1. Introduction

As economic development and employment have become more unstable and uncertain, the government has been optimising the business environment by improving the socialist rule of law system and increasing efficiency, and actively encouraging the public to start new businesses to boost employment and economic development. "Mass entrepreneurship" often takes the "small, medium, and weak" group as the carrier, which also determines that the initial form of small and micro enterprises are primarily families. However, family entrepreneurship faces more serious financing constraints and information asymmetry problems. The emergence of inclusive finance is changing the scope of services provided by other financial companies, making the "small, medium, and weak" groups and micro and small enterprises the target of financial services. As of December 2022, the number of Chinese search engine users reached 821 million, and the size of the Internet population reached 1.051 billion, with people using mobile terminals to connect to the outside world via the Internet[1]. In the process, much personal information is left behind. Mobile Internet technology can effectively promote financial services by rapidly collecting information on massive amounts of user data. Digital inclusive finance combines traditional financial products with the Internet and mobile Internet to channel financial resources from the market to disadvantaged areas, industries, and links and to spread financial services to poor regions with relatively backward economic mechanisms to achieve a rational allocation of resources and help crack the problem of investment and financing in key areas such as the "Agriculture, Rural Areas, Farmers" and small and micro enterprises. It also provides new ideas for financing families with low income, little wealth, and weak capacity to start their businesses. The country has actively issued relevant policies to guide the development of inclusive finance. More digital inclusive finance platforms have emerged to provide financial services for family business start-ups. Central traditional commercial banks have also opened exclusive APPs for inclusive finance, such as the Construction Bank of China, Industrial and Commercial Bank of China, and Bank of China, and significant online banks, such as Ant Financial. Jingdong Financial has also effectively reduced financing costs and provided convenience. Financial services are also available through various means. This paper adopts a dynamic game approach with the theme of household entrepreneurship in the context of inclusive digital finance, constructs a game model with households and inclusive finance platforms as the main subjects, and explores the factors influencing the choice of the main subjects' behaviour through numerical simulation analysis. On this basis, the key factors affecting the support of the digitally inclusive financial platform and the choice of family entrepreneurship are identified further to promote the construction of the digitally inclusive financial platform, provide a guarantee system for family entrepreneurship, and promote the increase of family entrepreneurship.

2. Review of the Literature

Evans and Jovanovic suggest that the prerequisite for entrepreneurs to start a business is adequate capital, especially the requirement of capital liquidity that causes a portion of those with insufficient money to stop at the pre-entrepreneurial stage. With the creation of inclusive digital finance, its most significant advantage is reflected in the acceleration of the capital mobility dimension [2]. Whether entrepreneurship can achieve the desired results is usually influenced by wealth status. The relationship between the two is positive, and only having a certain level of wealth can enhance the probability of entrepreneurial success [3]. Through an analysis of digital finance, Zhang argue that it can effectively lower the financing threshold for small-scale entrepreneurial projects, allowing more operators to use their families as the basis for entrepreneurship to generate income, plus the role of digital finance will cause all kinds of new ideas and logic in entrepreneurial activities [4]. Sun Jiguo studied the 2017 CHFS data situation in detail, and the results showed that digital finance needs to be achieved by promoting resident entrepreneurship to reduce the constraints of credit constraints fundamentally [5]. Taking the development of inclusive digital finance at the provincial level as a premise to explore the intrinsic correlation between it and household entrepreneurship, Xie et al showed that regions with relatively lagging urbanisation development are more intuitively affected, while some other scholars argue that the impact brought by mobile payments and internet finance is also very intuitive [6].

Regarding the promotion effect of digital financial inclusion on entrepreneurship, most studies have focused on household entrepreneurship decisions. The factors affecting household entrepreneurship mainly include two aspects one is financing constraints. The other is information asymmetry. If inclusive digital finance is introduced in this process, it not only broadens the information channels for people but also provides them with much information [7]. It reduces the difficulty of access and improves the efficiency of information acquisition [8]. In addition to laying the foundation for improving financial infrastructure, reducing the difficulty of access to finance for mainly poor residents, and significantly reducing the intensity of financing constraints, more notably by lowering the cost of financial services to promote entrepreneurship [9,10]. Entrepreneurial decisions are also positively influenced by household wealth and financial literacy level [11,12].

In recent years, digital finance's popularity has increased significantly in China, and some scholars have begun to study the intrinsic correlation between finance and entrepreneurship. From the current research results, most academics have cut from a macro perspective and stand at the micro level, with few research results. There needs to be more literature on the impact of financial inclusion on household entrepreneurial behaviour through dynamic game analysis. In this paper, we take the government and households as the primary research objects under the game theory perspective and take a micro view to clarify the correlation between inclusive digital financial platforms and household entrepreneurship.

3. Mechanisms for the Development of the Platform's Policies

3.1. Basic Assumption of the Game

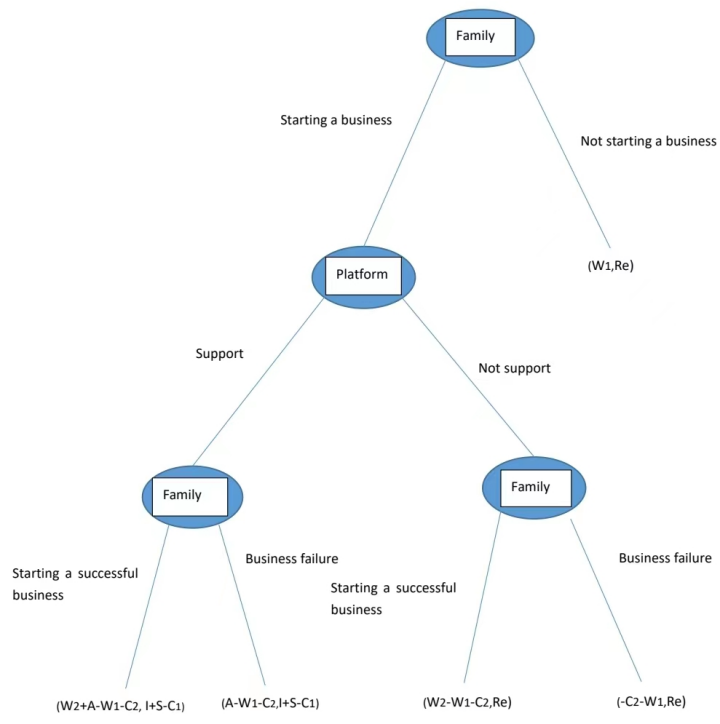

First, both parties to the game are rational economic agents, implying that the digital inclusive finance platform aims to maximise returns and minimize risks. In contrast, households aim to maximise entrepreneurial profits. Secondly, both parties to the game have information asymmetry. Households have in-depth knowledge of their members' knowledge level, ability and credit. In contrast, digital inclusive finance platforms need access to comprehensive information, and platforms are at an information disadvantage relative to households. Thirdly, the game is a dynamic game with incomplete information, where the actions of one party are predicated on the actions of the other party, i.e. one party judges the strategy it will adopt based on the previous actions of the other party.

3.2. Analysis of the Game Process

Assumptions of the platform

The cost of the digital inclusive finance platform is C1, the interest earned on loan am I, the digital inclusive finance platform will receive government subsidies when it chooses to support household entrepreneurship is S, and the opportunity cost of the bank if it does not lend the funds to households and this money is used for other channels to disburse to large enterprises, the maximum possible benefit to the bank is Re.

Assumptions for households

The cost invested by the household in starting the business and the cost paid for the loan to the platform, including the various types of costs such as money, time and effort, is C2, the expected return that the household will receive when the business is successful is W2, the household will take a job in an enterprise or institution when it does not choose to start a business, and the wage income received is W1, indicating that the household entrepreneur starts a business with the free legal education, discounts on financial management software and loans granted by the platform resource support as A.The game process and results are shown in the table 1.

Table 1: Analysis of the Game Process.

Decision outcome | Household benefit analysis | Platform benefit analysis | Payment function of both parties (household, platform) |

Household chooses to start a business Platform chooses to support and succeeds in starting a business | Income from successful business plus resource support from platform minus opportunity cost of giving up job choice to start a business and start-up costs W2+A-W1-C2 | Interest on loan and state subsidy, minus transaction costs I+S-C1 | (W2+A-W1-C2, I+S-C1) |

Household chooses to start a business Platform chooses to support and does not succeed in starting a business | Platform resources support minus opportunity costs of not starting a business and start-up costs A-W1-C2 | Recovery of interest earned on loans and state subsidies, minus transaction costs I+S-C1 | (A-W1-C2,I+S-C1) |

Household chooses to start a business Platform chooses not to support but the household succeeds in starting a business | Gains from success in starting a business minus opportunity costs of not starting a business and start-up costs W2-W1-C2 | Bank disburses this money to a large business with gains Re | (W2-W1-C2,Re) |

Household chooses to start a business Platform chooses not to support but the household business is not successful | Less the opportunity cost of starting a business and the opportunity cost of not starting a business-C2-W1 | The bank disburses this money to the large firm, with a return of Re | (-C2-W1,Re) |

Household does not choose to start a business | Household does not choose to start a business and will work in a firm to earn income W1 | Bank disburses this money to a large firm with a return of Re | (W1,Re) |

3.3. Tree Equilibrium Solution

The above game between the digital inclusive finance platform and the household belongs to the dynamic game with asymmetric information of limited times, and the whole game process has two decision nodes, under each node the two sides of the game make decisions based on their own information sets, and these decisions are a sub-game relative to the total decision process, and the inverse induction method can be used to achieve the equilibrium solution, and the game tree is shown in Figure 1.

1) Second game (platform side)

When the platform side is faced with the choice of supporting or not supporting family entrepreneurship, it will compare the benefits obtained by supporting family entrepreneurship with those obtained by not supporting family entrepreneurship out of the consideration of maximizing benefits.

The information asymmetry between the two sides of the game, where families have in-depth knowledge of their members' knowledge level, ability, credit, etc., and the digital inclusive finance platform cannot obtain comprehensive information, puts the platform at an information disadvantage relative to families, increasing the lending risk of the financial platform. Secondly, the platform's lending cost for family businesses is increased. Due to the weakness of family businesses, the platform needs to collect more costs and gather more information to judge the credit and ability of the family compared to large enterprises, and the platform's management cost for SME loans is much higher than that of larger enterprises. And often the cost of lending to large enterprises with clear financial systems, good credit standing and quality collateral assets is often much lower and the risk faced is smaller than that of family-founded MSMEs. Although the state gives a certain subsidy to platforms that support the family business this subsidy is much smaller than the cost incurred by the platform to support the family business. Therefore, the benefit of the platform choosing not to support = Re, whose value is greater than the benefit of supporting family entrepreneurship = I+S-C1, so the first game that when the bank is faced with the choice of supporting or not supporting, its choice is not supporting

2) First game (family side)

Families know that if they choose to start their own business, the probability of the platform choosing to support them is not very high, and they also need to pay certain application costs. At the same time, families face great risks in starting their own businesses, and if the business fails, many families suffer from the shock that cannot be relieved in a short period of time and may cause serious difficulties in survival. The increase in labour costs and land rent also greatly increases the cost of starting a family business. And give up entrepreneurship, but choosing to work in enterprises and institutions to obtain a stable income is undoubtedly a better choice. Therefore, the benefits of not starting a business = w1 is greater than the benefits of starting a business = W2+A-W1-C2/A-W1-C2. Therefore, the choice of the first game is not to start a business or not to start a business.

The equilibrium solution of the game is that the household chooses not to start a business and the digital inclusive finance platform chooses not to support it, and the gains of both parties are (W1,Re).

Figure 1: tree equilibrium solution.

4. Root Causes of Platform Finance Policymaking

Combined with the results of the game analysis, the information asymmetry in the game process causes the financial platform to increase the risk of lending; at the same time, for the financial platform, compared with large enterprises loans, the cost of loans for family entrepreneurship is higher; and the government subsidy for the platform is much smaller than the cost paid by the government to provide loans and various preferential services to families, such as free legal literacy and discounted use of the software. Therefore, without considering external factors and only considering the platform's own will, the platform will not choose to support the family business, so it will not make relevant policies. However, the reality is that in the context of financial inclusion, financial platforms have the responsibility to respond to the government's call to reduce the financing restrictions for family entrepreneurship. For example, financial platforms will the loan threshold for family entrepreneurship as well as provide free legal services for family entrepreneurship, etc

5. Root Causes of Household Choice to Start a Business

From the results of the game analysis above, it is clear that one of the biggest reasons households choose to start a business is if they choose to start a business. The platform chooses to support them, and if they are successful, the benefits = W2+I-W1-C2, which are much greater than the income w1 that households would have earned from working in an enterprise or institution if they had not chosen to start a business and because households know that the platform chooses to support them, their willingness to start a business will increase. At the same time, the probability that they will be successful will also increase. The probability of the household starting a business also increases. Secondly, when the household chooses to start a business, and the platform chooses not to support it, its earnings = W2 - W1 - C2 will be greater than its fixed wage income W1 under normal circumstances. Since the platform does not support it, the probability that the household will choose to start a business and succeed in doing so will be lower. In this case, the only incentive to start a business is to earn more than their wages.

6. Policy Recommendations to Drive up the Rate of Household Entrepreneurship

6.1. From the Government's Perspective

1) The government should increase subsidies to digital inclusive finance platforms to improve the platforms' risk resilience.

The government should subsidise any "non-performing" ones for unique loan products issued by the platform. Establish a risk compensation pool for inclusive (small, medium and micro) financing, and provide a certain percentage of risk compensation for all government-bank (guarantee) cooperation products that meet the requirements. Implement an appraisal system and give ladder rewards to the leadership team of the digital inclusive finance platform that ranks high in appraisal performance. The government should improve financial regulation and strengthen the construction of a digital society and digital government. It should establish a readiness and exit mechanism for the industry and raise the entry threshold; strengthen the construction of a personal credit system and establish a personal credit rating system; strengthen online lending information disclosure and platform self-regulation. Moreover, build a risk assessment system and platform certification mechanism.

2) Government reduces the cost of starting a business for households.

Tax support is given to small and micro enterprises, incubation institutions, and angel investments invested in innovative activities. The government should prioritise arranging business premises for family business start-ups, arrange for a certain proportion of premises in various business start-up carriers invested and developed by the government to be provided free of charge to family entrepreneurs, and make full use of idle resources to provide low-cost premises support. The government should waive administrative charges for eligible families to start their businesses. Provide subsidies for entrepreneurial training. Families need more to have the will to start a successful business; the key is to improve the family's entrepreneurial capabilities.

6.2. From the Perspective of a Digital Inclusive Finance Platform

1) To alleviate the problem of information asymmetry and reduce the risk of platform lending.

Platforms can use the Internet, big data, cloud computing, and other information technologies to effectively reduce market transaction costs and improve transaction speed and efficiency, reshape how information is disseminated, and help alleviate market information asymmetry. It should strengthen the construction of the platform's wind control system, improve the borrower audit system and overdue loan payment mechanism, strengthen the lousy debt risk transfer mechanism, establish a real-name authentication mechanism and standardise the collection management mechanism to alleviate information asymmetry and reduce the platform's credit risk and liquidity risk and other loan risks by using social relations, signalling and reputation constraints.

2) Improve platform construction and reduce platform service costs.

The digital inclusive finance platform should improve data control standards and enhance relevant systems' control capacity. In the era of big data, banks need to supplement relevant standards from data standards, data models, metadata, data quality, data life cycle and other aspects based on the characteristics of unstructured data and achieve control through the corresponding control system to ensure that unstructured data are effectively controlled and applied. The platform should use big data technology to enhance integration and sharing capabilities. On the one hand, the platform should adopt distributed computing and other big data technologies to build an open, efficient, heterogeneous and flexible big data platform to achieve comprehensive analysis and rapid sharing of "all-channel, all-customer and all-product" information to enhance customer development, risk control and innovative marketing capabilities. On the other hand, using big data technology, we focus on improving and supplementing basic information other than banking services and integrating customer information according to unified customer standards to form a complete customer view, realising visualisation services such as "data maps" through big data technology to enhance the ease of use of data assets; and providing information retrieval, metrics and analysis through the unified management of metadata. Through the unified management and analysis of metadata, we provide data services such as information retrieval and flexible customisation of indicators to improve the consistency and usability of data assets.

7. Conclusion

This paper simulates the game process between households and digital inclusive financial platforms when making entrepreneurial choices. The study finds that financial platforms do not support household entrepreneurship regarding reduced financing constraints and free legal literacy when only their willingness is considered and that households' willingness to start a business decreases significantly without financial platform support. This paper clarifies the outcome of the game between financial platforms and families. It provides ideas on how to increase the rate of household entrepreneurship, i.e. whether digital inclusive financial platforms provide support for household entrepreneurship is influenced by factors such as loan risk, loan and platform service costs, and government subsidy policies. The choice of household entrepreneurship is directly affected by the support provided by digital inclusive finance platforms, the cost of starting a business, and the benefits of household entrepreneurship. Therefore, the government can promote financial platforms to improve their platforms and support household entrepreneurship through subsidies and policy calls. The government and the digital inclusive finance platform should take measures to improve the protection system and platform construction for household entrepreneurship to increase the willingness of household entrepreneurship and promote the rate of entrepreneurship. However, there is room for improvement in this paper's parameter setting in the game stage, which can be further improved and expanded in subsequent research.

References

[1]. In the first half of 2022, the scale of China's search engine users reached 821 million, accounting for 78.2% of the overall Internet users (Figure) - China Business Intelligence Network. (n.d.). In the first half of 2022, the scale of China's search engine users reached 821 million, accounting for 78.2% of the overall Internet users (Figure) - China Competition Information website.https://www.askci.com/news/chanye/20221118/1005352026917.shtml

[2]. David S. Evans, Boyan Jovanovic.Journal | [J] Journal of Political Economy. Volume 97 , Issue 4 . 1989. PP 808-827

[3]. Balaban Mladenka;Župljanin Slobodan;Ivanovia journal.Journal | [J] Economic Analysis. Volume 49, Issue 1/2 . 2016. pp 48-58

[4]. Zhang Bing,Sheng Yanghong. A study on the impact of digital finance on household entrepreneurship [J]. Finance and Economics,2021,No.522(01):40-47+71.DOI:10.19622/j.cnki.cn36-1005/f.2021.01.005.

[5]. Sun Jiguo,Hu Jinyan,Yang Lu. Can the development of inclusive finance promote innovation in SMEs? --An empirical test based on a double difference model[J]. Research on Finance and Economics,2020,No.443(10):47-54.DOI:10.19654/j.cnki.cjwtyj.2020.10.006.

[6]. Xie, Gorgeous, Shen, Yan, Zhang, Haoxing et al. Can digital finance promote entrepreneurship? --Evidence from China[J]. Economics (Quarterly),2018,17(04):1557-1580.DOI:10.13821/j.cnki.ceq.2018.03.12.

[7]. Zhang LY, Yang J, Zhang HN. Financial development, household entrepreneurship and urban and rural residents' income - an empirical analysis based on micro perspective[J]. China Rural Economy,2013,No.343(07):47-57+84

[8]. Liu Jianshen, He Xiaobin, Lv Shumin. Mobility experience, social trust and Internet financing of county enterprises--an empirical analysis of data from a national survey of county enterprises[J]. Journal of Northwest Agriculture and Forestry University of Science and Technology (Social Science Edition),2021,21(01):133-144.DOI:10.13968/j.cnki.1009-9107.2021.01.15.

[9]. Li QH, Hou MAM. Self-efficacy and financial planning of urban residents in China--based on micro data of urban households in China[J]. Jianghan Academic,2019,38(01):15-24.DOI:10.16388/j.cnki.cn42-1843/c.2019.01.002.

[10]. Li JJ, Peng YC, Ma SC. Financial inclusion and China's economic development:A multidimensional connotation and empirical analysis[J]. Economic Research,2020,55(04):37-52.

[11]. Yin Zichao, Wu Yu, Gan Li. Financial accessibility, financial market participation and household asset choice[J]. Economic Research,2015,50(03):87-99.

[12]. Li Jianjun, Li Juncheng. Financial Inclusion and Entrepreneurship: "Teach people to fish" or "Teach people to fish"? [J]. Financial Studies,2020,No.475(01):69-87.

Cite this article

Ding,Z.;Li,Y. (2023). Game Analysis of Digital Inclusive Financial Platform and Family Entrepreneurial Choice. Advances in Economics, Management and Political Sciences,33,13-21.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. In the first half of 2022, the scale of China's search engine users reached 821 million, accounting for 78.2% of the overall Internet users (Figure) - China Business Intelligence Network. (n.d.). In the first half of 2022, the scale of China's search engine users reached 821 million, accounting for 78.2% of the overall Internet users (Figure) - China Competition Information website.https://www.askci.com/news/chanye/20221118/1005352026917.shtml

[2]. David S. Evans, Boyan Jovanovic.Journal | [J] Journal of Political Economy. Volume 97 , Issue 4 . 1989. PP 808-827

[3]. Balaban Mladenka;Župljanin Slobodan;Ivanovia journal.Journal | [J] Economic Analysis. Volume 49, Issue 1/2 . 2016. pp 48-58

[4]. Zhang Bing,Sheng Yanghong. A study on the impact of digital finance on household entrepreneurship [J]. Finance and Economics,2021,No.522(01):40-47+71.DOI:10.19622/j.cnki.cn36-1005/f.2021.01.005.

[5]. Sun Jiguo,Hu Jinyan,Yang Lu. Can the development of inclusive finance promote innovation in SMEs? --An empirical test based on a double difference model[J]. Research on Finance and Economics,2020,No.443(10):47-54.DOI:10.19654/j.cnki.cjwtyj.2020.10.006.

[6]. Xie, Gorgeous, Shen, Yan, Zhang, Haoxing et al. Can digital finance promote entrepreneurship? --Evidence from China[J]. Economics (Quarterly),2018,17(04):1557-1580.DOI:10.13821/j.cnki.ceq.2018.03.12.

[7]. Zhang LY, Yang J, Zhang HN. Financial development, household entrepreneurship and urban and rural residents' income - an empirical analysis based on micro perspective[J]. China Rural Economy,2013,No.343(07):47-57+84

[8]. Liu Jianshen, He Xiaobin, Lv Shumin. Mobility experience, social trust and Internet financing of county enterprises--an empirical analysis of data from a national survey of county enterprises[J]. Journal of Northwest Agriculture and Forestry University of Science and Technology (Social Science Edition),2021,21(01):133-144.DOI:10.13968/j.cnki.1009-9107.2021.01.15.

[9]. Li QH, Hou MAM. Self-efficacy and financial planning of urban residents in China--based on micro data of urban households in China[J]. Jianghan Academic,2019,38(01):15-24.DOI:10.16388/j.cnki.cn42-1843/c.2019.01.002.

[10]. Li JJ, Peng YC, Ma SC. Financial inclusion and China's economic development:A multidimensional connotation and empirical analysis[J]. Economic Research,2020,55(04):37-52.

[11]. Yin Zichao, Wu Yu, Gan Li. Financial accessibility, financial market participation and household asset choice[J]. Economic Research,2015,50(03):87-99.

[12]. Li Jianjun, Li Juncheng. Financial Inclusion and Entrepreneurship: "Teach people to fish" or "Teach people to fish"? [J]. Financial Studies,2020,No.475(01):69-87.