1. Introduction

1.1. Research Background

Founded in 1987, China Merchants Bank is the first joint-stock commercial bank owned by legal persons in mainland China and the first pilot bank to promote banking reform outside the system. At the beginning of its establishment, China Merchants Bank had 1 branch, 100 million yuan of capital, and 34 employees. In contrast, by the first half of 2022, after 35 years of development, China Merchants Bank has 143 branches and 1771 sub-branches in China, covering more than 130 cities. Moreover, it has 6 branches, 2 representative offices, and over 100,000 employees beyond China.

In 2022, China Merchants Bank ranked 174th in the Fortune Global 500 list and 11th in the Top 1000 Global Banks in 2022, published by the British magazine THE BANKER, ranking among the top 20 banks for five consecutive years. The bank also won Euromoney’s “Best Bank in China” Award from 2019 to 2022, the first time a bank has won four consecutive times in these awards.

From unknown to fame to a banking group listed in Shanghai and Hong Kong, China Merchants Bank with financial licenses such as commercial banking, financial leasing, fund management, life insurance, overseas investment banking, consumer finance, and wealth management subsidiaries. With these outstanding outcomes, the issue of how China Merchants Bank can achieve such outstanding global performance in merely 36 years, accompanied by distinct development characteristics and important market influence, is worth noting. What kind of excellent strategy, management, and culture is contained in the development of its enterprise that can be so remarkably effective? This paper aims to identify and analyze the value of leadership and master the secret of enterprise operation from the development of a commercial bank, China Merchants Bank.

1.2. Literature Review

It expounds the core values of China Merchants Bank that are born because of trial, change because of time, be the first because of well-adapted, take actions because of the market, change because of the world, plan according to the situation, and summarizes the core values of China Merchants Bank, which is “change because of customers”. In addition, it points out the three cultural tools that China Merchants Bank has achieved in the early stage of development: service, innovation, and stability. To begin with, service, the bank believes that customers are the world, everything. Moreover, it is innovation, the lifeline of the bank. Last but not least, stability; is due to the fact that quality is the first theme of development, which comprehensively and profoundly elaborates the importance of culture to the development of enterprises. The book makes people deeply understand the value of corporate culture to the development of enterprises, and corporate culture is like the DNA of an enterprise. Due to that, forging excellent corporate culture is an important path to enhance the value of leadership [1].

The article consists of three chapters: Leading IT ability creates the king of retail, the pioneer of mobile Internet in China Merchants Bank, and “light banking” leads China Merchants Bank to occupy the first opportunity of fintech. This paper reviews the development path of China Merchants Bank to achieve two transformations with fintech as the lead. They are conveying the concept that transformation is the strategy, the goal. Besides, science and technology is the method. This article will corroborate part of this thesis argument and provide some support for arguments.

Based on the article “Review and Impact Analysis of China’s Interest rate liberalization Process”, the development situation and historical process of China’s interest rate marketization so as to understand the impact of interest rate marketization on commercial banks can be mastered, explore the reasons for the transformation of China Merchants Bank, and find out the basis for the transformation path of China Merchants Bank.

The article “Study on the Impact of Strategic Adjustment of Economic Structure on the Operation of Commercial Banks and its Optimization Measures”, discusses the impact of economic structure adjustment on commercial banks to realize the transformation logic of China Merchants Bank in the new economic situation can be understood.

Based on the article “Analysis and Enlightenment of China Merchants Bank’s Three Times of Transformation”, this study understands the direction, mode, stage, and initial results of China Merchants Bank’s transformation, explores the key to the success of China Merchants Bank, and provides a reference for the future development of commercial banks.

1.3. Logic of the Article

This paper will analyze and elaborate on three sections: “Why to transform”, “The goal and vision of transformation,” and “The path to realizing the vision”. First of all, the reasons for the transformation will start from the external environment that China’s commercial banks have faced in the past 36 years, from the changes in the capital market, the adjustment of the economic pattern, the impact of the digital age, and the analysis of the external causes that promote the transformation of China Merchants Bank. Then, this paper will analyze the internal factors that promote the transformation of China Merchants Bank from the inside of China Merchants Bank, through the two dimensions of profit model transformation needs and the needs of its own management and development, and then combine both to discuss the reason of the transformation. Secondly, this study will elaborate on China Merchants Bank’s transformation goal and vision from the strategy, management, and culture of China Merchants Bank’s transformation definition. Eventually, from the three dimensions of the logic of commercial banks in the digital era, the open and integrated future development mode, and the talent strategy, the path to realizing the transformation of China Merchants Bank is expounded. The key to the success of the development of China Merchants Bank is sorted out.

2. Method

2.1. Survey

This paper will use the method of investigation and research by going deep into the enterprise’s internal visits, exchanges, and field visits to the enterprise staff and customers to obtain first-hand information as an important basis for demonstration.

2.2. Comparative Data Analysis

This paper will use the method of data comparison, through the comparative analysis of the data before and after the enterprise transformation, to prove the leadership significance of transformation and management mode innovation for enterprise development, demonstrate the effectiveness of China Merchants Bank transformation in order to give more convincing conclusions for readers’ reference.

2.3. Inductive Deduction

By studying the company’s books, news, websites, apps, and products, this paper will summarize the relevant contents so as to grasp the company’s development strategy and direction and explore the underlying logic and realistic mode of China Merchants Bank’s strategic transformation and management innovation.

3. Result

3.1. A transformation of China Merchants Bank

In order to study the transformation of China Merchants Bank and the password that the transformation leads China Merchants Bank to success, the first thing is to clarify the context of the transformation of China Merchants Bank, the second is to clarify the reasons for the transformation of China Merchants Bank, and the third is to clarify the goal and path of the transformation of China Merchants Bank. In the 36 years of development, China Merchants Bank has experienced two transitions and a deepening of the development concept. It can be learned from the article “China Merchants Bank 32 Years of Revelation: Two Transformation Achievements of Retail King” that the first transformation of China Merchants Bank was in 2004 [1]. At that time, China was about to implement interest rate liberalization and began implementing capital adequacy ratio management on commercial banks, unprecedentedly impacting the operating environment and profit model of Chinese commercial banks. At the same time, China began to open up to foreign banks fully, “the Wolf is really coming”. Chinese commercial banks must change their business thinking and business model and find new development paths. They can compete with the flexible and diversified business models and business types of foreign banks, do not rely too much on interest rate differential income, and have an excellent asset structure to withstand risks. In January 2005, China Merchants Bank proposed to speed up the transformation to retail business, intermediate business, and small and medium-sized enterprise business at the national branch governors’ meeting, marking the beginning of a transformation of the bank. Since then, based on the comprehensive retail product system established by a series of products, such as all-in-one card, All-in-One, Golden Sunflower Finance, credit card, etc., China Merchants Bank achieved a compound growth rate of net profit of 56.71% during the five years from 2003 to 2008, ranking among the best in the banking industry [2].

3.2. The Second Transformation of China Merchants Bank

China Merchants Bank’s second transformation was in 2010. In 2008, the subprime mortgage crisis broke out in the United States. In the following two years, China’s economy fluctuated accordingly, coupled with the continuous deepening of interest rate liberalization, the rise of Internet finance, and increasingly high regulatory requirements on capital. The dividends brought by the transformation of China Merchants Bank began to decline, and China Merchants Bank once again faced the challenge of having to change. In 2010, China Merchants Bank proposed a “secondary transformation”. Suppose the first transformation of China Merchants Bank is mainly about the adjustment of business structure compared to the first transformation. In that case, the second transformation is more about management transformation, aiming at transforming the development road of “extensive extension” into the fine management of “intensive connotation”. In this transformation, China Merchants Bank will set the goal of reducing capital consumption, improving loan pricing, controlling financial costs, increasing value customers, and ensuring controllable risks.

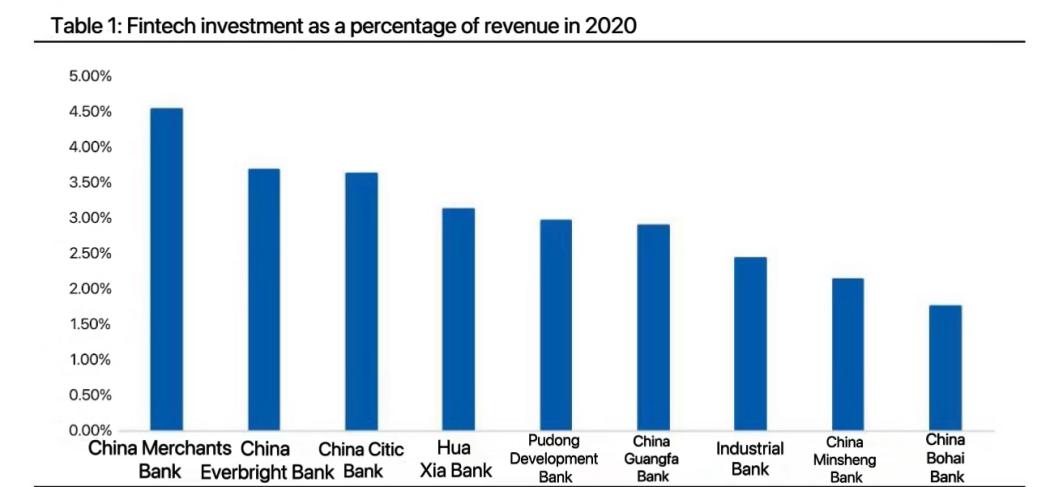

In 2013, the transaction scale of third-party mobile payment increased by 8 times, which astonished all banks. The battle for data is undoubtedly the battle of the future. In January 2014, China Merchants Bank proposed to accelerate the realization of the second transformation and build a “light bank” strategic transformation goal and proposed the strategic idea of “one body and two wings” (“one body “is retail banking,” two wings “are corporate finance and inter-bank finance). In 2015, the concept of FinTech was introduced into China, ushering in the first year of fintech in China. Faced with the impact of the wave of new technology, China Merchants Bank proposed to transform into a “networked, data-oriented and intelligent” future bank in 2016. In 2017, it was more focused on technology, positioning itself as a “fintech bank”, with fintech as the nuclear power to create the best customer experience and achieve non-linear growth, as shown in Figure 1.

Figure 1: Fintech investment as a percentage of revenue in 2020

(Note: The table is from the article “China Merchants Bank Research Report: Reform, Transformation and Differentiation” [3])

In the second transformation of China Merchants Bank, the first half mainly solved the problems of “light assets” and “light operation”, and the second half relied on science and technology to solve the problems of “light management” and “light culture”. At this point, China Merchants Bank takes customers and technology as the core, focuses on customer experience and fintech, re-examines everything in bank operation and management, and opens a new digital transformation era. After that, in 2020, China Merchants Bank began to explore a new development model for commercial banks and entered the first year of wealth management. In 2021, China Merchants Bank formally proposed to build the 3.0 model of “big wealth management business model + digital operation model + open and integrated organizational model”. Around the 3.0 model, China Merchants Bank’s “heavy” and “light” features are remarkable. CMB has increased its “heavy” measures to build a fintech bank with its prehistoric strength, emphasizing scientific and technological investment, fintech talents, intelligent banking services, digital operation ability, service efficiency improvement, and customer management ability. Mobile, intelligent, data, platform, and ecological are the path to 3.0 mode. It is through a series of “heavy” investments in science and technology that “light” experience is brought to users, which also brings the success of China Merchants Bank [4]. In 2023, China Merchants Bank proposed to build a “value bank”, consolidating the core concept of “customer-centric, creating value for customers”. Value Bank is regarded as a deepening of the secondary transformation of China Merchants Bank, which makes this bank, which has been on the road of innovation, more promising in the future.

3.3. The Results of China Merchants Bank’s Transformation Stand Out

“Since China Merchants Bank proposed the first retail transformation, during the 17 years from 2005 to 2021, the retail business revenue of China Merchants Bank increased from 4.898 billion yuan to 179.15 billion yuan, an increase of 35.55 times; Revenue share increased from 25.54% to 54.04%; Profit increased by 89.15 times from 862 million yuan to 77.709 billion yuan; Profit share increased from 13.26% to 52.44%” [5].

Look at the annual report data of China Merchants Bank in 2021. Here will list some important indicators to measure a bank’s soft power in mobility, intelligence, data, platform, and ecology.

In 2021, the monthly active users (MAU) of the China Merchants Bank App and Mobile Life App reached 111 million at the C end. The number of monthly active users in 28 scenarios exceeded 10 million. China Merchants Bank has 170 million App users, with a peak daily active user of 17.540,700. In 2021, the number of transactions was 1.914 billion, with a year-on-year growth of 6.16%, and the transaction amount was 59.62 trillion yuan, with a year-on-year growth of 45.73%. The total number of Handheld Life App users is 127 million, and the peak number of daily active users is 7,477,300.

In the B terminal, the number of customers of the wholesale electronic channel of China Merchants Bank is 2,178,100, the customer coverage rate is 94.00%, and the number of monthly active customers is 1,562,900. At the same time, in 2021, the online enterprise bank of China Merchants Bank released the U-Bank11 version. By the end of the year, the number of customers was 2,122,400, the number of monthly active customers was 1,273,300, and the number of transactions was 283 million, with a year-on-year growth of 13.87%. The transaction amount is 150.68 trillion yuan, up 19.59% year on year [4].

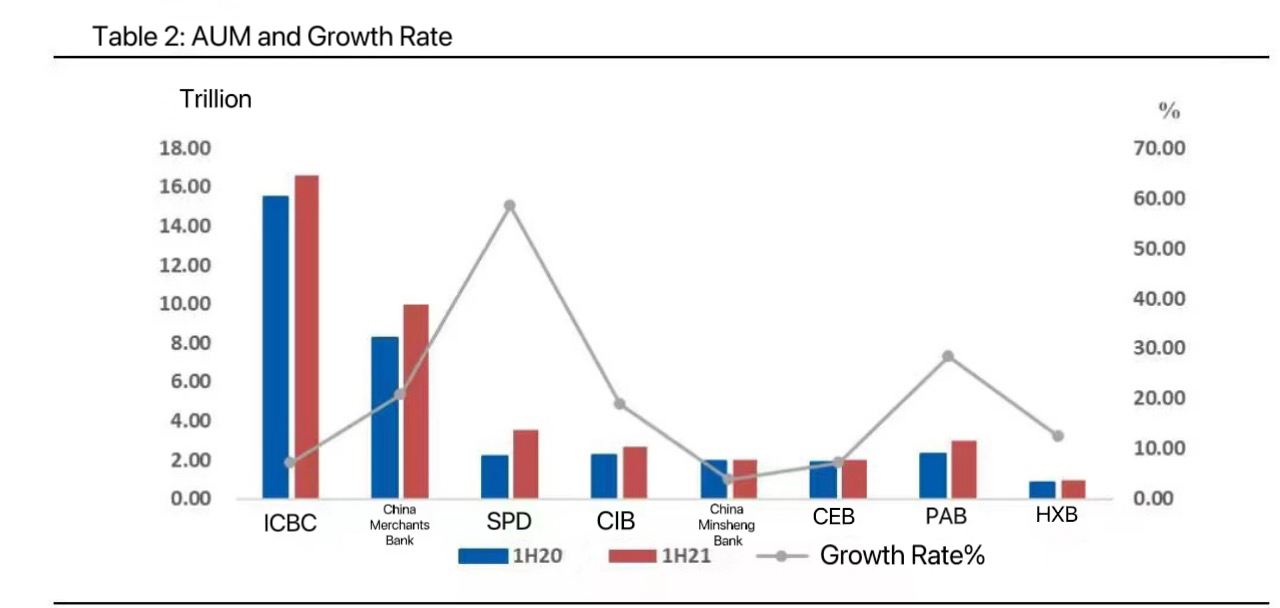

In addition, the Research Report of China Merchants Bank: Reform, Transformation, and Differentiation [3] not only deeply analyzed the transformation path of China Merchants

Bank but also provided specific results data, including the results of China Merchants Bank’s promotion of big wealth management from the perspective of scale, as shown in Figure 2:

Figure 2: AUM scale and growth rate of each bank

(Source: China Merchants Bank Research Report: Reform, transformation and differentiation, https://my.mbd.baidu.com/r/XwxAtgozKM?f=cp&u=ada53df2b7a832de)

In the first half of 2021, the average monthly AUM scale of China Merchants Bank was 9.99 trillion yuan, ranking the second among listed banks that announced this index. Meanwhile, it maintained a fast growth rate, with a year-on-year growth of 21%, higher than the average.

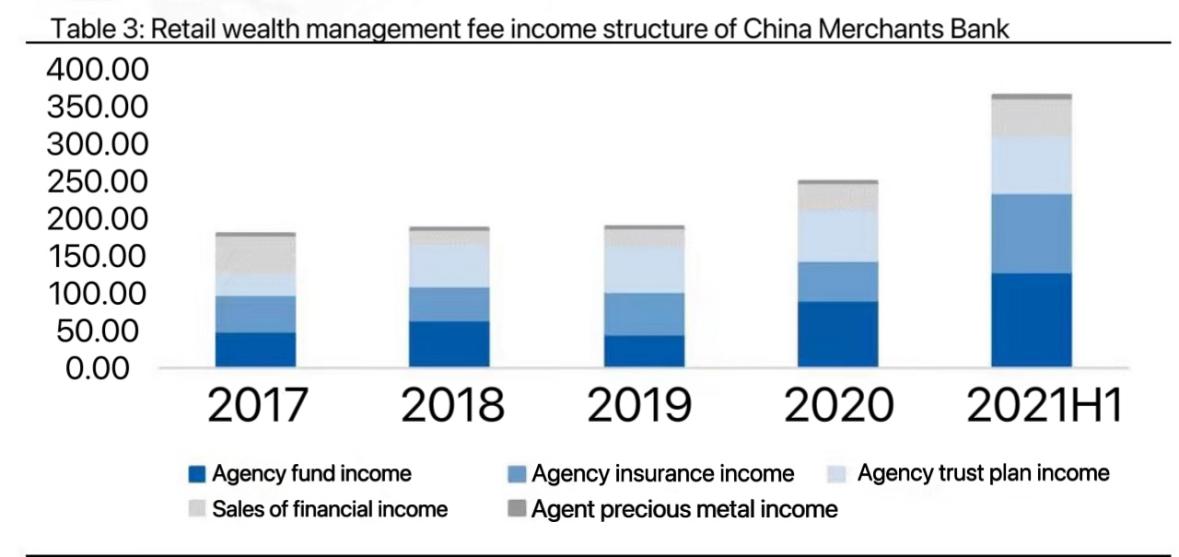

Looking at the achievements of CMB Wealth Management from the perspective of income:

Figure 3: Structure of retail wealth management commission income of China Merchants Bank

(Note: The table is from the article “China Merchants Bank Research Report: Reform, Transformation and Differentiation” [3])

3.4. Analysis of Successful Reasons for the Transformation of China Merchants Bank

From the context of the transformation of China Merchants Bank, it is not difficult to see that the most critical factor for the success of China Merchants Bank is the strategy of “changing with the situation”. Under the guidance of strategy, the management of China Merchants Bank has transformed from extensive extension to intensive connotation and then to the implementation of light management and digital management. At the same time, in the development process of China Merchants Bank, there is a special element that deserves attention: the corporate culture of China Merchants Bank. “The culture of China Merchants Bank has been continuously inherited and improved from” reputation, flexibility, service and innovation “at the initial stage in 1987, to the core values of” service, innovation and stability “proposed in 2004, and then to the launch of a new generation of corporate culture system in 2023. Culture has become an inexhaustible driving force for China Merchants Bank” (oral interview with employees of China Merchants Bank) [6]. Tong Pondering mentioned in his article “Revelation of the Movement” [7]. In 2012, Ma Weihua, the second president of China Merchants Bank, summed up three successful experiences of China Merchants Bank, namely, “market-oriented forward-looking formulation and implementation of scientific development strategy”, “customer-centered continuous improvement of management level”, and “employee-based meticulous cultivation of positive and excellent corporate culture.” Strategy, management, and culture are defined in this paper as the three driving forces for the success of China Merchants Bank.

4. Discussion

4.1. Analysis of Successful Reasons for the Transformation of China Merchants Bank

From the context of the transformation of China Merchants Bank, it is not difficult to conclude that the most critical factor for the success of China Merchants Bank is the strategy of “changing with the situation”. Under the guidance of strategy, the management of China Merchants Bank has transformed from extensive extension to intensive connotation and then to the implementation of light management and digital management. At the same time, in the development process of China Merchants Bank, there is a special element that deserves attention: the corporate culture of China Merchants Bank. “The culture of China Merchants Bank has been continuously inherited and improved from” reputation, flexibility, service and innovation “at the initial stage in 1987, to the core values of” service, innovation and stability “proposed in 2004, and then to the launch of a new generation of corporate culture system in 2023. Culture has become an inexhaustible driving force for China Merchants Bank” (oral interview with employees of China Merchants Bank) Tong Pondering mentioned in his article “Revelation of the Movement” [6]. In 2012, Ma Weihua, the second president of China Merchants Bank, summed up three successful experiences of China Merchants Bank, namely, “market-oriented forward-looking formulation and implementation of scientific development strategy”, “customer-centered continuous improvement of management level”, and “employee-based meticulous cultivation of positive and excellent corporate culture.” Strategy, management, and culture are defined in this paper as the three driving forces for the success of China Merchants Bank.

The success of China Merchants Bank lies in its excellent strategy, management, and culture. The success of China Merchants Bank gives modern commercial banks and even modern enterprises lessons: strategy, management, and culture are the foundation of an enterprise’s development. Throughout the world’s century-old enterprises, Mi Jianguo, a researcher at the Development Research Center of The State Council, said at the 11th Influential -- China CEO Summit Forum in 2015 that continuous innovation is the root of the century-old enterprises’ standing [7]. The book Brief Analysis of Century-old Chinese and Foreign Enterprises [8] summarizes six characteristics of successful century-old enterprises: adhering to integrity and trustworthy management, well-known independent brands, strengthening innovation-driven development, attaching importance to strategic management and control, strengthening law and compliance management, and carry forward excellent corporate culture. These qualities can be found in the strategy, management, and culture of China Merchants Bank.

4.2. The Century-Old Store and the Successful Gene of China Merchants Bank

First, strategic management control. Undoubtedly, every transformation of China Merchants Bank is a strategic transformation that follows the market’s assessment of the situation. China Merchants Bank proposed retail transformation in 2004 when the public was king, and nobody paid attention to retail. After the 2008-2009 financial crisis, China Merchants Bank began to implement the transformation to reduce capital consumption, raise loan pricing, control financial costs, etc. In 2012, faced with macro-economic risk exposure and deterioration of bank asset quality, China Merchants Bank put forward the strategy of “one body and two wings”, and then the mobile Internet on the other side gained momentum. China Merchants Bank proposed the transformation of bank 3.0 mode and finally proposed the “value bank” by 2022. On the basis of adhering to the weak cyclical advantages of retail banks and the advantages of internal capital growth of “light banks”, China Merchants Bank will pursue the maximization of the comprehensive value of customers, employees, shareholders, partners, and society. It creates a new pattern of high-quality development and strive to build itself into a world-class commercial bank [9]. At every step of the strategy, China Merchants Bank complies with The Times, the market, the situation, and the people, so there is no disadvantage.

Secondly, strengthen innovation-driven development (including well-known independent brands). As a share-holding commercial bank in Shekou, born at the forefront of China’s reform and opening, China Merchants Bank is born with the innovation gene. In the early stage of the construction Bank, in terms of corporate governance, CMB innovated the president responsibility system under the board of directors’ leadership and advocated “expert governance”. In terms of the employment mechanism, the “six energy mechanism” is proposed (cadres can go up or down, incomes can be high or low, and employees can enter or leave); In terms of products and services, China Merchants Bank launched the “All-in-one Card” in 1995, which took “customer number” management as its core concept. In 1997, China Merchants Bank launched the “All-in-One” online bank, followed by a series of products and platforms such as “mobile banking” and a handheld banking app, laying the foundation of its brand of “technology banking” [10]. Always daring to be the first is the strongest weapon of success.

Third, carry forward excellent corporate culture (including honest and trustworthy management + law and compliance management). March 8, 2023, the 19th China Merchants Bank Corporate Culture Festival opened. In this festival, China Merchants Bank once again inherited and promoted its corporate culture, in summary, including The entrepreneurial culture of “hard work and dedication”, the service culture of “change because of you”, the innovation culture of “daring to be the first”, the risk culture of “prudent and prudent”, the compliance culture of “compliance first”, the management culture of “strict norms”, the humanistic culture of “respect, care and sharing”, and the breeze culture of “openness, integration and inclusiveness”. The eight cultures have formed a powerful cultural system, which China Merchants Bank has continuously created, enriched, and developed during its development. Corporate culture is the sum of the business philosophy, purpose, policy, behavior, image, values, brand image, and social responsibility formed in the business activities of an enterprise. It is the fundamental embodiment of enterprise individuation and the soul of enterprise survival, competition, and development. The cultural structure and genes of China Merchants Bank and the enterprise’s emphasis on the culture show this enterprise’s long-term vision and broad mind.

5. Conclusion

From the development course of China Merchants Bank’s strategic transformation and its 36 years of operation and management, the most critical leadership element for an enterprise to create its own territory and succeed in the surging market can be seen. The first is strategy. This strategy is a strategic vision that changes according to the situation, a strategic mind that considers the situation, and a goal and direction based on the overall vision. This strategy requires far-sighted, broad-sighted, Clear-minded, comprehensive vision, and clear, accurate, unique, and sensitive insights. The transformation of China Merchants Bank is the best embodiment of its strategy. The second is management. Management is the foundation of enterprise development. China Merchants Bank constantly deepens and refines its management around its strategic transformation. The most concentrated is the comprehensive management upgrading in the secondary transformation from extensive management to intensive management and the application of scientific and technological means to realize the 3.0 mode of “light management” in “light banking”. Management escorts the development of China Merchants Bank. Third, culture is the invisible productivity, the spiritual power of enterprise development, and the recessive leadership of an enterprise. China Merchants Bank is a consistent service, innovation, and steady culture, for its solid foundation for development. It can be seen from the development of China Merchants Bank that excellent corporate culture will help enterprises form cohesion, attraction, development force, and market competitiveness to promote enterprises’ success.

References

[1]. Shenzhen Securities Times, China Merchants Bank 32 years of Revelation: Two transformation achievements of retail king, 2019-08-19, 2023-02-25, https://mbd.baidu.com/newspage/data/landingsuper?rs=1199548269&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_8789199315895557231%22%7D

[2]. Yu, H. The wave of fintech in banking industry: Three transformation achievements of China Banking Technology, 2019-09-24,2023-02-26,http://chsh.cbimc.cn/2019-09/24/content_305826.htm

[3]. Chen, Y. L. Research Report of China Merchants Bank: Reform, Transformation and Differentiation, 2022-02-16, 2023-02-26, https://mbd.baidu.com/newspage/data/landingsuper?rs=851362056&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_9562179960742853177%22%7D

[4]. Fang, J. Annual report interpretation: “3.0 model” under the China Merchants Bank is how to become “light”? 2022-03-21, 2023-02-28, https://mbd.baidu.com/newspage/data/landingshare?context=%7B%22nid%22%3A%22news_9292040059844371862%22%7D&isBdboxFrom=1&pageType=1&rs=2963989003&ruk=nXt1MPChBUjUhkpeS9O2cg&sid_for_share=&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D

[5]. Ma, W. H. Integrated and Two-Wing Strategy of China Merchants Bank, 2023-03-01, 2023-03-10, https://www.jiansulushi.cn/news/422935.html

[6]. Tong, S. X. Revelation of the Act, 2019-12-17, 2023-03-11, https://mbd.baidu.com/newspage/data/landingsuper?rs=1087345259&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_9499174126064152611%22%7D

[7]. Guan, X., Mi, J. G. Continuous innovation is the root of the century-old store’s standing, 2015-11-02, 2023-3-11, http://www.jjckb.cn/2015-11/02/c_134772630.htm

[8]. Yu, J. A Brief Analysis of century-old Enterprises at Home and abroad, 2022–01-01

[9]. Yu, B. C. China Merchants Bank Strategic Transformation: Build a “value bank”, 2023-03-26,2023-04-03, https://baijiahao.baidu.com/s?id=1761391448255444540&wfr=spider&for=pc

[10]. Ou, S. J. Change Because of The Time, lead the trend first,2018-07-24,2023-04-03, , https://www.sohu.com/a/242930890_157267

Cite this article

Zheng,Z. (2023). Research on Strategic Transformation and Management Innovation of China Merchants Bank. Advances in Economics, Management and Political Sciences,31,31-39.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Shenzhen Securities Times, China Merchants Bank 32 years of Revelation: Two transformation achievements of retail king, 2019-08-19, 2023-02-25, https://mbd.baidu.com/newspage/data/landingsuper?rs=1199548269&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_8789199315895557231%22%7D

[2]. Yu, H. The wave of fintech in banking industry: Three transformation achievements of China Banking Technology, 2019-09-24,2023-02-26,http://chsh.cbimc.cn/2019-09/24/content_305826.htm

[3]. Chen, Y. L. Research Report of China Merchants Bank: Reform, Transformation and Differentiation, 2022-02-16, 2023-02-26, https://mbd.baidu.com/newspage/data/landingsuper?rs=851362056&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_9562179960742853177%22%7D

[4]. Fang, J. Annual report interpretation: “3.0 model” under the China Merchants Bank is how to become “light”? 2022-03-21, 2023-02-28, https://mbd.baidu.com/newspage/data/landingshare?context=%7B%22nid%22%3A%22news_9292040059844371862%22%7D&isBdboxFrom=1&pageType=1&rs=2963989003&ruk=nXt1MPChBUjUhkpeS9O2cg&sid_for_share=&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D

[5]. Ma, W. H. Integrated and Two-Wing Strategy of China Merchants Bank, 2023-03-01, 2023-03-10, https://www.jiansulushi.cn/news/422935.html

[6]. Tong, S. X. Revelation of the Act, 2019-12-17, 2023-03-11, https://mbd.baidu.com/newspage/data/landingsuper?rs=1087345259&ruk=nXt1MPChBUjUhkpeS9O2cg&urlext=%7B%22cuid%22%3A%220P2ua08MHa_hi-8ClPvi8liQSuYZ8v8O0a2gigiI2i_vavi3jP2gilf5SOrj8SaJID7mA%22%7D&isBdboxFrom=1&pageType=1&sid_for_share=&context=%7B%22nid%22%3A%22news_9499174126064152611%22%7D

[7]. Guan, X., Mi, J. G. Continuous innovation is the root of the century-old store’s standing, 2015-11-02, 2023-3-11, http://www.jjckb.cn/2015-11/02/c_134772630.htm

[8]. Yu, J. A Brief Analysis of century-old Enterprises at Home and abroad, 2022–01-01

[9]. Yu, B. C. China Merchants Bank Strategic Transformation: Build a “value bank”, 2023-03-26,2023-04-03, https://baijiahao.baidu.com/s?id=1761391448255444540&wfr=spider&for=pc

[10]. Ou, S. J. Change Because of The Time, lead the trend first,2018-07-24,2023-04-03, , https://www.sohu.com/a/242930890_157267