1. Introduction

With the rapid economic development of North Asia, the cosmetics industry is becoming increasingly important in the region. According to Euromonitor, Japan and South Korea are among the world's largest cosmetics markets. In addition, China's cosmetics market is also growing rapidly and is predicted to become one of the largest cosmetics markets in the world [1].

The North Asian market is a huge opportunity for international cosmetics brands, but there is also fierce competition. In this market, factors such as brand awareness, product quality and market positioning have an important impact on consumers' purchase decisions [2-4]. As a leading global cosmetics brand, L'Oréal has successfully expanded into the North Asian market. The company actively adjusts its product and brand positioning to suit local consumer demand through constant market research and consumer feedback. For example, in the Korean market, L'Oréal has launched “Korea Special Edition” products, which were carefully screened and reviewed to meet the needs of the local market. In addition to product adaptation, L'Oréal is also strengthening its visibility and influence in the North Asian market through advertising and brand marketing. For example, in the South Korean market, L'Oréal cooperates with local stars in advertising to attract more consumers [3].

However, there are not only advantages but also disadvantages for L'Oréal to expand the North Asian market. SWOT is a useful tool that can help an enterprise to understand its internal and external environment and develop appropriate strategies to maintain its competitive advantage. At the same time, for global brands like L'Oréal, it is also crucial to have a deep understanding of the local market and consumer demand, which can be achieved through market research, consumer feedback and other data analysis [5,6].

The paper is organized as the following. Next section introduces some background information, followed by a SWOT analysis of L'Oréal's development situation in North Asia in section 3. The marketing strategy suggestions based on SWOT are put forward in Section 4, and the Section 5 concludes the paper.

2. Background Overview

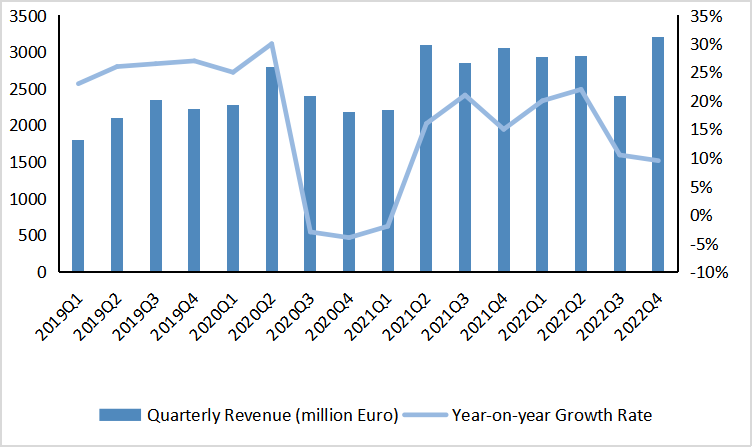

According to the financial data released by L'Oréal, in the first half of 2021, L'Oréal achieved a sales growth of 26.1% in the Chinese mainland market, and other markets in North Asia also showed good performance. Figure 1 shows the Revenue and Growth rate of L'Oréal. It can be seen that since 2019, the growth rate of L'Oréal in the Asian market has always maintained a high degree, except for 2020 because of the impact of Covid-19. L'Oréal actively promotes the development of online sales in the regional market and improves its market competitiveness through digital operation and personalized marketing. L'Oréal still has certain advantages and potential in the North Asian market despite the challenges such as intensifying industry competition and changing consumer demand. Its marketing strategy in North Asia until 2020 mainly focuses on product localization and advertising according to the specific needs and preferences of consumers in each country.

Digital marketing is a key strategy. The company recognizes the growing importance of e-commerce and social media in this region and has invested significant resources in building its online presence. L'Oréal, for example, has partnered with popular e-commerce platforms such as Tmall in China and Lazada in Southeast Asia to sell its products directly to consumers. The company also has a strong presence in social media, using platforms such as WeChat, Line and KakaoTalk to engage with consumers and promote its products.

L'Oréal also launch products according to the specific situation. In China, the company has rolled out a skincare line tailored to the country's humid climate. In 2018, L'Oréal acquired Nanda, a South Korean cosmetic brand popular among young people, gaining a foothold in the highly competitive South Korean market.

Note: 19Q1-21Q1 covers the Asia-Pacific region, 21Q2-22Q4 covers the North Asia region (Data source: Bloomberg, Minsheng Securities Research Institute)

Figure 1: Revenue and expansion rate of L'Oréal.

In addition, L'Oréal focus on influencer marketing very much. The company has partnered with popular beauty bloggers in the region to promote its products and increase brand awareness. In China, L'Oréal works with well-known bloggers such as Jiaqi Li and Weiya to promote its products. The investment in digital marketing, differentiation strategy and partnership with influencers have helped it build a strong brand presence in the region and set the stage for continued growth in the future.

3. SWOT Analysis of L'Oréal in North Asia Market

Understanding the business environment is central to a strategic planning process [7]. SWOT is a method for strategy making that considers the internal conditions and external environment factors of enterprise. To determine best business strategies the enterprise should adopt, SWOT analyze the enterprise by evaluating the strengths, weaknesses, opportunities, and threats in a business project [8]. All in all, the guiding principle of SWOT analysis is making strategy fit for enterprise’s future development based on the internal strengths and weakness, and external opportunities and threats. SWOT analysis results are usually presented in the form of matrix, which can clearly and intuitively show the current development chances and challenges of the enterprise, so it can provide good help for L'Oréal's strategy formulation.

3.1. Strengths

3.1.1. Rich Experience and Mature Technology

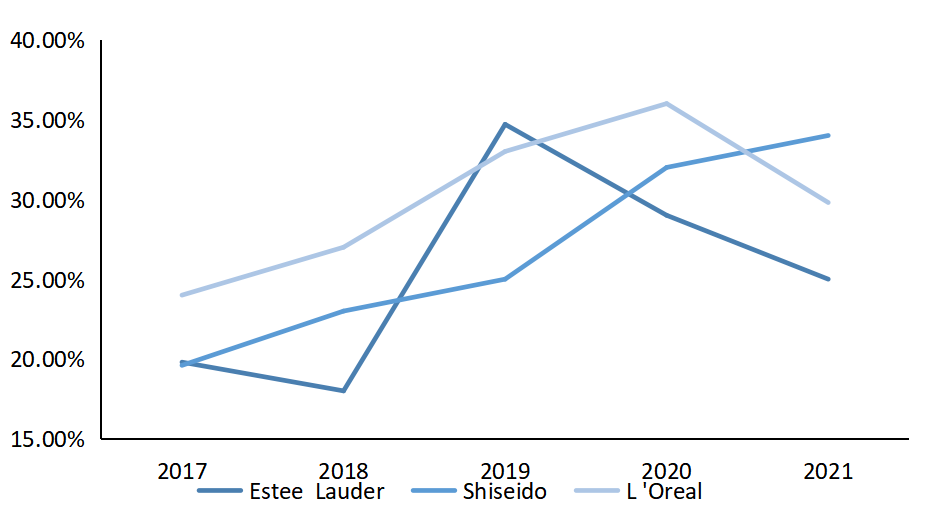

L'Oréal Group was founded in France in 1907. As of 2019, its business scope has covered 150 countries and regions around the world. L'Oréal has a very long-term experience in research and sales, and its production involve the skin care, beauty, perfume and so on. For 100 years, L'Oréal has paid close attention to market trends and changes in people's needs, continuously developing its technology to produce a wide range of healthy, and high-quality products. As can be seen from the figure 2, from 2017 to 2021, L'Oréal maintained more than 25% of the cosmetics market share in North Asia, which has laid a solid foundation for its deep cultivation in the North Asian market.

Note: Shiseido adopts Asia-Pacific sales excluding Japan, and Euclidean adopts North Asia sales for 2021 redefinition of geographical region (Data source: Company annual report, Western Securities Research and Development Center).

Figure 2: Sales of cosmetics groups in North Asia.

3.1.2. Good Brand Image

At present, L'Oréal's products are divided into four series of high-end cosmetics, popular cosmetics, active health cosmetics and professional hair cosmetics. It has 36 brands including the famous ones such as Helena, Lancôme, Biotherm and Maybelline. With its efficient skin care technology and fashionable beauty concept, L'Oréal has attracted customers of different ages and won the support and trust of the public. On the other hand, L'Oréal also pays attention to the developing continuity of the acquired brands. In December 2020, L'Oréal announced the acquisition of Takami, a Japanese company. Takami brand is known for its iconic metabolizing essence of muscle base. After the acquisition, L'Oréal Group continued to build on the brand's professional status and image, and on this basis continued to grow Takami. L'Oréal has built a good corporate image through its high-end products and careful service, so its popularity has risen all the way.

3.1.3. Mature Distribution Channels

After a long time of exploration in the global market, L'Oréal has formed a wide range of mature sales channels with stable consumer groups. In 2014, L'Oréal Group was being in the era of digital transformation, facing huge operating pressure. At that time, L'Oréal didn't have a deep exploration in e-commerce, but relied mainly on offline sales. In the face of the change of the international market trend, L'Oréal Group began to carry out channel reform and started the digital expedition. Because L'Oréal has no need for distributors to expand the market, consumers have less bargaining power, which gives L'Oréal strong price control.

3.2. Weaknesses

3.2.1. Vague Corporate Image

L'Oréal has always paid great attention to the building of its major brands, but few people know that these brands belong to L'Oréal Group. It’s obvious that L'Oréal ignores the shaping of corporate image and the promotion of corporate culture while focusing on brand strategy. Although this problem does not pose a great threat to L'Oréal at present, it cannot be ignored that it is difficult for an enterprise to achieve long-term development without core cohesion.

3.2.2. Ignorance of Less Developed Areas

Although L'Oréal has high-end cosmetics and mass cosmetics, it is still mostly positioned as high-end brand. With prices generally high, L'Oréal has lost some of the low consumption market. L'Oréal has many counters in North Asia, but most of them focus on high-end consumption. The reality of many underdeveloped regions in Northeast Asia will affect L'Oréal's comprehensive expansion of North Asian market to a certain extent.

3.2.3. Homogenous Brands and Lack of Innovation

L'Oréal has a large number of beauty products, but the effects of each brand’s products are similar, and there are no unique outstanding features for each brand. For example, the functions of Lancôme skin care products mainly include moisturizing, lightening wrinkles and repairing, while the functions of other brands such as YSL, Kiehl's and Biotherm are very similar. Therefore, it is difficult for consumers to clearly recognize the differences between various products. In addition, L'Oréal offline counter marketing model is less innovative and intelligent, and there is almost no difference with other cosmetics counters. Therefore, it is difficult to stand out among a variety of brands. At present, L'Oréal can still dominate the beauty market with its inherent brand effect. However, with market changing and other brands entering the market, L'Oréal's brand advantage will be greatly weakened.

3.3. Opportunity

3.3.1. Mature Supervision and Management System

Taking China, Japan and South Korea for example, these three countries have quite complete cosmetics supervision laws and systems. In 2021, the “Regulations on the Supervision and Administration of Cosmetics” promulgated by China were officially implemented, and moderate adjustments were made to the regulations based on the actual situation. It means the establishment of a healthy and efficient cosmetics management system, providing a safety guarantee for the healthy development of China's cosmetics industry. In 2019, Japan revised the specifications of 48 raw materials in the “Specification of Foreign Raw Materials of the Ministry of Medicine 2006”. South Korea has revised the “Enforcement Rules of the Cosmetics Law” and the “Enforcement Order of Cosmetics” to strengthen supervision over the quality and safety of cosmetics. The improvement of the cosmetics management system in the North Asian market is conducive to L'Oréal's continuous improvement of product quality, and with its high quality, it will stand out among many cosmetic products of mixed good and bad.

3.3.2. Strong Purchasing Power

China, Japan and South Korea, the core countries in North Asia, all have a good level of economic development and strong purchasing power. In recent years, with the development of entertainment industries such as talent shows, movies and TV dramas, the public has a higher and higher demand for beauty makeup and attaches great importance to their own image. L'Oréal can take advantage of this opportunity to continue producing beauty products that meet the needs of the masses in Northeast Asia.

3.3.3. Similar Sense of Beauty and Ethnic Background

In 2021, L'Oréal put forward the strategic plan of building the Golden Triangle of China, Japan and South Korea, trying to make North Asia a new engine of global cosmetics market. Taking Female Asian for example, the similar customs, traditions, and facial features create the current ideal looks include a smooth, convex forehead, large eyes, a petite nose with a raised bridge, full but not prominent lips that are proportionally balanced, and an oval, egg-shaped face with a neat v-shaped jawline[9].Therefore, L'Oréal can create beauty products that meet the Asian facial features and aesthetic characteristics of the people of China, Japan and South Korea, which can benefit the promotion of its integration strategy in North Asia.

3.3.4. Favorable Weather Conditions

Environment plays a pertinent role in production and consumption pattern, which include water, forests, atmosphere and so on [10]. Most areas of China, Japan and South Korea belong to plain areas, with four distinct seasons, mild climate and few climate disasters. Most people in North Asia have relatively good skin condition, so the requirements for skin care products like repair technology and anti-allergy technology are not too high. As a result, L'Oréal has less pressure on technology development in North Asia.

3.4. Threats

3.4.1. Fierce Competitive Environment

With the development of economy and the improvement of living standard, people's demand for beauty and skin care is increasing. Major beauty and skin care companies have increased investment, and new competitors have entered the industry, which leads to intensified competition in the market. China, Japan, Korea and other countries in North Asia, as major consuming country of cosmetic products, will naturally attract more cosmetic brands to enter the market. If L'Oréal fails to develop new products that meet the market demand in time, its leading position in the market segment may be affected, resulting in a slowdown or even decline in the growth of its sales revenue, and the company’s profitability may be adversely affected.

3.4.2. Diminishing Willingness to Shop Online

COVID-19 has created a common non-face-to-face environment. In particular, a new form of non-face-to-face consumption that combines live streaming and e-commerce platforms is rapidly developing and spreading [11]. In today's digital age, unlike the transition of 2014, online shopping has evolved into consumers' indispensable choice. Therefore, in this case, if L'Oréal does not innovate or break through in the way of online sales, it is likely to be drowned in the tide of the Internet age.

4. Suggestions on L'Oréal's North Asian Marketing Strategy

4.1. Product

Adapt to local conditions to create cosmetic products in line with the aesthetic characteristics of North east countries. With the rapid development of the Asian market, consumers' demands are constantly changing. Therefore, L'Oréal should create cosmetic products in line with the aesthetic characteristics in different countries. For example, in Chinese market, consumers have a high demand for products with whitening, antioxidant and moisturizing effects. While in the Japanese market, consumers have a high demand for fresh, natural and long-lasting products. L'Oréal can launch products such as waterproof mascara.

Integrate homogeneous products and enhance product diversification. L'Oréal's products of different brands have similar functions; therefore, L'Oréal should integrate homogeneous products and enhance product diversification. For example, it can launch several lipsticks in different colors, textures and functions in the Asian market to meet the needs of different consumers.

Strengthen technological innovation and improve product quality and safety. In recent years, the regulatory system for cosmetics in North Asia has become increasingly strict. To get more competitiveness, L'Oréal should guarantee product quality and safety. L'Oréal can use new production processes and materials to develop safer and more effective products.

4.2. Pricing

Implement differentiated pricing. According to research, the purchasing behavior and consumption habits of consumers vary in different regions. For example, Chinese consumers pay more attention to efficacy and quality of products, while Indian consumers attach more importance to price. Therefore, L'Oréal can launch product lines with different prices according to the consumer demand in different regions to realize differentiated pricing [12]. The high-end products can be priced higher, while Low-end products can be priced at a lower price in pursuit of economic benefits and popularity.

Carry on low-price promotion activities regularly. Low price promotion activities can be carried out through discounts, full discount, gifts and other ways to improve consumers' purchase desire and brand loyalty. In addition, L'Oréal can also publicize and promote through social media to increase the visibility and influence of low-price promotions [13,14].

4.3. Branding

Maintain inherent advantages of the brand and build the overall image of the enterprise. At present, most of L'Oréal's brands have high popularity, but its corporate image is not clear. Therefore, on the one hand, L'Oréal should increase advertising investment, grasp the market key-points through extensive research. On the other hand, L'Oréal should focus on building corporate culture and building the overall image of the company. Chinese beauty brand “perfect diary” has set a good example in the construction of brand social image. While launching animal series eyeshadow plates, it pays attention to college stray animals, opening stray animal account in colleges, which has been recognized by many consumers. L'Oréal group can learn from its experience and deepen the overall image through public welfare activities.

Adjust brand positioning and pay attention to economic backward areas. L'Oréal has been focusing on creating mid-to-high end products that are too expensive for poor people to afford. Therefore, L'Oréal should build some middle and low-end brands to meet the needs of people in less developed areas. Moreover, the male market has grown rapidly since men began to be more concerned about their appearance and that society has stopped to be so judgmental about men taking care of themselves, making them more opened to go to hair salons and use beauty and aesthetics services. Therefore, the male market also should be one of the targets of expansion of L'Oréal's future brand strategy.

4.4. Sales

Enrich offline sales channels and strengthen the service. Although L'Oréal has a large number of offline counters, its sales method is similar to other beauty counters. L'Oréal can deepen its understanding of the culture of China, Japan and South Korea and apply regional culture to its products. Taking China as an example, L'Oréal can contact local Han Chinese Clothing fan associations to carry out relevant offline activities and joint sales. In addition, L'Oréal should also strengthen the service level of offline stores, carrying out virtual reality, makeup testing, and smart skin testing.

Innovate online sales methods and combine online and offline. L'Oréal must constantly update its online sales approach as online shopping becomes a part of everyday life. In China, Japan and South Korea, where the film and television industry are developed, L'Oréal can cooperate with other online platforms to carry out effective marketing or cooperate with film or cartoon corporation to build brand IP. In addition, L'Oréal should make full use of both online and offline channels, guide consumers to online through some creative store marketing methods, and connect online and offline together.

5. Conclusion

With the development of economy and the improvement of people's consumption level in North Asia, the cosmetics market in this region has showed an unprecedented competition situation. Cosmetics brands from all over the world have settled in, and continue to expand the North Asian market, among which L'Oréal Group has made the most outstanding achievements. With its rich market experience and superb product research and development technology, L'Oréal has won the trust of consumers and a firm foothold in the Northeast Asian market. However, his bumper results have inevitably been accompanied by problems.

In this paper, L'Oréal is selected as the research object using SWOT to analyze the strengths, weakness, opportunities and threats of L'Oréal Group in the North Asian market. It is believed that the group should comprehensively consider the local market situation in North Asia, the macro environment and its own ability when making strategic adjustment. As far as L'Oréal Group is concerned, it should strengthen scientific and technological innovation, build healthy and high-quality diversified products. It also ought to implement differentiated pricing and adjust brand positioning, paying more attention to economically backward areas. In addition, the building of overall image and expansion of sales channels are also important. For similar multinational beauty brands, they should know the target market in advance, conduct extensive research on market status and consumer needs, so they could create beauty products suitable for local conditions.

In a word, in the digital age with the global market constantly changing, whether to develop an appropriate market strategy has become the key to the long-term survival of enterprises. Paying close attention to market changes and adjusting market strategies according to specific conditions is the only way for all beauty brands to survive in the international market for a long time.

References

[1]. Li, X., Li, H., Li, X.: Exploring Chinese Consumers' Purchase Intention towards Foreign Cosmetics Brands. Sustainability, 10(9), 3229 (2018).

[2]. Kim, J., Kim, M.: The influence of product attributes and consumer characteristics on perceived value and repurchase intention in the Korean cosmetics market. Journal of Retailing and Consumer Services, 24, 87-96 (2015).

[3]. Seo, J., Chung, K.: How global brands compete in the Korean market: An analysis of their advertising campaigns. Journal of Business Research, 70, 149-156 (2017).

[4]. Yeo, S., Kim, H.: Consumer perceptions of international luxury cosmetics brands: A case study of Korean consumers. Journal of Retailing and Consumer Services, 55, 102148 (2020).

[5]. Yin, R.: Case study research and applications: Design and methods. Sage publications (2018).

[6]. Zikmund, W., Babin, B., Carr, J., Griffin, M.: Business research methods. South-Western Cengage Learning (2013).

[7]. Phadermrod, B., Crowder, R., Wills, G.: Importance-Performance Analysis based SWOT analysis. International Journal of International Management 44, pp.194-203 (2019)

[8]. Komari A., Indrasari, L., Tripariyanto, A., Rahayuningsih, S.: Analysis of SWOT Marketing Strategies and 7P Influence on Purchasing Decision. International Conference on Science and Technology 1569 (2020) 032002 (2019).

[9]. Liew, S., Wu, W., Chan, H., Wilson, W., Kim, H., Greg, J., Peter, H., John D.: Consensus on Changing Trends, Attitudes, and Concepts of Asian Beauty. Aesth Plast Surg 44:1186–1194 (2020).

[10]. Withisuphakorn, P., Batra, I., Parameswar, N., Dhir, S.: Sustainable development in practice: Case study of L'Oréal. Journal of Business and Retail Management Research, 13 (2019).

[11]. Lee, J., Han, K.: Mobile shopping beauty live commerce changes in COVID-19 pandemic focused on fun contents of MZ generation in Republic of Korea. Jouranl of Cosmetic Dermatology 21:2298–2306 (2022).

[12]. Li, X., Li, Y.: A study on the pricing strategy of L'Oréal in China. International Journal of Business and Social Science 4(16), 152-160 (2013).

[13]. Wang, Y.: The impact of promotional activities on consumer buying behavior: A study of L'Oréal. Journal of Marketing and Consumer Research, 25, 1-8 (2016).

[14]. Huang, J.: Study on the effectiveness of promotional activities of L'Oréal in China. Journal of Business and Management 4(3), 29-34 (2015).

Cite this article

Luo,J.;Zhao,Z. (2023). SWOT Analysis on L'Oréal's Marketing Strategies in North Asia. Advances in Economics, Management and Political Sciences,32,209-217.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li, X., Li, H., Li, X.: Exploring Chinese Consumers' Purchase Intention towards Foreign Cosmetics Brands. Sustainability, 10(9), 3229 (2018).

[2]. Kim, J., Kim, M.: The influence of product attributes and consumer characteristics on perceived value and repurchase intention in the Korean cosmetics market. Journal of Retailing and Consumer Services, 24, 87-96 (2015).

[3]. Seo, J., Chung, K.: How global brands compete in the Korean market: An analysis of their advertising campaigns. Journal of Business Research, 70, 149-156 (2017).

[4]. Yeo, S., Kim, H.: Consumer perceptions of international luxury cosmetics brands: A case study of Korean consumers. Journal of Retailing and Consumer Services, 55, 102148 (2020).

[5]. Yin, R.: Case study research and applications: Design and methods. Sage publications (2018).

[6]. Zikmund, W., Babin, B., Carr, J., Griffin, M.: Business research methods. South-Western Cengage Learning (2013).

[7]. Phadermrod, B., Crowder, R., Wills, G.: Importance-Performance Analysis based SWOT analysis. International Journal of International Management 44, pp.194-203 (2019)

[8]. Komari A., Indrasari, L., Tripariyanto, A., Rahayuningsih, S.: Analysis of SWOT Marketing Strategies and 7P Influence on Purchasing Decision. International Conference on Science and Technology 1569 (2020) 032002 (2019).

[9]. Liew, S., Wu, W., Chan, H., Wilson, W., Kim, H., Greg, J., Peter, H., John D.: Consensus on Changing Trends, Attitudes, and Concepts of Asian Beauty. Aesth Plast Surg 44:1186–1194 (2020).

[10]. Withisuphakorn, P., Batra, I., Parameswar, N., Dhir, S.: Sustainable development in practice: Case study of L'Oréal. Journal of Business and Retail Management Research, 13 (2019).

[11]. Lee, J., Han, K.: Mobile shopping beauty live commerce changes in COVID-19 pandemic focused on fun contents of MZ generation in Republic of Korea. Jouranl of Cosmetic Dermatology 21:2298–2306 (2022).

[12]. Li, X., Li, Y.: A study on the pricing strategy of L'Oréal in China. International Journal of Business and Social Science 4(16), 152-160 (2013).

[13]. Wang, Y.: The impact of promotional activities on consumer buying behavior: A study of L'Oréal. Journal of Marketing and Consumer Research, 25, 1-8 (2016).

[14]. Huang, J.: Study on the effectiveness of promotional activities of L'Oréal in China. Journal of Business and Management 4(3), 29-34 (2015).