1. Introduction

With the rapid development of Internet technology in China, two significant industries, e-commerce, and tourism, have become hot topics in the national economy. On this basis, online travel agencies have emerged. Ota, as a vertical field platform for travel services, enables travel consumers to book travel products or services online through a web platform, i.e., the networking of the traditional travel agency sales model. Its rich display pages deliver product information more widely, while interactive communication makes it easier for tourists to consult and order. However, the sudden epidemic in 2020 brought a severe test for the survival and development of China’s travel industry and OTA platforms. Due to the rapid growth of the epidemic and stringent epidemic prevention measures, China’s tourism industry was almost at a standstill, with tourism services suspended one after another around the country, which had a stressful and prolonged impact on the tourism industry, causing it to suffer severe losses [1], with nearly 2.88 billion domestic tourist arrivals and about 2.2 trillion yuan of domestic tourism revenue achieved for the year affected by the epidemic, according to statistics from the Ministry of Culture and Tourism 2020, compared to In 2019, the number of domestic travelers fell by 52.1% and 61.1% respectively: adding to the economic downturn in growth [2]. In such a severe environment, the impact on OTAs and how OTAs can respond and develop to restore the industry’s vitality become important issues for this paper to study.

The academic significance of this paper’s research is: first, it argues the impact of corporate development on the crisis, resilience measures, and experience when rebounding under sudden public turmoil. Second, the case study in the Chinese context examines the unshifted characteristics of how companies develop in crises, and provides ideas for Chinese companies’ crisis response.

The practical significance of this study is to retrace the coping and recovery process of Chinese OTA enterprises represented by Ctrip under great uncertainty, which can provide a useful reference for the resolution of unexpected crises in the Chinese context in the future. Second, to summarize the experience of the case companies and propose methods to provide specific countermeasures and suggestions for tourism enterprises to cope with the shock and improve their coping ability [3].

The first chapter of this paper introduces the background of the selected topic, research questions, and significance. The second chapter is a literature review. Chapter three conducts a case study, first introducing the development history and current situation of Ctrip, then examining the impact on Ctrip under the epidemic shock and the specific measures made by Ctrip, and finally making suggestions for other enterprises when facing the unexpected crisis. Chapter four provides a summary.

2. Theoretical Background

OTAs refer to online travel agencies that facilitate travel services including hotel booking, flight ticketing, car rentals, and vacation packages through online platforms [4]. Since 2018, the OTA industry has experienced remarkable growth and has occupied a significant position in the global travel industry. This review paper highlights recent academic studies on the development, impact, and challenges of OTAs, citing 10 academic papers published between 2018 and 2023. These studies explore OTA trends, their influence on hotel and airline profitability, their effect on consumer behavior, and their impact on the travel industry and market competition [5].

Several of these studies suggest that OTAs play a crucial role in the hotel booking market, helping hotels to enhance their market share and revenue [6]. However, they also present challenges for hotels such as loss of profits and harm to brand image due to reliance on OTA platforms. In addition, OTAs have transformed the competitive landscape of the travel market, resulting in industry consolidation and the emergence of monopolies that challenge the existence of smaller travel companies. While consumers benefit from the increased convenience and options brought about by OTAs, there are also associated risks and challenges such as information asymmetry, consumer traps, and protection of consumer rights [7, 8].

These studies reveal that the position and influence of OTAs in the tourism industry is still expanding, but it is essential to address the challenges and risks they pose [9, 10]. Hence, tourism enterprises and government departments should explore collaboration models to enhance the regulation and standardization of OTAs to safeguard consumer rights and ensure healthy industry development. This review contributes to a deeper understanding of the current status and impact of OTAs on the tourism industry, offering insights for tourism practitioners and policy makers.

3. Case Study

3.1. The Development History and Current Situation of Ctrip

3.1.1. The Development History of Ctrip

Ctrip was founded in 1999, headquartered in Shanghai, China, and has set up branches in 17 cities, including Beijing and Tianjin, and is the leading hotel booking service center in China. in December 2003, Ctrip was successfully listed on NASDAQ in the U.S. On October 29, 2019, Ctrip announced that its English name was officially changed to "Trip.com Group "On April 16, 2021, it was reported that Ctrip Group was officially listed on the Hong Kong Stock Exchange on April 19.

The development of Ctrip.com can be divided into five stages: founding and steady development stage, strategic investment and global expansion stage, multiple layouts and high-quality development stage, slow development stage, and recovery development stage. Ctrip took more than ten years to develop Ctrip into the largest travel group in China. 2002-2003 the transaction volume exceeded 100 million RMB for the first time in that month, and in 2004 the first domestic online booking platform for international air tickets was established, with more than 10 million registered members; in 2014, 200 million USD was invested in Tongcheng Travel, which became the largest travel group in China that year. In 2015, Ctrip merged with Where to Go, selling its shares of Where to Go for Baidu, then holding Ctrip and reaching an equity swap with Baidu, and in 2016, acquiring Skyscanner and starting global expansion. In 2017, we launched the "High Speed Travel" channel and "Travel Photo" function, and upgraded the "Global Travel SOS Platform". In 2020, the tourism industry had its worst year due to the epidemic, but among the three major international travel giants, Ctrip took the lead over Booking and Expedia in getting out of the predicament, and Ctrip launched the "Ctrip Revival V Plan" and achieved a turnaround in 2022. In the post-epidemic era, Ctrip has improved its comprehensive strength and is poised to welcome the recovery of the overseas travel market.

3.1.2. Ctrip’s Current Situation

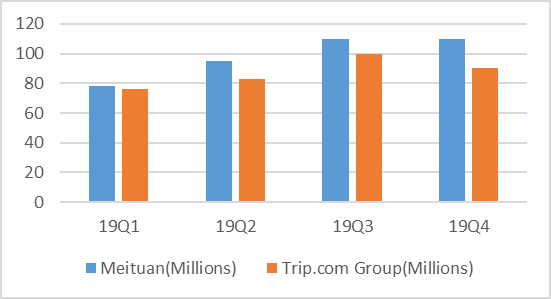

The market competition is getting fierce and Ctrip’s leading position is being challenged. After listing, Meituan Dianping massively expanded its business and put more hope for future profitability in the hotel business. Meituan launched a super group purchase product for wine and travel, attracting investment for international and domestic mid- to high-end hotels, and participating hotels offer benefits such as low prices equivalent to 60% offline. Meituan’s use of low price killer led to a 3% year-over-year increase in the number of high-star hotel nights this quarter. (As shown in Fig.1) The gross profit of this business accounted for nearly 60% of the company’s total gross profit in the third quarter. Meituan has been growing strongly in recent years, and if you compare the hotel platforms, Ctrip’s order volume is not as good as Meituan’s. And because Meituan’s group-buying-based business is not as good as Meituan’s, Ctrip’s order volume is not as good. And because Meituan’s started with group buying, low-end hotels have a larger audience and relatively more production, in the hotel industry Meituan may become Ctrip’s biggest competitor in the future. But Ctrip’s eyes are not only limited to domestic business, but also to the international market.

Figure 1: Meituan’s room nights catch up with Ctrip (Source: trade and social services industry 2022 annual strategy report: Yunxia out of the sea dawn).

3.2. Impact and Measures of the Epidemic

3.2.1. Impact of the Epidemic

The unprecedented COVID-19 pandemic swept across the world in early 2020, affecting almost all aspects of global economic and social life, but tourism was the most severely affected because of its dependence on population mobility. In China, the lockdown of Wuhan on January 23, 2020 and the subsequent travel ban greatly restricted inter-provincial and inter-city population movements, resulting in a sharp decline in the number of major travelers. Much economic activity has resumed in China since late March 2020, and Wuhan was unsealed on 8 April 2020. Although the outbreak has been brought under control and economic activity has resumed in China, people’s willingness to travel, especially for long distances, remains low due to fear of unknown risks.

Ctrip suffered a large number of cancellations during what was supposed to be the peak sales season. The company’s first-quarter earnings fell sharply, with an operating loss of 1.5 billion yuan. Net operating revenue decreased 42% compared to the same period in 2019; Net interest rate decreased by 170% year-on-year and 137% quarter-on-quarter; Return on total assets decreased by 5.55% year-on-year and 3.93% quarter-on-quarter. Roe dropped 10.14% year-on-year and 7.15% month-on-month. The financial performance of the company’s various businesses was also poor. The company’s most market-share strong and competitive hotel business was hit the hardest, with hotel booking revenue down 62% compared to the same period in 2019 and down 61% sequentially; Tourism revenue was down 50% year-on-year and 31% month-on-month; Corporate travel revenue was down 47% from the same period in 2019 and down 66% sequentially. Transport ticket revenue fell 29 per cent year-on-year and 31 per cent quarter-on-quarter. Since April 2020, as the COVID-19 epidemic has been effectively controlled and all industries have gradually resumed work and production, various business lines have also achieved varying degrees of recovery. Ctrip’s resilience has gradually emerged and its profitability has gradually recovered.

3.2.2. Measures

Under the repeated impact of the epidemic, Ctrip has taken a series of countermeasures.

Launch the “Tourism Revival V Plan”. In March 2020, Ctrip, together with more than 100 destinations and ten thousand brands, jointly invested 1 billion yuan in the recovery fund, aiming to form a community with a shared future for the tourism industry, stimulate tourism consumption, and revitalize the post-epidemic tourism economy. The plan is divided into three stages. The recovery period mainly locks in the content soft start and the target population; during the recovery period, the "booking future travel" pre-sale product matrix is launched, and user orders are locked in advance through rich pre-sale forms to help suppliers return funds; during the rebound period, it actively creates its own IP, the whole industry chain cooperation and a variety of resource combinations help the industry fully embrace recovery.

Launch “Boss Live + Hotel Pre-sale”. Liang Jianzhang, chairman of Ctrip, personally carried out live sales. He used 20 kinds of identities, showed the "national essence" face change, Rap, Guankou and other skills, this strongly related his personal IP with the hotel scene of live streaming, which led to the recovery of nearly 300 destination cities. Focusing on customers who will have higher requirements in terms of hotel standards, service quality, etc. At the same time, it radiates more potential users and potential merchants, and successfully meets the changes of consumers’ needs from low-end group tours to high-end travel routes and high-end hotels during the epidemic. This measure adds new revenue growth points for enterprises.

Layout overseas travel in advance. Ctrip has lent a helping hand to 25 countries around the world, donating more than 3 million medical masks to help their local response to COVID-19. This behavior shows that Ctrip has well fulfilled the social responsibility of the leading enterprises in the industry. It has also established an image of love in the hearts of consumers and set a good example for other enterprises. It has also consolidated the company’s close relationship with other governments, which is conducive to the development and expansion of overseas tourism business in the future.

Launch “Cloud Tourism”.Ctrip launched "Scenery Cloud Tourism" and cooperated with a number of suppliers to provide free audio navigation services for tourists on the platform developed by itself, providing users with various styles of language explanations, so that tourists can "travel" at home. Now it has covered more than 5,000 scenic spots and more than 300 museum scenic spots. This new measure has also eased the impact on Ctrip during the epidemic and brought profit growth to the business recovery process.

3.3. Suggestion

The enterprise should have cash reserves and financing ability to ensure that the enterprise can use a large amount of reserve funds to make up for unexpected losses in the face of crisis. It is reported that Ctrip had 68.2 billion yuan in reserves at the end of 2020. Ctrip’s cash reserves have laid a solid foundation for its continued development under the impact of the epidemic.

A good corporate culture is also a top priority. Since the outbreak coincided with the Spring Festival travel rush and subscriber cancellations surged, Ctrip’s air ticket business department confirmed all airlines’ policies overnight and gave priority to order data with clear policies. The move quickly relieved the pressure on other departments, and the solidarity of the entire company’s employees also made consumers feel the hard work culture of Ctrip. At the same time, the founder of Ctrip live broadcast, carefully planned live content, to show the historical and cultural features of various places. This spirit of leading by example not only gives employees strong confidence and working motivation, but also enables consumers to see the attitude and strength of Ctrip, which increases Ctrip’s hotel pre-sale business income and tourism income and promotes the resilience of the entire tourism industry.

The enterprise should be supported by information technology. As the world enters the "era of big data", China’s tourism industry has also begun to transform into "smart tourism". Ctrip also keeps pace with The Times and uses high-level information technology to effectively help the recovery and smooth development of various businesses of the enterprise. Consumers can self-service ticket refund business. At the same time, through the processing and analysis of the massive data generated by all users of the platform every day, Ctrip can realize the precise matching of customer needs, personalized marketing and customized services through artificial intelligence technology, so as to truly realize the matching consumption, enhance the sense of use of users, enhance consumer stickiness, and help Ctrip quickly recover business in crisis.

Enterprises should actively expand overseas markets. In recent years, Ctrip has adopted the international business strategy, and has successfully purchased many overseas companies to realize the development of the international brand. In 2019, Ctrip’s revenue from international business accounted for more than 35% of its total revenue. During the COVID-19 pandemic, the prevention and control of the epidemic in foreign countries was later than that in China, so the international transportation ticketing of Ctrip in the first quarter of 2020 was not significantly affected. Ctrip’s pure overseas business contributed about 10% of its overall revenue in 2019, and its overseas business is recovering strongly as the impact of the pandemic fades.

4. Conclusion

Under the impact of the epidemic, Ctrip launched the "Tourism Revival V Plan", launched the "Boss Live + Hotel Pre-sale", laid out the overseas market in advance, and launched the "Cloud Tourism". A series of measures taken by Ctrip have provided suggestions for other companies; enterprises should have cash reserves and financing capabilities, and a good corporate culture is also a top priority. Enterprises should be supported by information technology, and enterprises should actively expand overseas markets.

Based on the development research of the online tourism platform under the impact of the epidemic, it is restricted by its own cognitive level and comprehension ability when writing. This article also has certain limitations in the research process: First, the research content mainly studies the development of Ctrip under the impact of the epidemic and does not study the development of other online tourism platforms and is not universal. Second, in terms of research methods, this paper mainly adopts the case analysis method. The selection range is relatively narrow, and the collected data is subjective. Third, the factors affecting the development of Ctrip need to be more comprehensive.

References

[1]. Wang, B.,Huang, Y.: Research on the development of online travel agencies in China under the impact of the epi-demic - Ctrip as an example. Journal of Economic Research 08, 38-41(2021).

[2]. Yu, J.: Research on the development strategy of Ctrip in the post-epidemic period. Huazhong Normal University, (2021).

[3]. Li, X.: Research on the resilience of tourism enterprises under the impact of the new crown epidemic and its mechanism of action. Beijing Second Foreign Language Institute, (2021).

[4]. Hua, N., Wang, D., Liang, L.: How do online travel agencies affect hotel performance? The moderating role of hotel brand. International Journal of Hospitality Management 77, 14-24 (2018).

[5]. Li, X., Liang, X., Liang, J.: How do online travel agencies affect hotel profitability? Evidence from Chinese tour-ist hotel sector. International Journal of Hospitality Management 80, 1-10 (2019).

[6]. Park, S. Y., Gretzel, U.: The influence of online travel agency’s advertising on consumer search behavior. Jour-nal of Travel Research 58(3), 450-465 (2019).

[7]. Aydinli, A., Karatepe, O. M.: The impact of online travel agencies on airline pricing strategies. Journal of Travel Research 59(1), 56-72 (2020).

[8]. Kim, H. J., Kim, J. H.: The impact of online travel agencies on the hotel industry: A comparison between chain and independent hotels. International Journal of Hospitality Management 89, 102559 (2020).

[9]. Qiu, R. T., Zhang, L.: Competition between traditional travel agencies and online travel agencies in China. Asia Pacific Journal of Tourism Research 25(6), 610-625 (2020).

[10]. Li, H., Li, X.: The impact of online travel agencies on consumers’ decision-making processes: A comparison be-tween China and the United States. Journal of Travel Research, 0047287520986656 (2021).

Cite this article

Liu,Z.;Zeng,J.;Zhou,J. (2023). Impact of COVID-19 on OTA Platforms and Development: A Case Study of Ctrip. Advances in Economics, Management and Political Sciences,29,55-60.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, B.,Huang, Y.: Research on the development of online travel agencies in China under the impact of the epi-demic - Ctrip as an example. Journal of Economic Research 08, 38-41(2021).

[2]. Yu, J.: Research on the development strategy of Ctrip in the post-epidemic period. Huazhong Normal University, (2021).

[3]. Li, X.: Research on the resilience of tourism enterprises under the impact of the new crown epidemic and its mechanism of action. Beijing Second Foreign Language Institute, (2021).

[4]. Hua, N., Wang, D., Liang, L.: How do online travel agencies affect hotel performance? The moderating role of hotel brand. International Journal of Hospitality Management 77, 14-24 (2018).

[5]. Li, X., Liang, X., Liang, J.: How do online travel agencies affect hotel profitability? Evidence from Chinese tour-ist hotel sector. International Journal of Hospitality Management 80, 1-10 (2019).

[6]. Park, S. Y., Gretzel, U.: The influence of online travel agency’s advertising on consumer search behavior. Jour-nal of Travel Research 58(3), 450-465 (2019).

[7]. Aydinli, A., Karatepe, O. M.: The impact of online travel agencies on airline pricing strategies. Journal of Travel Research 59(1), 56-72 (2020).

[8]. Kim, H. J., Kim, J. H.: The impact of online travel agencies on the hotel industry: A comparison between chain and independent hotels. International Journal of Hospitality Management 89, 102559 (2020).

[9]. Qiu, R. T., Zhang, L.: Competition between traditional travel agencies and online travel agencies in China. Asia Pacific Journal of Tourism Research 25(6), 610-625 (2020).

[10]. Li, H., Li, X.: The impact of online travel agencies on consumers’ decision-making processes: A comparison be-tween China and the United States. Journal of Travel Research, 0047287520986656 (2021).