantifying ESG controversy scores can be difficult, as it is difficult to assign scores to specific numerical ranges that measure the impact of actions taken or the public.

Nonetheless, a significant obstacle to a company's ESG performance can be its ESG controversies, which raise doubts about its prospects and can damage firm value [10]. This means that socially responsible activities may act in their own interests on behalf of managers, thus leading to agency problems. Therefore, in order to restore the public image, sensitive industries specifically disclose more information than other industries in their sustainability reports and achieve higher ESG performance [11].

Encouraged and regulated by the government, many Chinese companies have begun to voluntarily declare ESG-related information in order to adapt to the opening of the capital market. As of mid-2020, there were 1,021 Chinese A-share listed companies (those listed in renminbi on the Shenzhen and Shanghai stock exchanges) issuing annual ESG reports (including "sustainability" and "corporate social responsibility"), up from 371 in 2009. About 130 A-share companies are dual-listed in Hong Kong, which requires ESG reporting. (The Hong Kong Stock Exchange (HKEX) has required listed companies to publish ESG reports since 2016.) In 2020, more than a quarter of A-share companies released annual CSR/ESG reports.

It's relatively new in terms of its audience. 61% of respondents were unaware that ESG methods could be used for saving and investing. The term ESG is not widely known and can confuse many investors or companies who are just starting to get acquainted with the term. Most people refer to the ESG concept simply as "long-term sustainability." However, it is not. During the investment process, financial advisors who are familiar with ESG scores and standards often don't bother explaining to investors how it represents a company, and sometimes choose to ignore ESG scores. It is a common misconception that people with a vague understanding of ESG may give up on ESG because of some common misconceptions. The biggest misconception is that this pervasive phenomenon called ESG is either the problem or the solution. The reality is much more complicated, partly because ESG is in its infancy, and partly because we may debate whether "ESG" makes sense. This makes it impossible to tell whether ESG is good or bad, so experts are always on different sides.

3. Methods and Data

3.1. Regression Models

In this paper, we applied ordinary least squares regression models to discover an unknown parameter in a function. In this paper, we have incorporated three dependent variables, which are the variables we will compute, which are Tobin's Q, ROA and ROE. The independent variables we will be adjusting are the ESG Combined score, which can also be broken down into E, S, and G scores: EPS, SPS, and GPS. To maximize the rigor and accuracy of our research, we include different control variables that always remain the same: the employees, the Market Capacity, and the Debt Ratio of a company. Fixed effects would be GICS industry sectors and the particular years of the data taken.

\( y={β_{0}}+{β_{1}}*{ESGCombined_{it-1}}+fixedeffect+control+ε \) (1)

From an economic point of view, the most effective and intuitive evidence used to measure the development of a company is the calculation of Tobin's Q. After all, a company's stock price is the best evidence to prove the operating performance of a company. Tobin's Q, in general, is calculated as the Equity Market Value divided by the Equity Book value.

\( {Tobi{n^{ \prime }}s Q_{it}}={β_{0}}+{β_{1}}∙{ESGCombined_{it-1}}+{β_{2}}∙{MarketCap_{it-1}}+{β_{3}}∙ \)

\( {DebtRatio_{it-1}}+{β_{4}}∙{Employees_{it-1}}+{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (2)

\( {Tobi{n^{ \prime }}s Q_{it}}={β_{0}}+{β_{1}}∙{EPS_{it-1}}+{β_{2}}∙{SPS_{it-1}}+{β_{3}}∙{GPS_{it-1}} \)

\( +{β_{4}}∙{MarketCap_{it-1}}+{β_{5}}∙{DebtRatio_{it-1}}+{β_{6}}∙{Employees_{it-1}} \)

\( +{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (3)

In this set of equations, Tobin's Q has been tested with ESG Combined scores in equation 2. As stated in equation 3, \( {β_{1}}*{ESGCombined_{it-1}} \) is replaced with \( {β_{1}}*{EPS_{it-1}}+{β_{2}}*{SPS_{it-1}}+{β_{3}}*{GPS_{it-1}} \) . Equation 2 will improve the accuracy of the computed results. \( {{β_{2}}*{MarketCap_{it-1}}+{β_{3}}*DebtRatio_{it-1}}+{β_{4}}*{Employees_{it-1}} \) is the control group, and the \( {γ_{1}}*{GICS SectorName_{i}}+{γ_{2}}*{year_{t}} \) would be the Fixed Effects. \( α \) in the equation stands for the intercept of the equation. At the same time, \( β \) is the coefficient of the control variable, and \( γ \) is the coefficient of each industry sector and the annual effect.

\( {ROA_{it}}={β_{0}}+{β_{1}}∙{ESGCombined_{it-1}}+{β_{2}}∙{MarketCap_{it-1}}+{β_{3}}∙ \)

\( {DebtRatio_{it-1}}+{β_{4}}∙{Employees_{it-1}}+{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (4)

\( {ROA_{it}}={β_{0}}+{β_{1}}∙{EPS_{it-1}}+{β_{2}}∙{SPS_{it-1}}+{β_{3}}∙{GPS_{it-1}} \)

\( +{β_{4}}∙{MarketCap_{it-1}}+{β_{5}}∙{DebtRatio_{it-1}}+{β_{6}}∙{Employees_{it-1}} \)

\( +{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (5)

In this set of equations, ROA has been tested with ESG Combined scores in equation 4. As stated in equation 5, \( {β_{1}}*{ESGCombined_{it-1}} \) is replaced with \( {β_{1}}*{EPS_{it-1}}+{β_{2}}*{SPS_{it-1}}+{β_{3}}*{GPS_{it-1}} \) . Equation 2 will improve the accuracy of the computed results. \( {{β_{2}}*{MarketCap_{it-1}}+{β_{3}}*DebtRatio_{it-1}}+{β_{4}}*{Employees_{it-1}} \) is the control group, and the \( {γ_{1}}*{GICS SectorName_{i}}+{γ_{2}}*{year_{t}} \) would be the Fixed Effects. \( α \) in the equation stands for the intercept of the equation, while \( β \) is the coefficient of the control variable, and \( γ \) is the coefficient of each industry sector and the annual effect.

\( {ROE_{it}}={β_{0}}+{β_{1}}∙{ESGCombined_{it-1}}+{β_{2}}∙{MarketCap_{it-1}}+{β_{3}}∙ \)

\( {DebtRatio_{it-1}}+{β_{4}}∙{Employees_{it-1}}+{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (6)

\( {ROE_{it}}={β_{0}}+{β_{1}}∙{EPS_{it-1}}+{β_{2}}∙{SPS_{it-1}}+{β_{3}}∙{GPS_{it-1}} \)

\( +{β_{4}}∙{MarketCap_{it-1}}+{β_{5}}∙{DebtRatio_{it-1}}+{β_{6}}∙{Employees_{it-1}} \)

\( +{γ_{1}}∙{GICS SectorName_{i}}+{γ_{2}}∙{year_{t}}+ε \) (7)

In this set of equations, ROE has been tested with ESG Combined scores in equation 6. As stated in equation 7, \( {β_{1}}∙{ESGCombined_{it-1}} \) is replaced with \( {β_{1}}*{EPS_{it-1}}+{β_{2}}*{SPS_{it-1}}+{β_{3}}*{GPS_{it-1}} \) . Equation 2 will improve the accuracy of the computed results. \( {{β_{2}}*{MarketCap_{it-1}}+{β_{3}}*DebtRatio_{it-1}}+{β_{4}}*{Employees_{it-1}} \) is the control group, and the \( {γ_{1}}*{GICS SectorName_{i}}+{γ_{2}}*{year_{t}} \) would be the Fixed Effects. \( α \) in the equation stands for the intercept of the equation, while \( β \) is the coefficient of control variable, and \( γ \) is the coefficient of each industry sector and the annual effect.

3.2. Data

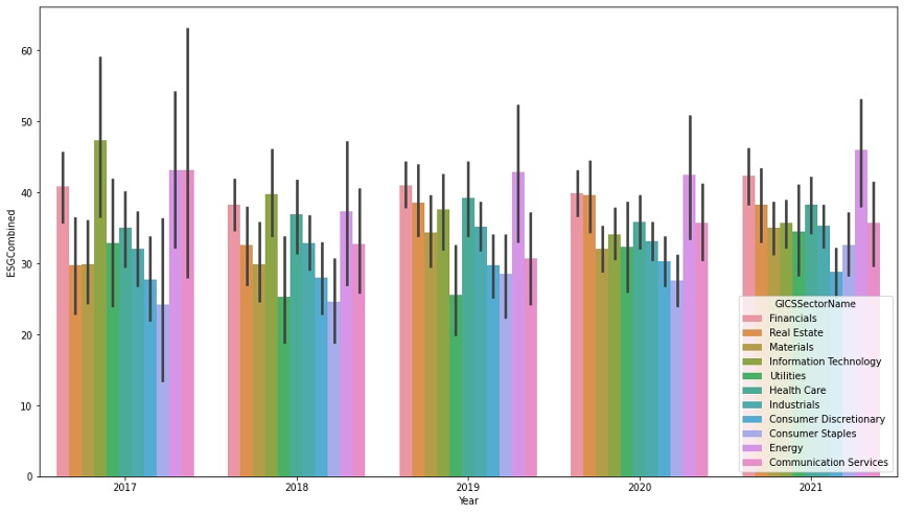

This paper uses panel data of listed companies from 2017 to 2021 to conduct an empirical test. This data set directly displays companies in China from 11 GICS Sectors and 52 different TRBC Industry Groups. The ESG Combined scores are significantly shown from 2020 to 2021. Shown by the data source from Refiniv, there are 158 data recorded in 2017, 346 in 2018, 405 in 2019, 656 in 2020, and 567 in 2021, indicating a significant improvement in the attention on ESG developments in China. The exponential growth in the amount of data recorded and the increase in the number of companies is a result of the improvement in attaching attention to ESG scores. People's Interest in ESG has Skyrocketed. Several factored integrate and lead to the increasing popularity of ESG strategies. For instance, negative cost and risks, reputational risks, implementation, and customer expectations.

Figure 1: S.G. composite score.

ESG combined Score, EPS, SPS, and GPS are all defined for A-shares in Shenzhen, and Shanghai.

Refinitiv ESG scores are the industry standard database that reflects official company disclosure on environmental, social, and governance metrics. With the increased attention on ESG scores worldwide during the last decade, ESG data availability and quality have improved significantly.

"ESG scores from Refinitiv are designed to transparently and objectively measure a company's relative ESG performance, commitment, and effectiveness across ten main themes (emissions, environmental product innovation, human rights, shareholders, etc.) based on publicly-reported data." Refinitiv ESG scores measure a company's ESG performance based on publicly available verifiable reported data. The primary measures are based on comparability, impact, data availability, and industry relevance and differ within each industry group. These are divided into ten categories that comprise the three pillar scores and the final ESG score, which reflect the company's ESG performance, commitment and effectiveness based on publicly reported information.

The category scores are divided into three pillars: environmental, social, and corporate governance. "ESG pillar score is a relative sum of the category weights, which vary per industry for the 'Environmental' and 'Social' categories." All the weights remain the same across all sectors. Sustainable investing is a hot topic in modern investment management. Future investors are more committed to sustainability and make more environmentally conscious choices than previous generations. "Refinitiv's combined ESG scores analysis in 4 regions 2 ESG data is becoming increasingly available from data providers such as Refinitiv. ESG-related information is collected for a vast range of companies. This process combines enormous information sources and cutting-edge analytics to extract ESG-related details from those sources." Refinitiv ESG scores are the industry standard database that reflects official company disclosure on environmental, social, and governance metrics.

When ESG-related information is widely collected, it is not just a process of information collection but gathering many information sources and cutting-edge analytical techniques. These details can reflect the comp-any's official disclosure of environmental, social, and governance indicators.

As demonstrated in this graph, across different GISC sectors, ESG Combined scores have different values. The purple bar, representing the energy industry sector, stands out significantly in this graph. The Energy sector has a relatively high ESG performance, especially from 2019 to 2021. One of the main reasons for this phenomenon is the world's proposal on CO2 emissions limitations. Although the energy sector appears on the surface to have the worst performance in its index, Environmental also sees a growing global effort to upgrade its mobile bills. Not just in China, the concept of reducing carbon emissions is barely known. While after 2019, the widespread implementation of new energy vehicles, as well as the publicity and widespread of many low-carbon behaviors, has gradually improved the ESG Combined Score of the Energy Industry Sector. Produces Consumer Staples' Industry sector produces the continuous lowest ESG combined score. Over the 2017-2021 period, Consumer Staple's Industry Sector barely registered any improvement in terms of ESG Combined score, except for a minimal increase in 2021. Well, there's a reason for that. The industry is not as big as energy, so trading volumes are small. When the trading volume and future profit are low, the number of investors will be relatively small. Then companies in this industry will not spend a lot of energy and time maintaining an ESG score in this industry.

4. Results

In this section, regression results for the effect of ESG on corporate financial performance, including Tobin's Q, ROA, and ROE, are presented as below.

Table 1: Regression results for the effect of ESG (lagged value) on Tobin's Q.

Dependent Variable | Tobin’s Q | Tobin’s Q | Tobin’s Q | Tobin’s Q |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0269*** | -0.0301*** | ||

| (0.007) | (0.007) | ||

EPS | -0.0183** | -0.0183** | ||

|

| (0.008) |

| (0.008) |

SPS | -0.01 | -0.01 | ||

(0.013) | (0.013) | |||

GPS | 0.002 | 0.002 | ||

(0.008) | (0.008) | |||

Employees | -1.803e-05*** | -1.759e-05*** | -1.711e-05** | -1.959e-05** |

(2.01e-06) | (2.03e-06) | (1.97e-06) | (3.7e-06) | |

DebtRatio | -5.5415*** | -5.5639*** | -1.6386*** | -0.8434*** |

(0.451) | (0.454) | (0.563) | (0.993) | |

MarketCap | 6.753e-12*** | 6.843e-12*** | 6.727e-12*** | 7.869e-12*** |

(5.83e-13) | (5.89e-13) | (5.78e-13) | (1.03e-12) | |

Sector | No | No | Yes | Yes |

Year | No | No | Yes | Yes |

Adjusted R2 | 0.179 | 0.180 | 0.291 | 0.258 |

Number of Observations | 1681 | 1681 | 1681 | 1681 |

***p<0.001, **p<0.01, *p<0.05

Table 1 summarizes the effect of ESG Combined scores and separate scores on three pillars on Tobin's Q. The dependent variable Tobin's Q was estimated with OLS models with a set of control variables, including Employees, DebtRatio and MarketCap. Furthermore, the fixed effect of the industry sector and the year (2018, 2019, 2020, 2021) are also added. The regression results show that ESG scores negatively correlate with Tobin's Q, indicating that Chinese companies tend to be undervalued when their ESG ratings increase. It is further shown that environmental score may be the main factor to explain such correlation, as both social and governance scores do not have a statistically significant relationship with Tobin's Q. One possible explanation would be that its environmental efforts do not evaluate Chinese companies with higher environment scores. These results are consistent and robust when fixed effects are included.

Table 2: Regression results for the effect of ESG (lagged value) on the Return on Asset (ROA).

Dependent Variable | ROA | ROA | ROA | ROA |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0064 | 0.0045 | ||

| (0.012) | (0.012) | ||

EPS | 0.0009 | 0.014 | ||

|

| (0.010) |

| (0.011) |

SPS | 0.0091 | 0.0031 | ||

(0.013) | (0.013) | |||

GPS | -0.0075 | -0.0045 | ||

(0.008) | (0.008) | |||

Employees | -1.06e-05*** | -1.081e-05*** | -7.646e-06** | -8.275e-06** |

(3.33e-06) | (3.36e-06) | (3.48e-06) | (3.49e-06) | |

DebtRatio | -20.8276*** | -21.0145*** | -22.9861*** | -23.1716*** |

(0.748) | (0.754) | (0.991) | (0.995) | |

MarketCap | 8.06e-12*** | 7.826e-12*** | 6.464e-12*** | 6.219e-12*** |

(9.68e-13) | (9.78e-13) | (1.02e-12) | (1.03e-12) | |

Sector | No | No | Yes | Yes |

Year | No | No | Yes | Yes |

Adjusted R2 | 0.351 | 0.351 | 0.369 | 0.370 |

Number of Observations | 1681 | 1681 | 1681 | 1681 |

***p<0.001, **p<0.01, *p<0.05

Table 2 summarizes the effect of ESG Combined scores on the Returns on Assets (ROA). The dependent variable ROA was tested with two fixed variables, the GICSSectorName and the year (2018, 2019, 2020, 2021). The regression results show that industries such as consumer discretionary, financials, real estate, and utilities have a negative coefficient. Also, among the four years present in the data set, only 2018 has a positive coefficient. The r-square, in this case, is even lower than ESG Combined versus Tobin's Q, 0.085, meaning the coefficient of determination.

It can be seen from the results that the coefficients of ESG on ROA are not significant, which implies that ESG does not significantly improve ROA. At the same time, the coefficient of ESG on ROE is also insignificant, indicating that ESG does not considerably improve ROA. ESG's index of Tobin's Q is significantly equal to that of Tobin's Q, meaning that ESG significantly reduces Tobin's Q index. The above findings fully demonstrate that the influence of ESG on corporate financial performance is complex.

Table 3: Regression results for the effect of ESG (lagged value) on the Return on Equity (ROE).

Dependent Variable | ROE | ROE | ROE | ROE |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0022 | 0.0463 | ||

| (0.061) | (0.064) | ||

EPS | 0.0398 | 0.086 | ||

|

| (0.053) |

| (0.066) |

SPS | 0.0821 | 0.0930 | ||

(0.066) | (0.081) | |||

GPS | -0.1128 | 0.0185 | ||

(0.043) | (0.051) | |||

Employees | 8.88e-06 | 9.29e-06 | 5.292e-08 | -3.594e-06 |

(1.74e-05) | (1.75e-05) | (2.3e-05) | (2.31e-05) | |

DebtRatio | -36.5957*** | -37.7390*** | -55.080*** | -56.2235*** |

(3.998) | (4.020) | (6.228) | (6.232) | |

MarketCap | 1.671e-11*** | 1.435e-11*** | 1.852e-11*** | 1.722e-11*** |

(5.06e-12) | (5.1e-12) | (6.37e-12) | (6.43e-12) | |

Sector | No | No | Yes | Yes |

Year | No | No | Yes | Yes |

Adjusted R2 | 0.054 | 0.058 | 0.077 | 0.082 |

Number of Observations | 1681 | 1681 | 1681 | 1681 |

***p<0.001, **p<0.01, *p<0.05

ROE without a doubt is one of the most essential financial calculating formulas. Returns of Equity, ROE, measure the amount of net income a company can make with the money that shareholders are investing. The dependent variable ROA was tested with two fixed variables the GICSSectorName and the year (2018, 2019, 2020, 2021). Among the results, the industry Consumer Discretionary has a coefficient of -22.8183, and 2019 has a coefficient of -27.2845, these both standout in the results.

Table 4: Regression results for the effect of ESG (lagged value) on the Tobin’s Q of small capital and large capital companies(continue).

Dependent Variable | Tobin’s Q Small capital | Tobin’s Q Small capital | Tobin’s Q Large capital | Tobin’s Q Large capital |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0239*** | -0.0219*** | -0.0475*** | -0.0594*** |

| (0.006) | (0.006) | (0.012) | (0.011) |

Employees | -3.07e-05*** | -4.236e-05*** | -1.708e-05*** | -1.561e-05** |

(5.64e-06) | (5.85e-06) | (2.54e-06) | (2.53e-06) | |

DebtRatio | -2.5057*** | -0.423 | -8.31*** | -1.1698 |

(0.375) | (0.431) | (0.31) | (1.16) | |

Table 4:(continued). | ||||

Sector | No | Yes | Yes | Yes |

Year | No | Yes | Yes | Yes |

Adjusted R2 | 0.113 | 0.255 | 0.291 | 0.391 |

Number of Observations | 856 | 856 | 825 | 825 |

***p<0.001, **p<0.01, *p<0.05

Table 4 summarizes the effect of ESG Combined scores and separate scores on three pillars on Tobin's Q for Chinese companies below (low) and above (high) the median sector-specific market capital. The regression results show that ESG scores negatively correlate with Tobin's Q, indicating that Chinese companies tend to be undervalued when their ESG ratings increase. It is further shown that environmental score may be the main factor to explain such correlation, as both social and governance scores do not have a statistically significant relationship with Tobin's Q. One possible explanation would be that its environmental efforts do not evaluate Chinese companies with higher environment scores. These results are consistent and robust when fixed effects are included.

Table 5: Regression results for the effect of ESG (lagged value) on the ROE of small capital and large capital companies.

Dependent Variable | ROE Small capital | ROE Small capital | ROE Large capital | ROE Large capital |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0825 | -0.0648 | -0.0913*** | -0.0878*** |

| (0.121) | (0.127) | (0.03) | (0.031) |

Employees | -6.276e-06 | 0.0002 | -2.294e-05*** | -1.783e-05*** |

(1.01e-06) | (0.0001) | (6.43e-06) | (6.91e-06) | |

DebtRatio | -62.7694*** | -94.2784*** | -8.471*** | -5.9898*** |

(7.340) | (9.351) | (2.078) | (3.19) | |

Sector | No | Yes | Yes | Yes |

Year | No | Yes | Yes | Yes |

Adjusted R2 | 0.113 | 0.112 | 0.081 | 0.131 |

Number of Observations | 855 | 855 | 821 | 821 |

***p<0.001, **p<0.01, *p<0.05

Table 6: Regression results for the effect of ESG (lagged value) on the ROA of small capital and large capital companies(continue).

Dependent Variable | ROA Small capital | ROA Small capital | ROA Large capital | ROA Large capital |

Model | OLS | OLS | OLS | OLS |

ESGCombined | -0.0244 | -0.0159 | -0.0294** | -0.0323** |

| (0.018) | (0.019) | (0.03) | (0.015) |

Employees | -1.188e-05 | 4.427e-06 | -1.543e-05*** | -1.247e-05*** |

(1.62e-05) | (1.8e-05) | (3.03e-06) | (3.26e-06) | |

Table 6:(continued). | ||||

DebtRatio | -22.5003*** | -25.4836*** | -18.7142*** | -16.2925*** |

(1.075) | (1.326) | (0.974) | (1.495) | |

Sector | No | Yes | Yes | Yes |

Year | No | Yes | Yes | Yes |

Adjusted R2 | 0.356 | 0.378 | 0.408 | 0.438 |

Number of Observations | 855 | 855 | 821 | 821 |

***p<0.001, **p<0.01, *p<0.05

5. Discussion and Conclusions

In the macro context of sustainable development of enterprises, the theoretical framework and practical experience of ESG are continuously enriched, and ESG has been fully applied to all aspects of corporate governance. As a result, ESG may have a significant impact on a company's financial performance in developed markets. This paper uses the microdata of public companies listed in Chinese stock markets from 2017 to 2021 to conduct empirical analyses, and discovers that ESG ratings has different impacts on each indicator of corporate financial performance, implying that the impact of ESG on corporate performance does not similarly affect companies in Chinese stock market. In particular, the financial performance of Chinese companies is still not fully priced with their ESG practices, because ESG is a relatively new concept that is not well accepted into the investment strategy. It is shown that the both ROA and ROE of the Chinese companies are not correlated with ESG ratings and those with the higher ESG tend to be undervalued, evidence by the negative correlations with Tobin's Q. Furthermore, for companies with large market capitals, their corporate financial performance is negatively correlated with the ESG ratings. This indicates that these companies do not benefit from their ESG practices, possibly due to the lack of investor preferences in sustainable investing. Therefore, it is of great significance to further understand how would ESG may play a positive role in promoting the corporate social responsibility and governance.

Several economic and policy implications may be drawn from the findings of this paper. First, the regulator may consider implementing the institutional framework of ESG that mandates companies to disclose standardized ESG practices for evaluation purposes. Second, in the process of performing ESG, companies should avoid the negative impact of ESG on corporate financial performance. Third, financial literacy regarding sustainable investing can be promoted to educate the investors to adopt more responsible investment strategies. Fourth, the regulator should pay special attention to helping small and medium companies to take more ESG practices.

Although this article has been discussed in detail, there may be some limitations. First of all, due to data limitations, this paper studies ESG on financial performance at the enterprise level without considering ESG on macroeconomic factors. Meanwhile, the ESG ratings that are based on the scoring methodology for developed markets may not fully reflect the ESG practices in emerging markets such as the Chinese stock market. In the future, we aim to explain the relationship between ESG and macroeconomic performance. At the same time, this paper does not establish the causal relationship between ESG ratings and corporate financial performance, and companies' heterogeneity can be incorporated into the research framework in the future.

Acknowledgment

I would like to express my appreciation to my teacher who guided and provided me with valuable opinions, which solved many doubts in paper writing and gave me a goal and direction for my research. He gave me careful guidance and education, so that I can continue to learn and improve, and the main research results of these subjects have also become the main material of this paper. At the same time, I admire his profound knowledge and rigorous attitude towards learning, and he is an example for me to learn and work in the future.

References

[1]. Tan Y, Zhu Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness[J]. Technology in society, 2022,68:101906.

[2]. Susec, M., & Sardy, M. (2021). How Different ESG Factors Across Cultures Affect Financial Performance.

[3]. Alareeni B A, Hamdan A. ESG impact on the performance of US S&P 500-listed firms[J]. Corporate Governance: The International Journal of Business in Society, 2020,20(7):1409-1428.

[4]. DasGupta R. Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world[J]. Finance Research Letters, 2022,46:102487.

[5]. Li, P., Zhou, R., & Xiong, Y. (2020). Can ESG performance affect bond default rate? Evidence from China. Sustainability, 12(7), 2954.

[6]. ESG should be boiled down to one simple measure: emissions. Retrieved July 21, 2022, from https://www.economist.com/leaders/2022/07/21/esg-should-be-boiled-down-to-one-simple-measure-emissions

[7]. Amadio, F. (2021). Relationship between ESG score and corporate financial performance: evidence from over 1000 companies in 23 developed countries.

[8]. Deng, X., & Cheng, X. (2019). Can ESG indices improve the enterprises’ stock market performance?—An empirical study from China. Sustainability, 11(17), 4765.

[9]. Aouadi A, Marsat S. Do ESG Controversies Matter for Firm Value? Evidence from International Data[J]. Journal of Business Ethics, 2018,151(4):1027-1047.

[10]. Ionescu, G. H., Firoiu, D., Pirvu, R., & Vilag, R. D. (2019). The impact of ESG factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy, 25(5), 820-849.

[11]. Garcia A S, Mendes-Da-Silva W, Orsato R J. Sensitive industries produce better ESG performance: Evidence from emerging markets[J]. Journal of Cleaner Production, 2017,150:135-147.

Cite this article

Zhao,X. (2023). Is ESG a New Trick for the Chinese Stock Market? An Empirical Analysis of the Relationship Between Corporate ESG and Financial Performance. Advances in Economics, Management and Political Sciences,28,1-12.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tan Y, Zhu Z. The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness[J]. Technology in society, 2022,68:101906.

[2]. Susec, M., & Sardy, M. (2021). How Different ESG Factors Across Cultures Affect Financial Performance.

[3]. Alareeni B A, Hamdan A. ESG impact on the performance of US S&P 500-listed firms[J]. Corporate Governance: The International Journal of Business in Society, 2020,20(7):1409-1428.

[4]. DasGupta R. Financial performance shortfall, ESG controversies, and ESG performance: Evidence from firms around the world[J]. Finance Research Letters, 2022,46:102487.

[5]. Li, P., Zhou, R., & Xiong, Y. (2020). Can ESG performance affect bond default rate? Evidence from China. Sustainability, 12(7), 2954.

[6]. ESG should be boiled down to one simple measure: emissions. Retrieved July 21, 2022, from https://www.economist.com/leaders/2022/07/21/esg-should-be-boiled-down-to-one-simple-measure-emissions

[7]. Amadio, F. (2021). Relationship between ESG score and corporate financial performance: evidence from over 1000 companies in 23 developed countries.

[8]. Deng, X., & Cheng, X. (2019). Can ESG indices improve the enterprises’ stock market performance?—An empirical study from China. Sustainability, 11(17), 4765.

[9]. Aouadi A, Marsat S. Do ESG Controversies Matter for Firm Value? Evidence from International Data[J]. Journal of Business Ethics, 2018,151(4):1027-1047.

[10]. Ionescu, G. H., Firoiu, D., Pirvu, R., & Vilag, R. D. (2019). The impact of ESG factors on market value of companies from travel and tourism industry. Technological and Economic Development of Economy, 25(5), 820-849.

[11]. Garcia A S, Mendes-Da-Silva W, Orsato R J. Sensitive industries produce better ESG performance: Evidence from emerging markets[J]. Journal of Cleaner Production, 2017,150:135-147.